Getting US credit cards is often viewed as an effective long-term strategy rather than a means towards short-term gains, given the considerable efforts involved during the initial setup phase. In this post, I wanted to give you guys an update on my US credit card journey now that my US credit file is approaching three years of history, to give you an idea of the rewards you might be able to reap after your credit file has matured to a certain degree.

The Story So Far

I started out with US credit cards in 2016 by getting what was the American Express US Premier Rewards Gold Card at the time (which later became the Amex US Gold Card) via a Global Transfer. After getting my ITIN set up, I then picked up the Amex US SPG Card and Amex US Business SPG Card in mid-2017 (which later became their respective Bonvoy versions).

In late 2017, with my US credit history about one year old, I applied for the Chase Sapphire Preferred quite a few times, initially getting declined for having “too thin” of a credit history before successfully getting approved via the reconsideration process on my third attempt.

Chase Sapphire Preferred

Then, in mid-2018, I applied for the Amex US Business Platinum for 100,000 US Membership Rewards points, and I’ve since found the card’s many benefits – in particular the complimentary year of global WeWork access – to be incredibly useful.

As I held on to these cards, I needed to decide whether they were worth keeping in the long run. The two Bonvoy cards, for example, are great to keep around forever, since they provide an annual free night certificate that more than offsets the annual fee. (Note that the personal Amex US Bonvoy Card is no longer available to new applications, having essentially been replaced by the higher-end Bonvoy Brilliant Card.)

I also found enough value in using the Chase Sapphire Preferred along my travels (since the card has no FX fee and Visa is accepted almost everywhere) to justify keeping it for the US$95 annual fee.

However, after initially keeping the Amex US Gold Card for a second year, I couldn’t quite find enough value in it to keep it for a third year, so I cancelled that one. The lesson that you should heed here is that your first US credit card should always be one that you intend on keeping forever, since that’s what’s best for your credit history.

Anyway, that’s how the picture looked going into 2019…

Getting the Amex US Hilton Cards

With the introduction of the Marriott Bonvoy program also signalling a slow decline in value from the legacy SPG and Marriott Rewards programs, I was eager to participate in other hotel loyalty programs that I could use to redeem for some free nights along my travels. That brought me to the Hilton Honors credit card portfolio, which was newly introduced by Amex US in early 2018.

There are a variety of Hilton products in this lineup, including:

-

The entry-level Hilton Honors Card with no annual fee and a signup bonus of up to 85,000–95,000 Hilton Honors points (if you apply via incognito mode)

-

The mid-tier Hilton Honors Surpass Card with an annual fee of US$95 and a signup bonus of 135,000 Hilton Honors points

-

The premium Hilton Honors Aspire Card with an annual fee of US$450 and a signup bonus of 150,000 Hilton Honors points

-

The Hilton Honors Business Card with an annual fee of US$95 and a signup bonus of 125,000 Hilton Honors points

Redeem Hilton Honors points at Grand Wailea, a Waldorf Astoria Resort, Maui

In early 2019, I applied for the entry-level Hilton Honors Card in order to begin diversifying my hotel points holdings, and in recent months I’ve also picked up the Hilton Honors Aspire Card for its hefty signup bonus as well.

While the Aspire Card’s US$450 annual fee may appear daunting at first, there are many perks and benefits that make this card extremely worthwhile despite the high nominal fee. The card offers a total of US$500 in statement credits alone – US$250 in Hilton resort credits and US$250 in airline fee credits – so if you can take full advantage of these credits, you’re already coming out US$50 ahead.

Then you’ve also got the annual free night certificate that’s valid at most Hilton properties around the world (including many top-tier hotels that often retail for $500+/night), the Priority Pass Select membership that gives you access to 1,000+ airport lounges around the world, and the instant Hilton Honors Diamond status that gives you top-tier treatment when staying with Hilton hotels – indeed, the Aspire Card is the only credit card through which you can earn top-tier elite status with a major hotel chain.

Hilton Honors Diamond status gets you free breakfast at Hilton hotels!

The value in the Hilton Honors Aspire Card is clear for all to see, so this is definitely a card I plan to hold onto for the long term, and you may well see me starting to relinquish my blind loyalty to Marriott hotels and stay with Hilton a fair bit more.

In addition to applying for new cards, you should also be paying to the Amex US upgrade and downgrade paths, because they often allow existing cardholders of a certain product to claim the bonus a second or third time when upgrading to a different product, whereas you’d normally be limited to once-in-a-lifetime bonuses when submitting a new application directly.

For example, there have been many data points of base-level Hilton Honors Card members being offered an upgrade to the Surpass or Aspire cards along with the full signup bonus, usually at least one year after obtaining the Hilton Honors Card to begin with. I’ll definitely be keeping an eye out for these upgrade offers as time goes on, in the hopes of strengthening my Hilton card lineup even further.

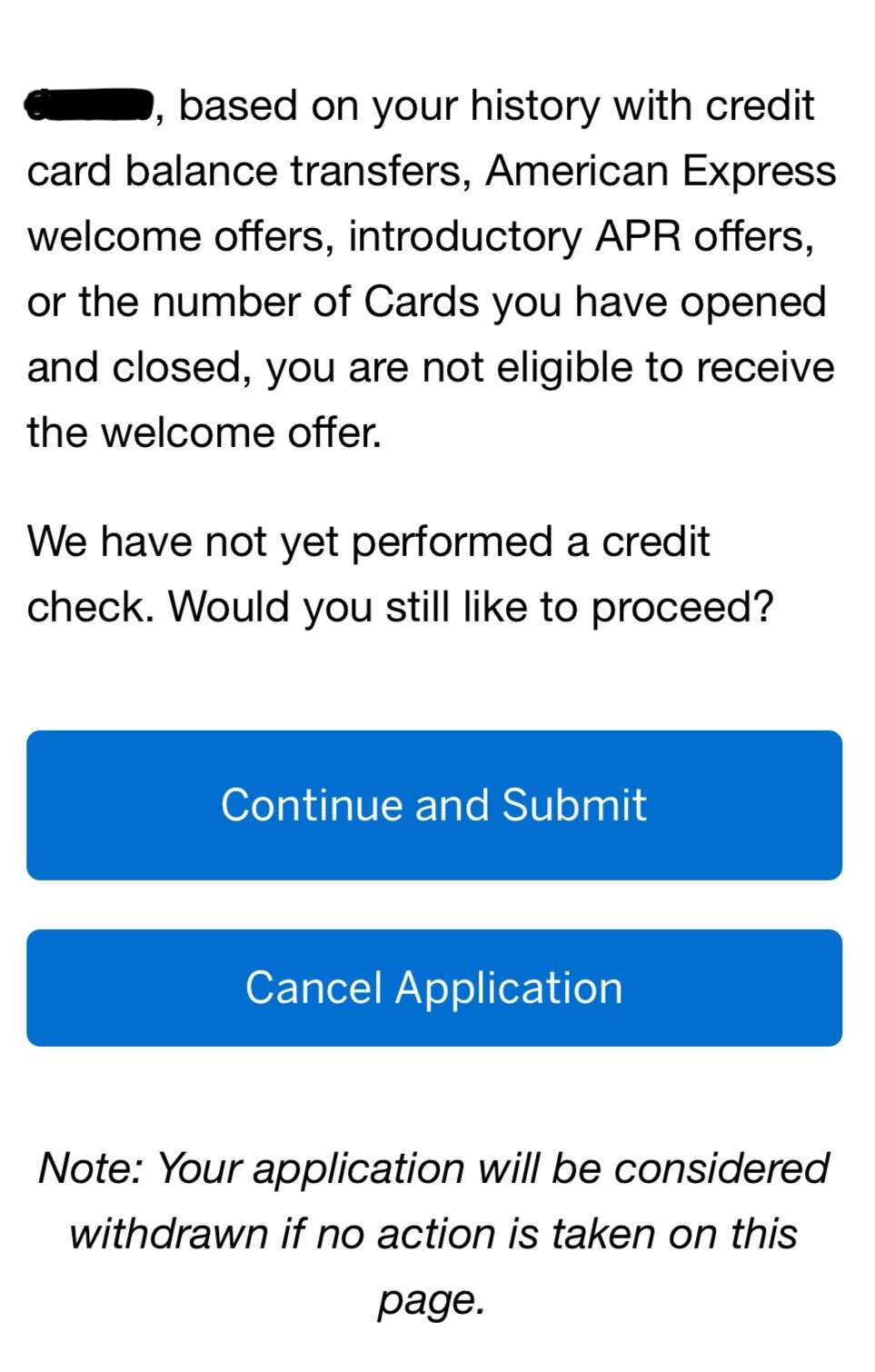

One thing I wanted to mention is that when I was applying for the Hilton Aspire Card recently, I was hit with the “dreaded pop-up” by Amex US informing me that I was not eligible for the signup bonus due to my previous history with welcome offers.

This is a measure that Amex US implemented a few years ago to combat unprofitable behaviour among cardmembers, such as those who simply meet the minimum spending requirement, claim the bonus, and then no longer use the card for any of their purchases.

Many data points indicate that regular spending on your Amex US cards is key to avoiding this pop-up, and indeed, after putting a few regular charges on each of my Amex US cards, I was able to try the application again a few weeks later and the pop-up never appeared.

Getting the Chase IHG & Chase Ink Preferred

Compared to Amex US, Chase is slightly more strict with approving people that have relatively new credit histories, so I needed to build up my credit history until the one-year mark until they were willing to even consider my application. Even then, they had cited that my credit file, which had two personal credit cards on it at the time, was still “too thin” during the reconsideration process, and they had wanted to see more accounts on my file to increase their comfort levels.

This brings us to a dilemma when it comes to building up your US credit history with a view to eventually getting Chase cards: on one hand, you need more personal accounts in order to beef up your credit history (remember, business credit cards in the US often don’t report to personal credit files); on the other hand, Chase’s well-documented 5/24 rule means that they won’t approve you if you’ve opened more than five credit cards in the past 24 months – so by getting two or three Amex US personal cards to start with, you’re rendering yourself ineligible for getting many Chase cards down the road.

In my situation, I had two personal cards on my credit file when I first got approved for the Chase Sapphire Preferred, so after that I could only get a further two Chase cards before going over 5/24.

I decided to pursue the Chase Ink Preferred, the small business product that grants 80,000 Ultimate Rewards points as a signup bonus, as well as the Chase IHG Card, which had a special offer at the time of 125,000 IHG Rewards points that could further help me diversify my hotel game.

Chase is relatively strict on business cards, and I had some troubles getting approved for the Chase Ink Preferred on my first few tries. Eventually, I swung by the Chase branch on a recent trip to New York and got it done in-person with a small business representative.

The card seemed to get intercepted and used fraudulently somewhere along the way to my US address, but I was eventually able to get it re-issued and delivered to me so that I can work on the US$5,000 minimum spend.

Visiting a branch in the US can help build your relationship with Chase

I was also informed that the Chase branch reps are able to waive the 5/24 requirement if you’re applying for business cards, so that’ll be very useful for me in the future now that I’m over 5/24.

One piece of advice that’s often disseminated when talking about applying for Chase cards is that opening a Chase checking account (which you can do on any visit to the US using only your Canadian passport) can you help you build a relationship with them early on, and this is another example of why that in-person banking relationship might be useful if you want to take advantage of Chase’s bonuses in the long run.

The personal Chase IHG Card was much easier to get approved for, and I’ve now got a healthy balance of IHG Rewards points which can hopefully cover two or three nights at an InterContinental hotel sometime soon. This card is also a great card to keep for the long run, since it grants a free anniversary night worth 40,000 IHG Rewards points every year, which easily outweighs the US$89 annual fee.

Redeem your Chase IHG annual free night certificate at the InterContinental Bangkok!

Getting the Citi Premier Card

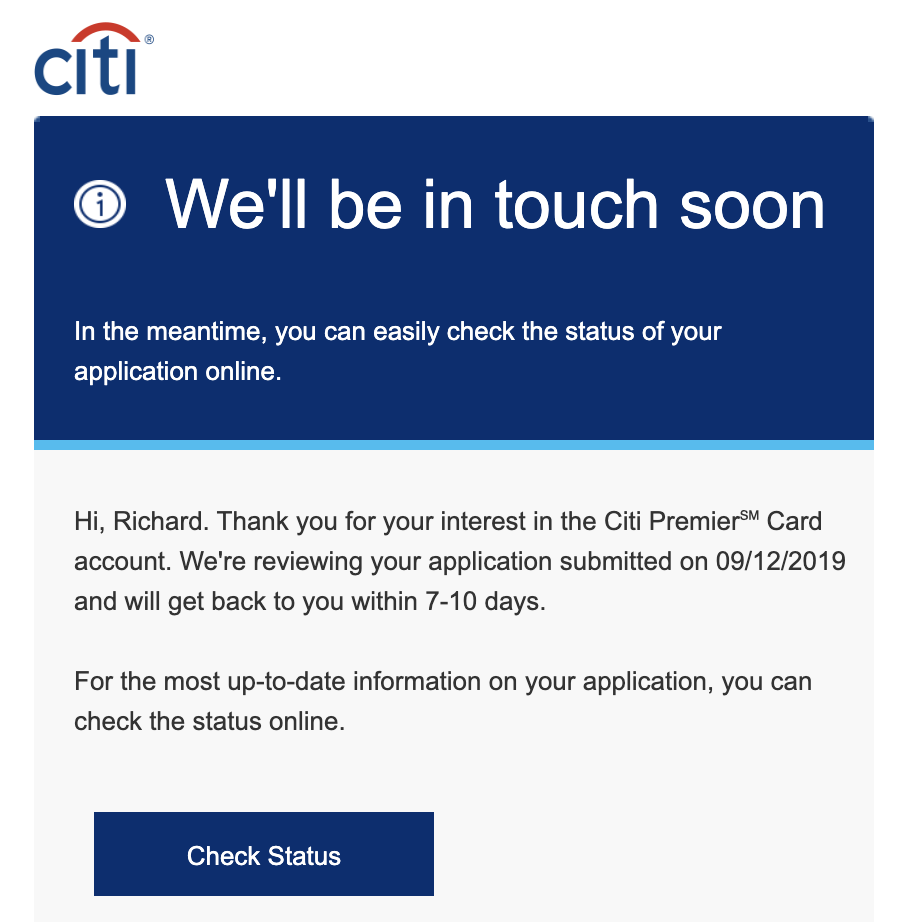

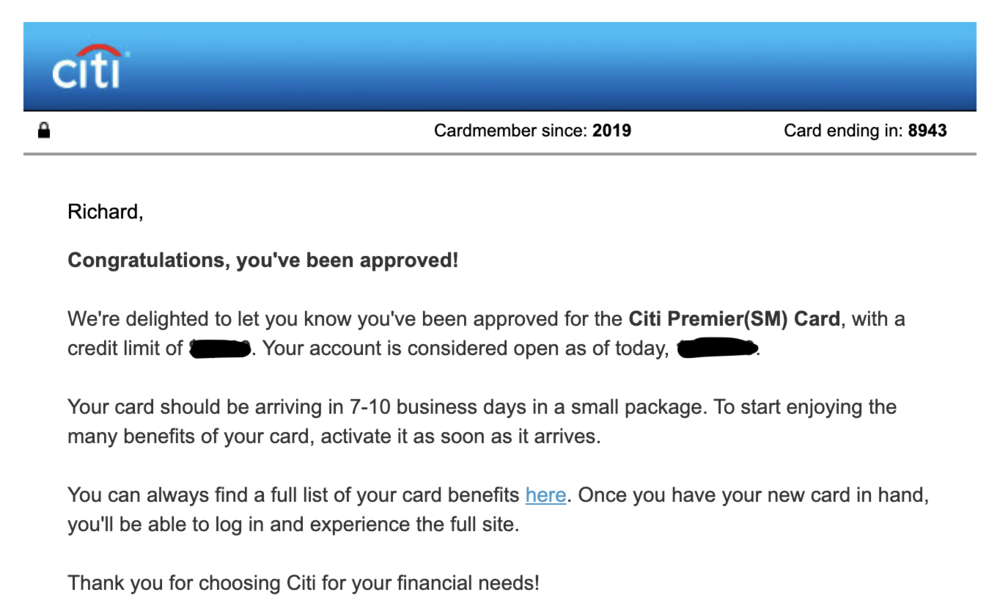

In the long run, of course, you’ll also want to expand beyond Amex US and Chase. But there don’t seem to be many data points out there about applying for the other major issuers as a “newcomer” to the US, so last month I decided to try my luck applying for the Citi Premier Card as my first credit card from Citi.

The Citi Premier offers 60,000 ThankYou points after spending US$4,000 in the first three months, and comes with an annual fee of US$95. ThankYou points can be converted into a wide range of frequent flyer programs like Cathay Pacific Asia Miles, Singapore Airlines KrisFlyer, Virgin Atlantic Flying Club, or Avianca LifeMiles, so I’m sure I’ll be able to find use for those points somewhere down the line.

I filled in the application with my ITIN under the SSN field, since it’s my understanding that Citi does indeed accept ITINs in place of SSNs. I received a notification that my application was processing…

…but I still hadn’t heard anything until a few weeks later. That was until I received a letter in the mail saying that Citi had stopped reviewing my application and needed me to call them about something in order to proceed.

I called the Citi new accounts team, and it turns out that they just wanted to see proof of my ITIN, which is pretty standard procedure when dealing with a brand-new customer. I sent the scanned copy of my ITIN to the email address they provided me, and then lo and behold, I was approved for the card within a few days!

I’m excited to add the Citi Premier Card to my wallet and start building my relationship there – eventually I hope to get some of Citi’s American AAdvantage cards as well in order to boost my balance in that program and redeem for some more premium flights on Etihad Airways.

The other major US issuer that I’ve got my eye on is Bank of America and their US-issued Alaska Airlines Signature Visa, but it’s my understanding that Bank of America only accepts the ITIN in place of the SSN when applying in-branch, so I may have to swing by a BoA branch the next time I’m the US to get the ball rolling there.

Conclusion

Just like in Canada, the US credit card scene tends to reward you with more and more rewarding credit card bonuses as time goes on and your credit history builds up to a healthy age. With my US credit file approaching its third birthday, I’ve collected a nice new round of bonuses in recent months from Amex US, Chase, and Citi, so hopefully some of you find this recap of my experiences helpful along your own US credit card journeys – although I’m fairly confident you could in fact move at an even faster pace than I have!

Amazon letter method didn’t work for me either.

I resent my application with Amazon letter on thick paper/photoshopped out underlines. Fingers crossed.

Great article. I have the Hilton aspire and recentky got the delta gold that is on promotion until today for no fee. 60k bonus delta skymiles in case anyone is interested. I use my skymilesto fly on westjet.

Hi Ricky, I’ve been denied an ITIN for the second time this week. I did exactly what you mentioned. You said at the meetup in Montreal that you could dig a little bit to find new ways to get a letter supporting an ITIN application since the Amazon letter doesn’t seem to work anymore. I guess I’m not the only one who is having trouble getting an ITIN. Any tip and advice would be much appreciated

Hi everyone,

For Canadians not spending too much time south of the border – do you use those US cards here in Canada and just bite the bullet on the foreign transaction fees?

Is there a workaround for minimizing the cost of using those cards here in Canada?

Thanks!

If you’re going to do a Global Transfer through American Express, then get the Hilton Honors. They have no annual fees and no FX fees on that card – if foreign transaction fees are your primary concern and you still travel enough to warrant having points built up with the Hilton brand.

Thanks XX – I am indeed going to do a Global Transfer through Amex to start with.

But limiting myself only to the no annual fee / FYF cards loses the purpose of the hassle of US cards for Canadians.

So, for all other cards (after I finish with the Hilton Honors) – should I just use those here in Canada and pay the fees?

Moreover – I will still have to pay the statement (which is in USD) from my CAD funds – since I work here in Canada and my salary is in CAD..

Would love to hear any ideas to tackle this issue – otherwise, about 5% out of pocket to get those bonus points seems a bit too high..

I don’t know your particular use case for wanting to obtain a US credit card so I can’t help you any further.

Check out Ricky’s guide on getting US credit cards as a Canadian.

Hey Ricky,

Couple questions for you. I hope you don’t mind hitting me back.

1) Do you ever use your Canadian address for any of these US credit cards or is it strictly the 247 US one?

2) Do you see any benefit in opening a US bank account with Chase or BoA – if we are looking at getting their products?

Thanks Ricky.

Always the US address. Yes, like I mentioned in the article, opening an account with Chase early on can build your relationship and get you approved for their cards faster. Same goes for BoA I presume – plus the fact that they only take ITINs in-branch means that an in-person visit is inevitable.

Hey Ricky,

Thanks for replying. I worded my sentence wrong, I meant to ask if you use your Canadian address for any of the US bank accounts or do you use your US address only? I assume they ask for ID (passport).

I’m going to book a consultation with you once my ITIN comes in next month. I have a dozen small questions that I believe would be best answered in one sitting over the phone.

Thanks again.

Ricky, what are your plans for when your ITIN expires? (From IRS website)"Your ITIN may expire before you file a tax return in 2020. All ITINs not used on a federal tax return at least once in the last three years will expire on December 31, 2019. " I think I’m a year away from this but sounds like you’ve had yours 3yrs so looking for guidance.

Good question. For the purposes of using your ITIN as a unique identifier on your credit file, the ITIN expiring shouldn’t actually have any effect, since your ITIN would already be attached to the credit file.

The problem is if you ever need to provide proof of your ITIN again – in that case, the original ITIN document you received might or might not work. I plan to cross that bridge when I get to it.

Its just bit late that i came across this article as i was hit with “dreaded pop-up” as well few days back and ended up continuting hoping that i will get the bonus as i never held same card before and i was spending organically for the last 9 months (except last month).

I have AMEX person bonvoy card opened in Feb-2019, met MSR of 1k and contd.. spent few more months..until last month.. Still got the pop-up but ignored and went ahead and got approved.

Lets hope they can manually adjust upon request by sighting the spending habits.

Chase called and asked for proof of residence, no bank statements, either rental agreement or utility bills. How does one get around this?

I’m in the same boat, let me know if you figure this out.

@Jeff Open a US bank account with Chase next time you’re down south.

I did this, it still didn’t help me, they still ask for the proof of residence (rental agreement or utility bills)

Just read about the new AMEX Green card benefits. This is going straight to the top of my want-list.

Also have both Chase IHG cards for the free night certificates.

Lucky man! I got in on the IHG shortly after the original card was phased out.

Recently hit the min spend for the CIP and I can confirm it’s $5k, not $4k. Toughest card approval for me to date (took me 3 tries).

Other cards in my wallet right now:

AMEX Gold -> retention offer of 15k MR/$2k spend so decided to kept it

AMEX Marriott Brilliant & Business

CSP -> retention offer $60 credit (dropping annual fee to $35). Will downgrade to Freedom next year so I can get the sign-up bonus for CSR (48 month wait time!).

*Next on my want-list are the Chase Ink Cash & Unlimited Bus cards for their sign-up bonuses and no fee.

@Ricky: Surprised you cancelled AMEX Gold. Lots of value there with 4x MR/$1 on restaurants globally and tons of great AMEX offers. Were you offered a retention bonus? BOA Alaska is a solid choice for your next card.

Correct on the $5k min spend, I’ve updated that. Three tries for myself as well, incidentally.

Yeah the Gold was borderline for me in terms of keeping it vs. going with a middling retention offer. I could’ve played it differently, but it doesn’t make too much of a difference for me in the end.

Hi Jules: How did you get CIP as a Canadian. How did you fill out the business app? and how do you pay the MSR in USD, transferwise?

@Brian I’m Canadian but I also have a SSN. Complete the business app with your name and as a sole proprietorship (unless you have an actual legit business). Transferwise indeed.

Are you able to confirm that those with USA AMEX cards but without ITIN/SSN are still building US credit history? I’ve seen answers both ways on this, some say yes you are building credit based on all your other info (name, birthdate, address, etc) going to the bureaus plus the fact AMEX gives you an Experian score and others say only an ITIN/SSN will help you build US credit history. Just wondering if you had any further insight into this. Thanks!

Have you found a US high interest savings account that takes Canadians? I had looked at the Amex account, but it requires a W9 certifying US residency, which would have US tax consequences.

Never read an article so rich in useful datapoints. POT delivers. Or, since content was US-related, POTUS

(lame)

Surprised you haven’t gone for Chase’s Hyatt card.

Yeah, in hindsight I’m pretty annoyed with myself for choosing the IHG over the Hyatt as well. Now that I’m over 5/24, I’ll need to lay low for a while before picking that one up.