At the start of 2018, I wrote an article titled “Why Marriott Rewards Is So Hot Right Now”. The old Marriott Rewards program, having added the ability to transfer points freely with the now-defunct Starwood Preferred Guest as the two hotel programs sought to complete their merger, was providing Canadian travellers with spectacular opportunities to earn and redeem hotel points at an excellent value.

It’s fair to say that things have mostly gone downhill since then, and that the introduction of Marriott Bonvoy as the successor to both Marriott Rewards and SPG has brought with it more negative than positive developments for the savvy hotel points collector.

Many of those negative changes were understandable, or even expected, given that the previous arrangement was probably overly generous; however, several other changes seem to be overly punitive towards Marriott’s most loyal members, resulting in a huge decline in the value of the program compared to yesteryear.

In this post, I wanted to outline the major challenges that face Marriott Bonvoy members these days, what little pockets of value still remain, and what the overall hotel points strategy looks like for Canadians hoping to score some free nights along their travels.

Harder to Earn…

Marriott points used to be extremely easy to come by, but they’ve gotten harder to earn as time goes by. That in itself isn’t surprising – after all, ongoing devaluations in almost every points program are a fact of life in the Miles & Points landscape.

What does raise eyebrows, however, is the sheer pace at which the many opportunities for earning Marriott points have evaporated before our eyes. Over only the past 18 months or so:

-

The popular Chase Marriott Visa was discontinued as Chase exited the Canadian market, taking with it the opportunity to earn 50,000 Marriott points as a signup bonus

-

The transfer ratio from Amex MR and MR Select points to Marriott points, which used to be effectively 1:1.5 (2:1 to Starwood Preferred Guest, and then 1:3 to Marriott Rewards), was slashed by 20% to 1:1.2

-

The earning rate on general purchases on the Amex Bonvoy personal and business cards, which used to be effectively 3 Marriott points per dollar spent (since it was 1 Starpoint per dollar spent when they were branded as the Amex SPG cards), was slashed by 33% to 2 Marriott points per dollar spent

-

The signup bonus on the Amex Bonvoy Cards, which used to be effectively 60,000 Marriott points (since it was historically 20,000 Starpoints when they were branded as the Amex SPG cards)… very briefly remained at that level when Bonvoy was first introduced, before dropping down by 16% to 50,000 Marriott points

-

Great Canadian Rebates used to consistently offer $50 cash back on the old Amex SPG cards, but the cash back offers on the Amex Bonvoy cards have been very subdued and inconsistent as of late, fluctuating at seemingly random intervals between $0 and $20

While this is a pretty shocking list of negative changes to take place in such a short time, they have, to be fair, been at least partially offset by the emergence of Amex MR Select points in recent years, which can be earned via the Cobalt Card or the newly-introduced Business Edge Card, and then transferred into Marriott Bonvoy at the ratio of 1:1.2.

…and Harder to Redeem

On that last point, though, the question that collectors of MR Select points often face is whether it’s even worthwhile to transfer their points to Marriott, because the program has also seen a sharp decline in value on the redemption side as well.

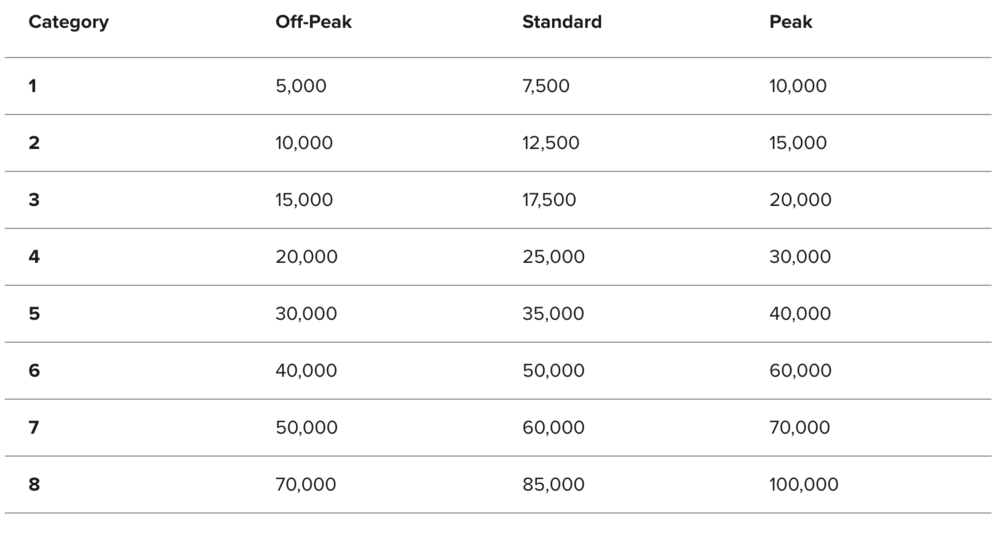

Nominally speaking, the top-tier Category 9 in the old Marriott Rewards program had once cost only 45,000 points per point, but nowadays the top-tier Category 8 costs 85,000 points per night at the standard rate and even 100,000 points on peak dates.

I think we can give Marriott some leeway here, though – after all, the merger with Starwood brought into the portfolio a wide range of hotels from St. Regis, W Hotels, Luxury Collection, etc., which you’d generally think of as more luxurious than a JW Marriott or an Autograph Collection property. I’d say that Marriott did a pretty fair job in recategorizing their new combined portfolio of 7,000+ hotels into a single eight-tier award chart, at least originally in August 2018.

However, the multiple rounds of changes that took place in subsequent months did not make for pretty viewing, even if we knew to some extent that these changes were coming.

March 2019, shortly after Bonvoy was introduced, brought about the first major reshuffle of hotel categories, which saw far more price increases than price decreases – some of the more cynical observers commented that Marriott had purposefully introduced a seemingly favourable state of affairs back in August 2018, only to implement the merciless devaluations they were always looking to implement barely six months later.

Then, in September, we saw a two-pronged change in the form of the introduction of peak and off-peak awards, as well as a drastic change to the Points Advance policy.

Peak and off-peak dates makes the program more dynamic in nature, cutting away at one of the main advantages of having a fixed award chart, which is that you can get great value from your points by redeeming them when the cash price would otherwise be very high.

Meanwhile, the Points Advance changes were understandable in the sense that the policy was probably far too generous to begin with, but still, the current policy that “Points Advance locks in the room, not the rate” seems to defeat the entire purpose of the feature to begin with, and one wonders if there were possibly any less heavy-handed methods of reining things in.

All that is merely what’s going on at the surface level. We’re constantly hearing all sorts of stories of individual Marriott hotels playing games with award availability to discourage points redemptions – for example, One Mile at a Time reports a case of a hotel setting up one specific room category that’s available for award bookings and yet zeroing out that room type across the board, even though the exact same room is bookable for cash under a different category name.

Marriott hasn’t helped themselves here either, as they have allowed their hotels to get away with things by setting loose policies at the corporate level – for example, by allowing individual hotels to set their own peak and off-peak dates and to make changes to those dates on an ongoing basis.

What’s Still Good About Marriott Bonvoy?

Alas, Marriott Bonvoy still ranks by quite some distance as the easiest hotel loyalty program for Canadians to participate in, so we’d be much better served by focusing on the sweet spots that do remain in the program, instead of turning away from it entirely.

One easy way of continuing to extract value out of the program is through the US-issued Amex Bonvoy credit cards: the Amex US Bonvoy Brilliant and the Amex US Bonvoy Business. US-issued cards don’t grant repeat signup bonuses, so it’s a no-brainer to grab these cards (look out for when they have elevated signup bonuses of 100,000 Bonvoy points) and keep them around forever.

The US Bonvoy Business gives you an anniversary free night certificate worth up to 35,000 Bonvoy points every year in exchange for a US$125 annual fee, while the US Bonvoy Brilliant gives you an anniversary free night worth up to 50,000 Bonvoy points, in exchange for a net US$150 annual fee after the US$300 in Marriott statement credits. You should be able to get multiple times’ your money’s worth with both of these certificates quite easily.

Despite all the changes that have taken place, Marriott Bonvoy also remains one of the most compelling programs for treating yourself to world-class luxury hotels for which you’d never consider paying cash. High-end resorts in places like the Maldives, Bora Bora, Aspen during ski season, or the Italian countryside during the summer can retail for upwards of $1,000+ per night, so redeeming points would be a far preferable option.

My personal favourite, of course, would be the Al Maha Desert Resort on the outskirts of Dubai, which is unparalleled in providing three complimentary meals and two desert activities per day in a unique oasis of tranquillity in the middle of the desert.

Remember, even the top-tier hotels within Marriott Bonvoy will be priced at off-peak rates at certain times of the year, so redeeming 70,000 points per night during these periods could earn you a very respectable return on your points as well as an unforgettable luxury experience.

Lower-end and mid-tier hotels can also represent good value on certain occasions, although I find that they more often than not fall short of the threshold of 1 cent per point (cpp) that I generally set for my Bonvoy points – especially when it’s the type of “average chain hotel in your average big city” kind of situation.

On these occasions, I’d much rather just pay cash and save my Bonvoy points for more valuable redemptions in the future, but if you’re more interested in using your points to save money as imminently as possible, then you might well select a lower threshold than 1cpp when deciding between cash and points.

Finally, I also think that Marriott Bonvoy’s elite program is still pretty compelling at the end of the day. You can easily earn 25 elite qualifying nights per year just buy having a credit card and booking a meeting at a Marriott hotel, so you only need 25 more nights to achieve Platinum Elite status, which comes with a host of benefits that are easily worth thousands of dollars per year.

The fact that there’s no annual spending requirement for any status level besides top-tier Ambassador Elite means that you can simultaneously stay at Marriott hotels mostly on points while also reaping the elite benefits – although now that I think about it, I should probably stop giving Marriott any ideas here…

Going Forward: The Hotel Points Strategy

As I mentioned, I’m still very much loyal to Marriott given their wide pool of high-end hotels and the generous elite benefits I receive when staying with them. However, after focusing my attention solely on Marriott for the past few years, I’ve admittedly started to look elsewhere in search for some more opportunities for redeeming points for free nights at a good value.

A majority of these efforts have involved looking south of the border to pick up US-issued co-branded credit cards with the other major hotel chains. As I wrote about in last week’s post on my US credit card journey, the Amex US Hilton cards, Chase IHG card, and Chase Hyatt card all offer viable alternatives to Marriott in your pursuit of hotel award nights.

You’ll also want to register for the various promotions that all of these hotel chains regularly offer, which can some provide you with extremely meaningful discounts when paying cash for your stay.

For example, Hilton is currently offering members that hold one of its Amex US co-branded credit cards a triple points promotion, which means you’ll earn a total of 54 points per USD spent at Hilton hotels if you have an Amex US Hilton Aspire Card (10 base points, 14 points for booking on your Aspire card, another 10 base points as an Aspire-conferred Diamond member, and a further 20 base points as a result of the promotion).

I value Hilton Honors points at 0.5 US cents per point, meaning that you’re effectively getting an instant 27% discount on all your Hilton hotel stays under this promotion – and that’s not even considering things like Amex offers, Amex Fine Hotels & Resorts benefits, cash back portals, or hotel-specific reservation codes that can bring the cost down even further!

Finally, one idea for offsetting the cost of your hotel stays that’s potentially out of left field is redeeming RBC Avion points for Hotels.com gift cards, often at a promotional rate that’s better than 1:1.

Yes, there are potentially better uses of RBC Avion points by transferring to programs like Avios or Asia Miles, but hey, with RBC Avion points being by far the easiest to rack up quickly out of the Big 5 banks, Hotels.com gift cards could definitely be a good way cash out some of your holdings in exchange for free hotel nights.

Conclusion

It’s sad to think of how loudly I had once sung the praises of the legacy Marriott Rewards and SPG programs, and how much their successor has spoiled the party for us in the short period since then.

While Marriott Bonvoy remains the first place I look when it’s time to book hotels, I’m definitely looking to diversify my hotel game these days; moreover, like I’ve touched upon before, the reality of my hotel bookings these days is that I’m often focused on optimizing my return on cash stays rather than redeeming points all the time, instead choosing to save my hard-earned points for truly special stays at memorable high-end properties.

Hey Ricky, would you be able to find out if Canada issued Marriott Bonvoy credit cards, who have both the personal and business, be able to get 30 elite nights? I know that in the USA, they have already offered this perks to their clients.

Thanks,

Unfortunately, the Canadian side has confirmed that this isn’t being offered for the time being. The only way to get the 30 elite nights is by getting personal and business US cards.

I’d love to see a follow-up post on the best status matches for those of us thinking of switching away from Bonvoy.

I would recommend reading the fine print to the Bonvoy Card. I had the SPG card in 2018 and cancelled it, and signed up for the Bonvoy in 2019. The sign up points were not awarded, and the agent confirmed this.

I would recommend not speaking with reps surrounding a sign-up bonus you are not entitled to.

I would recommend reading the fine print to the Bonvoy Card. I had the SPG card in 2018 and cancelled it, and signed up for the Bonvoy in 2019. The sign up points were not awarded, and the agent confirmed this.

I would recommend not speaking with reps surrounding a sign-up bonus you are not entitled to.

A few more negatives. As a Sheraton member I was able to get points in hotel restaurants while not staying in the Hotel. The new “Eat Around Town" program is only available to US customers. When I left a corportate job many years ago, Sheraton told me I can use the corporate number for life – not sure what is happening with that.

The problem with the Canadian AMX is the foreign exchange surcharge. If I used an AMX card anywhere but Canada, I pay 2.5% more on my expenses.

when can we expect the review pn the yacht collection Ricky?

when can we expect the review pn the yacht collection Ricky?

Dumb question but the annual $300 statement credit for the US Bonvoy Brilliant, I assume you can apply that against paying cash for a room (and not just for incidentals)? T&Cs weren’t totally clear to me.

Yes, it applies against any Marriott hotel charges, so it’s essentially as good as cash if you spend at least US$300 with Marriott per year.

Even more unfavourable Marriott changes.

https://loyaltylobby.com/2019/10/29/marriott-bonvoy-program-terms-conditions-changes-october-30-2019/?omhide=true

I remember when there used to be a hidden link to the chase visa that would give 80k Marriot, should’ve churned that more haha

I remember when there used to be a hidden link to the chase visa that would give 80k Marriot, should’ve churned that more haha

That’s how I got started with Marriott. That was a decent card for the no foreign exchange fee too. I think I got like 3 or 4 certificates out of that card too and only ever paid one yearly fee. It’s no wonder Chase left the market. I think overall they were just losing way to much money between the Marriott, Amazon and Sears branded cards.

I had forgotten about that! Those were the good old days.

There’s currently an active Amex offer of $60 statement credit when purchasing $300 or more on the Cobalt card. There are some restrictions but, I think it’s the first Amex Offer that I’ve seen that’s designed for hotels in Canada.

I got the offer on my cobalt, aeroplan and business cards. I stayed last week at the Coral tower in Atlantis and split my bill four ways to see if I’d get the credit (there is no definitive list of properties eligible for the offer but I spoke to an agent who said Coral was still eligible – Beach and Cove are no longer eligible).

To add: offer was also on my cdn plat and my US delta go,d.

I got the same offer but on my BonVoy Business Card which is perfect!

update: I did get the $60 off the $300 (on each of the four cards that I split my Atlantis bill on – nice to get back $240) – all CAD currency.

Sarah

There’s currently an active Amex offer of $60 statement credit when purchasing $300 or more on the Cobalt card. There are some restrictions but, I think it’s the first Amex Offer that I’ve seen that’s designed for hotels in Canada.

I got the same offer but on my BonVoy Business Card which is perfect!

update: I did get the $60 off the $300 (on each of the four cards that I split my Atlantis bill on – nice to get back $240) – all CAD currency.

Sarah