American Express has been known for offering the best credit card signup bonuses in Canada for many years.

Today’s breaking news is no exception, as they’ve unleashed some unfathomable offers on the Platinum Card, the personal Marriott Bonvoy Card, and the Marriott Bonvoy Business Card.

Not to be outdone, the Aeroplan Reserve Card, the Aeroplan Business Reserve Card, and the Aeroplan Card have also set a new high-water mark, obliterating the old offers by an order of magnitude while also providing juicy bonuses for existing cardholders.

These offers are all available if you apply before August 3, 2021. Without further ado, I’ll let the numbers speak for themselves.

In This Post

- Amex Aeroplan Reserve: 150,000 Aeroplan Points!

- Amex Aeroplan Business Reserve: 150,000 Aeroplan Points!

- Amex Aeroplan Card: 75,000 Aeroplan Points!

- Refer-a-Friend: Double Bonuses for the Referrer

- Spend-Based Offers for Existing Cardholders

- Everyday Status Qualification: Instantly Reach Aeroplan 25K

- Conclusion

Amex Aeroplan Reserve: 150,000 Aeroplan Points!

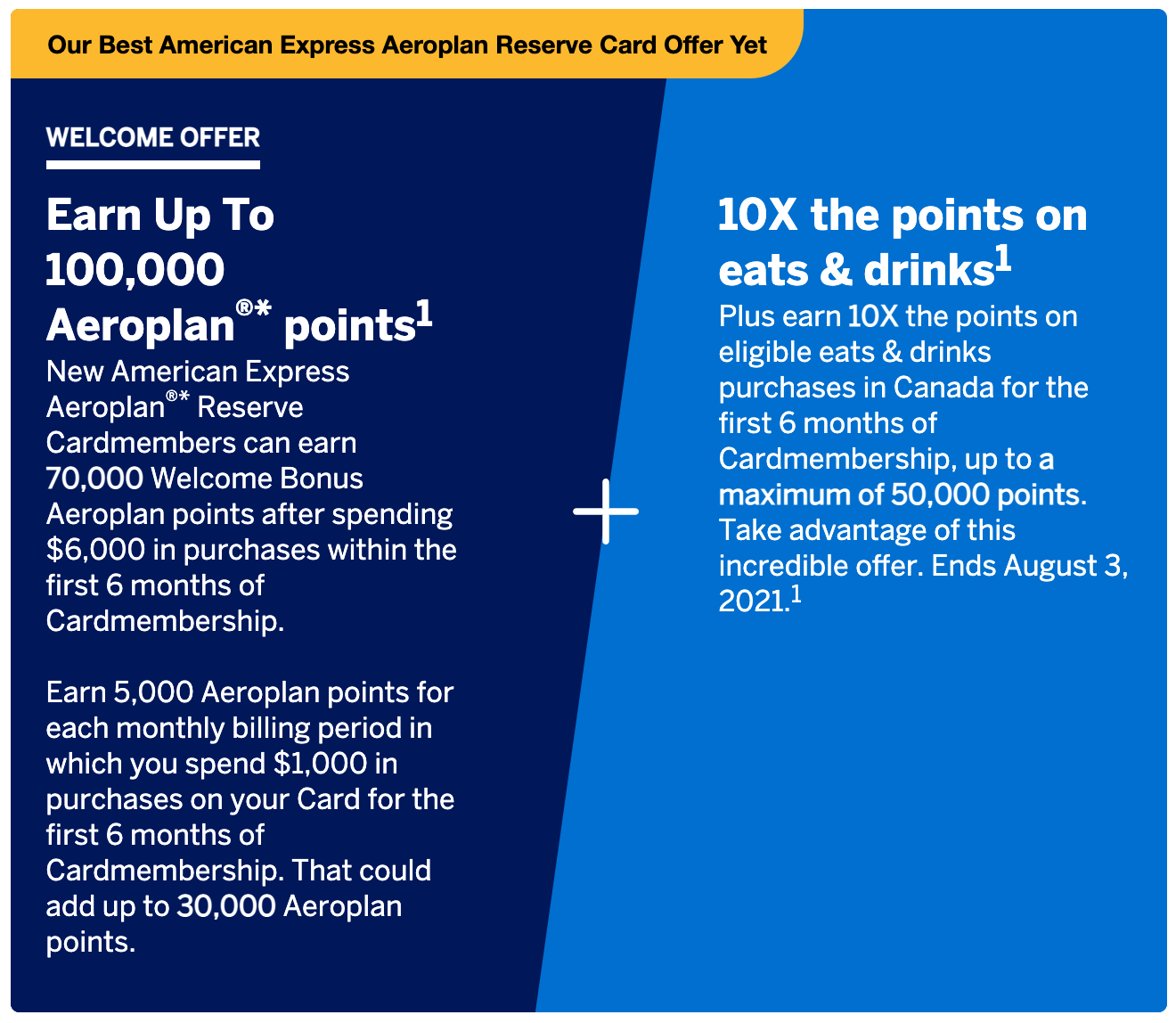

The American Express Aeroplan Reserve Card, Amex’s flagship premium Aeroplan product, is boasting an offer of a whopping 150,000 Aeroplan points, broken down into a few separate parts:

- 70,000 Aeroplan points upon spending $6,000 in the first six months

- 5,000 Aeroplan points for each of the first six months in which you spend $1,000, for a total of 30,000 Aeroplan points

- 10x Aeroplan points on eats and drinks in Canada in the first six months, up to a maximum of 50,000 Aeroplan points (on $5,000 of spending)

“Eats and drinks” follows the “standard” Amex definition, including grocery stores, food-primary restaurants and cafes, liquor-primary bars, and food delivery services. Basically, if it earns 5x points on the Cobalt Card, it will earn 10x points on the personal Aeroplan Reserve Card with this promotion.

On the surface, it looks a bit tricky to hit all the requirements, but they’re actually incredibly easy to meet. That’s because every dollar you spend can count towards more than one part of the bonus.

So, rather than immediately spending $6,000 to earn 70,000 points, plus $1,000 each month for six months, plus $5,000 to maximize the eats and drinks, you could strategically spread out your spending. If you spend $1,000 per month on eats and drinks, you’d tick all three boxes without having to do any additional spending (although we do recommend over-spending the requirement just in case you miscalculate or have a return).

Even without the dining and grocery bonus, you could still hit 100,000 Aeroplan points on other expenses, which alone would exceed the card’s previous all-time-high signup bonus.

Also, note that the 10x earn rate replaces the base earn rate. You won’t get the regular 2x Aeroplan points on dining in addition to the promotional bonus, but it’s a drop in the bucket compared to this spectacular offer.

All in all, $6,000 spent over six months is a very doable task to earn 150,000 Aeroplan points, and it’s within reach even for low spenders. At $1,000 spent per month, that might bring this enormous points bonus within reach for those of you who are more frugal with your regular spending habits.

The annual fee of $599 is a steep but worthwhile expense for the privilege of 150,000 Aeroplan points. At our current valuation of 2.1 cents per point, you can expect to get out at least five times the value you put in, while flexible travellers should have no trouble stretching that number even further.

(Note, however, that the previous $100 first-year statement credit on the Amex Aeroplan Reserve is no longer being offered.)

As always, with a premium Aeroplan credit card, you’ll get priority airport treatment, best-in-class earn rates on daily spending, strong preferred pricing discounts on Aeroplan redemptions, and likely some offers throughout the year to offset your annual fee.

- Earn 60,000 Aeroplan points upon spending $7,500 in the first three months

- Plus, earn an additional 40,000 Aeroplan points upon spending $45,000 in the first year

- And, earn 30,000 Aeroplan points upon making a purchase in months 15–17 as a cardholder

- Always earn 3x Aeroplan points on Air Canada purchases and 2x Aeroplan points on dining and food delivery

- Aeroplan preferred pricing, free first checked bag, priority check-in and boarding on Air Canada flights

- Unlimited Air Canada Maple Leaf Lounge access in North America

- Bonus Aeroplan points for referring family and friends

- No minimum income requirement

- Annual fee: $599

Amex Aeroplan Business Reserve: 150,000 Aeroplan Points!

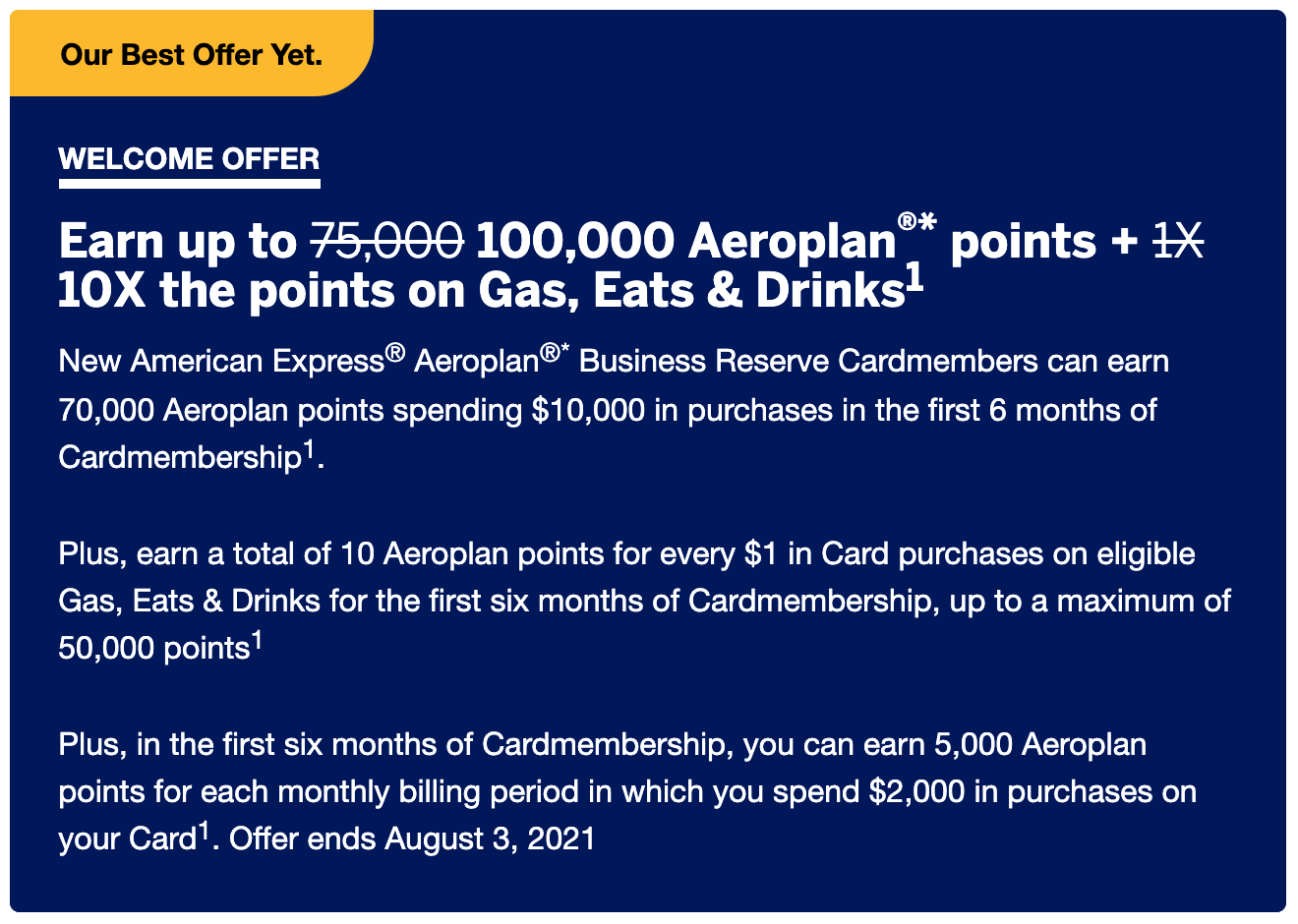

The American Express Aeroplan Business Reserve Card is offering the same number of points, but with higher spending requirements:

- 70,000 Aeroplan points upon spending $10,000 in the first six months

- 5,000 Aeroplan points for each of the first six months in which you spend $2,000, for a total of 30,000 Aeroplan points

- 10x Aeroplan points on gas, eats, and drinks in Canada in the first six months, up to a maximum of 50,000 Aeroplan points (on $5,000 of spending)

This isn’t a huge surprise, as Amex has typically put higher spending requirements on its business products. To hit all of the monthly bonuses, you’d have to spend a total of $12,000, spread out evenly over six months.

In doing so, you’d overshoot the 10x cap by $7,000, earning a minimum of an additional 7,000 Aeroplan points for the trouble.

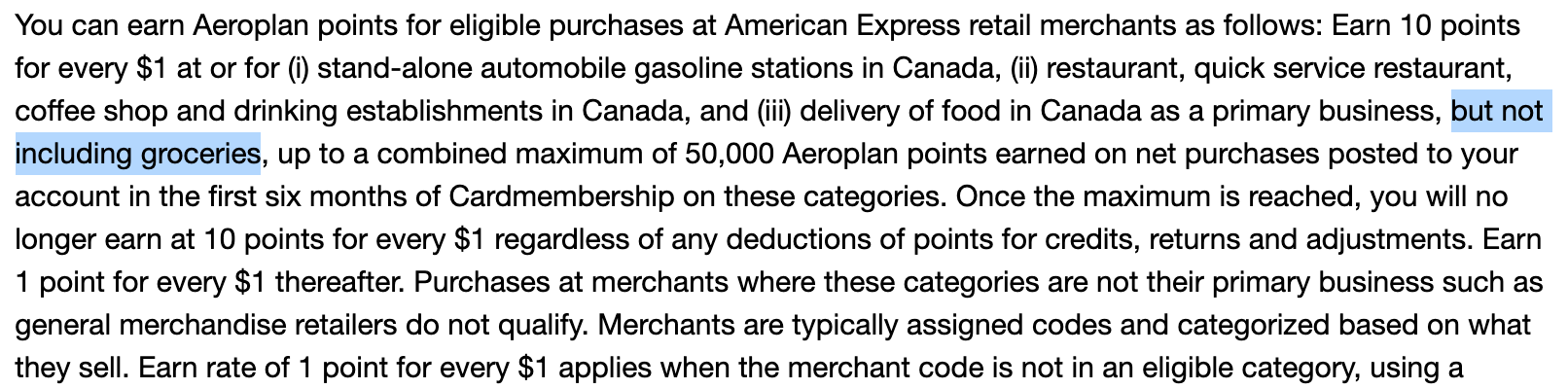

However, and this is a big caveat, “eats and drinks” follows what I’ll call a “substandard” definition. Groceries are excluded on the Aeroplan Business Reserve Card.

This is a big disappointment if you ask me, but not an entirely surprising one. Business products tend to encourage the type of spending that business owners are more likely to incur, such as client lunches and commuting costs.

Fortunately, there’s a silver lining: you can still buy gift cards at many gas stations. That way, you’d still be able to effectively earn 10x Aeroplan points on a wider variety of your purchases.

If you can only get one, the personal Aeroplan Reserve Card is definitely a better choice, although that shouldn’t detract from this very strong offer on the business version.

- Earn 65,000 Aeroplan points upon spending $10,500 in the first three months

- Plus, earn 45,000 Aeroplan points upon spending $75,000 in the first 12 months

- And, earn 30,000 Aeroplan points upon making a purchase in months 15–17

- Also, earn 3x Aeroplan points on Air Canada purchases and 2x Aeroplan points on hotels and car rentals

- Aeroplan preferred pricing, free first checked bag, priority check-in and boarding on Air Canada flights

- Unlimited Air Canada Maple Leaf Lounge access

- Bonus Aeroplan points for referring family and friends

- Qualify for the card as a sole proprietor

- Annual fee: $599

Amex Aeroplan Card: 75,000 Aeroplan Points!

While the premium Aeroplan cards shine brightest, the Amex Aeroplan Card honourably pulls its weight and shouldn’t be overlooked.

The card is offering up to 75,000 Aeroplan points for new applicants. For the core tier of Aeroplan cards, this new benchmark absolutely annihilates its competitors.

Among the core cards, the previous high on the TD Aeroplan Visa Infinite Card or the CIBC Aeroplan Visa Infinite Card was 50,000 Aeroplan points, and that’s assuming you earned and converted the Air Canada Buddy Pass into points.

The new offer on the Amex Aeroplan Card is in the same format as the bonuses on the premium Reserve cards, just with lower numbers across the board:

- 44,000 Aeroplan points upon spending $3,000 in the first six months

- 1,000 Aeroplan points for each of the first six months in which you spend $500, for a total of 6,000 Aeroplan points

- 5x Aeroplan points on eats and drinks in Canada in the first six months, up to a maximum of 25,000 Aeroplan points (on $5,000 of spending)

Note that the Buddy Pass has been removed from the core Amex card’s offer, but with so many points on the table, I can’t say I’ll miss it.

Like with the premium cards, the first two parts of the bonus line up nicely: if you hit all of the monthly spends, you’ll hit the main component by default. That would put you at $3,000 spent, but I’d plan to spend $5,000 over six months at restaurants and grocery stores to maximize the last part of the offer.

The real appeal of this offer is the lower annual fee of $120, making this offer a fantastic choice for anyone whose credit card strategy revolves around keeping annual fees down.

While there’s no first-year annual fee waiver, you’ll be hard-pressed to find 75,000 Aeroplan points for $120 anywhere else. For the holdouts who are determined to pay $0 out of pocket to earn “free” travel, I suspect this will be the offer that gets you to change your tune.

At a cost of 0.16 cents per point, the value proposition is undeniable. Personally, as I’ve already hoarded an enormous balance of points and don’t need the premium offers to pad my stats, I’m strongly tempted to apply for the core Aeroplan Card instead.

Furthermore, the core Aeroplan Card is a charge card. Unlike the Reserve and Business Reserve, which are credit cards, it doesn’t impact Amex’s limit of holding four credit cards per person at a time. If you’re already tight against the cap, you may not be able to get both (or even just one!) of the premium cards.

For that reason, this mid-tier card should appeal to just about anyone looking to add to their travel rewards, no matter what your strategy is or how far you’ve progressed in the Miles & Points game.

- Earn 30,000 Aeroplan points upon spending $3,000 in the first three months

- Plus, earn an additional 10,000 Aeroplan points when you spend $1,000 in month 13

- Always earn 2x Aeroplan points on Air Canada purchases

- Aeroplan preferred pricing, free checked bag on Air Canada flights

- Bonus Aeroplan points for referring family and friends

- Annual fee: $120

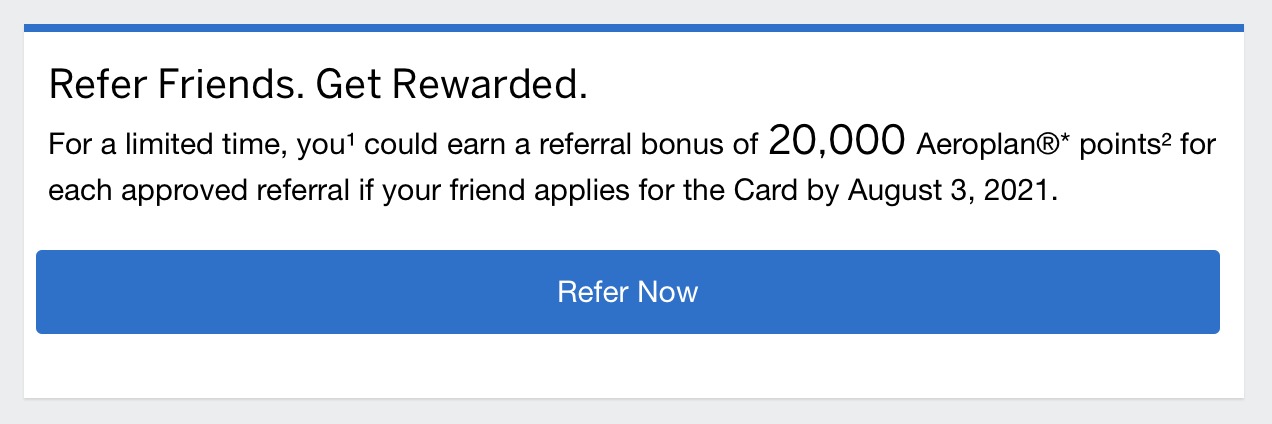

Refer-a-Friend: Double Bonuses for the Referrer

The bonuses for new applicants are the same no matter how you apply, whether through a referral link or via the American Express website directly. Therefore, it’s best to use a referral link to spread the love, as all things are equal for the applicant.

However, the bonus for the referrer has now improved on both personal Aeroplan cards:

- Successful referrals initiated from the Aeroplan Reserve Card will award 20,000 Aeroplan points to the referrer, up from 10,000 points previously

- Successful referrals initiated from the Aeroplan Card will award 10,000 Aeroplan points to the referrer, up from 5,000 points previously

Notably, 20,000 Aeroplan points is equivalent to the referrer’s bonus on the Business Platinum Card, at 20,000 MR Points.

Typically, Amex has kept the best refer-a-friend bonuses exclusive to cardmembers who hold their top-of-the-line business product, but now other premium cardholders will be able to benefit to the same degree.

If you collect points in two-player mode, this is an extra little bonus you won’t want to pass up. Much like the Business Platinum Card, you’ll want to start your sequence with the card that gives the highest bonus for the referrer, in this case the personal Aeroplan Reserve Card.

For example, you could apply for the Aeroplan Reserve Card for 150,000 points, then refer your spouse for their own Aeroplan Reserve Card for an additional 150,000 points for them, plus 20,000 points for yourself.

Next, you could refer each other to the Aeroplan Business Reserve Card. In total, an optimized two-player gambit would net your Family Sharing pool 660,000 Aeroplan points for $2,396 in annual fees across four cards. I’ll leave it to you to figure out just how outlandish a ticket you could fly with that kind of rewards balance!

Oddly, you can refer from the Aeroplan Reserve Card to itself or to the Business Reserve Card, but not to the core Aeroplan Card. That might dampen your earnings a bit if you’d hoped to have your partner open both personal Aeroplan cards, but the elevated referrer’s bonus is a great consolation.

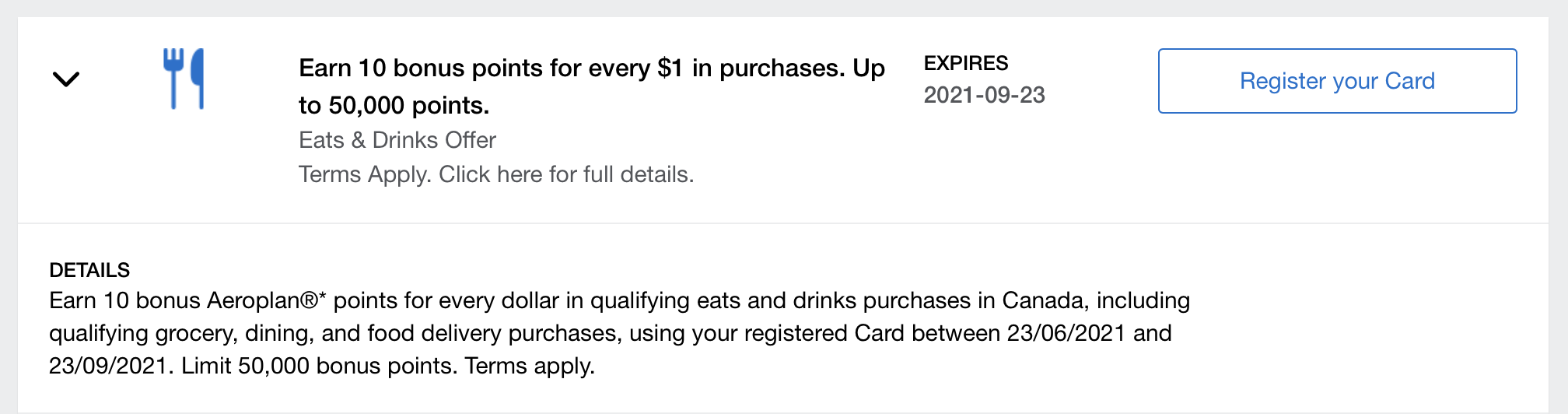

Spend-Based Offers for Existing Cardholders

As with today’s new Platinum and Bonvoy card offers, the spend-based portion of the welcome bonus will also be available to existing cardholders of the two personal Aeroplan cards:

- Amex Aeroplan Reserve Card: Earn 10x Aeroplan points on eats and drinks in Canada until September 23, 2021, up to a maximum of 50,000 Aeroplan points (on $5,000 of spending)

- Amex Aeroplan Card: Earn 5x Aeroplan points on eats and drinks in Canada until September 23, 2021, up to a maximum of 25,000 Aeroplan points (on $5,000 of spending)

That’s fantastic news for those of us who steadfastly kept paying annual fees through a down year, without many opportunities to use our premium credit card benefits.

There are a few key differences compared to the welcome offer. First, you’ll only have until September 23 to maximize the offer. But with a vaccinated two-dose summer of endless patios, I challenge you to rack up $5,000 on eats and drinks in the next three months.

Also, unlike the new cardholder incentive, Amex Offers are cumulative. As an existing cardholder, you’ll earn 10x Aeroplan points on top of the base rate, pushing your total to 11 or 12 points per dollar spent on eats and drinks.

Make sure you’ve activated the 10x eats and drinks bonus in the Amex Offers on your online dashboard before you begin spending. New applicants, however, will receive the boosted earn rate automatically, with no action necessary on their part.

Everyday Status Qualification: Instantly Reach Aeroplan 25K

Here’s an interesting wrinkle: with two premium credit cards, you’ll be able to automatically earn Aeroplan Elite Status in a way that wasn’t previously possible!

With Everyday Status Qualification, you can earn Aeroplan status without flying, through everyday points activities. However, not all points-earning transactions will qualify for status.

In particular, points earned on spending do count, whereas points earned from welcome bonuses don’t count.

Interestingly, while the initial spending bonus and monthly bonuses are treated like welcome bonuses, the 10x points on eats and drinks are treated like regular spending. That means that you can rack up 50,000 everyday-qualifying points on both the Aeroplan Reserve and Aeroplan Business Reserve cards, just for spending $5,000 on each (in the appropriate categories) within six months.

In total, with both cards, you could pay $1,198 in annual fees, achieve the maximum welcome bonuses, and you’d already have 100,000 everyday-qualifying points, enough to reach Aeroplan 25K status without breaking a sweat. I can’t think of a more appealing way to spend your way to status.

As the lowest status tier, Aeroplan 25K won’t dramatically transform your travel experience, and you still can’t spend your way to higher tiers, where the real valuable benefits kick in. Instead, 25K merely guarantees you a baseline level of perks, like preferred pricing on award tickets, 20 eUpgrade credits per year, two Maple Leaf Lounge passes per year, and free checked bags on Air Canada flights.

Still, it’s great to have in your back pocket to maintain a modicum of travel comfort, in case you decide against renewing your co-branded credit cards. Also, this would be a great opportunity for Miles & Points newcomers to jumpstart your way to Aeroplan 25K Status, if you missed out on the plethora of status-earning and extension opportunities last year.

Conclusion

With travel in our sights after far too long, American Express has stunned the Canadian credit card market with the most lucrative incentives we’ve ever seen for new and existing cardmembers alike.

Amex’s new offers today are full of hits upon hits upon hits all around, and I must say I like the Aeroplan offers the most. For a comparable premium annual fee, you can earn the full bonus within six months, without an obligation to pay a subsequent annual fee if you later decide not to keep the card long-term.

On the other hand, the new offers on the Platinum Card and the Marriott Bonvoy cards don’t award the full points bonus until after the second-year fee has been charged. While there’s lots of value to be found in holding both cards year over year, with ongoing offers throughout the year and annual free hotel nights, I’d want to be more certain of my long-term strategy before applying with confidence.

Whether you’ve been eyeing a premium credit card, a new American Express product, or more Aeroplan points, I can’t imagine a better time to apply than right now. I hope you’ve kept an Amex credit card slot open as I have, so you can take advantage of these outrageous offers before they end on August 3, 2021.

On the Amex Business Reserve card, I’m not seeing the 10X bonus on “gas and dining” being posted as EDQ on Aeroplan, which only shows it as bonus points similar to the Welcome Bonus points.

Ricky, is there anyway to confirm the 10X “gas and dining” should be qualified as EDQ’s?

Would make diverse purchases on Amazon count as grocery/ shopping

Hi Dym,

Apologies …

Called customer service stated that the 10X offer does not apply to Personal Reserve card ( recieved this week).for Groceries. Can u clarify how you can go about utilizing the Grocery purchase option.?

I would like to know the same. The Amex website says it does not include groceries for the 10X. I have not had my card long enough to get my first statement but when I check the app I am trying to calculate the points I received and the amount I spent at grocery stores and I seem to be getting the 10X. I want to wait for my first statement to be 100% sure.

Groceries are included, 100%.

Ricky

Are they 100% included for the business version of the AP reserve? It’s been 4 billing cycles and I don’t see the bonus 10X. Called multiple times and Amex says grocery doesn’t qualify for this offer.

I’ve applied for Amex Aeroplan ($120) in July and am part of the 50k+ 10x points food and drink offer. I can see my restaurant bills getting the multiplier bonus, unfortunately my Walmart grocery bills do not show the multiplier at all. I’ve tried online and in store, no bonus.

For the 10x points on food and drink, I just checked those points are categorized as Promotional bonus, not EDQ. Just wondering if you know Aeroplan has confirmed that these food and drink bonus points are counted as EDQ before I call them.

I had the same issue, did you resolve this?

Can I get both the personal Aeroplan Reserve and the personal Aeroplan and still get the bonuses?

Yes you may.

About the every day qualifying points… You can pool these among two different aeroplan accounts to achieve status? Ie in the post it says if P1 and P2 get the reserve and hit the 50k points from spending on 10x categories you’d hit the 100k threshold but each one would be 50k separately.?

The post refers to if a single person were to hit the 50K points on both the Aeroplan Reserve and the Aeroplan Business Reserve. If P1 and P2 were to earn 50K individually, they’d each earn 50,000 points towards Everyday Status Qualification, but they’d each need to earn 50,000 more points to reach 100,000 if they wanted to achieve Aeroplan 25K status.

Ah ok that’s what I was missing! Thanks!

Hi Guys,

Apologies i know its been addressed below but u just called Amex Customer service and they stated the Personal Amex Reserve card does not qualify for Grocery spend 10 X Food and Drink.. Am i misled am i missing something..

Your comment is very unclear… You called Amex or you’re asking us if we did? If you called… Well when did you apply for your card? If you applied before the promo then you needed to register for the promo they offered to existing reserve members.

Hi Dym,

Apologies …

Called customer service stated that the 10X offer does not apply to Personal Reserve card ( recieved this week).for Groceries. Can u clarify how you can go about utilizing the Grocery purchase option.?

If you have the $599 annual fee Amex Aeroplan reserve then you have the 10x promo which includes groceries. Go to a stand alone grocery store and make a purchase or order on instacart and you will see a bonus points post on the app… this customer service rep doesn’t know what’s going on.

Hi Dym,

Apologies …

Called customer service stated that the 10X offer does not apply to Personal Reserve card ( recievwd tbus week).for Groceries. Can u clarify how you can go about utilizing the Grocery purchase option.?

Hi Dym,

Apologies

I called Amex. today as i’ve just

received my personal Amex Reserve card this week. I had inquired with customer service about the 10 X offer on Food and Drinks and they stated that Grocery purchases were not part of the promotional offer.. Can you clarily.?

Since Aeroplan changed last November, and effectively all credit card issuers did a refresh of the product, if I had the Amex AP core card ($120 annual fee) three years ago, would I still qualify for the welcome bonus if I apply for the new Amex AP core card?

To add: for example, I had the AeroplanPlus Gold as of Feb. 2020, can I apply for the “new” Amex Aeroplan Card now and and get the welcome bonus upon meeting the minimum spend and all?

Technically, you wouldn’t be eligible, but given the transition to the new product I wouldn’t be surprised if you ended up getting the bonus.

Hello, does anyone know if Superstore counts as a grocery store? Walmart doesn’t so I’m worried Superstore also would be excluded. Thanks!

Superstore doesn’t accept amex so it doesn’t really matter. If you order through instacart though you can use AMEX and it will code as groceries.

Does reaching 25k via everyday status qualification enable you to reach 35k easier discussed by Ricky here: https://princeoftravel.com/blog/video-aeroplan-extends-elite-status-to-2022-new-airline-partner-offers/

No, you’d still have to spend the full $4,000 SQD on Air Canada flights to reach 35K.

If I already hold the AP reserve, probably smart to apply for the regular AP Amex no?

Dors the SAQ in Quebec count for drinks?

2 Player Mode for us: AP Reserve and Plat for spouse and referral bonuses to me; AP Business Reserve for me and referral bonus to her. With bonus on grocery spend, worth about 400k AP/MR points.

Thanks Josh/Ricky for the heads up on 2 player mode and 4 credit card limits. Will fund Barbados in March and Europe in Summer 2022.

Hi Josh,

For exisitng cardholder who have the 10x points on eats and drinks offer until Sept. 23, will that spend count towards everyday status as well (at 10x) similar to your comments in the article for new card holders? I know it’s a shorter period but might be worth it if it’s counts towards 25K status.

Yes, Aeroplan has confirmed with me that new and existing cardholders will both have the 5x/10x count towards Everyday Status Qualification!

Fantastic, good luck with all that spending at once! 😃

Heads up in case you were counting on it, no grocery bonus on the Business card – noticed yesterday and updated the article.

“In total, an optimized two-player gambit would net your Family Sharing pool 660,000 Aeroplan points for $2,396 in annual fees across four cards” – maybe I am missing something but the current offers end in ~30 days. So you would have to run all (4) cards in parallel for multipliers and MSR, with $32K spend in 6-7 months.

That’s correct – doable in theory but not necessarily in practice. Look for a post next week on realistic card combinations to maximize all of these offers.

I just applied and was accepted last week for the amex aeroplan card but haven’t received it yet.

Would I get the old or the new bonus?

Old bonus unfortunately, but you should be eligible for the “existing cardholder” portion – although you might have to contact Amex, as those offers don’t always show up on new accounts immediately.

Just tried chatting to amex to at least get the 5x food and drink offer for existing card holders. Said he knows nothing about it…

Hi Josh, “the core Aeroplan Card is a charge card” ? so all 3 AMEX Aeroplan card consider charge card? but my AMEX reserve still comes with a fixed credit limit?

The Reserve and Business Reserve are credit cards, not charge cards. Only the core card is a charge card.

I have 2 Amex Reserve cards. The old one is a charge card and the new one a credit card.

I assume you had the old AeroplanPlus Platinum (charge) before the November relaunch, then got a new Aeroplan Reserve (credit) more recently? Funny that they’d issue you a refreshed product with all the new terms, but the terms on which they’ve lent to you are unchanged.

It’s very tempting to get the two aeroplan cards. But….$10,000 in eats and drinks + $5000 for the offer on the platinum is $15,000. In about 2.5 months, or $6000 a month.

That could be done via gift cards at stores on top of ordinary grocery spending, but it seems like it would be obviously suspicious, especially if grocery spending suddenly dropped after.

Think there’s a risk of investigation if someone used all three cards?

Getting both the Reserve and the Platinum would be pretty aggressive, no surprise it would result in high spending requirements- note, though, that you would have six months to do the spending on rate and drinks, not. 2.5. So about 2.5k per month instead of 6k.

Oh! I got mixed up. The eats and drink offer for existing platinum cardmembers is only valid till late sept. (I already have plat?

But you’re right: six months for the other two. I could certainly meet that spending, but that still does seem like a lot of cards. I had been thinking of getting the reserve and the business version.

Reserve *might* be worth keeping for the air canada and airport benefits and the aeroplan discounts. I’m keeping platinum so far because the offers have been so good.

Yeah…I thought I was alone in this thought. High points, but it’s not as easy as they make it seem. Especially for me, with no local grocery stores taking Amex.

These offers are great, but still no match for CSP’s 100k offer.

Any idea if Instacart delivery counts for x10 points?

Groceries shopping @ Walmart counts?

No Groceries at Walmart likely don’t count… Walmart isn’t categorized as a grocery store.

I think it depends on the type of Walmart store. A Super Centre Walmart where half the store is devoted to food counts as grocery even if you buy a bbq. Groceries bought at a standard Walmart get coded as a dept store.

I used my reserve in Walmart and it does trigger 10x. BTW it also triggered the 2x for grocery ( old card offer ), but never for cobalt 5x.

Would be nice to find at least 1 Walmart per major cities that counts as groceries for Amex. I used my Amex reserve in a super center in Ottawa and it didn’t trigger the 10x.

Interesting. I do large scale grocery purchases at Walmart as part of our business. Will be interesting to see if we have the same experience with the AP Reserve. Be nice if it was.

Hello Josh,

‘Eats and Drinks’ mean Dinning, restaurants, take-out? Groceries do not count, right?

Grocery stores do count for this offer!

i don’t think grocery is part of business AP rev. it says pretty clear in the T&C

The old Amex bait and switch! Let’s call it “Eats and Drinks Select” … thanks for pointing this out, apologies for the confusion.

Is this verified that for the AP Biz Reserve card ‘eats and drinks’ do not include grocery stores?

Can someone link me the T&C?

Very odd that the personal AP card and Cobalt include grocery but not the biz card 🙁

A great post again. My only negative concern going forward is: too many easy points are being given away? Suggests to me a big devaluation is on the way. Their business model can’t survive this? Would like others who are smarter than me comment on this? But this is a great deal that even trumps all offers given in the USA

I know the kneejerk reaction is to cry “devaluation” every time there’s good news, but think of it this way: it’s a unique marketing opportunity for banks to onboard new customers on the cusp of a once-in-a-lifetime explosion of the travel industry. Same goes for the Aeroplan side – why pull the rug out from under its loyal members when we haven’t even had a chance to enjoy the new program yet?

In short, points cost banks and airlines less than the value that we redeem them for as consumers. I’m hoping to find time to write an article on this.

But yes, very pleasantly surprised to see Canadian offers that beat the stronger US credit card landscape!

Great deals, thanks! Do you think it’s possible to PS from AP Reserve card to AP regular Amex and maybe even get remainder of the year fee transferred to regular AP Amex?

Likely not in the first year – truly a pay-to-play offer.

Hi Josh, so you know if I would get the bonus for applying Amex AP card if I already hold the AP reserve card? Are we able to hold both tier of card at the same time?

I don’t see why not – plenty of people have Amex Plat+Gold, both Bonvoy cards, etc, and have received both bonuses.