With just under a week to go until 2024 draws to a close, it’s time for all of us to wrap up another year of points-collecting endeavours.

As in previous years, let’s talk about a few key tasks you should be looking to complete during this period as you take stock of your annual progress and prepare for next year.

1. Wrap Up the Aeroplan Elite Status 2024 Benefit Year

As always, Aeroplan Elite Status takes a prominent role in the Miles & Points strategy of Canada-based enthusiasts. Since many of its deadlines and transitions are associated with the calendar year, now’s the time to take stock and make sure you’re well-positioned for the transition into 2025.

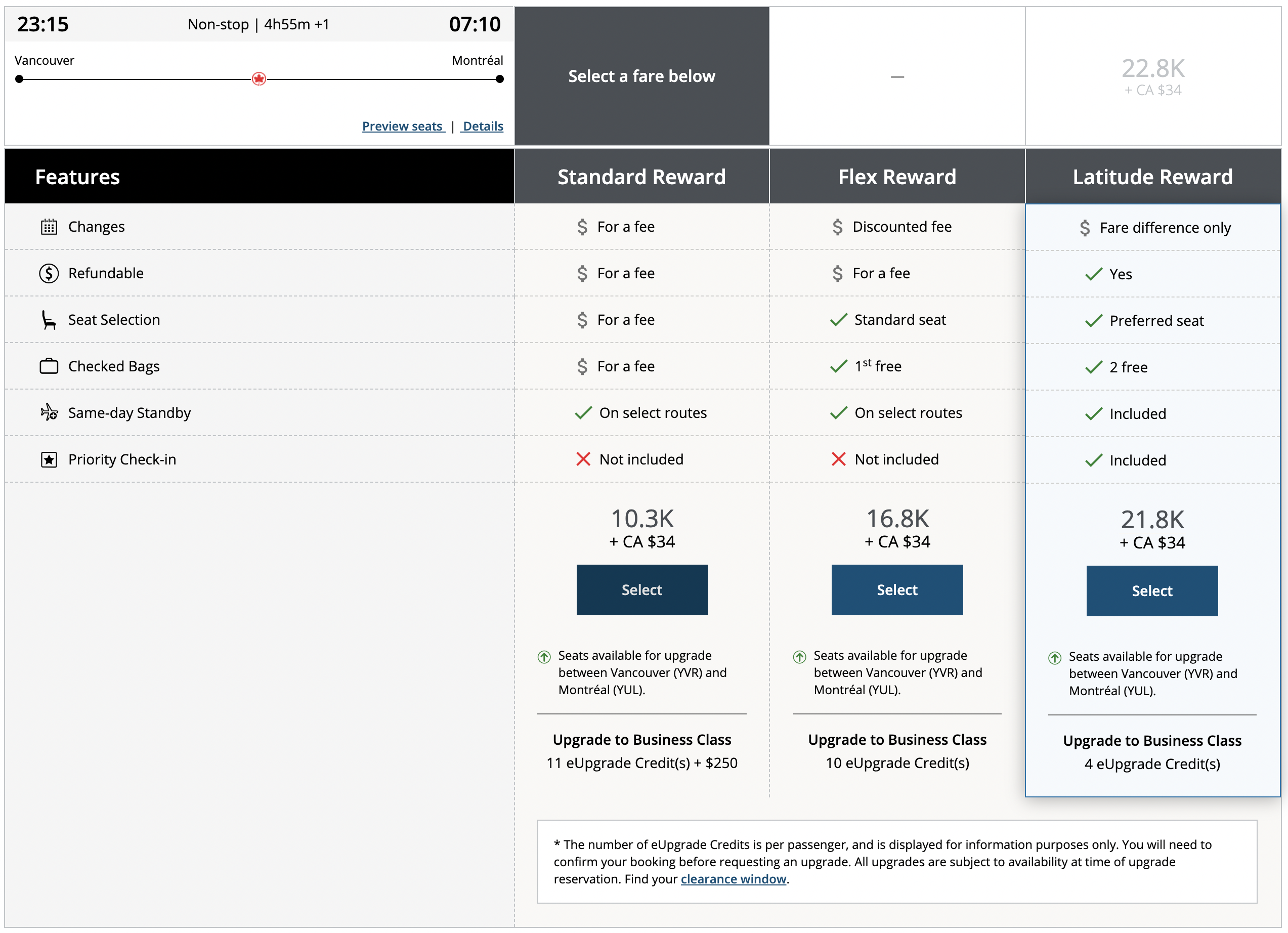

One of the most valuable status benefits is eUpgrades, and you may have some eUpgrade credits that are expiring at the end of the 2024 benefit year. Be sure to use them up on any flights before they expire, otherwise you could lose them altogether.

Keep in mind that Air Canada implemented some changes to eUpgrades validity periods earlier this year. If you’ve earned eUpgrade credits before July 1, 2024, your credits should have an expiry date of mid-January 2025.

For premium Aeroplan credit card holders, these eUpgrade credits will roll over one final time and will be extended until January 15, 2026.

For credits earned on or after July 1, 2024, the validity period is 12 months from the date of issue. However, if you hold a premium Aeroplan credit card, the credits will remain valid for 24 months.

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

Up to 140,000 Aeroplan points

$599 annual fee

|

Up to 140,000 Aeroplan points | $3,680 | Apply Now |

|

130,000 Aeroplan points

$599 annual fee

|

130,000 Aeroplan points | $2,682 | Apply Now |

|

Up to 85,000 Aeroplan points†

$599 annual fee

|

Up to 85,000 Aeroplan points† | $871 | Apply Now |

|

85,000 Aeroplan points

$599 annual fee

|

85,000 Aeroplan points | $845 | Apply Now |

eUpgrades aren’t the only valuable benefits that will need to be used up by the year-end period. If you’re holding onto Maple Leaf Lounge passes or Status Passes, those also need to be used up before December 31.

We’ve seen many members of the Prince of Travel community offering up these perks as free gifts to fellow travellers in the Prince of Travel Club Lounge or Prince of Travel Elites Facebook group. If you’re sitting on passes that might otherwise go to waste, consider sharing the joy of an elevated travel experience this holiday season!

Incidentally, if you’ve qualified for Aeroplan Elite Status but haven’t made use of any of these benefits yet, then December 31, 2024 also marks the final date to choose your Select Benefits for the 2024 benefit year.

If you don’t make your selections by then, you could lose out on some very valuable benefits to use in 2025.

And lastly, if you’ve yet to qualify for status at all, then don’t forget that the Everyday Status Qualification counter resets at the end of the year.

Now’s the time to seriously consider whether or not to make a late push for Aeroplan 25K status with your end-of-year spending.

2. Finalize Hotel Elite Status Qualification

Besides Air Canada and Aeroplan, the end of year usually also marks the end of the qualification period for other elite status programs, too.

Now’s the time to assess your projected status level for 2024. Among hotel programs, take stock of your Marriott Bonvoy, Hilton Honors, and World of Hyatt status progress while there’s still time to squeeze in a few stays.

If you still find yourself a few nights short of the 50-night threshold for the highly valuable Marriott Platinum Elite, then it could make sense to either embark on a last-ditch holiday trip or make a quick trip to an affordably-priced hotel in order to earn the additional nights required.

Keep in mind, however, that Marriott Bonvoy is again granting “status soft landing” in 2025. This means if you’ve failed to requalify for your current elite status in 2024, you’ll receive only a one-status downgrade in 2025, as follows:

- 2024 Ambassador members will enjoy Titanium status

- 2024 Titanium members will enjoy Platinum statatus

- 2024 Platinum members will enjoy Gold status

- 2024 Gold members will enjoy Silver status

If you plan on being in Vancouver or Edmonton before the end of the year, be sure to take advantage of the Stay Vancouver Hotels or Edmonton’s Best Hotels promotions. You can score a hotel at a very favourable price, and you’ll also earn nights towards your status qualification.

And if you’re close to reaching Marriott Titanium status, consider making a final push by the end of the year. After all, the Annual Choice Benefit upon accumulating 75 elite qualifying nights gives you a Free Night Award worth 40,000 Bonvoy points, so as long as you’re spending no more than 40,000 points on your mattress run, you can think of it as effectively not costing you anything.

Moreover, due to the recent status match announcement between Mariott Bonvoy and Air Canada, Marriott Bonvoy Titanium members and above will receive complimentary Aeroplan 25k status. The Aeroplan 25k status will be even more beneficial for those who travel light just with a carry-on, as there will be some changes to baggage rules come January 2025.

Moreover, with the recent status match announcement between Marriott Bonvoy and Air Canada, Marriott Bonvoy Titanium members and above will now receive complimentary Aeroplan 25K status. This status will be particularly advantageous for those who prefer to travel light with just a carry-on, especially given the upcoming changes to baggage rules in January 3, 2025.

3. Maximize Year-End Limits for Points Transfers and Purchases

The end of the year is often treated as a reset date for many types of annual limits within loyalty programs, such as for transferring or purchasing points.

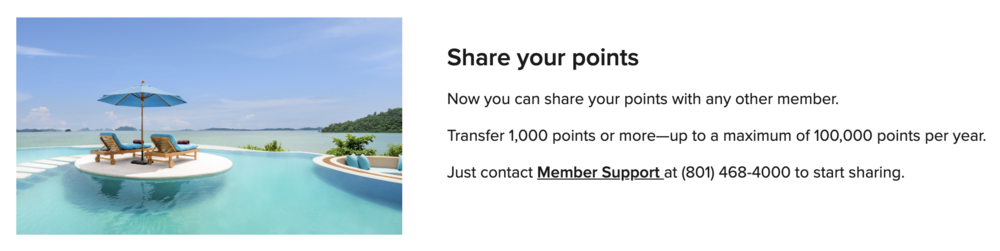

Most notably, Marriott Bonvoy allows members to send up to 100,000 Bonvoy points per calendar year to another member’s account, and to receive up to 500,000 Bonvoy points per calendar year from other members.

For those of you earning points as a couple or as a family, you should definitely make sure you’ve maximized this transfer capacity for 2024 and pooled your Bonvoy points into a single household member’s account to as great an extent as possible.

Ideally, pool your household members’ points into the account of the member who earns the most elite qualifying nights, and therefore the highest elite status level. After all, Platinum status on one account means free breakfast for two, room upgrades, and late check-out.

In the same vein, if you’re in the habit of accelerating your earning power by purchasing miles when it makes sense, then you’ll know that the loyalty programs usually have a capped amount on how many miles you can purchase per year.

If your needs for buying miles happen to exceed this cap, then you’d want to make sure you’ve met the cap for 2024 before it resets for the year.

As a reminder, the following programs have promotions for buying points up to the end of the year:

- Buy Aeroplan points at a 30% discount (ends Jan 3, 2025)

- Buy Hilton Honors points with a 100% bonus (ends Dec 31, 2024)

- Buy World of Hyatt points with a 25% bonus (ends Jan 4, 2025)

4. Use Up Year-End Credits and Offers

Similar to the above, many types of credits and certificates expire at the end of the year, and you’ll just want to quickly check that you’ve taken care of these before 2025 rolls around.

For example, many of the US-issued American Express cards have airline fee credits which work on a calendar year basis, such as the $250 (USD) airline fee credit on the US Platinum Card or the US Business Platinum Card.

If you haven’t taken advantage of these credits to offset your annual fee yet, you have just a few days left to take action.

Then there are other types of annual credits, like the $200 (USD) Dell credit on the Amex US Business Platinum Card, the $50 (USD) Saks Fifth Avenue credit on the Amex US Platinum Card, and so on.

In Canada, there are a handful of annual credits to make use of before 2024, including:

- CIBC Aventura Visa Infinite Privilege Card: $200 (CAD) annual travel credit

- BMO eclipse Visa Infinite Privilege Card: $200 (CAD) lifestyle credit

- National Bank World Elite Mastercard: $150 (CAD) annual travel credit

- TD First Class Travel Visa Infinite Card: $100 (CAD) Expedia for TD credit

- BMO eclipse Visa Infinite Card: $50 (CAD) lifestyle credit

There’s also a variety of different Canadian Amex Offers that will be ending on December 31 as well. Most notably, the following Amex Offers are set to expire before the end of the year:

- Auberge Resorts Collection: Spend $1,000, get $200

- Enterprise Rent-A-Car: Spend $300 and get $60

- Amex Shop Small Promotion on Scotiabank Amex cards

In the US, there are many more Amex Offers available, so be sure to check your accounts for any intriguing offers that are about to expire.

5. Review Accounts and Look Ahead at 2025

While this isn’t necessarily an end-of-year activity, something you can do during the final few weeks of each year is to take some time to review your points expiry dates, hotel stays, and airline activity.

One reason to do this is to check for any points nearing expiration and take steps to extend their validity.

Another reason is to catch any errors that may have occurred that you may have overlooked during the year, such as missing night credits, points not posting correctly, or forgotten future reservations.

Now is the perfect time to review your mileage activity across all the loyalty programs you participate in and reach out to the program if anything needs to be corrected.

Looking forward at 2025, you can also review your spreadsheet to tally up your total points earnings for the year and think about further optimization for next year.

Take a moment at the end of the year to put your feet up, relax, and look ahead in anticipation for your list of upcoming reservations for 2025.

Conclusion

‘Tis the season for tying up the loose ends in Miles & Points as 2024 draws to a close.

Take some time during the last few weeks of the year to deal with the many elements in our space that move in yearly cycles, such as elite status qualification, points transfers and purchases, and the various credit cards’ and loyalty programs’ credits, certificates, and benefits.