I like to write a post at the beginning of every year charting out the lay of the land in terms of the prevailing Miles & Points strategies for the upcoming year.

Success in this space is all about learning, research, and then executing on these strategies, so the goal of this post is to highlight the many different areas in which to focus your efforts, so that you may check back periodically throughout the year and keep track of your progress.

While 2019’s game plan was mostly a continuation from previous years, 2020 looks certain to introduce a few exciting new elements, with the introduction of a brand-new Air Canada loyalty program on the horizon and the many new co-branded credit card products that are certain to arrive on the market to much fanfare.

Without further ado, let’s go through the 2020 Miles & Points Grand Strategy, an appraisal of all the angles to consider as you go about putting in the work to earn and redeem points for maximum value this year.

1. Credit Card Signup Bonuses

Credit card signup bonuses are by far the fastest way to rack up meaningful amounts of points to travel the world. They’re part of the furniture in our space, and the most elementary starting point for those who’d like to raise their points game to new heights.

Among the major financial institutions in Canada, American Express has by far the most compelling signup offers, but it can be difficult to keep track of all the different products and offers floating around out there.

That’s why I keep track of everything using the Amex Flowchart, which aims to distill all that information and show you the optimal strategies to apply for the seven major American Express charge cards and credit cards, so that you aren’t leaving any bonuses on the table.

The introduction of the Business Edge Card in late 2019 added an extra dimension to what’s possible with Amex: not only does the Business Edge offer up to 42,000 MR Select points in the first year, but since it’s part of the same referral “family” as the Business Platinum Card, you may earn an extra 25,000 MR points as a referral bonus by applying via the Business Platinum’s referral link.

Looking at other issuers, there are quite a few very strong offers floating around as well. The RBC Avion has put out a few limited-time bonuses of 25,000 Avion points + First Year Free recently, although the long-standing offer of 20,000 Avion points + First Year Free is a great deal as well.

Meanwhile, the RBC WestJet is currently offering a record-high 350 WestJet Dollars, and I wouldn’t be surprised to see WestJet continuing to aggressively pursue market share given the heightened uncertainty surrounding Aeroplan and Air Canada’s loyalty offering at the moment.

Speaking of which, the TD Aeroplan Visa Infinite’s current offer of 30,000 Aeroplan miles + First Year Free is another strong contender for a place in your wallet; however, it’s highly likely that TD, CIBC, and potentially Amex will be launching brand-new products to coincide with the new Air Canada loyalty program, so I imagine we could see this series of offers growing even stronger at some point in 2020.

The MBNA Alaska Airlines MasterCard remains a stalwart of the credit card scene, and a set of strategies particular to MBNA – involving downgrading cards and making use of MBNA’s ability to push through approvals by splitting credit limits – allows you to effectively shorten the “cycle” of the MBNA Alaska to roughly three months rather than the standard six.

Finally, once you’ve worked your way through the major credit cards associated with the top loyalty programs – keeping in mind the credit impact of each application to ensure your credit remains in good shape, of course – you can then turn your attention to the secondary credit cards and programs out there, like the CIBC Aventura, the Scotia Passport, or the HSBC World Elite, which can help you save significant sums of money on any additional travel expenses (i.e., costs beyond the flights and hotels that you book on points) that you might incur throughout the year.

2. US Credit Cards

Getting into US credit cards is the natural next step for Canadians who feel as though they’re adequately comfortable with the Canadian side of the game and are looking to optimize even further. Compared to Canada, the US credit card market has a far wider range of credit cards, greater sums of signup bonuses in general, and a larger pool of potential airline and hotel partners whose sweet spots you can access.

All the key ingredients are readily available for any Canadian points collector looking to diversify into the US: an Amex Global Transfer can unlock your first Amex US card as long as you’ve held a Canadian Amex product for three months in good standing, a US bank account can be opened via the cross-border banking services of most of the Big 5 banks, and 24/7 Parcel stands ready to meet any of your mail-forwarding needs.

As for the process of obtaining an ITIN to access Chase and Citi credit cards, I recognize that some people have had difficulties using the Amazon.com supporting letter, and I’ll definitely share any potential alternatives that I may come across. For now, my friend Jayce from PointsNerd has offered up a paid solution that could save you plenty of headache if you’ve been dealing with a rejected ITIN application or two.

While the US market no doubt offers many more credit card opportunities, one potential downside is that the bonuses are largely once-in-a-lifetime, or otherwise have much more restrictive rules than Canada in terms of how often you can get the bonus.

This isn’t entirely a bad thing, though, because many of the best US cards provide so much value that it makes perfect sense to keep them around for the longer term.

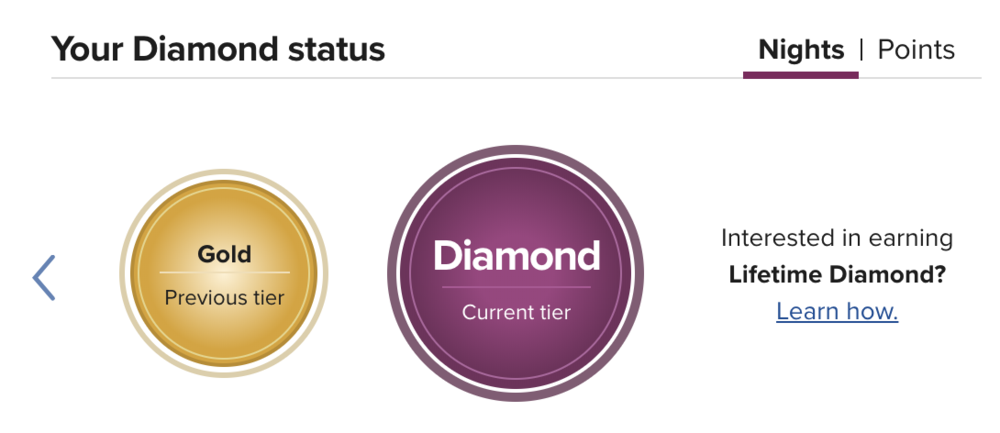

For example, the Hilton Aspire Card provides US$500 worth of credits (a US$250 airline fee credit and a US$250 Hilton resort credit) to offset its US$450 annual fee. If you’re able to take full advantage of these credits, you’re basically coming out ahead by US$50 every year, and on top of that you get a free weekend night award (redeemable at the vast majority of Hilton properties, including some spectacular luxury hotels), top-tier Hilton Diamond status to make your hotel stays as enjoyable as possible, unlimited Priority Pass access… oh, and the signup bonus of 150,000 Hilton Honors points as a first-time cardholder.

It’s a similar story with the other Hilton products, or the Marriott Bonvoy Brilliant or Marriott Bonvoy Business cards: the sooner you apply for these cards, the sooner you’ll get access to their continued yearly benefits, all while beefing up your US credit history.

I’ll definitely be doing a few deep-dives on optimal strategies in the US throughout 2020 to help you navigate the landscape south of the border.

3. Multi-Player Mode

One of the most natural ways for Miles & Points practitioners to scale up their operations on the earning side is to add multiple “players” to their team. Most commonly, one enlists a spouse or partner to join them in two-player mode, thus maximizing the potential referral bonuses along the way and allowing the benefits of one person’s perks (from elite status, credit card lounge access, etc.) to be enjoyed by two.

Thinking even bigger, though, it could be mutually beneficial to share the joys of travelling on points with any other family members who plan to go somewhere in 2020 as well.

Let’s say your parents had a special anniversary coming up – you could offer to show them how they could treat themselves to a memorable luxurious getaway simply by getting a few credit cards, or better yet, you could make good on your filial obligations by offering to manage the process on their behalf!

I know many individuals who have, in this fashion, successfully convinced their parents, siblings, and in-laws to let the person manage their cards and points on their behalf, and in exchange getting to reap the benefits when they take a trip as well. Obviously, a great deal of trust among all parties is required for this to work, but it’s a scenario in which everybody benefits as long as you can get the system up and running.

4. Diversifying Across Frequent Flyer Programs

Let’s move on from the earning side and survey the loyalty landscape as well. We’ll go over each of the major programs briefly and discuss which ones you should focus on depending on your travel goals, but I’m sure there will be lots more to talk about as 2020 goes on.

Aeroplan, long considered to be the best loyalty program for Canadians to redeem miles for travel premium cabins, is in something of a limbo state at the moment.

Air Canada has acquired Aeroplan, and will be introducing a new program of their own to replace it, sometime in 2020; at that point, existing Aeroplan miles will be ported over into the new program. That much we know.

Therefore, it shouldn’t be surprising that at the moment, whoever is calling the shots at Aeroplan isn’t too fussed about improving the current program or shoring up its issues prior to the transition.

Their attention is likely fully focused on the particulars of the new program, leaving little time to address the many deficiencies that have plagued Aeroplan ever since the migration to the Amadeus PSS, such as long call centre wait times and difficulties in booking custom-built itineraries over the phone.

And even after the new Air Canada loyalty program is announced and launched, there are likely to be many IT issues and operational challenges on a project of this scale.

All of this is to say that while Aeroplan has historically been the central focus of the redemption side of the game in Canada in previous years, and will likely continue to provide value going forward, 2020 may well be the year to expand your attention towards maximizing the many other loyalty programs at our disposal as well.

The sweet spots of British Airways Avios will be most beneficial to those living in Canada’s largest population centres, with redemptions such as Toronto–Dublin on Aer Lingus or West Coast–Hawaii on Alaska Airlines representing some of the best use cases.

Meanwhile, for those looking to travel to Asia or Oceania in premium cabins, both Alaska Mileage Plan and Cathay Pacific Asia Miles are highly suitable, and indeed, their sweet spots largely overlap with each other, giving you a wider range of options depending on your ability to earn miles with each program.

In light of this, RBC Avion in particular looks to be a key program to be involved in, thanks to the ability to transfer points to both Avios and Asia Miles, often with compelling conversion bonuses of 20% to 50% on top.

Note that, unlike Aeroplan, these fellow programs can be more challenging to use if you live outside Toronto, Montreal, Vancouver, or Calgary, due to a lack of partner airlines serving the smaller Canadian cities.

Thus, whether it’s for shorter trips within North America or positioning flights to catch a larger international redemption, there’s always a need for points currencies that excel in domestic and transborder travel as well.

And I’d highlight WestJet’s Member Exclusive fares as the best program for this purpose, given how easy it is to earn WestJet Dollars via the WestJet RBC MasterCard, and the fact that domestic flights cost only 125 WSD when the cash price could be over three times that.

5. Maximizing Hotel Points & Elite Status

On the hotel side, Marriott Bonvoy and Hilton Honors remain the easiest programs for Canadians to maximize. The former allows you to earn points easily through the Canadian-issued co-branded cards, while the latter requires the added step of going through US credit cards.

From the credit card bonuses alone, you’d probably earn enough hotel points to cover a week or two’s worth of hotel stays, depending on your general preference for the quality of hotels.

After that, the strategy shifts to how to maximize your return when paying cash for hotels, such as by taking advantage of Amex Offers, cash back portals, or double- or triple-points promotions. This way, you’ll be minimizing your out-of-pocket costs on each hotel stay while earning maximum points to get you closer to the next big redemption.

Meanwhile, if you’re more interested in getting as nice of an experience as possible when staying at hotels, then you’ll need to be thinking about how to maximize elite status.

I imagine many of you might’ve earned Marriott Platinum Elite status with the help of the “meetings trick” in 2019 (may it rest in peace), so you’ll be looking to maximize the value you get out of your Marriott hotel stays this year, knowing that re-qualifying for Platinum in 2020 might be a tougher hill to climb. Don’t forget to always chat with the hotel in advance of your stay to boost your chances of getting the best experience possible!

And like I mentioned above, applying for the Amex US Hilton Aspire Card is a truly effortless way to start getting to know Hilton’s portfolio in style, and offers an easy alternative to Marriott in terms of having top-tier hotel elite status.

(Indeed, perhaps because it’s so easy that my recent Hilton stays in New Zealand proved to be not quite as fruitful in terms of elite benefits as my Marriott stays, but I’ll need a few more experiences in order to truly pass judgment.)

Low-hanging fruit, such as the status matching opportunity to Wyndham and Caesars, must not be overlooked either. This particular sequence of status matches can be obtained simply by holding an American Express Platinum Card, and can result in many thousands of dollars’ worth of free hotel nights and on-property perks in Las Vegas, the Bahamas, or other gaming-oriented hotspots.

Finally, any time you’re looking to book hotels at a chain with whom you don’t have status, remember that you can emulate those status perks by booking via third-party hotel booking services, which usually give you many extra perks while paying the same as the standard rate.

6. Networking + Learning from the Community

You can follow what I write here at Prince of Travel down to the letter, but at the end of the day, I’m only one person. It’s by engaging actively with the rest of the community and learning from one another’s experiences that you can greatly accelerate the process of detecting patterns, developing strategies, and taking action to make your travel goals a reality.

That’s why I created the Prince of Travel Elites Facebook group, and I’ve been very pleased with the way that our members are actively answering each other’s questions, giving suggestions to each other’s situations, and generally helping each other out.

It’s often said that the best way to learn is to teach, and Elites gives everyone a platform to seek help, provide guidance, share data points, and even perhaps clue in on some of the stuff that doesn’t get talked about in more public spheres. I’d highly encourage you to join the group!

On my part, I had previously mentioned that I’d love to bring back something akin to the PointsU Conference from previous years in 2020, and I still do harbour those aspirations for organizing a larger-scale event for our community sometime this year. Stay tuned for details on this!

Conclusion

Miles & Points is a multifaceted and ever-changing pursuit, and I’m sure many of us will agree that that’s exactly what makes it so interesting. I’ve shared with you what I’d consider to be the “grand strategy” for 2020 – think of it as a curriculum, covering all of the areas of concentration and things to look out for in a year that’s certain to see even more changes in the landscape than usual.

There is much work to be done in the year ahead: dozens of credit cards to be crunched, hundreds of thousands of miles to be earned, and countless new memories to be made as you explore the world. So what are you waiting for?

Hi Just reading this to get some pointers. I am doing the US credit cards but I find some ask for a US ID in order to process the application. Do you have any workaround for this?

Happy new year Ricky,

You are my inspiration to travel the world using miles and successfully completed 3 MRTW and even ventured into US market.

Question, i already have Hilton Honors card and wondering whether i will be getting WB for having Hilton Aspire card as well as they seems to be both same family products?

Yes, you will get the bonus on every individual Hilton credit card (regular no-fee card, Surpass, Aspire, and Business) as long as you haven’t held that card before, and you don’t get hit with the dreaded pop-up.

Nice summary Ricky, we have our work cut out for 2020.

I have a question regarding hotel strategy: it’s clear to me that my focus will be first to secure Marriott Platinum. After that it gets fuzzy. Should I go after Titanium (my preference?) as it would give me more points per stay (I travel for business regularly), a free 40K night certificate and mainly get me ahead of Platinum for upgrades? Or go after Hilton, at the risk of splitting the vote and not having a significant status with either brands. Any thoughts on that?

Great question. What I would do is get the Amex US Hilton Aspire for instant Hilton Diamond status. Then you don’t need to worry about achieving status with Hilton, you already have it (basically) forever. You can choose Marriott hotels when they make sense and work towards Titanium, or you can choose Hilton hotels when they make sense and be treated very nicely during your stay.