Many credit cards let you add an authorized user to your account.

For most people, the thought of giving someone else the power to spend your credit is downright terrifying; however, there are other reasons to add an authorized user, such as elevated rewards and travel perks.

Different banks use different terminology. You’ll see phrases like authorized user, additional cardholder, supplementary card, or secondary card, but these all refer to the same thing.

How Do Authorized User Cards Work?

A supplementary card generally has a different name and number on it, but is linked to the primary credit account.

It’s important to distinguish between the account and the cards: the account refers the primary cardholder plus any authorized users, whereas the cards refer to each cardholder individually.

Generally speaking, rewards and credit obligations are tied to the account, while benefits and access to information are tied to the cards.

Are authorized users the same as a joint account?

No. By adding an additional cardholder, you’re creating a card in someone else’s name on the same credit account. You’re authorizing them to make purchases on your account.

The primary cardholder is still responsible for paying all charges on the account. Even if a separate statement is issued showing only the secondary card’s transactions, the primary cardholder is ultimately liable for any purchases made on the account, including the authorized users’.

How are the cardholders’ credit reports affected?

In Canada, an authorized user’s credit report isn’t affected at all. The bank won’t do a credit inquiry to verify the secondary cardholder’s identity or creditworthiness. (There’s no additional inquiry for the primary cardholder either, if you add a card to an account that’s already open.)

Also, the card won’t appear on their credit report as a new account or impact their utilization. Instead, the total utilization, including spending by all authorized users, only affects the primary cardholder’s credit file.

Therefore, you can’t add an authorized user to help them build or rebuild their credit history. They need to be the primary cardholder to do this.

Basically, authorized users are nothing more than a name embossed on an extra piece of plastic (or metal). You could get one for literally anyone, and it’s smooth sailing as long as you pay the full balance.

Who can see transactions on the account?

As the primary cardholder, you’ll see all of the authorized users’ purchases on your own online profile, and on your account statement. Many banks also issue separate statements for authorized users and grant them online access, but they can only see their own transactions.

The separation of transactions may be useful for anyone who wants to track expenses individually for purchases on the same account, such as families or small business owners.

How do authorized users earn and redeem rewards?

Authorized users earn rewards on spending at the same rates as the primary card.

Rewards are earned on the account, not on each individual card. They’re pooled under the primary cardholder, and for co-branded cards, they’ll be transferred to the account holder’s linked loyalty program.

Do additional cards have a welcome bonus?

Not a big one. Some cards give you a token amount of extra points for adding an additional cardholder, but there’s no minimum spend requirement or large bonus to achieve for the secondary card.

As with regular rewards on spending, welcome bonuses are tied to the account, not the cards. Unless otherwise specified, purchases on all cards will count towards the minimum spend requirement for a welcome bonus.

For example, $2,000 spent on the primary card plus $1,000 spent on a secondary card would satisfy a welcome bonus with a $3,000 threshold.

Do authorized users get cardholder benefits?

It depends. Most products offer partial benefits to additional cardholders, but the extent of these perks varies.

For example, American Express Platinum Card supplementary cardholders get lounge access:

However, Scotiabank Passport Visa Infinite supplementary cardholders do not get lounge access, even though primary cardholders do:

Many cards also extend their travel insurance policies to additional cardholders. As always, the fine print for insurance can be quite granular, and it’s not something you want to get wrong.

Before adding an authorized user with the expectation that they’d reap this or any other benefit, definitely confirm their eligibility first to avoid disappointment or no coverage.

How much do authorized user cards cost?

Some authorized user cards have an annual fee, which is in addition to the primary cardholder’s annual fee. As with the primary card, fees are often higher for premium products, up to $200.

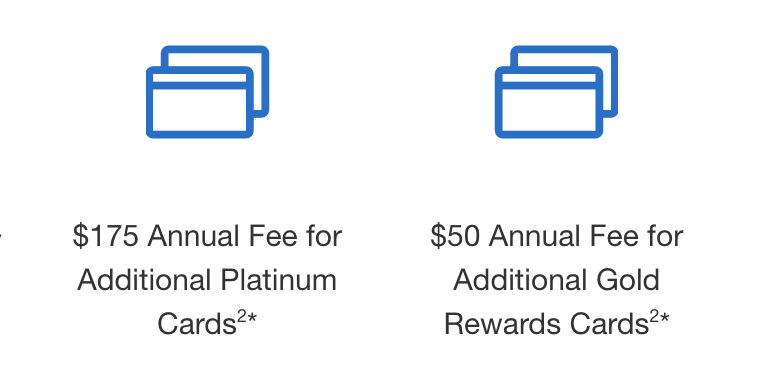

Some products provide one supplementary card for free, but charge a fee for any additional cards thereafter, such as the American Express Gold Rewards Card:

Many compelling credit card offers waive the primary annual fee for the first year. Sometimes, this discount also extends to a supplementary cardholder, as we’ve seen with many CIBC offers in the recent past:

Furthermore, if you have a credit card annual fee waiver from a premium banking package, some banks also waive the fee on one or more authorized user cards.

Strategies for Supplementary Cardholders

For most products, there aren’t a lot of award or travel advantages to adding an additional cardholder. The intended purpose is to create a pseudo-joint account with a spouse, and even that is less useful with the rise of mobile payments, where you don’t actually need two physical cards.

If allowing additional spenders is more important to you than points or perks, consider cards like the American Express Cobalt Card or the Marriott Bonvoy American Express Card, which have no annual fee for up to nine authorized users.

For others, there are a few specific products and situations where adding another card has a distinct benefit.

BMO eclipse Visa Cards

As an ongoing benefit, BMO is offering increased rewards on spending if you add an authorized user to your account. The bonus applies to purchases made on the primary card or any additional cards.

Ordinarily, the cards already have high earn rates on many popular categories:

- The BMO eclipse Visa Infinite Card earns 5 BMO Rewards points per dollar spent on groceries, restaurants, gas, and transit

- The BMO eclipse Visa Infinite Privilege Card earns 5 BMO Rewards points per dollar spent on groceries, restaurants, gas, drugstores, and travel

With the authorized user bonus, the Visa Infinite card gives 10% more points, earning 5.5 points per dollar spent on bonus categories. Considering the 0.67 cents per point valuation of BMO Rewards points, that’s equivalent to a net return of 3.69%.

Likewise, the Visa Infinite Privilege card gives 25% more points, earning 6.25 points per dollar spent on bonus categories, for a net return of 4.19%.

The annual fees for an authorized user are $50 and $99, respectively. They cannot be reduced with a First Year Free offer or with premium banking.

Even so, it’s worth it if your annual spend is high enough. To break even, you’d have to spend $15,000 per year on the Visa Infinite card, or $12,000 per year on the Visa Infinite Privilege card. Any purchases beyond those amounts will increase the net value you get from using the card.

Aeroplan Credit Cards

On the suite of co-branded credit cards, Air Canada has enhanced the way Aeroplan benefits are integrated for credit card members.

Secondary cardholders enjoy many of the same perks as their parent card. For core and premium cards, they get one free checked bag for themselves and up to eight companions on Air Canada flights. The authorized user doesn’t need to be travelling with the primary cardholder.

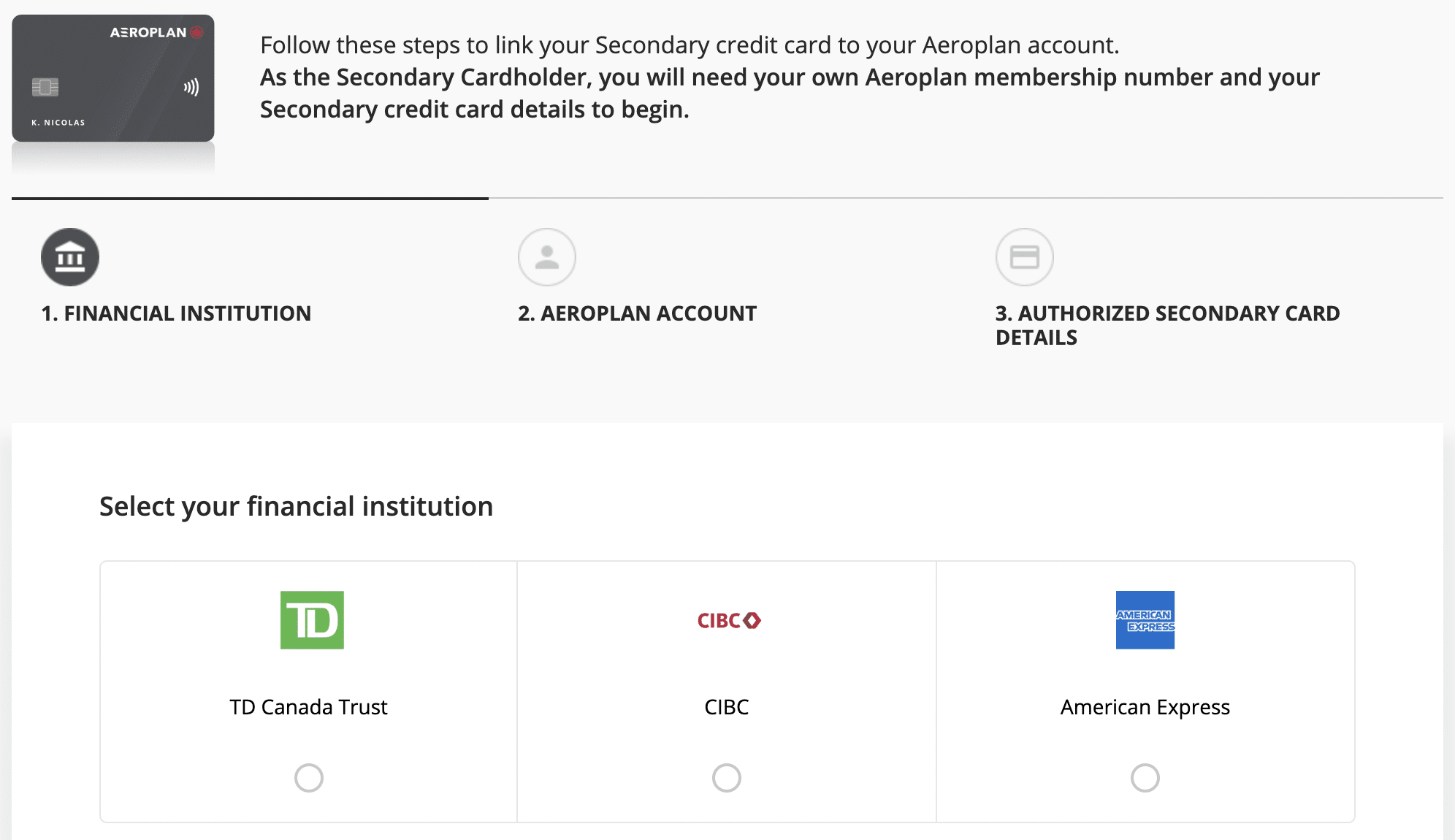

You can link a secondary card to the cardholder’s Aeroplan account on Air Canada’s website.

In particular, the core Aeroplan cards are a great way to treat family and friends to these Aeroplan perks. TD and CIBC’s cards have a few ways to eliminate the annual fee for authorized users:

- The TD Aeroplan Visa Infinite Card waives the first year annual fee for up to three authorized users as part of the welcome bonus, or in perpetuity with TD All-Inclusive Banking. The regular fee is $75 per card.

- The CIBC Aeroplan Visa Infinite Card waives the first year annual fee for up to three authorized users as part of the welcome bonus, or in perpetuity with the CIBC Smart Plus Account. The regular fee is $50 per card.

Furthermore, the TD Aeroplan cards give a NEXUS rebate to up to four cardholders on the same primary account.

The premium cards also offer these benefits for authorized users, but with higher fees.

Airport Lounges

Many premium credit cards provide free memberships or passes to airport lounges. Some of these cards extend this perk to supplementary cards:

- American Express Platinum Card: Global Lounge Collection + guests, depending on the lounge ($175 annual fee)

- BMO eclipse Visa Infinite Privilege Card: DragonPass membership + six visits ($99 annual fee)

- CIBC Aeroplan Visa Infinite Privilege Card: DragonPass membership + six visits; Maple Leaf Lounge + one guest ($149 annual fee)

- TD Aeroplan Visa Infinite Privilege Card: DragonPass membership + six visits; Maple Leaf Lounge + one guest ($199 annual fee)

American Express Cards

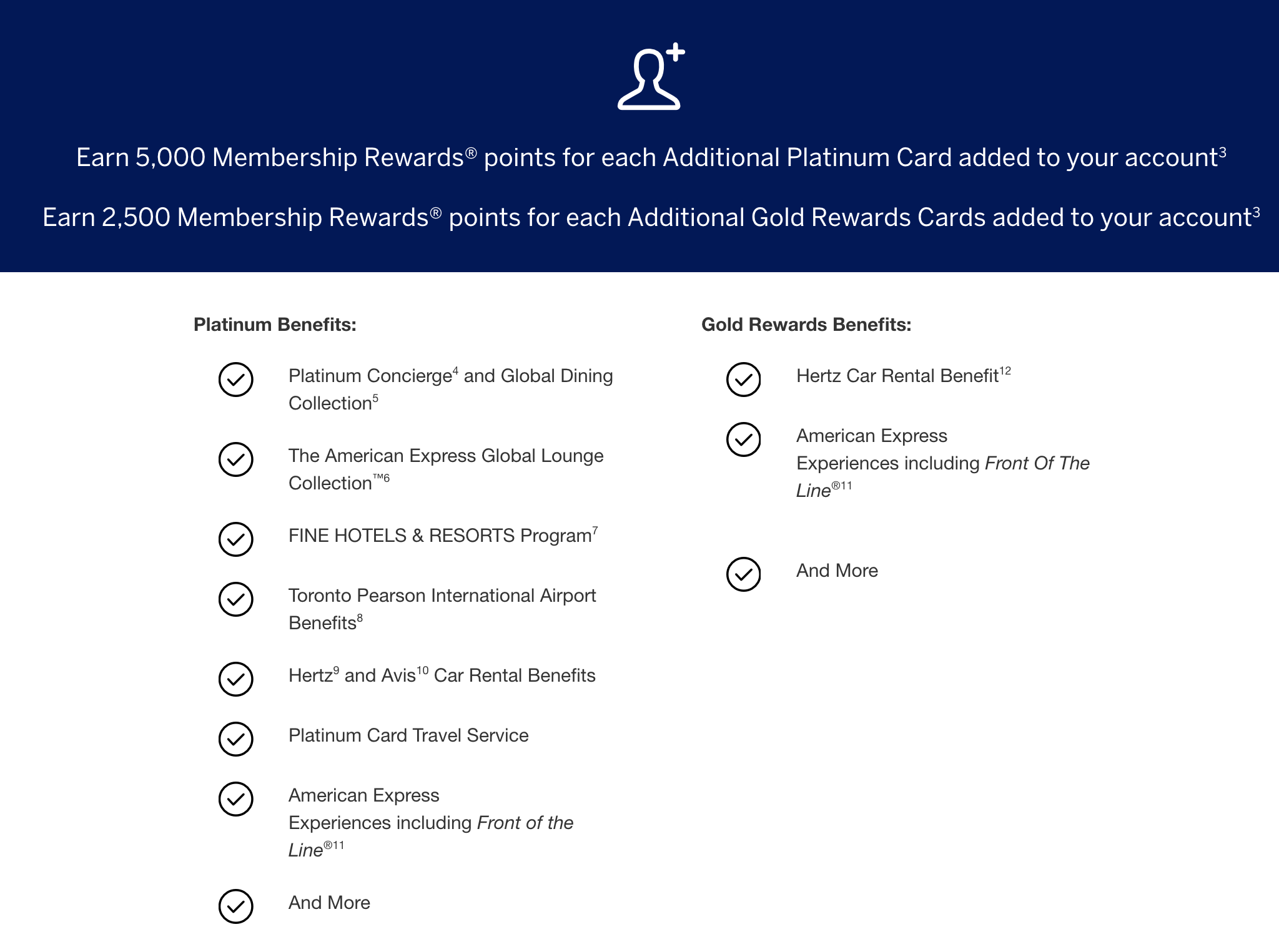

American Express cards are known for high-value welcome bonuses. Many of these offers can be increased by adding a supplementary cardholder, which is clearly displayed at the time of application when it’s available.

Amex also has a peculiar structure where you can add additional cards that aren’t the same product as the primary card. This would be useful if you want someone else to have access to a premium account’s spending power, but without paying the high fees for premium perks on the secondary card.

For instance, you can add a supplementary Gold card to a Platinum account. The card earns at Platinum rates but only provides Gold perks – so no unlimited lounge access, but a much lower annual fee.

You’ll earn 5,000 Membership Rewards points for each additional Platinum card, or 2,500 points for each additional Gold card on a Platinum account. At $50 per secondary Gold card, you can effectively buy MR points at 2 cents per point, even if you have no need for an authorized user.

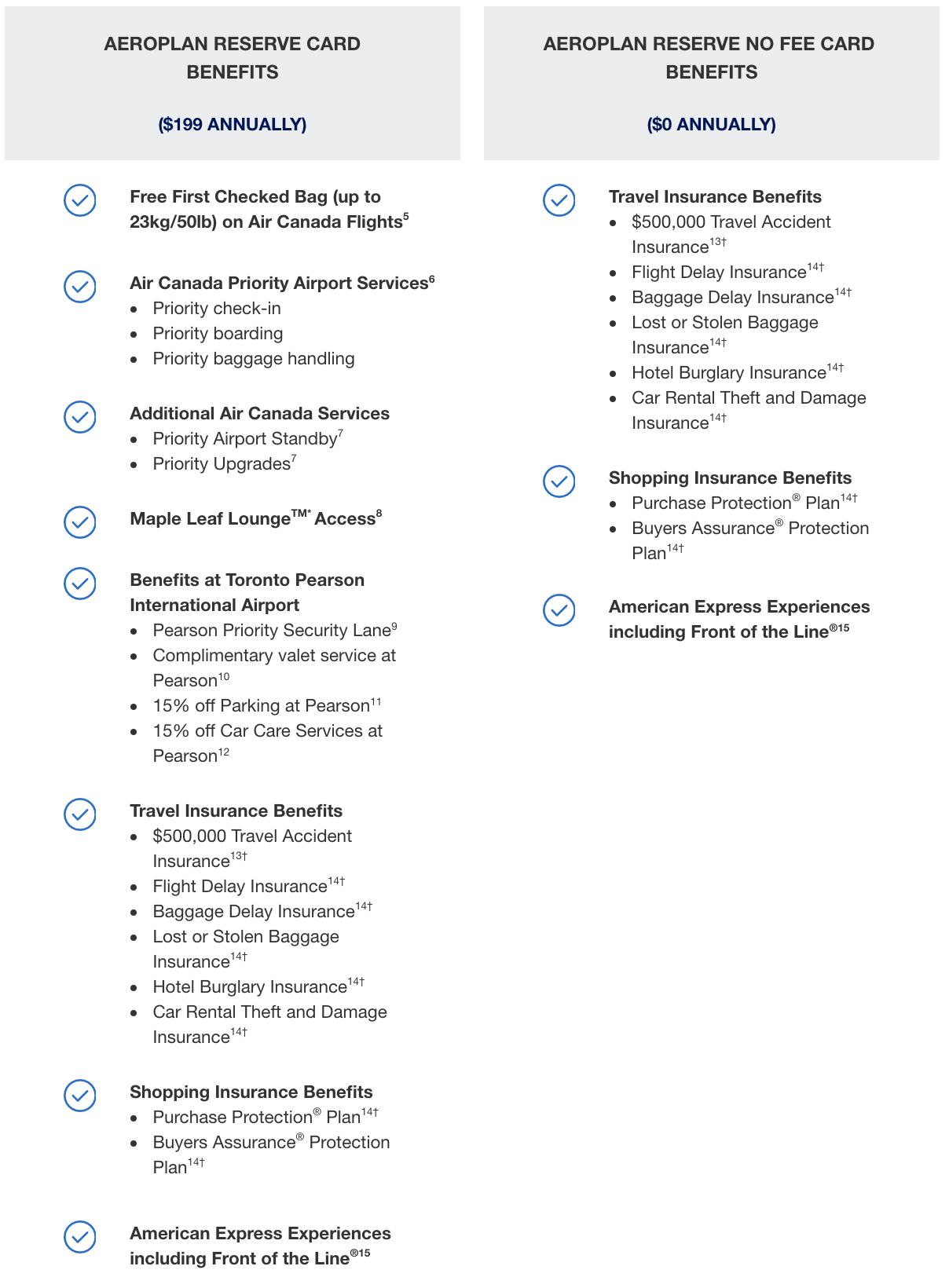

You can do the same with the American Express Aeroplan Reserve Card. Amex offers two types of supplementary cards:

- The full Additional Aeroplan Reserve Card provides the same comprehensive Aeroplan benefits as the primary card, such as free checked bags, Maple Leaf Lounge access, and priority boarding, with an annual fee of $199.

- The Additional Aeroplan Reserve No Fee Card only provides some benefits, like insurance and Front of the Line event tickets. These more closely resemble card issuer perks from Amex, rather than loyalty program perks from Aeroplan. This card is uniquely available as a secondary card on a primary Aeroplan Reserve account, and not as a primary card itself.

Building US Credit History

As mentioned above, Canadian supplementary cards have absolutely no impact on the secondary cardholder’s credit report.

In the US, supplementary cards share many features with their parent account, like pooled rewards and the total credit limit.

Unlike their Canadian counterparts, these cards do report to the secondary cardholder’s credit file. In most cases, the information reported, like utilization, age of account, and history of repayment, is the same for all cardholders on the account.

This means that you can add an authorized user to help them build their credit history.

For Canadians looking to get your first US cards, see if you can be added as an authorized user on someone else’s old account. By backdating your credit history with an existing healthy file, you’ll look more attractive to prospective lenders when you apply for your own cards.

Technically, secondary cards do count against Chase’s “5/24 rule”, although there is some flexibility if you explain that you’re not the primary cardholder. Even though this strategy can kickstart a straggling US credit journey, it could still be an unnecessary complication if you hope to apply for many cards quickly.

Conclusion

Authorized user cards can offer quite a few appealing benefits, even for single spenders with no need for a joint account. I’d begin by looking for any ways you can earn bonus points by adding supplementary cards to your existing accounts or upcoming applications, ideally for free.

If you have friends or family whom you trust with the authorization to spend on your account, but who haven’t begun collecting points yet themselves, cards with airport lounge access or free checked bags are a fun way to lure them in with a taste of what they’re missing!

Re: secondary card holders – my wife just received her CIBC Aeroplan Visa Infinite, and has asked for a secondary card for me. When it arrives, can I link my own existing Aeroplan number to the card, or does it need to be connected to her Aeroplan number to receive any credit card perks or Aeroplan flight discounts?

Can you refund the additional cardholder fee within 30 days if you no longer wish to keep the card?

You mention “TravelZoo’s generous offer on the American Express Platinum Card in 2019, which gave First Year Free on a supplementary Platinum Card.”

It’s in fact an indefinitely free supplementary card. Only 699$ was charged at renewal.

Even better! Hope we see an offer like that again soon.

very informative post! just curious, can someone who is a supplementary card holder on a particular card also apply for the same card on their own?

Of course! Supplementary cards don’t count as “opening a new account” for the secondary cardholder, neither for their credit report nor for the bank.