With its range of 12 credit cards, Capital One lets you earn miles easily through lucrative welcome bonuses and everyday spending.

Then, as you accumulate Capital One miles, you can transfer them to a long list of partner loyalty programs and redeem them for aspirational luxury travel. Alternatively, you can simply redeem your miles for statement credits.

In this guide, we’ll cover everything there is to know about Capital One miles, including how to optimize your earning and redeeming within the program.

Earning Capital One Miles Through Welcome Bonuses

The easiest way to rack up Capital One miles is through credit card welcome bonuses. Currently, 12 credit cards comprise the Capital One lineup.

Capital One miles can straightforwardly be earned through seven personal and business credit cards. In addition, miles can also be earned in a roundabout way through five cash back credit cards.

The amount you can earn through signup bonuses is different for every card, and the offers change from time to time. Some cards may not even offer bonuses at all.

It’s also possible to get targeted offers that are higher than publicly available offers, and you can check through this landing page if you’re eligible for one.

Capital One Miles Credit Cards

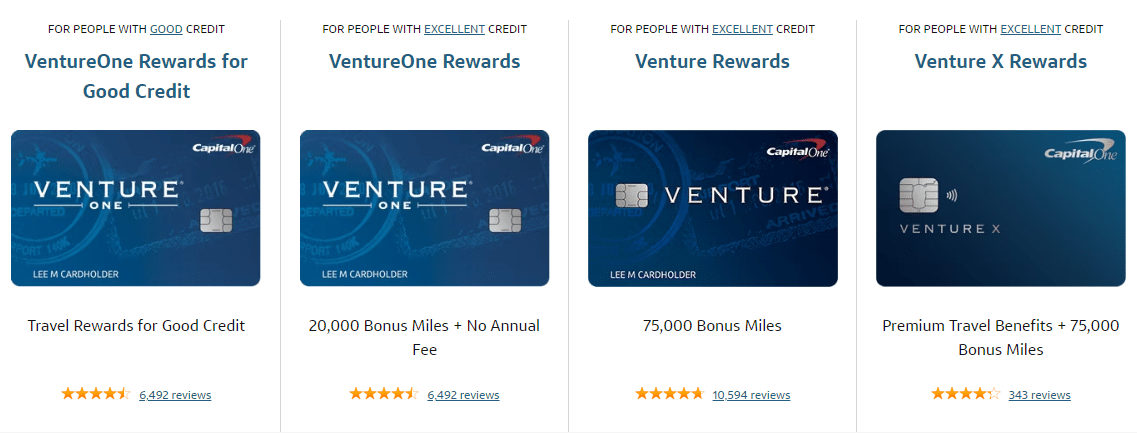

Five credit cards earn Capital One miles directly: three personal cards under the Venture brand, and two business cards under the Spark brand.

Capital One’s flagship personal credit card is the Capital One Venture X, which is seen as a competitor to other high-end cards, like the Chase Sapphire Reserve and the Platinum Card by American Express.

Capital One Venture X usually offers a welcome bonus in the range of 75,000 miles, although it has previously been as high as 100,000 miles.

Aside from the generous welcome offer, the card’s hefty annual fee of $395 is offset by a $300 credit for Capital One Travel, a $100 experience credit with the Premier Collection of luxury hotels, and a $100 credit for Global Entry or TSA PreCheck. The Venture X also comes with a slew of travel perks, such as unlimited airport lounge access and Hertz President Circle status.

The mid-tier counterpart of Capital One Venture X is the Capital One Venture Rewards, which commands a modest $95 annual fee. Like the Venture X, the Venture Rewards’s welcome bonus ranges between 75,000 and 100,000 miles; however, given its lower annual fee, its travel benefits are limited to a $100 credit for Global Entry or TSA PreCheck and three complimentary airport lounge visits.

Lastly, the Capital One VentureOne is the entry-level personal card that carries no annual fee. Its welcome bonus is usually modest, ranging from 20,000 miles to a high of 40,000 miles.

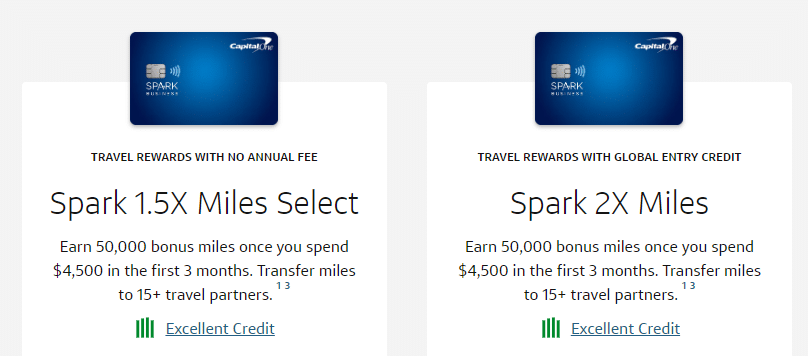

For business cards, Capital One’s top-tier offering is the Spark 2x Miles card, which earns an unlimited 2x miles as its primary feature. With an annual fee of $95, its usual welcome bonus is 50,000 miles upon spending $4,500 within the first three months of opening.

Meanwhile, Capital One’s no-fee small business card is the Spark 1.5x Miles Select card, which carries a slightly lower 1.5x multiplier for spending. While its miles-earning power is lower than the Spark 2x Miles card, its welcome bonus is typically the same at 50,000 miles.

There’s also the Capital One Venture X Business card; however, it’s only available to certain Capital One business clients. If you’re eligible, you’ll need to go through your Capital One relationship manager to apply for the card.

Capital One Cash Back Credit Cards

An interesting feature of Capital One’s cash back credit cards is that you’re allowed to convert cash back to miles, as long as you also hold a miles-earning card. One cash back cent can be converted to one mile.

Currently, there are seven cards that earn cash back: seven personal cards under the Quicksilver and Savor brands, and four business cards under the Spark brand.

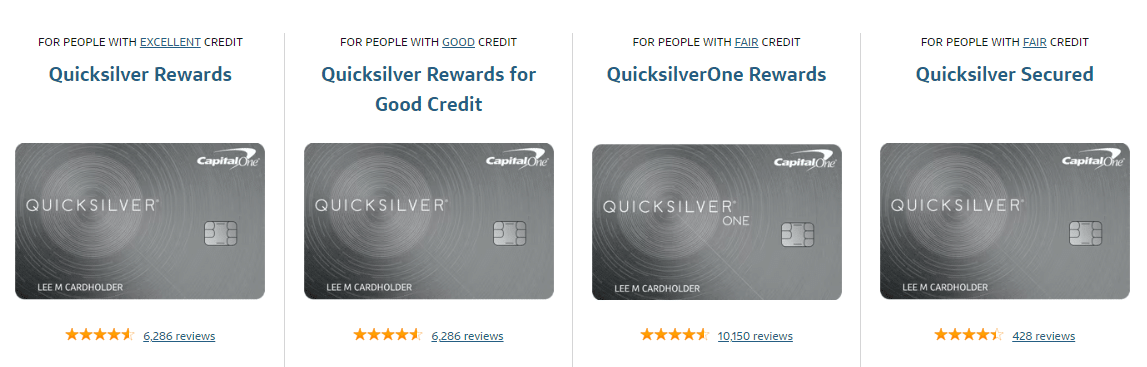

The Quicksilver line of cards all offer a uniform 1.5% cash back on purchases. Only the Capital OneQuicksilverOne Rewards card carries an annual fee of $29. The rest of the lineup, namely Capital One Quicksilver Rewards, Capital One Quicksilver Rewards for Good Credit, and Capital One Quicksilver Rewards Secured, don’t come with an annual fee.

The Quicksilver line is intended for applicants who have fair to good credit, so cards don’t come with many perks. Only the Quicksilver Rewards card, meant for those with excellent credit, offers a $200 cash bonus after spending the first $500.

In contrast, the Savor line of cards, which includes Capital One SavorOne Rewards for Good Credit, Capital One SavorOne Rewards, andCapital One Savor Rewards, is meant for those with good to excellent credit. The cards feature better earning rates and welcome bonuses.

The flagship card, Capital One Savor Rewards, comes with a $95 annual fee, but it’s offset by the welcome offer of $300 cash bonus upon spending $5,000.

Meanwhile, the no-fee Capital One SavorOne Rewards card offers a $200 cash bonus upon spending $500, which you may view as a better deal given the smaller minimum spend requirement.

As for business cards, the Spark line of cards includes the Capital One Spark 2% Cash Plus, Capital One Spark 1.5% Cash Select, Capital One Spark 1.5% Cash Select for Good Credit, and Capital One Spark 1% Classic. As their names suggest, the cards are differentiated by their cash back earning rate.

The Capital One Spark 2% Cash Plus comes with a welcome offer of $500 cash back upon spending $5,000 and another $500 upon spending $50,000 in the first six months. Its annual fee of $95 has historically been waived in the past.

Meanwhile, the Spark 1.5% Cash Select has no annual fee, yet it still comes with a welcome bonus of $500 upon spending $4,500 in the first six months.

Meant for those with fair to good credit, the two other Spark cards don’t charge annual fees, but they also don’t come with any welcome bonuses.

Again, you can convert cash back to miles at a rate of 1 cent = 1 mile, as long as you also hold a card that earns miles. Hence, if you accrue $500 in cash back as a welcome bonus on the Quicksilver Rewards card, you can subsequently convert it to 50,000 miles.

Earning Capital One Miles Through Credit Card Spending

After collecting miles through credit card signup bonuses, spending on your miles and cash back credit cards is the next best way to earn more Capital One miles.

You’ll earn different amounts of miles or cash back rewards that can be converted to miles, depending on the card you’re using and the category of your spend.

Capital One Miles Credit Cards

- Capital One Venture X

- 10 miles per dollar spent on hotels and rental cars booked through Capital One Travel

- 5 miles per dollar spent on flights booked through Capital One Travel

- 2 miles per dollar spent on all other purchases

- Capital One Venture Rewards

- 5 miles per dollar spent on hotels and rental cars booked through Capital One Travel

- 2 miles per dollar spent on all other purchases

- Capital One Venture One Rewards

- 5 miles per dollar spent on hotels and rental cars booked through Capital One Travel

- 1.25 miles per dollar spent on all other purchases

- Capital One Spark 2x Miles

- 2 miles per dollar spent on all purchases

- Capital One Spark 1.5x Miles Select

- 1.5 miles per dollar spent on all purchases

Capital One Cash Back Credit Cards

- Capital One Quicksilver Rewards

- 1.5% cash back per dollar spent on all purchases

- Capital One QuicksilverOne Rewards

- 1.5% cash back per dollar spent on all purchases

- Capital One Savor Rewards

- 4% cash back per dollar spent on dining, entertainment, and streaming services

- 3% cash back per dollar spent at grocery stores

- 1% cash back per dollar spent on all other purchases

- Capital One SavorOne Rewards

- 3% cash back per dollar spent on dining, entertainment, popular streaming services, and grocery stores

- 1% cash back per dollar spent on all other purchases

- Capital One Spark 2% Cash Plus

- 2% cash back per dollar spent on all purchases

- Capital One Spark 1.5% Cash Select

- 1.5% cash back per dollar spent on all purchases

- Capital One Spark 1% Classic

- 1% cash back per dollar spent on all purchases

Among Capital One’s miles-earning cards, Capital One Venture X and Capital One Venture Rewards are your best bet, since both cards offer two miles per dollar spent on all categories. Plus, if you book through the Capital One Travel portal, you can earn 5–10 miles per dollar spent.

Meanwhile, amongst the cash back cards, the Savor Rewards card is the best choice, as it could potentially earn you 3–4% cash back, which is equivalent to 3–4 miles per dollar spent on different purchase categories.

Earning Capital One Miles Through Refer-a-Friend

Another way to earn extra Capital One miles is through Capital One’s refer-a-friend program. Not every cardholder will get the same amount per referral; thus, in order to see if you’re eligible and how much you can earn, simply sign into your account through the dedicated landing page.

Capital One Venture X Rewards cardholders can earn 25,000 miles per referral, up to a maximum of 100,000 miles per calendar year.

Venture Rewards, VentureOne Rewards, Spark 2x Miles, and Spark 1.5x Miles cardholders can earn between 10,000–20,000 miles per approved referral, up to a maximum of 50,000 miles per calendar year.

Lastly, all eligible cash back cards can earn between $100–200 per referral, depending on the card and what offer you get.

Redeeming Capital One Miles

Capital One miles are fairly flexible to redeem. While they can easily be redeemed as statement credits, you can derive better value by transferring them to other airline or hotel loyalty programs.

By transferring your miles to an airline loyalty program, for example, you can get outsized value by using your miles to book business class or First Class seats.

That being said, redeeming miles for statement credits is a lot more straightforward, and it isn’t a terrible option, especially if you don’t have any upcoming trips planned.

Transferring Capital One Miles to Other Loyalty Programs

Capital One miles can be transferred to an impressive range of 15 airline and three hotel transfer partners. Unless there is a bonus promotion, you can transfer Capital One miles to all available loyalty programs at a rate of 1:1, with a couple of exceptions as noted below.

Transfer bonuses do come up from time to time, and they generally range between 20-30% extra points or miles, depending on the program you’re transferring to.

The following are Capital One’s transfer partners:

Airlines

- Aeromexico Club Premier

- Air Canada Aeroplan

- Air France/KLM Flying Blue

- Cathay Pacific Asia Miles

- Avianca LifeMiles

- British Airways Executive Club

- Emirates Skywards

- Etihad Guest

- Eva Air Infinity MileageLands (1 Capital One mile to 0.75 Eva Air mile)

- Finnair Plus

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Miles&Go

- Turkish Airlines Miles&Smiles

- Virgin Red

Hotels

- Accor Live Limitless (2 Capital One miles to 1 Accor point)

- Choice Privileges

- Wyndham Rewards

Transfer times to most programs on the list tend to complete instantly, with the exception of the following:

- Accor Live Limitless (up to two business days)

- Cathay Pacific Asia Miles (up to 24 hours)

- Choice Privileges (up to 24 hours)

- Eva Infinity MileageLands (up to 36 hours)

It’s always best to have specific travel plans before transferring Capital One miles to another loyalty program. Once once you transfer your miles, you won’t be able to transfer them back.

The best airline program to transfer your miles depends on your own travel goals and your personal circumstances, like which airlines fly out of your nearest airport.

However, if you’re looking for suggestions, Air Canada’s Aeroplan program is great for redeeming premium seats on flights it operates, as well as those operated by its Star Alliance and other partner airlines.

On the other hand, British Airways Executive Club, with Avios as its currency, is a great program for booking short-haul Oneworld partner flights in parts of Asia and Oceania. British Airways Avios can also be transferred to Qatar Airways Privilege Club, and can consequently be used to book coveted Qsuites and First Class seats on Qatar Airways.

Singapore KrisFlyer is the only means to redeem Singapore Airlines Suites awards. The highly-sought after experience lets you have your own private suite, with the option of having a double bed in the sky if you’re flying with someone else.

Finally, Air France/KLM Flying Blue can be an excellent option for flights from North America to Europe, especially if you take advantage of Promo Rewards. Every month, Flying Blue’s Promo Rewards offers certain routes to be redeemed at a discount.

Redeeming Capital One Miles as Statement Credits or Cash

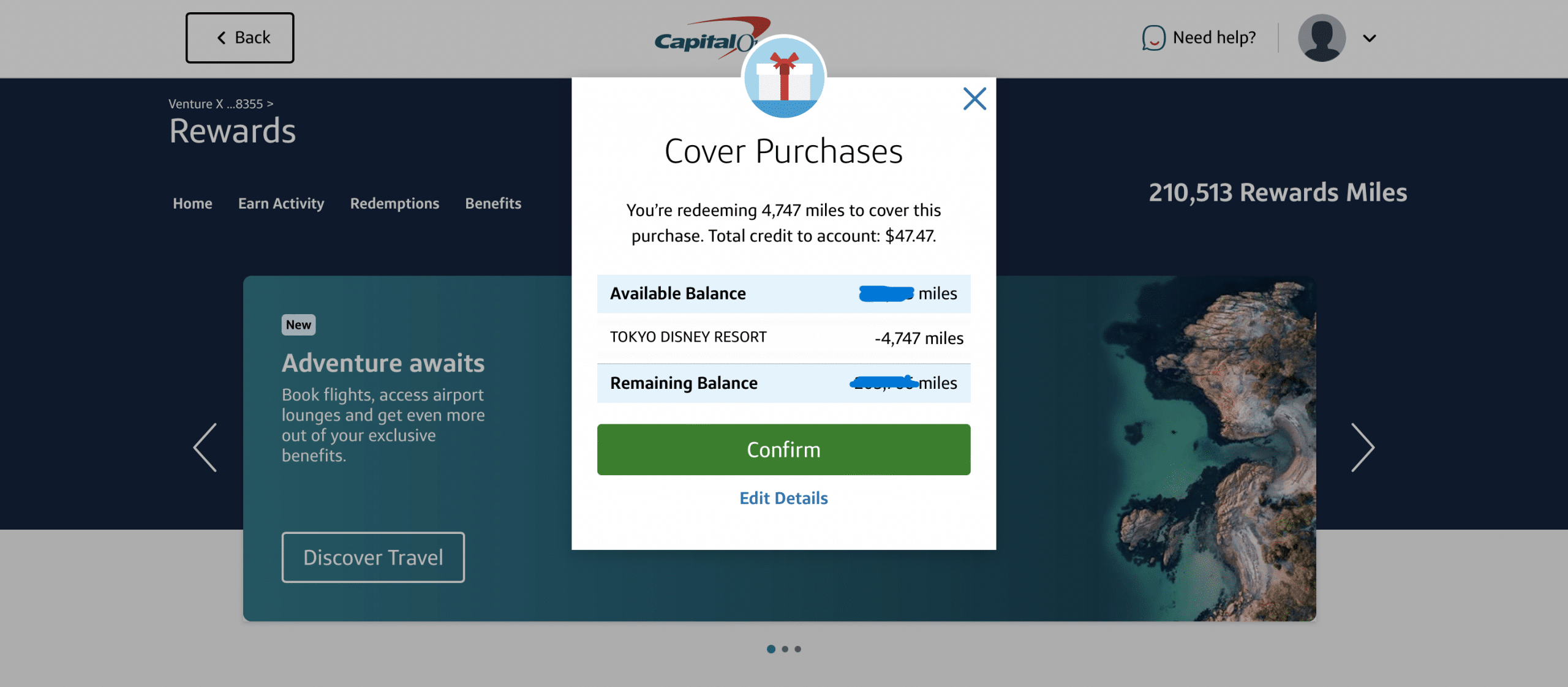

Capital One miles can be redeemed as statement credits to cover a travel purchase you have previously made, or as cash at a lower rate.

You can redeem your Capital One miles for any travel expense you’ve made with your eligible Capital One card within the last 90 days.

Miles can be redeemed at a rate of 1 cent per mile, and there’s no minimum amount of miles required to cover a portion or all of your travel purchase.

You can redeem miles for travel expenses by navigating to the Rewards page on your Capital One account, and clicking on the “Cover travel purchases” option.

From there, you can choose what purchase you want to cover, and how many miles you would like to use to cover that purchase.

If you don’t have any eligible travel expenses in the past 90 days, you can redeem your miles for a statement credit on your credit card, or by receiving a check in the mail. However, the redemption rate for converting miles to cash is significantly lower at 0.5 cents per mile.

If you redeem this way, you’re getting half the value compared to offsetting travel purchases, and potentially even less compared to transferring to loyalty programs.

Redeeming Capital One Miles Through Capital One Travel

You can also redeem Capital One miles directly and immediately when you book travel through the Capital One Travel portal.

However, it’s not necessary to limit yourself to redeeming through Capital One Travel. While miles can be redeemed at 1 cent per mile through Capital One Travel, it’s the same redemption rate you’ll get by simply redeeming your Capital One miles against all your travel purchases, as described above.

What’s more, if you redeem miles directly through Capital One Travel, you’ll be missing out on the generous earning rates you’d otherwise earn if you pay with a qualifying card.

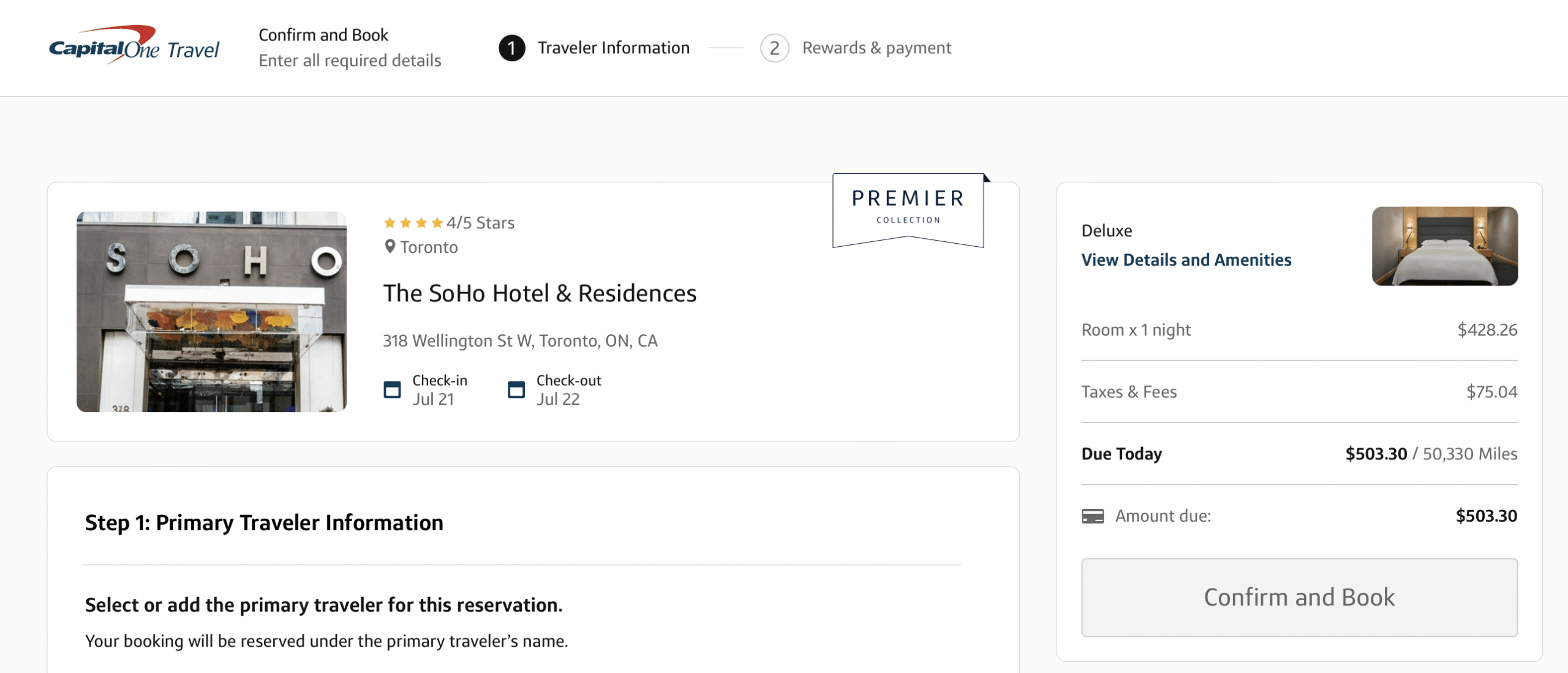

Also, hotels booked through Capital One Travel won’t count for status earning activity, and you most likely will not receive your elite status benefits at one of the major hotel chains. This is because Capital One Travel acts as an online travel agency, similar to Expedia.

If you wish to book a hotel where you’d normally get elite status benefits or earn elite qualifying night status, you’ll be better off booking through the hotel directly and then applying your Capital One miles to the purchase afterwards, unless you book through Premier Collection.

Premier Collection is Capital One’s preferred partner hotel program. Similar to Fine Hotels & Resorts by American Express, you’ll have access to elevated benefits if you are a Venture X or Venture X Business cardholder.

With Premier Collection, you’ll receive a $100 hotel credit, daily breakfast for two, and when available, room upgrades, early check-in, and late checkout.

Remember that Premier Collection rates can be more expensive. You should always compare the prices of a Premier Collection package with booking directly with the hotel, or with other similar preferred hotel programs like Marriott STARS and Luminous.

Other Options for Redeeming Capital One Miles

Capital One provides other redemption options aside transferring to another program and statement credits. However, these options provide significantly less value for your points, and should generally be avoided.

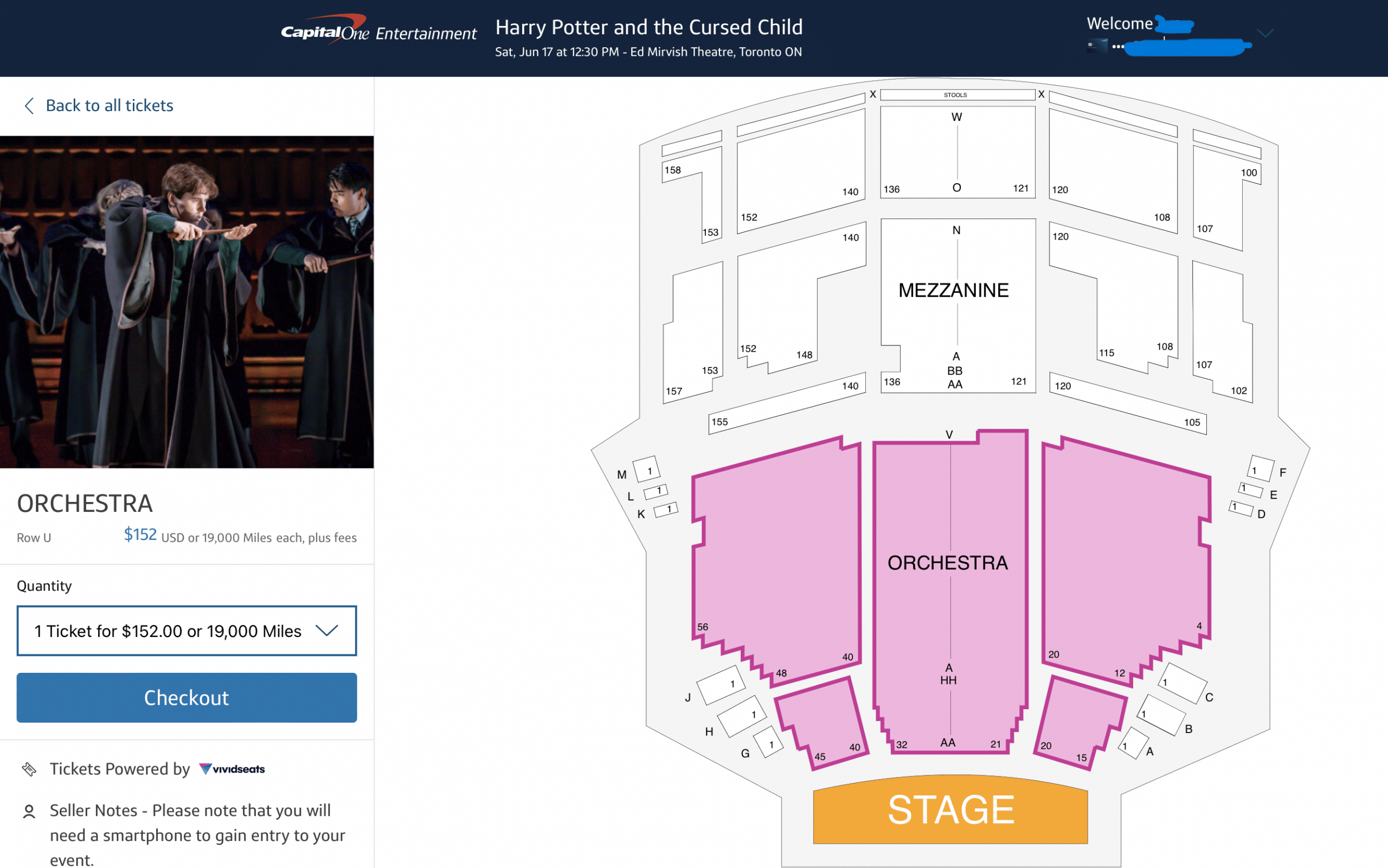

Capital One Entertainment is a platform where you can book tickets for concerts, sporting events, dining, and other experiences. While you may find some good deals, you should remember that you’re getting only 0.8 cents per mile redeeming this way.

Similar to Capital One Entertainment, you can also redeem Capital One miles for gift cards, Amazon credits, and Paypal rebates at a suboptimal rate of 0.8 cents per mile.

Transferring Capital One Miles

Capital One uniquely and generously allows you to transfer your miles to someone else for free. This added feature can be incredibly useful, as you can share your miles with anyone, even if they don’t live in the same household. You can also transfer an unlimited number of miles.

Once transferred, the miles can be redeemed per usual by your beneficiary – they can, for example, transfer them to their own airline or hotel loyalty programs.

In order to transfer your points to someone else, you’ll have to call Capital One, as the option isn’t available online.

Conclusion

Capital One miles are a great currency to collect. They are extremely flexible in that you can transfer them to one of many airline and hotel loyalty programs, or you can simply redeem them for statement credits to offset your own travel purchases. You can also transfer an unlimited number of miles to anyone.

The best way to earn Capital One miles is through credit card signup bonuses, especially with the Venture X and the Venture Rewards cards. Both cards also let you earn 2 miles per dollar spent on all purchases, and 5–10 miles per dollar spent on bookings through the Capital One Travel portal.

On the other hand, the best way to redeem Capital One miles is by transferring them to one of the 15 airline loyalty program partners. That way, you can book premium cabin seats without having to pay full price.

In all, you should definitely consider adding Capital One cards to your arsenal if you’re already in the US credit card game or if you’re planning to.

I have a Capital One Venture card and recently noted that they have added an MFA for transferring points to partners (e.g. airline or hotel partners). The MFA is for a OTP that must go to a U.S. phone number – no other options! Capital One customer service agents are unable to transfer my points on my behalf so they are stuck in limbo right now. Any suggestions for how to get around this?

Hi, you may try using GoogleFi, setting up a one-time local prepaid SIM to get a US number. this will only work if used to set up another service like Voice since access will no longer exist ofc after the Sim expires.

Alternatively, use Google Voice (set up using Google Fi or Voice)