RBC Avion points are a valuable and versatile rewards currency within the Canadian market.

With a strong lineup of airline transfer partners, flexible redemption options, and a wide range of eligible credit cards, the program is well-positioned for travellers looking to maximize the value of their spending.

Avion points can be earned through a variety of RBC products, but not all Avion membership tiers are equal. The program is divided into three distinct membership tiers, and the redemption options available vary significantly depending on which tier a member belongs to.

Understanding the Avion Rewards Membership Tiers

RBC Avion Rewards is divided into three membership tiers: Select, Premium, and Elite, with each tier offering different ways to earn and redeem points.

- Avion Select: Assigned to Canadian residents of the age of majority who register for Avion Rewards without holding an eligible RBC product that qualifies for a higher tier. Points are earned exclusively through the Avion Rewards shopping portal and can be redeemed for merchandise, gift cards, or travel at a fixed rate. This tier does not include access to airline transfer partners or the RBC Air Travel Redemption Schedule.

- Avion Premium: Assigned to holders of eligible RBC products such as personal deposit accounts, investment accounts, or loans. The only products that earn Avion points through spending are the RBC ION Visa and RBC ION+ Visa credit cards. A full list of qualifying products is available on RBC’s eligibility page. These points can be redeemed for travel at a fixed rate of 0.58 cents per point (CAD) or transferred to WestJet Rewards at a 1:1 ratio (100 Avion points = 100 WestJet points). The points can be transferred at a ratio of 1:1 to Avion Elite Tier (if you hold a card that qualifies you for the Avion Elite tier), unlocking significantly better redemption options.

- Avion Elite: Assigned to holders of eligible RBC Avion-branded credit cards, such as the RBC® Avion Visa Infinite†. They offer the most extensive range of redemption options within the program. Points can be transferred to airline loyalty programs including The British Airways Club, Cathay Pacific Asia Miles, and American Airlines AAdvantage. They can also be redeemed through the RBC Air Travel Redemption Schedule for up to 2.3 cents per point. Additional options include fixed-value travel credits at 1 cent per point and gift card redemptions.

In this guide, we’ll be focusing on the Avion Elite tier, while also outlining how to maximize value by transferring earnings from Avion Premium tier.

Earning RBC Avion Points

The main way to earn RBC Avion points is through RBC credit cards. The type of card held determines which Avion Rewards membership tier the account is associated with: Avion Premium or Avion Elite.

The credit cards that earn Avion points under the Avion Elite tier include all cards in the RBC Avion lineup.

Credit Card

Best Offer

Value

55,000 Avion points^

$1,080

Apply Now

Up to 70,000 RBC Avion points†

$826

Apply Now

35,000 RBC Avion points

$700

Apply Now

35,000 RBC Avion points

$580

Apply Now

55,000 RBC Avion points^

$580

Apply Now

Meanwhile, credit cards that fall under the Avion Premium tier include the duo in the RBC ION lineup.

Credit Card Welcome Bonuses

One of the best ways to earn RBC Avion points is through welcome bonuses.

Welcome bonuses fluctuate depending on the current promotion. However, you can usually expect an RBC Avion card to come with a welcome bonus of 15,000–35,000 Avion points, with the bonus sometimes getting as high as 55,000 Avion points if you’re able to meet the associated spending requirements.

Despite having similar welcome bonuses, the Avion cards do all have slight differences in the benefits they offer, their earning rates, and their annual fees.

The RBC® Avion Visa Platinum†, RBC® Avion Visa Infinite†, and RBC® Avion Visa Business all have an annual fee of $120 (all figures in CAD).

Meanwhile, the RBC® Avion Visa Infinite† Business has an annual fee of $175, and lastly, the RBC® Avion Visa Infinite Privilege† card has the highest annual fee at $399.

With the higher annual fees, you can usually expect to also see additional benefits, such as higher earning rates and access to airport lounges.

By comparison, RBC ION cards typically offer smaller welcome bonuses ranging from 3,500 to 7,000 points, with occasional limited-time offers up to 14,000 points.

However, these cards come with minimal fees: the RBC® ION Visa has no annual fee, while the RBC® ION+ Visa charges $4 per month.

Credit Card Spending

In addition to earning the welcome bonus, you’re also able to earn Avion points on your day-to-day purchases.

The RBC Avion-branded credit cards come with the following earning rates on daily spending. You’ll notice that the earning rates on these cards tend to be weaker than their ION counterparts (described below); however, Avion cards tend to offer a higher welcome bonus, and the points earned are in the Elite membership tier (more on that below).

- 1.25 Avion points per dollar spent on all travel purchases (flights, hotels, car rentals, etc.)

- 1 Avion point per dollar spent on all other qualifying purchases

- Earn 35,000 Avion points upon approval^

- Earn 20,000 Avion points upon spending $5,000 in the first six months^

- Earn 1.25x Avion points on qualifying travel purchases

- Transfer Avion points to British Airways Executive Club and other frequent flyer programs for premium flights†

- Redeem Avion points for flights with the RBC Air Travel Redemption Schedule†

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $120

- Supplementary card fee: $50

- 1 Avion point per dollar spent on all qualifying purchases

- Earn 35,000 Avion points upon approval^

- Earn 20,000 Avion points upon spending $5,000 in the first six months^

- Earn 1 Avion point per dollar spent† on all qualifying purchases

- Transfer Avion points to British Airways Executive Club and other frequent flyer programs for premium flights†

- Redeem Avion points with the RBC Air Travel Redemption Schedule†

- No minimum income requirement

- Annual fee: $120

RBC® Avion Visa Infinite Privilege†

- 1.25 Avion points per dollar spent on all qualifying purchases

- Earn up to 35,000 Avion points upon approval†

- Then, earn 20,000 Avion points upon spending $5,000 in the first six months†

- Then, earn 15,000 Avion points as a one-time anniversary bonus upon renewal†

- Plus, earn 1.25x RBC Avion points† on all qualifying purchases

- Use your rewards for any business class flight with no restrictions on dates, seats, or airlines†

- Transfer points to one of four airline partners†

- DragonPass membership with six free lounge visits per year†

- Minimum income: $200,000 personal or household†

- Annual fee: $399†

- 1 Avion point per dollar spent on all qualifying purchases

- Earn 35,000 RBC Avion points† when you get approved for the card†

- Plus, earn 1x RBC Avion point on all purchases†

- Transfer points to one of four airline partners†

- Qualify for the card with a registered business

- Annual fee: $120

RBC® Avion Visa Infinite† Business

- 1.25 Avion points per dollar spent on all qualifying purchases

- Earn 35,000 RBC Avion points when you get approved for the card

- Plus, earn 1.25x RBC Avion points on all purchases

- Use your rewards for any business class or First Class flight with no restrictions on dates, seats, or airlines

- Transfer points to one of four airline partners

- Qualify for the card with a registered business

- Annual fee: $175

Cards associated with the Avion Premium tier—namely the RBC ION Visa and RBC ION+ Visa—offer stronger multipliers in select spending categories, but typically come with lower welcome offers than their Avion counterparts:

- 1.5 Avion points per dollar spent on qualifying grocery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming, and digital subscriptions

- 1 Avion point per dollar spent on all other qualifying purchases

- Earn 4,000 Avion points upon approval^

- Earn an additional 7,000 Avion points upon spending $500 in the first three months^

- Earn 1.5x Avion points† on qualifying grocery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming and digital subscriptions†

- Annual fee: $0

- 3 Avion points per dollar spent on qualifying grocery, dining, food delivery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming, and digital subscriptions

- 1 Avion point per dollar spent spent on all other qualifying purchases

- Earn 7,000 Avion points upon approval^

- Earn 14,000 Avion points upon spending $1,500 in the first six months^

- Earn 3x points† on qualifying grocery, dining, food delivery, gas, rideshare, daily public transit, electric vehicle charging, streaming, digital gaming and digital subscriptions†

- Earn 1 extra Moi Rewards point for every two dollars spent at Metro, Food Basics, Super C, Jean Coutu, Brunet and Première Moisson when you scan your Moi card and pay with your linked RBC Card (minimum purchase required).¹¹

- Mobile device insurance†

- Annual fee: $48†

The Optimized RBC Credit Card Portfolio

As you may have noticed, there’s a unique situation with RBC’s lineup of credit cards when you compare the Avion and ION lineup:

- Avion cards have stronger welcome offers, but weaker earning rates

- ION cards have lower welcome offers, but stronger earning rates

- Avion cards come with membership in the Elite tier (offering more powerful redemption options), while ION cards come with membership in the Premium tier (offering less powerful redemption options)

With this in mind, there’s actually a way to get the best of both worlds by building what we call “The Optimized RBC Credit Card Portfolio“.

In short, by holding both an Avion card – such as the RBC® Avion Visa Infinite† – as well as an ION card – such as the RBC® ION+ Visa – you can leverage the powerful earning rates on the RBC® ION+ Visa with the more flexible redemption options that come with the RBC® Avion Visa Infinite†.

We’ve got everything you need to know about this setup – including the many reasons why it’s so powerful – in the guide linked below.

Avion Rewards Platform

A relatively recent addition to the RBC Avion program is Avion Rewards, which is open for RBC clients and non-clients alike.

Since all points transactions are made under its platform, those with an Avion or ION card product have automatically been registered to Avion Rewards, while those with other RBC products may use their existing RBC credentials to enroll.

Under Avion Rewards, you may benefit from two types of offers: “save & earn” offers, and “shop now” offers.

The former lets you earn Avion points, discounts, and cash back when you use your eligible RBC card at participating online and in-store establishments. Meanwhile, the latter lets you earn cash back on online purchases, akin to the Aeroplan eStore and Rakuten.

Examples of save & earn Avion points offers are as follows:

- Earn 1,000 Avion points when you spend $300 or more at participating Marriott Bonvoy hotels in Canada

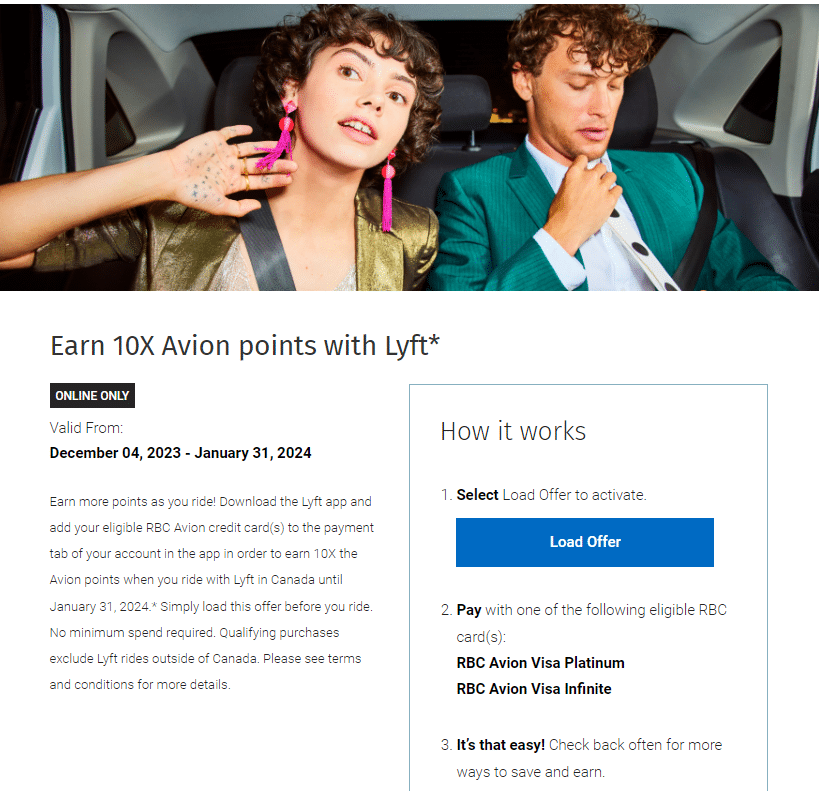

- Earn 10x Avion points on Lyft rides

- Earn 2x Avion points on eligible Apple purchases

For save & earn offers, you must opt into each offer by logging into your Avion Rewards account.

Redeeming RBC Avion Points

What makes the RBC Avion program so powerful is the flexible nature of Avion points.

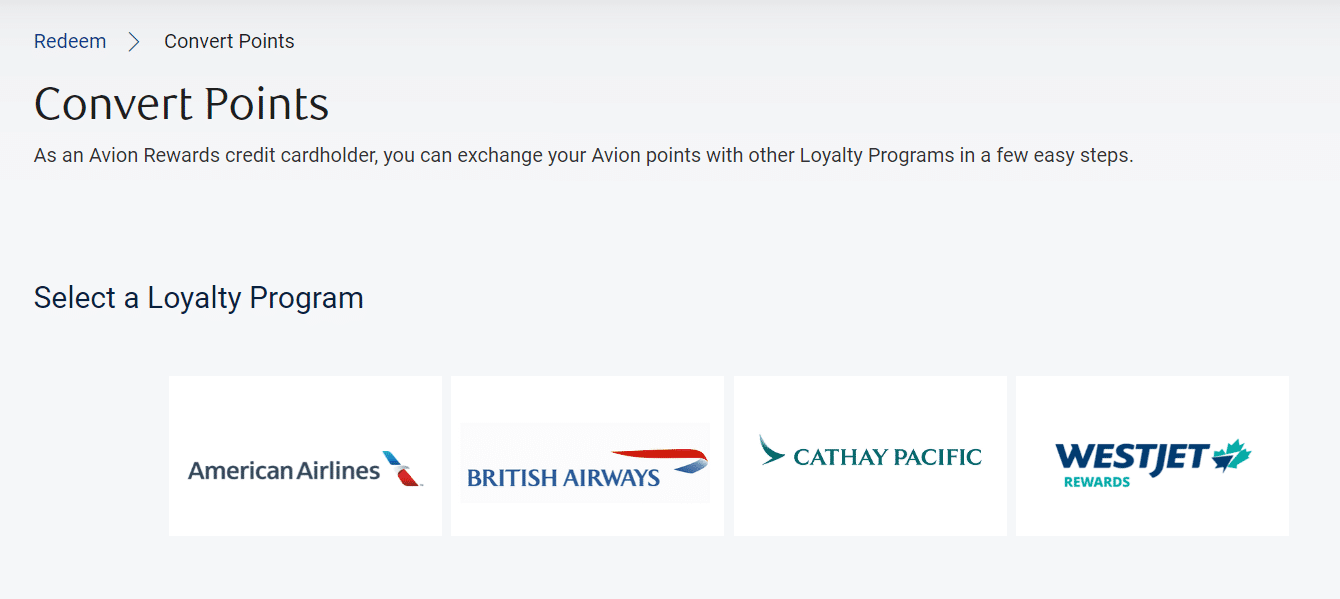

Avion points earned under an account in the Avion Elite tier can be transferred to four airline loyalty programs (The British Airways Club at a 1:1 ratio, Cathay Pacific Asia Miles at a 1:1 ratio, American Airlines AAdvantage at a 1:0.7 ratio, and WestJet Rewards at a 1:1 ratio), redeemed through RBC’s Air Travel Redemption Schedule for outsized value, or used for gift cards and statement credits for lesser value.

By comparison, Avion points earned under the Avion Premium tier have more limited options. These points can only be transferred to WestJet Rewards at a 1:1 ratio, redeemed for travel at a rate of 0.58 cents per point, or redeemed for gift cards and statement credits. They cannot be transferred to other airline loyalty programs or used with RBC’s Air Travel Redemption Schedule.

To unlock additional redemption options, Avion points from an account in the Premium tier can be transferred to an account in the Elite tier, as long as the account holder has an eligible RBC Avion credit card.

Even for those who don’t currently hold an Avion card, it’s worth holding onto Avion points earned under the Premium tier with the goal of unlocking Elite-tier access later.

For this reason, we’ll look exclusively at the redemption options available to Avion Elite-tier account holders.

Transferring to Partner Programs

You can transfer your RBC Avion points under the Elite tier at a 1:1 ratio to The British Airways Club (Avios) and Cathay Pacific Asia Miles, and to WestJet Rewards at a rate of 1 Avion point = 1 WestJet point.

You can also transfer points to American Airlines AAdvantage at a rate of 10 Avion points = 7 AAdvantage miles.

Transfer times to the partner programs vary, so if you’ve found a redemption that you’d like to book, be sure to factor in the time it will take for your Avion points to make their way into your account.

Transferring RBC Avion Points to The British Airways Club

RBC Avion points transfer to The British Airways Club at a 1:1 ratio, where they become British Airways Avios.

If you have your eyes set on a flight with British Airways to or through London, you’ll also benefit from the best award availability (though it’s worth noting that you’ll be on the hook for a pretty hefty amount of taxes and fees, depending on which class of service you fly in).

In fact, British Airways guarantees at least eight award seats in economy, two award seats in premium economy, and four award seats in business class on every long-haul route. There’s something to be said for predictability, especially in the world of award travel.

The British Airways Club is a also great program to use for short-haul journeys in Europe (with British Airways), Asia (with Cathay Pacific, Japan Airlines, and Malaysia Airlines), and Australia (with Qantas), as well as long-haul trips in economy class.

Plus, The British Airways Club provides access to what’s widely regarded as the world’s best business class: Qatar Airways Qsuites.

For 70,000 Avios, you can fly one-way from North America to Doha in Qsuites, which is a pleasure to fly. In other words, if you have 70,000 RBC Avion points in your account, you can convert them to 70,000 Avios to book this flight (subject to award availability).

As it stands, Qatar Airways flies to both Toronto and Montreal, as well as a number of cities in the United States.

Plus, you can instantly convert British Airways Avios to Qatar Airways Avios at a 1:1 ratio as well as other “flavours” of Avios, since other airline loyalty programs also use Avios as a currency.

Keep an eye out for transfer bonus events, during which you can get a 30–50% bonus on Avion points transferred to Avios. These tend to happen a couple of times per year.

Transferring RBC Avion Points to Cathay Pacific Asia Miles

RBC Avion points transfer to Cathay Pacific Asia Miles at a 1:1 ratio. This is the best transfer ratio available in Canada, since American Express Membership Rewards transfer to Asia Miles at a 1:0.75 ratio.

Asia Miles offers the most abundant – and in many cases, the only – award availability for flights with the Hong Kong-based carrier.

In Canada, Cathay Pacific flies to Vancouver and Toronto, and you can expect to find competitive award pricing for flights in economy on transpacific routes, which start at 27,000 miles from Vancouver to Hong Kong, or 38,000 miles from Toronto to Hong Kong.

In business class, you can expect to pay 88,000 Asia Miles between Vancouver and Hong Kong, or 115,000 Asia Miles between Toronto and Hong Kong.

As a oneworld-member airline, you can also book flights with a number of other carriers.

In fact, if you have your heart set on a long-haul flight with British Airways in business class, Asia Miles is the best program to use, since you’ll pay a reasonable amount of miles and less taxes and fees than you’d pay with other programs.

For example, a one-way flight from North America to London will cost 63,000 Asia Miles, plus a few hundred dollars in taxes and fees.

While comparatively rare, keep an eye out for transfer bonus events when you convert Avion points into Asia Miles.

For more information, you can consult our in-depth guide to Asia Miles for a list of great redemptions available through the program.

Transferring RBC Avion Points to American Airlines AAdvantage

RBC Avion points transfer to American Airlines AAdvantage miles at a 1:0.7 ratio. In other words, for every 1,000 Avion points, you’ll get 700 AAdvantage miles.

American Airlines AAdvantage is one of the most powerful loyalty programs out there, offering excellent redemption rates for oneworld airlines.

In fact, you can book one-way flights from Vancouver to Cancun via Dallas for just 20,000 AAdvantage miles in business class.

Or, you could fly from North America to Africa via Doha in Qatar Airways Qsuites for just 75,000 AAdvantage miles.

One of the best products in commercial aviation – Etihad Airways A380 First Class Apartments – can also be booked with AAdvantage miles. A one-way flight between Europe and Abu Dhabi in your own private suite, complete with access to a shower, can be booked for 62,500 AAdvantage miles.

We’ve seen rare transfer bonus events, whereby you can improve the 1:0.7 transfer ratio. However, these are quite rare, so be sure to sign up for our newsletter to know about them when they happen.

There are a number of other great rdemptions with AAdvantage miles, so be sure to consult our full guide for more information.

Transferring RBC Avion Points to WestJet Rewards

RBC Avion points transfer to WestJet Rewards at a 1:1 ratio, where they become WestJet points.

However, we typically don’t recommend converting Avion points into WestJet points, and that’s because WestJet points have a capped value of around 1 cent per point.

Indeed, we value RBC Avion points at 2 cents per point (given their flexibility and many ways to redeem), so using this figure, you’d be losing out on value by moving them into your WestJet Rewards account.

Unlike other loyalty programs, WestJet Rewards doesn’t offer many (if any) opportunities to score outsized value.

In the vast majority of cases, you’re better off redeeming Avion points in other ways instead of converting them into WestJet points.

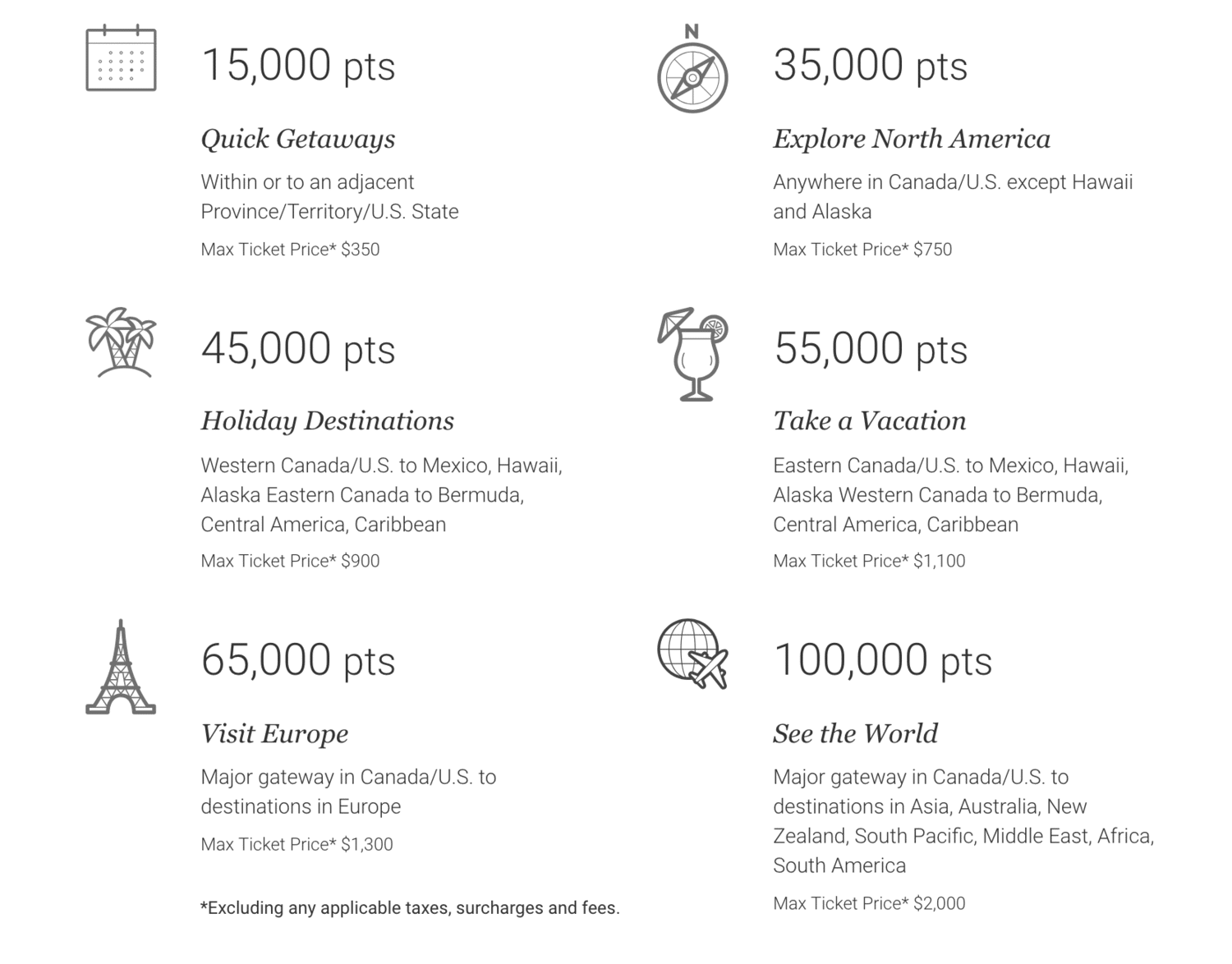

RBC Air Travel Redemption Schedule

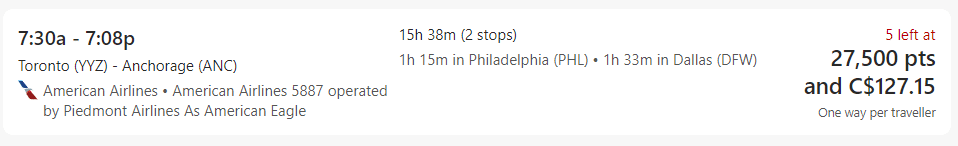

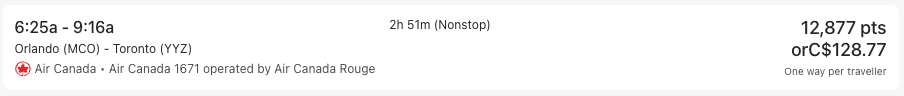

If you’re not interested in transferring your Avion points to an airline loyalty program, you can still get great value by redeeming points through the RBC Air Travel Redemption Schedule.

Through the Air Travel Redemption Schedule, you’ll be able to redeem Avion points in the Elite tier at a fixed rate for the base fare of any flight booked through the Avion Rewards portal, powered by Expedia.

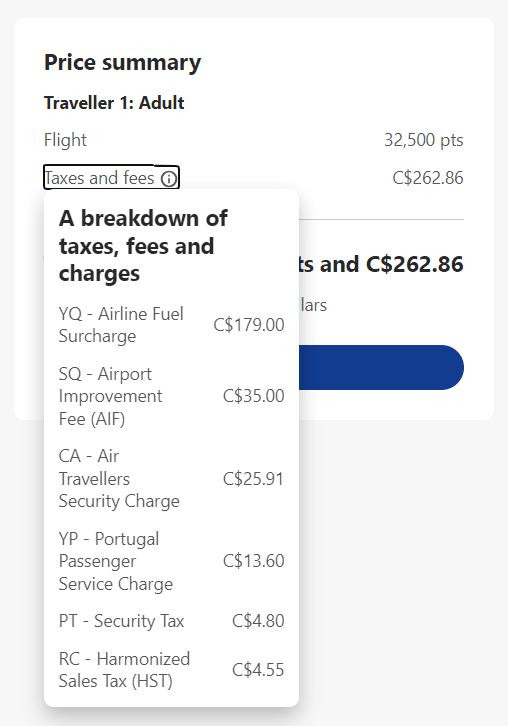

Each redemption option allows you to use the specified number of points towards a listed maximum base fare.

It’s important to note that you’ll be responsible to pay for any base fare amount that’s over the maximum base fare listed in each category, as well as for the taxes and additional fees.

If you wish to redeem Avion points for the additional costs, you can choose to do so, albeit at the lower redemption rate of 1 cent per Avion point.

When using RBC’s Air Travel Redemption Schedule to book a flight, you’ll get a value of up to 2.3 cents per Avion point, depending on the origin and destination of your trip and the cost of the base fare.

The maximum value of 2.3 cents per Avion point can be found in the “Quick Getaway” category when you redeem 15,000 Avion points for the maximum return-trip base fare of $350.

In all the other categories, the maximum value you’ll be able to extract is 2 cents per Avion point, when booking a round-trip for the maximum base fare amount.

As an example, if you were to redeem 100,000 Avion points for a round-trip flight from Toronto to Lima with a base fare cost of $1,700, you would receive a value of 1.7 cents per point.

Notably, with the Air Travel Redemption Schedule, the number of Avion points required for a redemption in each category doesn’t fluctuate with the cost of the base fare.

Using the above example of the round-trip flight between Toronto and Lima, even if the base fare was only $900, you would still need to redeem 100,000 Avion points.

Based on this, to extract maximum value from your Avion points when using the Air Travel Redemption Schedule, you’ll want to aim to redeem for base fares that are as close to the category’s maximum base fare as possible.

For this reason, the fixed-rate redemption chart can be particularly valuable for bookings during busy times of year, such as holiday seasons, when travel costs are elevated.

This is because the fixed-rate nature of the Air Travel Redemption Chart allows you to book these more expensive dates of travel for the same number of points as a cheaper date of travel (assuming the base fare remains below the maximum threshold for the category).

Travel Credit

Another option for redeeming your Avion points under the Elite tier is for fixed-rate travel statement credits through the Avion Rewards platfo.

By booking through this avenue, most cardholders will receive a fixed rate of 1 cent per point, and if you hold the RBC® Avion Visa Infinite Privilege† or the RBC® Avion Visa Infinite† Business, you’ll have access to a fixed rate of 2 cents per point if you’re booking a business class or First Class flight.

When compared to the Air Travel Redemption Schedule, this may seem like a similar or even slightly worse valuation; however, it can actually prove to be better in certain scenarios.

As we mentioned above, when redeeming Avion points through the Air Travel Redemption Schedule, you are required to redeem the set number of points regardless of the cost of the base fare, as long as it’s under the maximum amount.

Looking at the “Explore North America” category from the Air Travel Redemption Schedule, this means that even if the base fare ends up being less than the $750 maximum listed, you’ll still have to pay the full 35,000 Avion points.

Taking a deeper dive, based on the redemption rate of 1 Avion point = 1 cent, the 35,000 Avion points required for this booking is equal to $350.

This means that if you’re looking at redemptions using the Air Travel Redemption Schedule and you find a base fare within this category for less than $350, you’ll be better off booking the flight on your own and then redeeming your Avion points for a travel credit.

Other Ways to Redeem Avion Points

Beyond what’s already been mentioned, RBC provides a number of additional options for redeeming Avion points through the Avion Rewards platform. However, these options are not particularly valuable.

For example, you can use points to send e-transfers, pay bills, add to your existing investments, make a mortgage payment, or even pay off your credit card.

For most of these financial redemption options, you’ll get a value of 0.83 cents per point, and if you want to pay your credit card directly, the value is only 0.58 cents per point.

You can access better value than this by redeeming Avion points for gift cards, with some options offering value as high as 1 cent per point (and occasionally higher during promotions), but the best value can still found by transferring Avion points to partner airline loyalty programs.

One additional option is to redeem Avion points for merchandise, but similarly to the other non-travel redemption options, this doesn’t offer nearly as much value for your Avion points.

Conclusion

RBC Avion is an important rewards program that can help unlock some amazing sweet spots through transfers to partnered airline loyalty programs, such as The British Airways Club, Cathay Pacific Asia Miles, and American Airlines AAdvantage.

Thanks to its unique set of transfer partners, the relative ease of accumulating points via RBC’s Avion- and ION-branded credit cards, and the frequency of transfer promotions, Avion points are extremely useful to collect as a way to supplement the other major Canadian points programs.

†Terms and conditions apply. Refer to the card issuer’s website for complete, up-to-date information.

Can you tell me how is the Avion Visa Infinite Card better than say.. the RBC British Airways Visa Infinite?

RBC Avion Visa Infinite

– earn 1.25 points on travel, 1 point everywhere else

– transfer points to Cathay/American Airlines/WestJet/British Airway

RBC British Airways Visa Infinite

-earn 3 points when buying British Airway tickets, 2 points on Dining/Grocery, 1 point everything else

Yes. The Visa Infinite appears to have better flexibility on paper, but since all of those airlines are part of the one-world alliance, you automatically have access to all those airlines anyways, does that “flexibility” even still matter? With the BA card you are very likely to earn much more points?

The BA card does cost $45 more annualy, but as it earn more points I think that’s justifiable? not to mention the BA card also gives a free companion voucher every year?

Hi Jon, there a pros and cons to each card mentioned. As you said, one advantage of the Avion family of cards is the ability to transfer to more than one partner program. While British Airways, Cathay Pacific, and American Airlines are all One World airlines, each program has unique sweet spots that can be utilized. There are also occasional transfer bonuses when transferring Avion points to partner programs. You mentioned the British Airways card having a free companion voucher, however this voucher in only awarded after spending $30,000 in a calendar year. An underrated strategy with Avion cards is pairing an RBC ION+ card with an Avion, and taking advantage of the 3x earn rates in popular categories offered by the ION+. An Avion/ION+ combination would have annual feels of $168 ($120 + $48), just about equal to the British Airways Visa Infinite’s $165 annual fee. One other advantage to the Avion/ION+ cards is that you can apply for the Avion Platinum card if you do not meet the $60,000 income threshold of a Visa Infinite product.

I tried Transferring Avion Points to Qatar Airlines and it did not work. Apparently, Qatar Airlines requires to have at least 1000 points balance in order to transfer or purchase additional points 🙁 However, I had a great experience with British Airways – a great value for the tickets!

You can’t transfer directly from RBC Avions to Qatar Avios, only RBC Avions to BA Avios. And if your BA Avios is connected to QR Avios, then you can freely move the Avios between the 2 airlines program

i’ve held the RBC infinite priveledge card for over a year now and finally used it for a redemption at 2cpp (flight for myself & family from Tokyo to Manila this december 2023). I’m so impressed by the discount on the tickets I got via the points redemption that I’m eager to earn more avion points. I wish I could transfer points from my wife’s regular Visa infinite (RBC) avion to mine which gets 2cpp but as far as I can tell this isn’t allowed.

Hi Ricky,

Does RBC qualify you back for a welcome bonus if you already received one ?

Generally yes

You never know! 😉

I sometime find booking though airlines is cheaper than using the RBC reward travel orbitz. Does RBC offer price matching?

Can I use my avion points to up grade at the AIRPORT the day of departure.

There’s no easy way to do this. Your best bet would be to bid-upgrade with cash.

can transfer my westjet dollars to avion

Can you redeem Avion points for statement credit.

I’m short 2000 points for a flight . Can you buy points?

Hi,

Just wondering if you know when the next RBC avion to westjet dollar promotion is?

I don’t believe this conversion bonus is ever coming back.

Hi Ricky, any idea if there’ll be another transfer bonus to Avios this year?

With it being mid-November already, it’s looking doubtful.

Hi,

Can you use RBC Infinite Avion points to redeem PREMIUM Economy class of Air Canada.

e.g. 100,000 points from Canada to Middle East.

Or does RBC only allow to redeem Economy class?