How to Keep Your Airline Points from Expiring

Imagine logging into your airline account, excited to book that dream trip, only to find out that your points have expired.

It’s a frustrating situation that happens more often than you think, as the reality is that many of us don’t realize that points can expire if we’re not using or earning them regularly.

As we wrap up the year 2025, it’s a good time to take on a simple but important task: reviewing your loyalty accounts.

An annual check for points at risk of expiring is a quick habit that can save your hard-earned rewards and keep them ready for future adventures.

The good news is, keeping your points alive is easier than you think.

In this post, we’ll cover the expiration policies for major airline loyalty programs and share strategies to keep your points active without too much effort.

Let’s dive into the simple steps to ensure your miles don’t expire.

1. Know the Rules of Your Loyalty Program

Most loyalty programs require you to engage in some form of qualifying activity at regular intervals to keep your airline points from expiring.

However, each airline program has its own set of rules. Some consider both earning and redeeming points as qualifying activities, while others only count earning.

Additionally, there are some programs whose points never expire, while others have points that will expire after a certain period of inactivity. In some programs, your points expire after a set period of time, no matter how much activity there’s been.

Knowing the specifics of your loyalty program is the first step to safeguarding your points balances.

Here are the expiration policies for some popular airline loyalty programs for North Americans:

- Air Canada Aeroplan: Points normally expire after 18 months of account inactivity; however, points expiry is paused until November 30, 2026. After that date, the 18-month inactivity rule will apply again.

- WestJet Rewards: WestJet points don’t expire; however, your account must have at least one earning, redeeming, transferring, or converting activity every 24 months to stay active. Certain promotional rewards may have their own expiry dates.

- Air France KLM Flying Blue: Miles can expire if you go 24 months without any qualifying flight or eligible co-branded credit card activity. A qualifying flight or eligible card purchase generally resets the clock for your balance.

- Atmos Rewards: Technically, miles don’t expire, but your account may be deactivated after 24 months of inactivity. (You then have 12 months to reactivate your account.)

- American Airlines AAdvantage: Miles expire after 24 months of account inactivity.

- Avianca LifeMiles: Miles expire after 12 months without any points accrual activity.

- The British Airways Club: Avios expire after 36 months of account inactivity.

- Cathay Pacific Asia Miles: Miles expire after 18 months of account inactivity.

- Delta SkyMiles: SkyMiles never expire.

- Korean Air SKYPASS: Miles expire 10 years after they’re earned. (Miles earned on or before June 30, 2008 don’t expire and are valid for the member’s lifetime)

- Singapore Airlines KrisFlyer: Miles expire 36 months after they’re earned.

- United MileagePlus: Miles never expire.

- Virgin Atlantic Flying Club: Points never expire.

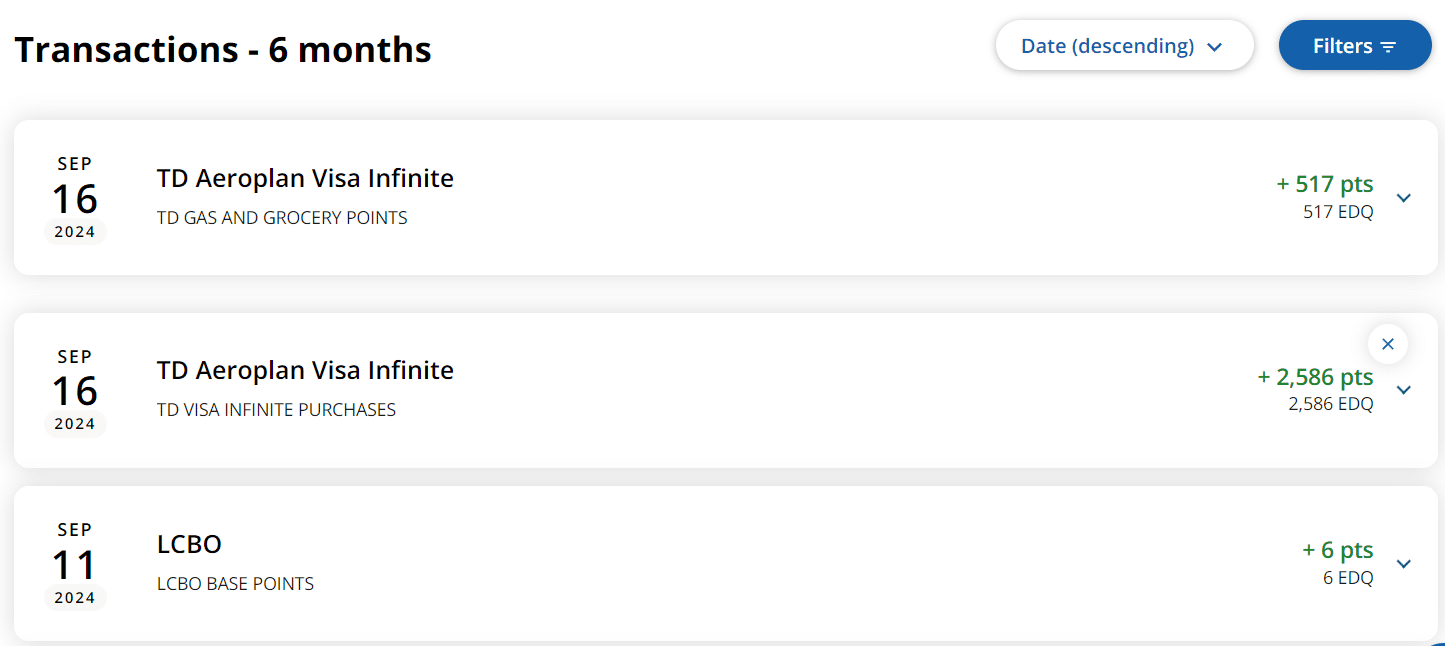

2. Earn Points from Co-Branded Credit Cards

One of the easiest ways to keep your airline points from expiring is by using co-branded credit cards. These cards allow you to earn points on everyday purchases like groceries, dining, and gas.

For example, if you hold a TD® Aeroplan® Visa Infinite* Card, every time you make a purchase, you’re not only earning Aeroplan points from those purchases, but you’re also extending your points balance expiration date by 18 months.

If you don’t already have one, check if your airline offers a co-branded credit card.

Many airlines partner with major banks to provide cards that offer generous welcome bonuses, travel perks, and most importantly, the ability to earn the rewards currency of your choice and help keep your points from expiring.

First-year value

$588

Annual fee: $139First Year Rebate

• Earn 10,000 points on first purchase

• Earn 15,000 points upon spending $3,000 in the first 3 months

• Earn 20,000 points on card anniversary upon spending $12,000 in the first 12 months

Earning rates

Key perks

- Free first checked bag for cardholder + up to 8 companions

- 1,000 SQC per $20,000 spend toward Aeroplan Elite Status (up to 25,000 SQC/year)

- $100 NEXUS rebate every 48 months

- 4th night free on Aeroplan hotel redemptions

- Troon Rewards Silver (10% off at 95+ golf courses)

- Avis Preferred Plus (1 car-class upgrade)

Annual fee: $139First Year Rebate

• Earn 10,000 points on first purchase

• Earn 15,000 points upon spending $3,000 in the first 3 months

• Earn 20,000 points on card anniversary upon spending $12,000 in the first 12 months

Earning rates

Key perks

- Free first checked bag for cardholder + up to 8 companions

- 1,000 SQC per $20,000 spend toward Aeroplan Elite Status (up to 25,000 SQC/year)

- $100 NEXUS rebate every 48 months

- 4th night free on Aeroplan hotel redemptions

- Troon Rewards Silver (10% off at 95+ golf courses)

- Avis Preferred Plus (1 car-class upgrade)

Transfer Points from Bank Programs

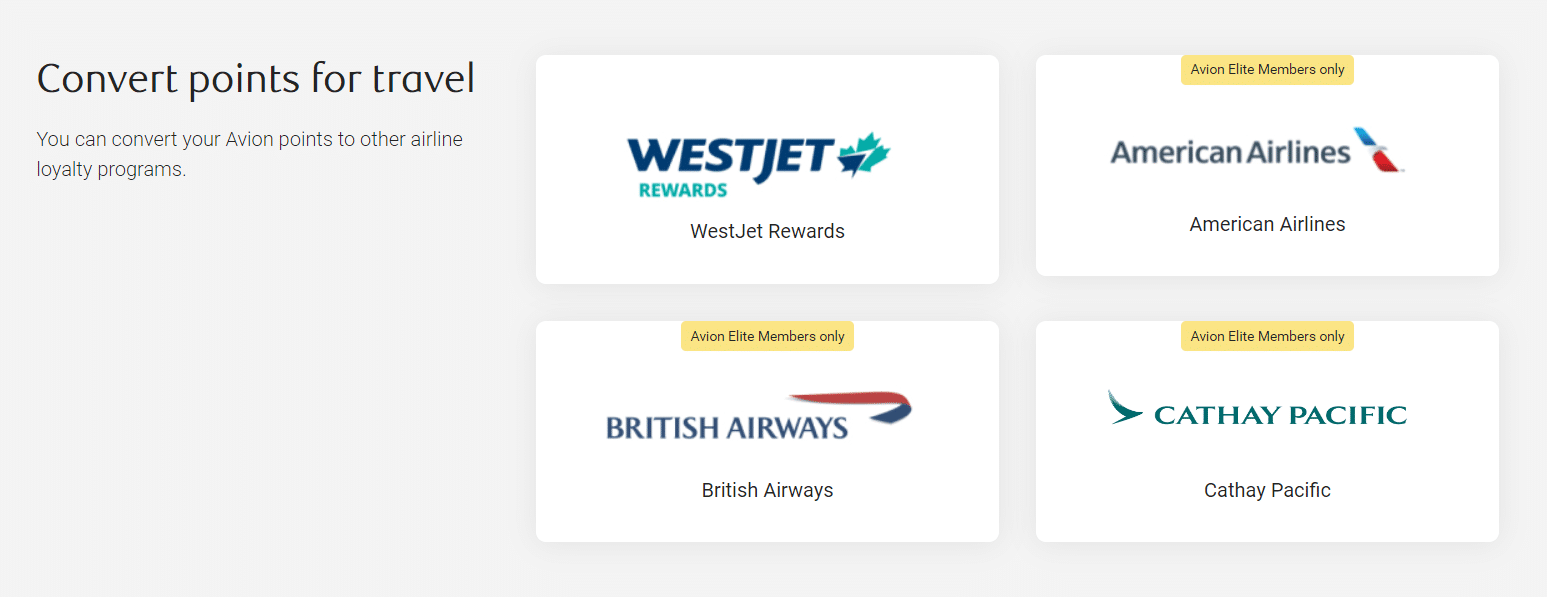

If a co-branded credit card isn’t available for the airline you have in mind, or if the product isn’t offered in your country, consider another convenient option: transferring points from a flexible currency program.

In Canada, there are two points currencies that can be converted into various airline and hotel partners: American Express Membership Rewards and RBC Avion Rewards.

In the United States, there are many more programs available. Some of the most popular ones include American Express US Membership Rewards, Bilt Rewards, Capital One Miles, Citi ThankYou Rewards, and Chase Ultimate Rewards.

By transferring points from one program into your airline’s loyalty program, you can add qualifying activity and extend the life of your points or miles. This is especially useful if you have a balance with an airline that you don’t fly with frequently, but you’d still like to keep your points active.

50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

The Essential Guide to American Express Membership Rewards

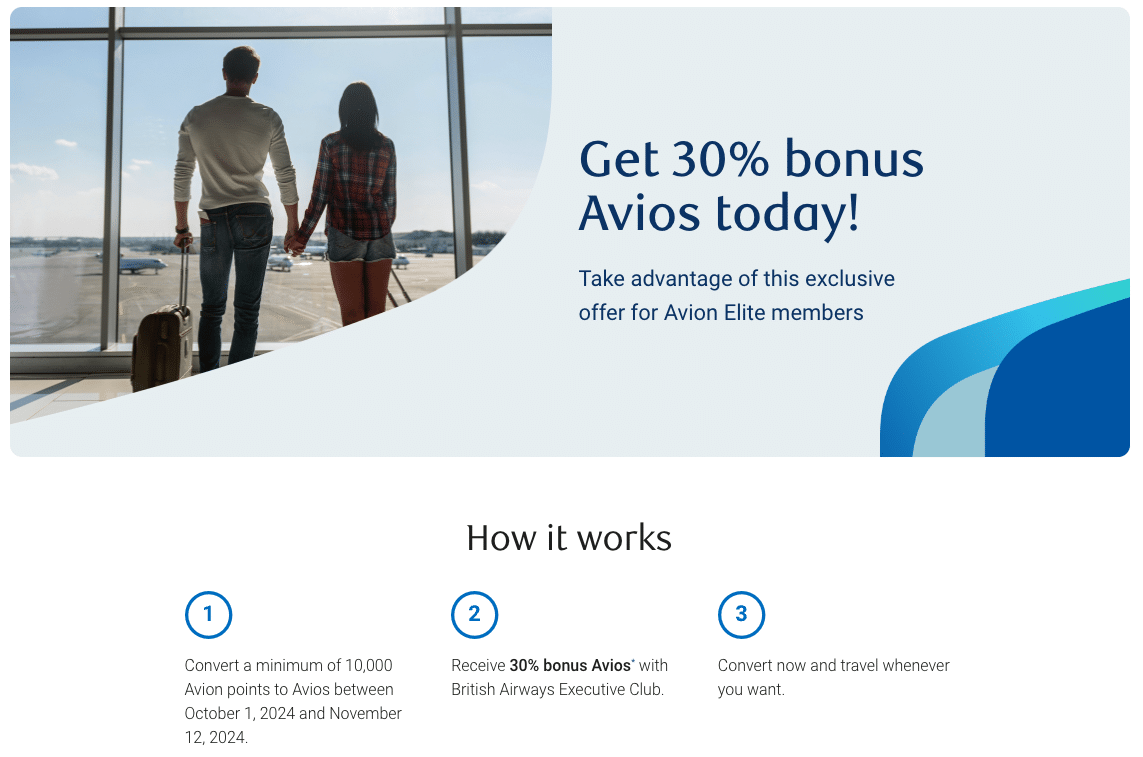

Read moreFor example, converting RBC Avion points into British Airways Avios counts as a qualifying activity within your British Airways account, thus extending the expiry date of your Avios by another three years.

If you’re thinking of going this route, keep in mind that depending on which program you’re transferring from there may be the occasional transfer bonus promotions that let you enjoy 10–50% more points when you transfer.

For example, RBC Avion Rewards fairly regularly runs transfer bonus promotions from their in-house Avion points to British Airways Executive Club, allowing you to get more value out of your Avion points.

Given this, unless you’re in a rush to prevent your points from expiring, it’s wise to wait for these offers.

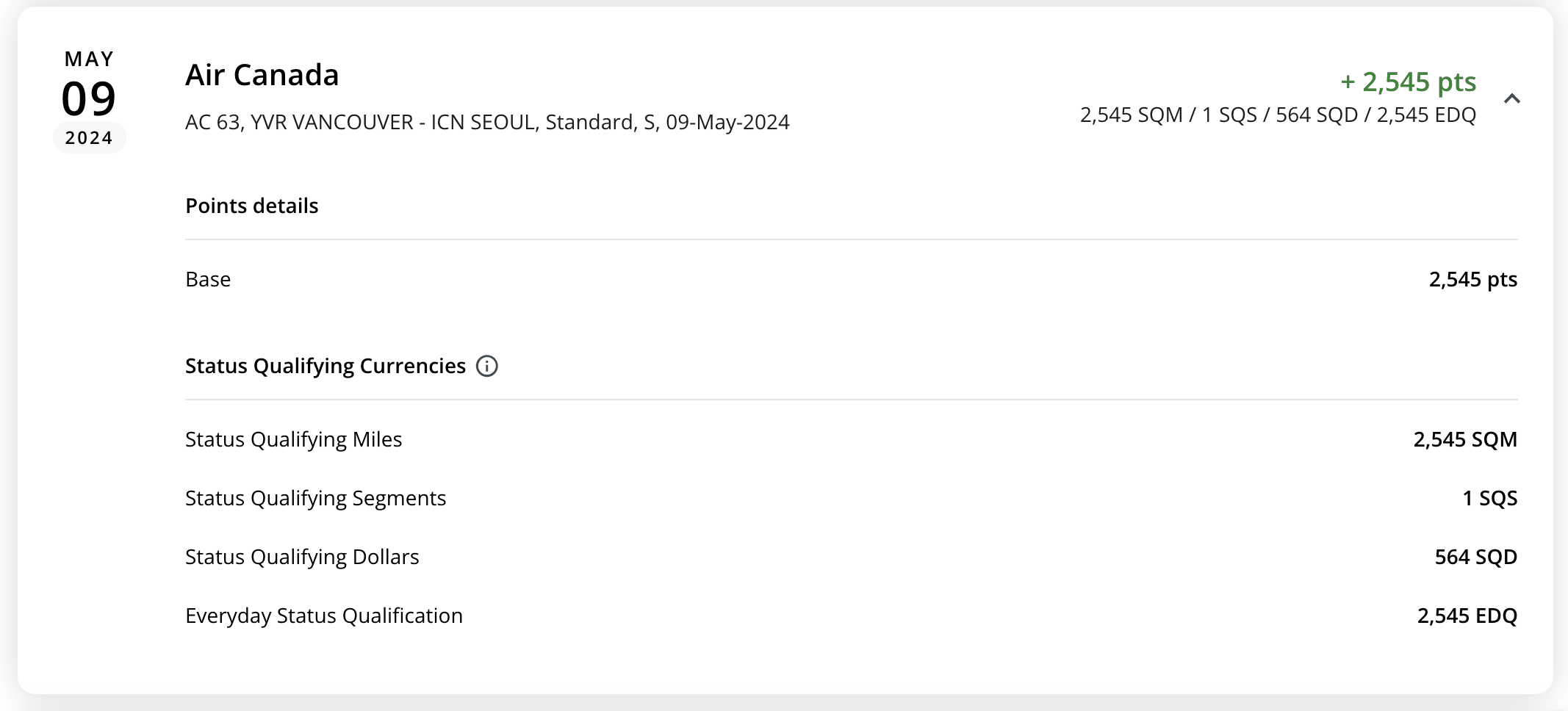

3. Earn from Flying Activity

It may sound obvious, but flying with the airline is a surefire way to keep your points from expiring in almost all cases. Any time you book a flight and earn miles, your account activity is refreshed, extending the expiration date of your points.

The exceptions to this rule are programs like Korean Air SKYPASS and Singapore Airlines KrisFlyer as your points have an unchangeable and unextendable expiration date in relation to when they were earned.

Redeeming points for flights can also count as qualifying activity in most programs, making it another great way to keep your points active while enjoying the rewards you’ve earned.

However, keep in mind that there are some programs, like Avianca LifeMiles, that DO NOT count redeeming points as qualifying activity, so always double-check the points expiration policy of your airline to be sure.

4. Earn from Non-Flying Activity

If you’re not flying anytime soon, don’t worry.

There are numerous other ways to earn points without flying, helping you to continue to prevent your points from expiring.

Book hotels, car rentals, and activities through an affiliated booking portal

Many airlines have affiliated booking portals where you can earn points by booking hotels, car rentals, or even activities. Transactions made through these portals count as qualifying earning activity and help extend your points’ expiration.

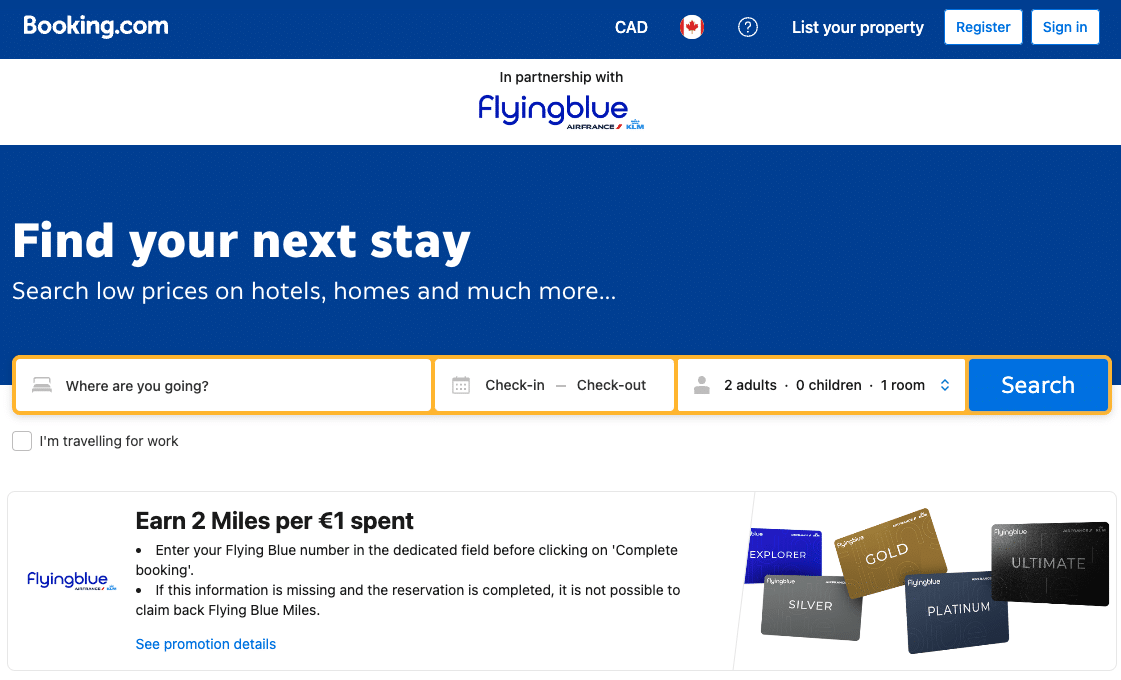

For instance, Air France KLM Flying Blue has partnered with Booking.com, allowing you to earn 2 Flying Blue miles per euro spent on hotel bookings when you go through the airline’s booking portal.

However, not all airlines have a partnership with OTAs (Online Travel Agencies) that provide a booking site like this.

If that’s the case, you can check the airline’s online shopping portal for another way to keep your points from expiring.

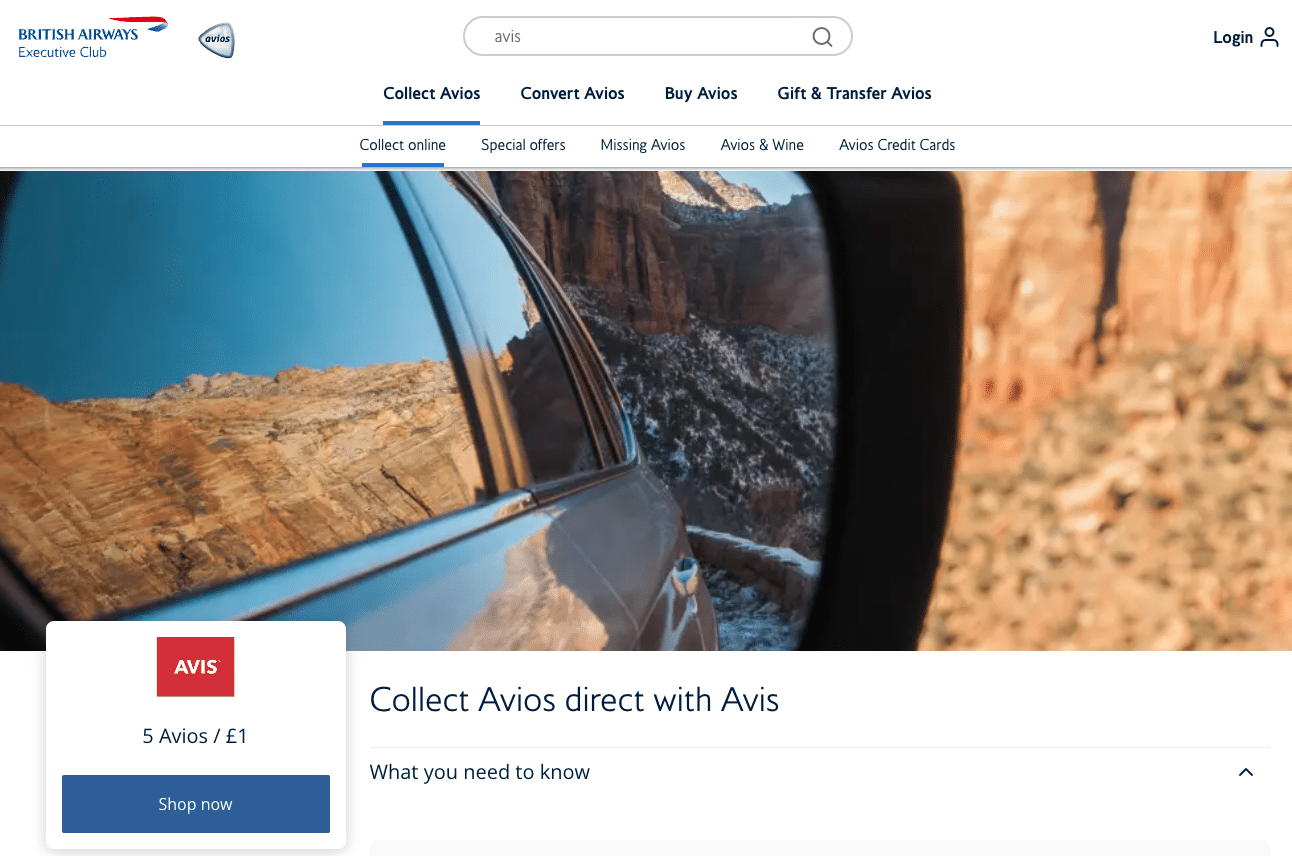

For example, through the British Airways Executive Club eStore, you can earn Avios by clicking their shopping link for AVIS car rentals and making a reservation, or by making a booking through Airbnb. This is an easy way to keep your points active while booking essential services like car rentals or short-term rentals.

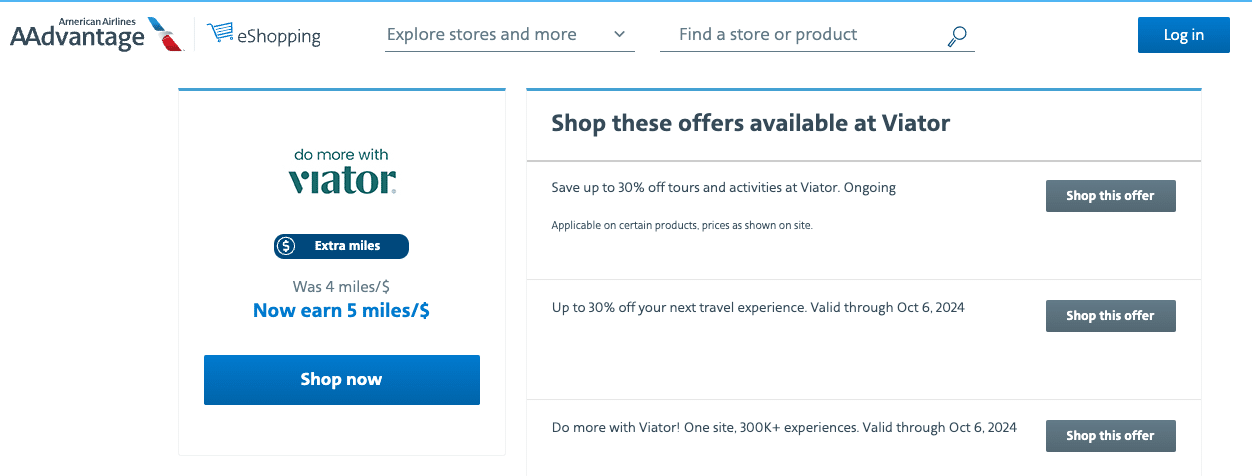

If neither hotel stays nor car rentals are in your plans, you can also consider booking an activity to earn points. For example, through the American Airlines AAdvantage eStore, you can earn AAdvantage miles by booking tours and activities via Viator.

Just be sure that you’re making your bookings through the airline’s online booking portal or shopping portal and not through the everyday, public versions of booking portals in order to earn your rewards and keep your points from expiring.

To ensure you’re on the right site, always start from the airline’s or airline loyalty program’s website and click through to the associated booking portal.

Use Rideshare and Food Ordering Apps

Some airline loyalty programs are linked to rideshare apps like Uber and Lyft, or food ordering apps like Starbucks. By linking your accounts, you can automatically earn points on every ride or food order, keeping your account in good standing.

For example, you can link your Aeroplan account to Uber and earn Aeroplan points every time you catch an Uber ride or order food through Uber Eats.

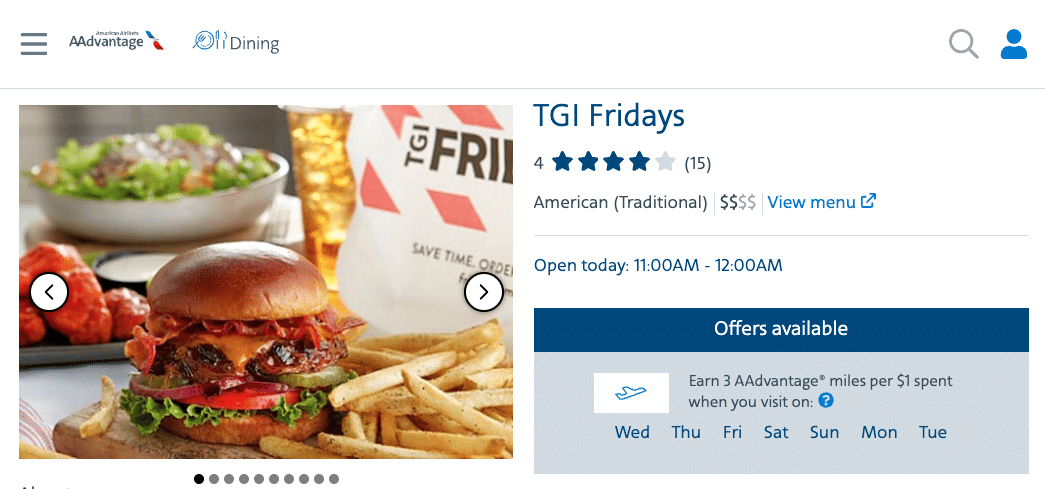

Airline Dining Programs

Airline dining programs are another great way to earn miles without flying. By dining at participating restaurants and paying with a credit card that’s linked to your loyalty account, you’ll earn miles every time you eat out.

However, this option is only offered in the US at the moment.

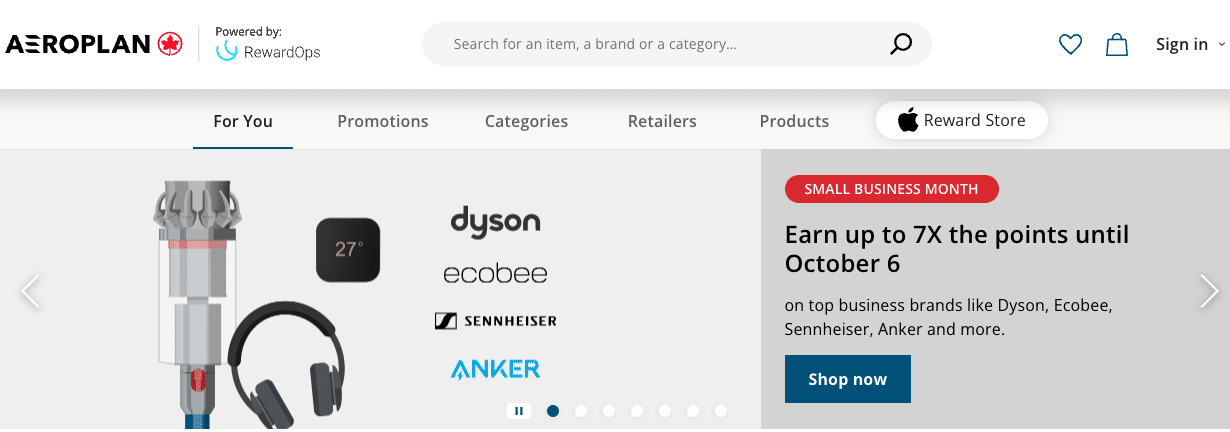

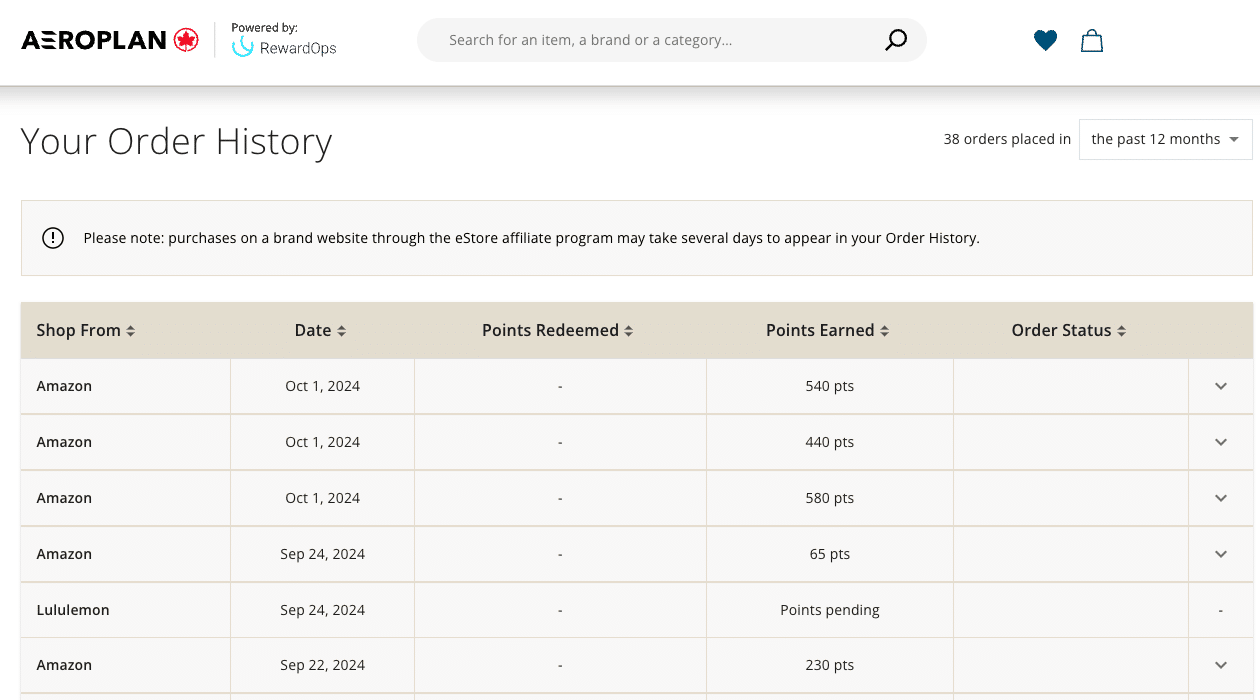

5. Earn Through Online Shopping Portals

Shopping through your airline’s online shopping portal is one of the easiest ways to earn points from home. These portals partner with a wide range of retailers, allowing you to earn points on many of your usual purchases.

One of the best examples of an online shopping portal is the Aeroplan eStore which has a long list of retail partners in Canada, such as Amazon, Apple, and Lululemon.

To earn points from shopping, simply find the retailer you want through the airline’s shopping portal and click the “Shop” button to be redirected. Be sure to review the details for each retailer, as certain product categories are often excluded from earning points.

If you’re looking to maximize your earnings while keeping your account active, keep an eye out for bonus points promotions on your airlines’ online shopping portal.

Waiting for your preferred retailer to offer extra points can really help you build up your point balance from the comfort of your own home.

6. Buy or Donate Points

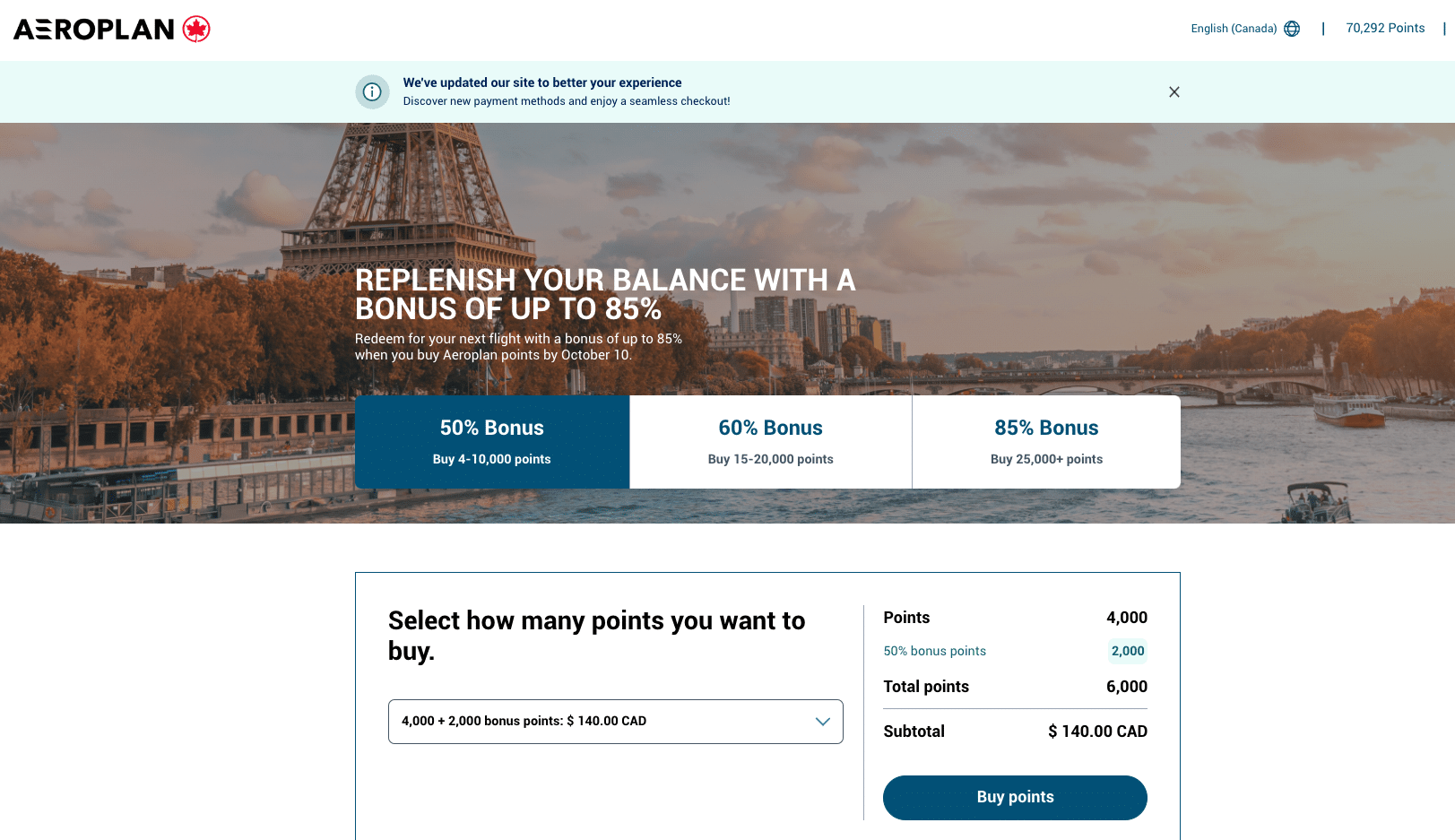

Buying points outright is the simplest way to add a qualifying activity to your account; however, convenience often comes with a cost.

Unless your points are about to expire, it’s better to see if any of the previously mentioned methods work for you first since buying points is typically not considered good value.

While buying points should be a last resort (as it can be pricey), it’s still better than losing them altogether.

Similarly to transferring points or making purchases through an airline’s online shopping portal, it’s a good idea to watch out for promotions that offer bonus points to maximize your purchase if you do decide to buy points.

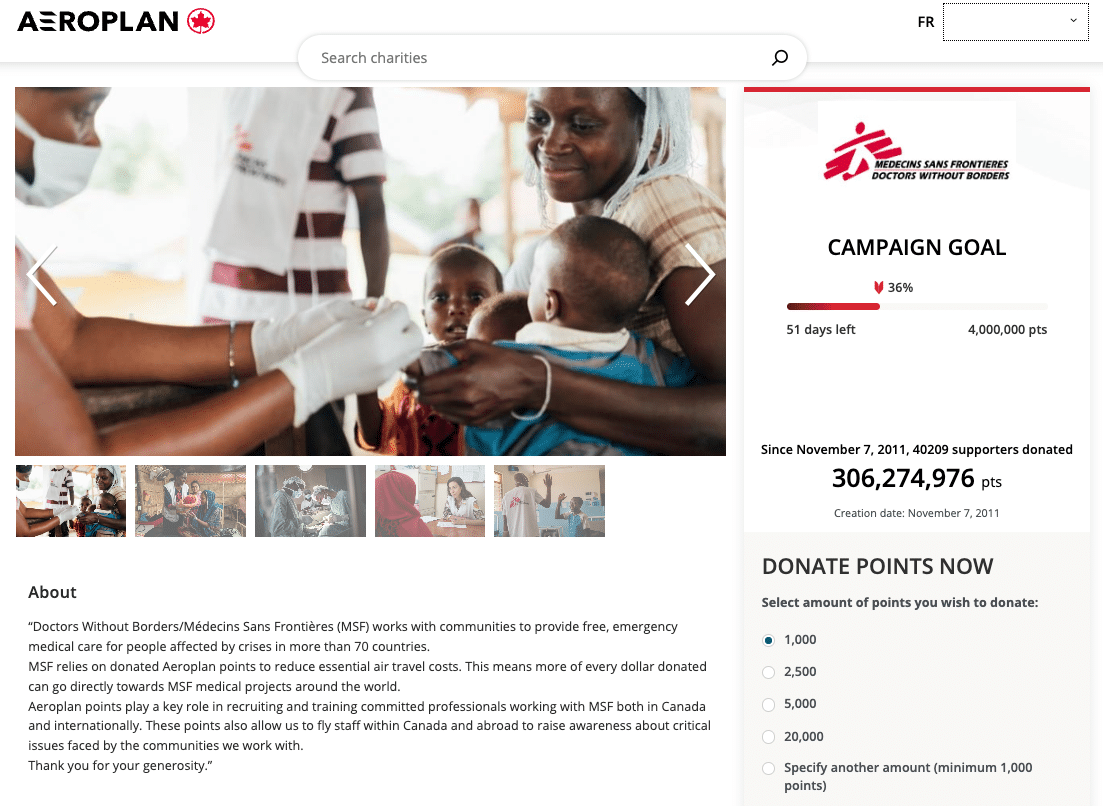

If buying points feels a bit expensive, consider donating points instead. This is a great way to keep your points account active while doing something good!

Many airlines allow you to donate points to select charities and then count the donation as a qualifying redemption activity – though, keep in mind that some airlines only count earning activity as qualifying activity, so you’ll want to double-check this for your loyalty program of choice.

7. Set Up Alerts and Track Your Points

The best way to avoid losing points is by staying organized.

One good practice might be to review your loyalty accounts at the end of each year and make note of the expiration dates.

Mark these dates on your calendar and set up an alert at least three months in advance, giving you enough time to take action and keep your points active. If you have a number of loyalty accounts to keep track of, we’ve found that a spreadsheet is useful to keep track of your points.

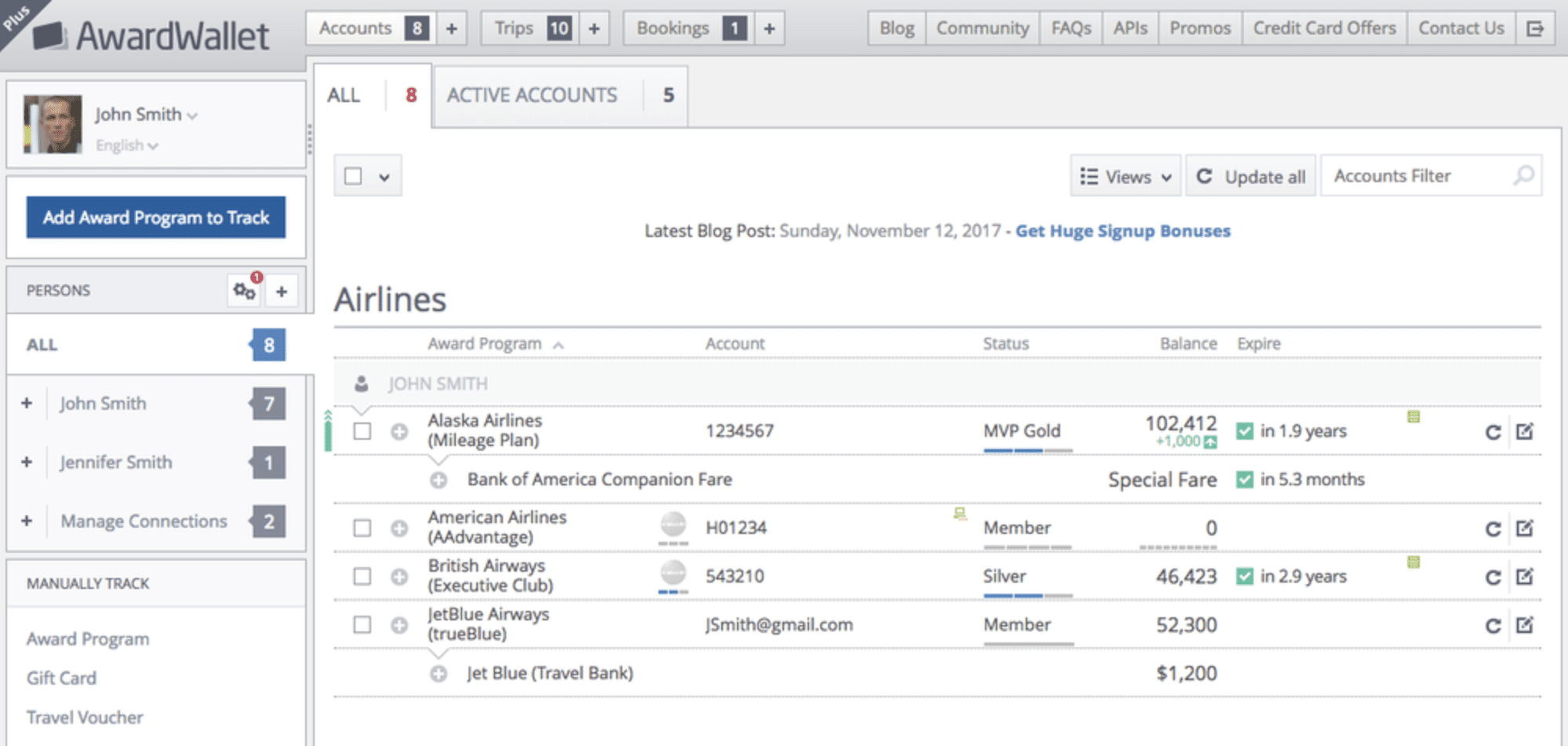

Alternatively, you can use a platform like AwardWallet to track your points balances across all your frequent flyer programs.

AwardWallet securely stores your login credentials for each loyalty program and regularly checks your accounts for any changes in points balances. It also monitors points expiration dates and sends you email alerts if any of your points are nearing expiration.

Conclusion

Airline loyalty programs often enforce inactivity policies, causing points to expire after a period of no qualifying account activity (typically around two years of inactivity).

While that might seem like plenty of time, life can get in the way, and you can easily forget to keep your accounts active and run the risk of losing all your hard-earned points.

Fortunately, preventing points from expiring is easier than it seems. A few small actions, like using a co-branded credit card for daily purchases, booking a last-minute flight, or shopping online, can often keep your account active and your points safe.

However, ultimately, the best practice for your points is to follow the “earn and burn” mantra of the Miles & Points community.

Treat points like currency that could lose value or disappear – that way, you wouldn’t leave any points to expire in the first place.

Jason thrives on connecting with the heart of a destination, seeking out experiences that go beyond the guidebooks.

First-year value

$588

Annual fee: $139First Year Rebate

• Earn 10,000 points on first purchase

• Earn 15,000 points upon spending $3,000 in the first 3 months

• Earn 20,000 points on card anniversary upon spending $12,000 in the first 12 months

Earning rates

Key perks

- Free first checked bag for cardholder + up to 8 companions

- 1,000 SQC per $20,000 spend toward Aeroplan Elite Status (up to 25,000 SQC/year)

- $100 NEXUS rebate every 48 months

- 4th night free on Aeroplan hotel redemptions

- Troon Rewards Silver (10% off at 95+ golf courses)

- Avis Preferred Plus (1 car-class upgrade)

Annual fee: $139First Year Rebate

• Earn 10,000 points on first purchase

• Earn 15,000 points upon spending $3,000 in the first 3 months

• Earn 20,000 points on card anniversary upon spending $12,000 in the first 12 months

Earning rates

Key perks

- Free first checked bag for cardholder + up to 8 companions

- 1,000 SQC per $20,000 spend toward Aeroplan Elite Status (up to 25,000 SQC/year)

- $100 NEXUS rebate every 48 months

- 4th night free on Aeroplan hotel redemptions

- Troon Rewards Silver (10% off at 95+ golf courses)

- Avis Preferred Plus (1 car-class upgrade)

Comments

Create a free account or become a member to comment.