Travel insurance is not a fun topic to read about. Reading policies, comparing coverage, combing over the fine print – it’s the least sexy aspect of planning a trip.

Personally, I never leave home without travel insurance. In this post, I’ll explain why. I’ll also arm you with the tips and information you need to pick a travel insurance plan for your next trip so you can travel with confidence, save money, and make the most out of your next adventure.

Why Do You Need Travel Insurance?

As an added expense, travel insurance is something budget travellers are wary of. After all, why should you pay hundreds of dollars (or more) for something you might not even use?

Indeed, it’s a question I get asked a lot.

“Do I actually need travel insurance? Chances are nothing will happen, so why should I even bother?”

While it’s a fair question, I can tell you from experience that travellers who don’t buy travel insurance instantly regret that decision the minute something goes wrong.

And, just like at home, things can go wrong while you’re travelling.

Lost luggage, delayed flights, broken bones, natural disasters – I’ve seen it all. I’ve even been mugged while travelling.

And while it’s not fun to think about things going wrong as you plan your dream getaway, it’s important to be realistic.

Travel insurance is a safety net that protects you in an emergency. While unexpected incidents are rare, they happen to travellers more often that you think.

In 2022 alone, over 20% of flights were delayed and hundreds of thousands of flights were cancelled. While seemingly minor compared to, say, a broken limb, delayed and cancelled flights can mean missed connections, missed tours and excursions, and ruined vacations.

In addition to countless delayed and cancelled flights, I’ve relied on my travel insurance to help me when my luggage was lost, when my brand-new camera was broken in Italy, and when I needed medical attention. Maybe I’m a bit unlucky, but this has happened several times over the years, including when I popped my eardrum in Thailand.

Each and every time, travel insurance was there to help me navigate the situation, and to ensure I was compensated for my expenses.

Lost or stolen gear can cost thousands of dollars to replace. Medical emergencies can cost tens of thousands in hospital bills, and emergency evacuations can cost upwards of $250,000 USD!

While I never leave home without travel insurance, I know travellers who have. And they instantly regretted it, having been forced to pay thousands of dollars out of pocket for unexpected medical expenses.

Don’t make that same mistake. For just a couple bucks a day, you can travel worry free, knowing that you’re protected from the high costs of unexpected medical bills.

To me, it’s well worth the price.

1. Know What to Look For in a Policy

Now that you know why you need insurance, it’s time to compare policies and prices. Not all insurance companies are created equally, as some offer robust coverage while others provide the bare minimum.

To help you find a plan that suits your needs and budget, here’s what I look for when buying an insurance plan:

- 24/7 emergency assistance via telephone

- Coverage for injuries and illnesses (at least $100,000 USD)

- Coverage for all the destinations you plan on visiting

- Some gear/electronic coverage (at least $500 USD per item)

- Coverage for lost or stolen goods (baggage, jewelry, etc.)

- Coverage for delays and cancellations

- Evacuation coverage for civil unrest, natural disasters, and injuries

- Car rental coverage (if you’re renting a vehicle during your trip)

- Trip cancellation and interruption coverage

- Compensation for death and dismemberment

- Ability to submit claims online and receive reimbursement direct to your bank (and not by cheque)

- Ability to extend your policy online while travelling

When looking for a policy, make sure you have at least $100,000 USD in emergency medical coverage. While that seems like a lot, the last thing you want is to blow through your coverage in an emergency and then have to foot the bill yourself while you’re still in the hospital.

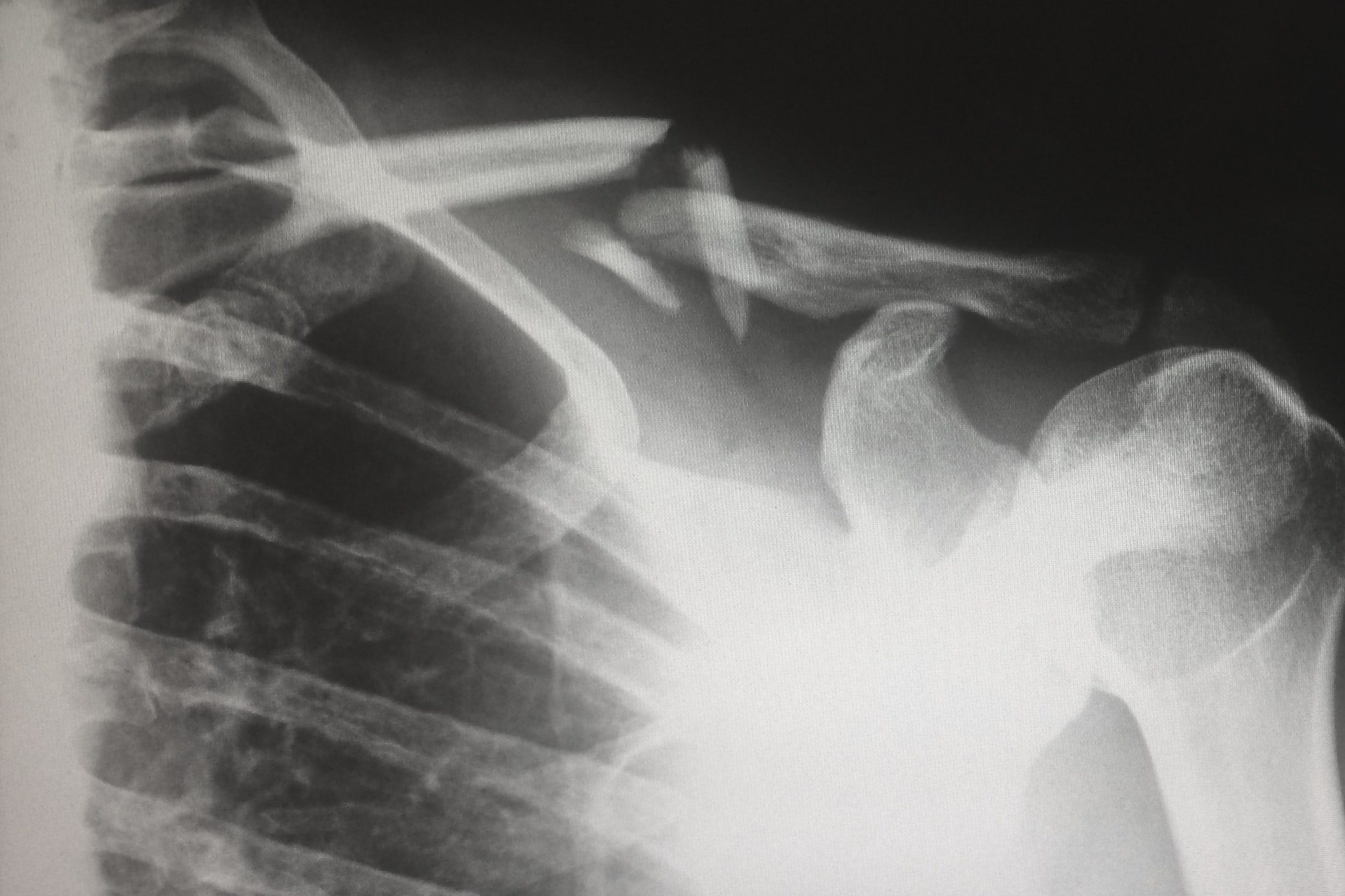

Broken bones alone can cost $10,000 USD or more. Don’t cheap out on a plan with just $25,000 USD in coverage – make sure you have at least $100,000 USD.

For evacuation coverage, aim for at least $300,000 USD. Emergency evacuations due to natural disasters or political upheaval (not to mention medical emergencies that require you to fly home) aren’t cheap, costing between $200,000–300,000 USD alone!

When comparing plans, you’ll notice that some companies primarily focus on covering unexpected medical costs (such as Safety Wing), while others offer more comprehensive coverage (such as World Nomads).

While it’s important to know what’s covered, it’s also important to learn what’s not covered by each policy.

2. Find Out What Isn’t Covered

While every insurance policy is different, there are some standard events and activities that usually aren’t covered. These generally include:

- Injuries sustained while intoxicated

- Anything related to pre-existing conditions (some plans do have coverage for pre-existing conditions, but they are few and far between)

- Most adrenaline activities (skydiving, bungee jumping, etc.)

- Hikes above a certain altitude (think Mount Kilimanjaro, Everest Base Camp)

- Gear (most policies cap reimbursement for items like phones and computers at $500 USD per item)

- Evacuation due to civil unrest, if your government has not called for an evacuation

- Lost or stolen cash

- Lost or stolen personal items due to negligence on your part (such as leaving bags unattended)

While you can find plans that cover some of these, most insurance policies (especially budget policies) generally don’t cover all of them.

With this in mind, many companies have upgrades or multiple tiers available to include coverage for adrenaline activities, coverage for gear, and coverage for pre-existing conditions.

If you plan on taking part in adventure sports or high-altitude climbing or hiking, make sure the policy explicitly mentions that it is included. If it doesn’t, call the insurance company to ensure that you’ll be covered.

3. Make Sure Your Policy Has COVID-19 Coverage

Many insurance companies have adapted to our new reality and now provide varying degrees of coverage for COVID-19 (and other pandemics). Whether it’s coverage for cancellations, quarantine, hospitalization, or treatment if you’ve contracted COVID-19, there are plenty of plans and policies out there now for travellers concerned about getting COVID-19 during their trip.

Some companies that offer COVID-19 coverage include:

As always, make sure to read the fine print regarding pandemics and COVID-19, as the industry is still in flux. If you have questions, call the company and ask so you get the most up-to-date and accurate information.

4. Compare Companies

Now that you know why you need insurance, what to look for in a plan, and what’s not included, it’s time to start comparing companies to find a policy that suits your needs and budget.

I’ve been buying travel insurance for over 14 years and writing about the industry for over a decade. In that time, I’ve read countless reviews, tested numerous companies, and talked to thousands of travellers about their experiences.

Here are the companies I suggest you consider when you’re looking for travel insurance.

SafetyWing is the company I recommend the most because it’s super affordable and covers all the basics. They are the best choice for backpackers and long-term travellers on a budget.

You can read my detailed SafetyWing review if you want to learn more about their coverage.

IMGlobal has a tonne of different plans and policies, ranging from budget-friendly to extremely comprehensive (with a price tag to match). If you’re looking for coverage more akin to health insurance, start here.

For more comprehensive coverage, pick World Nomads. They have two tiers of plans that are great for budget and mid-range travellers who want additional coverage for activities and gear, as well as cancellations and delays.

You can read my comprehensive World Nomads review if you want to learn more about what’s covered.

Insured Nomads has plans similar in coverage and price to World Nomads; however, they also have comprehensive plans for digital nomads. This includes both emergency coverage and non-emergency coverage, which is similar to your health plan back home, including mental health coverage and telehealth options.

While not cheap, if you’re working and travelling, you’ll likely want something more in-depth than standard travel insurance.

Medjet is a membership program that provides no-questions-asked medical transport to the hospital of your choice should something happen. Most travel insurance companies don’t guarantee you’ll be sent home in an emergency, and usually just send you to the nearest “acceptable” facility. Medjet ensures you get home.

Read my in-depth Medjet review if you want to learn more.

One thing to remember when researching travel insurance companies is that you should take reviews you read online with a grain of salt. People are much more likely to write a negative review than a positive one.

Remember, travel insurance companies are for-profit companies: they aren’t offering to cover you during your trip out of the goodness of their hearts. They’re in it because it’s a billion-dollar industry, so be sure to read the policy and review the claims process before you purchase.

5. Review the Claims Process

As you research policies, read up on the claims process for your prospective travel insurance companies to make sure you understand what is required and expected should you need to make a claim.

While the exact claims processes are different for every company, there are a few quick tips worth knowing that apply to every traveler.

- Call the insurance company right away and let them know you’re making a claim. They can walk you through the specific next steps.

- Keep copies of all your important documents in your email. Plane tickets, accommodation receipts, excursion receipts, receipts for any big-ticket items you’re bringing with you (laptop, phone, etc.), and a copy of your passport should all be digitized so you can easily submit them for a claim if necessary. That way if you lose your phone or laptop, you can still access the copies.

- Take photos of your luggage and packed items before you go. If your backpack/suitcase is lost or stolen, you’ll have photographic proof of what was in it.

- Document everything. If your luggage is lost by an airline, keep all correspondence from them. If you visit the hospital, make sure you get documentation and receipts. Insurance companies only pay out claims when you follow their instructions to the letter. That means obtaining documentation for every little incident along the way.

- If your claim is taking longer than expected, follow up. Sometimes more information is needed or things get lost in the mix.

- If your claim is rejected, ask why. Sometimes it’s just a matter of missing information or documents so don’t hesitate to politely (but firmly) ask for a second evaluation.

6. Other Tips & Suggestions

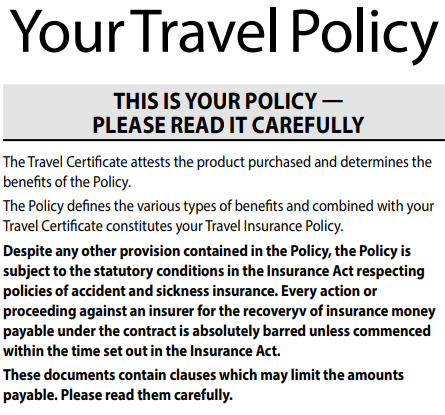

Always read the fine print. Most insurance companies provide quotes online and have a simple breakdown of what’s covered, usually in a chart or brochure that explains the basics.

While that info is helpful for getting started, you’ll want to read the actual policy before you buy a plan just to make sure you fully understand what’s included. More often than not, when someone emails me complaining about their insurance company, it’s because they didn’t read the entire policy.

Don’t make that same mistake – always read the fine print before you purchase a plan.

Save your insurance company’s contact number. Every insurance company has an emergency hotline you can call should something happen.

Save that number in your phone and share it with your family. That way, you won’t have to waste time in an emergency looking for a number and can contact the company right away.

Buy your insurance right away. Once you’ve booked your flight, buy your insurance plan.

Trip cancellation benefits usually kicks in right when you buy your plan, so purchase your insurance the minute you start paying deposits and/or buying flights. The extra coverage will come in handy if you need to delay or cancel your trip.

Conclusion

Nobody wants to think about their trip getting ruined or getting injured abroad. But after over fifteen years travelling the world, I’ve seen first-hand just how important it can be.

From minor incidents like delayed flights to serious injuries like broken limbs, you just never know what’s going to happen once you get on the road. That’s why I never leave home without travel insurance, and neither should you.

Good advice . This year, I found TD Banks travel insurance very competitive. With the lowest rate for the same coverage, compare to BCAA, Manulife,and other biggies… Check it out, login to your TD account, click the Other Products/ insurance/ Travel insurance…. You can get an instant quote online in a couple minutes… While I haven’t filed any claims (god bless…), I think as a big good reputation bank, it should be Ok..

Also, compare with your own banks, RBC, Scotia, CIBC, etc,. Also BCAA, Manulife, etc etc

Also, check out their Annual Multi Trips plan. I found it very reasonable and subscribed to their multi trip plan, as I’ve booked more than 5 long haul trips within the next 10 months, so make sense to get this multi trip plan. It also cover short trips to USA, …. Good for Canadians travel abroad and to the USA frequently.

Insurance is necessary for events that could bankrupt you. That means out of country medical insurance! For everything else, just pay out of pocket i.e. extra hotel night/cancellation fees/lost baggage, etc., etc.

Surprised credit card insurance and how it fits in wasn’t part of this piece.

My claims from RBC, all processed in good faith and paid promptly, were from RBC credit cards with medical. I did not use the cards to pay for any portion of the trip, nor did I use them to pay for any portion of the medical charges.

Agreed, it’s odd nothing about credit card insurance, considering all the credit card content on this site.

Yes, I second this. Would like to see how cc insurance compares to the listed providers in this article.

Excellent advice. I’ve had very good claims experience with RBC insurance, when I’ve filed claims with them multiple times, including an ear problem in Thailand! (Thailand is very hard on the ears I guess LOL). RBC reimbursed me quickly (I paid medical expenses myself with credit cards) once I submitted all relevant documents. In one case, the cheque was in my mailbox when I returned from the trip! For me, claims experience is the important differentiator between competing insurance offerings. I would only change companies after learning how they behave towards a claimant.