The HSBC World Elite Mastercard has long been a strong contender for one of Canada’s overall best credit cards. Whether it’s earning versatile HSBC Rewards points, saving money abroad with no foreign transaction fees, or offsetting costs with the annual $100 travel enhancement credit, there are many reasons why Canadians have opted to keep this card open year after year.

To further sweeten the deal, the HSBC World Elite Mastercard often comes with a competitive welcome bonus and an annual fee rebate for the first year. When combined together, you can easily score a first-year value of over $700 without paying a dime.

With this in mind, here are 10 reasons why the HSBC World Elite Mastercard deserves a permanent spot in your wallet.

1. 80,000+ HSBC Rewards Welcome Bonus

The HSBC World Elite Mastercard currently is offering up to 80,000 HSBC Rewards points as a welcome bonus for Canadian residents outside of Quebec. Until May 31, 2023, the welcome bonus is broken down as follows:

- 20,000 HSBC Rewards points upon making the first purchase

- 10,000 HSBC Rewards points upon spending $1,000 (CAD) in each of the first six months, up to 60,000 points

There is a separate offer for up to 110,000 HSBC Rewards points for residents of Quebec, also valid until May 31, 2023, which is structured as follows:

- 20,000 HSBC Rewards upon making the first purchase

- 90,000 HSBC Rewards upon keeping your account open and in good standing for the first six months

It’s important to note that the welcome bonus isn’t the only difference between the two separate offers. As we’ll discuss in greater detail below, Canadians outside of Quebec benefit from an annual fee rebate for the first year, whereas Quebecers are subject to the $149 (CAD) annual fee in the first year.

The 30,000 extra points in the Quebec offer essentially make up for having to pay the annual fee, since HSBC Rewards points are worth a minimum of 0.5 cents per point (cpp) when redeemed against travel purchases as a statement credit.

In either situation, you can stand to benefit from a generous welcome bonus without an overly burdensome spending requirement.

Since Mastercard is basically accepted anywhere in Canada and abroad, most households shouldn’t run into too many hurdles for meeting the minimum spending requirement of $1,000 (CAD) each month for six months. This is especially true for anyone who shops at Costco, which only accepts Mastercard credit cards.

As we’ll explore in detail below, HSBC Rewards points are great to have because they can be easily redeemed in many different ways. You have the option of transferring your points to British Airways Avios, Singapore Airlines KrisFlyer, or Cathay Pacific Asia Miles, or you can simply redeem them against any travel purchase at a rate of 200 points = $1 (CAD), or 0.5 cents per point.

This means that at the bare minimum, the welcome bonuses are worth $400 and $550, respectively, using the 0.5 cents per point as a reference. However, when you take the annual fee for Quebec residents into consideration, the value from the welcome bonuses is essentially equal.

2. Annual Fee Rebate

Typically, the HSBC World Elite Mastercard has an annual fee of $149 (CAD). While Quebecers will have to pay the annual fee in the first year as a cardholder, other Canadian residents can benefit from an annual fee rebate in the first year.

This puts the HSBC World Elite Mastercard on a competitive playing field with offers for other World Elite products, such as the National Bank World Elite Mastercard, as well as other credit cards in the same tier, such as the TD Aeroplan Visa Infinite Card or the CIBC Aeroplan Visa Infinite Card.

Without an annual fee to pay in the first year, you get to give the card a test drive and enjoy its many benefits without paying a cent. Even once you’ve maximized the welcome bonus, there are many arguments to be made for paying the annual fee for the second year, especially if you tend to frequently travel outside of the country with its no foreign transaction fees.

Even if you don’t tend to travel out of the country or spend large sums of money abroad, the card’s other perks will likely make up the difference in no time.

It’s worth noting that HSBC Private clients receive a $149 annual fee rebate each year, while HSBC Premier clients receive a $50 rebate and HSBC Advance clients receive a $25 rebate.

3. No Foreign Transaction Fees

Almost all Canadian credit cards impose a hefty 2.5% foreign transaction fee on purchases made in currencies other than the Canadian dollar. Luckily, you won’t encounter this unnecessary added expense with the HSBC World Elite Mastercard.

If you’re someone who tends to travel outside of Canadian very often, or if you perhaps often make purchases in other currencies, this card feature can wind up saving you hundreds of dollars in fees each year.

In fact, if you spend over $6,000 (CAD) abroad over the course of a year, the card would have already paid for itself, since you’d have saved $149 that you would have otherwise paid with a 2.5% foreign transaction fee on a different credit card.

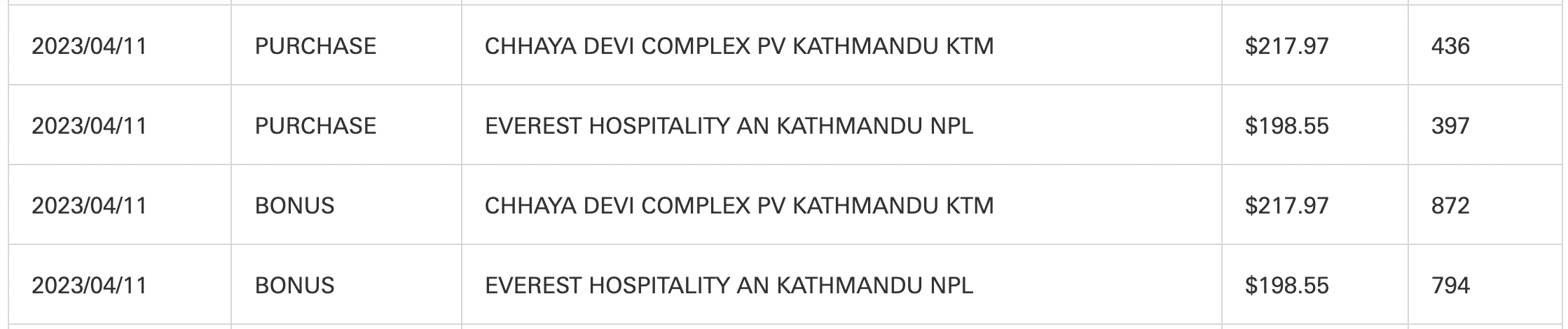

It’s also worth noting that unlike other credit cards, you’ll earn category multipliers on purchases made abroad. For example, you’ll earn the same 6 points per dollar spent on a travel purchase in Canada as you would for a travel purchase in, say, Kathmandu.

With the dynamic duo of saving money on foreign transaction fees and earning points as you would back at home, be sure to sign up for the HSBC World Elite Mastercard before your next big trip abroad.

4. Annual $100 Travel Enhancement Credit

The HSBC World Elite Mastercard is one of many Canadian credit cards that offers an annual credit of some sort. In this case, cardholders are entitled to an annual $100 travel enhancement credit, which can be put towards seat upgrades, baggage fees, airport lounge passes, and more.

While the scope of the credit may be less flexible than those of, say, the American Express Platinum Card or the American Express Gold Rewards Card, your options may not necessarily be limited to the scope of the listed categories.

You won’t be able to redeem your $100 travel enhancement credit for a booking made directly with a hotel; however, bookings made with an online travel agency have been known to appear as eligible purchases.

Furthermore, some HSBC World Elite cardholders have also been able to redeem their credit for award taxes and fees on Aeroplan and British Airways Avios redemptions. You’ll just want to be sure you’ve arranged for other travel insurance coverage for your trip, since you won’t be eligible for award bookings on this card.

Once you’ve made a qualifying purchase, you can easily apply this credit yourself on the HSBC Rewards website. All you need to do is select an eligible expense made within the last 60 days, and then apply the credit against it.

While the credit might not be as versatile or as generous as with other credit cards, if you can make good use of it, it essentially reduces the card’s annual fee from $149 to $49. This puts it well in the realm of reason to have it as a keeper card, and even as a daily driver for when other cards with higher earning rates aren’t accepted.

5. 6, 4, 2 Earning Rate

The HSBC World Elite Mastercard underwent a bit of a makeover in February 2023. One of the main changes that took place was how you earn points with the card.

As is the case with more and more credit cards in today’s market, the HSBC World Elite Mastercard has a tiered earning rate, which is structured as follows:

- Earn 6 HSBC Rewards points per dollar spent on travel

- Earn 4 HSBC Rewards points points per dollar spent on groceries, gas, and drugstores

- Earn 2 HSBC Rewards points per dollar spent on all other purchases

It’s important to understand that while you may be earning 6, 4, or 2 points per dollar spent, you’re essentially getting a minimum 3%, 2%, and 1% return, respectively, with each category.

This is the case since HSBC Rewards points can be redeemed as a statement credit for travel purchases at a rate of 200 points = $1, or 0.5 cents per point. So, at the bare minimum, you can expect to get back 1–3% on every purchase made with the card.

However, we value HSBC Rewards points at 0.8 cents per point, due to the ability to transfer them out to three different airline loyalty programs. If you look at it this way, then you’re getting 4.8, 3.2, or 1.6 cents per point for every dollar spent in each respective category.

Even with the base value of 0.5 cents per point, a minimum 3% return on travel purchases is very competitive rate when pitted against other strong Canadian travel credit cards. And when you add in no foreign transaction fees for purchases made outside of Canada, you’ll find a very strong argument to make this credit card your first choice for payments abroad.

6. Transfer Points to Airline Partners

After earning a tidy sum of HSBC Rewards points, you’ll have many different redemption options at your disposal. One of the more popular ways to redeem HSBC Rewards points is to transfer them to one of three airline loyalty programs.

HSBC Rewards is a unique transferable points currency in Canada. While other loyalty programs, such as RBC Avion or American Express Membership Rewards, also offer access to British Airways Avios and Cathay Pacific Asia Miles, HSBC Rewards is the sole Canadian loyalty program that lets you transfer points directly to Singapore Airlines KrisFlyer.

The transfer ratio to each program is different, and is also a bit unorthodox:

- 25,000 HSBC Rewards = 10,000 British Airways Avios

- 25,000 HSBC Rewards = 9,000 Singapore Airlines KrisFlyer miles

- 25,000 HSBC Rewards = 8,000 Cathay Pacific Asia Miles

To complicate matters a bit more, you must redeem at least 25,000 HSBC Rewards points to begin with, and then you can only transfer points in further increments of 10,000 points.

Despite the notable differences from other programs, one of the most intriguing uses of HSBC Rewards points is to transfer them to Singapore Airlines KrisFlyer and redeem them for one of the most aspirational aviation experiences out there: Singapore Airlines Suites Class.

If you can manage to score award space on any route that features the Airbus A380, you’ll be rewarded with exceptional dining, a seat that pivots, and an actual bed in your own private suite. To make it even better, if you can snag two seats on the same flight, you’ll be treated to a double-bed in the sky, which is surely a memorable experience.

From time to time, HSBC also offers a transfer bonus to the airline programs, usually in realm of 30%. If you manage to time your redemption accordingly, you’ll be squeezing even more value out of your points.

7. Offset Travel Purchases with Points

While transferring HSBC Rewards points earned on your HSBC World Elite Mastercard to airlines can be a great way to maximize their value, a much easier method is to simply redeem them against travel purchases at a value of 200 points = $1 (CAD), or 0.5 cents per point.

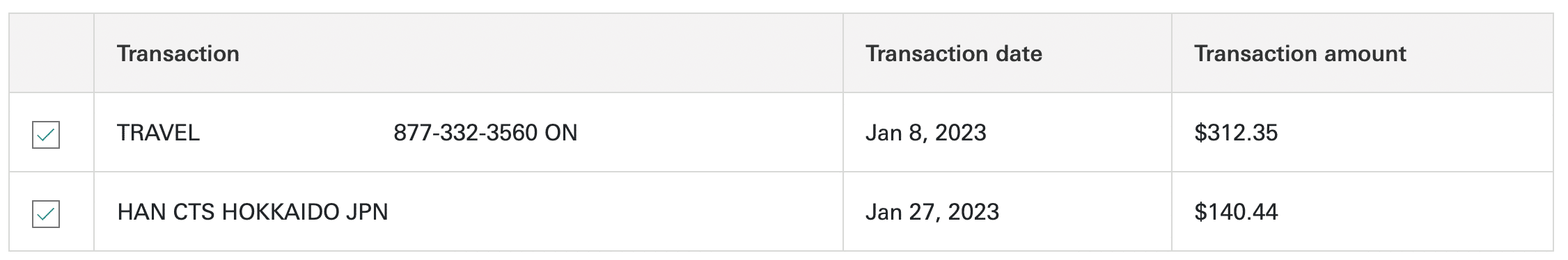

You can book any travel of any kind, including flights, independent hotels, trains, short-term rentals, cars, cruises, vacation packages, and others, with any provider and offset the cost using HSBC Rewards points within 90 days of the purchase posting to your account.

Many similar fixed-value currencies require you to book travel through a dedicated portal, which usually limits the scope of travel purchases you can make. However, that’s not the case with points earned from your HSBC World Elite Mastercard, and since you can book directly with travel providers, your purchase will count towards earning or leveraging perks from your elite status.

When it comes time to redeem, simply select an eligible purchase from your account and select the amount of points you’d like to use to offset the expense. You’ll be able to redeem points either against the full amount or a partial amount, which is convenient if you don’t have enough to cover an entire purchase.

Using HSBC Rewards points this way is great for reducing the cost of travel-related expenses that are otherwise difficult to redeem points for. When used in conjunction with a different points currency that can cover the bulk of the cost of award flight bookings or hotel stays, redeeming your points for a statement credit can go a long way to reducing the cost of travel.

It’s worth noting that you can also redeem HSBC Rewards points in other ways, such as for gift cards; however, you’ll be getting subpar value.

8. Strong Insurance Coverage

Another reason to apply for the HSBC World Elite Mastercard is its recently revamped insurance coverage.

For emergency medical insurance, you’ll be covered for up to $2 million in claims for trips up to 31 days, or 21 days for cardholders 65 years or older. This is particularly valuable for anyone over 65, as they’re often underserved by or excluded from insurance provided through a credit card.

If your baggage happens to be delayed by six hours or longer during your travels, you can claim up to $200 (CAD) to purchase clothing and toiletries.

Similarly, if your flight is delayed for over six hours, you’re covered for up to $250 (CAD) per day, up to a maximum of $500 (CAD), for meals, toiletries, and other essentials.

As for everyday purchases, cardholders also enjoy mobile device insurance up to $1,000 (CAD), which covers loss, theft, mechanical failure, or accidental damage such as drops, cracks, or spills.

Lastly, with the HSBC World Elite Mastercard, you’ll enjoy price protection coverage, which is relatively rare in the Canadian credit card scene. With this, you’re able to claim up to a $500 (CAD) difference between the price you paid and a lower advertised price if the price drops within 60 days of your purchase, up to $1,000 (CAD) per calendar year.

9. No Supplementary Card Fees

The HSBC World Elite Mastercard doesn’t charge a fee to add a supplementary card to your account. In fact, you can add up to four supplementary cards to your account without any additional costs, which can be a great way to streamline earning as a household or as a family unit.

Having multiple authorized users can be beneficial in a number of ways.

For example, the amounts spent across all cards will count towards the minimum spending requirement. So, if you tend to have fewer expenses, having charges from other family members can help to ease the burden of the spending to maximize the welcome bonus.

Furthermore, you can add an authorized user who can then save money when using the card overseas, earning you points in the process.

Most other credit cards charge extra for additional users, which makes the HSBC World Elite Mastercard one of the few that doesn’t.

10. 12 Free Boingo Wi-Fi Sessions

Lastly, as a World Elite Mastercard, you’ll enjoy 12 complimentary Boingo Wi-Fi sessions each year on flights that feature the service. There’s no limit as to how many sessions you use at over one million hotspots worldwide, which can be useful if you’re in need of some Wi-Fi and come across a connection.

Paying for this benefit would usually cost $14.99 (USD) per month, so if you’re someone who likes to be connected while you’re traversing the skies, the value can easily add up over the course of a year.

Enrolling is easy, and you just need to enter in your HSBC World Elite Mastercard number on the Boingo website to get started.

Conclusion

The HSBC World Elite Mastercard is one of Canada’s best Mastercard products. With a consistently strong welcome bonus, an annual fee rebate for Canadians outside of Quebec, and no foreign transaction fees, this card is a must-have for any Canadian frequent traveller.

There’s also a strong argument to be made for keeping this card around year after year, with its annual $100 travel enhancement credit, its generous earning rate on travel, and its valuable HSBC Rewards points. When used in conjunction with other credit cards, it’s an excellent addition to your travel card portfolio.

Be sure to apply for the HSBC World Elite Mastercard before May 31, 2023, to take advantage of the current offer.

Wants me to go into branch to complete… Not worth the hassle.

HSBC Cards are good with some unique benefits, travel insurance for 65+ is definitely the best. However with HSBC getting merged with RBC, Will these cards get killed and replaced with RBC’s existing cards?

As of now, there’s no indication that anything will change, so you can take advantage of the card’s many great features until we hear otherwise.