If you use credit cards to earn rewards (as you should), you’ll quickly notice that focusing on welcome bonuses is the way to go. You’ll rack up big balances of points very easily that way, much more quickly than you would from ongoing spending.

Once you’ve dialled in your rhythm of opening new credit cards, eventually you’re bound to find yourself in a bizarre situation: what do you do when you’re not spending towards a welcome bonus?

Optimizing every dollar spent towards a welcome bonus isn’t always realistic, and in some cases it may even be inadvisable. Let’s take a look at some situations when you might decide not to spend towards a welcome bonus, and what to do when you might not be able to.

Welcome Bonuses Reign Supreme

If you’ve been around Miles & Points for a while, this should be a self-evident truth, but let’s briefly break down why good welcome bonuses will always be the most efficient way to maximize your Return on Spend.

Suppose the welcome bonus on a credit card offers 20,000 points for new signups: 10,000 points upon first purchase, and an additional 10,000 points upon spending $1,000 in the first three months.

You’d effectively get 20 points per dollar spent until you reach the welcome bonus spending threshold.

If you exclude the first “freebie” 10,000 points and only consider the second portion of the bonus, the latter 10,000 points with a spending requirement, you’d still earn 10 points per dollar spent.

Compare this to a standard earning rate of 1 point per dollar spent, or maybe 1.5 points per dollar spent on select categories, and it’s no contest. It doesn’t take any fancy math to see that once you’ve met the welcome bonus conditions, you’re better off shelving the card and turning your efforts to a new card with a new welcome bonus.

However, although worthwhile welcome bonuses are usually the optimal way to earn points, you might prefer to use a different card with a higher category earning rate anyway.

For example, even when I’m working towards a minimum spending requirement, sometimes I still use my American Express Cobalt Card or my American Express US Gold Card for their overpowered earning rates on groceries (5 Amex MR points per dollar spent) and restaurants (4 Amex US MR points per US dollar spent), respectively.

Of course, this only makes sense if you’re confident that you’ll be able to meet the new card’s spending threshold in other ways. I relentlessly lean on my new cards for other purchases, and always for uncategorized spend, but for my high-spend categories with high earn rates, I’m inclined to use other cards with a distinct advantage in those areas whenever possible.

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

Up to 70,000 BMO Rewards points

First Year Free

|

Up to 70,000 BMO Rewards points | $549 | Apply Now |

|

10% cash back

First Year Free

|

10% cash back | $480 | Apply Now |

|

45,000 Scene+ points

$120 annual fee

|

45,000 Scene+ points | $405 | Apply Now |

| 15,000 MR points | $372 | Apply Now | |

|

30,000 MBNA Rewards points30,000 MBNA Rewards points†

$120 annual fee

|

30,000 MBNA Rewards points30,000 MBNA Rewards points† | $200 | Apply Now |

|

$150 annual fee

$150 annual fee

|

$150 annual fee | $0 | Apply Now |

|

Up to 4% cash back

$100 annual fee

|

Up to 4% cash back | $0 | Apply Now |

Limitations on Opening New Credit Cards

Unfortunately, it’s not always quite as simple as just moving onto the next welcome bonus. We can’t have it all, and sooner or later, you’ll run out of worthwhile offers to apply for.

As you measure which offers you want to pursue, it’s essential to rule out offers that you won’t be able to achieve. If you’re a low spender, you’ll want to maximize your Return on Spend. If you have limited capital to invest in annual fees, you’ll want to maximize your Return on Fees.

Inevitably, whether or not those constraints are a challenge for you, everyone will want to maximize Net Gain. You’ll never be approved for every single credit card, and you can’t reapply for the same products as often as you may wish.

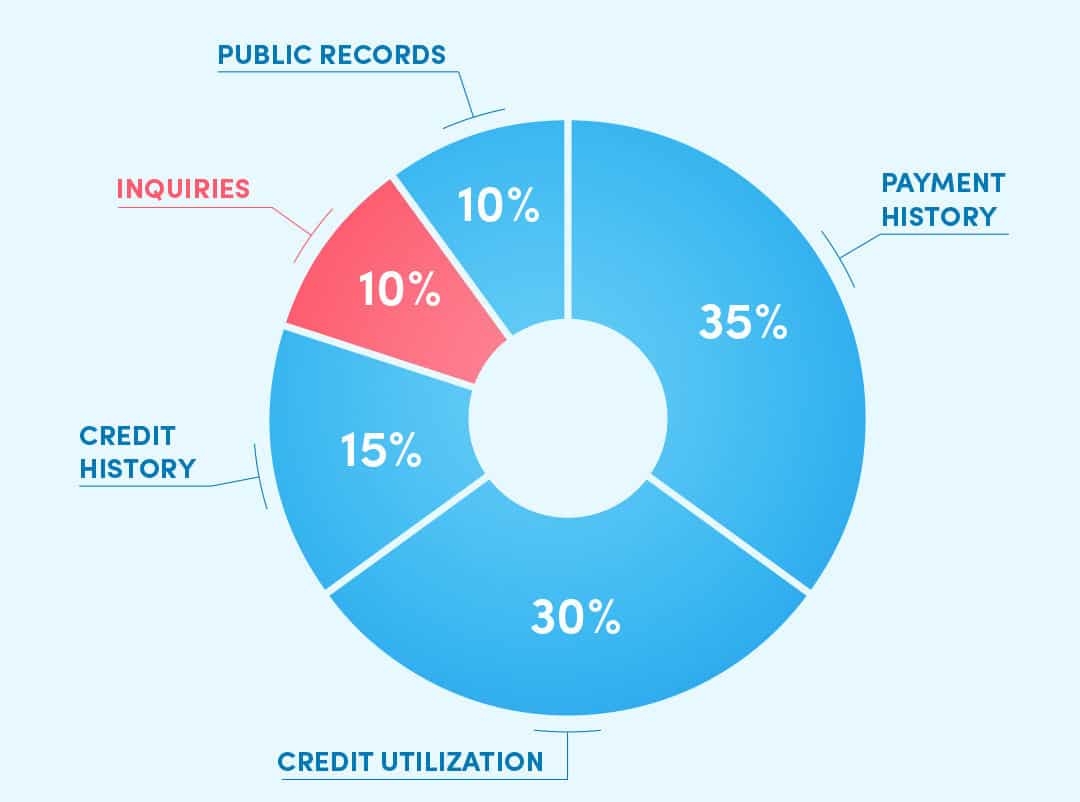

Good bonuses come and go, but credit inquiries and new accounts stick around for a while. I prefer to keep my credit-seeking behaviour down — instead of burning hard credit pulls chasing low-value offers, I’d rather be in a good position to nab as many signup bonuses as I can when there’s a glut of good offers on the market.

I also think it’s important to prioritize the offers that fit your goals. For instance, even though the Air Miles credit cards offer good value on paper, it’s not a program that I actively collect these days.

When I run out of other cards to apply for, sometimes I’d rather earn more Aeroplan points the “slow way” on everyday spending, and not chase yet another rewards program the “fast way” via welcome bonuses. After all, in this complex game we play, there’s value in simplicity.

When I’m in between welcome bonuses (whether waiting for my credit file to cool down, waiting for a new card to arrive, or waiting for the available offers to improve), there’s nothing wrong with a brief top-up for a program of need, even at a low earning rate. I do think it’s good to maximize category bonuses first, but for uncategorized purchases, you can just pick whichever rewards program you like best.

In particular, I prioritize earning transferable rewards currencies like Amex Membership Rewards or RBC Avion for their flexibility and high value, especially using my Amex Business Platinum for the 1.25x earning rate on all purchases.

Maintaining Long-Term Insurance Benefits

For most credit cards, the bulk of their value comes in the first year, thanks to the welcome bonus. In subsequent years, cards that give you more value than the cost of the annual fee are the exception, not the norm.

If you open a credit card primarily for the welcome bonus, you may decide not to keep the card for the second year. If that’s the case, you’ll lose any benefits associated with the card.

That means that if you’re relying on credit card insurance for any long-term purchases, you might want to make the purchase with a card that you expect you’ll keep open for the duration of the period for which you require coverage.

For example, it’s often necessary to book an award flight quite far in advance, especially if you need very specific dates, routes, and seats. If you use your credit card for coverage like trip cancellation or common carrier accident insurance, you should use a card that not only extends insurance to award tickets, but also one that you intend to keep open until you’ve returned from your trip.

Also, if you’re buying a new home appliance, you might want to use a keeper card for an extra year or two of extended warranty. Similarly, if you buy a new phone with a card that offers two years of mobile device protection, that insurance does you no good in the second year if you don’t keep the card long-term.

This presents a bit of a dilemma.

Big one-off purchases like these are a great way to put a significant dent into a large spending requirement. However, the cards with the highest spending requirements tend to have the highest annual fees, and therefore are among the least likely cards that you’ll keep for the second year and beyond.

Especially if you’re normally quite frugal, but want to capitalize when a rare opportunity for a larger spend arises, these sorts of purchases might be the only way for you to meet prohibitively high thresholds like what’s usually required of the Business Platinum Card from American Express.

In that case, you’d have to weigh the value of a welcome bonus which would usually be out of reach, versus the value of the insurance benefits of using a lower-fee keeper card already in your wallet.

It’s a bit simpler when you’re picking a card for spending while between welcome bonuses — you can throw your purchases on any card with high earning rates, whether you plan on keeping the card long-term or not. But when it comes to insurance, it’s prudent to be a bit selective about which cards you use.

Among cards with good insurance benefits, it’s good to designate one or two keepers. For those cards, I’d be looking for two key features: low annual fees, and cards that you don’t intend to cancel.

For travel insurance on award tickets, we often recommend Aeroplan credit cards (for Aeroplan tickets only), or the National Bank World Elite Mastercard.

As a keeper card, I’d favour the National Bank World Elite Mastercard. You’ll be covered for insurance for award bookings from any loyalty program, and it offers enough annual credits to offset the annual fee.

For mobile device insurance, there are a number of credit cards with no annual fee that offer coverage.

Credit cards from Tangerine or Brim are a decent choice for mobile device purchases, since there’s no long-term cost involved with keeping the cards around.

Conclusion

As much as we’d like to optimize our rewards game, it’s never possible to ensure that every single dollar we spend will earn rewards in the most efficient way possible. While we can measure our mileage earnings to maximize our points to the best of our ability, we’ll never quite get all the way there, and it’s important to know how to effectively fill in the gaps when we’re not able to work towards a welcome bonus.

For the times when it doesn’t make sense to squeeze every last drop, it’s still useful to be mindful of category earning rates and our preferred rewards programs. It’s also important to stay on top of which cards you want to keep long-term, and how you can use them to your benefit for purchases where insurance considerations may outweigh the rewards.

If you’re not sure whether the next welcome bonus is worth it, I invite you to play around with our Credit Cards comparison tool. Set some parameters which might limit you, like your maximum spend, maximum fees, preferred rewards, and income. If you don’t find any cards with a welcome bonus which you deem to be worth a credit inquiry, maybe it’s time to stick to everyday earning rates for a bit.

Precisaria viajar pra solucionar os problemas de finanças porque aqui não sei aonde está esse dinheiro se estiver em corretoras são 5 só vou investir em 2 e o resto do dinheiro vai pra montar um negócio e pagar as dividas e ir ai

Thank you for a nice, detailed post!

When I was living in the south (US obviously), I often used The Points Guy app on my phone to tell me which card to use at which place, based on the credit cards I’m having. For example, I have AmEx Cobalt and CIBC Aeroplan Infinite, and I’m going to Sobeys, then the app will tell me to use AmEx Cobalt. If I’m going to Shell for some gas, the app will tell me to use CIBC Aeroplan. Now I have to do that calculation in my head 🙂

Another thing I want to add is don’t be too sad if we didn’t pick the most optimized card for a big purchase like I used AmEx Gold to buy a new laptop instead of AmEx Biz Plat. We can always earn more in the future.

Definitely agree that there are diminishing returns to excessive optimization. 1x MR vs 1.25x MR for a single purchase isn’t a huge deal when the bulk of your points earnings come in larger chunks from welcome bonuses.

Spot on. Nice post 👌