Getting US Credit Cards for Canadians

In this guide, we’ll explore how savvy Canadian consumers can go about obtaining their very first US-issued credit card.

Once you get your first US card, you’ll start building credit history in the US, and eventually you’ll be eligible for most, if not all, of the credit cards in the US marketplace.

If you’re looking to rack up the sky-high welcome bonuses on US credit cards to travel the world, having access to US credit cards as a Canadian can be useful in many circumstances. Here’s how to get your US credit file up and running.

Why Get US Credit Cards?

If you’re at an intermediate level in the Canadian credit card game (or wherever you live outside of the US), it’s worth exploring the possibility of getting into US credit cards.

As the world’s most lucrative market for credit card rewards, US-issued credit cards offer bigger welcome bonuses, better cardholder benefits, and a much wider range of points redemption options – dramatically increasing the range of travel rewards that are available to you.

For example, consider that American Express Canada only offers 11 airline and hotel transfer partners in total.

Meanwhile, American Express US has a whopping 21 partners, including several powerful programs that we don’t have access to in Canada – like Emirates Skywards or Singapore Airlines KrisFlyer for booking Emirates First Class or Singapore Suites, respectively.

US credit cards can also give you a major leg up when it comes to other meaningful benefits along your travels, such as hotel elite status or airport lounge access.

For example, a single US-issued card can give you instant top-tier Hilton Diamond status, whereas you’d need to stay 60 nights with Hilton per year to earn this status organically.

Likewise, for Marriott Bonvoy Platinum status, you can either hustle to stay 50 nights in a calendar year, or you can simply hold the American Express Marriott Bonvoy Brilliant Card, which offers the status as an ongoing perk.

Needless to say, if you’re serious about raising your travel game on a global level, you absolutely need to get involved with US credit cards.

Step 1: Get a US Address

First off, you’re going to need to have a residential address that’s domiciled in the United States.

If you have family or good friends down in the US – lucky you!

As long as they agree to let you use their address, you can ask them to forward your mail periodically, pick it up yourself when you visit them, or simply ask them to take pictures of your mail and send it on to you.

For the rest of us, getting a US address is as simple as using a mail forwarding or mailbox service.

Our recommended service is 24/7 Parcel, which provides services to meet the needs of many Canadians getting into the US credit card market.

While 24/7 Parcel mainly offers parcel receiving and pickup services, they’ll also forward your letter mail for $1.50 (USD) per envelope plus postage. Typically, the total cost is $2.70 (USD) per letter forwarded to Canada.

24/7 Parcel charges a fee of $90 (USD) per year; however, Prince of Travel readers can obtain a $20 (USD) discount by mentioning that we referred you to the service.

There are also other mail forwarding services out there you can choose from, and you’re very much encouraged to do some of your own research as well.

Read More

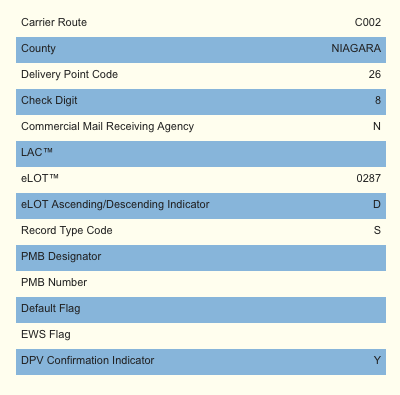

No matter which mailbox service you pick, make sure to verify one thing. Go to the USPS address lookup tool and enter the address of your mailbox, and make sure that “Commercial Mail Receiving Agency” isn’t marked as “Y”.

That’s because many credit card companies deem these addresses ineligible once they see that it’s registered as a mail forwarding service.

As long as the “Commercial Mail Receiving Agency” line is marked with an “N” (as is the case for 24/7 Parcel’s private address), issuers will recognize the address as a residential address, and you’ll be good to go.

Step 2: Get a US Bank Account

The next step in the process is to set up a US bank account.

The reason for getting a US bank account is twofold:

- Paying off your US credit card bills (although this can also be done via select higher-end Canadian-based bank accounts)

- Verifying your US address with US credit card issuers

This step is fairly easy. Several Canadian banks have subsidiaries in the US, and if you bank with them on the Canadian side, it tends to be a pretty straightforward process to set up an account in the US as well.

For example, if you bank with CIBC in Canada, you could explore options with its US counterpart, CIBC US. One option is to open a Smart Account, which has a no monthly fee and includes free incoming wire payments and free bill payments.

It’s really easy to get set up if you’re an existing CIBC client with Canada. You can apply online, and also transfer US funds between your Canadian- and US-domiciled CIBC accounts instantly online.

The Best US Bank Accounts for Canadians

Read more50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

The equivalent holds true with TD Canada Trust and TD Bank (the Convenience Checking account is a very affordable option), BMO Bank of Montreal and BMO Harris Bank, as well as RBC Royal Bank and RBC Bank.

All of these banks have very well-established Cross-Border Banking products and guidelines, so simply go online to get more information on their personal checking options and to open an account.

No matter which US bank account you go with, you’ll ideally want to set your US address (from Step 1) as the primary address on the account, such that the US address shows up on all your monthly banking statements. This will be useful when it’s time to verify your address with credit card issuers later on.

Step 3: Get Your First American Express US Card

Once you have a bank account and address, you can start applying for cards now.

You need to open a few accounts to start building credit history from scratch, and the easiest issuer to begin with is American Express US.

Amex is a global company, and they offer their cardholders some easy ways to transfer their membership to another country whenever they “relocate”.

Method 1: American Express Global Transfer

Presently, the easiest option to kickstart your journey into US credit cards is to initiate an American Express Global Transfer from Canada to the US.

To be eligible for a Global Transfer, you need to have at least one Canadian-issued American Express account that’s been open and in good standing for at least three months.

Then, you can call the Global Transfer office and tell them you’d like to do a Global Transfer as a current Canadian cardholder to a US credit card, and then proceed to complete the US credit card application over the phone.

Alternatively, you can complete the process online.

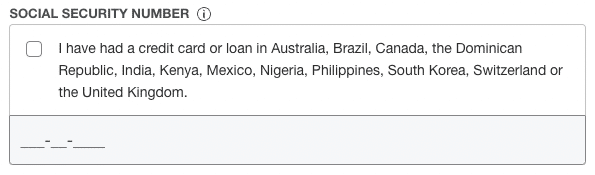

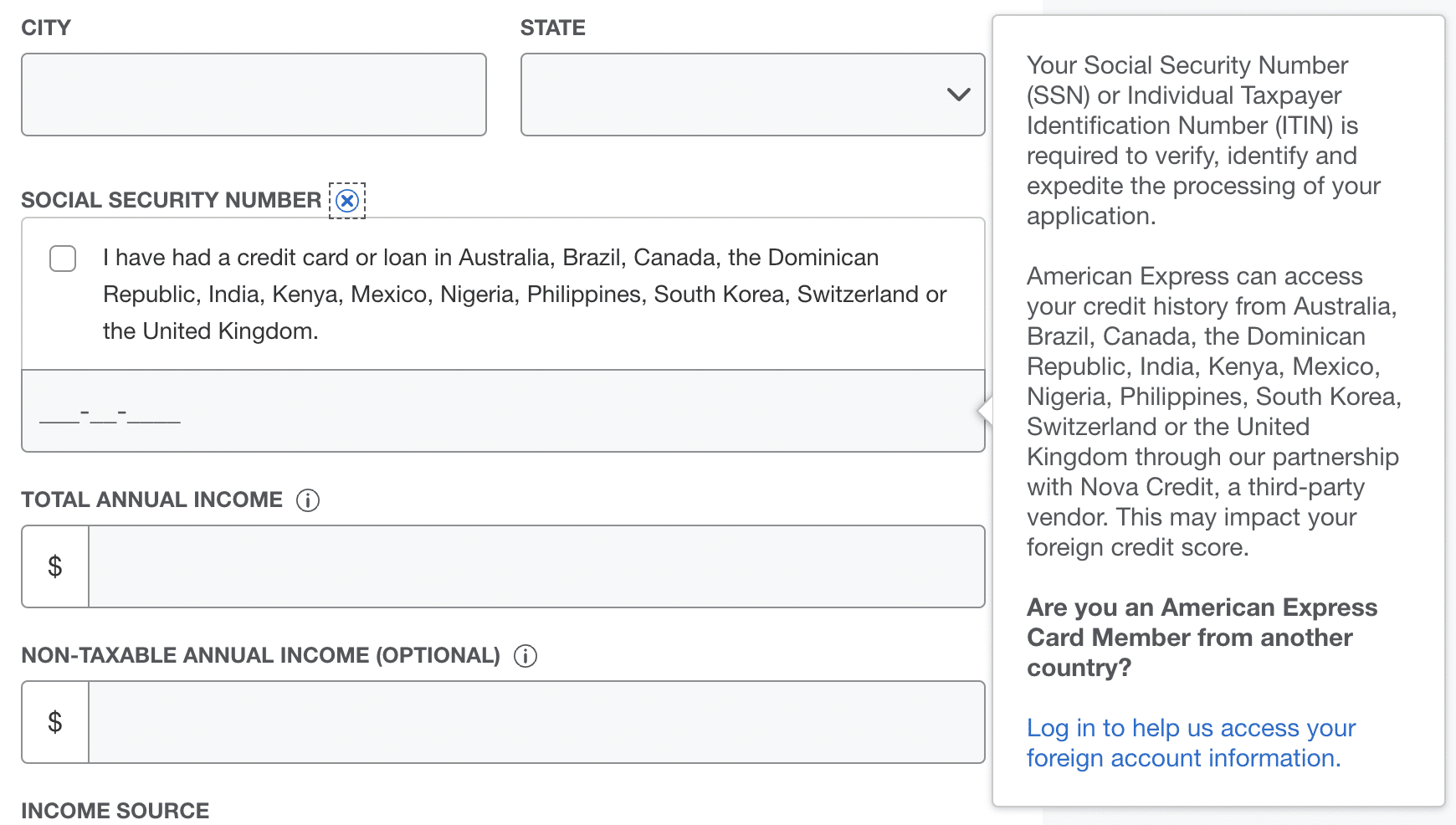

On the Amex US credit card application page, look for the Social Security Number (SSN) box. If you don’t have a US SSN or Individual Taxpayer Identification Number (see below), look for the box that says “I have had a credit card or loan in Australia, Brazil, Canada, the Dominican Republic, India, Kenya, Mexico, Nigeria, Philippines, South Korea, Switzerland, or the United Kingdom”.

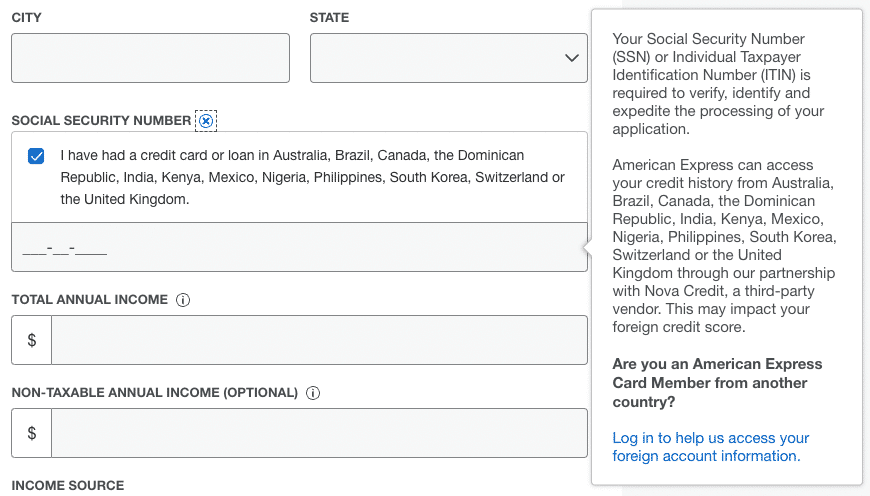

If you click on the information symbol (the circled “i” next to Social Security Number), a popup will appear on the page. At the end of the blurb, there’s a link to log in to your Amex account from another country. Click on this link.

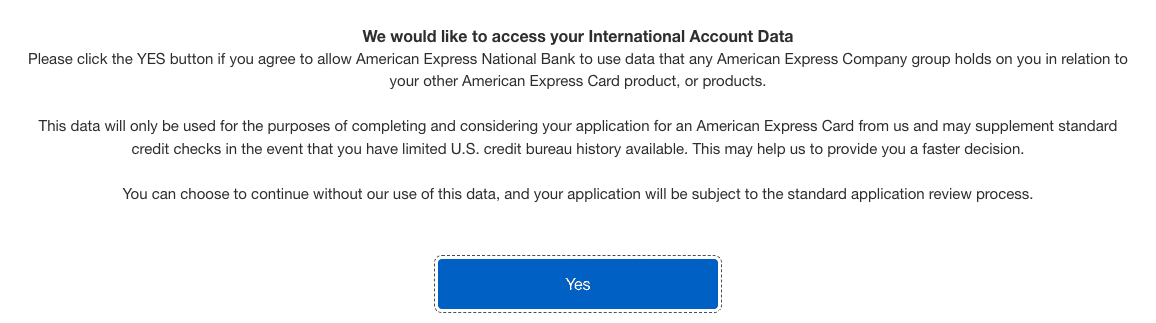

Another popup will appear, and you’ll need to agree to Amex US accessing your Amex account history from another country.

You’ll then be prompted to login to your Amex account, and some of your information will auto-fill on the application page.

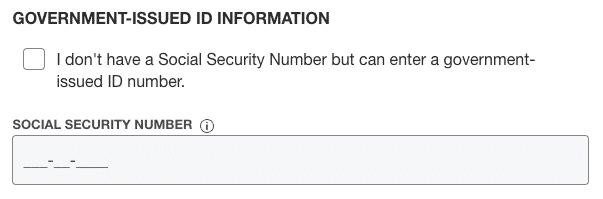

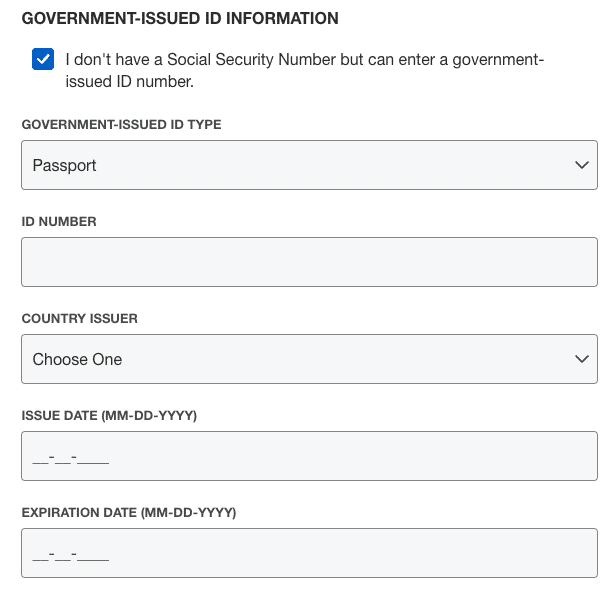

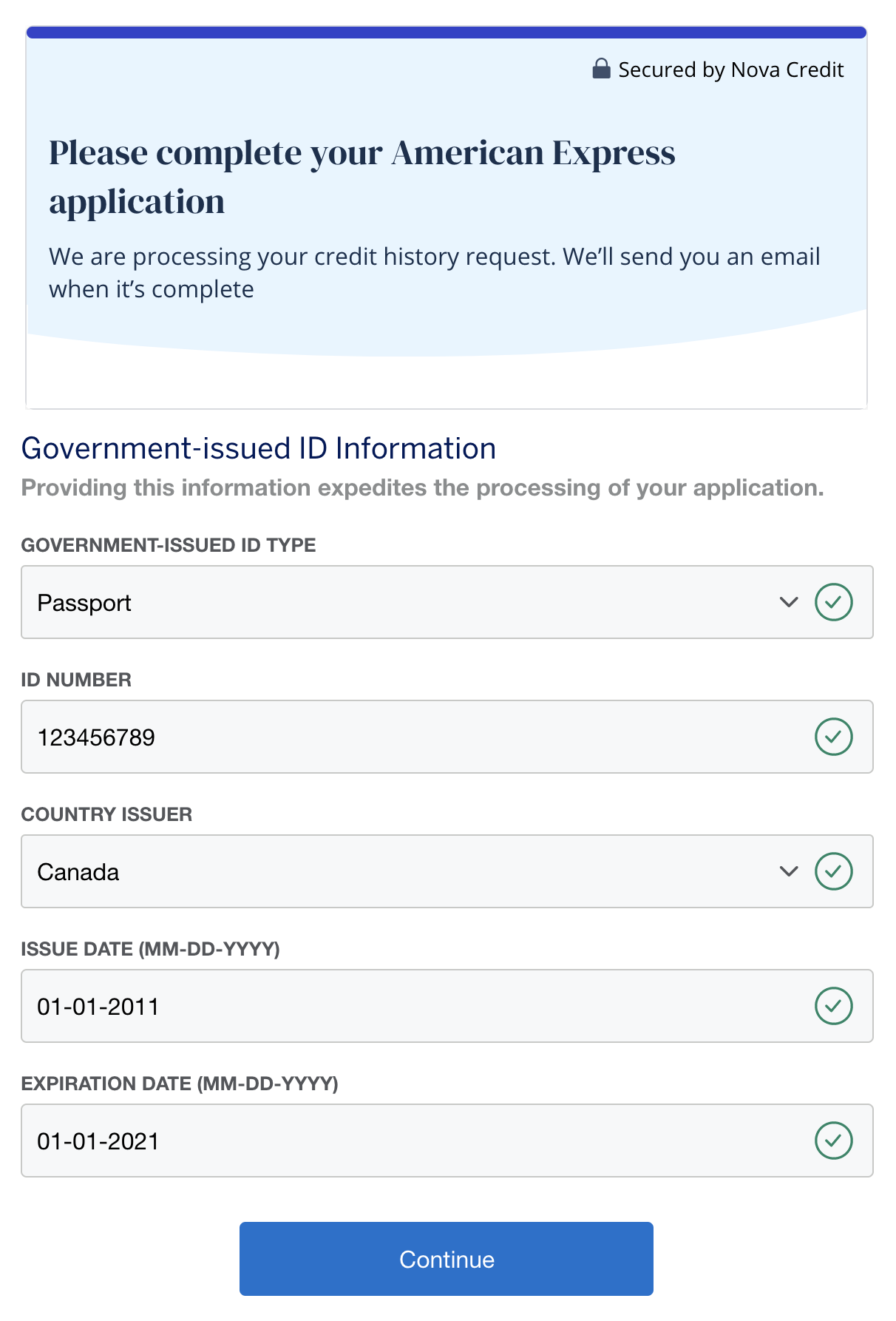

You’ll be asked to provide government-issued ID information. Again, if you don’t have a US SSN or ITIN, check the box that says “I don’t have a Social Security Number but can enter a government-issued ID number”.

Next, choose an eligible document from the government-issued ID type dropdown menu. The best option is likely your passport.

At this point, you can complete the application. If you’re lucky, you’ll be instantly approved, and your new US-issued card will be mailed to your US address.

However, there’s a good chance that you’ll be contacted by Amex US to verify the information you provided on the application, which can include:

- Verifying your identity documents, such as uploading a PDF copy of the passport information you provided

- Verifying your US address, such as uploading a bank statement from Step 2 with your US address on it, or calling American Express and speaking with an agent, who’ll initiate a three-way call with your bank to verify your address

If you just need to upload a document or two to the Amex website, the verification process shouldn’t take very long. However, if Amex needs to do a three-way call, it could result in a long time spent on hold, or it could fail completely if they’re unable to reach your bank.

In any event, be sure to have all of your documents ready, as it will reduce the turnaround time to get your US credit card in your hands.

Method 2: Nova Credit

In recent years, American Express US has begun working with a service known as Nova Credit to apply for US cards directly using your Canadian TransUnion credit file, without needing to be an existing Amex cardholder on the Canadian side.

However, Amex US recently made it necessary to have a US SSN or ITIN before you can apply using Nova Credit. Therefore, the below process only works if you have a US SSN or ITIN. If you have neither, then you’ll have to apply via Global Transfer (see above).

If you don’t have an SSN or ITIN, check out our guide on how to obtain an ITIN in Step 4 below.

To apply via Nova Credit, open up the application form for any Amex US personal credit card, and then click the “I have had a credit card or loan in… ” checkbox where it asks for your Social Security Number. You’ll also need to add your ITIN or SSN here.

Note where it says, “Log in to help us access your foreign account information.” Even if you happen to be an existing Amex Canada cardholder, it isn’t necessary to sign in.

In fact, doing so will initiate the “Global Transfer” process described above, whereas not signing in will result in the arguably smoother Nova Credit process, as long as you have an SSN or ITIN.

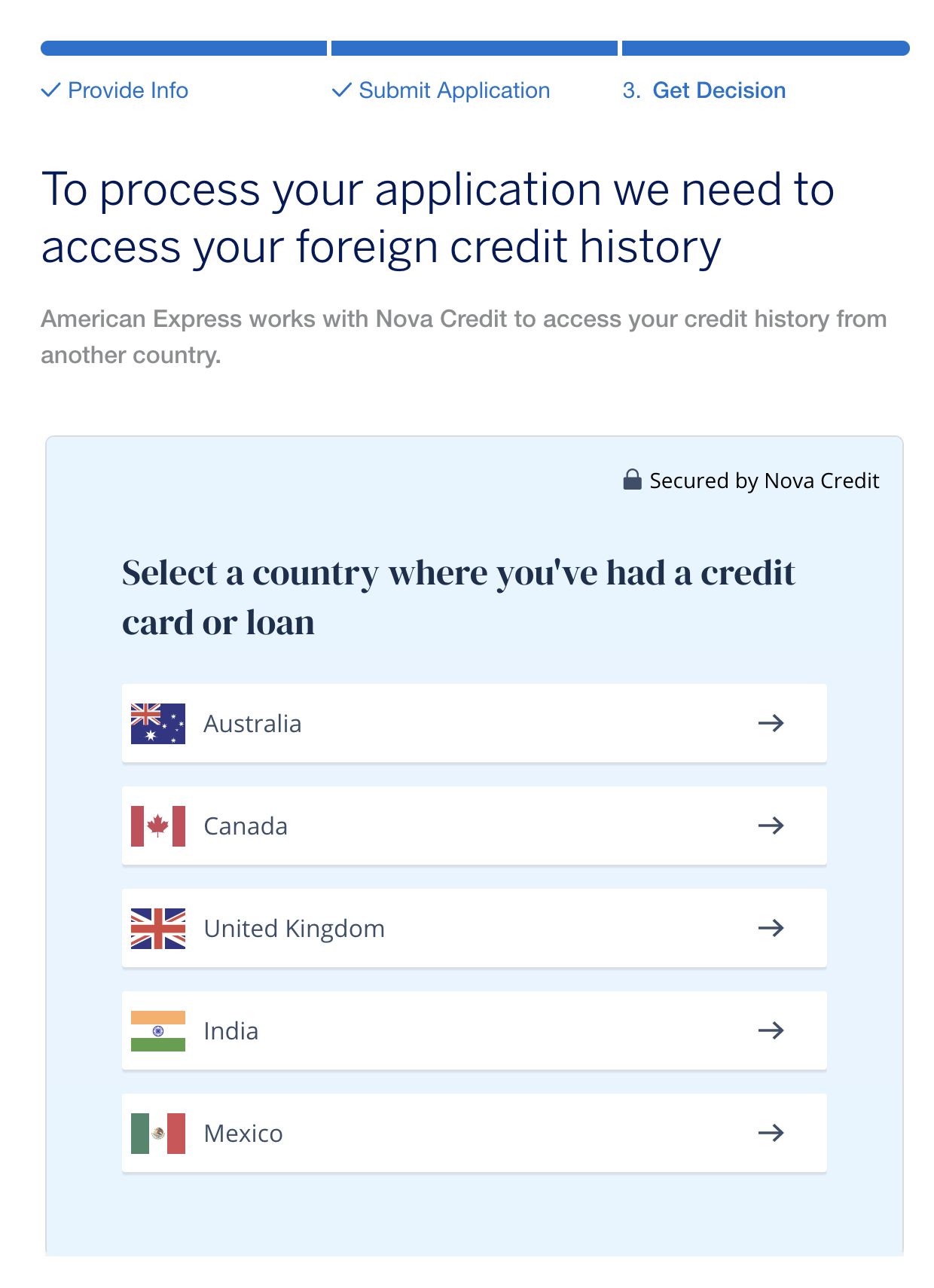

Submitting the application will bring you to the Nova Credit portal, where you’ll be asked to select the foreign credit history on which you’d like to base your application.

Canadians would select Canada, although the same process could be used by residents of Australia, India, Mexico, and the UK to apply for US credit cards as well.

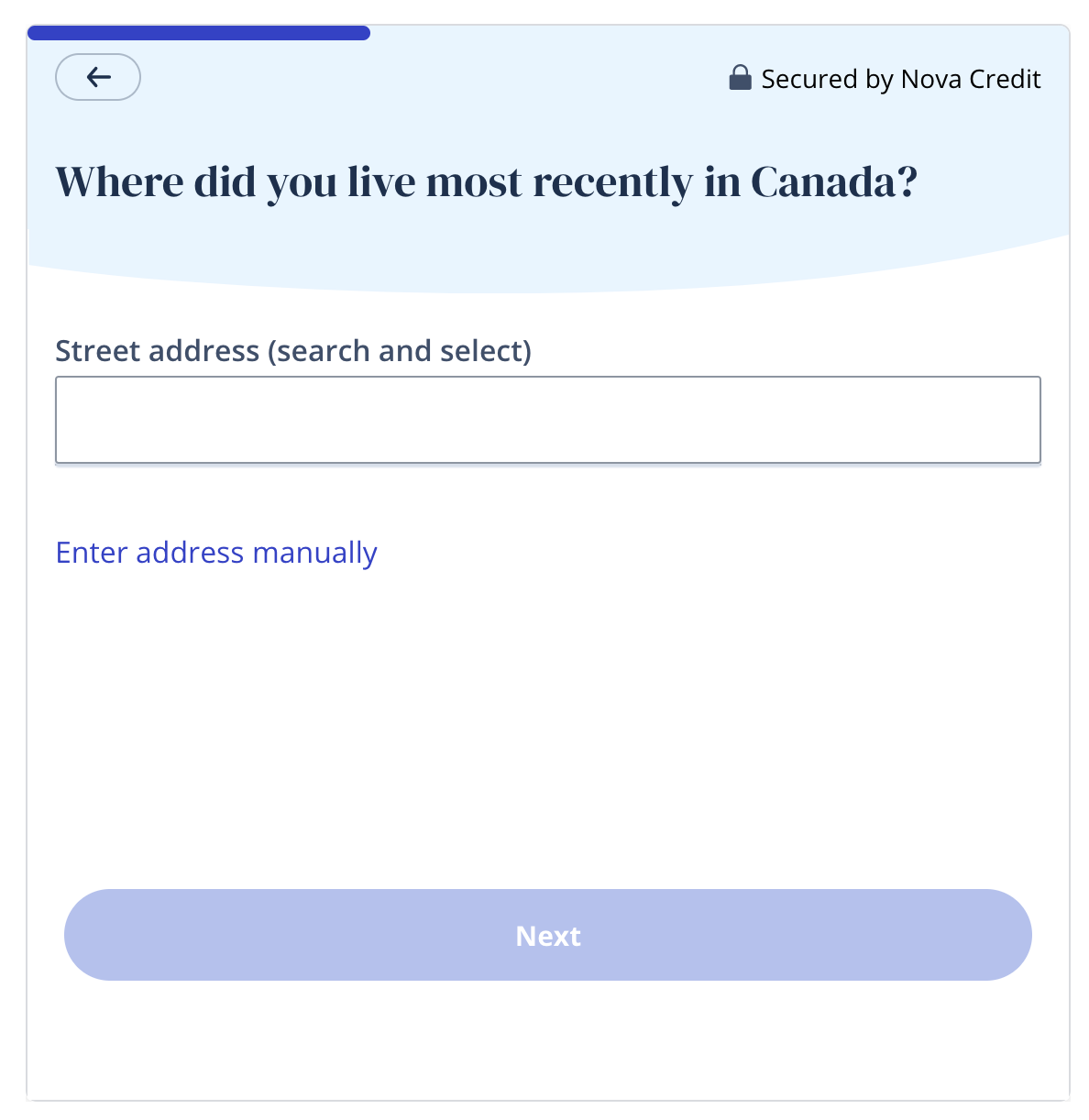

You’ll be asked to fill in some information to locate your Canadian TransUnion file, including your name, date of birth, and recent address. Once a potential match to your credit file is located, you’ll also be asked a set of three identity questions based on your TransUnion credit file as another verification step.

(The Nova Credit process results in only a soft inquiry, not a hard inquiry, on your TransUnion credit file in Canada.)

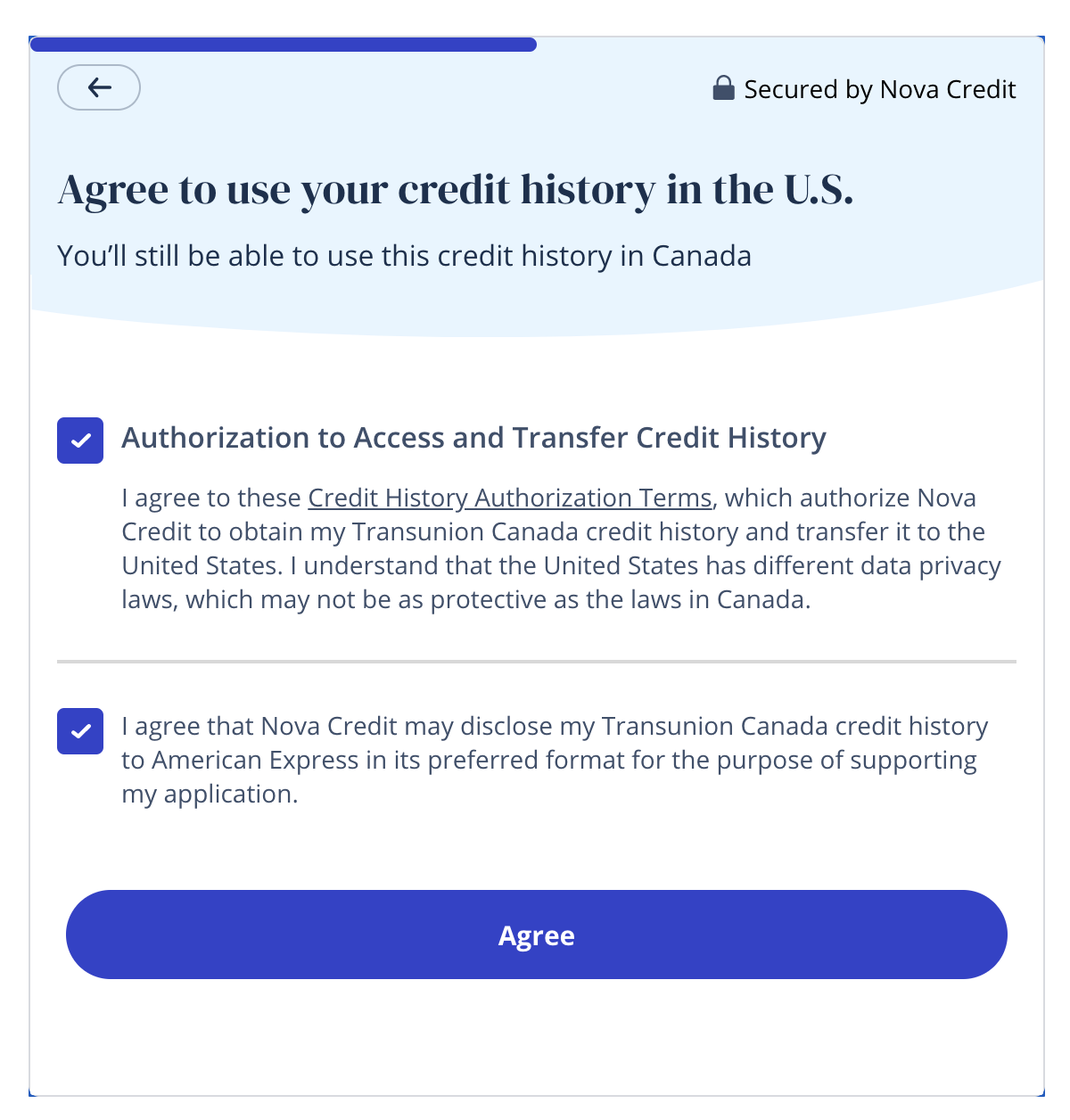

Once that’s done, you check a few boxes to authorize Nova Credit to transmit your Canadian credit information over to American Express US.

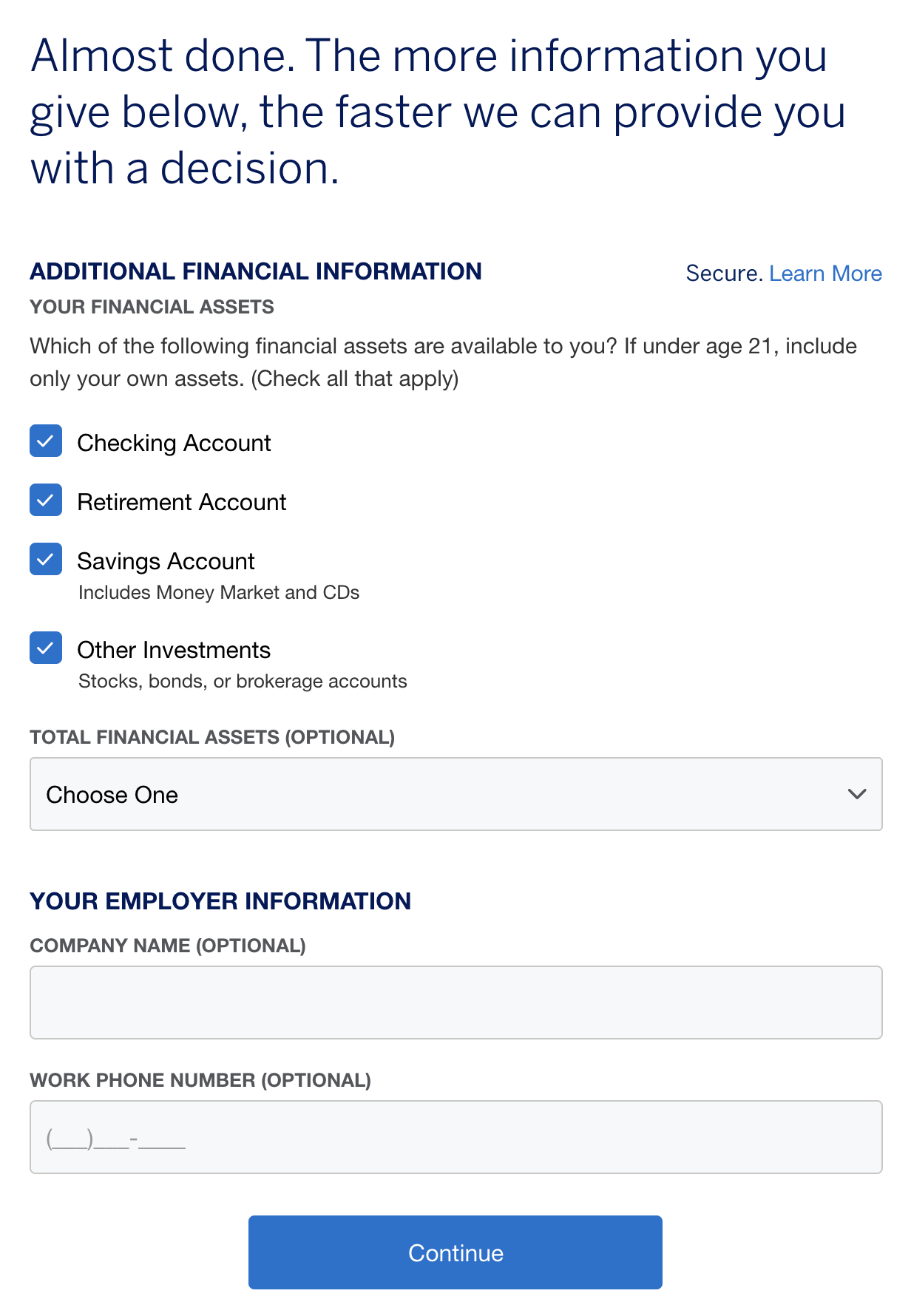

Next, you may be asked for some supplemental information about your finances. Providing this information is optional, but may help speed up your application’s processing time.

The final step is to provide details of a foreign ID, such as a passport, that can help prove you are who you say you are. A Canadian passport should work fine.

Once this is done, there’s a small chance that you’ll be instantly approved at this stage, if everything lines up.

However, it’s more likely that you’ll be asked to verify some information before your application is approved, as is the case with Global Transfer.

Once all of your information is verified, you should expect a shiny new piece of plastic (or metal!) to be on its way to your US address.

Some individuals’ experiences indicate the Nova Credit method can be used to apply for multiple Amex US personal credit cards in quick succession when you’re first starting out with US credit cards.

You aren’t guaranteed to get approved for multiple Amex US cards via Nova Credit to start, but the strategy has paid off for many applicants in the past.

It’s recommended to apply in as quick succession as possible if you’re interested in starting off with more than one Amex US card, as it seems like the longer you wait between multiple Nova Credit applications, the less likely you’ll be approved on subsequent applications.

Which Amex US Credit Card Should You Start With?

One question might be on your mind: which Amex US product should you pick as your first American credit card?

In most cases, it’s best to start out with a basic Amex credit card with no annual fee, such as the American Express US Hilton Honors Card.

That’s because this is going to be the oldest account on your US credit history, and you’ll be helping your credit score the most if you keep this account open forever.

Another option would be to choose a card that could make sense to keep around for the long run, such as the Amex US Hilton Aspire Card.

Not only does this card typically offer a very impressive welcome bonus, but its annual fee of $550 (USD) is offset by a $400 (USD) Hilton Resort credit and a $200 (USD) flight credit, plus you get an annual Hilton Free Night Reward and top-tier Hilton Diamond status for as long as you hold the card.

Which Amex US Credit Card Should You Get First?

Read moreSometimes there are limited-time elevated offers that seem very attractive on premium cards like the Amex US Gold Card or the Amex US Platinum Card, which could make for a wise choice for your first US credit card too.

However, in these cases, you should either be comfortable paying the card’s annual fee year after year to preserve your US credit health, or recognize that your credit score may take a hit if you were to cancel your original and oldest US credit card in the future.

It’s also worth noting that most business credit cards don’t report to personal credit bureaus in the United States. Therefore, business credit cards don’t help you build credit history and therefore wouldn’t be a good choice as a starter US card.

If you’re interested in one of the Amex US small business cards, your best bet would be to first set up a US credit history by getting one of the personal cards, and then applying for a business card 3–6 months later (see Step 5 below for more on this).

Step 4: Get an ITIN

While it’s easy to get your first credit card with Amex US or one of the Big 5 banks’ US arms, you’ll need to have a credit file identifier if you want to eventually move onto the other American issuers, like Chase, Citi, Capital One, or Bank of America.

Just like Canada, personal credit reports in the US are associated with a unique identifier – typically a Social Security Number (SSN), the equivalent of our SIN.

If you already have a SSN as a result of being born, living, or working in the US, then once again, lucky you! Forget about this step, find those mouthwatering signup bonuses, and go forth and conquer!

For the rest of us, we’re gonna need to put in a little bit of work here. In addition to the SSN, credit card companies also accept what’s known as an Individual Taxpayer Identification Number (ITIN) on credit card applications.

ITINs are issued by the US Internal Revenue Service (IRS), so getting one requires mailing a bunch of documents to the IRS, or applying in person.

Now, listen up here, because this is important. One of the reasons one might be eligible for (and in fact, encouraged to apply for) an ITIN is if they are a foreign resident who earns income in the US, you’ll need to declare it and pay the corresponding taxes.

If we think about it, anyone who’s earned some money through US-based services – such as casino winnings in Las Vegas, betting with US-based online betting companies, or trading stocks with a US-based brokerage – should be applying for an ITIN and self-reporting their income if they want to fulfill their obligations to the IRS.

After all, if you didn’t have an ITIN, you’d be subject to hefty withholding taxes on all your winnings, royalties, and dividends. We wouldn’t want that, would we?

(The fact that these sums may be as low as $5 is not important here.)

There are two primary approaches to obtaining an ITIN: getting help through a dedicated service, or the do-it-yourself method.

Method 1: Use a Dedicated ITIN Service

These days, the most reliable method to obtain an ITIN is to seek out a paid service to help you with your ITIN application.

Services that Prince of Travel readers have found useful include:

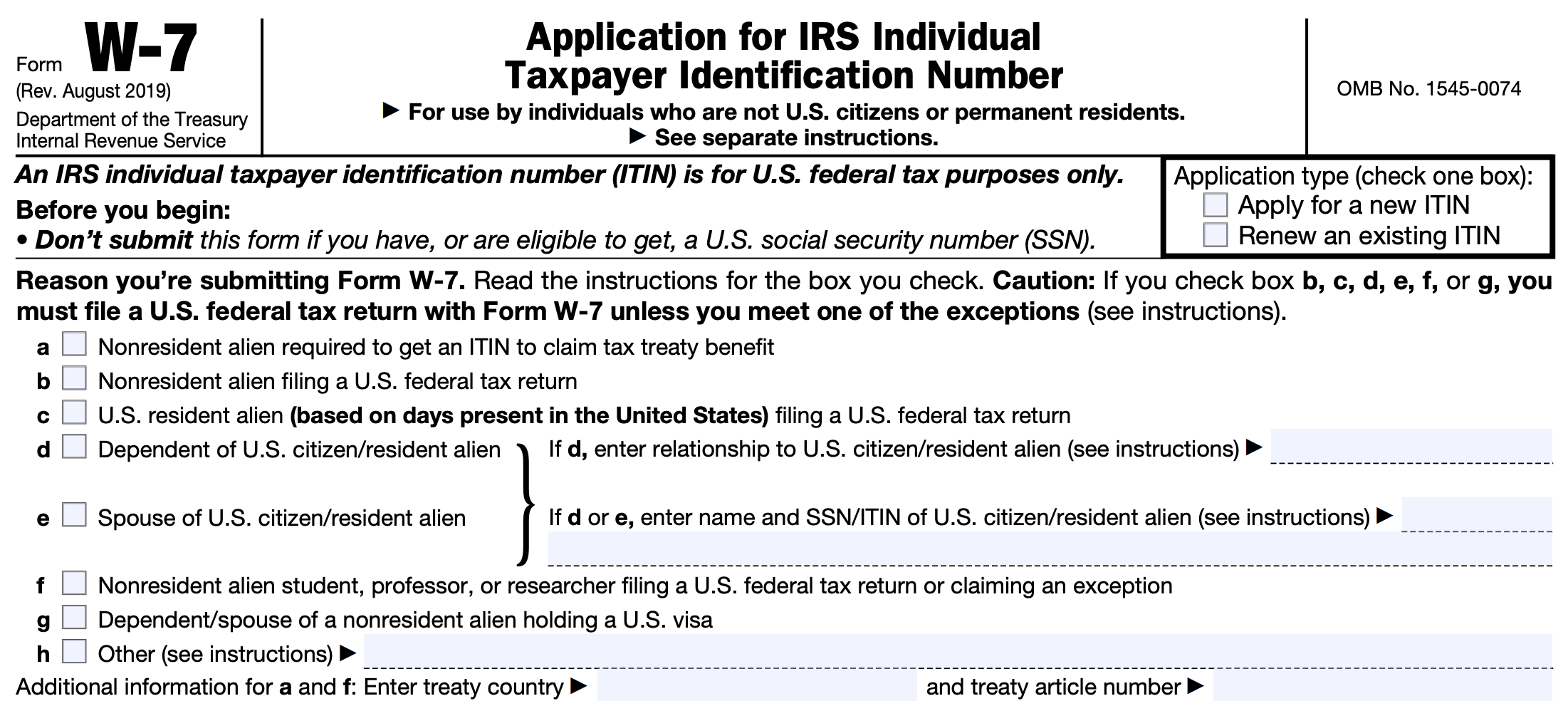

These services will generally provide you with a completed W-7 form, which is the ITIN application form.

They’ll also help you complete a valid US tax return on your behalf based on any amount of earned income from US sources that you declare (such as $5 in gambling winnings). This serves to justify why you require an ITIN in your application.

It’s worth noting that there are other dedicated services, known as Certified Acceptance Agents, who also provide full assistance with ITINs. However, the fees are typically quite hefty, so if you look into this option, be prepared to pay a premium.

Method 2: Do It Yourself

If you’d rather not pay for professional services, you can also take the do-it-yourself approach to getting an ITIN.

However, be warned that even small discrepancies in how the forms are filled in can result in a rejected application, and each application can take several weeks or months to complete.

All of the information you need to apply for an ITIN is listed on the dedicated page on the IRS website. In particular, you’ll need to compile the following documents and send it off to the IRS, or make an appointment in person and bring the documents with you:

-

Document justifying the need for an ITIN (e.g., a 1040NR US tax return with a small amount of income declared)

-

Completed W-7 ITIN application form

-

Original foreign passport, or a certified copy

You can find the official IRS instructions for the W-7 form here. Tax advice is beyond the scope of this website, although there are many online resources to guide you through the process of filling in IRS forms.

In addition, you also need to include a copy of your passport with the application as a means to verify your status as a foreign national. It’s up to you whether to send in your original passport or a certified copy.

You won’t get your documents back in the mail from the IRS for a while, so keep that in mind if you might need your passport for upcoming travel. Personally, I didn’t want to risk my passport getting lost in the mail, so I went with the certified copies.

Importantly, a certified copy is not the same as a notarized copy of a passport that you can get at any lawyer or public accountant’s office.

Instead, it’s provided directly to you by Passport Canada, so you’ll have to schedule an appointment with your local passport office or apply by mail for a certified copy. Keep in mind that there could be a backlog of appointments, so apply sooner rather than later if you want to expedite the process.

The fee for certified copies is $45 (CAD), which is good for one, two, or three copies. Most people opt for three copies, sending one to the IRS and keeping the other two around for another occasion when they might prove useful (hint: they probably won’t).

Lastly, whether you’ve sought help from a dedicated service or filled in the forms yourself, compile all of the documents in an envelope addressed to the IRS’s receiving address indicated on the ITIN information website, send it off, and wait.

Or, make an appointment at an IRS office for your next visit to the US, and then make sure you bring everything with you.

You should expect to wait quite a while – as of 2023, the current turnaround times at the ITIN processing office seem to be in the region of about eight weeks.

If you’ve done everything right, you should eventually receive a letter in the mail indicating your newly minted nine-digit ITIN.

Step 5: Build Your Credit History

Once you’ve set up your address, bank account, first credit card, and ITIN, the hard work is over.

Now all that’s left is to wait for your credit history to mature long enough for you to be approved for some of the credit cards with bigger bonuses.

Chase Credit Cards

Once your relationship with Amex US matures to a few months (usually 3–6 months), you’ll be able to start applying for more Amex US cards and getting approved for them.

However, you’ll want to pace yourself a little bit, with a view of getting cards from Chase in the future:

- Chase credit cards unlock unique new opportunities that aren’t otherwise available with American Express on either side of the border, such as 1:1 points transfers to World of Hyatt program for high-end Hyatt hotel redemptions.

- Chase is stricter than American Express when it comes to approving clients with “fresh” credit histories. They’ll generally want to see 12–18 months of responsible credit usage before approving you for your first Chase card.

- One way to build your relationship quicker and speed up the process with Chase is to open a Chase checking account (which you can easily do as a Canadian) at a branch on one of your trips down to the US.

- Chase also has the infamous “5/24 rule”, in which you won’t be approved for any credit cards if you’ve opened more than five cards in the past 24 months. That’s a key obstacle to keep in mind as you begin to navigate the US landscape.

Therefore, you want to get a handful of Amex US cards to use responsibly as you wait to be eligible for Chase cards.

But at the same time, you don’t want to get too many Amex US cards – or else you’ll lock yourself out of the “5/24 rule” by the time you’re eligible for Chase.

Read More

Amex US Business Credit Cards

One way around this conundrum is by going for the American Express small business credit cards after you’ve gotten your first Amex US product.

As mentioned earlier, Amex business credit cards don’t report to personal credit files in the United States, so you can rack up the signup bonuses on the business products without affecting your future Chase 5/24 eligibility.

Examples would include the Amex US Marriott Bonvoy Business Card, the Amex US Hilton Business Card, or the Amex US Business Platinum Card.

Of these, one reason to consider the Amex US Marriott Bonvoy Business Card is that the 15 elite qualifying nights given each year as a cardholder benefit stack with the Amex US Marriott Bonvoy personal cards.

If you also happen to hold the Amex US Marriott Bonvoy Brilliant Card, you’ll get a total of 40 elite qualifying nights each year (25 from the Bonvoy Brilliant, and 15 from the Bonvoy Business.

Note that Amex US business cards cannot be obtained through Nova Credit; however, an SSN or ITIN is not absolutely necessary to apply either.

If you don’t have an SSN or ITIN, you can apply for Amex US business cards over the phone by submitting your foreign passport as a valid form of ID in place of the SSN or ITIN.

Capital One Credit Cards

Capital One has a strong presence in the United States. In particular, its Capital One Venture X Card is absolutely worth considering as you explore various US credit card options.

Similar to American Express Membership Rewards and Chase Ultimate Rewards, Capital One Miles transfer 1:1 to useful airline programs, such as Aeroplan, British Airways Avios, Cathay Pacific Asia Miles, and Air France KLM Flying Blue.

As with Chase, Capital One generally approves applicants who have an established US credit history. Some data points suggest that you should have around three years of credit history and no more than one application in the past six months across all three credit bureaus.

Keep an eye out for attractive signup offers with the Capital One Venture X Card after you’ve established your US credit history, as it may well be a worthy addition to your US credit card portfolio.

Other US Credit Card Issuers

In addition to Chase and Capital One, a few other US-based issuers will also accept ITINs for credit card applications, with many products that are worth getting:

- Citi’s credit cards allow you to earn Citi ThankYou Rewards, which can be transferred to a variety of useful or unique airline partners.

- Bank of America’s Alaska Airlines or Air France KLM co-branded credit cards offer another way to earn miles with Alaska Airlines Mileage Plan and Air France KLM Flying Blue.

- Bank of America only accepts ITIN applications over the phone or in-branch.

Overall, the goal for US credit cards is a lot more focused on playing the long game than up here in Canada.

US-issued credit cards tend to have strict rules on welcome bonus eligibility, so the strategy is generally more conservative and more about building your credit history over the long run to be eligible for the much wider range of bonuses and benefits found in the US.

Lastly, if you have a spouse or partner, it’s recommended to go through this process for both of you at the same time. After all, we know that maximizing points in two-player mode is one of the best ways to scale up your earnings, so just imagine how much is on the table when it comes to US credit cards.

America, the land of opportunity indeed!

Conclusion

Getting your very first US-issued credit card can be quite a complicated but worthwhile undertaking.

From registering for a US mailbox to dealing with the highly involved process of getting an ITIN, it’s a tricky process to manage and can easily take up a good chunk of your time.

This guide aims to lay out the key elements for you and helps you break down the process into more manageable steps, as you pursue all of the bountiful bonuses and benefits south of the border.

First-year value

$336

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Comments

Create a free account or become a member to comment.