Banks love our money. The more capital they hold, the more they can use it to make more money.

To get it, they’ll tempt us with perks—like waiving the annual fee on a premium credit card, no monthly account maintenance fees, free safety deposit box if we park enough cash in a chequing account.

Of course, that cash will earn next to nothing. And yes, it’s an opportunity cost. Money you could invest elsewhere.

But if you know how to work the system, those perks can outweigh the lost interest. Especially when you’re dodging the steep annual fees on high-value travel credit cards.

Premium credit cards are a backbone of any Miles & Points strategy. The trick is keeping them without paying full price.

Let’s see how we can use these accounts to boost our credit card gains.

In This Post

All About Premium Bank Accounts

Every big bank has a premium tier.

Top-tier chequing accounts usually come with a long list of perks: unlimited transactions, free ATM withdrawals, complimentary cheques, bank drafts, money orders, and even a safety deposit box.

Some customers genuinely value these extras and sign up for premium banking without even thinking about credit cards.

What’s the appeal for travellers?

Even if you have no need for the other features of a premium banking package, credit card enthusiasts may find enough value in the annual fee rebate alone.

In particular, this is valuable as you seek to decrease the associated costs for any cards you plan on keeping long-term.

After all, first-year annual fee rebate on a new card isn’t forever, and there are more considerations to keep in mind than merely a welcome bonus.

Avid travellers can rely on their credit cards for travel insurance. If you book a trip far in advance, you want to ensure that you’ll hold the card you booked with through the duration of the trip, so that the insurance remains valid. It’s wise to designate a keeper card for this purpose.

Also, it’s good for your credit file to keep your oldest cards open, even if they don’t give you much everyday value anymore. If any of these are premium cards which you can’t or don’t want to downgrade, you can eliminate the annual fee while keeping your credit score healthy as you focus on newer cards in your portfolio.

Not to mention, some cards with annual fees offer great ongoing value for daily use. Maybe you’d like to maintain high earn rates at grocery stores. Or if you frequently make Aeroplan bookings on Air Canada flights, you’d benefit from preferred pricing discounts as a Visa Infinite Privilege cardholder.

How does it work?

Premium bank accounts come with high fees, around $30/month. Of course, there’s no good reason to pay $360/year to waive a $120 credit card fee (unless you value premium banking itself at $240).

The smarter move? Maintain the bank’s minimum balance—usually around $6,000—and they’ll waive the monthly account fee.

From there, the play is simple:

- Get the premium bank account that offers a credit card fee rebate.

- Keep the required balance so you’re not paying for the account.

- Enjoy your premium card for free.

Some banks also offer a partial rebate for seniors or students, but these can’t be combined with the full fee waiver for holding a minimum balance, nor are they enough to remove fees entirely on their own. These discounts might be useful if you’re interested in premium banking for its own sake, but not if you’re only chasing for a free credit card.

What are the drawbacks?

Before committing a large cash deposit to obtain a credit card fee waiver, it’s important to consider the opportunity cost.

With the funds idle in a chequing account, they won’t earn interest or grow as they would in a more lucrative savings or investment vehicle.

Also, by parking the money, you lose liquidity. Even if you don’t plan on touching the balance, it’s less accessible than a true emergency fund.

You can always move the money out if you need to, but you’d have to go through the hassle of downgrading or closing the chequing account and credit card, if you’re not willing to start paying ongoing fees.

Credit Card Rebate Packages

Each of Canada’s major banks offer multiple ways to reduce credit card fees through their banking products. Not all packages are created equal, however, and the details of the fees, benefits, and requirements vary widely.

BMO

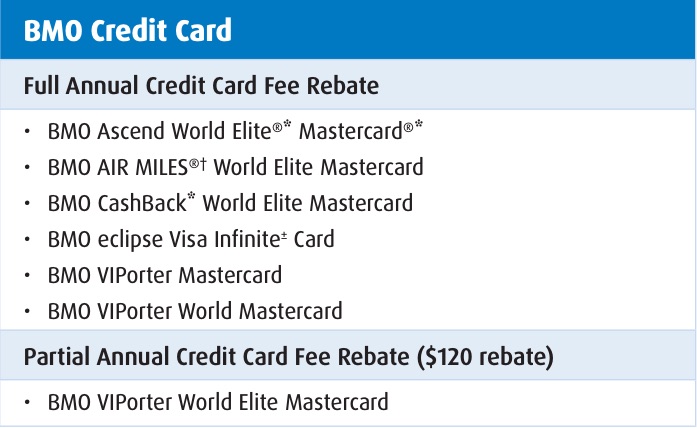

The Bank of Montreal offers two accounts that provide a credit card fee waiver:

- Premium Plan – $6,000 minimum balance waives the $30 monthly fee. Provides a full annual fee waiver on one BMO credit card of your choice. Eligible cards include the BMO Ascend World Elite®* Mastercard®*, BMO eclipse Visa Infinite* Card, BMO AIR MILES®† World Elite®* Mastercard®*, BMO CashBack World Elite®* Mastercard®*, and the BMO VIPorter Mastercard®*

- Performance Plan – $4,000 minimum balance waives the $17.95 monthly fee. Provides only a $40 rebate on the credit card fee.

Neither tier covers the BMO eclipse Visa Infinite Privilege* Card, even partially, nor do they extend rebates to supplementary cards. That’s unfortunate, since pairing the two eclipse cards can be a powerful strategy for maximizing rewards.

Between the two tiers, the top-tier Premium Plan is a better proposition. Better to go all-in if you’re going to bother at all.

BMO also offers a Family Bundle, allowing up to 20 accounts at the same address. This extends some premium perks—like unlimited transactions—to household members.

However, the credit card rebate only applies to the primary account holder.

A missed opportunity, but still useful if you want to teach teenagers about money management rather than enlisting older kids to chase extra AIR MILES.

Speaking of enlisting, members of the Canadian Defence Community can get the Performance tier for no monthly fee, with no minimum balance. With the $40 credit card rebate, that would bring your net annual cost to $80 for a keeper travel insurance card, with no opportunity cost on your principal.

CIBC

CIBC offers two premium banking tiers: Smart and Smart Plus. Only Smart Plus includes a credit card rebate.

- Smart Account – $4,000 minimum balance waives the $16.696 monthly fee, but no credit card rebate.

- Smart Plus Account – $6,000 minimum balance waives the $29.95 monthly fee, and provides:

- Full rebate for the CIBC Dividend® Visa Infinite* Card, CIBC Aventura® Visa Infinite* Card, or CIBC Aeroplan® Visa Infinite* Card.

- Partial rebate of $139 for the CIBC Aventura® Visa Infinite Privilege* Card or the CIBC Aeroplan® Visa Infinite Privilege* Card.

Alternatively, CIBC waives banking fees with $100,000 in eligible savings and investments. This way, your cash isn’t sitting idle in chequing—it’s actually working for you. CIBC counts a wide range of registered and non-registered accounts, whether managed or self-directed.

A wide variety of investment vehicles are available, including registered and non-registered accounts, both managed and self-directed.

If you go this route, you and your partner can double-count investments in joint accounts. As long as you both reach the $100,000 threshold as a sum of your own individual and joint assets, you can both waive your premium banking fees.

Smart Plus accountholders also get a $50 fee rebate on up to three authorized users. That means supplementary cards are free with Visa Infinite, or reduced to $49 with Visa Infinite Privilege.

This can be especially useful with Aeroplan cards, since authorized users can link their own Aeroplan number and still get perks like free checked bags on Air Canada. It’s a handy way to extend benefits to family—or even friends you want to nudge into the world of Miles & Points.

For existing cardholders looking to later take advantage of this chequing package, you’ll even receive a pro-rated retroactive rebate if you’ve already paid the credit card annual fee.

Finally, keep in mind that CIBC’s co-branded Aeroplan cards shine for insurance coverage on Aeroplan award tickets. The no-fee CIBC Aeroplan Visa Card doesn’t include much, but coverage kicks in once you’re at the Infinite tier or higher—where a waived fee can make holding the card much more attractive.

National Bank

National Bank offers three different tiers of chequing accounts: The Minimalist, The Connected, and The Total.

Of these, The Connected and The Total offer credit card annual fee offsets.

- The Connected – $4,500 minimum balance waives the $15.95 monthly fee. Provides a $30 annual credit towards the annual fee of an eligible credit card.

- The Total – $6,000 minimum balance waives the $28.95 monthly fee. Provides a $150 annual credit towards the annual fee of an eligible credit card.

National Bank takes a bit of a different approach to offsetting credit card fees with an eligible chequing account, as you’ll get a credit applied to your statement instead of having it waived outright.

Eligible cards include the National Bank® World Elite® Mastercard®, as well as the Echo, Cash Back, Syncro, Platinum, and World products.

You’ll need to open your credit card account after signing up for an eligible chequing account, and unfortunately the rebate doesn’t apply to supplementary cards. The rebate applies to the first year only, meaning that you can’t benefit from the fee waiver year after year.

RBC

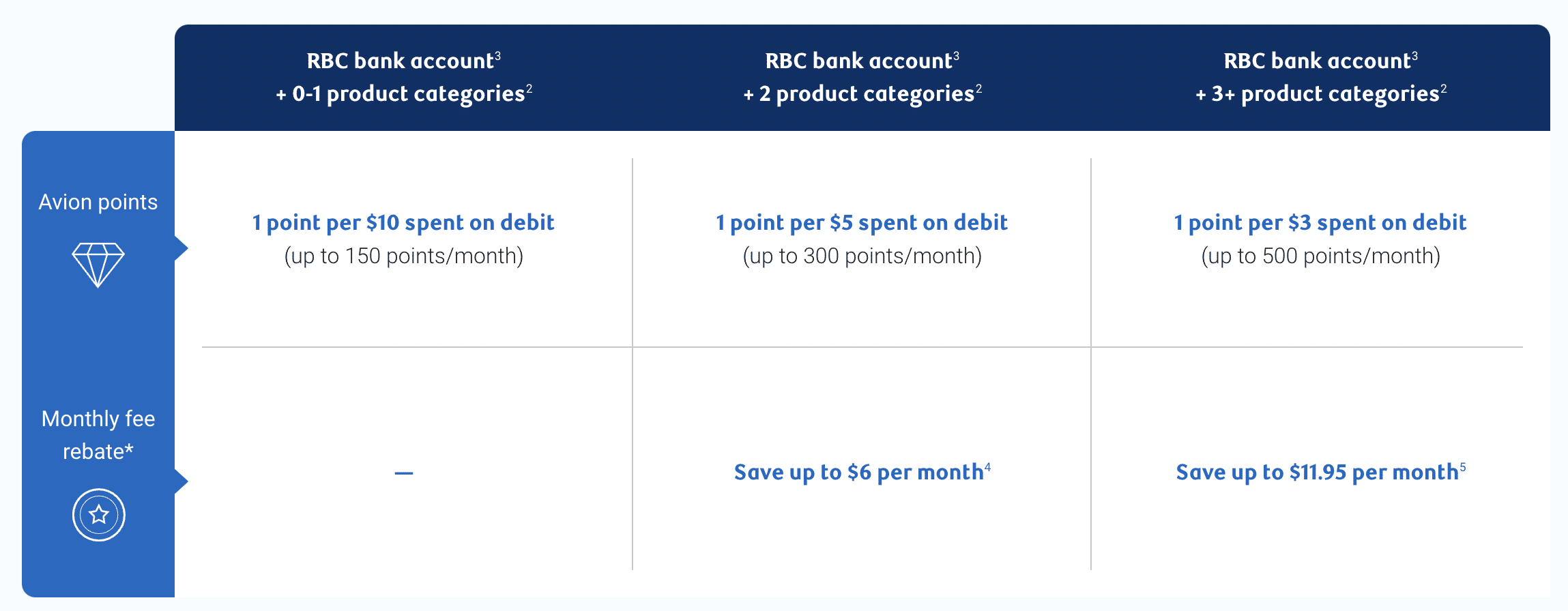

RBC has two tiers of banking packages with credit card fee reductions: Signature No Limit Banking at $16.95/month, or VIP Banking at $30/month.

Signature No Limit Banking offers partial rebates that varies depending on the type of credit card:

- $48 rebate for the RBC® ION+ Visa

- $39 rebate for the Signature® RBC Rewards Visa and the WestJet RBC® Mastercard

- $35 rebate for the RBC® Avion Visa Infinite Privilege†, RBC® Avion Visa Infinite†, and RBC® Avion Visa Platinum, as well as the RBC® British Airways Visa Infinite†, and WestJet RBC® World Elite Mastercard, amongst others

VIP Banking extends a $120 partial rebate on the RBC® Avion Visa Infinite Privilege†, and a full annual rebate on the other cards mentioned above. The RBC® British Airways Visa Infinite† is a quirky case, as you can get the entire $165 fee rebated here.

Unlike other banks, RBC doesn’t have an option to waive chequing fees with a minimum balance. Instead, they offer a “Value Program” with different qualification criteria for account fee rebates.

With the Value Program, the Signature No Limit Banking fee can drop as low as $4/month, and the VIP Banking fee can fall to $17.05/month.

To qualify, you’ll need to:

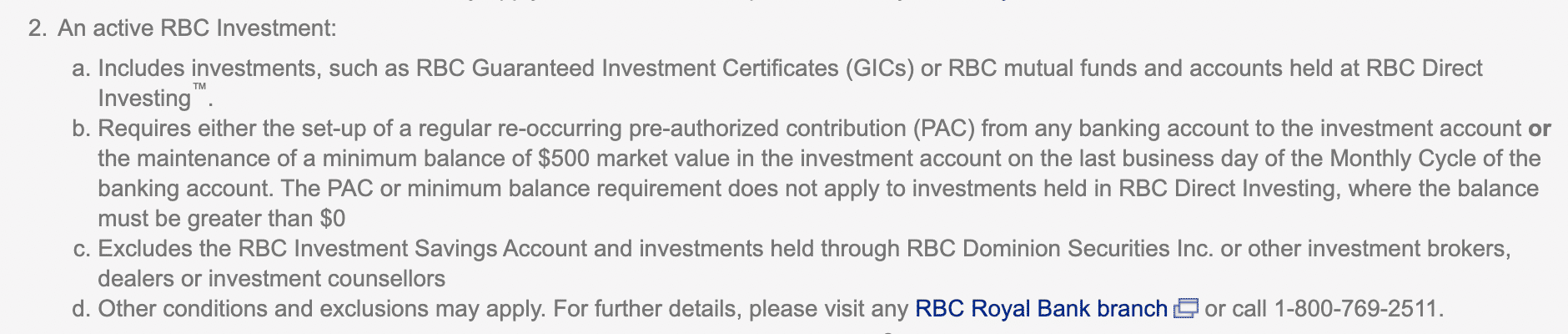

- Hold two or more other eligible RBC products (such as a mortgage, investment account, or credit card).

- Complete at least two activities each month (like a direct deposit, bill payment, or pre-authorized payment).

While the mortgage is a bit of big ask if you’re not set up already, you can fulfill the investment requirement rather easily with recurring pre-authorized contributions, a minimum $500 value, or any amount in an RBC Direct Investing account.

Even with those discounts, you’ll still pay something to maintain an RBC account.

And frankly, there’s not much appeal here if your only goal is to save on a credit card annual fee.

Unless you already use multiple RBC products—or really value unique features like their cross-border banking—other banks generally offer stronger options.

Scotiabank

Scotiabank offers two levels of premium banking: the mid-range Preferred Package and the top-tier Ultimate Package.

- Preferred Package – $4,000 balance waives the $16.95 monthly fee. Includes a first-year card rebate up to $150.

- Ultimate Package – $6,000 balance waives the $30.95 monthly fee. Includes an ongoing card rebate up to $150.

Cards eligible for a fee waiver include their core roster of the Scotiabank Gold American Express® Card, Scotiabank Passport® Visa Infinite* Card , Scotiabank Passport® Visa Infinite Privilege* Card, Scotiabank Momentum® Visa Infinite* Card, and Scotiabank Value Visa Card. Most of these options provide an array of long-term appeal, including high earn rates on groceries and restaurants, lounge passes, and no foreign transaction fees.

The Preferred Package grants a full annual fee waiver on one card up to $150, but only for the first year. This is still an improvement compared to other banks, where it’s usually not worth going for the mid-range chequing account for only a partial fee waiver.

One strategy would be to open a Preferred account in your first year with the card, then upgrade to Ultimate in the second year for an extra $2,000 minimum balance.

Also, if you open the chequing account after the credit card, Scotiabank will still give you a full retroactive rebate on the credit card. This is definitely a step up from CIBC’s pro-rated incentive.

Indeed, it’s quite rare to see a big bank give you flexibility with the timing of your money movements, while still awarding the full benefits that come with your premium commitment.

TD

TD largely follows the same structure as Scotiabank. At the mid-range level, Unlimited Chequing requires a $4,000 balance to waive $16.95/month, with a first-year rebate of $139. At the top,

All-Inclusive Banking requires a $6,000 balance to waive $29.95/month, with an ongoing $139 rebate annually.

TD offers two premium chequing accounts that come with credit card fee rebates:

- Unlimited Chequing – $4,000 minimum balance waives the $17.95 monthly fee. Provides a first-year rebate of up to $139 on an eligible TD credit card†.

- All-Inclusive Banking – $6,000 minimum balance waives the $30.95 monthly fee. Provides an ongoing annual rebate of up to $139 on an eligible TD credit card†.

With both accounts, the rebate is available on any one of TD’s Visa Infinite or Visa Platinum cards, including the TD® Aeroplan® Visa Infinite* Card, the TD® Aeroplan® Visa Platinum* Card, and the TD First Class Travel® Visa Infinite* Card.

In practice, the Unlimited Chequing account’s first-year rebate is a bit of a moot point, since most TD cards already come with a first-year annual fee rebate—except for the Privilege card.

With the All-Inclusive Banking account, the TD® Aeroplan® Visa Infinite Privilege* Card is eligible for a partial rebate ($139 of the card’s $599 annual fee).

All-Inclusive Banking also gives a $75 rebate for one authorized user.

The TD® Aeroplan® Visa Infinite Privilege* Card card has a hefty $599 annual fee, but with the All-Inclusive Banking Plan you’ll shave off $139 for the primary cardholder and another $75 for a supplementary card. That brings the total to $584 for two cards.

This can be very useful for families travelling together. For example, if a dad holds the Privilege card and adds mom as an additional cardholder, both get full access to perks like Maple Leaf Lounges and Cafés, priority boarding, and priority security at select airports.

That means a family of four could access lounges with just those two cards—without needing to always travel together to share the benefits. Each adult holds their own Privilege card and can use the perks independently.

Comparison of Premium Bank Accounts

As you can see, the differences are quite nuanced. Here’s a quick breakdown of the key points for each bank:

Conclusion

Premium bank accounts with credit card fee rebates can be a smart way to cut down the cost of keeping valuable cards long-term.

Yes, you’ll need to park a chunk of cash in a chequing account that earns little to no interest. And yes, there’s an opportunity cost.

But if you’re strategic, the trade-off can be worth it—especially when you’re holding onto cards for travel insurance, strong earn rates, or perks like lounge access.

Every bank structures its rebates differently. Some only cover part of the fee, others extend it to supplementary cards, and a few only apply in the first year.

The key is matching the right account with the right card—and making sure you’re actually coming out ahead.

Used wisely, these fee rebates can save you hundreds of dollars a year while keeping your Miles & Points strategy strong.

We had BMO as our primary bank for years and took advantage of the fee waivers via maintaining a minimum balance. We switched our primary bank to HSBC a few years back to build a relationship with an international bank – thinking we’d spend a lot of time in Europe after retirement and HSBC could make that easy (okay, so that didn’t quite work out with the sale of most non-Asian regional banks including now in Canada).

Anyway, we kept the BMO chequing account open and we keep the minimum deposit there benefiting from the no monthly banking fees and the credit card for free. We kept it primarily because when we travel we have, on occasion, had something go wrong at an ATM that blocks us from accessing that bank (usually related to anti-fraud routines gone wrong). Takes a while to sort out and having an unrelated backup at another institution has been super helpful.

Otherwise, I agree, you can generally do better investing the money and just pay the $120 fee.

Anyone have data points on getting full fee waivers on the Privilege cards? Either through private banking or wealth management for high net worth individuals?

If you speak to you personal/private banker/advisor, they MAY waive it for you, especially if you have millions of assets managed by the bank

I’ve been keeping an eye on this during the HSBC transition to RBC. HSBC Private Client waived the full $499 fee for the Metal card automatically. Sadly RBC seems to be sticking with their standard approach of max $120 rebate for their Private Banking Visa Infinite Privilege @ $399 so you are on the hook for $279. I don’t yet have a formal communication so I’ll update here if I hear anything different.

I have a personal friend who is a private bank client of RBC, his AVION VIP is waived automatically every year. Many private client relationship and perks are not publicized and are individualized. So it’s best to inquire the private banker/financial adviser.

Opportunity costs are important to consider, true, but I consider the return to be greater than the 2.5-2.8% outlined here.

At TD, a $5,000 balance in the All-Inclusive Plan sees fees of 12x$30 = 360 plus the CC annual fee of $139 rebated. That’s a value of out of pocket savings of $499, or 10% on a 5K balance every year.

Also for Scotiabank Ultimate there are other perks that need to be taken into consideration such as no ATM charges at any non Scotiabank ATM and this also applies global so if you travel frequently outside of Canada this could save you money there. Unlimited e-transfers, small safety deposit box annual fee waiver and savings account interest rate boost on Momentum savings accounts so this account can be quite valuable with all the additional perks!

> For example, let’s say you open an account that requires $5,000 to waive a $120 credit card annual fee. This effectively represents a 2.4% return on your principal over the course of a year

Keep in mind that the $120 credit card annual fee is paid with after-tax dollars. You’d need at least $200 of income, depending on marginal tax rate, to end up with $120 in your wallet. So the effective interest rate you’d need to earn on the $5,000 is at least 4%.

The opportunity cost and reduced liquidity should absolutely be taken into consideration. It does not make sense to put down $4000-6000 only for the sack of waiving an $120 annual fee. Investing the same amount money in lower risk financial instructions such as broad market ETF and bonds will generate significantly higher return and allow the return to be compounded over the years, which will likely be more cost efficient than lending money to the bank interest free.