American Express US Membership Rewards (MR) is one of the most popular points currencies available. There are a number of excellent US-issued credit cards for earning MR points through welcome bonuses and daily spending, making it relatively easy to rack up points.

In addition to earning, there are a number of excellent ways to redeem MR points for luxury travel, statement credits, and more.

To be clear, on this page, we’re referring to American Express Membership Rewards earned through US-issued credit cards. If you’re looking for Canadian American Express Membership Rewards, be sure to check out our separate page for relevant information.

Earning American Express US Membership Rewards

American Express MR points can be earned in a number of ways, and we’ll explore each in turn.

Welcome Bonuses

Generally speaking, welcome bonuses are the best way to quickly rack up points from any issuer, and earning American Express MR points this way is no exception. In fact, American Express is known for being the most generous bank when it comes to signup bonuses, so if you’re able to be approved for a card and meet the minimum spending requirements, you’re in for a treat.

American Express has a number of credit cards with high welcome bonuses for both personal and business credit cards.

The full list of publicly available personal credit cards is as follows:

- American Express Platinum Card

- American Express Gold Card

- American Express Green Card

- American Express EveryDay Credit Card

- American Express EveryDay Preferred Credit Card

The full list of publicly available business credit cards is as follows:

- American Express Business Platinum Card

- American Express Business Gold Card

- American Express Business Green Rewards Card

- American Express Blue Business Plus Credit Card

On the personal side, American Express’s flagship Platinum Card tends to come with the highest signup bonus. We’ve seen offers reach up to 150,000 MR points, and while the card commands a high $695 (USD) annual fee, it’s offset by a multitude of benefits and available statement credits.

Note that there’s also the American Express Platinum Card for Schwab, and the American Express Platinum Card for Morgan Stanley. Both cards require you to have an eligible account with the respective banks before you’re allowed to apply, and have benefits that are almost identical to the Platinum Card, albeit with welcome bonuses that tend to range from 60,000–100,000 MR points.

The American Express Gold Card is a step down from the Platinum Card. It comes with a lower $250 (USD) annual fee, as well as a lowered welcome bonus which has been as high as 90,000 MR points.

The American Express Green Card is the base-level card of the three Platinum, Gold, and Green card lineup. The signup bonus goes as high as 50,000 MR points, and comes with a very reasonable $150 (USD) annual fee.

Rounding up the personal publicly available credit cards that earn MR points are the American Express EveryDay Credit Card and the American Express EveryDay Preferred Credit Card.

The EveryDay Card comes with no annual fee, and a signup bonus that has gone as high as 25,000 MR points. On the other hand, the EveryDay Preferred Card has a $95 (USD) annual fee, and a signup bonus that can reach up to 30,000 MR points.

In addition to the publicly available American Express personal cards, there’s also the Centurion Card and the Goldman Sachs Platinum Card. Both cards are significantly harder to get approved for, and the welcome bonuses and benefits aren’t publicly advertised.

Similar to the American Express personal cards, the best business card for earning MR points is the Business Platinum Card by American Express.

In the past there have been targeted promotions offered to high-spending individuals that have reached up to a staggering 250,000 MR points; however, the highest publicly available offer has been for 150,000 MR points. As a premium card, the annual fee is $695 (USD), but it also comes with a variety of benefits and statement credits that can easily make up for the hefty annual fee.

The American Express Business Gold Card has a $295 (USD) annual fee. Similar to the Business Platinum Card, there are sometimes targeted offers available with much higher signup bonuses, but the public offer hovers around 50,000–90,000 MR points.

The American Express Business Green Card has a lower $95 (USD) annual fee, and a fairly consistent signup bonus of 25,000 MR points.

Lastly, the American Express Blue Business Plus Credit Card has a $0 annual fee, and a public signup bonus that’s been as high as 15,000 MR points in recent years, with targeted offers going as high as 50,000 MR points.

Credit Card Spending

After meeting a minimum spending requirement in order to earn your signup bonus, you can continue to earn MR points through everyday spending.

The amount of MR points you’ll earn depends on the card you’re using, what category your purchase falls in, and in some cases, how much you spend.

The earning rates on US-issued American Express credit cards that earn MR points are as follows:

- American Express Platinum Card

- 5 MR points per dollar spent on flights purchased directly from airlines or through amextravel.com

- 5 MR points per dollar spent on prepaid hotels through amextravel.com

- 1 MR point per dollar spent on everything else

- American Express Gold Card

- 4 MR points per dollar spent at restaurants worldwide, takeout and delivery in the US

- 4 MR points per dollar spent at US supermarkets, up to an annual maximum of $25,000 (USD)

- 3 MR points per dollar spent on flights purchased directly from airlines or through amextravel.com

- 1 MR point per dollar spent on everything else

- American Express Green Card

- 3 MR points per dollar spent at restaurants worldwide

- 3 MR points per dollar spent on travel worldwide, including airfare, hotels, cruises, car rentals, transit, and third-party travel sites.

- 1 MR point per dollar spent on everything else

- American Express EveryDay Credit Card

- 2 MR point per dollar spent at US supermarkets, to an annual maximum of $6,000 (USD)

- 1 MR point per dollar spent on everything else

- An additional 20% bonus if you make 20 or more transactions each billing cycle (2.4 MR points per dollar spent at US supermarkets and 1.2 MR points per dollar spent on everything else)

- American Express EveryDay Preferred Credit Card

- 3 MR points per dollar spent at US supermarkets, up to an annual maximum of $6,000 (USD)

- 2 MR points per dollar spent at US gas stations

- 1 MR point per dollar spent on everything else

- An additional 50% bonus if you make 30 or more transactions each billing cycle (4.5 MR points per dollar spent at US supermarkets, 3 MR points per dollar spent at US gas stations, and 1.5 MR points per dollar spent on everything else)

As we can see, the earning rates on the personal cards vary widely. If you’re someone who tends to make a lot of travel purchases, then either the Platinum Card would give you the best rate of return; however, you’d want to make sure you’re earning enough points to justify the annual fee each year.

Otherwise, we see elevated earning rates on many everyday essentials, such as groceries, restaurants, and travel.

An interesting concept is seen on the two EveryDay cards, which offer elevated earning rates if you make a minimum number of transactions each month. In particular, the EveryDay Preferred Credit Card gives an outstanding 4.5 MR points per dollar spent at supermarkets, which can really add up quickly.

The earning rates for US-issued American Express business cards is as follows:

- American Express Business Platinum Card

- 5 MR points per dollar spent on prepaid hotels and flights booked through amextravel.com

- 1.5 MR points per dollar spent on purchases at US construction material and hardware suppliers, electronic goods retailers, software and cloud system providers, and shipping providers, up to $2,000,000 (USD) each year

- 1.5 MR points per dollar spent on all purchases of $5,000 (USD) or more, up to $2,000,000 (USD) each year

- 1 MR point per dollar spent on everything else

- American Express Business Gold Card

- 4 MR points per dollar spent on the two highest spending categories out of the following categories, up to $150,000 (USD) each calendar year:

- Airfare purchased directly from airlines

- Advertising in select US media outlets (online, TV, radio)

- Direct purchases made directly from select US technology providers of computer hardware, software, and cloud solutions

- US gas stations and restaurants (including takeout and delivery)

- US shipping

- 1 MR point per dollar spent on everything else

- 4 MR points per dollar spent on the two highest spending categories out of the following categories, up to $150,000 (USD) each calendar year:

- American Express Business Green Rewards Card

- 2 MR points per dollar spent on prepaid hotels and flights booked through amextravel.com

- 1 MR point per dollar spent on everything else

- American Express Blue Business Plus Credit Card

- 2 MR points per dollar spent on the first $50,000 (USD) of purchases per calendar year

- 1 MR point per dollar spent on everything else

The earning rates for the business credit cards are also varied, so be sure to take a look of your general spending habits to best suit your needs.

We also see a range of caps on elevated earning rates, which could be a factor to consider if your business puts through large volumes each year.

Refer-a-Friend Bonuses

Another great way to collect American Express MR points is through American Express’s refer-a-friend program.

If you have an American Express card, you can send a friend or family member a unique link for them to apply for the same card, or another card within the same card family.

The amount of MR points you can earn depends on the card you are referring from. There’s a limit to how many MR points you can earn per calendar year, which also changes depending on the card you are referring from.

You can see your referral options, as well as how many MR points you’ll get per referral by logging into your account and looking at each card.

Earning American Express US Membership Rewards through Credit Card Upgrades

American Express allows upgrades or downgrades between the three personal Platinum, Gold, and Green cards, the two personal Everyday and Everyday Preferred cards, and the three business Platinum, Gold, and Green cards.

In fact, American Express may give you MR points as an incentive to upgrade from a lower-tiered card to a higher one. Upgrades are targeted and will depend on a number of factors.

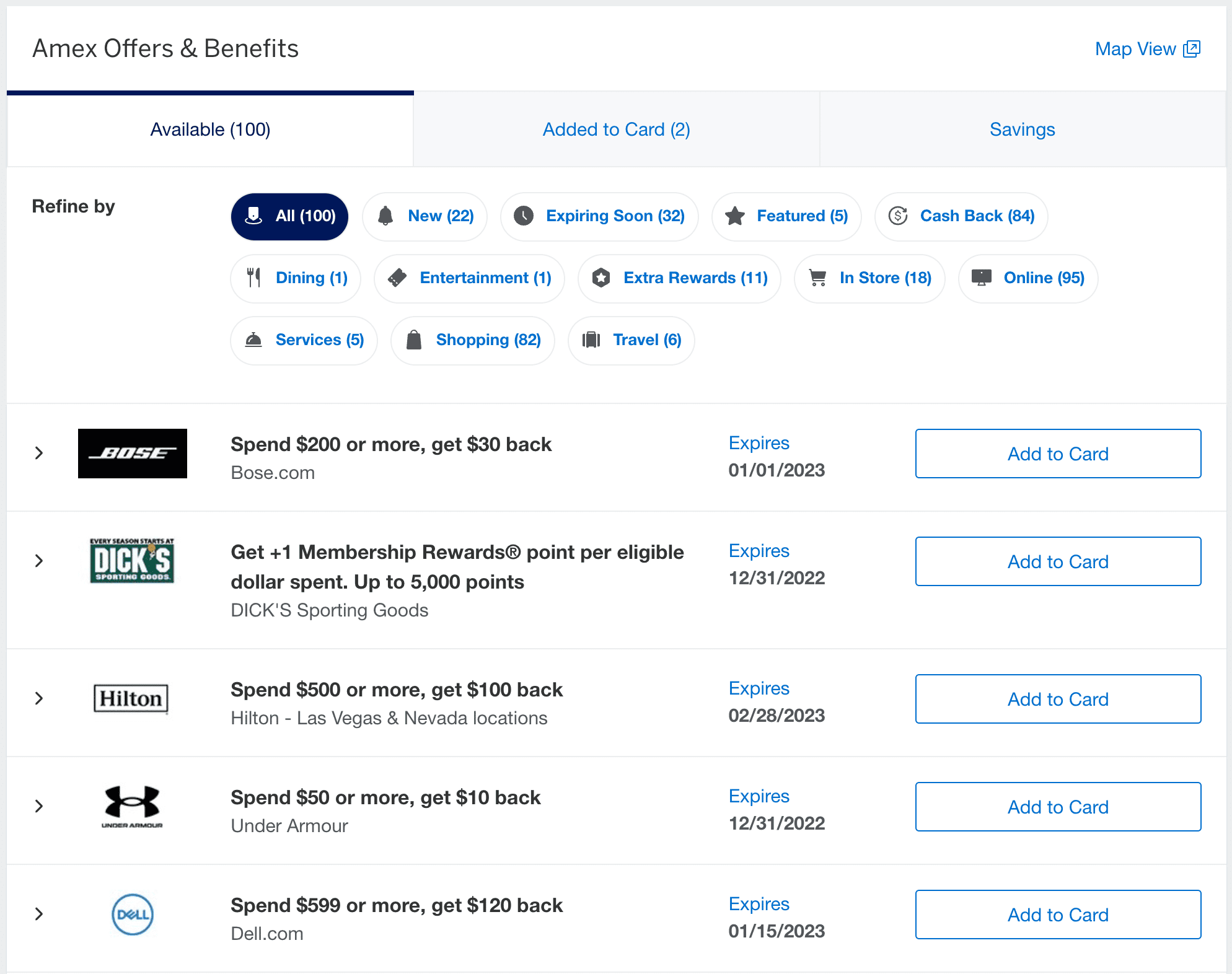

Amex Offers

Every American Express card comes with rotating promotions called “Amex Offers”. A large majority of Amex Offers provide statement credits; however, you can always find a few that offer MR points.

Some of these Amex Offers will earn you extra MR points per dollar spent, while others will hand out a bulk of points at one time after you hit a larger spending threshold at specific stores or businesses.

In order to be eligible for Amex Offers, you’ll have to add that offer to your card and then meet the specific requirements set out for that offer before the offer expires.

You can also only add one specific Amex Offer per card, so if you have multiple cards that earn MR points, you’ll want to be strategic about which card you add the offer to.

Supplementary Cardholders

Adding an authorized user to your account means that you can get another credit card in someone else’s name that they can use when you’re not with them.

This can be a great way to rack up more MR points, as your authorized user will be earn MR points for you on their own day-to-day spending. Of course, you’ll still be responsible for the bill at the end of the month, so you’ll only want to do this with a family member or someone else whom you trust.

What’s more, American Express has often run promotions in which authorized users earn extra MR points on qualifying spending, up to a maximum amount of MR points.

Some cards, like the personal Gold Card, allow you to add up to five authorized users for free. Adding supplementary users on other cards, such as the Platinum Card or Business Platinum Card, comes with with extra annual fees of $175 (USD) and $300 (USD), respectively.

Along with a greater earning potential on daily spending, cardholders can also take part in the card benefits, so the extra annual fees may certainly be worth it for the right person.

Rakuten

Rakuten, formerly known as Ebates, is a cash back site that allows you to earn money when you shop online through a dedicated shopping portal.

If you have a card that earns MR points, you can choose to get paid out in MR points rather than cash. For every 1% cash back you could earn, you’ll instead earn 1 MR point.

This can quickly add up, as there are often promotions during which you can earn as many as 10 MR points per dollar spent, which comes on top of the credit card points you’ll earn with the card you use to make the purchase.

You’ll want to pay attention to the fine print for the specific store you intend to shop from to make sure your purchase is eligible for the MR points.

Redeeming American Express US Membership Rewards

With so many options to earn points, you might find out that earning American Express MR points is actually the easy part. Deciding how to redeem your points for the best value possible can be a bit more challenging.

Fortunately, American Express provides quite a few options for redeeming MR points, which is indeed one of the strengths of the program. You’ll want to acquaint yourself with all the available options, though, to ensure you’re getting the best bang for your buck.

Transferring American Express US Membership Rewards to Travel Partners

You’ll almost always get the most value out of your MR points by transferring them to one of American Express’s many travel partners, and then booking flights or hotels from there.

In sum, there are 18 airlines and three hotel partners you’re able to transfer to.

The full list of airline partners, as well as the corresponding ratios and transfer times, is as follows:

- Airlines

- Aer Lingus Avios (1:1, instant)

- AeroMexico Club Premier (1:1.6, up to 24 hours)

- Air Canada Aeroplan (1:1, instant)

- Air France/KLM Flying Blue (1:1, instant)

- ANA Mileage Club (1:1, 48 hours)

- Avianca LifeMiles (1:1, instant)

- British Airways Avios (1:1, instant)

- Cathay Pacific Asia Miles (1:1, 48 hours)

- Delta SkyMiles (1:1, instant)

- Emirates Skywards (1:1, instant)

- Etihad Guest (1:1, instant)

- Hawaiian Airlines HawaiianMiles (1:1, instant)

- Iberia Plus Avios (1:1, 48 hours)

- JetBlue TrueBlue (250:200, instant)

- Qantas Frequent Flyer (1:1, instant)

- Qatar Airways Privilege Club (1:1, instant)

- Singapore Airlines KrisFlyer (1:1, up to 24 hours)

- Virgin Atlantic Flying Club (1:1, up to 24 hours)

If you need to top up your hotel loyalty program balance instead, you can choose from the following three programs:

- Hotels

- Choice Privileges (1:1, instant)

- Hilton Honors (1:2, instant)

- Marriott Bonvoy (1:1, instant)

There have also been promotions during which you can transfer MR points at better rates to specific loyalty programs. These bonuses can range from an extra 15% to as much as 50% to select programs.

The best program to transfer your MR points to will largely depend on your own travel goals.

Air Canada’s Aeroplan program is great for unlocking Star Alliance partner flights at fairly decent rates. Some of the most aspirational products you can book using the program include ANA First Class, Lufthansa First Class, Etihad Airways First Class, Singapore Airlines business class, and more.

British Airways Avios is a solid option for short-haul flights in parts of Asia and Australia, and can also be used to book Qatar Airways Qsuites.

For one of the most well-rounded aspirational experiences, consider transferring your MR points to Emirates Skywards and book Emirates A380 First Class.

Singapore Airlines KrisFlyer is one of the only ways to book the airline’s famous Suites Class and try out the double bed in the sky.

Or, you could consider transferring your points to Virgin Atlantic Flying Club and booking ANA First Class at a bargain.

While it’s harder to get the same level of outsized value transferring to hotel programs over airline programs, there are still situations in which it could make sense, especially if there are promotions offering bonus points for transfers. However, generally speaking, there’s definitely more value to be found transferring to airline programs.

Once you transfer MR points to another program, you won’t be able to transfer them back. So, it’s always best to have a specific redemption in mind before initiating your transfer rather than just transferring points without giving it much thought.

Your points will always be more valuable if they’re transferable, and since most transfers are instant, you don’t have to wait long for them to appear in your account.

Redeeming American Express US Membership Rewards with Amex Travel

If you book through Amex Travel, you can choose to pay with points instead of cash. You’ll get a fixed value of 1 cent per point (cpp) if you redeem for flights (including upgrades) booked through the portal, or hotels booked through Fine Hotels & Resorts.

You can pay with points for other travel including prepaid hotels, car rentals, and cruises at a much lower value of 0.7 cents per point.

If you have the American Express Business Gold Card or the American Express Business Platinum Card, you’ll get rebates on airline bookings made with a designated US airline you must select beforehand.

With the Business Gold card, you’ll receive a 25% rebate, up to a maximum of 250,000 MR points per year. This means your MR points will effectively be worth 1.33 cents per point.

If you have the Business Platinum Card, you’ll get a much higher 35% rebate, up to a maximum of 500,000 MR points per year. With the 35% rebate, you can get a much higher redemption value of 1.54 cents per MR point.

Redeeming for Gift Cards

You can redeem MR points for gift cards, and while there are a lot of gift card options available, most will leave you with subpar value.

Many popular stores are on the list, and you’ll get a value that ranges from 0.7–1 cent per point.

Redeeming American Express Membership Rewards Points for Online Shopping

You can redeem your MR points when shopping online at many stores, including Amazon, Best Buy, Dell, and others.

What’s more, if you are checking out with PayPal at any store that accepts PayPal, you can pay with MR points instead of cash.

All of the “Pay with Points at Checkout” options give a low redemption value of 0.7 cents per point, with the exception of NYC Taxis, where you can redeem MR points at a 1 cent per point.

Redeeming American Express Membership Reward Points for Statement Credits

MR points can also be used to redeem for statement credits. This is probably the quickest and easiest way to redeem your MR points.

However, you’ll get a significantly lower value of 0.6 cents per point, which is a terrible use of MR points, given the multitude of other options available.

Cashing out through Schwab or Morgan Stanley

If you hold one of the Platinum Cards from Schwab or Morgan Stanley, you can redeem your MR points for cash, which gets deposited directly into your bank account.

With the Morgan Stanley version of the Platinum Card, you can redeem your MR points directly into your investment account at a rate of 1 cent per point.

With Schwab, you can also cash out MR points directly into your account, but at a higher rate of 1.1 cents per point. This is a better rate than you’ll get if you redeem MR points for statement credits, online shopping, or Amex Travel.

Transferring points to American Express in another country

Lastly, if you hold an American Express card issued by a different country, you can transfer your MR points to that account. US MR points are some of the most valuable MR points around, so it might not always make sense to transfer points, even if you have an eligible card.

That being said, there are situations where it does make sense, especially if you have a Canadian American Express card with fewer transfer partners.

Conclusion

American Express MR points are an incredibly valuable points currency. With many ways to earn MR points, and even more redemption opportunities, you’ll quickly be able to reach your travel goals if you choose the right card(s).

The fastest way to earn MR points is through credit card signup bonuses. If you tend to spend a lot of money throughout the year, or if you have plenty of friends and family members to whom you can refer, you can also pad your balance year after year.

The best way to redeem MR points for top value is by transferring them to airline loyalty programs, through which you can book premium flights at a significantly discounted price.