The Best Ways to Book Independent Hotels on Points

There are many scenarios in which using cash for a hotel stay just makes more sense than redeeming points.

In fact, there are many properties around the world that don’t even have a loyalty program in the first place. These include independent properties, boutique hotels, cottages, and vacation homes.

In these situations, it’s good to know that you don’t always have to pay full price. There are ways to save money and even snag some extra perks, often at no extra cost.

Redeem Fixed-Value Points Currencies

Even if you can’t redeem hotel loyalty points directly for a hotel stay, that doesn’t mean you’re stuck paying entirely out of pocket.

This is because most credit card programs issue points that can be redeemed against travel expenses at a set value, which can help offset the cost of your stay.

Indeed, almost all banks in Canada have the option to redeem points for travel purchases–or at the very least, as statement credits that can help offset the cost of your travel expenses.

However, it’s important to keep in mind that redeeming points this way might not always offer the best value.

With transferable points currencies, such as American Express Membership Rewards and RBC Avion you can generally get better value by transferring your points to airline or hotel partners and strategically redeeming them, rather than by redeeming them for statement credits.

On the other hand, with programs such as TD Rewards, BMO Rewards, CIBC Aventura, Scene+, and National Bank À la carte Rewards, redeeming your points against hotel stays or other travel expenses might just be the best, most valuable use of those points.

American Express Membership Rewards

Generally speaking, you’ll get the most value out of your American Express Membership Rewards (MR) points by transferring them to a partnered loyalty program, such as Air Canada Aeroplan, The British Airways Club, or Marriott Bonvoy, to name a few.

However, if you’re looking to book a hotel stay that can’t otherwise be booked with points directly, you can use a credit card that earns American Express MR points to pay for the hotel, and you can then use your points balance to cover the cost.

You can redeem MR points against any purchase made on the card at a rate of 1 cent per point (all figures in CAD). This means that if you paid $200 for a hotel room, you can redeem 20,000 MR points for a $200 statement credit to cover the cost of that stay.

What’s more, American Express occasionally has targeted promotions, through which you could redeem your MR points for statement credits at a rate as high as 1.5 cents per point.

In these situations, the value you get from redeeming points creeps higher, and even approaches the value you might get with transfer partners. If any of these promotions come up, it’s worth considering how you might be able to benefit, unless you have a better immediate use for your points.

First-year value

$1,181

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

American Express Membership Rewards Credit Cards

Welcome bonus: 70,000 Membership Rewards points

Annual fee: $199

First-year value

$2,001

Welcome bonus: 130,000 Membership Rewards points

Annual fee: $799

First-year value

$1,594

Welcome bonus: 70,000 Membership Rewards points

Annual fee: $250

First-year value

$1,554

Welcome bonus: 110,000 Membership Rewards points

Annual fee: $799

First-year value

$1,181

Welcome bonus: 15,000 Membership Rewards points

Monthly fee: $15.99

First-year value

$336

Welcome bonus: 12,500 Membership Rewards points

Annual fee: No fee

First-year value

$301

RBC Avion

Similar to American Express Membership Rewards, you’ll tend to get the most value out of your RBC Avion points by transferring them out to airline partners, such as The British Airways Club, Cathay Pacific Asia Miles, WestJet Rewards, or American Airlines AAdvantage.

While RBC also allows you to redeem your Avion points for a statement credit, the redemption rate is 17,200 points = $100, or 0.58 cents per point, which isn’t necessarily a good deal, and should be avoided.

Instead, if you want to use your RBC Avion points to offset the cost of a hotel stay at a better rate, you can book your stay through the RBC Rewards travel portal.

Through the travel portal, you’ll be able to redeem Avion points at 1 cent per point, or 20,000 Avion points = $200.

However, keep in mind that this redemption rate is exclusive to Avion Elite points, which are available only if you hold an eligible Avion card.

When choosing this option, you’ll just want to compare the price of the stay as seen on RBC’s travel portal to other booking options to make sure you’re being offered a similar rate.

Sometimes, booking directly with hotels and other travel vendors results in better pricing.

First-year value

$1,080

Annual fee: $120

• Earn 35,000 points on approval

• Earn 20,000 points upon spending $5,000 in the first 6 months

Earning rates

Key perks

- Transfer to BA Avios, Cathay, WestJet, AA

- DoorDash DashPass for 12 months

- Petro-Canada 3c/L savings + 20% bonus Petro-Points

Annual fee: $120

• Earn 35,000 points on approval

• Earn 20,000 points upon spending $5,000 in the first 6 months

Earning rates

Key perks

- Transfer to BA Avios, Cathay, WestJet, AA

- DoorDash DashPass for 12 months

- Petro-Canada 3c/L savings + 20% bonus Petro-Points

RBC Avion Credit Cards

Welcome bonus: 55,000 Avion points

Annual fee: $120

First-year value

$1,080

Welcome bonus: 55,000 Avion points

Annual fee: $120

First-year value

$1,080

Welcome bonus: 70,000 Avion points

Annual fee: $399

First-year value

$826

Welcome bonus: 35,000 Avion points

Annual fee: $175

First-year value

$700

Welcome bonus: 35,000 Avion points

Annual fee: $120

First-year value

$580

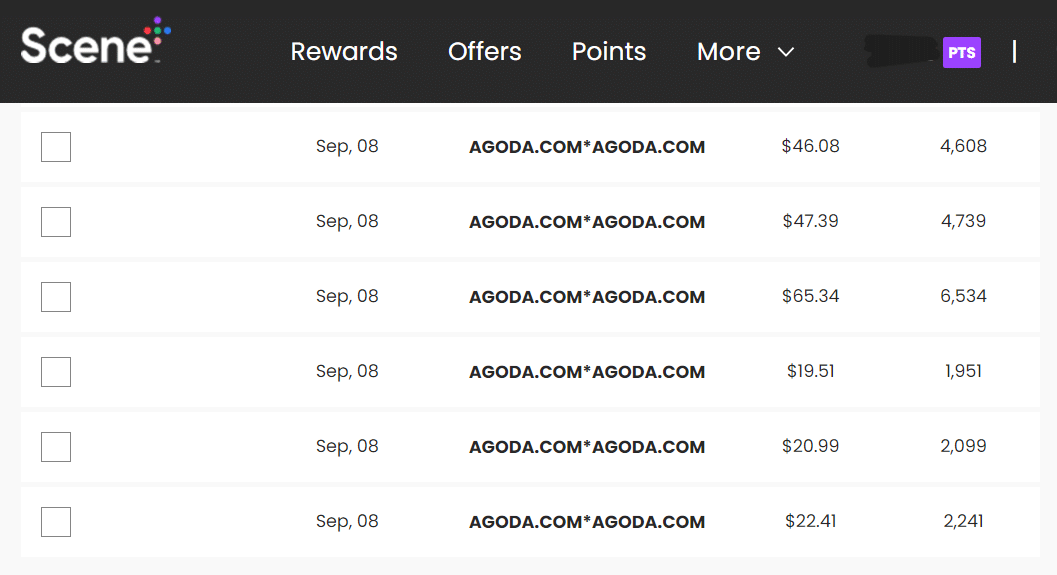

Scotiabank Scene+

Scotiabank’s Scene+ points can be used to offset any travel you’ve previously purchased with your Scene+ credit card at a rate of 1 cent per point, or 20,000 points for a $200 hotel stay.

The best part? You’re free to book directly with any vendor, and redeem your points at the highest possible value.

This means you can shop around for the best price, take advantage of cashback portals like Rakuten for extra savings, or book directly with hotels to earn elite qualifying nights toward status. Then, you can offset the cost afterward by redeeming your Scene+ points.

Scotiabank is also home to Canada’s best credit cards with no foreign transaction fees, which means that you’ll save money when travelling and still be able to offset the cost using your points.

First-year value

$525

Annual fee: $120First Year Free

• Earn 25,000 points upon spending $2,000 in the first 3 months

• Earn 20,000 points upon spending $7,500 in the first 12 months

Earning rates

Key perks

- No foreign transaction fees

- Amex Offers & Front of the Line access

Annual fee: $120First Year Free

• Earn 25,000 points upon spending $2,000 in the first 3 months

• Earn 20,000 points upon spending $7,500 in the first 12 months

Earning rates

Key perks

- No foreign transaction fees

- Amex Offers & Front of the Line access

Scotiabank Scene+ Credit Cards

Welcome bonus: 40,000 Scene+ points

Annual fee: $199

First-year value

$1,101

Welcome bonus: 60,000 Scene+ points

Annual fee: $150

First-year value

$850

Welcome bonus: 80,000 Scene+ points

Annual fee: $399

First-year value

$601

Welcome bonus: 45,000 Scene+ points

Annual fee: $120

First-year value

$525

Welcome bonus: 5,000 Scene+ points

Annual fee: No fee

First-year value

$60

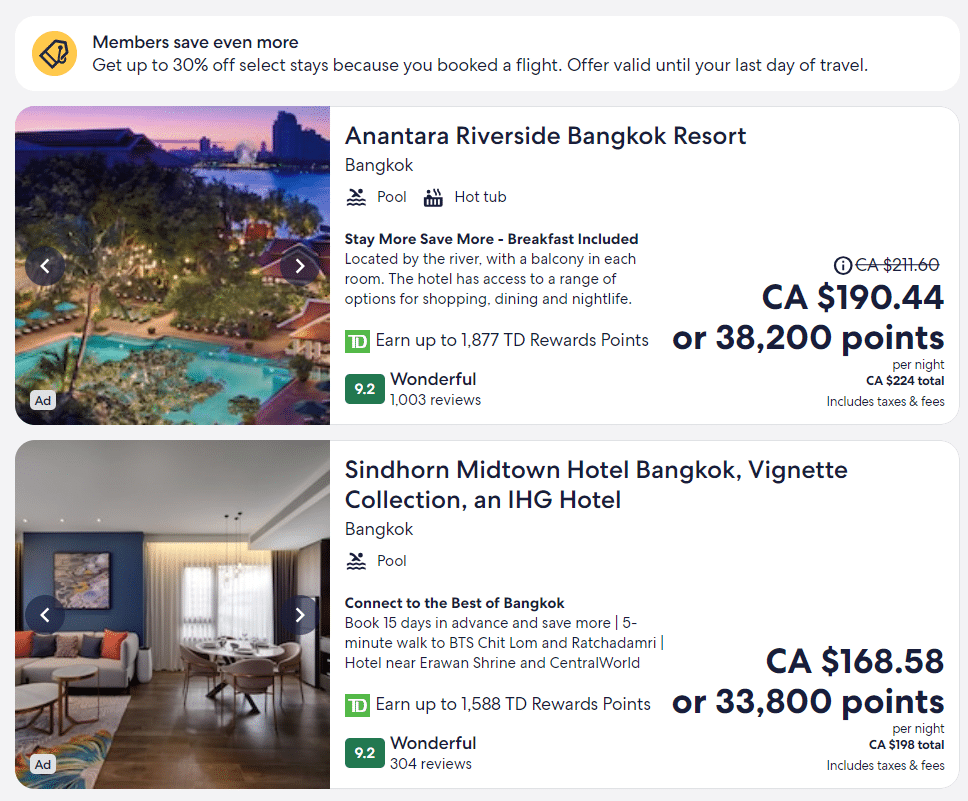

TD Rewards

TD Rewards allows you to redeem points for travel through Expedia for TD or travel booked on your own.

If you book a hotel stay through the Expedia for TD online portal, you’ll get a rate of 0.5 cents per point, or 40,000 TD Rewards points to cover $200 hotel stay.

However, if you book a hotel stay on your own with your TD Rewards credit card, you’ll have the option to redeem your TD Rewards points at a slightly lower rate of 0.44 cents per point via the Pay Off Purchases feature. In other words, you’ll need 50,000 TD Rewards points to cover a $220 hotel stay.

As long as you’re getting the same price for the same product, you should endeavour to redeem your points through the Expedia for TD portal, since doing so results in the best value.

First-year value

$900

Annual fee: $139First Year Free

• Earn 20,000 points on first purchase

• Earn 145,000 points upon spending $7,500

Earning rates

Key perks

- 4 Visa Airport Companion lounge visits per year

- $100 annual Expedia for TD travel credit

- Annual birthday bonus up to 10,000 TD Rewards points

Annual fee: $139First Year Free

• Earn 20,000 points on first purchase

• Earn 145,000 points upon spending $7,500

Earning rates

Key perks

- 4 Visa Airport Companion lounge visits per year

- $100 annual Expedia for TD travel credit

- Annual birthday bonus up to 10,000 TD Rewards points

TD Rewards Credit Cards

Welcome bonus: 165,000 TD Rewards Points

Annual fee: $139

First-year value

$900

Welcome bonus: 50,000 TD Rewards Points

Annual fee: $89

First-year value

$258

Welcome bonus: 15,152 TD Rewards Points

Annual fee: No fee

First-year value

$78

50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

CIBC Aventura

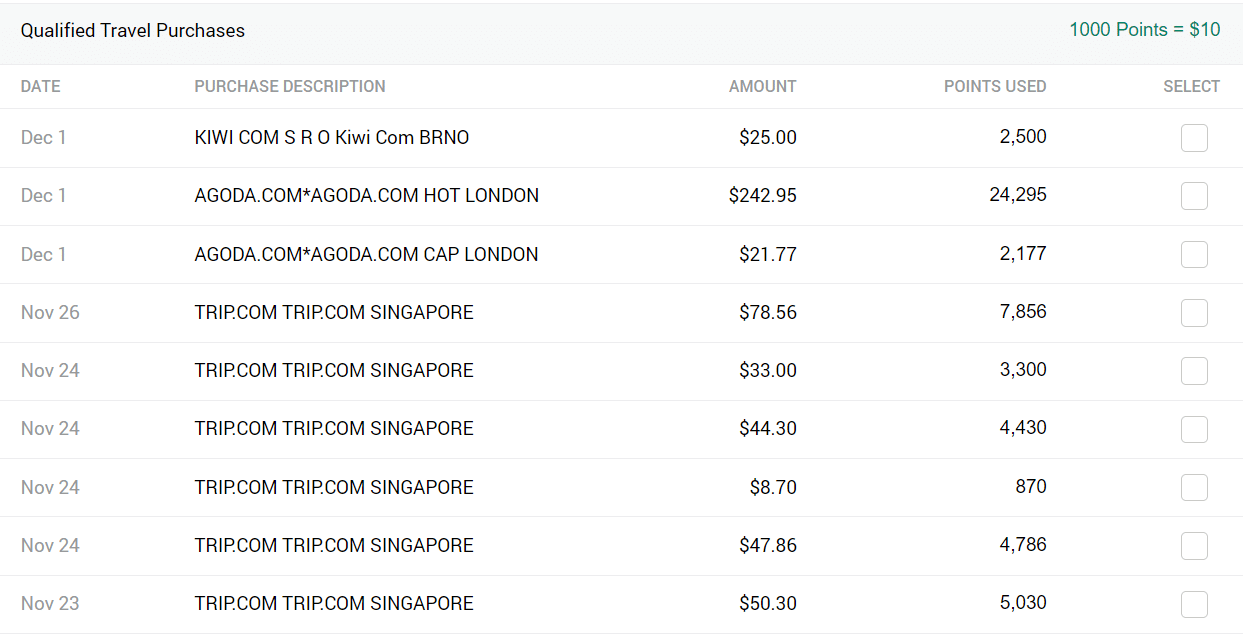

Similar to TD, the CIBC Aventura program also allows you to redeem Aventura Points against travel expenses, or to redeem points through CIBC’s in-house travel agency, at different rates.

By redeeming Aventura points through the travel agency, you’ll get a set value of 1 cent per point, or 20,000 Aventura points for a $200 hotel stay.

Alternatively, you can book a hotel with through any platform you choose, then redeem Aventura points also at a rate of 1 cent per point toward that travel purchase.

However, unlike Scene+ points—which give you up to 365 days to apply points toward a travel purchase—Aventura points must be redeemed while the charge is still pending.

So, be sure you have enough points ready to cover the cost of your travel purchase when you make the booking.

First-year value

$650

Annual fee: $139First Year Free

• Earn 15,000 points on first purchase

• Earn 30,000 points upon spending $3,000 in the first 4 months

• Earn 15,000 points upon spending $5,000 in the first 4 months

Earning rates

Key perks

- 4 Visa Airport Companion lounge visits per year

- Priority security at select Canadian airports

- NEXUS application fee rebate every 4 years

- Mobile device insurance

Annual fee: $139First Year Free

• Earn 15,000 points on first purchase

• Earn 30,000 points upon spending $3,000 in the first 4 months

• Earn 15,000 points upon spending $5,000 in the first 4 months

Earning rates

Key perks

- 4 Visa Airport Companion lounge visits per year

- Priority security at select Canadian airports

- NEXUS application fee rebate every 4 years

- Mobile device insurance

CIBC Aventura Credit Cards

Welcome bonus: 70,000 Aventura Points

Annual fee: $120

First-year value

$1,050

Welcome bonus: 60,000 Aventura Points

Annual fee: $139

First-year value

$650

Welcome bonus: 60,000 Aventura Points

Annual fee: $139

First-year value

$650

Welcome bonus: 12,500 Aventura Points

Annual fee: No fee

First-year value

$130

Welcome bonus: 80,000 Aventura Points

Annual fee: $499

First-year value

$76

BMO Rewards

With BMO Rewards, you’ll get a value of exactly 0.67 cents per point, whether you redeem your points against your own hotel booking charged to your BMO credit card, or you redeem for a booking made through BMO’s in-house travel agency.

With either route, it’ll cost you 29,850 BMO Rewards points to cover a $200 hotel stay.

If you have to choose between the two, it’s best to book directly with hotels, since you may be able to enjoy extra benefits through your elite status or by booking through a preferred partner program.

BMO Rewards Credit Cards

Welcome bonus: 70,000 BMO Rewards points

Annual fee: $120

First-year value

$549

Welcome bonus: 200,000 BMO Rewards points

Annual fee: $599

First-year value

$406

National Bank À la carte Rewards

As with the other programs we’ve mentioned, National Bank’s À la carte Rewards can also be used to cover travel expenses. When redeeming points through National Bank’s online travel portal, you’ll get a value of 1 cent per point, meaning you can redeem 20,000 points for a $200 hotel stay.

If you want to redeem À la carte Rewards points against your own hotel booking, redeeming fewer than 55,000 points will get you 0.83 cents per point, and redeeming more than 55,000 points will get you 0.92 cents per point.

Based on these rates, you’ll need 24,096 À la carte Rewards points to cover your $200 hotel stay.

Annual fee: $150

Earning rates

Key perks

- Airport lounge access

Annual fee: $150

Earning rates

Key perks

- Airport lounge access

National Bank World Elite Mastercard

Use Travel Credits

Another way that you can save on your hotel costs when you’re booking a cash stay is by using travel credit offered as a perk on select credit cards to offset the final price.

There are a number of cards that offer annual credits that can be used to book your next hotel stay. These cards, and their associated credits, include the following:

- American Express Platinum Card and Business Platinum Card from American Express: $200 annual travel credit

- American Express Gold Rewards Card: $100 annual travel credit

- CIBC Aventura Visa Infinite Privilege Card: $200 annual travel credit†

- BMO eclipse Visa Infinite* Card: $50 annual lifestyle credit†

- BMO eclipse Visa Infinite Privilege* Card: $200 annual lifestyle credit†

- Scotiabank Passport™ Visa Infinite Privilege* Card: $250 annual travel credit†

- TD First Class Travel Visa Infinite* Card: Receive a $100 statement credit when you spend $500 on lodging expenses on Expedia for TD†

Credit Cards with Travel Credits

Welcome bonus: 130,000 Membership Rewards points

Annual fee: $799

First-year value

$1,594

Welcome bonus: 70,000 Membership Rewards points

Annual fee: $250

First-year value

$1,554

Welcome bonus: 110,000 Membership Rewards points

Annual fee: $799

First-year value

$1,181

Welcome bonus: 165,000 TD Rewards Points

Annual fee: $139

First-year value

$900

Welcome bonus: 70,000 BMO Rewards points

Annual fee: $120

First-year value

$549

Welcome bonus: 200,000 BMO Rewards points

Annual fee: $599

First-year value

$406

Welcome bonus: 80,000 Aventura Points

Annual fee: $499

First-year value

$76

Of the above credits, some are fairly flexible, while others require that you jump through a hoop or two. This means that some of the credits allow you to redeem against any hotel expense, while others require that you book through certain travel portals connected with the card issuer.

Which Credit Cards Have Annual Credits?

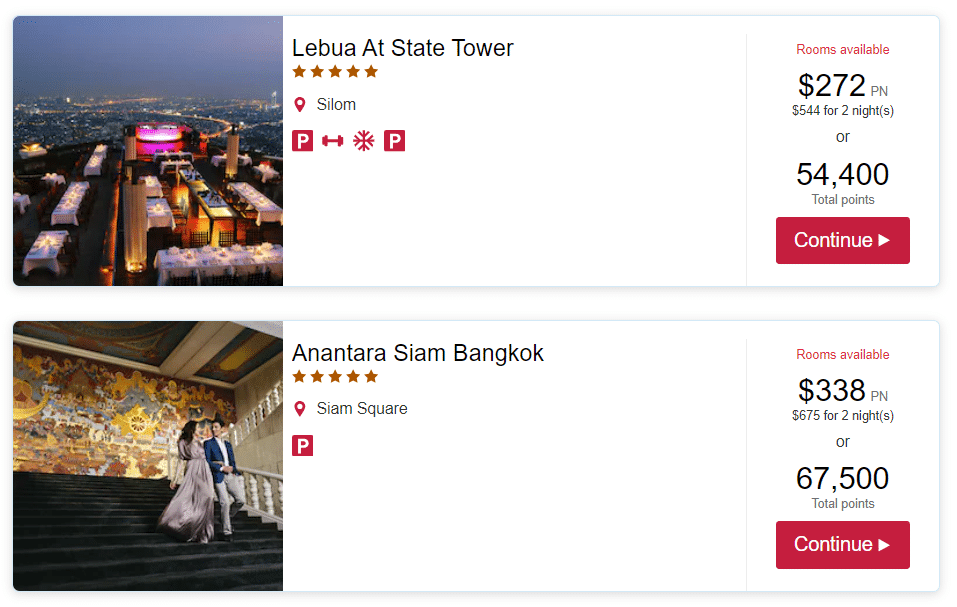

Read moreBook with Preferred Partner Programs

Pretty much every major hotel brand, whether they have a loyalty program or not, has what’s called a preferred partner program.

Preferred partner programs offer a selection of benefits to provide an elevated experience during your stay, which are similar to those enjoyed by guests with elite status.

It’s worth noting that in order to book a hotel through a preferred partner program, you do need to book through a travel advisor, and it’s not possible to book on your own.

While the exact perks vary by program and by property, the benefits that can be accessed through bookings using preferred partner programs typically include the following:

- Daily breakfast for two

- $100 (USD) hotel credit

- Welcome amenity

- Room upgrade (subject to availability)

- Early check-in and/or late check-out (subject to availability)

- Additional property-specific promotions

Notably, the cost to access and enjoy these benefits is the same price you’d pay if you booked with the hotel directly at the best flexible rate.

So, if you’re going to pay for a hotel with cash instead of points, it’s almost always in your best interest to book through preferred partner programs to enjoy extra benefits at no additional cost.

And since you’re charged directly by the hotel, you’ll still be able to offset the total cost of your stay by using fixed-value points from cards listed above, and you’ll enjoy any benefits associated with your elite status.

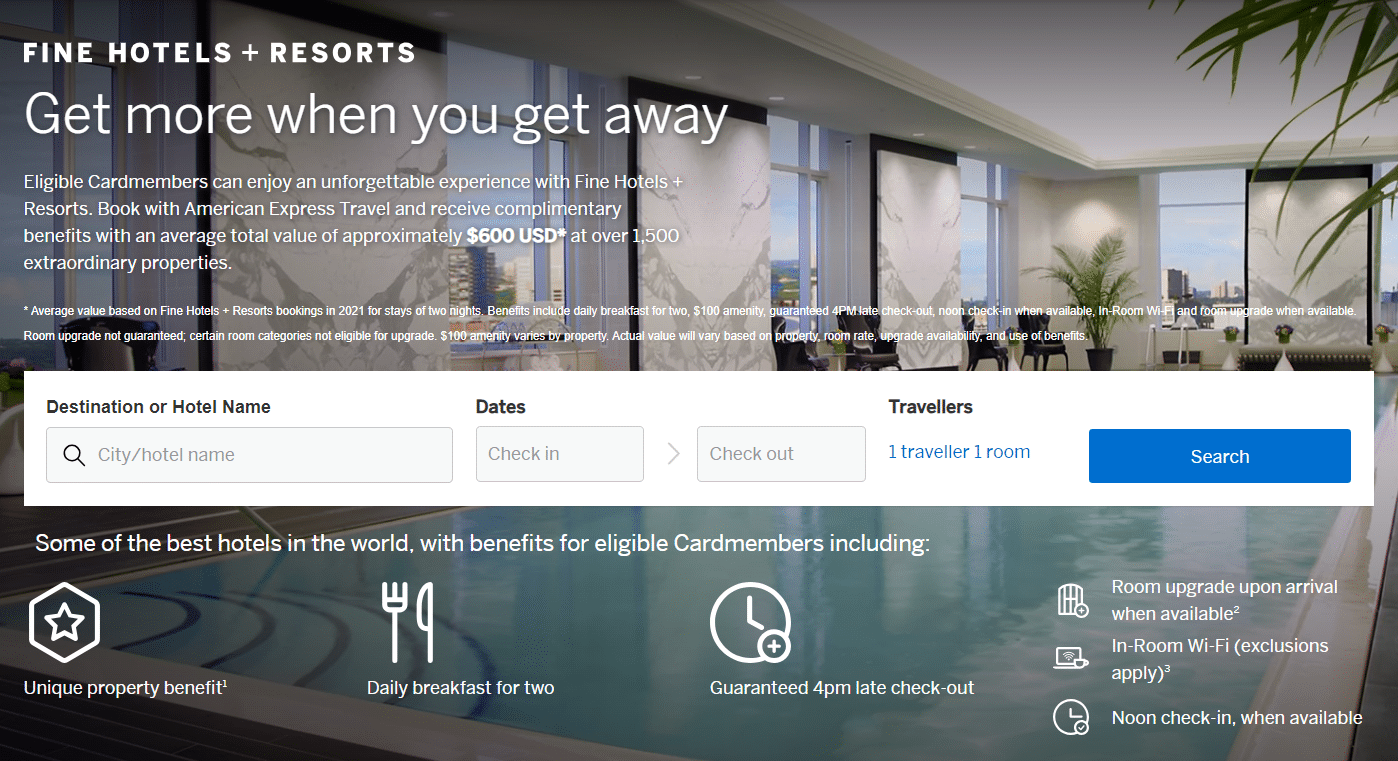

Book with American Express Fine Hotels + Resorts

If you have an American Express Platinum Card or a Business Platinum Card from American Express, you have access to the American Express Fine Hotels + Resorts (FHR) program.

Through the FHR program, you can book luxury hotels and enjoy some of the same benefits as you would if you booked through a preferred partner program.

However, not all luxury hotels are available to be booked through the FHR program, and for those that are, it may be better to book through the hotel’s own preferred partner program, as it might offer better benefits.

In any case, it’s worth comparing the available benefits and costs through all booking options to ensure you’re getting the best combination possible.

And if you’d like to use your MR points to offset the cost of your stay, you can choose to do so once you’ve been charged.

American Express Fine Hotels & Resorts: Exclusive Perks for Platinum Cardholders

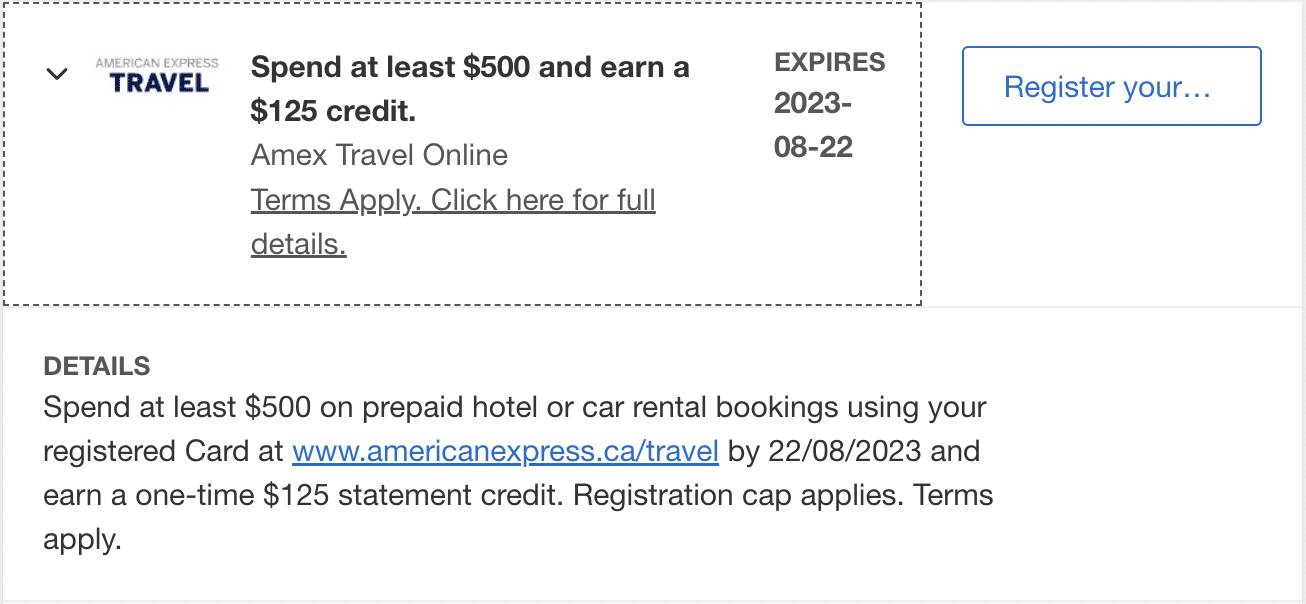

Read moreLeverage Amex Offers

American Express has frequent promotions called Amex Offers that are accessible to current American Express cardholders.

Generally speaking, you’ll need to register for an offer, and then you’ll receive a statement credit for fulfilling a minimum spending requirement at an eligible vendor.

The types of offers that you’ll find vary tremendously and change all the time. However, hotel promotions are fairly common, with some promotions focusing on a specific hotel brand, and others offering perks for spending done through Amex Travel.

Some examples of past Amex Offers include:

- 10% Discount on Expedia.ca Purchases

- Spend $500, Get $125 at Amex Travel

- Spend $500, Get $100 at Canadian Marriott hotels

- 20% Discount at Canadian Shangri-La Hotels

As long as you meet the minimum spending threshold to trigger the statement credit, Amex Offers essentially offer a meaningful discount on hotel stays.

Depending on the Amex Offer’s terms and conditions, you can also potentially stack the offer with elevated benefits from a preferred partner program. And if you wish, you can also use Amex MR points to offset the cost of the stay.

For example, let’s suppose you registered for the Spend $500, Get $100 at Canadian Marriott hotels Amex Offer.

You then make an eligible $500 booking at, say, the St. Regis Toronto, via Marriott STARS. Through the preferred partner program, you’ll get free breakfast for two, a $100 (CAD) property credit to use during your stay, priority for room upgrades, and more.

Since you’re charged directly by the hotel, you’d wind up with a $100 statement credit after your stay from the Amex Offer, which made the effective cost just $400. Then, you could use MR points to further offset the cost of the stay, which would bring the total cost down even further, perhaps even to $0.

Whenever there’s an Amex Offer for hotels, it’s certainly worth seeing if you can stack any more perks or offers to get more for less.

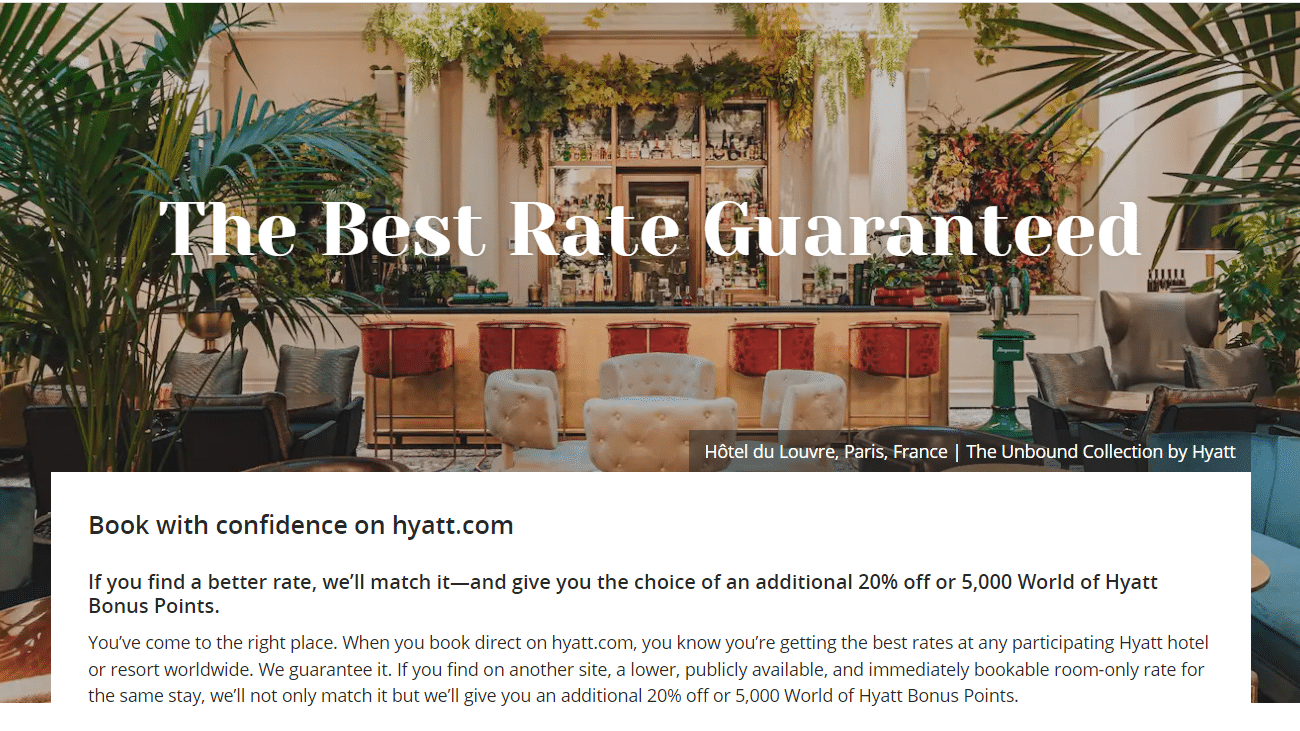

Best Rate Guarantees

Lastly, if you’re ever booking a hotel with cash, and especially if you are trying to find the cheapest rate possible, you should know that most major programs offer best rate guarantees.

With best rate guarantees, most hotels will price match your room rates if you happen to find a better eligible rate elsewhere. Not only will they match the rate, but you’ll often receive a further discount or a gift of points, depending on which hotel chain you’re staying with.

Every hotel that has a best rate guarantee policy with different terms and conditions, so make sure to read up on those differences before you make your next booking.

Best Rate Guarantees: Save Money or Earn Extra Points on Hotel Stays

Read moreConclusion

If you aren’t planning on redeeming points for a hotel stay, or if you’d like to book a hotel that can’t be booked with points from a loyalty program, there’s still a lot of ways you can squeeze value out of your next trip.

This can be done by leveraging fixed-value points currencies from credit cards, taking advantage of any travel credits you may have as a card benefit, getting the most out of a luxury hotel stay through preferred partner programs, or through promotions that come up.

Before you book your next hotel stay with cash, be sure to plan ahead, as you’ll likely find a few ways to optimize your stay.

T.J. is curious about everywhere he hasn’t been to yet. Exploring countries by foot and connecting with locals guide his love for travel. Earning and redeeming points to jazz up the experience has become the icing on his travel cake.

First-year value

$1,101

Annual fee: $199

• Earn 30,000 points upon spending $5,000 in the first 3 months

• Earn 10,000 points upon spending $60,000 in the first 12 months

Earning rates

Key perks

- No foreign transaction fees

- 6 Visa Airport Companion lounge visits per year

Annual fee: $199

• Earn 30,000 points upon spending $5,000 in the first 3 months

• Earn 10,000 points upon spending $60,000 in the first 12 months

Earning rates

Key perks

- No foreign transaction fees

- 6 Visa Airport Companion lounge visits per year