Air Canada has launched a series of statement credit and cash back offers for booking Air Canada flights on the core and premium Aeroplan co-branded credit cards issued by TD, CIBC, and American Express.

Starting today until later in 2021, you can earn $25 or $50 in cash back for booking an Air Canada flight, a total of five times, for a total of $125 or $250 in cash back on a single card.

In TD and CIBC’s case, this could translate into a discount of up to 50% on Air Canada flight bookings that you make between now and the end of the year. Let’s take a closer look at the details.

Register for the Offer

Before earning cash back on your future Air Canada flights, you’ll first need to register for the offer based on the exact Aeroplan credit card that you hold:

- TD Aeroplan Visa Infinite Card: Click here to register

- TD Aeroplan Visa Infinite Privilege Card: Click here to register

- CIBC Aeroplan Visa Infinite Card: Click here to register

- CIBC Aeroplan Visa Infinite Privilege Card: Click here to register

- American Express Aeroplan Card: Register under Amex Offers

- American Express Aeroplan Reserve Card: Register under Amex Offers

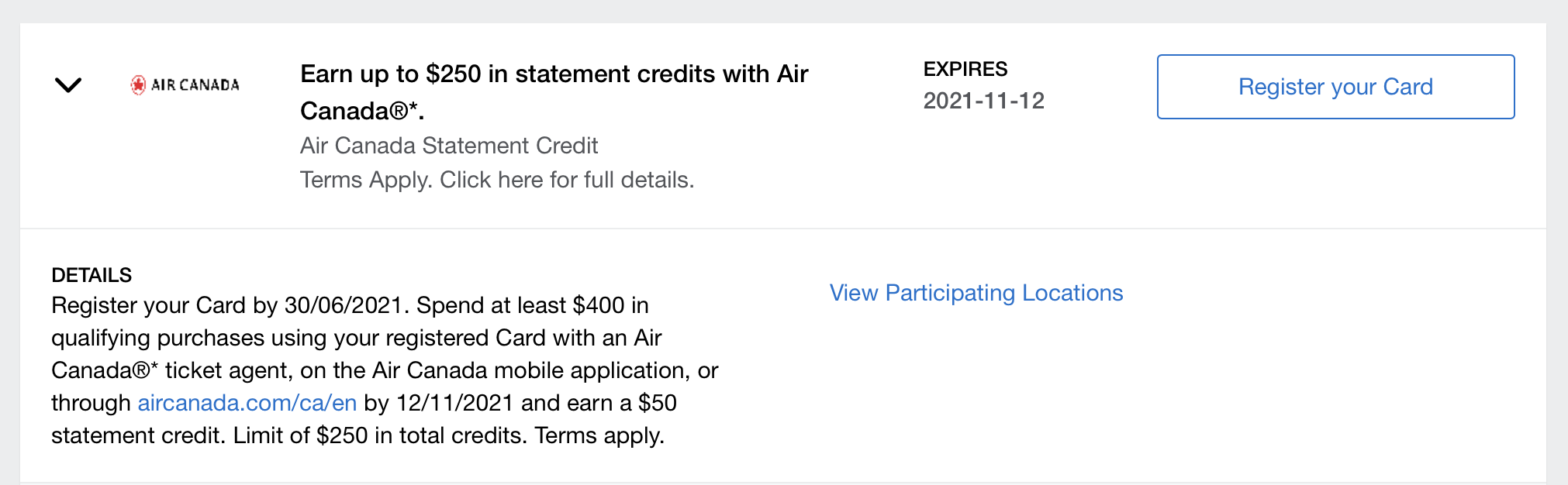

For the American Express core and premium cards, simply navigate to your Amex Offers dashboard and click “Register your Card”, and the offer will be activated.

The registration window is open until June 30, 2021, so make sure to submit your registrations by then. This also means that you’ll want to apply for any of the six credit cards before June 30 if you’d like to take advantage of this cash back offer on Air Canada flights.

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

130,000 Aeroplan points

$599 annual fee

|

130,000 Aeroplan points | $2,682 | Apply Now |

|

Up to 85,000 Aeroplan points†

$599 annual fee

|

Up to 85,000 Aeroplan points† | $871 | Apply Now |

|

85,000 Aeroplan points

$599 annual fee

|

85,000 Aeroplan points | $845 | Apply Now |

|

Up to 40,000 Aeroplan points†

First Year Free

|

Up to 40,000 Aeroplan points† | $683 | Apply Now |

|

40,000 Aeroplan points

$120 annual fee

|

40,000 Aeroplan points | $573 | Apply Now |

|

Up to 45,000 Aeroplan points†

$139 annual fee

|

Up to 45,000 Aeroplan points† | $525 | Apply Now |

Earn Up to $125 in Cash Back on the Core Aeroplan Cards

If you hold one of the core (or “grey”) Aeroplan co-branded credit cards, you are eligible for the following cash back offers on Air Canada flight bookings:

- TD Aeroplan Visa Infinite Card:

- Earn a $25 statement credit for a $100 flight booking, up to five times, for a total of $125 in statement credits.

- Booking must be made by December 31, 2021, for travel up to December 31, 2022.

- Offer not available in Quebec.

- CIBC Aeroplan Visa Infinite Card:

- Earn $25 statement credit for a $100 flight booking, up to five times, for a total of $125 in statement credits.

- Booking must be made by December 31, 2021, for travel up to December 31, 2022.

- Offer not available in Quebec.

- American Express Aeroplan Card:

- Earn a $25 statement credit for $400 in qualifying purchases, up to five times, for a total of of $125 in statement credits.

- Qualifying purchases must be made by November 12, 2021.

The three banks’ terms and conditions appear to vary in their interpretation of what counts as a qualifying transaction.

Reading TD and CIBC’s terms and conditions, it appears that each ticket must be at least $100 in order to trigger the $25 statement credit. This means that you wouldn’t earn the statement credit if you made two separate bookings of, say, $50 each.

On the other hand, American Express’s terms and conditions allow for cumulative qualifying purchases totalling at least $400, implying that you would trigger the $25 statement credit upon spending a total of $400 with Air Canada on the card.

The offers from the TD and CIBC Visa Infinite cards are definitely the strongest on paper, given the lower minimum purchase amount of $100 for every $25 statement credit.

On the core tier, that translates into a discount of up to 25% on your first five Air Canada flights of at least $100 per card, although you’d need to make bookings for exactly $100 to reach that 25% discount level.

On the other hand, the Amex Aeroplan Card’s offer only translates into a discount of 6.25%, but you could more easily unlock this discount by stacking cumulative bookings to reach the $400 threshold, or perhaps splitting a large booking of $800+ into two separate transactions to trigger the credits twice.

If you plan to book flights with Air Canada this year and can maximize the full $125 in cash back on any of these three cards, you’d go a long way towards offsetting the annual fee (in the case of the $139 TD and CIBC Visa Infinite cards) or indeed more than offset the fee (in the case of the $120 American Express Aeroplan Card)!

Earn Up to $250 in Cash Back on the Premium Aeroplan Cards

If you hold one of the premium (or “black”) Aeroplan co-branded credit cards, you are eligible for the following cash back offers on Air Canada flight bookings:

- TD Aeroplan Visa Infinite Privilege Card:

- Earn a $50 statement credit for a $100 flight booking, up to five times, for a total of $250 in statement credits.

- Booking must be made by December 31, 2021, for travel up to December 31, 2022.

- Offer not available in Quebec.

- CIBC Aeroplan Visa Infinite Privilege Card:

- Earn $50 statement credit for a $100 flight booking, up to five times, for a total of $250 in statement credits.

- Booking must be made by December 31, 2021, for travel up to December 31, 2022.

- Offer not available in Quebec.

- American Express Aeroplan Reserve Card:

- Earn a $50 statement credit for $400 in qualifying purchases, up to five times, for a total of of $250 in statement credits.

- Qualifying purchases must be made by November 12, 2021.

Again, the terms and conditions vary by issuer, with TD and CIBC making reference to a $50 statement credit per flight ticket of at least $100, and American Express simply referring to qualifying purchases.

TD and CIBC would offer you a discount of up to 50% on your first five Air Canada flights of at least $100 per card – but you’d need to spend exactly $100 to reach that 50% discount.

Meanwhile, American Express would only offer you a 12.5% discount, but you can unlock that discount as long as you spend at least $2,000 with Air Canada during the promotion period, without having to worry about optimizing for a specific amount on each transaction.

Either way, if you plan to book flights with Air Canada this year and can maximize the full $250 in cash back on any of these three cards, you’d recoup a fair chunk of the $599 annual fees on these premium cards.

Do Aeroplan Taxes & Fees Count?

These days, Aeroplan taxes and fees are processed directly by Air Canada on the same website as regular Air Canada flight purchases, so in theory, they should also count towards these statement credit offers.

Indeed, Air Canada has confirmed that Aeroplan taxes and fees will be eligible for these statement credits, as long as they’re at least $100 in a single transaction for the TD and CIBC offers, or they cumulatively add up to $400 for the American Express offers.

Could You Effectively Buy Aeroplan Points for Cheap?

Air Canada flights issued before May 31, 2021 can be converted into Aeroplan points with a 65% bonus in the case of a voluntary cancellation.

(This isn’t being advertised on the Air Canada website now that the airline is offering full refunds after April 13, but it remains in place until May 31 as per the original commitment before the refunds policy was announced.)

In theory, if you were able to purchase five $100 Air Canada flights on a TD or CIBC premium Aeroplan credit card and convert them into Aeroplan points at 1.8 cents per point (which is the equivalent purchase price after the 65% bonus), you’d end up with 27,778 Aeroplan points. Subtracting the $250 in statement credits on the $500 in flight bookings, and you’re effectively buying those Aeroplan points at a spectacularly low 0.9 cents per point.

TD’s terms and conditions appear to allow for this. The relevant portions state the following:

For clarity, a credit on the amount originally charged to the Account will cancel this statement credit offer if the $100 spend threshold is not met.

…

This offer can be combined with other Aeroplan and Air Canada offers.

When you convert the Air Canada flight into Aeroplan points, you aren’t getting any kind of credit back to your TD Aeroplan Visa Infinite Privilege account, nor are you causing the $100 spend threshold to be “not met” in any way. Furthermore, the terms explicitly state that this offer can be combined with other Aeroplan and Air Canada offers, which bodes well for our manoeuvre.

On the other hand, CIBC’s terms and conditions appear to be more ambiguous in this regard:

This offer can be combined with other Aeroplan and Air Canada offers. The statement credit can be withdrawn and reversed on the Account at any time if the qualifying flight ticket is cancelled for any reason.

Does cancelling your Air Canada flight to convert the value into Aeroplan points count under “the qualifying flight ticket is cancelled for any reason”? Well, yes, it kind of does, so your statement credit may be withdrawn.

(For what it’s worth, the American Express Aeroplan Reserve Card also states that the “statement credit may be reversed if qualifying purchase(s) is returned/cancelled”, but the 12.5% effective discount here is far less interesting than TD and CIBC’s 50% anyway.)

Conclusion

Air Canada and Aeroplan have put out a series of cash back offers on their core and premium Aeroplan co-branded credit cards to further incentivize bookings for future travel.

For TD and CIBC’s cash back offers, you must book flights of at least $100 to qualify, and the booking must be completed by December 31, 2021 for travel through December 31, 2022.

Meanwhile, on the American Express side, you’d earn the statement credit upon completing $400 in qualifying purchases by November 12, 2021, although they can be cumulative rather than on a single booking.

These are some fairly generous offers by Air Canada and their financial partners, and they represent only the first installment of a new series of “Aeroplan Ahead” limited-time offers designed to give members more ways to maximize Aeroplan points at home as they prepare for future travel.

The hyperlinks in the article are not working. And I cannot see the offer on the Aeroplan website.

Try now.

When does this rebate show on your credit card? Anyone have success?

Hi Flying4pandas!

I just booked a flight on Air Canada 3 days ago and I already see a 150$ credit on my account with the Amex Reserve card. My ticket is $1470.

Thanks for the reply. Amex is always so good with posting their cashback promos. I’m still waiting on the cobra see Aeroplan TD and CIBC cards

Hey, the hyperlinks to the registration page aren’t working for me. Can you double check? Also do you have the registration link for the $60 streaming promo for CIBC VI Aeroplan?

What have you seen with people owning multiple Aeroplan cards? Are they successfully linking them to their individual account to collect the points, are they creating separate accounts?

All your Aeroplan credit cards link to the same account, and all the points go there.

Has anyone used this yet? Looking to book YYC-YVR for later this summer (Aug/Sept), and hoping to burn eUp for J (yeah, I know – but they’re going to expire if I don’t) and I’m curious if the credit is $100 for 2 people or $200 for 2 on Amex Reserve.

Does this offer apply to TD business Aeroplan Visa?

I could not enter the link(s) provided for both TD and CIBC. Aeroplan told me this promotion is offered by the Credit Card providers. I called CIBC Aeroplan Credit Card to provide me with the proper link for registration. After clarifications with various departments, the representative confirmed that these offers are limited to SELECTED specific card holders (not for all Aeroplan Credit Card holders). Would you or other readers have the same information that under which criteria the Card holders would be

eligible to receive the offers via emails ?

Thanks

In my example, each ticket is $78 one way, so a roundtrip would amount to $156. Would a total ticket purchase exceeding $100 count for the TD VI? I’m thinking I’m better off with the AMEX offer given the “each ticket” clause but wanted to make sure. Thanks!

Do you still get the credit if you are booking tickets for other people? To be more specific, is the credit linked to the credit card used to book the flight or to the Aeroplan account of the person flying?

Yes, you do. The credit is linked to the credit card used to book the flight.

“This offer does not apply to Quebec residents.”

Looks like this applies to CIBC as well as TD (which I’ve just added in now). That’s a real shame, I guess as with other non-Quebec offers it’s due to the consumer protection laws that make it challenging for companies to incentivize spending.

This there a way to check on your Aeroplan account that the registration was successful? Would like to confirm this before booking tickets.

I’d recommend just going to the registration page and re-registering if you aren’t sure.

Let’s say I book four $100 tickets for four people using TD AP VI. The charge on my AP VI would be a single charge of $400. Would TD be able to see that I’ve actually booked four tickets and credit me with $100 in statement credits?

Yes – flight information gets transmitted as part of an airline purchase; you can often see these on your credit card statements.

Following L Lau’s question, if I was to book two round-trip tickets from YVR-YYZ totalling, say, $400, would I get $100 in statement credits, or do I need to book four one-way tickets at $100 each (ugh)?

An update (or a datapoint, I guess): I booked one ticket for one person on a roundtrip journey YYZ to YYC in December. One $25 credit has been applied on my TD Visa Infinite. I made the mistake of booking one roundtrip (ie. one ticket) instead of two one-ways (ie. two tickets). To rub salt on the wound, I could’ve saved a bit on the return leg by only paying GST instead of HST!