Whenever you make a flight booking, it’s a good idea to look at a breakdown of the total cost to see what you’re actually paying for.

The taxes and fees that you pay when booking a flight vary widely, and are dependent on the airline you fly with, the class of service you’re in, and the airport, province, territory, or country you depart from. In some situations, it amounts to next to nothing, while in others, it adds a significant cost.

Here’s an overview of the most common taxes, fees, and surcharges found on air travel bookings.

In This Post

Government Imposed Taxes and Fees

Many of the extra fees on airline tickets are imposed by governments around the world.

Taxes

From a Canadian perspective, the most obvious culprits are the Goods and Services Tax (GST) and Harmonized Sales Tax (HST). While this doesn’t have much of an impact on award bookings, depending on the cost of the base fare of a paid ticket, it could become sizeable.

In the context of transportation or means of conveyance, the Canada Revenue Agency (CRA) defines the country’s taxation area as Canada, the United States (except Hawaii), and the islands of St. Pierre and Miquelon. To put it simply, the following journeys are subject to Canadian taxes:

- Flights wholly within Canada

- Flights from Canada to the US

- Flights from Canada to St. Pierre and Miquelon

Note that journeys originating from the US and St. Pierre and Miquelon follow the tax rules of their respective jurisdictions. In other words, Canadian taxes don’t apply to them, even on the return trip.

While the Canadian federal government has blanket rules on taxing transportation, provinces and territories have varying rules and participation. Therefore, the amount of GST or HST you must pay is determined by the city of origin on your booking.

For example, a one-way booking from Vancouver to Toronto incurs a 5% GST cost, while a one-way booking from Toronto to Vancouver incurs a 13% HST cost.

For round-trip bookings, the tax amount is based on the city of origin for the entire booking. So, if you were to book from a city in a province with a lower tax burden, such as Calgary, you’d wind up paying less than from a city in a province with a higher tax burden, such as Toronto.

Suppose flights between Calgary and Toronto have a total cost, inclusive of the base fare and fees, of $100 per direction. For the purposes of this example, we’ll ignore the fact that you get charged HST on the Airport Improvement Fee in Toronto and GST on the Airport Improvement Fee in Calgary.

Booking two one-way flights between Toronto and Calgary would incur a total of $18 paid in taxes (5% GST for the Calgary–Toronto flight and 13% HST for the Toronto–Calgary flight), whereas booking the same flights round-trip out of Toronto would incur a total of $26 (13% HST for both legs).

While this particular example was done with a low fare, as the cost of the ticket increases, so would the amount of taxes charged on the booking. Depending on your province of origin, it may be worthwhile to consider booking two one-ways instead of a round-trip.

For example, the total sales tax for business class flights between Halifax and Vancouver might cost $375 if booked as a round-trip or $252 if booked as two one-ways. Indeed, there are many better ways to spend $123 on a trip than simply forking it over in taxes.

The same concept applies for international bookings. Government taxes on the base fare of the entire booking are dictated by the ticket’s country of departure.

Say you book a return ticket between Toronto and New York. Since the contiguous US is part of Canada’s taxation area and you’re travelling from Canada, the base fare of your entire ticket, including the return trip, is charged 5% GST.

Conversely, if you’re purchasing a ticket from New York to Toronto and back, your entire itinerary isn’t subject to Canadian taxes, since your country of origin is the US.

In the same manner, tickets to international destinations outside Canada’s taxation area are “zero-rated” or exempted from taxes. Hence, if you’re booking a ticket from Toronto to Tokyo, you won’t pay any Canadian taxes on your base fare.

Even if your ticket to Tokyo has a domestic flight component between Toronto and Vancouver, you won’t pay Canadian taxes on your base fare, long as the flights are on one continuous itinerary.

Further, even if you choose to do a stopover of more than 24 hours in one or more Canadian cities, your ticket’s base fare won’t incur Canadian taxes, if the final destination on the same ticket is outside Canada’s taxation area.

To illustrate, if your ticket is Toronto–Calgary–Vancouver–Bangkok, and you choose to stay more than 24 hours each in both Calgary and Vancouver, your ticket still won’t be subject to Canadian taxes. This is because your ticket’s final destination is Bangkok.

Security Charges

Another charge common to bookings around the world is some form of security charge.

In Canada, the Air Travellers Security Charge (ATSC) was introduced after the 9/11 attacks in New York City. This fee is meant to offset the additional security expenditures in airports that keep the travelling public safe.

The charge depends on your origin and destination:

- Up to $9.94 per direction within Canada

- Up to $16.89 for flights between Canada and the continental United States

- $34.42 for travel outside of “the continental zone”

In the United States, the similar September 11 Security Fee is currently $5.60 (USD) per one-way trip that originates in the United States.

Next time you’re standing in an endless line waiting to unpack your bags and have your body scanned, remember that you’ve paid for this privilege. Alternatively, apply for a NEXUS card for shorter lines and an expedited experience, including through the Canadian Verified Traveller program.

Arrival & Departure Fees

Some countries also impose fees on passengers during either their departure or arrival, or in some cases, for both. The amount you pay is sometimes also tied to your class of travel.

One of the most well-known examples is the so-called “luxury tax” for passengers departing from the UK. Known as the UK Air Passenger Duty, the amount paid depends on how far you’re travelling and the class of service you’re travelling in.

For example, a passenger flying in economy from London to Toronto would pay a total of ~$150 (CAD) for the UK Air Passenger Duty, while a passenger on the same flight in business class would pay ~$331 (CAD).

Planes that weigh more than 20 tonnes equipped to carry fewer than 19 passengers would have to pay around ~$991 (CAD) per passenger.

Similarly, when flying to or from countries that generate a lot of revenue from tourism, you may notice a host of extra fees added to your booking. In some cases, they can add up to fairly significant amounts.

For example, many countries in the Caribbean are notorious for adding on extra fees for air passengers.

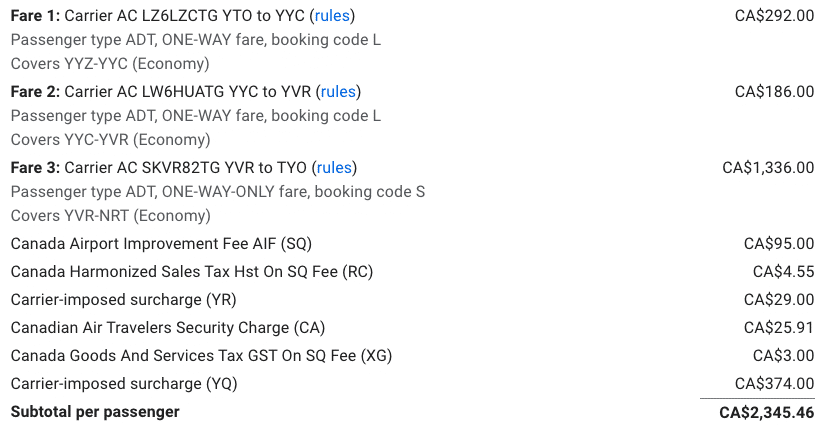

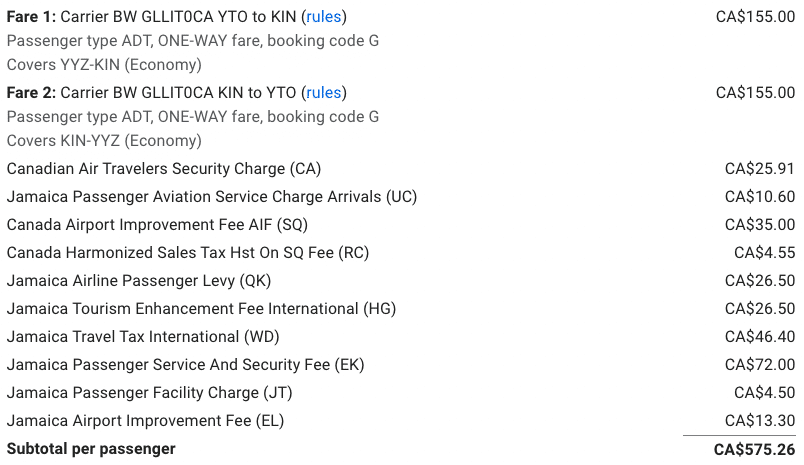

Using ITA Matrix, you can see that a round-trip ticket between Toronto and Kingston, Jamaica will yield the following fare calculation:

Of the 10 additional surcharges on this ticket that total $265.26 (CAD), those from Jamaica add up to $199.80 (CAD), or 34% of the total cost of the ticket.

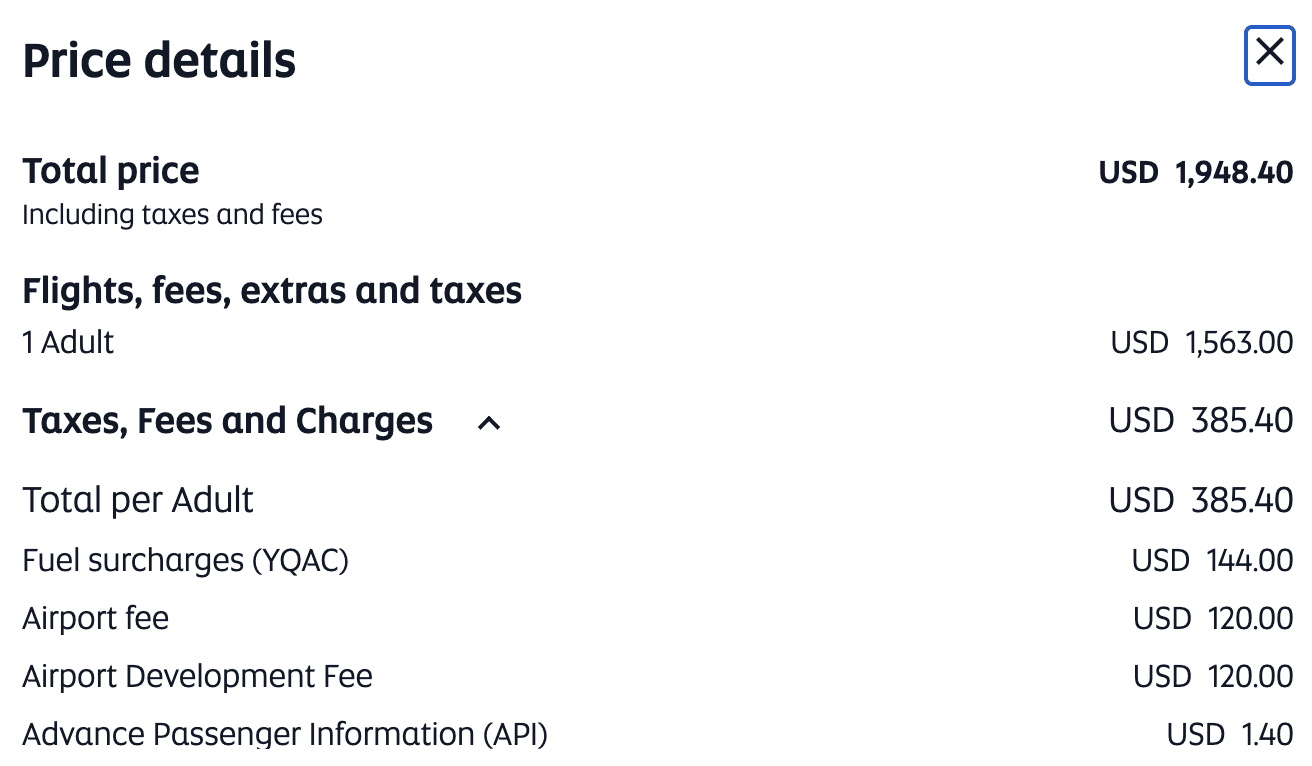

Another example of incremental taxes and fees comes from the Maldives. Booking a departing flight in economy from Malé to Abu Dhabi will incur an additional $100 (USD) in fees, structured as a Maldives Departure Fee ($50 USD) and a Maldives Airport Development Fee International Departures ($50 USD).

Taking the same flight in business class bumps the cost up to $240 (USD) ($120 for each of the same fees).

Therefore, not only will you be paying a premium for that overwater villa, but depending on the class of service in which you depart from the country, you’ll have to shell out some extra cash.

On the other hand, in many cases, you’re exempted from paying an arrival or departure tax, or you’re subjected to lower fees, if you’re only transiting in that country or airport.

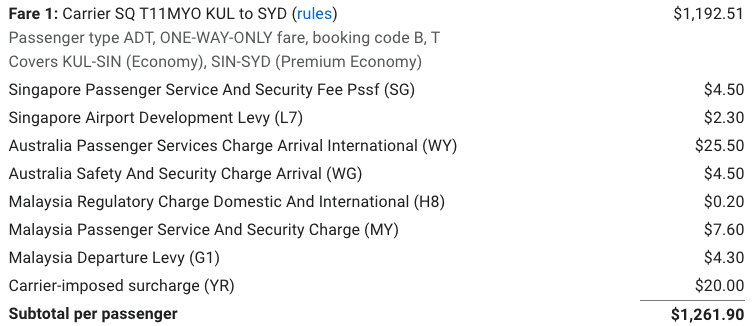

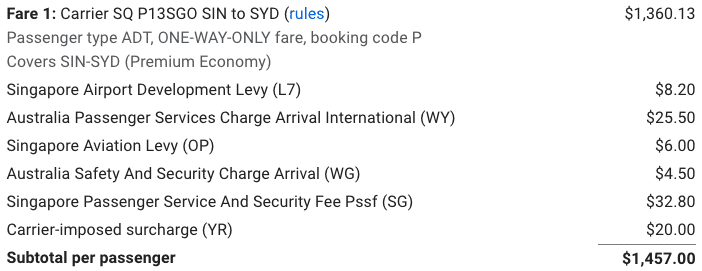

For example, Changi Airport in Singapore charges significantly lower fees for transit passengers versus departing passengers.

As a transit passenger, you’ll only incur $6.80 (USD) in fees from Singapore…

Whereas if you’re departing from Singapore, the amount adds up to nearly $50 (USD).

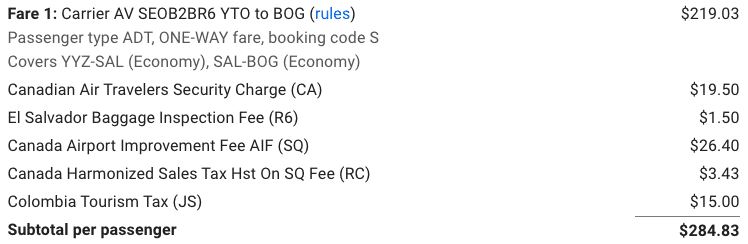

In the same manner, if you’re only connecting through San Salvador, you’re exempted from paying El Salvador’s hefty fees and taxes.

For example, flying from Toronto to Bogotá via San Salvador might only incur a $1.50 (USD) Baggage Inspection Fee from El Salvador…

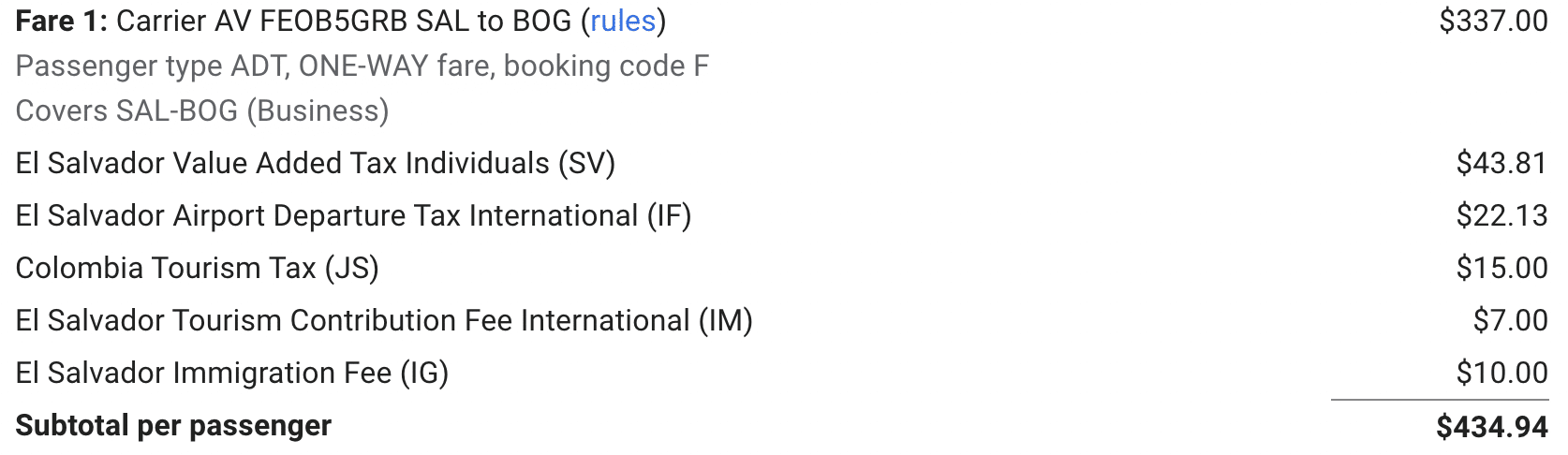

Whereas flying non-stop from San Salvador to Bogotá might incur a total of around $83 (USD) in taxes and fees from El Salvador.

Usually, a transfer or layover is defined as a stop in a city with a duration of less than 24 hours, consistent with international airline ticketing conventions.

If you exceed 24 hours in a city, your stay then becomes a stopover, and you’ll likely be charged the usual departure and/or arrival taxes.

Airport Improvement Fees

In Canada, most regional and major airports charge an Airport Improvement Fee (AIF) of between $2–42 to help maintain the airport’s infrastructure and expand to meet a growing passenger demand. Many airports have a detailed explanation on their website justifying the fee, as they need to get money somehow.

Airport Improvement Fees are especially contentious in Canada, since they’re higher than in the US and many other countries. Canadian passengers are said to be paying among the highest airport user fees in the world for domestic flights.

As a slight consolation, you may pay less in Airport Improvement Fees for short layovers in Canadian airports.

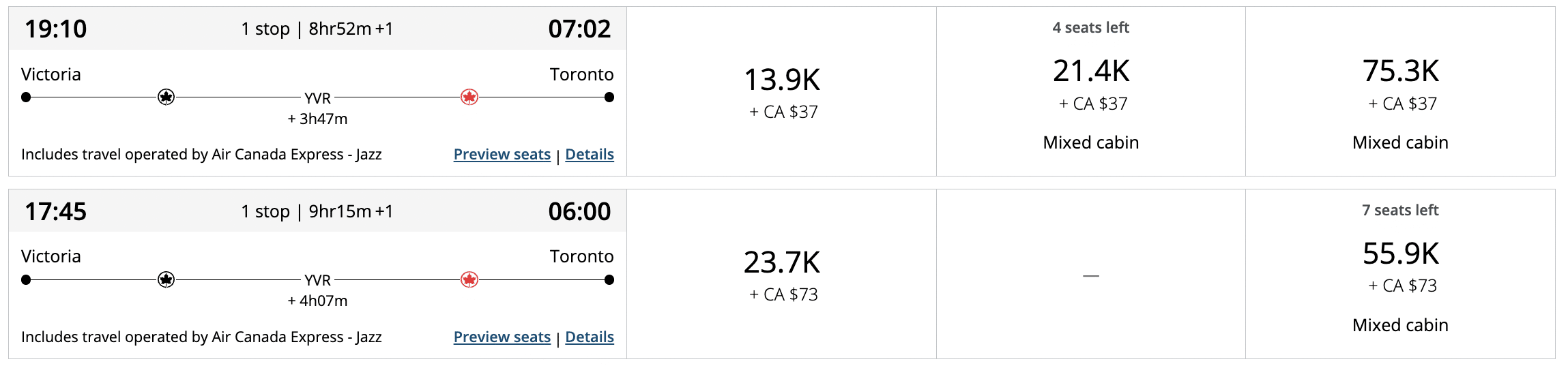

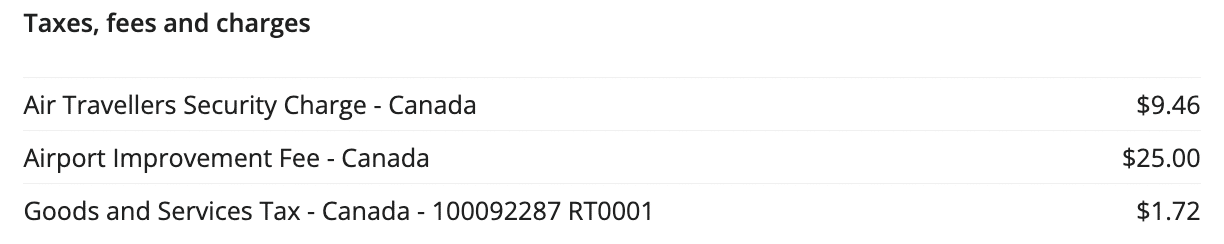

For example, at Vancouver International Airport, a layover of less than four hours costs around $36 less in total taxes and fees than a layover of more than four hours.

The fee breakdown on the payment page shows that the booking with a shorter layover was only subject to a $25 Airport Improvement Fee and a $9.46 Air Transportation Security Charge (ATSC).

Meanwhile, the longer layover is subject to a total of $50 in Airport Improvement Fees and a $18.92 ATSC. This appears to mean that you’re getting charged the Airport Improvement Fee for both Victoria ($25) and Vancouver ($25), as well as two ATSC charges, for layovers of longer than four hours.

Indeed, this seems to be the case in other airports in Canada, too:

- YYC’s website states that the $35 Airport Improvement Fee isn’t charged to domestic passengers with a connection of less than four hours or to international passengers with connections of less than 24 hours

- YYZ charges $35 for departing passengers and $7 for connecting passengers

If you enjoy spending time lounging in and exploring airports, the length of time on your layover may add a few extra dollars to your total cost, so be mindful of this as you’re planning out your trips.

Airline Imposed Charges

Carrier-imposed surcharges have long been the bane of points enthusiasts’ existences.

Airlines justify charging fuel surcharges as a way to protect themselves from volatile fuel prices, increased costs during peak travel periods, and unpredictable operational costs. In other words, it’s a way for them to generate more money to use how they see fit.

Unfortunately, with air travel largely deregulated around the world, airlines have free rein in deciding how much they’d charge. However, some countries may regulate these surcharges, or ban them outright, especially if market forces say they’re unwarranted.

Canada is one of the countries where air travel is largely deregulated, and you’ll always be on the hook for surcharges airlines may decide to charge.

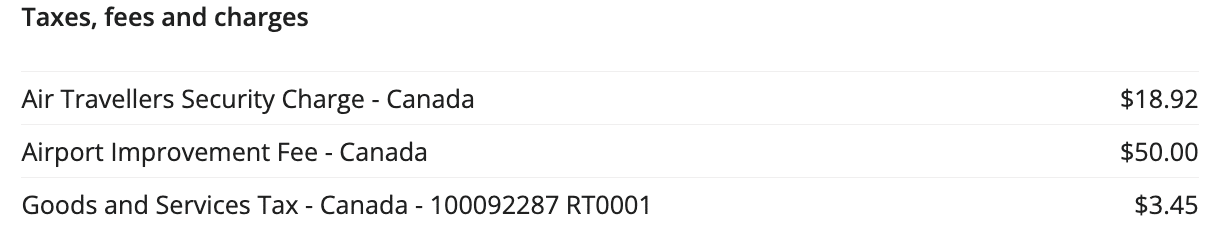

For instance, WestJet is known for its “Other ATC” or Other Air Transportation Charges, which it levies even on redemption tickets. It’s not entirely clear what’s included in the charges.

In some cases, the amount indicated on the Other ATC line may even exceed the base fare.

Recently, some travel agents have accused airlines of charging minuscule base fares and higher carrier-imposed surcharges to dodge paying out commissions to travel agents. Since travel agents only make commission on base fares, and not on carrier-imposed surcharges, some argue that this is a sneaky way for airlines to keep money for themselves, rather than paying it out to industry partners.

Conclusion

Taxes and fees are something that can’t be avoided when paying for an airline ticket.

Some of the fees imposed by governments go towards paying for the cost of keeping travellers safe or for using government-run facilities. Others seem like a revenue-generating mechanism to line the coffers of government accounts.

While the most frustrating fees are the ones imposed by airlines or airports, we must come to accept them as part of the cost of travel, and something we should be willing to pay – while still doing our best to avoid them whenever possible.

Very interesting, thank you . I’m cynical about the YQ charge, figure it has just been moved somewhere else less visible eg higher number of points needed for a reward.

Great write up as always, T.J.!

Good eye T.J.! Was never aware that the “Airport Improvement Fee amount depended on the length of layover at the airport”

That caught my eye as well. Thanks for the article TJ.