CIBC's travel rewards program with its own flight redemption chart offering strong value, plus a flexible travel portal as a backup option. Not a transferable currency – there are no airline or hotel transfer partners.

Our Valuation

1 cents per point

No transfer partners, but CIBC's own flight chart delivers up to 2.3 cents per point on premium cabin bookings. The travel portal gives a 1-cent floor on any travel purchase, so your points are never worth less than that.

Last updated: February 6, 2026

CIBC Aventura® is the flagship travel rewards program by the Canadian Imperial Bank of Commerce, which can only be earned on CIBC's Aventura-branded credit cards.

CIBC Aventura® is a fixed-value points currency, meaning that points can be redeemed only at a fixed value, through multiple ways.

These aren't necessarily the points to use for luxury hotels and First Class flights; however, they're great to offset the cost of other travel expenses, including boutique hotels, train tickets, economy flights, and other incidentals.

CIBC Aventura Credit Cards

Welcome bonus: 70,000 Aventura Points

Annual fee: $120

First-year value

$1,050

Welcome bonus: 45,000 Aventura Points

Annual fee: $139

First-year value

$480

Welcome bonus: 45,000 Aventura Points

Annual fee: $139

First-year value

$480

Welcome bonus: 80,000 Aventura Points

Annual fee: $499

First-year value

$276

Welcome bonus: 12,500 Aventura Points

Annual fee: No fee

First-year value

$130

Beyond signup offers, you can earn CIBC Aventura Points through daily spending on the above credit cards. The earning rates are as follows:

Earning 1.5 Aventura Points per dollar spent on gas and groceries is quite good, and unless you spend quite a bit in those categories, it's not necessarily worth paying a $499 annual fee to earn 2 points per dollar on the CIBC Aventura® Visa Infinite Privilege* Card.

If you’re looking to offset cash expenses for travel, such as tours, cruises, short-term rentals, or independent hotels, then redeeming Aventura Points directly against other travel purchases is an excellent use.

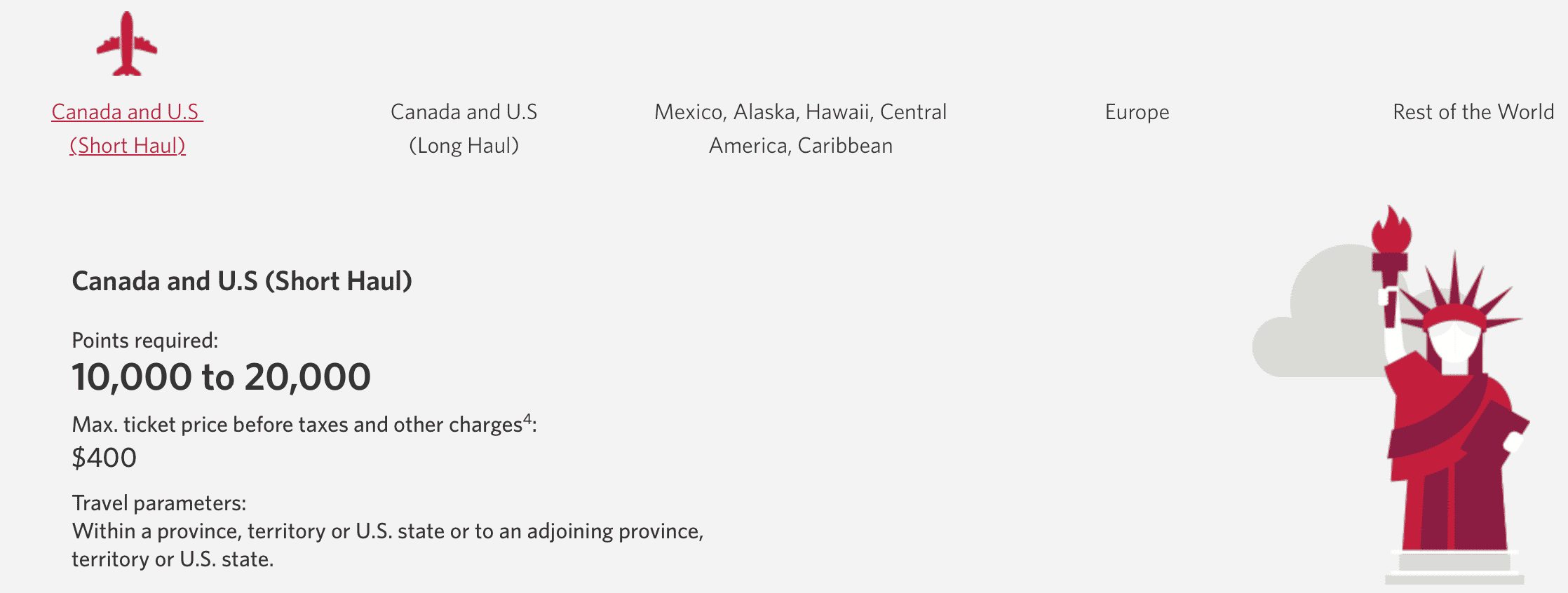

You can apply the number of points indicated on the chart to any cash ticket at or below the maximum ticket price that CIBC dictates.

For example, for short-haul flights in Canada and the U.S., you'll need 10,000–20,000 Aventura Points to book a one-way flight with a maximum cash ticket price of $400.

Note that the maximum ticket price only includes the base fare, and does not apply to any additional taxes and fees. If you wish to apply points towards the additional taxes and fees, you can at the fixed travel rate of 1 cent per point.

Redeeming points this way results in a value of up to 2.29 cents per point.

50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

How to Maximize the CIBC Aventura Airline Rewards Chart

Read moreYou might be wondering why flights are included if there's already a flight reward chart above. Well, CIBC's online travel portal can be limited in airlines it displays, so if you wish to redeem on low-cost-carriers or for flights with smaller airlines like Harbour Air, you'll have to do so via calling in to the CIBC Rewards Travel Centre.

If you’re using Aventura Points to redeem for hotels or car rentals, the usual warnings of using an online travel agency apply.

You won’t earn any hotel status benefits or accrue elite qualifying nights at hotels. For car rentals, you won't earn things like Hertz points or free rentals through National Free Days.

This doesn’t apply to airfare, though, as you’ll still accrue the same amount of elite qualifying miles, segments, and dollars. As long as you have your frequent flyer number attached to your booking, or add it in at the check-in counter, your travel should count towards elite status qualification.

One major thing to note about using CIBC to book airfare is that any and all changes and cancellations must be done through the third-party booking agency, and can't be done through the airline.

Considering all of the above, it’s still worthwhile to book car rentals or hotels, especially if it’s a one-off rental agency you're not concerned about accruing status for.

Similarly, if you're planning to stay at a boutique hotel where there’s no such thing as status, then booking through CIBC Travel won't make a difference.

Redeeming for these financial instruments is done using the "pay with points" feature in CIBC's online banking interface.

This doesn't take into account any additional points or savings you could accrue through the Aeroplan eStore and cash back portals, among others.

With gift cards, it's almost always going to come out to 0.71 cents per point in value. The only exception to this is redeeming for CIBC prepaid Visa cards, which have the lowest redemption value at just 0.63 cents per point.

Simply apply your using points in the CIBC online banking interface using the "pay with points" feature.

Needless to say, redeeming points at 0.63 cents each is a bad idea, and you'd be much better served with a cash back card.

Due to the nature of such redemptions, it's difficult to assign a cent per point value, but some of the bids can end up being quite reasonable. So, it's always worth a look to see if nobody is bidding for what's sure to be a good time.

Otherwise, you can think of CIBC Aventura Points as a stop-gap for miscellaneous travel purchases on your travels around the world, between traipsing from hotel to hotel and flight to flight.

Use them for train tickets, entrance fees, and all the other incidentals you may rack up on your journey.

†Terms and conditions apply. CIBC is not responsible for maintaining the content on this site. Please go to CIBC.com for the most up to date information.

First-year value

$1,050

Annual fee: $120First Year Free

• Earn 30,000 points on first purchase

• Earn 40,000 points upon spending $35,000 in the first 12 months

Earning rates

Annual fee: $120First Year Free

• Earn 30,000 points on first purchase

• Earn 40,000 points upon spending $35,000 in the first 12 months

Earning rates