When Should You Buy Points?

Besides credit card welcome bonuses, maximizing your return on daily spending, and then perhaps some advanced manoeuvres, one additional method to acquire loyalty points in some circumstances is by outright buying them from the loyalty program.

While it doesn’t quite have the same satisfying feeling of “travelling for almost free” that you might get from some of the other ways to earn points, and it’s not going to be a strategy that works at all times, a circumstance may arise in which purchasing points could be a good, if not outstanding, deal.

Most of these situations rely on airlines and hotels putting on promotions that allow you to purchase points at a discount from the regular rate, and these promotions come and go frequently, with their durations varying from as little as a few days to a whole month.

Let’s look at a few situations in which it might make sense to buy points outright, and hopefully you’ll be able to apply this analysis next time you receive one of these special offers in your inbox.

1. Buy Points to Top Up Your Account for a Redemption

Imagine that you’ve planned out a major redemption with a certain loyalty program, but you’re just shy of having enough miles to book it.

You’ve found your desired routing, located all the award availability, and set up the rest of your trip to perfectly align with these flights. All you’re missing is that final couple hundred or couple thousand miles before you’ll have enough to book the whole thing.

If it’s a program like Aeroplan where you can instantly transfer over your Amex MR points to top-up, then that would be the best option. Otherwise, if there’s no quick and easy solution to earn that extra small amount of miles, then it may well be in your best interest to purchase them outright, since you’d (presumably) still be getting great value on your redemption even if you have to spend some money.

And even if you’re still way off having enough miles for a major redemption, buying those additional miles to make the trip happen can still be a viable option compared to the alternative of paying cash out-of-pocket.

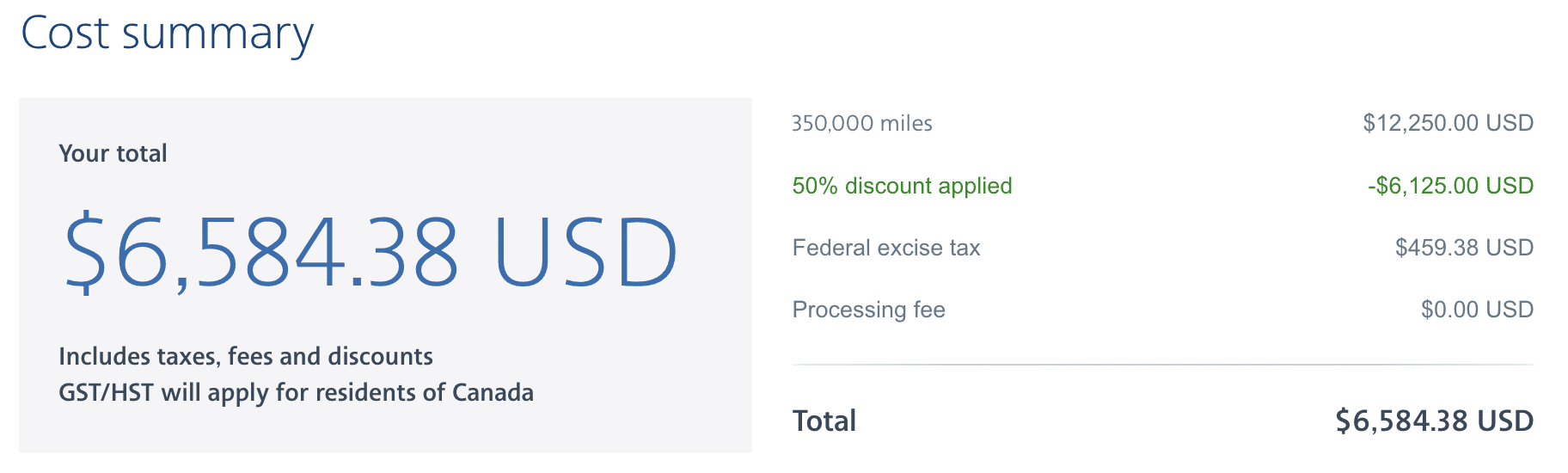

As an example, consider American Airlines AAdvantage, which regularly allows you to buy miles during a sale. On both sides of the border, coming across AAdvantage miles can be difficult, since the transfer ratio from RBC Avion isn’t ideal and there aren’t many other transfer partners.

If you’re just shy of having enough miles for a redemption on, say, Qatar Airways Qsuites or Qantas First Class, it may be very worthwhile to consider topping up your account.

Ideally, there’s an offer available for when you need to buy points, which would just wind up saving you some money in the end. If this is the case, then topping up your account becomes even more attractive.

Otherwise, you’ll need to pay the prevailing rate, which is typically 3.5 cents per point (USD).

Now, acquiring points at this rate usually isn’t a good deal. However, if you have a compelling use of AAdvantage miles in which you are confident of getting higher value than 3.5cpp, then that’d be a different story.

For example, if you were just shy of miles for a Qsuites redemption, you could top up your account and still be getting outsized value out of your points. The other option of paying cash for the flight is almost certainly going to be astronomically higher, so topping up your account is likely the best option.

Of course, this example relies on the loyalty account holder already having an existing balance of miles, so it’s not necessarily generalizable to everyone’s situation.

Nevertheless, it demonstrates an instance in which, given an existing desire to book a certain flight and the otherwise prohibitive cash prices, it can make perfect sense to take up American Airlines AAdvantage’s offer to buy miles, especially at a discount from the standard price.

2. Buy Points to Save Money on Premium Flights

The above example assumes that you have an existing balance with a certain loyalty program, and that you’re buying points to make up the difference for a specific usage of the points. However, what if you’re completely new to a loyalty program and haven’t even collected a single point yet? Would it still make sense to buy points?

Depending on your travel habits, it certainly could. Specifically, if you’re someone who’d otherwise pay cash for premium class flights or five-star hotels and resorts, then it might well be a good deal to buy points at a discount and use those points to book your desired flight, instead of paying the full retail rate.

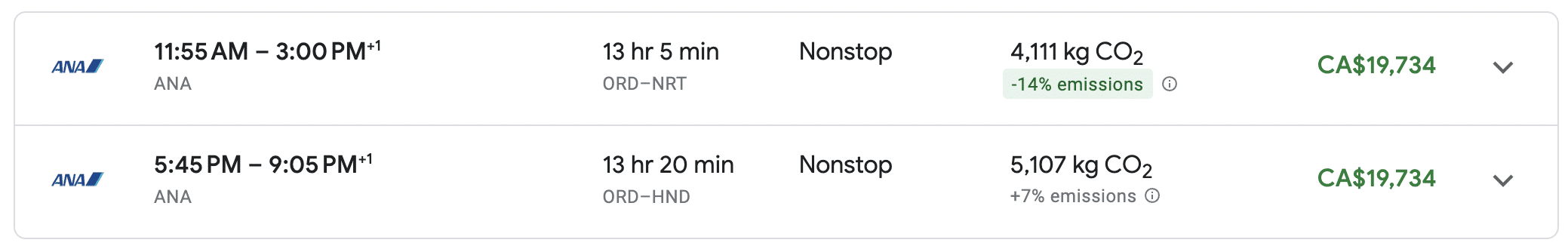

Take the example of Virgin Atlantic Flying Club, which has some very well-known sweet spots in premium cabins. In particular, ANA First Class and ANA business class are some of the most compelling uses of Virgin Points.

A one-way flight from the US to Japan in ANA First Class comes with a hefty price tag – one that most people wouldn’t pay for out-of-pocket.

However, if you buy enough Virgin Points during one of Virgin Atlantic’s promotions to cover the cost of an ANA First Class flight, you’d only need to spend around $1,335 (USD), which is a significant discount compared to buying a full-fare First Class ticket.

We tend to see promotions a few times throughout the year, so if you’ve had your eyes set on a luxurious flight to Japan, keep an eye out for an offer and then be ready to act.

Of course, you’ll need to make sure that there’s award availability on your desired flights before you pursue this strategy, so it’s best to check for availability first before making a major points purchase like this.

3. Buy Points to Save Money on Premium Hotels

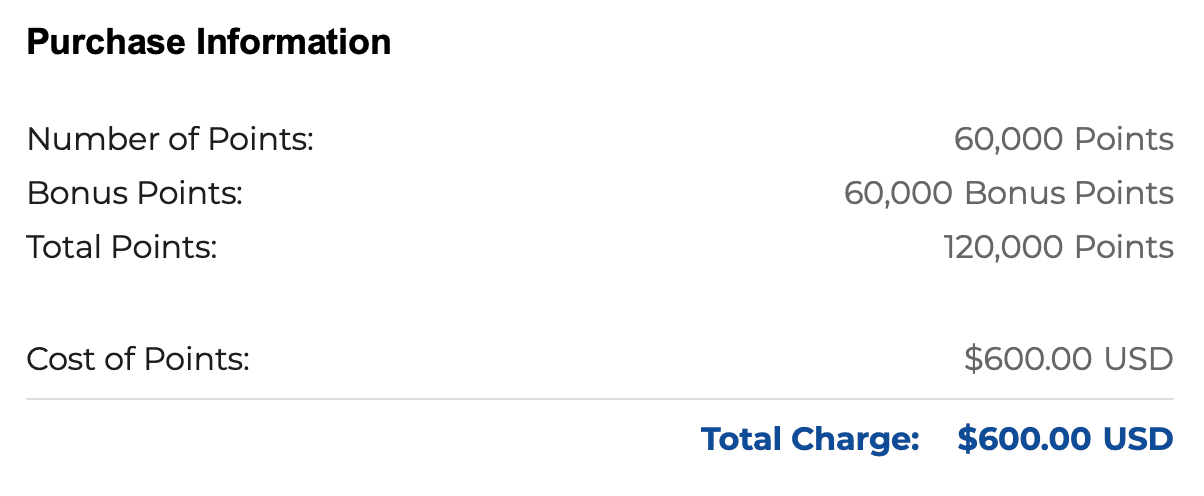

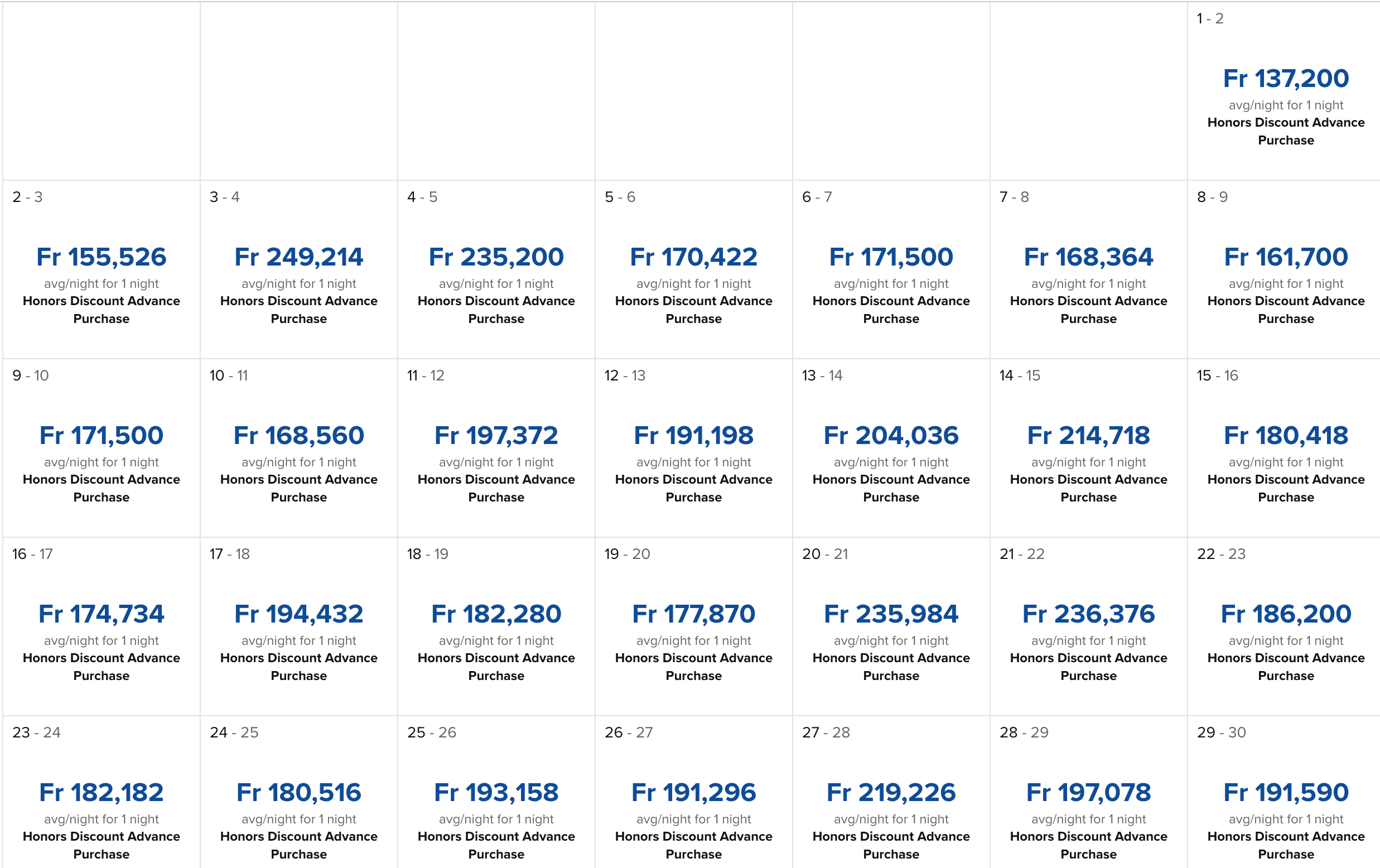

A similar idea also works well with luxury hotels and resorts. Let’s take a look at Hilton Honors’s recurring 100% bonus promotion, which tends to run throughout most of the year.

Hilton regularly sells points at 1 cent per point (USD), but with this promotion, they’re selling points at 0.5 cents per point (USD).

If you wanted to stay at the Conrad Bora Bora Nui, a free night would cost you 120,000 Hilton Honors points. Therefore, you could purchase 60,000 points under this promotion and get Hilton to match it, which would be enough for one night at the Conrad Bora Bora Nui for only $600 (USD).

Indeed, that’s still a significant splurge. But compared to retail rates, it’s a pretty handsome discount. (Note that 100,000 XPF is equivalent to around $900 USD).

But it can actually get even better, if we tie it back to the first example of buying points to top up your account. Let’s say you’ve been acquiring the US-issued Amex Hilton credit cards, and have already accumulated a healthy 320,000 Hilton Honors points.

Now if you were to buy 80,000 points under the promotion and get Hilton to match the additional 80,000, you’ll have enough points for not four, but five nights at the Conrad Bora Bora Nui, because Hilton offers a Fifth Night Free benefit on points redemptions.

So that $800 (USD) outlay is going towards additional nights at one of the best resorts in Bora Bora. If you’re the type to use your points for aspirational once-in-a-lifetime trips, then the opportunity to buy points under lucrative promotions to reach your goals should not be overlooked.

As with buying points for aspirational flights, you should be sure to locate award availability prior to making a points purchase, and then act quickly to secure your reservation.

4. Buy Points to Access Points Currencies That Are Harder to Earn

Buying points can also be a useful way to earn points in programs that don’t offer another convenient way to rack up a large balance.

For example, World of Hyatt is known for offering high-value hotel redemptions at its luxury properties, but the program doesn’t have a Canadian-issued co-branded credit card.

(It’s certainly possible to go through the process of getting US credit cards and eventually applying for a Chase Hyatt credit card, but that’s a laborious process that can take several years’ time.)

If you’d like to lock in a high-value Hyatt points redemption more imminently, you can consider buying Hyatt points during one of their frequent points sales.

This allows you to earn up to 55,000 points per year per account simply by acquiring them from the program, and you can reliably redeem these points for higher than their acquisition price to score some nice discounts on Hyatt’s top-tier hotels.

5. Buy Points on a Speculative Basis, Sparingly

One question that might come to mind is “Should you buy points without a redemption in mind?”

While it may be tempting to buy some points when they’re on sale, it’s almost never a good idea to do so if you don’t have a specific plan for using those points within, say, the next 6–12 months.

You might have a dream trip brewing in the back of your mind, but if the availability doesn’t work out or there’s a devaluation to the program’s award chart, your miles might not end up getting used as you had originally planned.

In some cases, you can take advantage of a limited-time offer to buy points at far lower than their target value. Whenever this happens, you have a chance at scoring an outstanding deal on a higher-value redemption in the future.

For example, in July 2025, Aeroplan points were being sold with a 110% bonus. The effective purchase price became 1.88 cents per point (CAD), which is far lower than our valuation of Aeroplan points at 2.1 cents per point (CAD).

In cases such as these, some Aeroplan members would be comfortable with taking a gamble by buying points without a specific use in mind. If they’re able to then apply those points at a higher value, then the result is positive – but there’s no guarantee of that outcome when making the initial speculative purchase, which is why it’s a gamble at the end of the day.

The Logistics of Buying Points

If you’re interested in purchasing points, be sure to keep a few things in mind about the actual process itself.

First off, if you’re buying points from a US-based loyalty program, like American Airlines AAdvantage or Atmos Rewards, then you’ll usually be hit with sales taxes if you input a Canadian billing address during the check-out process.

As you can imagine, this can quickly eat into the already tightened value that you’re getting from buying points in the first place. Thankfully, the way around this is simple: use a US credit card and a US billing address to buy points from these programs.

Another consideration is which credit card you should use when purchasing points, and the answer will depend on which category of transactions the purchase ultimately falls under. Some programs process your points purchases as a transaction with the airline or hotel itself, in which case it’d fall under the “travel” category, and would be eligible for category bonuses like 2x the points on the Amex Gold Rewards Card or the Amex Platinum Card.

However, most programs use a third-party vendor like Points.com to complete the transaction, in which case it’s just a general-category purchase like any other, so you can use any card on which you’re looking to complete a minimum spend.

Among the above examples, American Airlines AAdvantage processes points purchases directly as an airline purchase, whereas Atmos Rewards, Hilton Honors, and Aeroplan go through Points.com.

Lastly, you’ll want to be 100% certain that the flight or hotel for which you’re buying points is indeed available when you want it to be. You may run into “phantom” award space, which would be a very disappointing outcome if you’d just spent a large sum of cash on a speculative points purchase and can’t complete your booking.

Conclusion

Buying points allows you to capture the value in points programs without necessarily putting in the work to earn those points at a very low cost. The value of buying points varies depending on each specific situation, but it’s always good to consider your options and keep up to date with any current points sales.

It’s key to crunch the numbers and keep track of previous promotions to ensure you’re not overpaying, too. You’ll want to be 100% sure that you are getting more value out of your purchased points than what you pay for them, otherwise it’s probably not worth it.

Whether you’re short a couple hundred points for that big redemption or looking to save money on aspirational flights or hotels, there are numerous situations in which buying points could be advantageous.

Jason thrives on connecting with the heart of a destination, seeking out experiences that go beyond the guidebooks.

First-year value

$336

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Comments

Create a free account or become a member to comment.