In March 2021, Air Canada introduced the ability to convert the Air Canada Buddy Pass into 30,000 Aeroplan points – a feature that was introduced in recognition of the reality around travel planning during the pandemic.

Deadline for Buddy Pass Conversion: November 30, 2021, with an Exception

The ability to convert the Buddy Pass into 30,000 Aeroplan points was originally introduced with an end date of April 30, 2021. This later turned into a rolling deadline subject to further extensions, to account for the uncertainty of the ongoing pandemic.

In August 2021, Aeroplan indicated that November 30, 2021 would be the last date on which it is possible to convert the Buddy Pass into 30,000 Aeroplan points.

However, for a limited time, some cardholders will be granted an exception to convert their Buddy Pass beyond November 30:

- You must have opened the card in July or August 2021

- You must have your Buddy Pass deposited into your Aeroplan account after November 15, 2021

This exception is to account for the fact that some of the issuers (most notably TD) have taken a particularly long time to deposit the Buddy Pass into members’ accounts.

Cardholders may have applied in July or August 2021 with the intention of converting their Buddy Pass, but without having had the opportunity to do so because of these delays.

If you don’t fulfill the above criteria, then the deadline to convert the Buddy Pass into 30,000 Aeroplan points will remain fixed at November 30, 2021.

How to Convert the Buddy Pass for 30,000 Aeroplan Points

You earn an Air Canada Buddy Pass upon completing the minimum spending requirement associated with one of the Aeroplan co-branded credit cards.

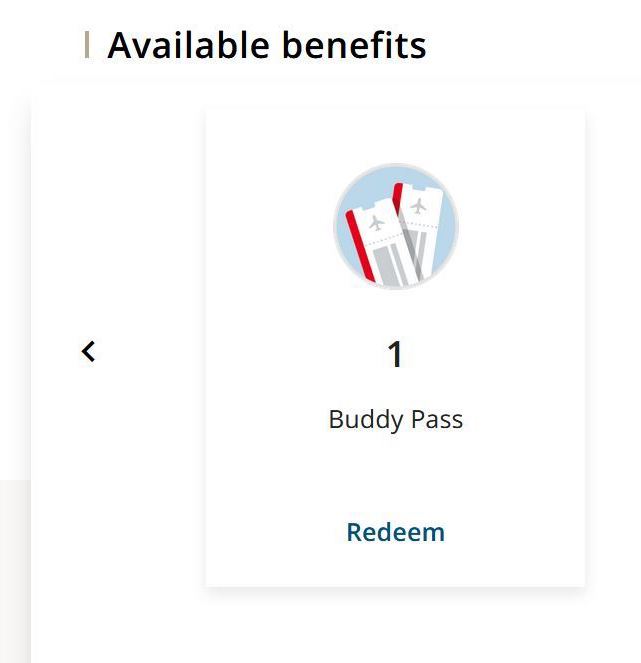

It should look like this:

Once the Buddy Pass has arrived in your account, you can either go ahead and use it to book a paid Air Canada flight for two passengers, with the second passenger paying a $0 base fare… or, as of now, you can call Aeroplan and ask to exchange the Buddy Pass for 30,000 Aeroplan points.

While the Buddy Pass itself has a one-year expiry period, the 30,000 Aeroplan points simply get deposited into your account alongside the rest of your Aeroplan balance, and you can go ahead and redeem those 30,000 Aeroplan points for a flight redemption just like all your other points.

Should You Convert the Buddy Pass?

You might be wondering: should you go ahead and exchange the Buddy Pass for 30,000 Aeroplan points?

In my opinion, you absolutely should, unless you have very specific travel plans in mind in which you can leverage the Buddy Pass in its original form for a high value.

By our current valuation of 2.1 cents per Aeroplan point, 30,000 Aeroplan points are worth $630 – and quite likely far more than that if you redeem them for a business class or First Class flight in the future.

Unless you have very firm plans to book paid Air Canada flights within North America for two people, in which you would’ve paid full fare for both passengers anyway and the second passenger’s base fare is greater than $630, I’d say that exchanging the Buddy Pass for 30,000 Aeroplan points is a no-brainer decision.

Aeroplan Credit Card Offers Are Now Incredible!

Needless to say, this is a major boost to the value proposition of all the Aeroplan co-branded credit cards that currently include Buddy Passes as part of the signup incentive.

Factoring in the option to exchange the Buddy Pass for 30,000 Aeroplan points, we’re looking at the following effective welcome bonus offers on Aeroplan credit cards:

- TD Aeroplan Visa Infinite: 55,000 Aeroplan points + First Year Free

- 10,000 Aeroplan points upon first purchase

- 45,000 Aeroplan points upon spending $1,000 in the first three months

- $139 annual fee, waived for the first year

- TD Aeroplan Visa Infinite Privilege: 95,000 Aeroplan points

- 20,000 Aeroplan points upon first purchase

- 75,000 Aeroplan points upon spending $1,000 in the first three months

- $599 annual fee

- TD Aeroplan Visa Business: 55,000 Aeroplan points + First Year Free

- 10,000 Aeroplan points upon first purchase

- 30,000 Aeroplan points upon spending $1,000 in the first three months

- 2x Aeroplan points in the first three months, up to an additional 20,000 points

- $149 annual fee, waived for the first year

- CIBC Aeroplan Visa Infinite: 50,000 Aeroplan points + First Year Free

- 10,000 Aeroplan points upon first purchase

- 40,000 Aeroplan points upon spending $1,000 in the first four months

- $139 annual fee, waived for the first year

- CIBC Aeroplan Visa Business: 50,000 Aeroplan points + First Year Free

- 10,000 Aeroplan points upon first purchase

- 40,000 Aeroplan points upon spending $3,000 in the first four months

- $180 annual fee, waived for the first year

- American Express Aeroplan Reserve Card: 120,000 Aeroplan points

- 60,000 Aeroplan points upon spending $3,000 in the first three months

- 5,000 Aeroplan points for each of the first 12 months in which you spend $1,000

- $599 annual fee

- American Express Aeroplan Card: 70,000 Aeroplan points

- 40,000 Aeroplan points upon spending $1,500 in the first three months

- 2,500 Aeroplan points for each of the first 12 months in which you spend $500

- $120 annual fee

Wow, wow, wow, wow, WOW!

50,000+ Aeroplan points for no first-year annual fee and only $1,000 in minimum spend – on no less than three co-branded credit cards. You’re looking at it!

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

130,000 Aeroplan points

$599 annual fee

|

130,000 Aeroplan points | $2,682 | Apply Now |

|

Up to 85,000 Aeroplan points†

$599 annual fee

|

Up to 85,000 Aeroplan points† | $871 | Apply Now |

|

Up to 60,000 Aeroplan points†

$180 annual fee

|

Up to 60,000 Aeroplan points† | $840 | Apply Now |

|

Up to 40,000 Aeroplan points†

First Year Free

|

Up to 40,000 Aeroplan points† | $683 | Apply Now |

|

40,000 Aeroplan points

$120 annual fee

|

40,000 Aeroplan points | $573 | Apply Now |

|

Up to 45,000 Aeroplan points†

$139 annual fee

|

Up to 45,000 Aeroplan points† | $525 | Apply Now |

Now, before you get too excited, I should remind you that the terms and conditions of the Aeroplan credit cards with Buddy Pass offerings include the following language:

This one-time Bonus Buddy Pass is only valid for eligible cardholders. You will not be eligible for the Bonus Buddy Pass if you have previously opened an Aeroplan Program credit card of the same type, regardless of the credit card issuer and have received the Welcome Bonus offer in the last 12 months.

Since you can only earn one Buddy Pass per “type” of Aeroplan credit card (i.e., core, premium, or small business) within a 12-month period, you’ll want to be selective about which cards to apply for.

Under the current offers (which are expected to last until the end of May), one possible winning combination might be as follows:

- TD Aeroplan Visa Infinite Privilege (premium)

- CIBC Aeroplan Visa Business (small business)

- TD Aeroplan Visa Infinite (core)

(You’ll also want to take action as soon as possible, since recent data points indicate that TD can take up to two months’ time to deposit the Buddy Pass into your account. That leaves you with a tight timeframe to act before the Buddy Pass conversion opportunity ends on November 30, 2021.)

If you applied for this trio of cards, you’d be able to earn 200,000 Aeroplan points for a net $599 outlay in the first year.

And even if you were to skip the premium card, you’d end up with 105,000 Aeroplan points for $0 out-of-pocket in the first year.

Factor in the points you earn from the minimum spending… and that’s already a round-trip business class flight from the West Coast to Japan for $0 out-of-pocket on annual fees.

That is simply outrageous, staggering, unreal… and dare I say, the “something amazing” that we were originally promised back in the day?

Conclusion

Due to the harsh realities of planning travel in the pandemic era, Air Canada introduced the ability to convert the Air Canada Buddy Pass into 30,000 Aeroplan points – a game-changer for the Canadian Miles & Points landscape in 2021.

As a result of this increased flexibility, the welcome bonuses on six of Aeroplan’s 11 co-branded credit cards have been sizzling hot, with up to 105,000 Aeroplan points on the table through first-year-free offers alone.

If you have a Buddy Pass in your Aeroplan account, you can go ahead and call Aeroplan to exchange the Buddy Pass for 30,000 Aeroplan points before November 30, 2021, with limited exceptions to this deadline if you opened your card in July or August 2021 and the Buddy Pass took a long time to show up.

No longer an option. Buddy pass conversion doesn’t exist, so don’t bother trying

I applied for two different credit cards that offered the buddy passes. I met the spending requirements but the TD pass never arrived. Almost a year has passed and I contacted TD. The agent agreed and escalated the matter to the resource team. I was eventually called and advised that I could not have a buddy pass because I had received a prior buddy pass from a different financial institution. They even knew that I had converted the other pass to points (privacy?). They said it was impossible for them to give me their reasoning in writing and that it was a matter I would have to discuss with Aeroplan because it had to do with their “Anti-Gambling” policy. The rep could or would not acknowledge that the agreement with TD was violated by TD and could not provide what portion of the agreement I violated. She could not confirm if TD pays for the promotional items as she did not know what the business practices were. I used the analogy that if a company offered a toaster (car, coffee maker) to join, the toaster was likely paid for by the company (ie TD) and that the toaster company wouldn’t be denying my the toaster. She suggested that my example was not reasonable in a capitalistic environment. I guess the TD must be the victim here.

I should also note that my prior conversations with aeroplan, who converted the prior buddy pass and confirmed the TD buddy pass had not arrived, saw no problem with what I was doing. I’m guessing I’m not the only one dealing with this.

Is it still “worth it” to get the buddy pass? Seems a lot less flexible compared to 30k points. No longer able to convert, right?

Here’s the scoop from my call today to convert my buddy pass:

The date that matters is the date it was linked to your Aeroplan account. It has to be in July or August.

With TD, this was 3 days after I applied (but still in August for me). I have an email from TD saying they were linked and the day I received the email matched Aeroplan’s records about the linking.

Interesting, I just got off a call with Aeroplan (Dec 10) (was actually transferred from TD directly to Aeroplan when I called about my missing Buddy Pass from an August card date) and Aeroplan said that not only wasn’t the Buddy Pass there, but also that even if it was they would not be able to convert. I mentioned the August date a number of times, and they said they say the date on their system, but that there was no exceptions beyond Dec 7 regardless of the original date. I protested a few times politely, but the agent was pretty firm that if the Buddy Pass wasn’t in the account that there is no exception regardless of the card issue date. Hope this turns out wrong, but the agent was very certain.

Final update on this, I got my Buddy Pass today, called in to Aeroplan, and they did the conversion to 30K with no problem or issue. Key factor was that the credit card account was opened before September (and showed in their system as such), and because of that they are accepting the conversion. Props to Aeroplan for taking care of it so efficiently in my call.

Well, I hope my conversion request goes through since it was after December 7. It’s still in my account but it usually is for a while until they convert. The agent also told me it currently takes about 21 days to process.

Ricky, thanks for the Buddy Pass update.

I’m wondering if the 12-month minimum gap for awarding a second Buddy Pass (BP) begins at:

1. Card issuance?

2. Qualification for BP? (My guess)

3. Date BP awarded? (2nd guess)

OR

4. (Doubtful) date BP converted to points?

Thank you!

The terms say “opened” a card in the past 12 months, so I’d say #1.

“You must have opened the card in July or August 2021”

Does that mean we had to APPLY for the card by August 31st, or had to ACTIVATE the card by August 31st? I’m asking because I applied for the card on August 28th and activated the card in September… Thanks for your reply

Hi Ricky,

I had 2 buddy passes, one from TD personal and one from TD business. Just called into Aeroplan to convert and they are saying you can only convert one per account. Does that sound right? I never read that anywhere before. Should I call and try someone else?

Ricky,

Thanks for your useful Buddy Pass conversion update.

Hey Ricky, any idea if I have to qualify for both of the criteria:

– You must have opened the card in July or August 2021

– You must have your Buddy Pass deposited into your Aeroplan account after November 15, 2021

I applied for my TD Aeroplan credit card in early September because it said it could take up to 8 weeks to get the Buddy pass, so the timeline was tight but still doable. So I only qualify for the latter criteria. Hoping the extension applies to me still, let me know!

We are in the same boat and called and they refused to help connect us with anyone who could override the july/aug exception. We met our min spend on Oct 23, 6 weeks before Nov 30 deadline, and yet TD only deposited the buddy pass on Dec 27. Because the card was opened in September they would not budge! Let us know if you get an exception or if anyone knows who to complain to about this!

Is there any confirmation that this may have been extended again?

There’s a report on the RedFlagDeals thread about this noting the conversion deadline has been extended until Dec 31?

https://forums.redflagdeals.com/air-canada-convert-air-canada-buddy-pass-30000-ap-points-2454091/60/#p35316068

If true, I’m going to hop on a CIBC application right away, and push my statement date up to make sure I have it in hand by Dec 31 🙂

No such confirmation as far as I’m aware.

Hey Ricky, I see that your article has been updated to reflect the limited extension. Thanks for sharing the details around the extension :). Guess it would be too late for me if I were to get a new card since there’s a limit through August!!

There are no specifics around the deadline for this exception, right?

It’s sounds like it’s basically indefinite as long as you meet the criteria…

It’s “limited-time” which means until Aeroplan decides to stop allowing it, basically. It won’t be forever.

Jumping on to let you know that we took your advice, sat on the phone for a bit but had a very helpful agent convert our points (we have 2 cards). Call was October 16th and points arrived November 22nd. A bit longer than we thought but not really an issue. Now we need some advice for best use of points to travel to Australia when it opens up! Thanks for the tips!

Glad to hear it!

Am I out of luck? I received my TD AEROPLAN card in July and met the requirements immediately. With the November 30th deadline, will I still be able to convert my points? Any suggestions?

Thanks for this post. Called yesterday and Aeroplan had no issues converting my Buddy Pass to 30,000 points. The agent was very familiar with the process and it sounds like they’ve been getting a lot of calls. She reminded me to keep the credit card that issued the buddy pass active until the process was complete (up to 30 days)

How long were you on hold for?

Is this for new credit card sign-ups or can someone who has had a card for a while and has a buddy pass in their account take advantage of the buddy pass to points conversion?

Anyone who has a Buddy Pass may convert it before November 30.

Thanks, Ricky. I called and was told no. I will try again.

Hey Ricky or anyone else who’s successfully converted buddy pass.

I spoke to Aeroplan 3 weeks ago when my buddy pass posted to my account and asked them to convert it. They said it would take 3 weeks – which is all fine..

However, last week the buddy pass disappeared from my account – which made me think the points were about to post – but now after 1 week there’s still no sign of the points – and my buddy pass is still gone.

Wondering if this is what to expect i.e. there is a gap between the buddy pass being removed form your account and the points appearing?

OK got through to an agent just as I was about to give up. She said this is expected and it’s taking at least a week for the points to be posted after the buddy pass has been removed from your account. So I guess I just wait and hope all is going as it should!

Hi just FYI…I got the TD Aeroplan Infinite Visa on May 11. I spent the required $1000 by June 11. still no buddy pass, so I called TD last week and they said they will deposit the buddy pass 8 weeks after the 90 days for the spend requirement has passed even if I hit the spend requirement a month after having card. So she told me to expect my buddy pass by mid-October. 🙁

I was told the same information when I met the spend on June 24 which means I will be cutting it very close to the November 30 deadline. TD put a note on my file to expedite this Buddy Pass last month and I still have nothing. Has anyone had better luck with TD? It is very frustrating they are taking up to 5 months to deposit this!

Hi Ricky, for these credit cards that provide a buddy pass, do you know how long it takes after you’ve met the minimum spend for the buddy pass to arrive in your Aeroplan account? With a Nov 30 deadline, timing wise, how realistic would it be to convert the buddy pass to the 30,000 points?

I have the same question, would love to know the answer! If I apply today I assume it will take at least 1-2 weeks to get the card. But I can easily spend 1000$ within a month. In that case can I get the buddy pass right away? Or do they only check if we met the $1000 dollar spending requirement after 3 months? If yes and we miss out on this opportunity should we wait till next year to get the card? Maybe they will have better offers?

“Factor in the points you earn from the minimum spending… and that’s already a round-trip business class flight from the West Coast to Japan for $0 out-of-pocket”

A bit sensational and misleading. You’re looking at a minimum of $100 in taxes and fees roundtrip out of YVR.

That’s right, it should be “$0 out-of-pocket on annual fees”, and it is very much a sensational deal.

Agreed – thanks for clarifying!

Which of the premium cards you recommend that will allow me to carry the e-upgrades, considering the bonuses they offer atm?

The TD Aeroplan VIP would be the best choice if you qualify for it, since its welcome bonus can be unlocked with only $1,000 spending in the first three months, rather than the Amex Aeroplan Reserve where the bonus is only earned after a full year.

Anyone know if this is still valid?

Yes!

Hey Ricky, quick question about CIBC small business. If I cancelled my CIBC Aventura Small Business at the end of Jan 2021, would this count as churning if I were to apply to CIBC Aeroplan Small Business today?

Many thanks.

It would. But I’d say your odds of getting the bonus are fairly good.

Hi Ricky

I have companion pass in my aeroplane account benifit, can I convert into aeroplane points or not.

Please advise

Thanks

Amish

Does it say “Buddy Pass” on it? If so, yes.

Can P1 and P2 both get a buddy pass if they get the same card in their own names using the same Aeroplan account?

Example:

P1 gets CIBC Aeroplan VI using Aeroplan account 123456789

P2 gets CIBC Aeroplan VI using Aeroplan account 123456789

Will both get the buddy pass and therefore 60k points after meeting MSR?

Thanks.

I don’t know, but why bother doing this when you could simply add P1 and P2’s accounts to the same Family Sharing group?

Meaning it makes no sense to continue pooling under the same Aeroplan, but instead P2 can get their own Aeroplan account and will get their own buddy pass?

Yes exactly – that would be the best way to proceed.

FWIW I did it tonight and the agent told me the offer ends at end of April. Also warned me it’s currently taking 3 weeks to post the 30k. I waited 2 weeks from achieving MinSpend, to seeing Buddy Pass in Aeroplan. My card is CIBC VI.

Hey Ricky,

If I changed my Aeroplan visa card from Platinum to Infinite, that means that I won’t get a buddy pass then right?

Hi Ricky

I went to the CIBC website and it states the first year is waived only if you have CIBC smart plus account is that accurate? I want to do CIBC instead of the TD card because after the first year I won’t be renewing the card and looking to drop down to a no fee Aéroplan card but it looks like TD doesn’t offer one?

Nope, it’s waived for the first year for all applicants, and only waived for subsequent years if you have the CIBC Smart Plus account. It’s just not very well worded, but if you look near the top of the page, you’ll see “plus, get a first-year fee waiver!”

I applied for / was approved for CIBC Aerogold Visa Infinite in July 2020 which has now become the CIBC Aeroplan Visa Infinite… wondering if I was supposed to have a Buddy Pass deposited when this transition was made? On my Aeroplan dashboard I do not see one under benefits. Would I call CIBC or AE about this?

Would love to exchange it for 30,000 points if I can in fact get a buddy pass.

Are there any recent DPs for applying online for TD and CIBC business cards? It used to be that they always require going in branch for verification, even if online application was conditionally approved. Is that still the case?

Hi Ricky,

Thanks for the info! I’ve heard people mentioned about going into branch to verify income for TD application. If that’s the case, is CIBC the better one here considering there is basically no difference between these two cards?

1. Is the 12 months for welcome bonus from last app, or when you last fulfilled the MSR? e.g. if i applied for TD AP VI in Mar 2020 but did not meet the MSR until Jun 2020, could I PS now (PSed to NF in Sept 2020) and get the full offer?

2. Alternatively to get full offer at CIBC, is it better to apply with a new app, or PS my Aventura to AP VI?

Hi Ricky, just to clarify something from your article. As long as I apply for the card before May 28, 2021 I am able to convert the buddy pass to APP regardless if I meet the MSR before that date? For example, if I meet the MSR on the third monthly statement in July 2021, I can still convert the buddy pass to APP.

Thanks for this as always!

Yes, it was specifically clarified that it would be based on whether the Buddy Pass conversion offer was active at the time of your application.

Hey Ricky, as long as I apply before May 28th, can I convert the buddy pass any time before it expires (eg. up to one year from now)?

Based on what we’ve learned from Aeroplan, yes.

Thanks Ricky for your heads up regarding these Aeroplan cards and maximizing points…these all look great. I really enjoy your analytical approach to the miles earn and burn game and you really have valuable insights that are timely and actionable.

I’m adding the CIBC Visa Infinite and TD Aeroplan Business to the TD Visa Infinite Privilege and Amex Aeroplan Reserve I already have in my wallet. Super return on spend!

I don’t think I can really keep them all on renewal and would appreciate near the end of the year which ones should be kept and which to return.

Now, if the estore could just speed up awarding points to my account.

Hi Ricky, quick questions:

I had a CIBC aerogold visa infinite, business visa, and TD aeroplan Visa infinite card until Feb 2021. I canceled all the aeroplan branded cards with the hope that I can re-apply at some point and get the welcome bonus offers again.

1) In your recommendation for triple cards, you included two TD cards. But TD seems to have put tougher restriction: only one aeroplan welcome bonus per calendar year?? That’s what the agent told me. Apparently I can’t apply for any type of aeroplan card for another year until I could apply for any of the aeroplan branded TD cards!! Any thoughts on that?

2) Do I call Air Canada after I meet the minimum spending req (which can be in June / July / Augu) or after activating the card?

It’s one Aeroplan welcome bonus per card every 12 months, not across all the cards.

Call Aeroplan to convert the Buddy Pass once the Buddy Pass is deposited into your account. Based on people’s data points, this will likely be very soon after hitting the minimum spend on a CIBC or Amex card, but up to eight weeks after hitting the minimum spend on a TD card.

Thanks for the quick response. Much appreciated.

If I canceled a TD card in couple of months ago and the last application was in Feb 2020, do I have to wait a year before I can apply for the card again? (that’s what TD rep told me)

Or Can I just apply as usual after 3 months of cancelation/switch?

By the terms and conditions, the welcome bonus is limited to once every 12 months, so if you last applied in Feb 2020 you should be fine.

If I currently hold a business CIBC Visa almost 1 year old (before the Buddy Pass was introduced) – will applying for another business card be considered as eligible buddy pass business tier application (despite me having another, older, business card)?

Thanks.

Yes. The once-per-type restriction applies to earning Buddy Passes, not to having business cards (or any other type of card).

Hi Ricky,

Welcome offer for CIBC Aeroplan® Visa* Business Card is follow:

Earn up to 20,000 Aeroplan points †

Earn 10,000 Aeroplan points when you make your first purchase.

Earn 10,000 (not 40,000) bonus Aeroplan points when you spend $3,000 or more during the first 4 monthly statement periods.

Factor in the Buddy Pass, and it’s 40,000 + 10,000 = 50,000.

ricky can I get the small business and a personal core card at the TD or do i have to go to cibc for one

Yes, you can get both from TD.

Has anyone actually gotten the 30k deposited to their aeroplan account, I called on March 29th and they said it would take approx 2 weeks. To date nothing and the Buddy Pass still shows up in the benefits.

I opened the former CIBC Aerogold card in June of 2020 and got the signup bonus of 20k. Would I be eligible for the TD Aeroplan Buddy Pass offer?

Yes!

Hi, How long after meeting minimum spend did you get buddy pass ? ( from statement date )

Thanks

I was surprised it showed up in my Aeroplan account the day after my statement date

Wish Westjet would match this offer for their companion vouchers…

In a sense, WestJet was earlier to the game with conversion options for their companion voucher, allowing you to convert into four lounge passes.

I’ll let you make your own comparisons between the value propositions here…

Yes, but those lounge passes have the same expiry date as the exchanging companion vouchers.

Hi Ricky,

Where to find the AMEX offer below, I cant see it anywhere….

American Express Aeroplan Card: 45,000 Aeroplan points

39,000 Aeroplan points upon spending $1,500 in the first three months

1,000 Aeroplan points for each of the first six months in which you spend $500

$120 annual fee

Here you go: https://www.americanexpress.com/ca/en/charge-cards/aeroplan-card/

Hi Ricky,

My wife doesn’t have any Aeroplan cards, so she is looking at the 3 you mention as possible options for 185 000 points but is there enough time between now and the end of May? Should she apply for 2 (TD and CIBC) in April? Thanks

My understanding is that the April 30 “deadline” is a rolling deadline that’s quite likely to be extended based on the COVID situation, so there should be enough time. Naturally, the earlier you apply, the better.

I can’t seem to find the AMX card that offers 39k plus 6k points with $120 annual fee??

Here you go: https://www.americanexpress.com/ca/en/charge-cards/aeroplan-card/

Where on the Aeroplan site can you see if you have a buddy pass?

Under “Benefits” on the dashboard.

Hi Ricky,

If we held these products before the November switch do you know if these cards are considered new products and we are eligible for welcome bonus?

Hi Ricky!

Just wanted to say thank you for all the insights you provide, it’s really helpful and very much appreciated 🙂

I signed up for the TD Aeroplan Infinite in May and should be getting my first buddy pass by August.

Now thinking of signing up for the Amex Business Reserve and the Amex Business Platinum, but will I get 2 buddy passes upon reaching the minimum spend, or are these two cards considered as same type and only qualify for one buddy pass between the two?

Neither of these cards provide a Buddy Pass – right now it’s only on the TD/CIBC core and business cards, as well as the TD premium card.

They’re considered to be successors to the old products, so each issuer’s usual eligibility rules (12 months for TD, once in a lifetime for American Express) and enforcement patterns (a bit of a toss-up for Amex, less strict for TD and CIBC) would apply.

What about CIBC’s eligibility rules?

If I have an existing CIBC AG VI opened on 2020-06-23 (and still open), do you know If I can still earn the full WB If I were to open another one today?

so please clarify, the total spend for cibc infinite and business, is 1k and 3 k respectively but over the prescribed statement times to get the buddy pass? So if do an instant 1k and 3k spend will buddy get deposited asap? Waiting to pull the trigger, thanks for the tireless work you guys do to guide our points accumulation, got enough for 2 round world business class so far and counting,( will get consulting on that one) cheers

Ricky, I think your MS periods are off for the CIBC products. I work at CIBC and it’s within 4 statement periods, not 4 months. The first statement period is very short and counts towards that. It’s actually effectively 3 months. You can call CIBC to clarify that if you’d like.

You are right. It looks like the language may have changed. It used to say 4 months. Now it says 4 monthly statement periods.

Hi Ricky,

Would you be able to get multiple buddy passes to convert into 30k points from the same card tier (ie. premium, core, business) or are you still limited to one buddy pass per tier. Specifically, looking at the business cards (TD and CIBC) which both offer a buddy pass and if get both would that enable 30k points conversion twice? (similarly for Core cards as well)

Hey Ricky, I heard someone said this buddy pass 30K AP point conversion is a promotion and will be expired on April 30, is that true? Thanks

It’s similar to the flexible rebooking policy or the Aeroplan cancellation policy – a rolling deadline that’s quite likely to be extended depending on how the COVID situation plays out.

Am I missing something? On the CIBC application page for the Aeroplan Infinite it says that AF rebate is only applicable if you have CIBC account.

Specifically: Annual fee rebate of up to $139 if you have a CIBC Smart Plus™ Account

That rebates the annual fee every year. The public offer currently has a first-year fee rebate: “Earn up to 20,000 Aeroplan points! Plus, get a first-year annual fee rebate!”

Waiting for pass to show in my account… your pic, you took that under “My Aeroplan” and then under “Benefits”, is that right?

If I apply both CIBC’s AP personal and business at the branch, would it be 1 hard poll credit check or 2 hard poll? Thanks!

CIBC can combine pulls at the branch, so it’d be one.

I would recommend TD business card over CIBC as the MSR of $1k with TD biz card will get your Buddy pass vs. CIBC $3k MSR.

so with one hard pull at branch both TD APVI and TD Biz AP should with $1k MSR should be the best strategy to get 50k + 40K = 90K with P2 on board its 180k with $0 AF.

Just talked to someone from Aeroplan and had a weird experience. They knew about the offer, but didn’t know how many points it would be exchanged for. Said they would need to request the bank to convert the buddy pass and deposit the points.

I recently got both the TD VI and CIBC VI. Have hit the min spend with TD and not yet hit it with CIBC so I assumed the buddy pass in my account was from TD. Apparently not, said this guy. Hope it all goes through ok, he said it’ll take up to 10 days. He also noted how it looks like I’ve “had many cards. Racking up the points there.” Hmmm

Hi Ricky, thanks for sharing this amazing news. I have a CIBC visa infinite since last July, before the cards revamped. If I apply for a new visa infinite from TD, does the 12 months restriction apply to me?

So, I chose to get the “loser” AmEx Aeroplan Reserve in February. At the time, it looked like a decent enough way to get 65,000 AP miles. No chance in hell of earning the buddy pass with this one, it requires $25,000 annual spend.

Question: at this point, would you advise calling AmEx to try to downgrade to the regular AmEx Aeroplan (non reserve)? Much cheaper and now with the extra 30,000 miles in lieu of buddy, not that big a difference in WB miles…

No because they are different products.

The CIBC Aeroplan Visa Infinite bonus is 20,000, not 50,000.

Ah, but with the Buddy Pass, it is!

“10,000 Aeroplan points upon first purchase

40,000 Aeroplan points upon spending $1,000 in the first four months”

Is not accurate.

Ah, but with the Buddy Pass, it is!

(You also get a Buddy Pass upon spending $1,000 in the first four months, which converts into 30,000 Aeroplan points.)

I got the CIBC AP Visa Infinite in January, 2020. If I cancel today, how long before I can re-apply?

Also got the TD AP Privilege on November 6, 2020 (before the 12 month language). Can I cancel and re-apply after 6 months?

Could not get multiple Buddy Passes. I logged in saw only one displayed despite having multiple AP different tier cards from both TD and CIBC. Upon calling, the agent could not confirm why only personal VI card was issued but Business Card did not. have to deal with TD and CIBC.

My guess is your second Buddy Pass hasn’t been deposited yet. In general, you’d speak to the banks about depositing the Buddy Pass, and you’d speak to Aeroplan about converting the Buddy Pass.

Ricky, do you know when the deadline to convert if this offer does not get extended?

There’s no explicit deadline as I understand it. It’s ongoing due to COVID. I’d expect us to have some notice before the conversion option ends.

Want to get the privilege card to make it 3, but $600 for 85000 is still hard to swallow.

That is similar to the Amex Reserve’s AF.

The TD/CIBC Privilege cards do not have a $200+ GCR rebate like Amex Reserve does though…

Interesting I thought we could only get one buddy pass but you say we get one per tier? I have the TD infinite and the amex ap which means I should have 2? Sadly I only see one.

If you’re referring to the Amex Aeroplan Card there, those are both the same tier (core) so you’d only get one.

In what section of the Air Canada website do you see your buddy pass? I’ve been looking all over and can’t tell where it says if I have mine yet.

It would be on your Aeroplan dashboard, under “Benefits”.

Thanks Ricky!

Isn’t the Buddy Pass good for flights to Hawaii and Mexico? Better value than 30,000 points, no?

Potentially – it’s all about whether you would’ve gotten high value out of the Buddy Pass (like in Steve’s example) in the first place. Travellers who are more interested in flying around North America with a partner may still prefer the Buddy Pass, whereas solo travellers or those who are all about maximizing Aeroplan points for premium cabins (as Jay mentioned) would greatly prefer the 30,000 points.

While it is nice to have the conversion option, and it depends on your travel plans, I wouldn’t consider doing this redemption a slam dunk. Take Toronto-Hawaii in economy (yuk, 9+ hours) return for one week next February, both ways non-stop flights.

The cost for two tickets – one purchased, plus the Buddy Pass taxes/fees, comes to $927. Two Aeroplan tickets would be 71,600 points plus $270 in taxes/fees. If I was faced with that situation, I would go the Buddy Pass route as the difference is $657 but I saved 71,600 Aeroplan points. I’d even end up getting 1,854 MR points paying with my Plat Amex.

Depends if you tend to fly in premium cabins.

I just talked to someone at Aeroplan and Air Canada Reservations. They both told me it is not possible to do this

HUCA.

I just got mine converted. The agent told me that this is targeted, and should have an email about it (although I never got the email). The points will arrive 10-14 days.

Can existing cardholders benefit from this ?? I have both AMEX and TD ….

Yes, if you signed up for a card after Nov 8 that had a Buddy Pass offer attached.

I had those cards before november 8th … Nothing then ??

Not unless you apply for new ones.

Hi Ricky: Quick question. My girlfriend is self-employed and tried to apply for a TD Aeroplan Visa Infinite card. Re employment status, they are asking for employment/student/homemaker etc. Nothing re self-employment in the drop down menu. What should we do? Do you have any idea? Thanks man! Rob

The most truthful option, and the option that gives you the greatest shot of approval in the automated system, would be to select “Employed” and enter her own name as the employer name.

Can we confirm this is an option that’s here to stay or could be limited time?

I’m thinking leave it as buddy pass till you go to redeem and then you’ll see which one has better value. Buddy pass or 30k AP

It’s specific to the COVID period for now and will be revisited on an ongoing basis, with no explicit end date. I’d expect there to be some notice for when it’s going to end, so your strategy seems pretty sound for now.

Good timing for the bonus considering it now costs 160k AP for 1 J seat in early April from YYZ-YVR (one-way).

I booked a YYZ-YVR for this weekend for 38,700 points, although it was the last seat left and the remaining seats all cost 160K. Then again, those flights wouldn’t have been bookable at all under the old program anyway.

The base-level pricing (38,700 points in my case) still gets much higher than the 25,000 points at the lower end of the dynamic range, though. That’s where the Buddy Pass conversion or eUpgrades might come in handy.

That’s true, it’s all availability that wasn’t accessible before. Having e-ups in your back pocket is definitely handy!

HUCA situation ? Called and agent didn’t budge. Can’t do it…

HUCA indeed, as not all agents seem to have been briefed on it yet.

“Now, before you get too excited” you are the one hyping it up with enthusiasm, lol.

Damn straight – before *I* get too excited, if anything.