Citi ThankYou Rewards is a versatile points program, which allows easy points earning through welcome bonuses and everyday spending.

Points earned can then be transferred to other loyalty programs, converted to cash, or redeemed in a few other ways, such as gift cards and travel products.

In this guide, we’ll cover everything there is to know about Citi ThankYou Rewards, including how to optimize your earning and redeeming within the program.

Earning ThankYou Points Through Welcome Bonuses

There are a number of ways to earn ThankYou Rewards points; however, the fastest way is through credit card welcome bonuses.

Among Citibank’s current lineup of credit cards, only the following five earn ThankYou points:

- Citi Premier Credit Card

- Citi Rewards+ Credit Card

- Citi Double Cash Credit Card

- Citi Custom Cash Card

- AT&T Points Plus Card from Citi

Before we continue, you should know that not all ThankYou points are created equally. Points earned through the Citi Premier have a lot more flexibility, with more transfer options.

However, if you’ve earned ThankYou points from any of the other cards, you can pool your points into a Citi Premier card and access more redemption options.

Citi Premier is the flagship Citibank credit card, but unlike other flagship cards like the CapitalOne Venture X, it fetches a modest $95 annual fee. Despite not offering travel perks like lounge access, its welcome bonus is usually a generous 80,000 points.

Second in line is Citi Rewards+, a no-fee card. It doesn’t come with as many transfer partners as the Citi Premier card, and its welcome bonus is usually only 25,000 points.

However, the Citi Rewards+ has a unique benefit that gives you back a bonus of 10% in points with each redemption, up to an annual maximum of 10,000 points.

Despite having “cash” in their name, the Citi Double Cash and Citi Custom Double Cash no-fee cards earn ThankYou Rewards points. The “cash back” of both cards is automatically converted at a rate of $1 in cash back = 100 ThankYou points.

Both cards usually come with a welcome bonus of $200 “cash back”, which is equivalent to 20,000 ThankYou points.

Lastly, as its name suggests, the no-fee AT&T Points Plus card is geared towards the telecom’s clientele. Its welcome bonus is a $100 statement credit that can’t be converted to ThankYou points.

Before you dive into Citibank cards, you should be aware of the bank’s strict application rules. For starters, there are a couple of unstated rules surrounding Citibank applications:

- You can only apply for a card every eight days.

- You can’t apply for more than two every 65 days.

There doesn’t seem to be a hard limit in the number of Citibank cards you can hold, but Citibank may deny you any more cards when you’ve reached the maximum credit the bank can lend you. This limit is, of course, dependent on your personal circumstances.

More importantly, you’ll only qualify for the welcome bonus of each card product every 48 months. For instance, the terms and conditions on the application page of Citi Premier states:

Bonus ThankYou® Points are not available if you have received a new account bonus for a Citi Premier account in the past 48 months.

Citi Premier and Citi Rewards+, while belonging to the same card “family”, are treated as separate products; hence, you’ll qualify for the welcome bonus of each one every 48 months.

It goes without saying that you must time your application for each card when there’s a lucrative welcome bonus, as you can only qualify for one once every four years.

Earning ThankYou Points Through Everyday Spending

After earning the welcome bonus, you can continue to earn ThankYou points by using your Citibank credit card towards everyday spending. You’ll earn a different number of points per dollar spent, depending on the card and spend category.

- Citi Premier Credit Card

- 10 points per dollar spent on hotels, car rentals, and attractions booked through the Citi Travel portal

- 3 points per dollar spent on groceries, air travel, hotels, restaurants, and gas

- 1 point per dollar spent on all other purchases

- Citi Rewards+ Credit Card

- 5 points per dollar spent on hotels, car rentals, and attractions booked through the Citi Travel portal

- 2 points per dollar spent on groceries and gas (for the first $6,000 per year)

- 1 point per dollar spent on all other purchases

The Citi Rewards+ card also rounds up all your points earning to the nearest 10 points. For example, if you were to spend $3 at a vending machine, you’ll get 10 points instead of 3 points.

- Citi Double Cash Credit Card

- 2 points per dollar spent on all purchases if balance is paid on time

- Citi Custom Cash Card

- 5 points per dollar spent on the top spend category each billing cycle (up to $500)

- 1 point per dollar spent on all other purchases

- AT&T Points Plus Card from Citi

- 3 points per dollar spent on gas

- 2 points per dollar spent on groceries

- 1 point per dollar spent on all other purchases

Redeeming Citi ThankYou Rewards Points

There are a number of options for redeeming Citi ThankYou Reward points. However, you’ll get the most value by redeeming your points by transferring them to other loyalty programs.

Transferring Points to Other Programs

Keep in mind that only ThankYou points in a Citi Premier account may be transferred to all partners. Points earned through all other cards may only be transferred to JetBlue TrueBlue, Choice Privileges, and Wyndham Rewards.

Again, you can pool ThankYou points into a Citi Premier card to take advantage of a wider range of partners and a more favourable transfer rate.

Airlines

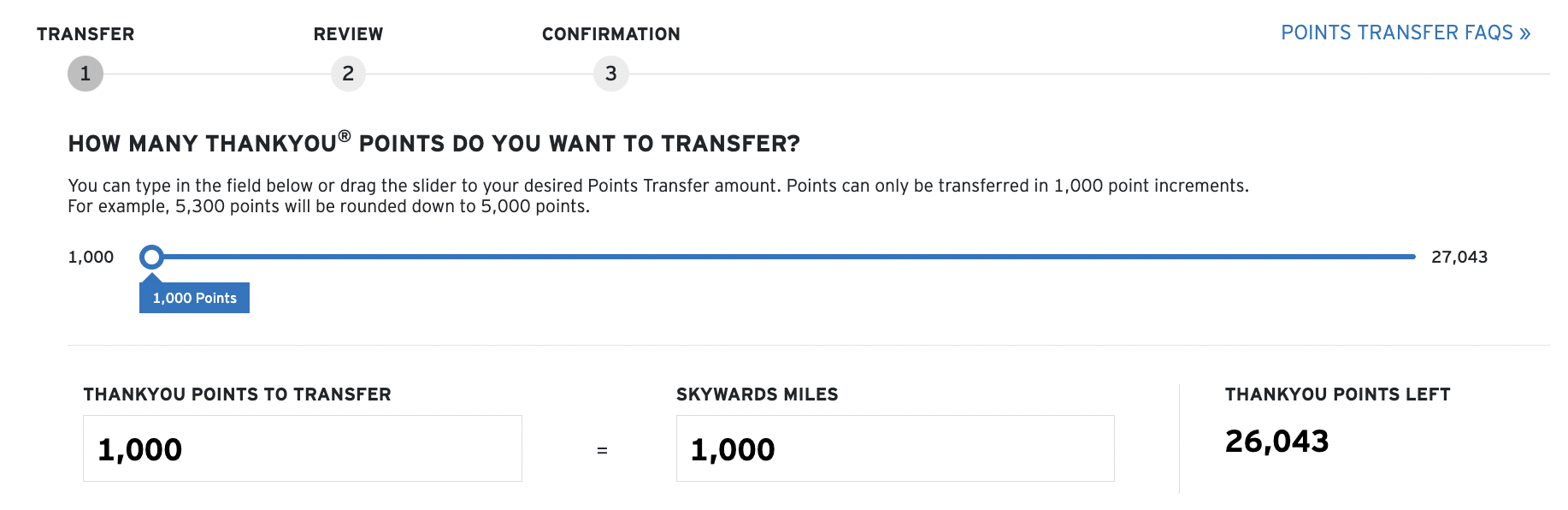

You can transfer ThankYou points to the following airline programs at a rate of 1,000 ThankYou points = 1,000 miles:

- Aeromexico Rewards

- Air France/KLM Flying Blue

- Avianca LifeMiles

- Cathay Pacific Asia Miles

- Emirates Skywards

- Etihad Guest

- EVA Air Infinity MileageLands

- JetBlue TrueBlue (1,000 ThankYou points = 800 miles for non-Citi Premier cards)

- Qantas Frequent Flyer

- Qatar Airways Privilege Club (Avios)

- Singapore Airlines KrisFlyer

- Thai Royal Orchid Plus

- Turkish Airlines Miles and Smiles

- Virgin Atlantic Flying Club

Hotels

As for hotels, you can transfer ThankYou points to the following chains at varying rates:

- Accor Live Limitless: 1,000 ThankYou points = 500 ALL points

- Choice Privileges: 1,000 ThankYou points = 2,000 points for Citi Premier; 1,000 ThankYou points = 1,500 points for all other cards

- Wyndham Rewards: 1,000 ThankYou points = 1,000 points for Citi Premier; 1,000 ThankYou points = 800 points for all other cards

It’s always best to have specific travel plans before transferring ThankYou points to another loyalty program. Once you transfer your points, you won’t be able to transfer them back.

Generally speaking, you won’t get as much value by transferring ThankYou points to any of the three hotel programs. That brings us to a better use of your ThankYou points: airline programs.

The best airline program to transfer your points to depends on your own travel goals and your personal circumstances, like which airlines fly out of your nearest airport.

However, if you’re looking for suggestions, here are some:

With Singapore Airlines KrisFlyer, you can access one of the most aspirational flight experiences, the Suites Class.

With Qatar Airways Privilege Club, you can earn Avios and book Qsuites or First Class. What’s more, you can easily transfer Avios between Qatar Airways Privilege Club and British Airways Executive Club.

With Virgin Atlantic Flying Club, you can book trans-Atlantic flights on Upper Class, as well as seats on ANA First Class.

Redeeming ThankYou Points for Cash

If you’re not looking to travel, you can redeem your ThankYou points for cash. While it isn’t the best way to redeem your points, it’s the easiest.

There are three ways of turning your ThankYou points into cash: through statement credits, direct deposit, or cheque by mail.

The cash equivalent of your points you’ll receive depends on which card you hold. The Citi Premier, Citi Double Cash, and the Citi Custom Cash cards all allow you to redeem ThankYou points at a rate of 1 cent per point.

Meanwhile, the other two cards, Citi Rewards+ and AT&T Points Plus, give you a significantly lower rate of 0.5 cent per point.

One benefit of redeeming points for cash is that you can redeem as low as 1 point for if you hold the Citi Premier, Citi Double Cash, or Citi Custom Cash cards. Thus, you can cash residual amounts once you’ve transferred the rest to other loyalty programs.

Other Ways to Redeem ThankYou Points

Aside from transferring points to another program and redeeming them for cash, you can use your ThankYou points in a few other ways.

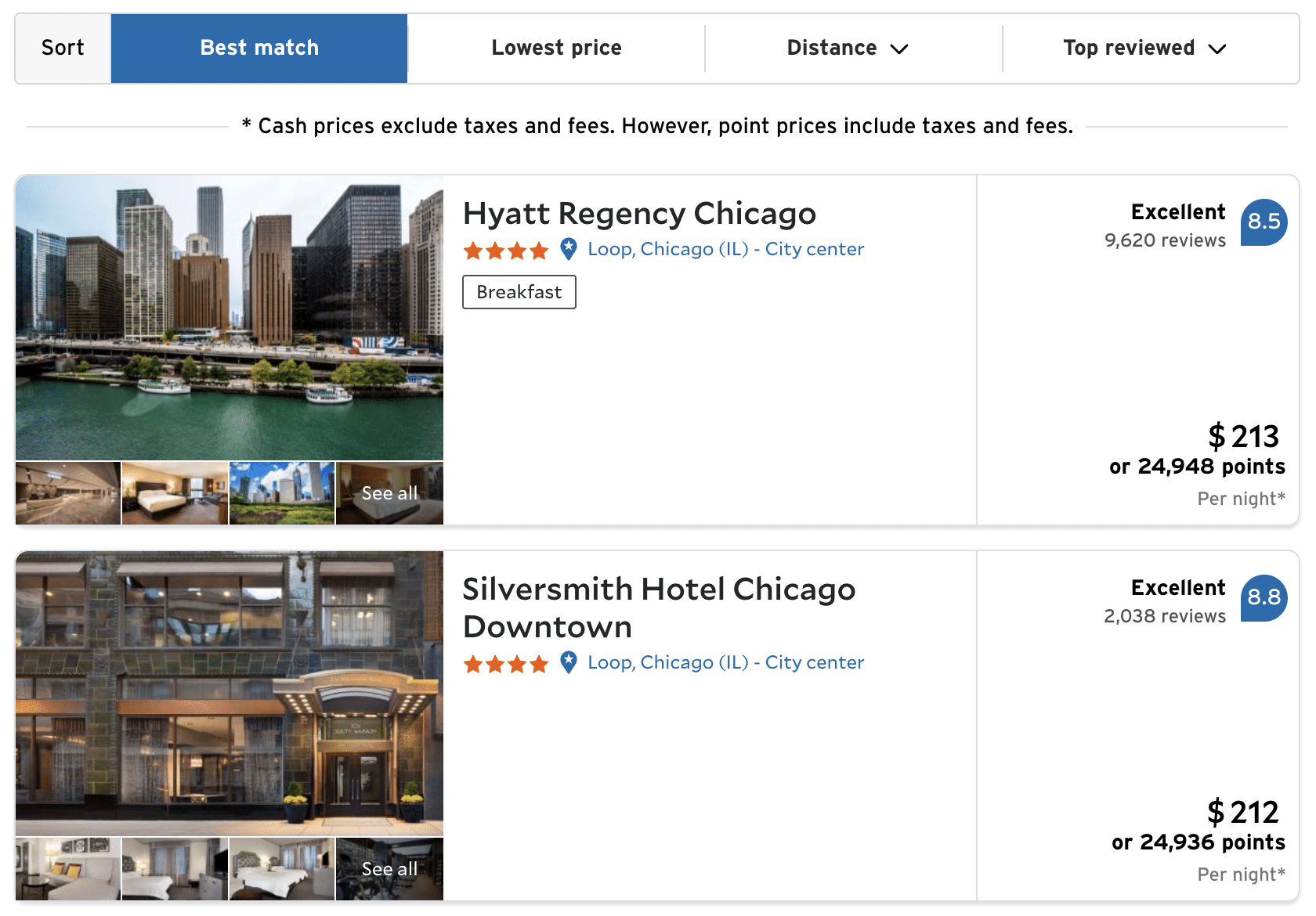

First off, you can also book travel products through Citibank’s travel portal powered by Booking.com. The portal lets you book hotels, flights, cars, and attractions at a rate of 1 cent per point.

You can also redeem ThankYou points for a wide variety of gift cards directly through the ThankYou portal. Redeeming this way, you can get gift cards at 1 cent per point, or more if there are gift card-specific promotions.

Lastly, you can use your ThankYou points to cover your online and in-store purchases at a rate of 0.8 cent per point.

Online, you can redeem your points through the following:

- Amazon

- PayPal

- BestBuy (as statement credits)

- 1-800flowers.com (as statement credits)

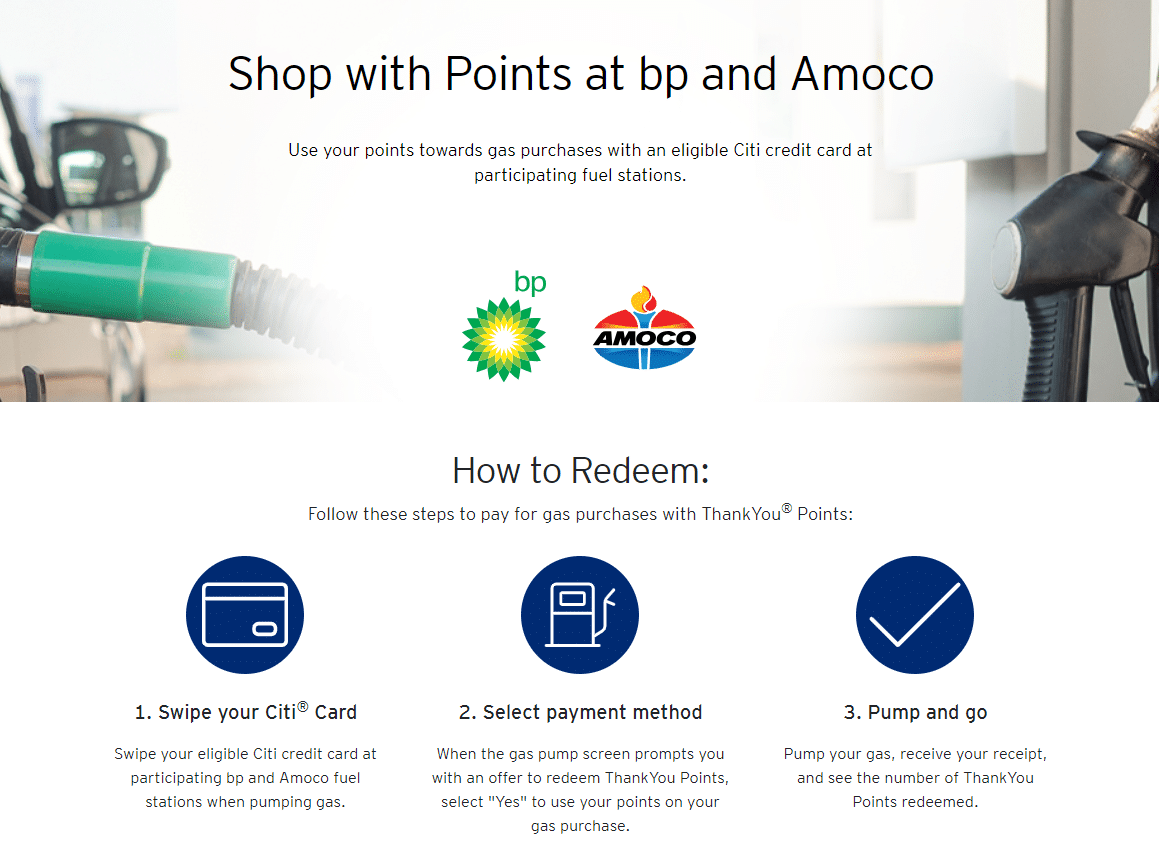

In-store, you can redeem your points at:

- BP and Amoco gas stations

- Shell gas stations

- CVS

- Walmart

With the redemption choices above, you’re getting between 0.8–1 cent per point. Clearly, you’re better off redeeming your ThankYou points as cash at 1 cent per point, or for potentially higher value when you transfer them to another loyalty program.

Points Sharing

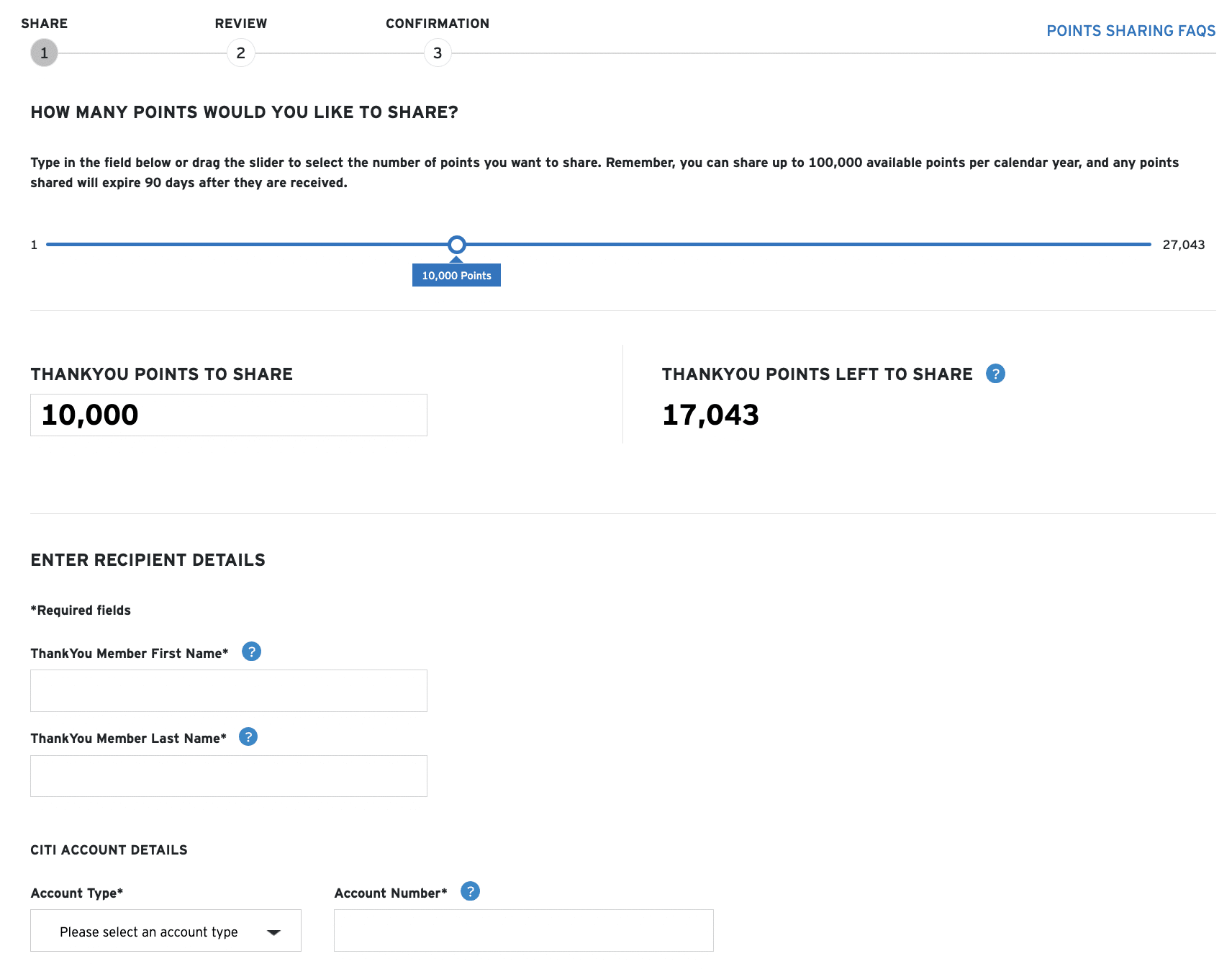

The Citi Thankyou Rewards program allows you to share your points to another member through the Points Sharing feature.

For now, Points Sharing is completely free. However, members may only transfer 100,000 ThankYou points and receive 100,000 Thank You points per year. Welcome bonus points may not be shared.

Moreover, once points are transferred, they’ll expire after 90 days of being received. Therefore, if you are looking to transfer or receive ThankYou points, make sure there’s a plan in place to redeem or transfer them out before they expire.

Note that Citi Custom Cash card accounts are not eligible for Points Sharing.

Conclusion

Although Citibank may not be offering cards with industry-leading benefits, its ThankYou program shouldn’t be ignored.

Points earned through the program can be transferred to 17 airline and hotel partners. Flexible ThankYou points can also be converted to cash, redeemed as gift cards, or used for online and in-store purchases.

What’s more, the flagship Citi Premier card, which usually offers 80,000 ThankYou points, commands an annual fee of only $95. The four other cards that earn ThankYou points, though offering modest welcome bonuses, are no-fee.