TD is one of Canada’s largest and most popular banks, offering a range of products and services through in-person and online banking.

In this guide, we provide an overview of TD’s bank account and credit card portfolio, with links to more in-depth articles on specific products and other key information.

In This Post

- A Brief History of TD

- Chequing and Savings Accounts

- TD Credit Cards

- TD Banking App

- Conclusion

- Frequently Asked Questions

A Brief History of TD

Toronto Dominion (TD) Bank was created on February 1, 1955, as an amalgamation of The Bank of Toronto and The Dominion Bank.

Over the past seven decades, TD has continued to grow in both size and in the diversity of its offerings.

Beginning with 499 branches at the time of amalgamation, TD now has over 2,200 branches and is currently the second largest bank in Canada and the tenth largest bank in the US.

Key Dates in TD History:

- 1855 – The Bank of Toronto was founded

- 1871 – The Dominion Bank opened its first branch

- 1955 – TD was created through the amalgamation of The Bank of Toronto and The Dominion Bank

- 2000 – TD purchases Canada Trust, expanding its market share in Canada

- 2005 – TD acquires Banknorth, marking its major entrance into US retail banking

- 2011 – TD acquires MBNA Canada’s credit card business

Chequing and Savings Accounts

TD has four personal chequing accounts and three personal savings accounts, which we’ll go over in this section.

When considering which type of account to open, it’s important to think about your banking priorities and preferences, and how you tend to use and access your account.

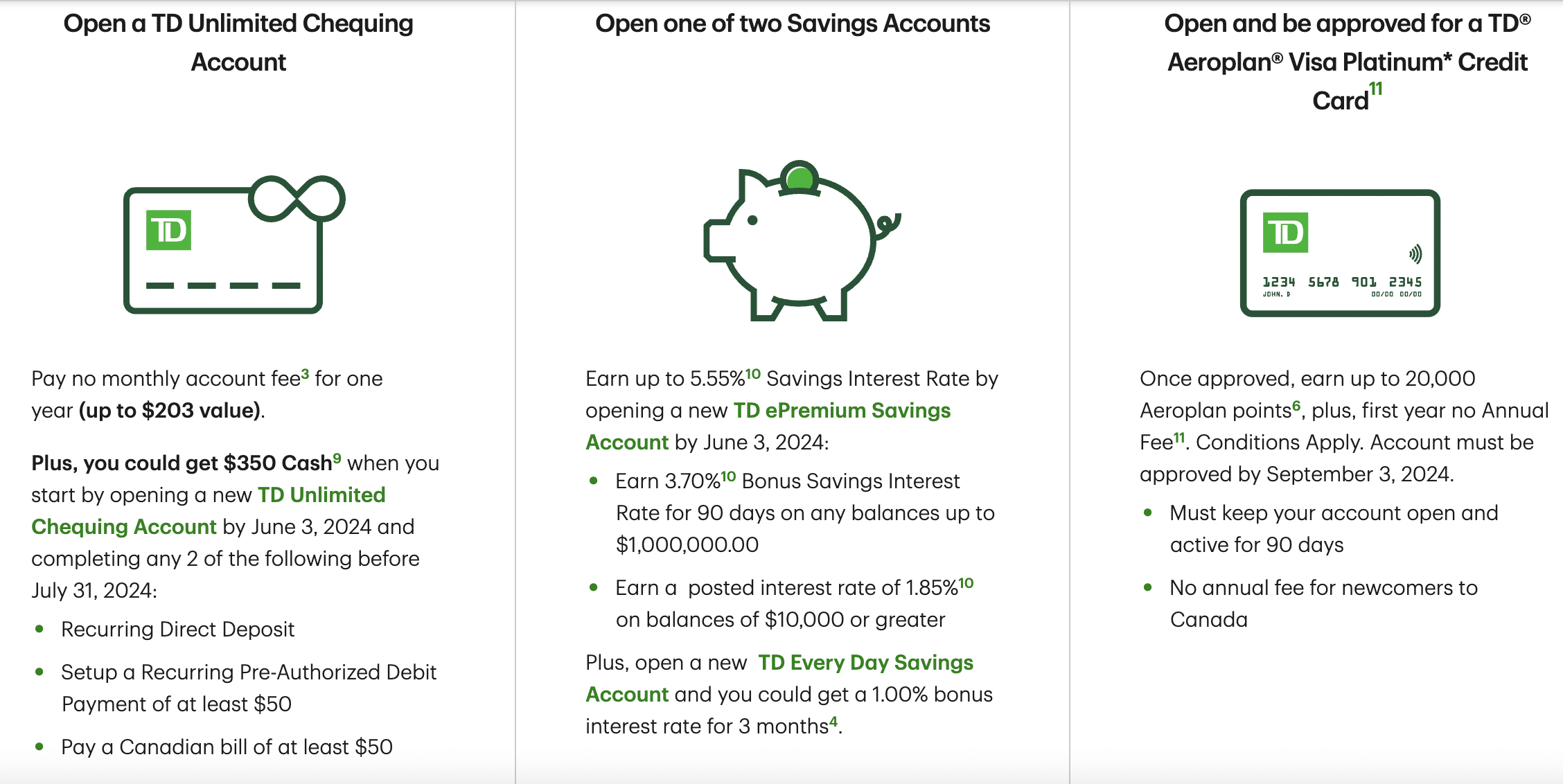

TD also often has promotional offers when you sign up for a specific account or multiple accounts together that can garner you a cash bonus, higher interest rates on savings, and other perks (e.g., merchandise).

Chequing Accounts

Chequing accounts are the best day-to-day account as they tend to offer more monthly transactions and lower fees compared to savings accounts. Plus, they often come with perks such as free Interac e-transfers and rebates on credit card annual fees.

To learn more, let’s take a look the key characteristics of each of TD’s personal chequing accounts from the simplest to the most comprehensive:

TD Minimum Chequing Account

- Monthly fee: $3.95 (all figures in CAD)

- Included transactions: 12 (additional transactions = $1.25/each)

- Interac e-transfers: $0.50/each (for transactions up to $100) and $1/each (for transactions above $100)

- ATM fees: $2 for non-TD ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Fee waivers: Fees waived for seniors receiving the Guaranteed Income Supplement (GIS) and for Registered Disability Savings Plan beneficiaries

- Best for: Individuals with minimal banking needs

TD Every Day Chequing Account

- Monthly fee: $10.95 (waived if a $3,000 account balance is maintained)

- Included transactions: 25 (additional transactions = $1.25/each)

- Interac e-transfers: Free

- ATM fees: $2 for non-TD ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Fee waivers: None

- Best for: Individuals who make fewer than 25 transactions per month

TD Unlimited Chequing Account

- Monthly fee: $16.95 (waived if a $4,000 account balance is maintained)

- Included transactions: Unlimited

- Interac e-transfers: Free

- ATM fees: $0 for all ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Fee waivers: First year annual fee rebate for an eligible TD credit card

- Best for: Individuals who want the freedom of unlimited transactions and who can take advantage of the credit card fee rebate

TD All-Inclusive Banking Plan

- Monthly fee: $29.95 (waived if a $5,000 account balance is maintained); $22.45 for seniors over the age of 60

- Included transactions: Unlimited

- Interac e-transfers: Free

- ATM fees: $0 for all ATMs globally

- Fee waivers: Yearly annual fee rebate for an eligible TD credit card

- Additional features: A small safety deposit box (subject to availability) and free personalized cheques

- Best For: Individuals who often use non-TD ATMs and those who can take advantage of the annual credit card fee rebate and the additional product perks

Savings Accounts

TD also offers three savings accounts for clients looking to build their savings while still having easy access to their funds.

Let’s explore these three accounts and what makes each one unique.

TD Every Day Savings Account

- Monthly fee: $0

- Annual interest rate: 0.010%

- Included transactions: One (additional transactions = $3/each)

- Transfers: Free to other TD deposit accounts

- ATM fees: $2 for non-TD ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Best For: Individuals looking for a simple place to start saving

TD High Interest Savings Account

- Monthly fee: $0

- Annual interest rate: 0.050% when account balance is $5,000 or higher; 0% when account balance is below $5,000

- Included transactions: Zero (transactions = $5/each, which is waived if a $25,000 account balance is maintained)

- Transfers: Free to other TD deposit accounts

- ATM fees: $2 for non-TD ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Best for: Individuals looking for an easy-to-access savings account

TD ePremium Savings Account

- Monthly fee: $0

- Annual interest rate: 1.85% when account balance is $10,000 or higher; 0% when account balance is below $10,000

- Included transactions: Zero (transactions = $5/each)

- Transfers: Free to other TD deposit accounts

- ATM fees: $2 for non-TD ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Best For: Individuals who can maintain an account balance of $10,000 or higher

Additionally, for individuals who have newly immigrated to Canada, TD has created a special offer called the TD New to Canada Banking Package.

This offer provides a variety of different financial incentives when you open specific chequing and savings accounts, plus additional rewards-based incentives when you sign-up for a specific credit card.

Student Bank Accounts

TD offers one account specifically for youth (under the age of 23) and students (of any age) who are enrolled in full-time post-secondary education: the TD Student Chequing Account.

TD Student Chequing Account

- Monthly fee: $0

- Included transactions: Unlimited

- Interac e-transfers: Free

- ATM fees: $2 for non-TD ATMs in Canada, $3 for foreign ATMs in the US and Mexico, and $5 for foreign ATMs in any other country

- Fee waivers: None

- Best for: Individuals who are under the age of 23 or who are enrolled in a full-time post-secondary program

Additionally, TD has created a special offer for young students who are new to Canada: the International Student Banking Package.

This package combines the TD Student Chequing Account, the TD Rewards Visa* Card, and the TD Every Day Savings Account and provides additional value to eligible account holders through Amazon gift cards and cash bonuses.

For new students looking to get started in Canada, this package provides both essential products and excellent added value.

US Dollar Accounts

TD has two US dollar accounts available: the US Daily Interest Chequing Account and the Borderless Account.

These accounts are ideal for people who have banking needs in both Canada and the US as they allow you to easily exchange funds between the two countries at a competitive rate.

The US Daily Interest Chequing Account has no monthly fee, making it an excellent account if you find yourself occasionally in need of banking access in the US.

Comparatively, the Borderless Account has a monthly fee of $4.95 (USD) which is waived if the account balance is $3,000 (USD).

This account enjoys a preferred exchange rate and provides account holders with free US bank drafts and basic cheques. These features make it ideal for frequent travellers to the US.

TD Credit Cards

TD offers its clients a range of personal credit cards that provide the opportunity to earn cash back, Aeroplan points, and TD Rewards Points.

Cash Back Credit Cards

TD offers two cash back credit cards: the TD Cash Back Visa Infinite* Card and the TD Cash Back Visa* Card.

These credit cards are ideal for people who like the simplicity of cash back rewards, which can be used to pay down your account at any time with a minimum of $25.

For an entry-level card, the TD Cash Back Visa* Card has no annual fee and earns 1% cash back on eligible grocery, gas, and recurring bill payments.†

Comparatively, the TD Cash Back Visa Infinite* has an annual fee of $139 but offers 3% cash back on eligible grocery, gas, and recurring bill payments.†

We’ve created individual in-depth guides to both of these cash back credit cards, where you can find up-to-date offers and enrollment information – just click above to learn more.

Aeroplan Co-Branded Credit Cards

For individuals looking to earn points with Canada’s most popular and powerful airline loyalty program, TD offers three personal credit cards that earn Aeroplan points on everyday spending.

The three cards are: the TD Aeroplan Visa Platinum* Card, TD Aeroplan Visa Infinite* Card, and the TD Aeroplan Visa Infinite Privilege* Card.

These cards are great choices for Aeroplan members looking to build up their points account balance to access award flights, as each card comes with a welcome bonus and earns Aeroplan points on everyday spend.

The entry-level member of the TD Aeroplan co-branded card family is the TD Aeroplan Visa Platinum* Card. This card often features a generous welcome bonus and comes with a few Air Canada perks.

This is a great card to consider if you have a more modest income or want to keep costs down while still earning points towards travel.

The TD Aeroplan Visa Infinite* Card is the next level up in TD’s Aeroplan credit card family.

Much like its Platinum counterpart, this card often comes with a nice welcome bonus, and it also offers cardholders one free checked bag on Air Canada flights and a fee rebate for your NEXUS application.†

This card is a good choice for individuals who travel often and can take advantage of the related perks.

The third card in the TD Aeroplan family is the TD Aeroplan Visa Infinite Privilege* Card. Of TD’s three Aeroplan credit cards, this one will come with the highest welcome bonus and the most valuable perks.

This card is ideal for individuals who don’t mind paying the high annual fee and for Air Canada frequent flyers who can maximize the utility of the associated travel benefits, including eUpgrade/Status Qualifying Miles rollover and unlimited Maple Leaf Lounge access.

Check out our in-depth guides for these three Aeroplan cards to learn about up-to-date offers and enrollment information – just click the card names above.

TD Rewards Credit Cards

TD offers three credit cards that earn TD Rewards Points on everyday spending. TD Rewards is the bank’s own rewards program, allowing clients to earn points that can be used for travel, statement credits, and gift cards.

The three TD Rewards cards are the TD Rewards Visa* Card, the TD Platinum Travel Visa* Card, and the TD First Class Travel Visa Infinite* Card.

TD Rewards Points are particularly valuable when redeemed for travel booked through Expedia® for TD, the bank’s online travel portal operated in partnership with Expedia®.

The TD Rewards Visa* Card is this credit card family’s entry-level offering and offers the opportunity to earn TD Rewards Points on everyday purchases with zero annual fee.†

This is a great card for individuals who are looking for a straightforward, low-cost card that lets them earn towards flexible future travel.

The TD Platinum Travel Visa* Card is the mid-level card of the TD Rewards credit card family, and new cardholders usually have the opportunity to earn a welcome bonus in the first few months of card membership.

This card also offers elevated TD Rewards Points earning rates, making it a good card for individuals looking to build up their points balance faster.

The TD First Class Travel Visa Infinite* Card is the premium card offering in the TD Rewards credit card family.

This card often features a generous welcome bonus and a first-year annual fee rebate.

Cardholders will also enjoy excellent earning rates for TD Rewards Points and a $100 accommodations/vacation credit that can be used when booking at least $500 worth of eligible travel through Expedia® for TD.†

This card is a good choice for individuals who are looking to quickly accumulate TD Rewards Points and who can make use of the $100 accommodations/vacation credit.

Click on the credit card names above to access our in-depth guides for the up-to-date offers and enrollment information for the three TD Rewards credit cards.

Low-Rate Credit Cards

TD offers one low-rate credit card in the TD Low Rate Visa* Card.

This card is a good choice for someone who often needs to carry a balance on their card and would benefit from the lower annual interest rate of 12.90%.

This card also often offers promotional interest rates for a set number of months, allowing new cardholders to make bigger or unexpected purchases without incurring as much interest.

TD Banking App

TD has an app available for both Apple iOS and Android.

Within the app, clients can access their chequing, savings, credit, and investment accounts. They can move money between these accounts, pay bills, and deposit cheques (by taking a photo of the cheque).

Clients can also send and request money within Canada via Interac e-transfer or to 200+ countries using TD Global Transfer.

Within the app, clients can also keep their debit and credit cards secure with the ability to lock a card if it is misplaced, lost, or stolen. They can then easily unlock the card in the app once it has been found.

If you’re new to the app, TD also provides some very helpful tutorials on their website to help you learn all about the different features.

Conclusion

TD is the second largest bank in Canada, with over 1,000 branches across the country.

TD offers a range of bank accounts, credit cards, and additional products designed to suit a myriad of different client types.

Whether you’re a student, a newcomer to Canada, or someone perusing new banking options, TD’s diversity of offerings are certainly worth exploring.

Frequently Asked Questions

What do I need to open a TD bank account?

To open a TD bank account, you’ll need your personal information including full name, birthdate address, phone number, and email address.

Additionally, you’ll need to provide two valid forms of identification, and if the bank account you plan to open will earn interest, you’ll also need to provide your Social Insurance Number for tax reporting purposes.

Valid forms of identification can include a Canadian driver’s license, health card, or passport, Canadian birth certificate, Old Age Security card, Certificate of Indian Status, citizenship certificate, permanent resident card, and more.

You can learn more about the ID requirements from the Financial Consumer Agency of Canada’s website. (https://www.canada.ca/en/financial-consumer-agency/services/banking/opening-bank-account.html)

What do I need to open a TD credit card?

To open a TD credit card, you’ll need your personal information including full name, birthdate, address, phone number, and email address.

Different credit cards will have different requirements, and for some credit cards you will be required to provide additional financial information such as your employment status (past and present) and your income.

How do I contact/access TD?

There are multiple ways to contact/access TD in Canada.

Information about TD and their personal banking products and services can be found on the TD website.

If you are already a TD client with either a personal bank account or personal credit card, you can sign in to your account on your computer and use the EasyWeb Messaging feature on the website to message with a live agent between the hours of 9am and 11pm Eastern Time Monday to Friday and between 10am and 7pm Eastern Time on Saturday and Sunday.

Alternatively, you can sign in on the TD App and select Contact Us from the menu, followed by Call Us. This will connect you with a live phone agent during business hours as long as you’re physically in Canada.

You can also reach out by telephone:

- For bank accounts, you can call 1-866-222-3456 (English) and 1-800-895-4463 (French)

- For credit cards, you can call 1-800-983-8472 (options for French and English), 1-877-233-5558 (Cantonese), and 1-877-233-5844 (Mandarin)

If you’d prefer to speak to someone in person, you can walk in to your local TD branch, or you can first make an appointment online.

Seems like you touched on most of the topics.

…but you didn’t mention TD Infinite Cashback card which is one of 3 cards in Canada with Road Side Assist for user included regardless of the car you are driving. Also, the ability to link a TD Canada CAD or USD account in Canada to a TD USA USD account in the USA with almost instant transfers between Canada & USA.

Want reason the TD Aeroplan business cards are never discussed on PoT? While maybe not the most impressive, it allows for the collection of SQS/SQM at $5,000 spends like the premium cards which is a pretty huge advantage for some (nice Visa companion to go along with a premium AMEX).

Ron, you are spot on! Not many people know that the 2 core Aeroplan Business cards from TD & CIBC actually earn 1,000 SQM + 1 SQS per $5,000 spent and not $10,000 like the personal version of the core cards.

Why don’t you advise any person applying for TD or other banks credit cards to read the legal. TD, CIBC and Westjet have one and your done clauses for Aeroplan points.

Ok?? lol