Whether you’re chasing massive welcome bonuses, maximizing everyday earn rates, or soaking up exclusive perks, the best credit cards usually come with hefty annual fees.

Sure, premium cards can be worth it when the value outweighs the cost, but let’s be honest—who wouldn’t want to save a few bucks?

After all, a free first year is nice, but it’s not forever. Signup incentives are easy to justify for new cards, but what about the ones that stick around in your wallet year after year?

Thankfully, the banks know they need to sweeten the deal to keep fee-paying cardholders loyal. That’s where annual credits come in.

In This Post

- American Express Platinum Cards

- American Express Gold Rewards Card

- Big 5 Banks: Travel & Lifestyle Credits

- National Bank: Travel Enhancement Credits

- US Credit Cards

- American Express Offers

- Conclusion

American Express Platinum Cards

The heavyweight champ of Canadian credit cards, the American Express Platinum Card, is a perks powerhouse. It’s got some of the best benefits around, making it a must-have for those who want to travel in style.

You get 2 Membership Rewards points per dollar spent on eligible dining and travel purchases, a complimentary Priority Pass membership with unlimited visits to airport lounges for you and one guest, and automatic hotel status including Marriott Bonvoy Gold Elite and Hilton Honors Gold. Throw in a robust travel insurance, and you’ve got yourself one flash piece of plastic, or should I say, metal.

Let’s be honest: beyond the perks, the Amex Platinum is a bit of a status symbol. It’s the credit card equivalent of pulling up in a luxury car. Whether that matters to you or not, there’s no denying the allure of its exclusivity and sleek branding.

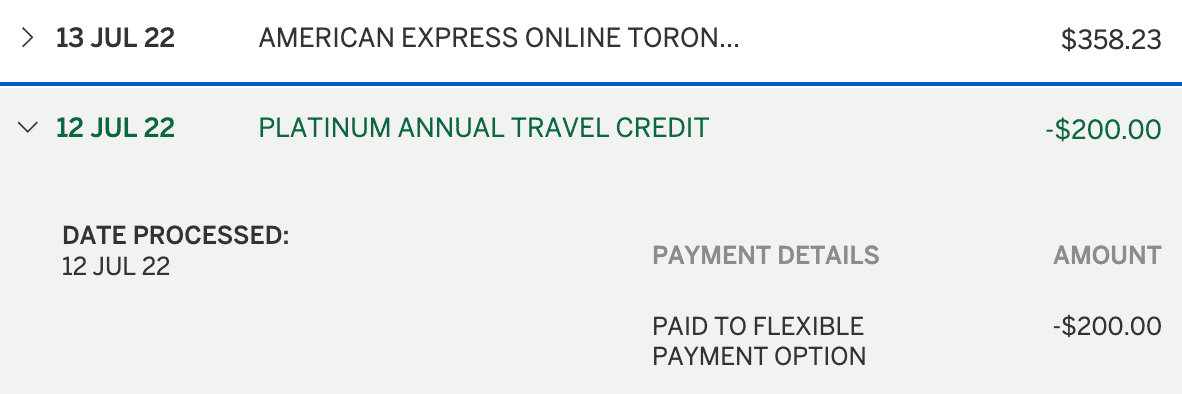

Of course, all that prestige and privilege doesn’t come cheap. The card now commands an eye-popping annual fee of $799 (all figures in CAD). But before you hit the back button, consider this: it comes with a $200 annual travel credit and a $200 annual dining credit, making that fee a little easier to stomach.

Its business variant, the Business Platinum Card from American Express, now also comes with a $200 annual travel credit; however, it didn’t get the $200 annual dining credit added to its list of perks during the most recent revamp.

The travel credit on both cards is extremely flexible and easy to use. You can apply it to any flight, hotel, car rental, or vacation package booked through American Express Travel Online or the Platinum Card Travel Service over the phone. It’s basically a $200 head start on your next adventure.

You have to use the credit when you make the booking; it can’t be applied later. Thanks to its versatility, I’d consider this credit as good as cash.

The $200 annual dining credit on the personal Platinum Card on the other hand, isn’t quite as flexible. It’s limited to a curated list of “top restaurants” handpicked by Amex, and spoiler alert—most of them are high-end spots.

For a dinner for two, you’ll likely end up spending more than the credit covers. Still, it’s a nice way to justify the Platinum Card’s annual fee, and when you stack it with the travel credit, you’re looking at an effective net cost of $399.

On the Business Platinum, the $200 annual travel credit makes the annual fee $599 instead of $799.

Now, $399 or $599 may still sound steep for a keeper card, but it’s actually on par with or lower than other top-tier cards. The TD Aeroplan® Visa Infinite* Card, the CIBC Aeroplan Visa Infinite Privilege, and the American Express Aeroplan Reserve Card all have $599 annual fees.

If you value the broad travel perks of the Amex Platinum cards over benefits specifically tailored to Air Canada flights, these cards are clear winners. It’s all about choosing what fits your travel style—global flexibility or airline-specific advantages.

American Express Gold Rewards Card

Think of the American Express Gold Rewards Card as slimmed down version of the Platinum Card.

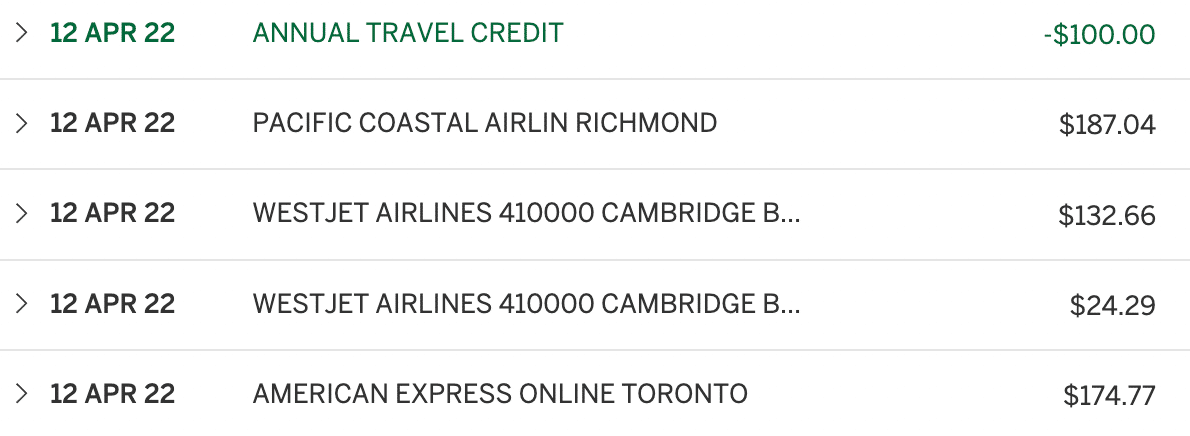

With an annual fee of $250, the Gold Rewards Card is easier on the wallet compared to the Platinum’s $799 annual fee. Add in a $100 annual travel credit, and you’re effectively looking at a $150 cost—a sweet spot that feels reasonable for most.

The annual travel credit can be used in essentially the same way as the Platinum’s. You have to apply it during the booking process on American Express Travel Online.

When you consider the card’s other perks, including four complimentary visits to Plaza Premium Lounges per year and a $50 NEXUS rebate every four years, there’s a decent amount of value to be found at a lower cost than the Platinum Card.

That said, pay attention to your spending habits. If dining out and grocery runs make up a big chunk of your budget, the American Express Cobalt Card might offer better value with five points per dollar spent on food and drinks, compared to the Gold Rewards Card’s two points.

Big 5 Banks: Travel & Lifestyle Credits

Let’s take a look at the travel credits, or lack thereof, offered by Canada’s Big 5.

CIBC

In a similar vein to the Amex Platinum Card, the CIBC Aventura® Visa Infinite Privilege* Card also has a $200 annual travel credit, bringing the card’s annual fee down from $499 to a net cost of $299. However, it’s not quite as flexible as the Amex Platinum or Gold credits.

You can only use this credit by booking through the CIBC Rewards Centre. While you can book flights, hotels, car rentals, vacation packages, and cruises, everything is done using CIBC’s agency rates and booking portals.

That means it’s not always easy to attach your loyalty number to a flight or hotel booking. Unless you can find an agent who’s willing to book a different way, you won’t be able to enjoy your hard earned elite benefits, and you can’t enjoy lower members-only rates that you may find.

While this credit isn’t as versatile as Amex’s, it’s still a reliable annual fee reducer.

Bank of Montreal

BMO takes a slightly different approach with its BMO eclipse Visa Infinite* and BMO eclipse Visa Infinite Privilege* cards. Instead of a travel credit, they offer a “lifestyle credit”, which can be redeemed against literally any purchase.

- The BMO eclipse Visa Infinite* comes with a $50 lifestyle credit, lowering the net annual fee from $120 to $70.

- The BMO eclipse Visa Infinite Privilege* comes with a $200 lifestyle credit, lowering the net annual fee from $499 to $299.

While the flexibility of the lifestyle credit is appealing, the bigger question is whether these cards are worth keeping long-term.

Let’s break it down. The BMO eclipse Visa Infinite Privilege* does offer a few travel perks, such as six complimentary visits to Visa Airport Companion Program lounges.

However, its sibling, the eclipse Visa Infinite*, is practically devoid of any travel benefits. Essentially, you’re paying $70 annually… for nothing.

Even for the eclipse Visa Infinite Privilege* card, the math doesn’t really add up. A net fee of $299 for six lounge passes?

Compare that to the Scotiabank Passport® Visa Infinite*, which costs half as much, also includes six lounge passes, and throws in no foreign transaction fees—a feature that can save you hundreds when travelling abroad.

TD

The TD First Class Travel® Visa Infinite* Card had a makeover in the fall of 2022, with changes to its earning structure, design, and annual fee, as well as the introduction of a travel credit of sorts.

Here’s how it works: the $100 TD Travel Credit is tied to accommodation bookings through Expedia for TD. After spending at least $500 on eligible lodging, you’ll receive a $100 statement credit.

While it’s a step forward for TD in the travel credit arena, the restrictions take away some of the shine. Unlike the straightforward, “use it how you want” credits on other cards, this one is a bit more rigid, making it less appealing for those who value flexibility.

However, the card’s annual fee is a modest $139 and is often waived in the first year. As long as you can take advantage of the travel credit each calendar year, your net fee effectively drops to just $39.

At that price point, it’s hard to argue against the value—especially if you’re already booking accommodations through Expedia for TD.

RBC & Scotiabank

When it comes to annual credits, RBC and Scotiabank are the underperformers among Canada’s Big 5 banks. They don’t offer any annual credits on their credit cards. But here’s the twist: I still consider their cards as keepers, thanks to transferability of RBC Avion points, and flexibility of Scotiabank Scene+ points.

If I’m going to use a card regularly, it needs to earn rewards that I find value in. RBC allows me to transfer their Avion points to British Airways Avios, American Airlines Aadvantage, and Cathay Pacific Asia miles, opening up opportunities to fly in Business or even First Class cabins.

On the other hand, Scotiabank’s Scene+ points offer unparalleled flexibility. I can book travel any way I like and redeem points against those purchases. This means I can book directly with hotels and fully enjoy the perks of the elite status I’ve worked so hard to earn.

For these reasons, I’d much rather keep cards that align with my travel goals than chase partial rebates on products that don’t offer long-term value. Rewards that fit my travel style will always take priority over perks that feel like half-hearted attempts at value.

National Bank: Travel Enhancement Credits

Apart from the Big 5, National Bank World Elite® Mastercard® also offers an annual credit, but it’s a bit of a puzzle to make sense of them.

Rather than a blanket travel credit that can be used for any booking, it offers a travel “enhancement” credit. They can’t be used for flights and hotels in the traditional sense – instead, they’re intended to be used to upgrade your travel experience.

Unfortunately, many of these upgrades are already covered by flying business class or having elite status, so let’s see if we can get value for them anyway.

You get a travel enhancement credit worth up to $150 per year, but it’s restricted to very specific types of expenses:

- Airport parking fees

- Baggage fees

- Seat selection fees

- Airport lounge access fees

- Ticket upgrade fees

Against an annual fee of $150, if you’re able to use all of the credits, you can essentially keep the card year-over-year without an annual fee. For a card that’s already worth keeping for award ticket insurance and emergency medical assistance on trips up to 60 days, eliminating the annual fee makes it a no-brainer.

However, National’s redemption process is quite byzantine. You need to submit an itemized invoice to the rewards department, showing a travel upgrade that was used (not purchased) on a past date.

At a certain point, you have to draw the line for how much effort you’re willing to put in. If it’s too much hassle to redeem the travel credit, or if it can only be used for expenses that don’t really add value for you, is it really worth it?

That said, as mentioned earlier, the award ticket insurance alone makes this card worth keeping. Sometimes, a single standout feature can tip the scales, saving you both money and peace of mind when things don’t go as planned.

US Credit Cards

This is where it gets fun. Annual credits are much, much more abundant on US cards than they are in Canada, with many cards providing more credits to cardholders than the cost of the annual fees.

Here’s a small sample of cards whose annual net costs are lower than they appear (all numbers in US dollars, with some credits distributed in chunks throughout the year):

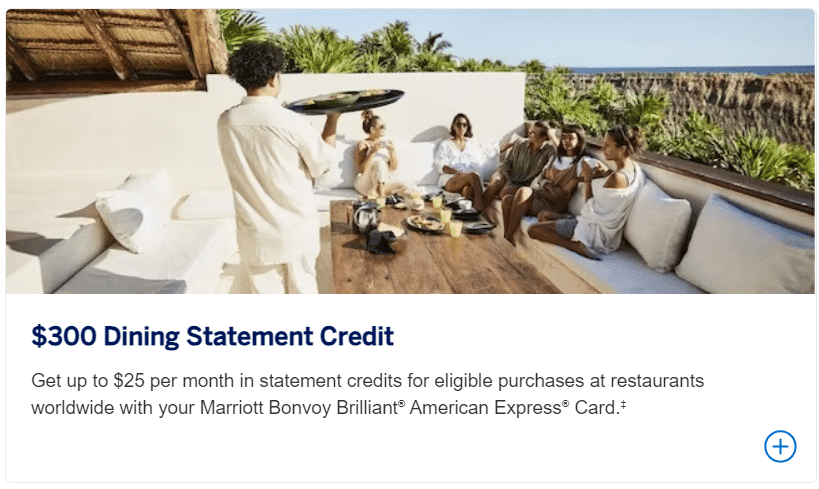

- American Express US Marriott Bonvoy Brilliant Card: $650 annual fee, offset by 12 × $25 monthly dining credits, $100 property credit at The Ritz-Carlton or St. Regis with two night minimum stay, and an anniversary Free Night Award worth 85,000 Bonvoy points (worth $595 as per our Points Valuations)

- American Express US Business Platinum Card: $695 annual fee, offset by a $200 annual airline credit + up to $400 in annual Dell credits + 12 × $10 wireless telephone service credits

- American Express US Hilton Honors Aspire Card: $550 annual fee, offset by 2 × $200 semi-annual Hilton resort credits + $200 flight credit + $100 on-property credit at Waldorf Astoria or Conrad

- American Express US Hilton Honors Surpass Card: $150 annual fee, offset by 4 × $50 quarterly Hilton property credits

- American Express US Platinum Card: $695 fee, offset by $200 airline fee credit + 2 × $50 semi-annual Saks Fifth Avenue credits + $200 hotel credit + 12 × $20 monthly digital entertainment credits + $200 Uber credit

- American Express US Gold Card: $250 fee, offset by 12 × $10 monthly Uber credits + 12 × $10 monthly dining credit at participating restaurants

- Capital One Venture X Rewards: $395, offset by up to $300 in in statement credits for flights, hotels, or rental cars booked through the Capital One Travel portal

- Citi Premier Card: $95 annual fee, offset by a $100 credit on a single hotel stay of $500 or more booked through thankyou.com

- Chase Sapphire Reserve: $550 fee, offset by $300 travel credit

Of course, many of these rebates are only valuable if they suit your lifestyle. There’s no point having the Hilton Aspire card if you don’t have cash expenses at their resorts and with eligible US airlines. But for those who’d benefit, it’s wild to see cards at the most premium tier practically paying you to be a cardholder.

Also, aside from hotels, many of the credits are difficult to use outside of the US. While the Amex US Gold Card offers an excellent 4x earning rate on restaurants around the world, you’d likely have to live in or frequently travel to the US to properly offset the annual fee with cash credits.

Additionally, the airline credits are only for incidental fees.

Keeper cards are a much bigger part of the Miles & Points strategy for Americans. In the US, repeat welcome bonuses are harder to come by, and it’s more important to maintain good relationships with credit card issuers by putting regular spend on your cards.

I think it’s worthwhile for Canadians to take note, as keeper cards and relationship-building are taking on a higher importance here as well. Hopefully we’ll see our banks follow suit and offer more credits as they try not only to gain our business, but also to retain it in a competitive marketplace.

American Express Offers

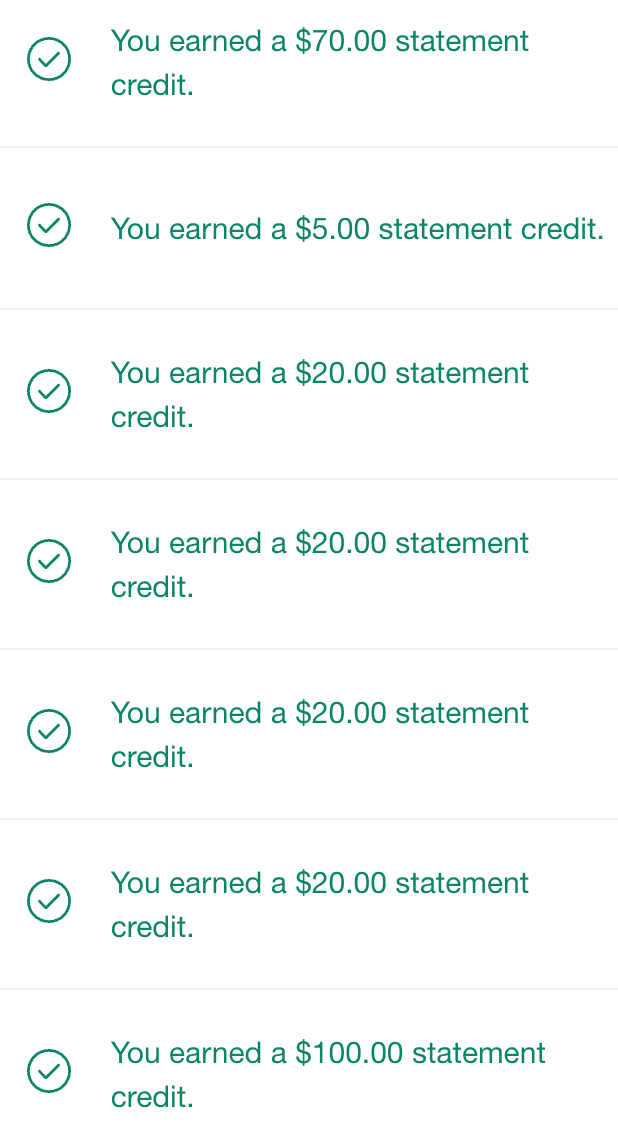

Beyond annual credits, Amex Offers give cardholders (including Scotiabank Amex cardholders) the chance to snag extra rewards points or cash rebates. These ongoing perks make a strong case for keeping Amex cards in your wallet year after year.

I don’t like to bank on guarantees, but some offers are like clockwork. Take the Marriott Offer, for example—it reliably pops up at least once a year and typically delivers a solid $50–$60 rebate per card.

Other offers are less predictable, but usually quite valuable.

More and more, we’re seeing that some banks are less likely to give repeat welcome bonuses, and that they’re more likely to approve you for new cards if you keep your cards long term.

If you can anticipate enough useful offers to offset your annual fee, it might be worth hanging onto a premium card beyond the first year to create a win-win situation for you and the issuer.

Conclusion

The more credit cards I add to my collection, the more I appreciate the value of keeping certain cards long-term. When it’s time to renew and face another annual fee, I always ask myself: Am I getting enough value to make it worth it?

Often, the earn rates and perks justify the cost, but it’s not always an easy comparison against other cards. That’s where annual credits come in—they provide peace of mind and cost certainty, acting as a reliable offset to those fees.

While there are countless other ways to offset costs, like hotel vouchers, companion fares, referral bonuses, bank account rebates, or even just negotiating with the issuer, they can be inconsistent and laborious.

For me, annual credits stand out because of their simplicity and predictability. I know I can count on their value, which makes them a cornerstone of my long-term credit card strategy.

For Amex Hilton Aspire, airline credit comment seems to be outdated. With the recent revamp, It is not limited to US airlines and even airfare is eligible.

Re Amex Platinum $200 travel credit. Do I understand correctly that you are saying we can use the credit (get the credit on our statement) and that if we cancel the booking afterwards, the credit is still applied, not taken back/lost?

National Credit Card. has changed the way you claim your travel credit you don’t need to send in any information just claim a relevant travel charge online and you get paid right away.