Earlier this year, RBC® released new offers on its trio of Avion personal credit cards: the RBC® Avion Visa Infinite†, RBC® Avion Visa Platinum†, and the RBC® Avion Visa Infinite Privilege†.

This time, we’ve seen a return to the record-high welcome bonus that was available for much of last year. However, these great offers are only valid through April 30, 2024, which leaves a short window of opportunity to take advantage of these sky-high bonuses.

RBC® Avion Visa Infinite†: Up to 55,000 Avion Points!†

There’s once again a record-high offer available on the RBC® Avion Visa Infinite†.

Until April 30, 2024, you can earn a welcome bonus of up to 55,000 Avion points,† structured as follows:

- Earn 35,000 Avion points upon approval†

- Earn 20,000 Avion points upon spending $5,000 in the first six months†

The card’s $120 annual fee isn’t rebated as part of this current offer; however, that shouldn’t dissuade you from applying since the offer is so lucrative.

We value RBC® Avion points† at 2 cents apiece, given their flexibility and frequent transfer bonuses to airline loyalty programs.

Using this valuation, we’d estimate that the record-high welcome bonus of up to 55,000 RBC® Avion points† is worth at least $1,100. Subtract the $120 annual fee from that, and we’d value the current offer at a minimum of $980, which is outstanding.

With this offer, you’ll get a large chunk of the welcome bonus upon being approved for the card.† Then, you have a full six months to meet the $5,000 minimum spending requirement to unlock the second allotment of 20,000 points.†

That averages out to $833 per month for six months; however, if you have any large purchases coming up, you can unlock the full welcome bonus even sooner.

If you haven’t yet added the RBC® Avion Visa Infinite† to your portfolio, head to the RBC website to learn more.

- Earn 35,000 RBC Avion points† when you get approved for the card

- Plus, earn 20,000 RBC Avion points† upon spending $5,000 in the first six months

- Earn 1.25x RBC Avion points† on qualifying travel purchases

- Transfer RBC Avion points to British Airways Executive Club and other frequent flyer programs for premium flights†

- Redeem Avion points for flights with the RBC Air Travel Redemption Schedule†

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $120†

RBC® Avion Visa Platinum†: Up to 55,000 Avion Points† with No Minimum Income†

The RBC® Avion Visa Platinum† is the entry-level product in the Avion family; however, it’s similar to the flagship Visa Infinite† in many ways.

Currently, its welcome bonus is also set at up to 55,000 Avion points†, with the same structure:

- Earn 35,000 Avion points upon approval†

- Earn 20,000 Avion points upon spending $5,000 in the first six months†

There are a few minor differences between the RBC® Avion Visa Platinum† and the RBC® Avion Visa Infinite†, including the following:

- The Visa Infinite† earns 1.25 Avion points per dollar spent† on eligible travel purchases, whereas the Visa Platinum† earns a flat 1 Avion point per dollar spent† on all eligible purchases

- The Visa Platinum† offers a less comprehensive insurance package – emergency medical insurance and mobile device insurance aren’t included, whereas they are included on the Visa Infinite†

- The Visa Platinum† doesn’t offer the unique dining, hotel, and events benefits that are exclusive to Visa Infinite† cards

However, the most important difference is that the RBC® Avion Visa Platinum† has no minimum income requirement, so this would be the right choice for you if you don’t meet the $60,000 or $100,000 in personal or household annual income, respectively, required for the Visa Infinite.†

- Earn 35,000 RBC Avion points† when you get approved for the card†

- Earn 20,000 RBC Avion points† upon spending $5,000 in the first six months†

- Earn 1 RBC Avion point per dollar spent† on all purchases

- Transfer RBC Avion points to British Airways Executive Club and other frequent flyer programs for premium flights†

- Redeem RBC Avion points with the RBC Air Travel Redemption Schedule†

- No minimum income requirement

- Annual fee: $120†

RBC® Avion Visa Infinite Privilege†: Up to 55,000 Avion Points† + VIP Benefits

The high-end premium product in the Avion family, the RBC® Avion Visa Infinite Privilege†, has the same welcome offer as the other two personal Avion cards in RBC’s lineup.†

You’ll earn up to 55,000 RBC® Avion points with the current offer†, structured as follows:

- Earn 35,000 Avion points upon approval†

- Earn 20,000 Avion points upon spending $5,000 in the first six months

The welcome bonus of up to 55,000 Avion points† surely outweighs the $399 annual fee on this card, although it’s not quite as good of a deal as only paying a $120 annual fee on the lower-tier Visa Infinite† or Visa Platinum† cards.

Moreover, the $200,000 minimum personal or household income requirement may be prohibitive for some applicants.

Nevertheless, if you’re looking to earn 1.25x Avion points on all purchases†, and try out the ability to redeem points directly against premium fares at 2 cents per point, now’s as good of a time as any to apply for the RBC® Avion Visa Infinite Privilege† with this bonus in play.

- Earn 35,000 RBC Avion points† when you get approved for the card†

- Then, earn 20,000 RBC Avion points† upon spending $5,000 in the first six months†

- Plus, earn 1.25x RBC Avion points† on all qualifying purchases

- Use your rewards for any business class flight with no restrictions on dates, seats, or airlines†

- Transfer points to one of four airline partners†

- DragonPass membership with six free lounge visits per year†

- Minimum income: $200,000 personal or household†

- Annual fee: $399†

The Best Ways to Redeem RBC® Avion Points†

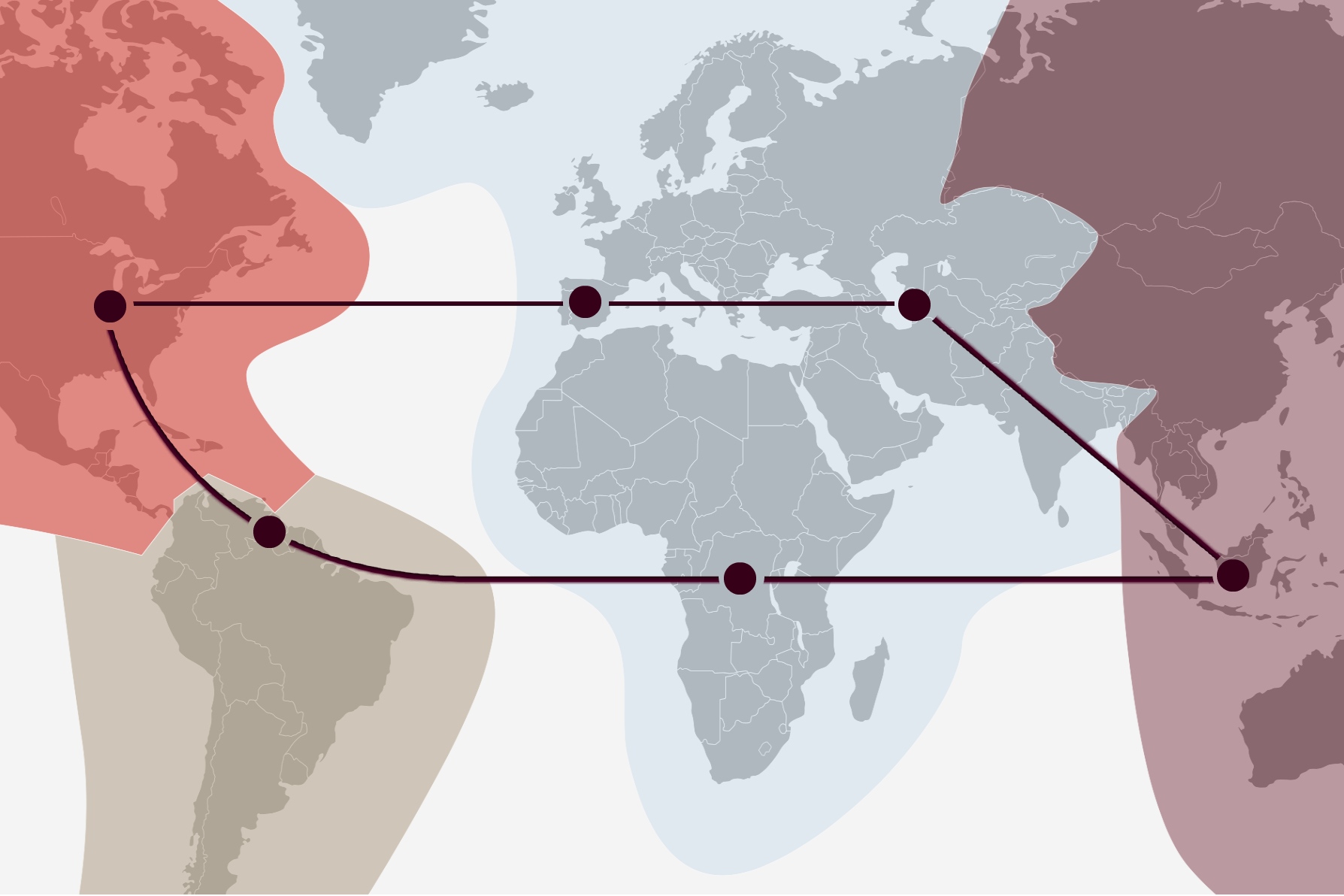

RBC® Avion is one of two transferable points currencies in Canada, which allows you to transfer the points you earn from any of these Avion cards to four frequent flyer programs:

- 1,000 Avion points = 1,000 British Airways Avios

- 1,000 Avion points = 1,000 Cathay Pacific Asia Miles

- 1,000 Avion points = 700 American Airlines AAdvantage miles

- 1,000 Avion points = 10 WestJet dollars

Therefore, you have the option of converting the 55,000 Avion points† you’d earn from the welcome bonus into any of the following:

- 55,000 British Airways Avios

- 55,000 Cathay Pacific Asia Miles

- 38,500 American Airlines AAdvantage miles

- 550 WestJet dollars

On top of the usual transfer ratios, RBC® is known for offering occasional transfer bonuses of 20%, 30%, or even 50% to its transfer partners.

If you’re wondering what 55,000 Avion points can get you, you may be happy to hear that it’s more than enough for a one-way flight in business class from Eastern North America to Spain on Iberia, assuming you can find off-peak award availability.

In addition, RBC® features Air Travel Redemption Schedule, which allows you to redeem a fixed number of points for a flight to a certain region with a maximum cash ticket cost allowance.

With this chart, the value is capped due to the maximum ticket cost, so it’s generally recommended to maximize your opportunities with RBC®’s frequent flyer partners instead.

Indeed, that’s where the bulk of the value in the Avion program lies, since you can transfer to any of their partners for a desired booking and aren’t locked in to a single loyalty program.

If, however, you find yourself in a situation in which you’re looking to book a one-way or round-trip flight within Canada and the mainland US, and you aren’t able to find any satisfactory options via British Airways Executive Club or WestJet Rewards, then the RBC® Travel Redemption Chart is a solid option.

It’ll allow you to use the 55,000 points† from one of the RBC® Avion cards to cover the base fare of any flight within North America, including Hawaii and Alaska, up to a maximum of $1,100, so that you don’t have to worry about any award availability constraints.

Conclusion

The welcome bonuses on RBC®‘s major Avion credit cards have been set at up to 55,000 Avion points† across the board, matching the all-time high.†

If you’re able to combine the offers with a potential transfer bonus to one of RBC®’s frequent flyer partners, or if you can leverage the RBC Air Travel Redemption Schedule, you’re all set to be booking some spectacular travel in 2024 and beyond.

Be sure to take advantage of these offers by April 30, 2024, which is when they’re set to expire.

†Refer to the RBC® website for up-to-date offer terms and conditions.

†This post contains affiliate links. Please read our disclaimer for more info.