The most versatile Canadian credit card points program, and the only one that transfers to Aeroplan. Eight transfer partners spanning all three airline alliances plus hotels, with the Cobalt card as the top everyday earner.

Our Valuation

2.2 cents per point

Valued above Aeroplan because MR points can transfer to Aeroplan and seven other partners, giving you optionality no other Canadian program matches. The most common play is a 1:1 transfer to Aeroplan, which effectively turns every Cobalt grocery dollar into 10.5 cents of travel value.

Last updated: February 6, 2026

American Express Membership Rewards (MR) points are by far the most powerful rewards currency in Canada.

Membership Rewards points excel in pretty much every metric: they are extremely easy to earn, they offer very good value on the redemption side, and as a transferable points currency, the flexibility they provide is unparalleled.

If you had to pick one rewards program in Canada to concentrate on, Amex Membership Rewards should be at the top of your list. Read this guide to find out the many reasons why this is the case.

In fact, there are six American Express credit cards that earn MR points to choose from – four personal cards and two business cards.

Looking closer, here’s the list of the available cards that you can use to earn American Express MR points:

American Express Membership Rewards Credit Cards

Welcome bonus: 70,000 Membership Rewards points

Annual fee: $199

First-year value

$2,001

Welcome bonus: 130,000 Membership Rewards points

Annual fee: $799

First-year value

$1,594

Welcome bonus: 70,000 Membership Rewards points

Annual fee: $250

First-year value

$1,554

Welcome bonus: 110,000 Membership Rewards points

Annual fee: $799

First-year value

$1,181

Welcome bonus: 15,000 Membership Rewards points

Monthly fee: $15.99

First-year value

$336

Welcome bonus: 12,500 Membership Rewards points

Annual fee: No fee

First-year value

$301

Within the personal card category, the flagship American Express Platinum Card tends to come with the highest welcome bonus, albeit paired with a hefty annual fee of $799 (all figures in CAD). This annual fee is offset by some strong benefits, including an annual $200 travel credit. as well as a $200 restaurant credit, effectively making the annual fee $399.

First-year value

$1,181

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

The American Express Gold Rewards Card has a lower annual fee of $250, and with it, a lower welcome bonus. You'll also get four complimentary visits to Plaza Premium Lounges and a $100 travel credit.

First-year value

$1,554

Annual fee: $250

• Earn 10,000 points upon spending $4,000 in the first 3 months

• Earn 5,000 points per month upon spending $1,000 per month for 12 months

Earning rates

Key perks

Annual fee: $250

• Earn 10,000 points upon spending $4,000 in the first 3 months

• Earn 5,000 points per month upon spending $1,000 per month for 12 months

Earning rates

Key perks

The American Express Cobalt Card offers a much lower welcome bonus than the Platinum Card and the Gold Card, but it has the best earning rates for daily spending in the country. The annual fee comes in the form of $12.99 monthly fee.

First-year value

$336

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

Lastly, the American Express Green Card is the only card in the lineup that earns MR points and has no annual fee.

First-year value

$301

No annual fee

• Earn 12,500 points upon spending $1,200 in the first 3 months

Earning rates

Key perks

No annual fee

• Earn 12,500 points upon spending $1,200 in the first 3 months

Earning rates

Key perks

Looking at the American Express business credit cards, the Business Platinum Card from American Express is the best in terms of earning MR points from a consistently strong welcome bonus. Like its personal counterpart, the annual fee is $799, and it comes with a $200 annual travel credit and excellent lounge access.

50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

First-year value

$1,594

Annual fee: $799

• Earn 90,000 points upon spending $15,000 in the first 3 months

• Plus, earn 40,000 points upon spending in month 13

Earning rates

Key perks

Annual fee: $799

• Earn 90,000 points upon spending $15,000 in the first 3 months

• Plus, earn 40,000 points upon spending in month 13

Earning rates

Key perks

Another option to consider is the American Express Business Gold Rewards Card, which has an annual fee of $199.

First-year value

$2,001

Annual fee: $199

• Earn 50,000 points upon spending $7,500 in the first 3 months

• Earn 20,000 points upon spending $30,000 in the first 12 months

Earning rates

Key perks

Annual fee: $199

• Earn 50,000 points upon spending $7,500 in the first 3 months

• Earn 20,000 points upon spending $30,000 in the first 12 months

Earning rates

Key perks

The number of MR points earned will depend on the card you are using, what category your spending falls within, and in some cases, how much you are spending.

Here are the rates at which each of the cards earns MR points:

American Express Platinum Card

You'll notice upgrade offers on your Amex Offers dashboard, and you'll likely also receive an email about them, too.

If you get an upgrade offer, you’ll be responsible for paying the annual fee on the new card, but you’ll also receive bonus MR points as an incentive to upgrade.

It’s worth noting that you’re always able to call American Express to see if you are eligible for an upgrade offer. That being said, you’re also able to wait and see if you get a promotional email inviting you to upgrade.

American Express Upgrade Offers: Switch to Cobalt, Gold, or Platinum (Ending Soon)

Read more

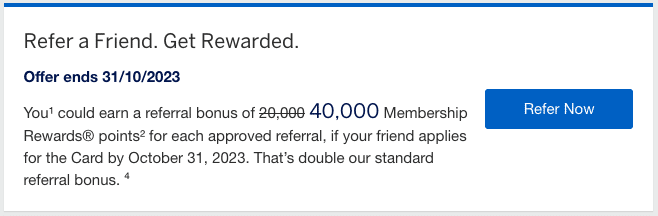

American Express Referral Program: Refer Friends, Earn Points

Read moreWith this program, if you have an American Express card, you can send a friend or family member a unique link through which they can apply for the same card or another eligible card. Once your friend’s application is approved, you’ll receive the corresponding number of points as set out by the program.

The number of MR points that you’ll earn will depend on the card you’re referring from and whether or not American Express is currently running a referral promotion.

It’s important to keep in mind that points will only be awarded if your friend’s application is approved, and that the points can take a few weeks to post to your account.

When there is no promotion running, you can expect to earn the following point quantities for successful referrals:

Personal Cards

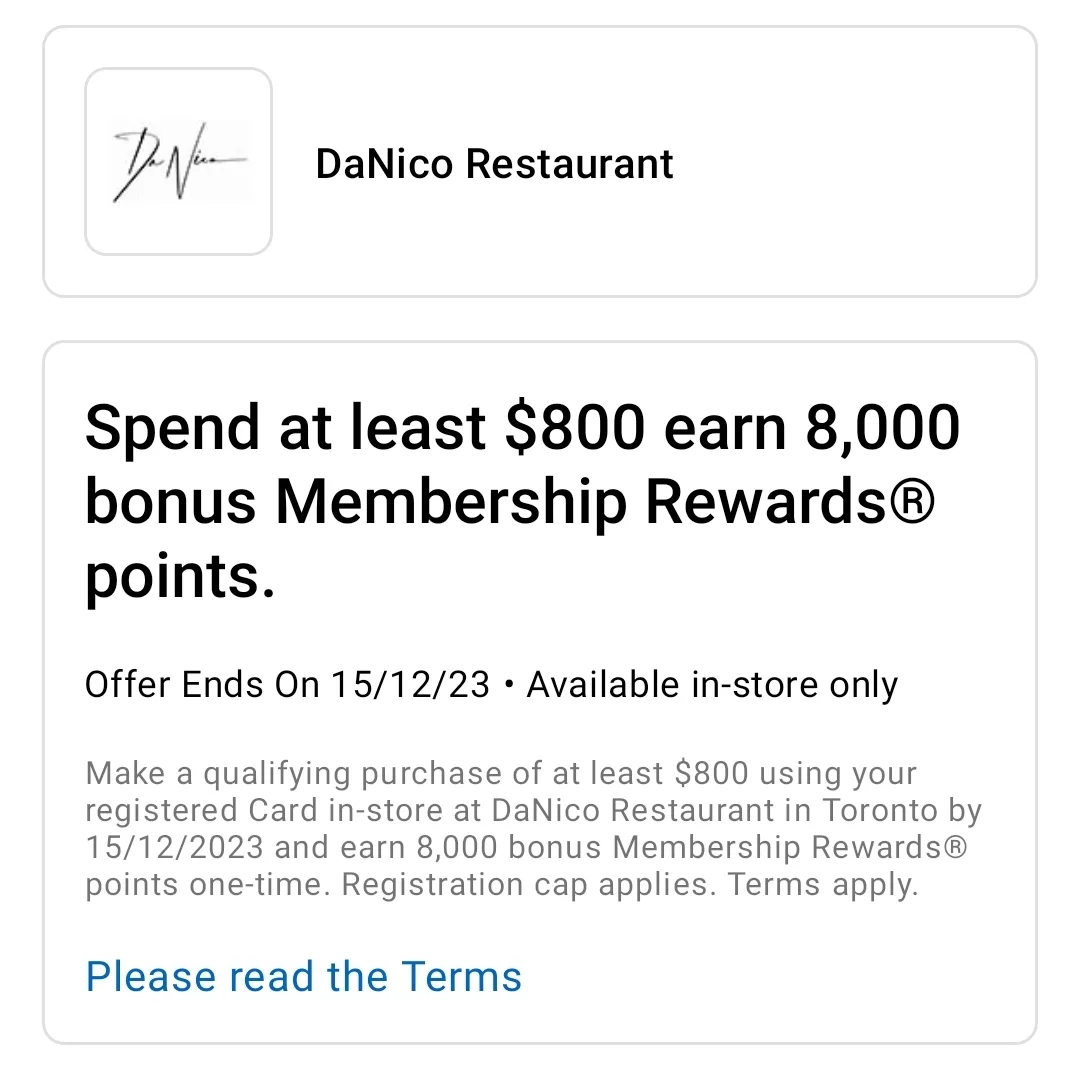

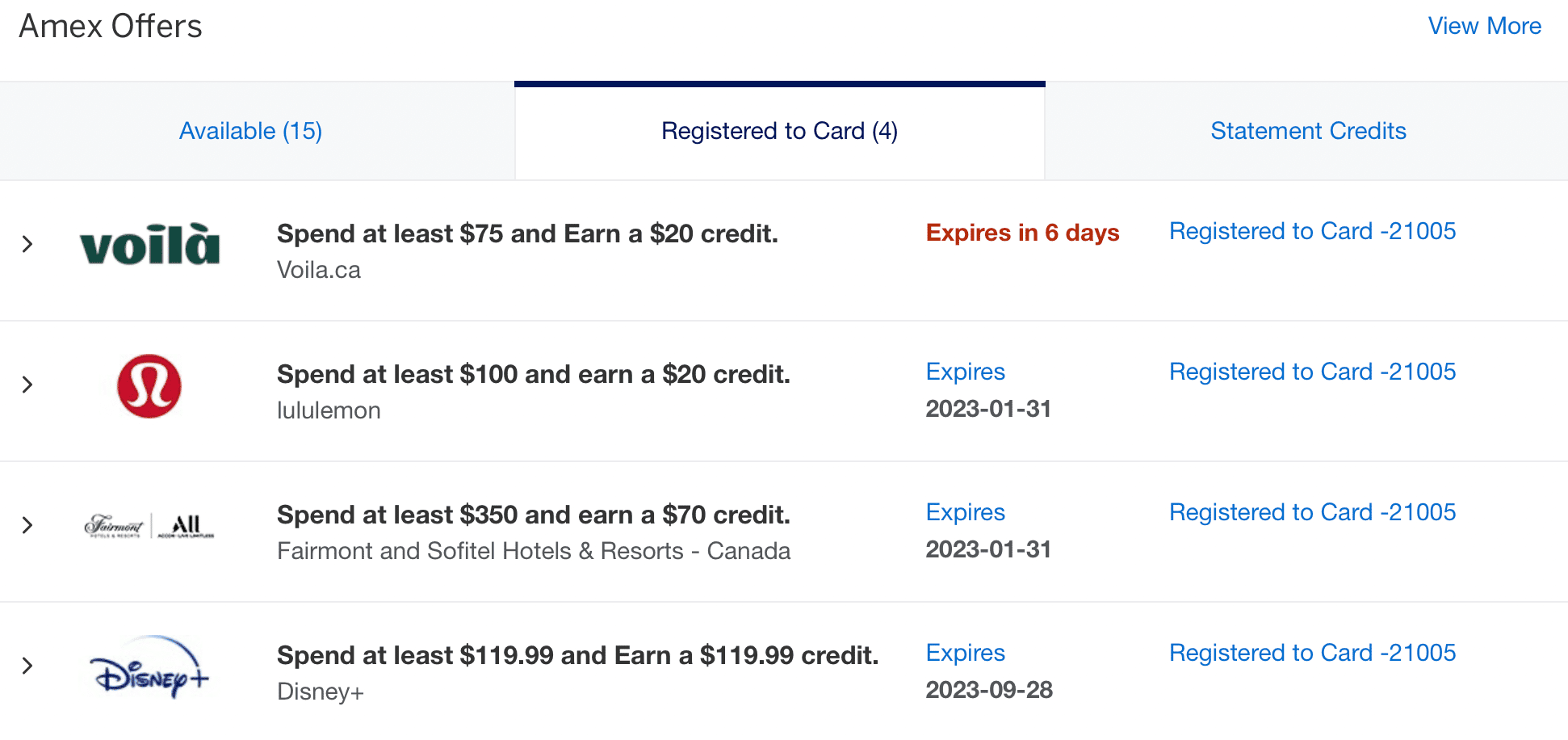

Some of these Amex Offers will earn you extra MR points per $1 spent, while others will hand out a pre-determined quantity of points in a single go after you hit a spending threshold at specific stores or with specific businesses.

In order to be eligible for Amex Offers, you’ll need to register for each offer individually through your American Express account. You’ll then need to meet the necessary requirements set out by that offer before the offer’s expiration date.

Keep in mind that each card has its own unique offers, so if you have more than one American Express card, you’ll want to make sure you check all the offers through your online profile or the mobile app.

Amex Offers: Earn Points or Statement Credits on Select Purchases

Read moreWhen debating your MR redemption choices, you’ll want to consider which redemption route offers the best opportunity to maximize the value of your points.

In general, transferring MR points to airline and hotel partner programs is often the best way to get the most value out of the American Express Membership Rewards program.

However, there’s also a variety of other ways to redeem MR points that still provide great value, and we’ll go over these options below.

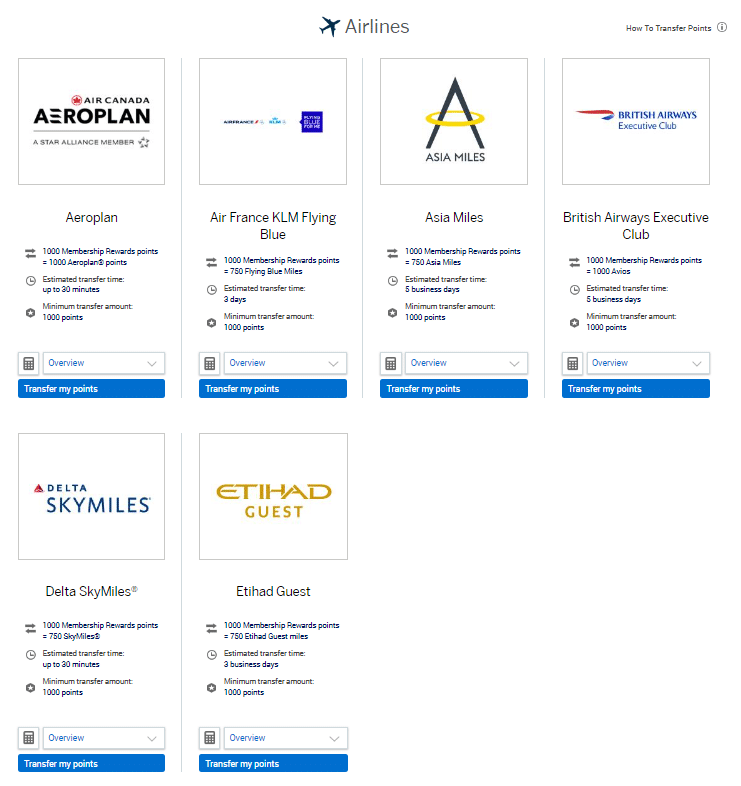

The American Express Membership Rewards program is partnered with six airlines and two hotel loyalty programs to which you can transfer your MR points.

The airline loyalty partner programs and the corresponding transfer ratios are as follows:

Comparatively, the other four airline programs have a less favourable transfer rate of 1:0.75 and follow the same rules for transfer amounts.

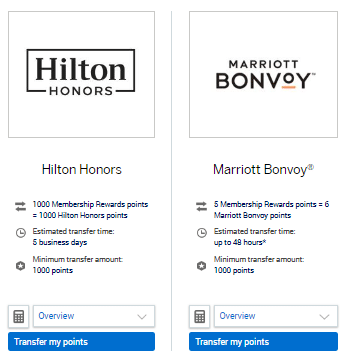

If you’re hoping to use your MR points to book a free hotel stay, you’re able to transfer points to the following hotel loyalty programs:

In this case, MR points can be transferred to Marriott Bonvoy at a rate of 5:6, and to Hilton Honors at a rate of 1:1, following the same rules for transfer quantities as above.

In some cases, transfers are instant, while in others, you'll have to wait a few days.

How Long Do Amex MR Points Transfers Take?

Read moreOne of the main reasons why Amex MR points are so powerful is that by earning a single points currency, you can transfer them to airline loyalty programs in all three major airline alliances: Air Canada Aeroplan (Star Alliance), The British Airways Club (oneworld), and Air France KLM Flying Blue (SkyTeam).

Within each of the programs, not only can you redeem points for flights with the member airline, but you can also redeem them for flights with other alliance members, as well as external partner airlines.

In other words, earning MR points gives you access to dozens of airlines for redemptions, which are accessible through the transfer partners.

The best program to transfer your MR points to will largely depend on your own travel goals, but you’ll generally get the most value by transferring to Aeroplan, Air France KLM Flying Blue, or The British Airways Club.

Air Canada’s Aeroplan program is great for unlocking Star Alliance partner flights at solid redemption rates. Some of the most aspirational products you can book using the program include ANA First Class, Lufthansa First Class, Singapore Airlines business class, and much more.

We have a comprehensive guide to Aeroplan redemptions, which you can find by clicking through below.

Air France KLM Flying Blue is arguably the best program for booking transatlantic flights with Air France or KLM in economy, premium economy, or business class, due to the very attractive award pricing.

You can also book flights with other SkyTeam airlines, such as China Airlines, as well as external partners, such as Etihad Airways.

British Airways Club Avios are an esxcellent option for short-haul flights in parts of Europe, Asia, and Australia, and can also be used to book Qatar Airways Qsuites – widely considered the best business class in the world.

Plus, you can instantly transfer your British Airways Avios into different "flavours" of Avios, since other airline loyalty programs (Aer Lingus AerClub, Finnair Plus, Iberia Plus, and Qatar Airways Privilege Club) also use it as a points currency.

When transferring to hotel programs instead airline programs, it’s harder to get the same level of outsized value; however, there’s still situations where it could make sense.

Generally speaking, transferring to Marriott Bonvoy will get your more value than transferring to Hilton Honors due to the value of Bonvoy points and the more favourable transfer rate.

It’s important to note that once you transfer MR points to another program, you won’t be able to transfer them back, so it’s always best to have a specific redemption in mind before initiating your transfer to avoid any post-transfer regret.

Plus, if you can time your redemption during a transfer bonus event, you can unlock even more value. Be sure to sign up for our newsletter to be the first to know about transfer bonus events!

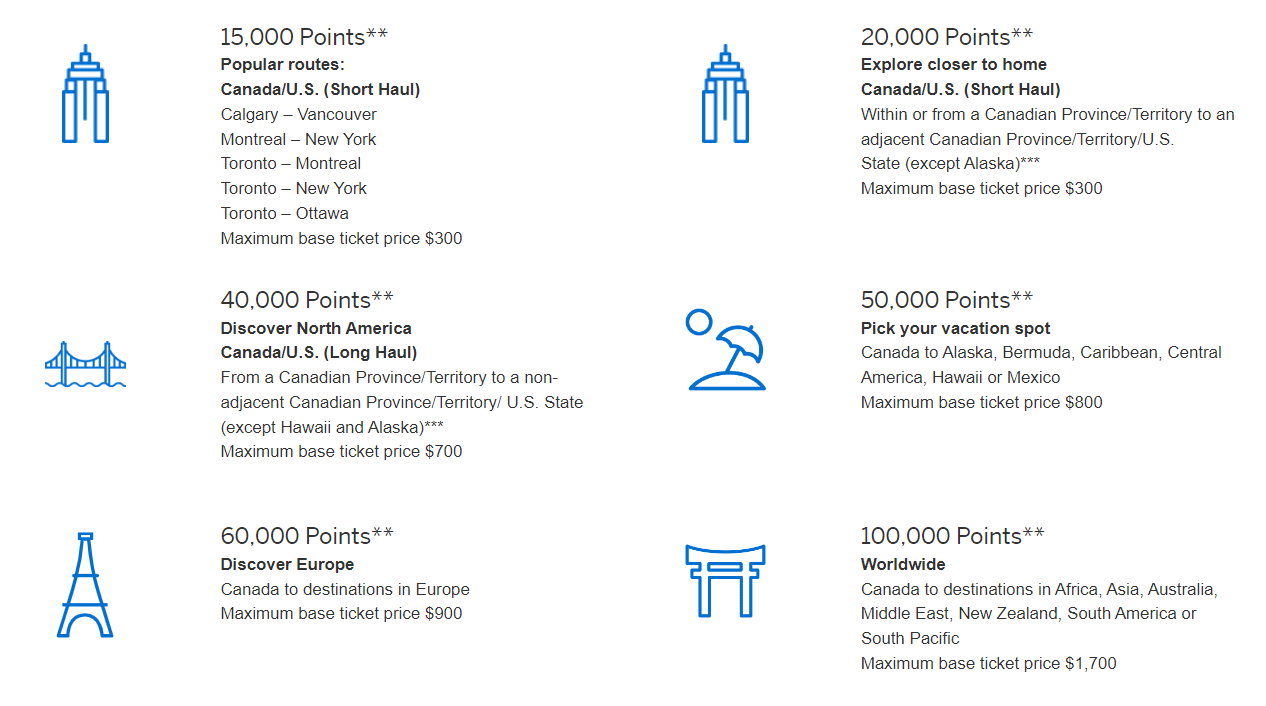

When booking flights through the Amex travel portal, you can use a specific number of MR points to cover the base ticket price of your fare, up to a certain amount (based on your chosen route).

To determine the number of MR points needed for each flight redemption, you’ll need to find out which the program’s six categories your flight falls within, with the categories being based primarily on the distance flown.

The categories are as follows:

Canada/US Popular Short-Haul Flights

This category offers redemptions for popular short-haul routes at a rate that is incrementally lower than the regular short-haul category below. The eligible routes include Calgary–Vancouver; Montreal–New York; Toronto–Montreal; Toronto–New York; and Toronto–Ottawa.

For a round-trip economy flight within this category, you’ll need to redeem 15,000 MR points, with a maximum base ticket price of $300. This redemption offers a value of 2 cents per MR point.

Canada/US Other Short-Haul Flights

This category allows you to redeem MR points for flights from a Canadian province or territory to a destination within the same province or in an adjacent Canadian province, Canadian territory, or US state (excluding Alaska).

For a round-trip economy flight within this category, you’ll need to redeem 20,000 MR points, with a maximum base fare price of $300, giving you a value of 1.5 cents per MR point.

Another option is to redeem 50,000 MR points for a maximum base fare of $800 in business class, offering a value of 1.6 cents per MR point.

Canada/US Long-Haul Flights

This category offers redemptions on flights travelling from a Canadian province or territory to a non-adjacent Canadian province, Canadian territory, or US state (excluding Alaska and Hawaii).

For a round-trip economy flight within this category, you’ll need to redeem 40,000 MR points for a maximum base ticket fare of $700. This provides a 1.75 cents per MR point value.

For a round-trip business class ticket, you’ll need to redeem 100,000 MR points for a maximum base fare of $1,800, giving you a value of 1.8 cents per MR point.

Canada to Specific Destinations

The last three categories offer flights to destinations outside of Canada and the US (plus Hawaii and Alaska).

North America and Central America

For round-trip economy flights from anywhere in Canada to Alaska, Bermuda, the Caribbean, Central America, Hawaii, or Mexico, you’ll need to redeem 50,000 MR points. With a maximum ticket price of $800, this redemption offers a value of 1.6 cents per MR point.

Round-trip business tickets within the same category require 120,000 MR points for a maximum base fare price of $2,100, offering a value of 1.75 cents per MR point.

Europe

For round-trip economy flights from anywhere in Canada to any destination in Europe, you’ll need to redeem 60,000 MR points for a maximum base fare price of $900. This exchange offers a redemption value of 1.5 cents per MR point.

If you’d prefer to travel business class, you can get a round-trip ticket for 140,000 MR points. This covers a maximum base fare of $2,500 and offers a redemption value of 1.79 cents per MR point.

Worldwide

The final redemption category is for flights from anywhere in Canada to destinations in Africa, Asia, Australia, Middle East, New Zealand, South America, or the South Pacific.

In this category, you’re able to redeem 100,000 MR points for a round-trip ticket in economy class. This redemption can have a maximum base fare of $1,700 and is valued at 1.7 cents per MR point.

You’re also able to book a round-trip business class ticket for 250,000 MR points, with a maximum base fare of $4,500. This offers a value of 1.8 cents per MR point.

Comparing all the redemption categories, the best value can be found in redeeming your MR points at 2 cents per point for a round-trip economy flight on one of the popular short-haul routes found in the first category.

To achieve this value, you’ll need to redeem the fixed amount of MR points (15,000 points) for the maximum base ticket price ($300).

That being said, you’ll want to compare all of your options when it comes to booking your flight, as you can still get better value from transferring your MR points to Aeroplan or The British Airways Club.

Amex Fixed Points Travel: Book Flights Easily at a Good Value

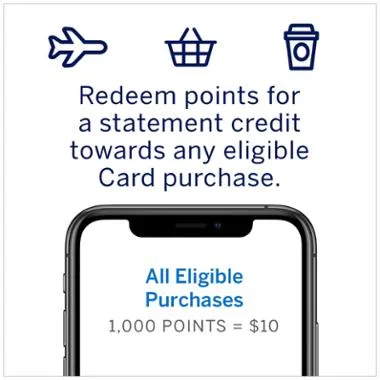

Read moreWhen redeeming your points for statement credits, you’ll get a fixed rate of 1 cent per MR point. To access this option, you’ll also need to redeem a minimum of 1,000 MR points.

As stated above, when compared to loyalty program transfers or redemptions for a flight through the fixed-points travel program, redeeming MR points for statement credits provides significantly worse value.

That being said, there have been promotions, which raise the statement credit from 1 cent per point to 1.2 or 1.5 cents per point.

While you still won’t get quite the same value as transferring your MR points out or redeeming them for a flight, you’re definitely getting a lot closer at 1.5 cents per point.

What’s more, given that statement credit redemption s are by far the quickest way of redeeming your MR points, this can be of value if you find you need to offload your points in a hurry.

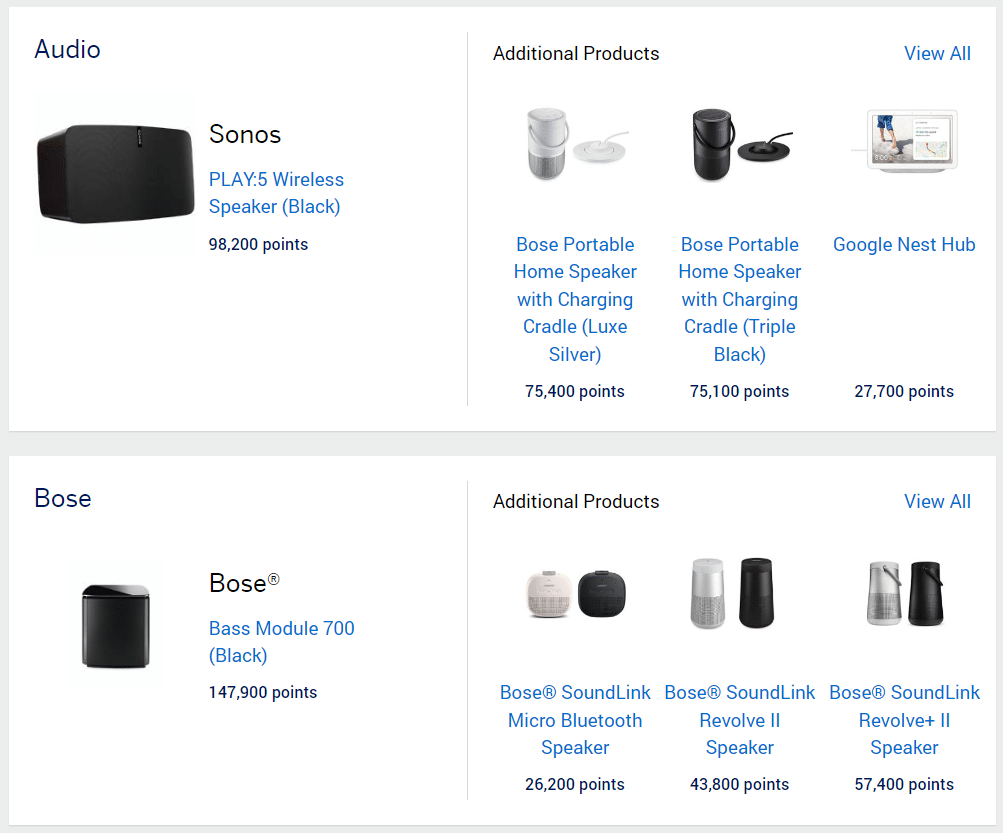

Each of these options provides a redemption rate of less than 1 cent per point. This means that you will always be better off simply redeeming your points for a statement credit against your purchases, rather than buying a gift card or an overpriced item.

For example, if you have an American Express US card that earns Amex US Membership Rewards points, you can transfer your Canadian MR points to your US Membership Rewards account.

MR points will be transferred based on the exchange rate, so you’ll end up with less US MR points than the number of Canadian MR points you started with. However, you’ll have access to more transfer partners in the US program, which may help you unlock flights that you don’t have access to through the Canadian MR transfer partners.

How to Transfer Amex MR Points Between US and Canada

Read moreThe program also offers a wide array of transfer partners, allowing you to piece together your travel plans through several airline and hotel loyalty programs, or to redeem your points for fixed-rate flights at a decent value.

With so many redemption choices, make sure you take some time to get to know all of the options in order to make the best decision for your needs.

First-year value

$1,181

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks