Bilt Rewards was launched in 2021 as a way for people to earn points when they pay their rent.

Once earned, the flexible points currency can be transferred to partner airline and hotel loyalty programs, redeemed for travel through Bilt’s travel portal, or even used to pay your rent and more.

Today, Bilt Rewards points are easily earned through the Bilt Mastercard®, but it’s also possible to earn points without the card.

In this guide, we’ll cover the best ways to earn and redeem Bilt Rewards points, plus how to earn elite status through the program.

Earning Bilt Rewards

There are a couple of ways to earn Bilt Rewards points. The first and best way to rack up the most Bilt Rewards points is with the Bilt Rewards Mastercard®.

Bilt Mastercard®

Bilt Mastercard® is a fairly standard rewards-earning credit card; however, it does have some unique features that are important to know about.

Let’s begin by looking at some of the drawbacks or less favourable aspects of the card, as there are two that stand out:

- The card doesn’t come with any type of welcome bonus, which makes it an outlier within the context of rewards-earning credit cards.

- In order to earn points, you have to use the card at least five times in each statement period.

However, as long as you can consistently use the Bilt Rewards Mastercard® at least five times each statement period (and there doesn’t appear to be a minimum amount requirement for these five transactions), the card comes with some competitive earning rates:

- Earn 3 points per dollar (USD) spent on dining

- Earn 2 points per dollar (USD) spent on eligible travel expenses

- Earn 1 point per dollar (USD) spent on rent payments (up to 100,000 points each calendar year)

- Earn 1 point per dollar (USD) spent on other eligible purchases

In addition to these earning rates, you’ll also earn double points on purchases made on the first day of the month (excluding rent) up to 1,000 points for Bilt Rent Day.

This means that if you’re able to time your purchases to the first of the month, you’ll enjoy the following earning rates:

- Earn 6 points per dollar (USD) spent on eligible dining purchases

- Earn 4 points per dollar (USD) spent on eligible travel expenses

- Earn 2 points per dollar (USD) spent on other eligible purchases (excluding rent)

Please refer to the Guide to Benefits on the Wells Fargo website for the more information.

If you’re planning to pay your rent with the Bilt Mastercard®, you’ll need to set up an account through Bilt Rewards.

From there, you can either pay through a Bilt Rent Account, which can be used to pay rent through online payment portals, or Bilt Rewards can mail a check to your landlord or property management company.

It’s important to note that you can only make one rental payment to one rental property per month with Bilt Rewards.

Also, if you fail to make the necessary five transactions to earn points for a statement period, but you make a rental payment with the Bilt Rewards Mastercard® during that period, you’ll earn a flat rate of 250 points, no matter how much your rental payment was.

Additionally, if your rent is under $250 (USD), you’ll still earn the flat rate 250 Bilt Rewards points.

You can also earn up to 5x Bilt points on Lyft rides when you link your Bilt account and pay with your Bilt card.

Lastly, you can earn 2,500 referral points each time you refer a friend to the Bilt Mastercard®. Plus, you’ll get an additional 10,000 bonus points for every five referrals, up to 50 referrals.

Earning Bilt Rewards Without the Bilt Mastercard®

Even if you don’t have the Bilt Mastercard®, you can still earn Bilt Rewards points through other purchases made on the Bilt Rewards website or with the app. These purchases may include rental payments, travel expenses, dining, and more.

Rental Payments

By signing up for a free Bilt Rewards account, you can earn points on rental payments even without the Bilt Mastercard®.

However, you can also earn Bilt points on rent using any debit or credit card, no matter where you live. To determine your eligibility, you’ll have to confirm with your property manager or on-site team to see if your rental is a Bilt Rewards Alliance property.

Unfortunately, even if your property is eligible, you still won’t earn nearly as many points as you would with the Bilt Rewards Mastercard®.

By making your eligible rent payment through the Bilt Rewards website/app, you’ll earn a flat rate of 250 Bilt Rewards points per on-time rental payment.

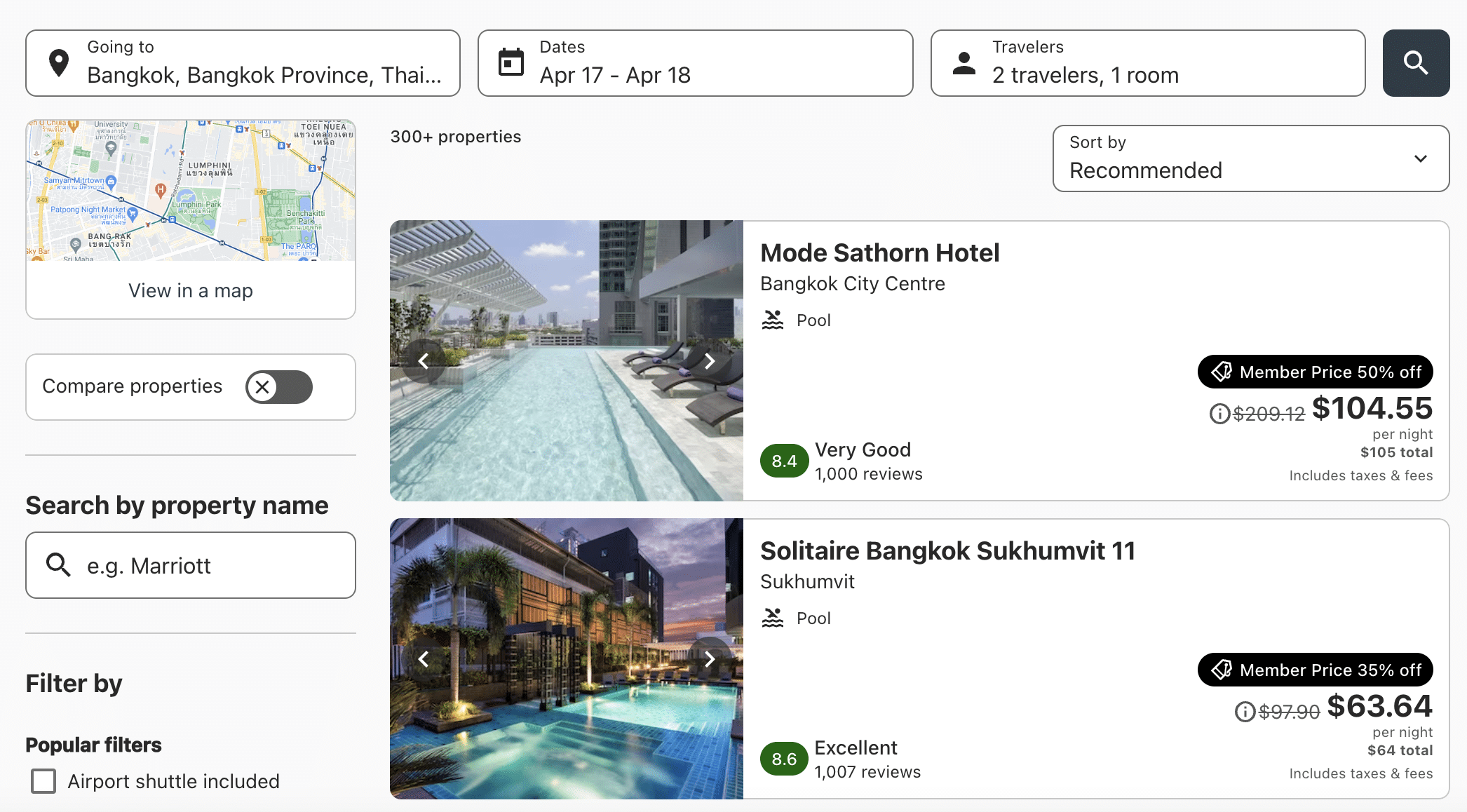

Bilt Travel Portal

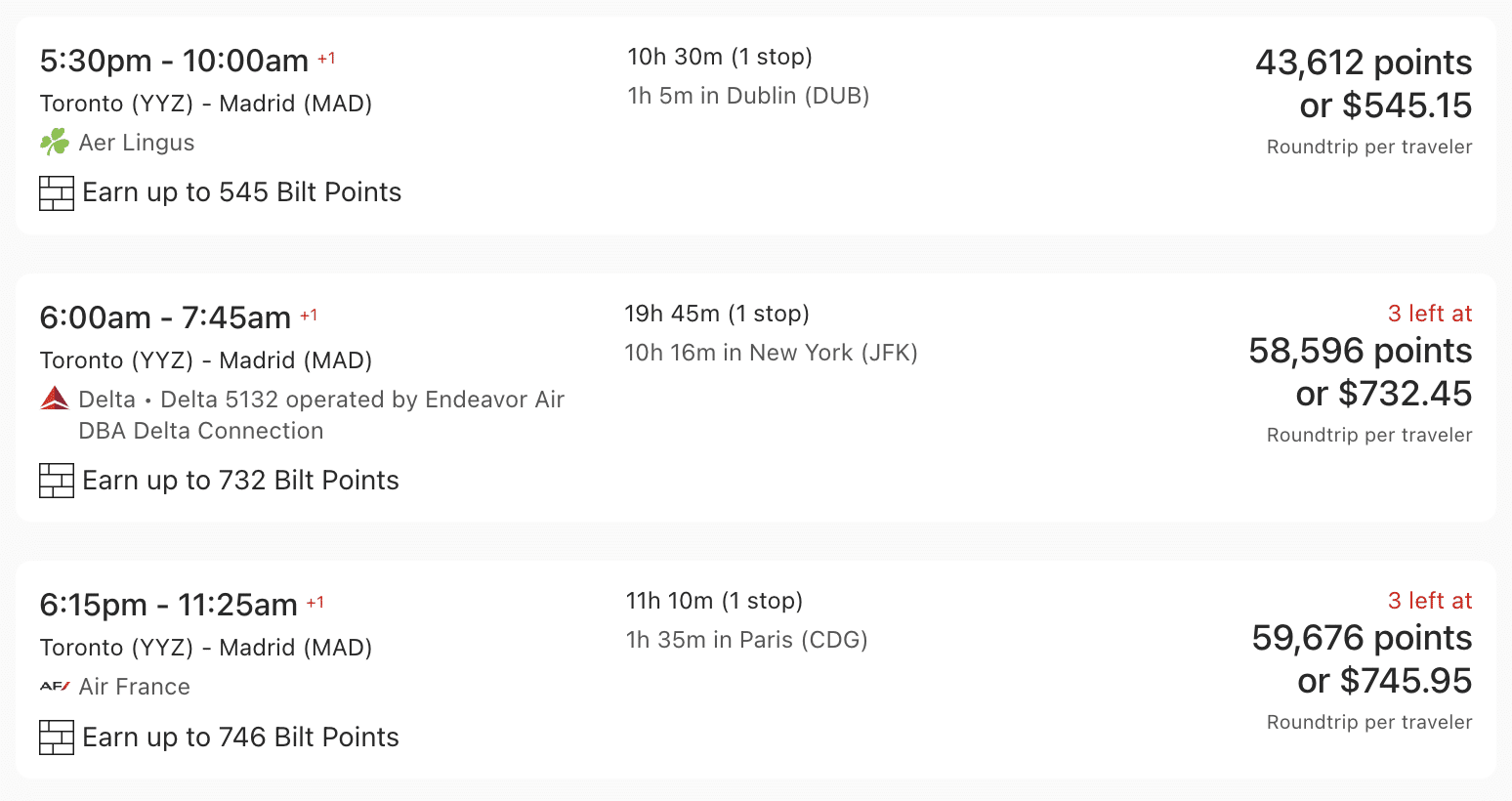

By booking travel through the Bilt Travel Portal, powered by Expedia, you’ll earn Bilt Rewards points, regardless of which credit card you use to pay.

If you book flights, accommodations, car rentals, or “Things to Do,” you’ll earn 1 point per dollar (USD) spent.

You’ll earn an increased rate of 2 points per dollar (USD) spent when you’re booking travel packages.

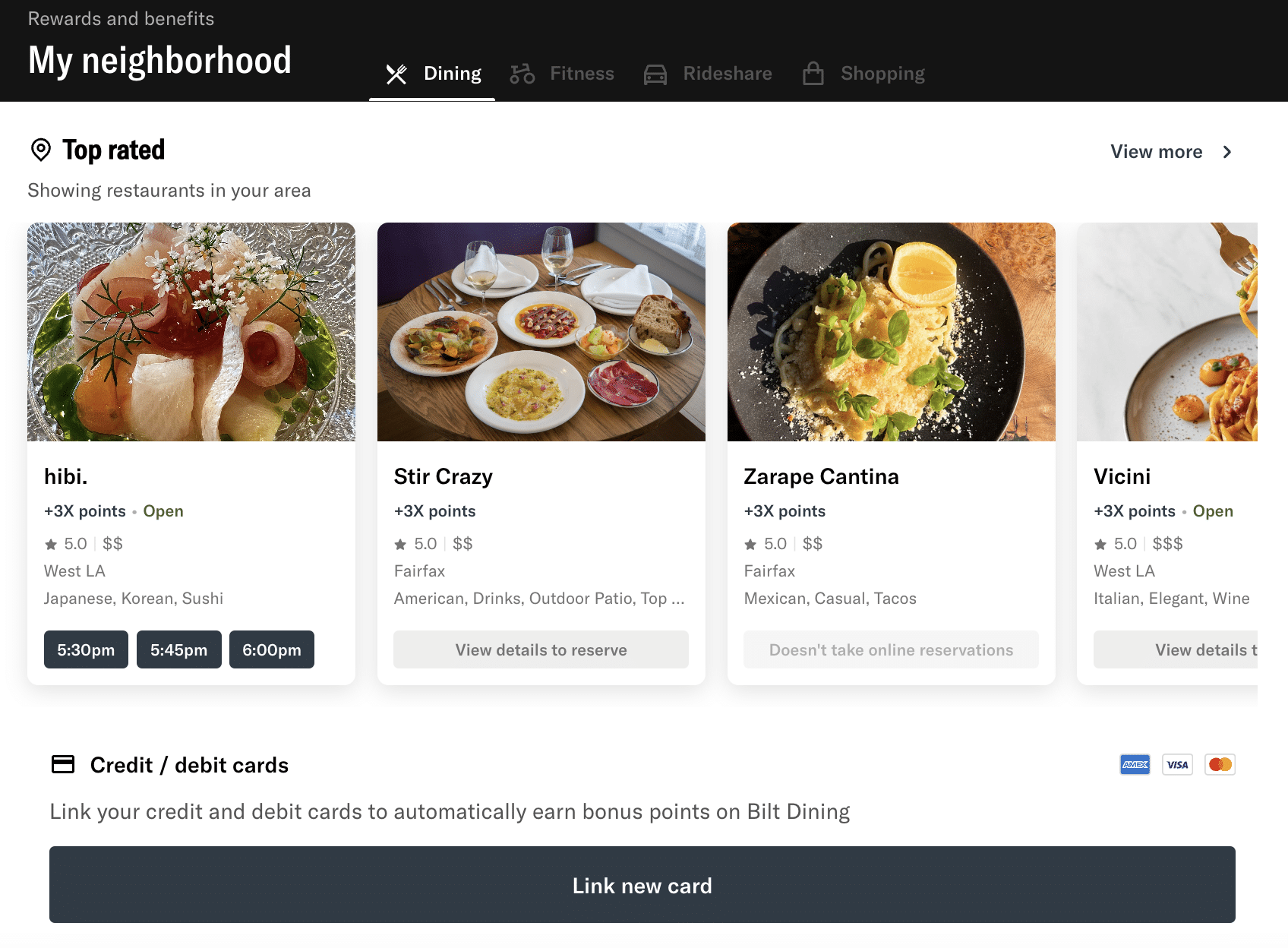

Bilt Dining

Bilt Dining is a program through which you can earn extra Bilt Rewards points at eligible restaurants in the US, with the full list of participating restaurants available on the Bilt Rewards website.

You can expect to earn between additional 2x–10x points per dollar (USD) spent at select locations.

To earn Bilt Rewards points at participating restaurants, you’ll need to have the Bilt Mastercard® or link to your Bilt Rewards account before using it to pay for your meal.

It’s also worth noting that points may take up to seven days to post to your Bilt Rewards account.

Bilt Partners

The Bilt Rewards program has partnerships with Lyft and SoulCycle.

By linking your Bilt Rewards account with your Lyft account, you’ll earn 2X points on Lyft rides as a loyalty member, and an additional 3X points when paid with a Bilt Mastercard®.

You’ll also earn 3x points for all fitness classes purchased through Bilt Rewards.

Promotions

Lastly, Bilt Rewards runs promotions from time to time through which you can earn points.

As an example, Bilt Rewards members can currently earn 100 points for adding an eligible card to their Bilt wallet, up to a maximum of 300 points earned.

Bilt Rewards is also giving away 100 points for every partner loyalty account you link to your account. There’s a total of 500 points up for grabs, earned if you’re able to link all 15 partner loyalty accounts.

Redeeming Bilt Rewards

There are quite a few ways to redeem Bilt Rewards points; however, you’ll get the most value out of the points by transferring them to an airline or hotel loyalty program.

Despite being a relatively new rewards program, Bilt Rewards has already partnered up with an impressive list of loyalty programs.

Transferring to Other Programs

There are a total of 17 transfer partners to which you can transfer Bilt Rewards points at a rate of 1:1. These 17 partners consist of 13 airline loyalty programs and four hotel loyalty programs.

Bilt Rewards’s airline transfer partners are as follows:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France KLM Flying Blue

- Alaska Airlines Mileage Plan

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Emirates Skywards

- Iberia Plus

- TAP Air Portugal Miles&Go

- Turkish Airlines Miles&Smiles

- United MileagePlus

- Virgin Atlantic Flying Club

Meanwhile, its hotel transfer partners are:

Within the above list, there’s lots of big names for both airlines and hotel loyalty programs. Ultimately, the program that’ll get you the most value will largely depend on your own travel ambitions and goals.

Notably, World of Hyatt points can only be transferred from one other bank program (Chase Ultimate Rewards) and may be a great transfer option for Bilt Rewards points if you’re planning to stay at Hyatt hotels and resorts.

Travel

If you’re looking to book travel on your own, you can redeem Bilt Rewards points through Bilt’s travel portal, powered by Expedia.

By redeeming points for flights, accommodations, car rentals, and more, you’ll receive a redemption value of 1.25 cents (USD) per point.

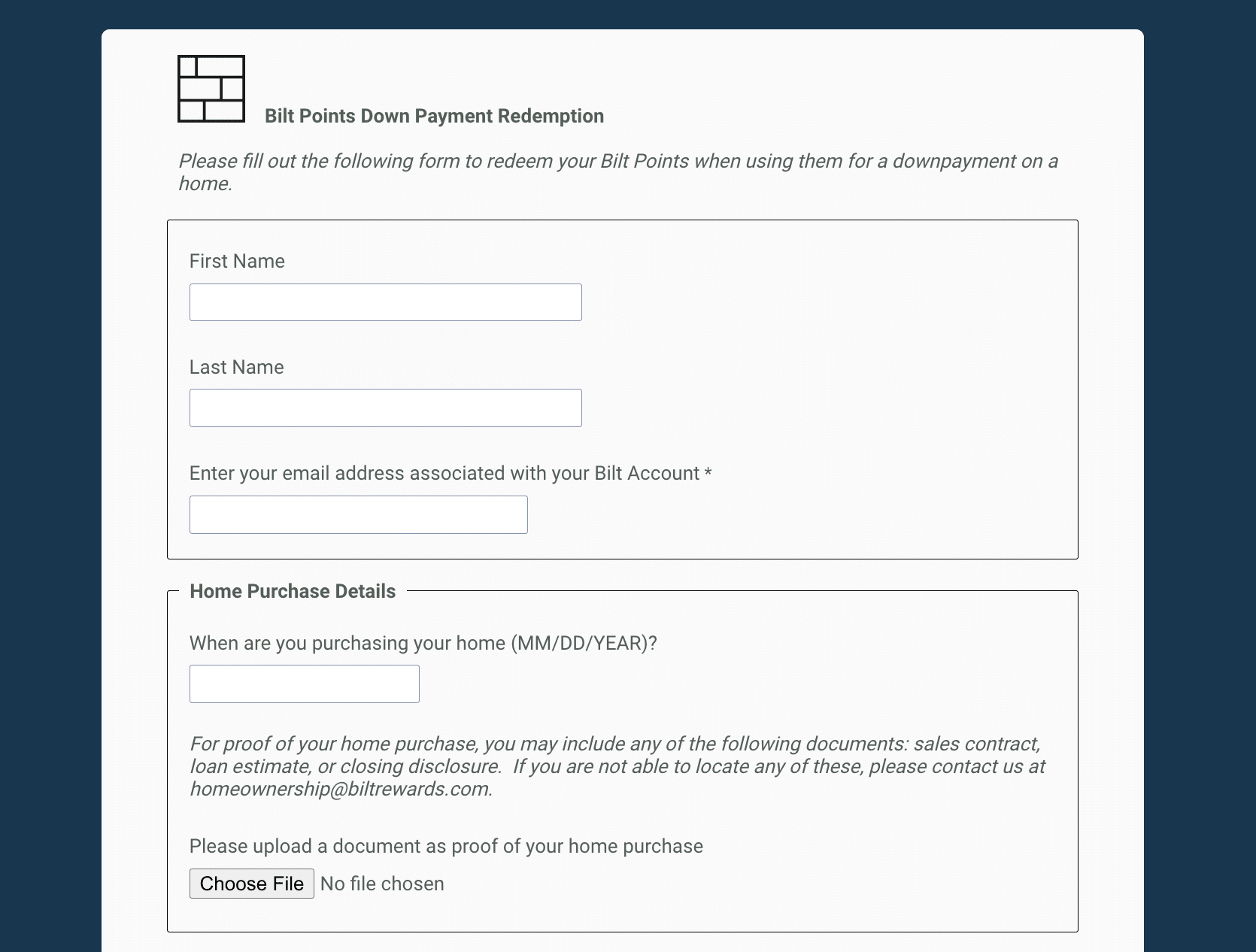

Toward a Down Payment

If you don’t want to redeem Bilt Rewards points for travel, there are some other unique redemption options that provide decent value.

One unique option is the ability to save up your points toward a down payment on a home.

To redeem your points towards a down payment, you’ll need to submit a form online and provide proof of your home purchase.

Bilt Rewards points can be redeemed towards your down payment at a rate of 1.5 cents (USD) per point.

You can also use Bilt Rewards points to pay your rent by simply selecting “Pay with points” when making your rent payment.

However, this option does not provide the best value, as you’ll only get 0.55 cents (USD) per point.

Other Ways to Redeem

There are other options for redeeming Bilt Rewards points, but they won’t provide the same level of value compared with most of the options we’ve already covered.

For example, you can use points for Amazon purchases at a rate of 0.7 cents (USD) per point.

You can also redeem points for items purchased through the Bilt Collection shopping portal, for fitness classes through SoulCycle, and more. However, most of these additional redemption options offer value of around 1 cent (USD) per point or less.

Bilt Rewards Elite Status

Another interesting and unique feature of the Bilt Rewards program is the inclusion of status levels.

Elite status is common with airline and hotel loyalty programs but not so much with loyalty programs of financial institutions, making this feature fairly notable.

With the Bilt Rewards program, you’ll earn status if you earn the following number of Bilt Rewards points in a calendar year:

- Blue: Entry level for all Bilt Rewards members

- Silver: 50,000 points earned or $10,000 spent on the Bilt Mastercard®

- Gold: 125,000 points earned or $25,000 spent on the Bilt Mastercard®

- Platinum: 200,000 points earned or $50,000 spent on the Bilt Mastercard®

Status earned at any point in the year expires at the end of the following year.

As you move up the status levels, you’ll gain access to some interesting perks. The full details of the benefits at each level can be found on the Bilt website.

Conclusion

The Bilt Rewards program is relatively new. However, it’s already demonstrating some great earning possibilities through the Bilt Mastercard®, as well as some amazing redemption options.

Points can be earned through spending on the Bilt Mastercard®, on rent payments, and on dining, travel, and more.

Redeeming points for top value is best done by transferring them to its airline and hotel partner loyalty programs. Alternatively, you can also redeem points for your own travel through the Bilt Travel portal, or you can save your points toward a down payment.

With its unique features, valuable transfer partners, and interesting earning and redemption opportunities, Bilt has set itself up to be a notable player in the rewards arena.

†Terms and conditions apply. Bilt Rewards is not responsible for maintaining the content on this site. Please check Bilt.com for the most up to date information.