Travelling the world on points can take on different forms depending on whether it’s a solo undertaking or a group effort.

Solo travellers benefit from a high degree of flexibility and the relative ease of finding a single award seat on the most desirable flights. Meanwhile, couples or families who travel together might have a slightly more challenging time with availability, but in return they get to share the experience and create lasting memories from their trips together.

As we all know, couples who pursue Miles & Points for amazing value together… stay together. With that in mind, here are some optimal strategies specifically for those of you playing the game in “two-player mode” – that is to say, you and a partner are looking to cooperate in order to get as much as possible out of your points.

In This Post

- Getting Your Partner in the Game

- Maximizing Credit Card Referrals

- Household Accounts & Pooling Points

- Sharing and Overlapping Benefits

- Conclusion

Getting Your Partner in the Game

Before you even think about maximizing your points as a couple, you need to make sure the other person is on-board with your plans in the first place. As plenty of us have witnessed, many couples in this game tend to consist of one person who’s super enthusiastic and one person who just sort of goes along with what the other person says.

Typically, one person scours the blogs and forums, meticulously tracks the credit cards, and spends hours upon hours crafting creative routes for an upcoming trip. Meanwhile, the other person was reluctant to be involved in the first place, begrudgingly signs up for credit cards when their partner asks them to, and maintains little interest in the nitty-gritty side of things.

Usually, the real buy-in from the reluctant one in the pair happens after the first business class flight or aspirational hotel experience. As you’re sipping on free-flowing bubbly onboard your flight or enjoying a magical sunset from an overwater villa far away from home, all of the inconveniences of credit card applications and learning about which card to use where suddenly become an afterthought.

If your partner is initially hesitant to get involved, your best bet is to lay things out for them and demonstrate the potential benefits as clearly as possible. If that still isn’t enough to tide them over, then you’ll have to put in the work on your own in the beginning stages and truly dazzle them with a memorable trip in order to change their mind – you’d better make it a good one!

Maximizing Credit Card Referrals

One of the key benefits of earning points as a couple is the ability to maximize referral bonuses when applying for new credit cards. Generally speaking, this refers to American Express cards, as other banks only offer referral programs as special promotions.

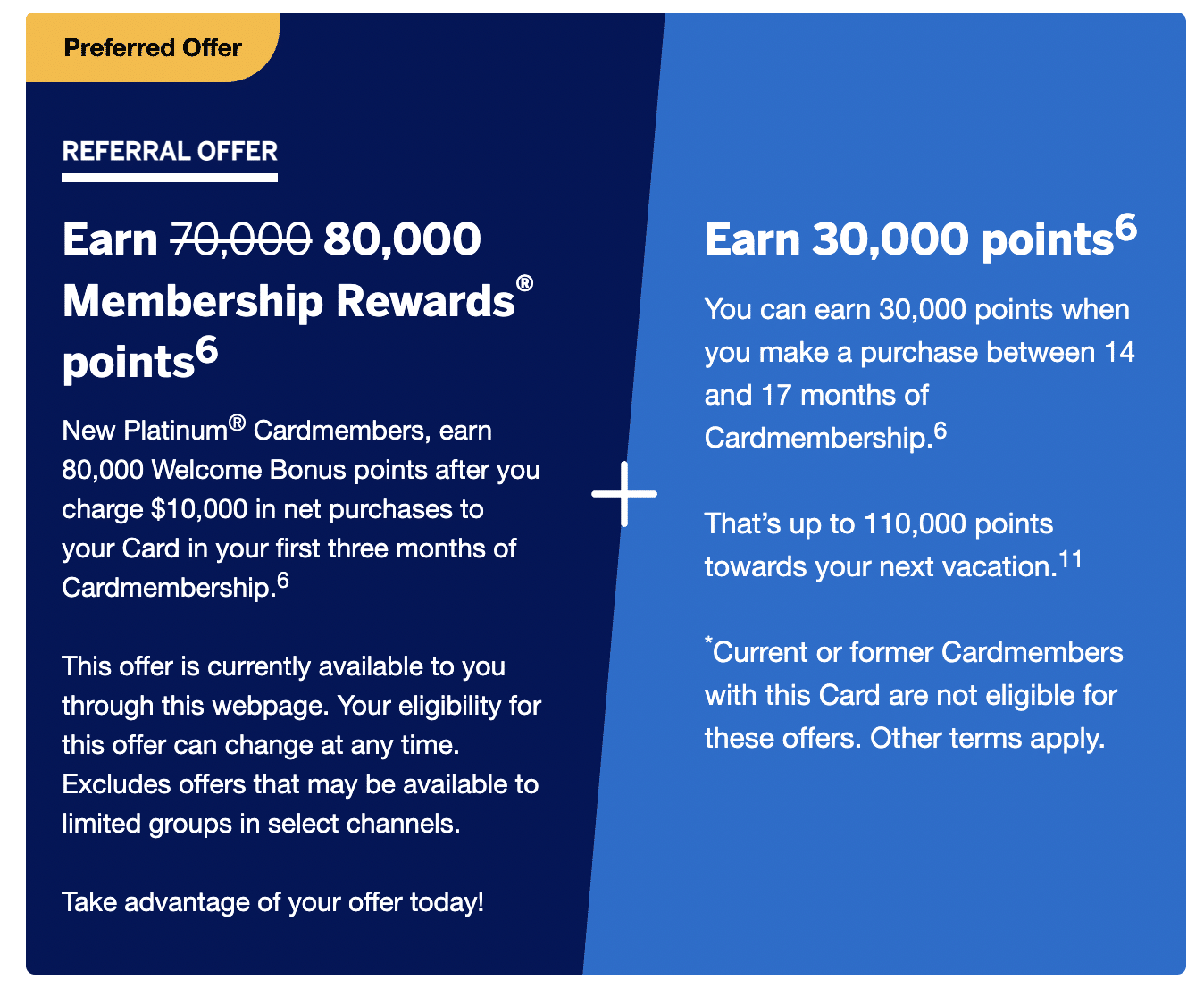

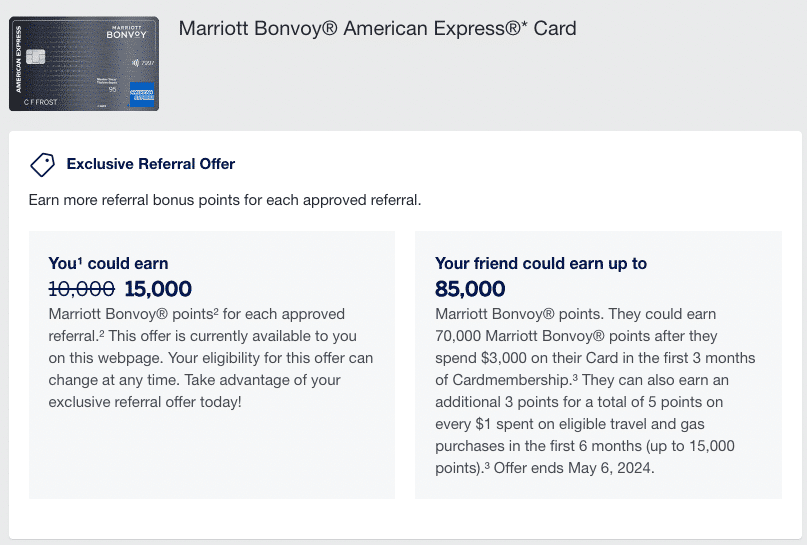

On American Express cards, the referrer sends a special link from their account to the referee, which in this case, is their partner. If the referee applies and is approved for a card, the referrer gets a kickback in points and the referee tends to get a better offer than the publicly available offer.

For example, let’s suppose that the best available public offer for the American Express Platinum Card is for 100,000 points. If you were to be sent a referral link, you might just see a better offer, perhaps for 110,000 points instead of 90,000.

In this case, the referrer would get 10,000 bonus points as a referral bonus, and the referee would get an additional 10,000 points over the public welcome bonus, netting the pair a cool 20,000 points over going through the regular channels.

You’ll want to take a good look at the details of the referral offer, as there might be a higher spending requirement to unlock the higher bonus.

Different American Express cards have different referral bonuses and maximums that you can receive throughout the year. Aside from referring your partner, referrals represent a great way to boost your balance every year if you can become the go-to credit card guru for your friends and family.

The American Express card families can be broken down into three main categories, leaving cash back cards out of the equation: Membership Rewards, Aeroplan, and Marriott Bonvoy. Within the the Membership Rewards and Aeroplan cards, you’ll also find various tiers, ranging from base-level cards with low annual fees to premium cards with high annual fees and added perks.

When you’re thinking about working in tandem for your credit card strategy, you’ll want to take advantage of juicy welcome bonuses and referrals to maximize the potential as a household. You may also want to sit down and plan out a long-term strategy to help you optimize the program for the referrer and the referee.

It’s important to note that there are some intricacies for the referral process.

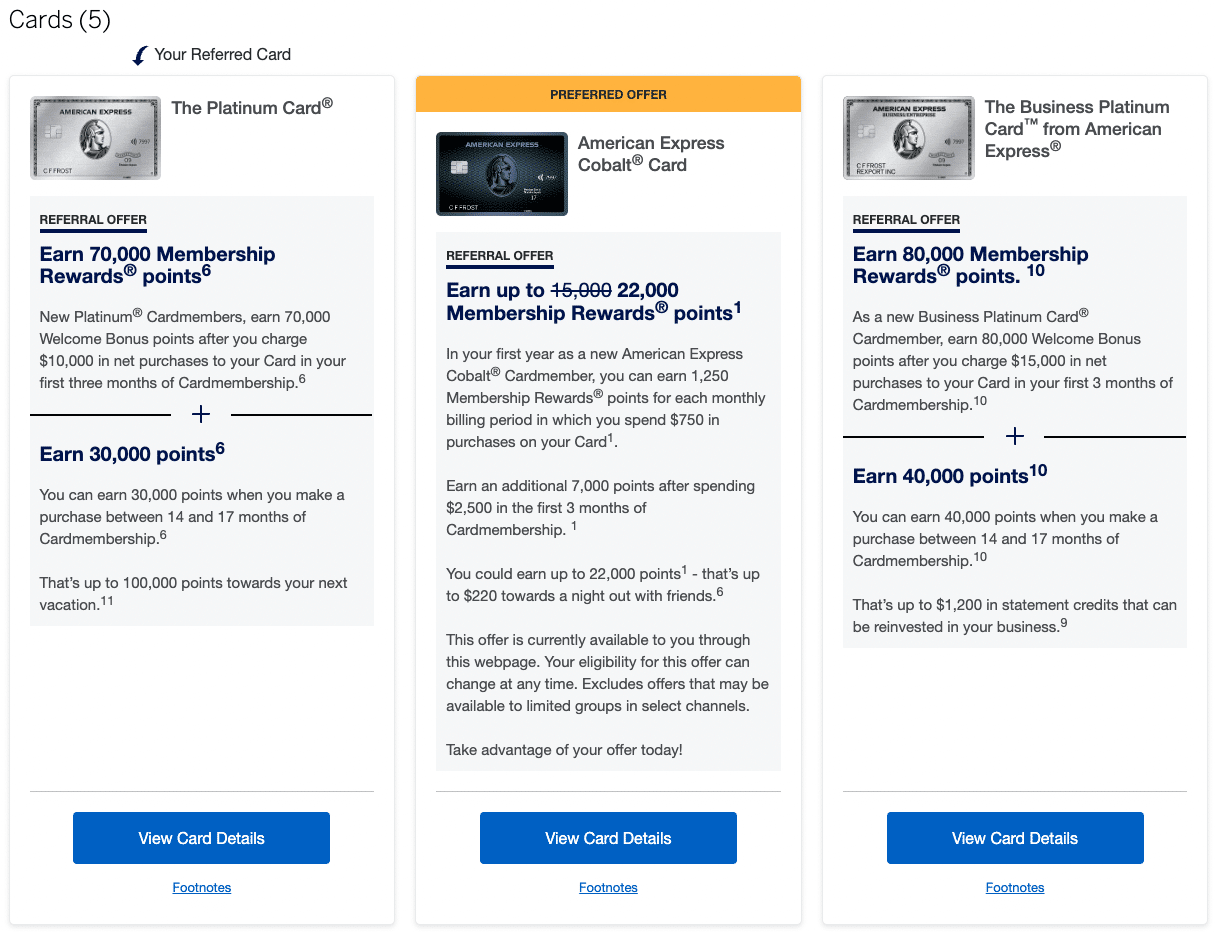

For example, the American Express Platinum Card can refer to itself or to most other Membership Rewards cards.

If you were to refer from the Platinum Card to the Business Platinum Card, you’d earn 10,000 points. However, if you were to refer from the Business Platinum Card to the Platinum Card, you’d earn 20,000 points, which is clearly the better way to approach the referral.

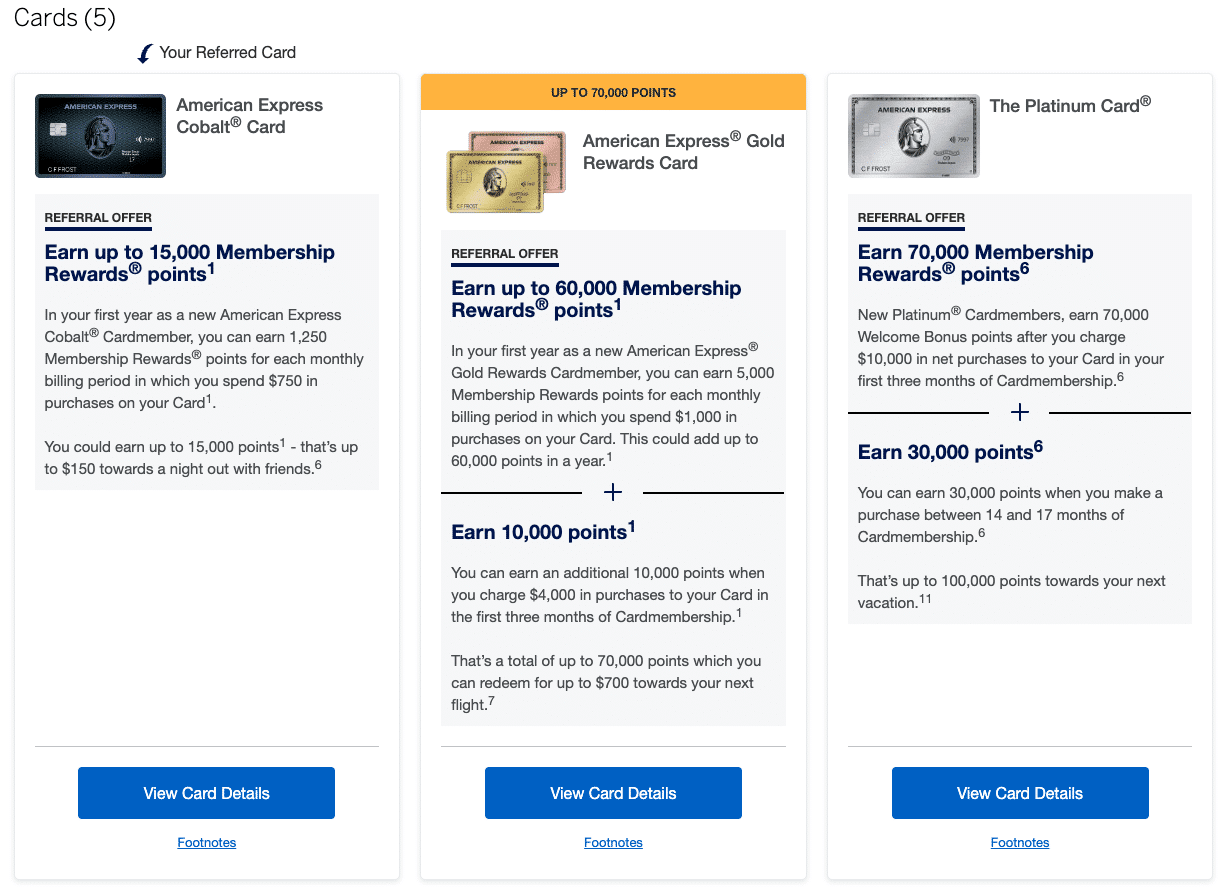

Likewise, the American Express Cobalt Card can refer to many different cards, including the American Express Gold Rewards Card, the American Express Platinum Card, the Business Platinum Card from American Express, and the American Express Business Gold Rewards Card.

However, if you were to refer from the Cobalt to, say, the Business Platinum, you’d be missing out on up to 15,000 points for the referral. Again, that’s because if you were to refer from the Business Platinum Card to the Business Platinum Card, the referrer would get a referral bonus of 20,000 points, whereas if you were to refer from the Cobalt Card to the Business Platinum Card, the referrer would only get 5,000 points as a bonus.

Therefore, you’ll want to think about how to maximize your referrals at every step along the way, since it represents a very easy method to boost your collective balances as a household.

The best approach is for one of the household members to always refer from a Business Platinum card, since you’ll earn 20,000 points per referral to cards in the Membership Rewards family.

- Earn 110,000 MR points upon spending $15,000 in the first three months

- Then, earn 60,000 MR points upon spending $90,000 in the first year

- Plus, earn 30,000 MR points upon making a purchase in months 15–17 as a cardholder

- And, earn 1.25x MR points on all purchases

- Also, receive a $200 annual travel credit

- Transfer MR points to Aeroplan and other frequent flyer programs for premium flights

- Unlimited airport lounge access for you and one guest at Priority Pass, Plaza Premium, Centurion, and other lounges

- Credits and rebates for business expenses throughout the year with Amex Offers

- Bonus MR points for referring family and friends

- Qualify for the card as a sole proprietor

- Annual fee: $799

To find out which cards you can refer to, click through a referral link and look for the “View our other Cards” button.

Lastly, you’ll also want to keep a keen eye out for any promotions for referrals, as American Express will sometimes offer extra bonus points to the referrer.

In these cases, the referrer will benefit from an extra boost to their balance. While it’s impossible to predict when these promotions happen, they’re always a great way to score extra points at minimal effort, which is ideal.

Each year, Amex tends to put out an excellent promotion for double or triple referral points, which is a fantastic opportunity to quickly boost your balance.

For another example, recall that the standard referral bonus for the Marriott Bonvoy American Express Card is 10,000 points per approved referral. During a promotion, you might get 15,000 points per referral instead, or 50% more than the standard offer.

Whenever a situation like this pops up, you may want to reach out to friends and family who have expressed interest in learning more about credit card options.

As always, you’ll want to be mindful of the limit of four credit cards per person imposed by American Express as you plan out your credit card journey.

Household Accounts & Pooling Points

When you’re earning and redeeming for two people, you’ll want to be aware of which programs are best for redeeming both of your points for both of your travels – whether that’s through transferring points, household accounts, or any other mechanism – and which are more strict in that regard.

Most points programs don’t allow you to transfer miles between accounts without a fee.

For example, if you’ve collected 100,000 Alaska miles in one account and 40,000 in another, there’s no way you can book two awards that cost 70,000 miles apiece. It’s just not going to happen unless you pay the fee for transferring 30,000 miles from the first account to the second, and since the fees are calculated on a per-mile basis, they can add up quickly.

You’ll therefore want to be careful as you’re earning points, and think about which accounts you’re using to build up your balances. Either earn enough points for both people in a single account, or earn what’s needed for each person in two separate accounts.

One notable program that allows you to pool points is The British Airways Club, which allows you to create Household Accounts. As long as two members have the same address, they can join up in a Household Account, and then the cumulative balance can be used to book trips for any member in the Household Account.

Likewise, Aeroplan has the Family Sharing feature, which allows members to link accounts and have their points pooled into a single balance. For example, if one member has 50,000 points in their account and another has 50,000 in their account, once combined, they’ll both see a balance of 100,000 points available.

There are a number of other programs that allow points to be pooled between accounts, and it’s in your best interest to know the rules from each program if you’re working together as a team.

In other cases, you can’t technically pool points together, but you can transfer points from one member to another for free.

One of the most common programs with this feature is Marriott Bonvoy, which allows any member to transfer up to 100,000 Bonvoy points per year for free. Any particular member can receive up to 500,000 points per year, too.

In this case, if one of the two members enjoys status with the hotel chain, you’d want to make redemptions from their account to have access to all the perks. Since you can transfer up to 100,000 points for free each year, the idea would be that the person without status can earn points on their own, and then transfer them to the person with status for maximum benefit.

As we’ve seen, whenever possible, it’s best to take advantage of programs that offer household accounts, since doing so opens the doors to earning from a variety of methods.

For example, you can both earn transferable rewards from various programs, such as American Express Membership Rewards and RBC Avion Rewards, and then pool them together in a shared Avios or Aeroplan account (depending on the partners in the program from which you are transferring points).

At the same time, you can also earn points on co-branded cards, such as the American Express Aeroplan Reserve Card, the CIBC Aeroplan Visa Infinite Card, or the TD® Aeroplan® Visa Infinite Privilege* Card, and they’ll all be deposited into and available to everyone in the accounts linked through Aeroplan’s Family Sharing feature.

This way, you’ll have an easier time when it comes time to redeem, since you can both be on a single booking rather than two separate ones.

In a similar fashion, perhaps there aren’t enough points in two separate accounts for a single aspirational booking, but when combined, the balance is sufficient.

Sharing and Overlapping Benefits

Most loyalty programs allow members to extend certain benefits to themselves and one guest, which is something you can look to maximize if you’re playing the game with a partner.

One example is Priority Pass, the world’s largest airport lounge network with over 1,200 lounges around the world. You get Priority Pass membership as a perk of the American Express Platinum Card and the Business Platinum Card from American Express, and you’re allowed unlimited visits together with one guest.

That means that as long as one of you is holding either one of those cards at any given time, then both of you will enjoy lounge access when travelling together.

So as you’re considering the higher-end Amex cards, you can maintain uninterrupted lounge access along your travels as long as you put some thought into the timing of your applications.

This also applies to the other perks on those premium cards, such as Marriott Gold Elite status, Hilton Honors Gold Elite status, access to Amex Fine Hotels & Resorts and the Platinum Concierge, etc., which are all benefits that can be held by one person and enjoyed by both.

Speaking of hotel status, what’s the best way for a couple to maximize their loyalty to a particular hotel brand? Well, anytime you stay at a hotel together, the elite nights and benefits are only going to the person whose name is on the booking.

It’s hard for both people to earn meaningful status with a hotel chain, unless you both travel extensively on your own as well.

Therefore, the strategy that makes the most sense is to make all the bookings under the person who travels relatively more frequently. Let’s say that Person #1 and Person #2 are playing the game as a couple, but when they aren’t travelling together, Person #1 tends to take a few more solo trips than Person #2.

In that case, you’d make all the bookings under Person #1’s account, because that account would earn status faster than Person #2’s. Elite benefits such as lounge access and free breakfast are usually extended to the member and one guest, so you’d both get to take advantage when you’re travelling together

Conclusion

Not only does earning and redeeming miles with a partner provide you with extremely rewarding shared experiences as a couple, but there are also many more extra strategies you can take advantage of, such as referral points, household accounts, and overlapping benefits.

Of course, this article drew upon examples involving a two-person team, but you can really extend these principles to your wider circle of family and friends, as well, to stretch your earning and redeeming possibilities even further.

To get the most out of your points as a dynamic duo, make sure you’re strategic about earning and redeeming.