RBC Avion is widely regarded as one of the leading transferrable points currency in Canada, second only to American Express Membership Rewards.

Avion points are easy to collect in large quantities over a short period of time, and are unique among the Big 5 banks’ points programs for being transferrable to a wide range of airline partners.

While the redemption pathways for Amex MR points are generally focused on the two 1:1 transfer partners of Aeroplan and Avios, the optimal strategy for RBC Avion points is perhaps less clear-cut, and I often receive questions from readers who’ve collected a large amount of Avion points but are unsure how to optimally tailor those points to their travel goals.

In this article, let’s compare the strengths and weaknesses of each of the possible uses of Avion points to see which redemption strategy might make sense for your specific situation.

In This Post

- WestJet Rewards: Ideal for Domestic Travel

- British Airways Avios: Short-Haul Flights or Multi-Carrier Trip

- Cathay Pacific Asia Miles: Premium Flights to Asia

- American AAdvantage: Limited Use for Canadians

- Redeeming Avion Points Directly

- Putting It All Together

- Conclusion

WestJet Rewards: Ideal for Domestic Travel

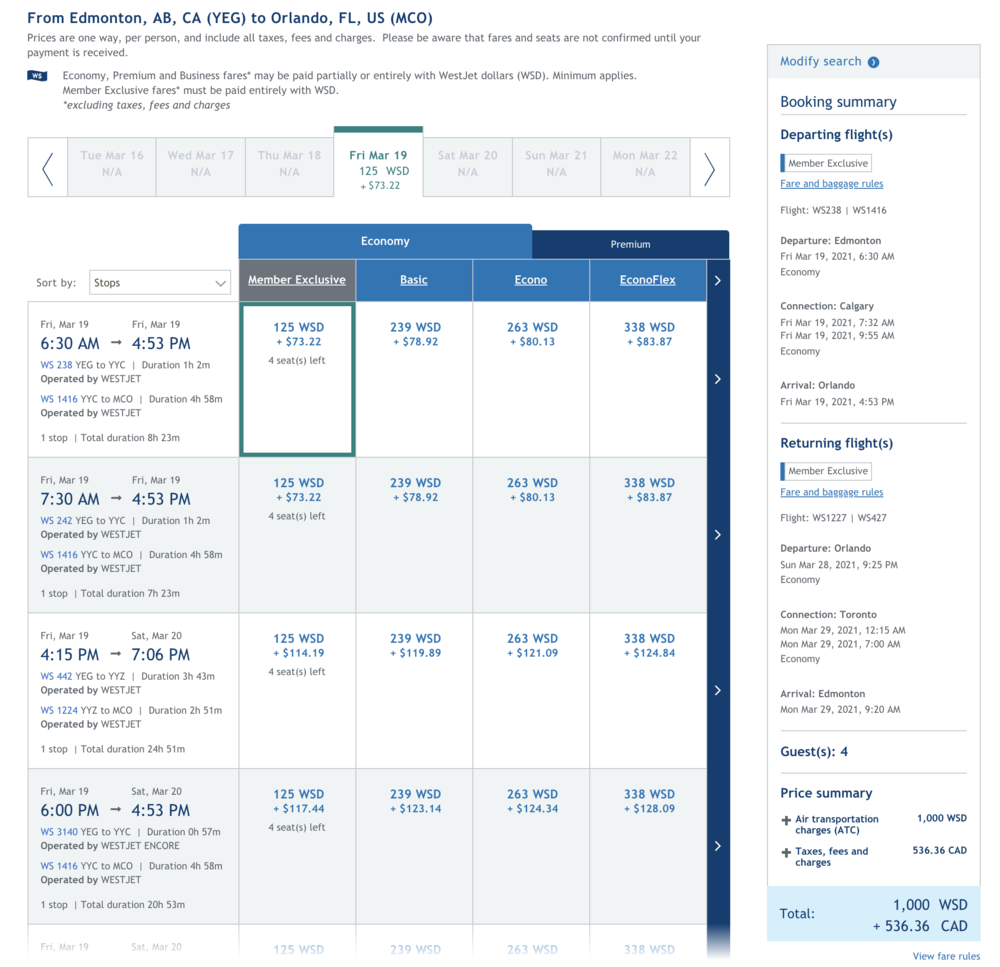

WestJet Rewards is an underrated program for travelling domestically, and converting your Avion points into WestJet Dollars (WSD) at a ratio of 100 points = 1 WSD can be a solid primary strategy for anyone whose travel patterns are primarily focused on North America.

The key to unlocking value is through WestJet’s Member Exclusive fares. Member Exclusive fares are similar to award tickets on other programs, and can be redeemed for a fixed price of 125 WestJet Dollars one-way for a flight within the continental North America on a space-available basis.

I cover some more information on Member Exclusive fares in the latter half of this video:

As a general rule, WestJet tends to release at least four Member Exclusive seats per flight, which is great news for those of you who often travel as a larger family.

A flight like Vancouver–Toronto can easily cost $400–500 one-way in the peak of summer, so being able to snag that for 125 WestJet Dollars (equivalent to 12,500 RBC Avion points) plus taxes and fees can amount to significant savings, especially when you’re booking for multiple passengers.

Similarly, a round-trip from, say, Edmonton to Orlando for a DisneyWorld trip during Spring Break usually starts at around $600 and only goes up from there.

Booking four seats for your family for 250 WSD (equivalent to 25,000 Avion points) per person will leave you with plenty of room in the travel budget for memorable experiences on the ground.

Combine this with the WestJet RBC World Elite MasterCard for free checked bags and wifi, and you can easily treat yourself and your family to an elevated travel experience even on domestic and transborder flights within North America.

And don’t forget that, should your WestJet Dollars balance be running low, you can always top-up by purchasing WestJet Dollars directly from Points.com at a rate very close to par.

In the past, we’ve seen conversion bonuses when transferring RBC Avion to WestJet; however, it’s my understanding that we are extremely unlikely to see these bonuses happen again in the future. Therefore, I wouldn’t recommend waiting for a conversion bonus if you’re looking to convert Avion points into WestJet Dollars, because you could be waiting for a long time.

British Airways Avios: Short-Haul Flights or Multi-Carrier Trip

One of the most popular ways to redeem Avion points is by transferring them to British Airways Avios at a 1:1 ratio for use on international flights with Oneworld carriers. Some of the most well-known sweet spots include Toronto–Dublin on Aer Lingus economy class for 13,000 Avios, Seattle–Hawaii on Alaska Airlines economy class for 13,000 Avios, or an Avios multi-carrier award visiting up to seven places around the world on a single trip.

The challenge with Avios, however, is that the sweet spots tend to be specific rather than general, especially from a Canadian standpoint.

If you live in a major city like Toronto or Vancouver, then you’d be well-positioned to take advantage of Oneworld flights that serve your city; however, if you live somewhere like Calgary, Winnipeg, or St. John’s, you’d need to catch a separate positioning flight before being able to hop on an Avios redemption, which reduces the value you’re getting.

In my view, transferring Avion points to Avios is ideally suited to two types of travellers:

-

Someone who likes to take extended trips to multiple destinations around the world, who can then take full advantage of the Avios multi-carrier award, as well as using Avios to book short-haul segments on Oneworld partners around the world for good value

-

Someone living in a major Canadian city who has their eye on a specific sweet spot on a direct route, like Toronto–Dublin, Seattle–Hawaii, or Montreal–Casablanca (since Avios tends to deliver higher value on direct routes vs. connecting routes due to the distance-based award chart)

If you don’t fit into either of these definitions, you might still get value out of Avios, but you’ll also want to weigh this option against some of the other options we’ll discuss below.

Historically, we’ve seen 30–50% conversion bonuses from Avion to Avios about twice per year. I get the sense that the usual spring conversion bonus won’t be offered in 2020 due to the challenging atmosphere in global travel, but there’s a chance it’ll return for the fall if you want to wait and get the best bang for your buck.

Cathay Pacific Asia Miles: Premium Flights to Asia

Another competitive frequent flyer program where you can transfer your Avion points at a 1:1 ratio is Cathay Pacific Asia Miles. While the program recently underwent a devaluation by removing the ability to add stopovers on a one-way flight, it still has its fair share of sweet spots for premium international travel on Oneworld airlines.

An example might be a Toronto–Hong Kong–Sydney redemption on Cathay Pacific business class for 85,000 Asia Miles or Vancouver–Tokyo on Japan Airlines business class for 61,000 Asia Miles, both of which carry minimal fuel surcharges.

Asia Miles can also access a significantly greater proportion of award availability on Cathay Pacific flights, compared to other partner programs like Alaska Mileage Plan. And while the “kinky one-way flights” have been kink-shamed into oblivion, there remain a few interesting quirks about the program, such as the mixed-cabin award pricing using a weighted average of the distance flown.

If your travel goals are primarily focused on Asia and you’d like to get there in a comfortable business class seat, then Asia Miles may be a very attractive transfer option for your Avion points. Conversion bonuses have been few and far between, with the most recent 10% bonus coming from Asia Miles’s side rather than RBC’s.

American AAdvantage: Limited Use for Canadians

Avion’s fourth and final airline partner is American Airlines AAdvantage, and you can convert Avion points into AAdvantage miles at a 1:0.7 ratio. Occasionally, there are 20% conversion bonuses along this axis, which bring the transfer ratio to 1:0.84.

In the past, I’ve proposed that AAdvantage could be a worthy way to spend your Avion points, because it was one of the few programs that let you book the Etihad Airways A380 First Class Apartments at a compelling price – indeed, I personally had redeemed 62,500 AAdvantage miles per person for the Apartments on my Maldives trip, and a large chunk of those miles came from an RBC Avion transfer.

However, the recent announcement of an Aeroplan & Etihad Airways partnership has flipped that narrative entirely on its head. Aeroplan is now by far the easiest way to book the Etihad Apartments, and there’s very little reason to go via AAdvantage.

With Aeroplan, you can redeem 110,000 miles for 27 hours of Apartments between New York and Sydney, via Abu Dhabi. Meanwhile, due to their restrictive routing rules, American AAdvantage wouldn’t even let you book those two routes on the same award – you’d have to pay a total of 215,000 AAdvantage miles for two separate awards!

The other aspirational award that AAdvantage might unlock is Qatar Airways Qsuites, but hey, those can also be booked pretty easily via Asia Miles as well.

Overall, there just isn’t a compelling reason for most Canadians to transfer Avion points to AAdvantage these days, especially when the transfer ratio is clearly the weakest out of all four options.

Redeeming Avion Points Directly

Besides the frequent flyer partners, we can also touch upon a few ways to redeem Avion points directly for travel, even though they generally do not provide as much value.

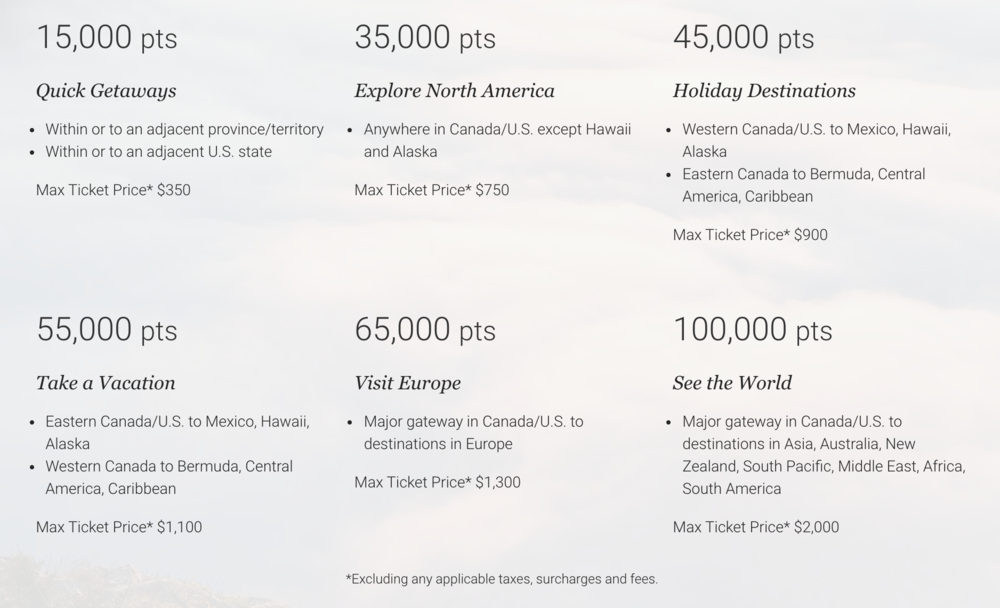

RBC themselves heavily advertise the Travel Redemption Schedule, which you can find published on the RBC Rewards website. This chart allows you to use the specified number of points towards a certain maximum ticket value of the “base fare” of your flight, which excludes things like airport improvement fees and government-imposed taxes that you’d have to pay separately.

The value in these redemptions may be limited, especially when compared to going through WestJet’s Member Exclusive fares. For example, if you’re considering an “Explore North America” round-trip redemption for 35,000 Avion points plus taxes and fees, it’s quite likely that you’ll also be able to find Member Exclusive fare space for 250 WSD (equivalent to 25,000 Avion points) instead.

For more luxury-minded travellers, don’t forget about the option of redeeming Avion points at 2cpp against revenue fares in business class and First Class. You’ll need an RBC Avion Visa Infinite Privilege or RBC Avion Visa Infinite Business to unlock this ability, but it can be quite a valuable way to diversify your redemptions away from the aforementioned frequent flyer programs and into the realm of favourably-priced cash fares as well.

Finally, if the current pandemic has you favouring cash-on-hand more than rewards points, then you can also redeem RBC Avion points against cash equivalents at mediocre rates (usually below 1cpp) for things like gift cards, statement credits, or TFSA deposits.

If you’re leaning in this direction, consider whether you might be open to taking some simple domestic trips over the next year or so, and whether transferring to WestJet Dollars to cover the cost of those trips might be a more sensible choice.

Putting It All Together

For most Canadians, I’d say that a good starting point in deciding what to do with your Avion points would be to think about your proportion of domestic/transborder vs. international travel, and use that as a metric to allocate your Avion points towards WestJet Rewards and one of Avios or Asia Miles.

For example, if roughly half of your trips per year are within continental North America, while the other half are to international destinations, then you might go with a 50/50 split. If it’s mostly domestic with the occasional overseas trip, you might earmark the points in an 80/20 split, and so on.

If you prefer to bring your whole family on North American trips, while travelling solo or with your partner on the long-haul jaunts, then that proportion might swing more in favour of WestJet Rewards, since you’d need more WestJet Dollars to cover more people’s flights.

Similarly, think about how Avion points fit into your wider points strategy: if most of your long-haul travel needs are already covered by miles earned in other currencies (like Amex MR points or Aeroplan miles), then you might also have less of a need for Avios or Asia Miles.

When deciding between Avios or Asia Miles, consider whether you’re in the game more for the luxury globetrotting (in which case Avios’s sweet spots and multi-carrier award might appeal to you) or for the convenience and comfort of a one-stop routing to the Asia-Pacific (in which case Asia Miles would be right up your alley).

And finally, don’t forget that each of the three best choices we’ve outlined here all have their own respective RBC co-branded credit cards as well: the WestJet World Elite, the British Airways Visa Infinite, and the Cathay Pacific Visa Platinum. Consider applying for or product-switching to these cards to further boost your balances.

Conclusion

RBC Avion is one of Canada’s most popular points programs and easily the most attractive program offered by a Big 5 bank, although the optimal strategies for redeeming Avion points for maximum value may not be so apparent at first glance.

The program caters to a wide variety of travel goals between cross-continent weekend getaways and seven-stop round-the-world trips, so I hope this analysis has been helpful in tailoring your Avion points holdings to the specific trips that you’d like to take.

My wife’s father has about 162,000 Avion points and wants to give them to us. (he’s 96, travel days are over). We dont’ have an RBC card, do have Westjet dollars. Is the best way to use them to transfer to our Westjet dollars account. And can we!

Does Avios has an expiry date?

Hi

Re: How to keep Avions points while waiting for a transfer bonus?

My RBC Avion Visa Infinite is expiring this month. I have been waiting for a transfer promotion (to transfer avion to avios points) but none have appeared during the past year. If I change this card to the RBC no fee Rewards VISA, will my points transfer to the Rewards VISA and remain as Avion points (i.e. not sure if the Reward points are the same as Avion points?)? Just looking for a way to keep the Avion points until a bonus transfer appears. Any suggestions? Thank you! 🙂

I believe only Avion-level cards can transfer to British Airways Avios. However, you could downgrade this card to the no-fee Rewards Visa for now, and then upgrade back to Avion Visa Infinite in the future when there’s a transfer bonus. I’m pretty confident this would work.

Do you know if you can use the Avion Points from Europe to Asia?

My VISA Infinite Avion card is due for renewal at the end of this month, will I lose my points when I cancel? If so, are you aware of any upcoming conversion bonus offers?

Yes, unless you transfer out to a partner or combine with another RBC Rewards card. Unfortunately, I’m not aware of any upcoming transfer bonuses – we were hoping for an Avios one in November (similar to last year) but as of now that looks unlikely to materialize.

“transfer out to a partner or combine with another RBC Rewards card” How exactly does this work? I once tried to combine points with my spouse but they did not allow that.

Thank you Ricky! Can I transfer RBC reward points to WJ dollar to make the WJ dollar not expired?

You sure can.

Thanks for this update. Quick questions:

1. Is there an option to transfer Avion points from one account to another? For example, I want to pool all my points and my partner’s point in one account.

2. Can I convert Avion points into somebody else’s WJ account?

No and no, I believe.

How long does it take when converting from RBC to WSD to see the WSD in the account? An RBC agent told me up to 4 weeks !!%!

It’s usually much faster than that. Should be a few business days.

Great post Ricky. Hello everyone, newbie question. How do I go about transferring my BA Avios to Aer Lingus for the Dublin flight? Also is there a way to store my Avios in one central place so I can use it for any of the Avios airlines?

You wouldn’t transfer your Avios to Aer Lingus; you’d use Avios to book Aer Lingus. The challenge is that Aer Lingus flights don’t show up online, so you can use either ExpertFlyer or United.com to look for space before calling British Airways to book.

If you transfer Avion points to your Avios account, they’ll all be stored there and can be used to redeem towards any of the Avios partner airlines.

Hi Ricky,

Thanks for the refresher!

Hey Ricky Thanks for another great post.

I’m looking at product changing options while keeping a safe-haven for these points. Kinda like how the US everyday card is for many who play the game in the US. Do you know if the business Avion allows us to merge personal points? If so, do you recommend PSing WJ/BA/CP/Avion cards? or since applying for the card gives you more points going through that route?

You can use the RBC rewards visa card (no fee) to store your avion points will you pursue other interests.

RBC Business Avion cards are harder to get (I had to provide business documentation and got offered a secured CC), have lackluster bonuses and I had to call in to move / use points. In hindsight, I don’t think getting a business card was worth it.

New applications give more points than product changes (with bonuses that aren’t guaranteed), we’ve seen 20k, 25k, 30k and 35k with / without FYF on the Avion Visa Infinite card and also $350 with / without WestJet Silver Status previously which are all offers that can’t be obtained through a product change.

Which F class product is that in the first photo?

JL.

Has It been hard applying for RBC CC? Applied for RBC WJ yesterday and was denied. First time denied.

There’s been a few data points that RBC has tightened up with approvals compared to before due to the pandemic. Andrew offers some good advice in his comment for the reconsideration process.

Generally speaking, many issuers have implemented stricter lending conditions, including RBC and Amex, given the current circumstances. You could try to have RBC reconsider your application, but it often requires a visit to the branch and another hard pull. Wait for your letter from RBC and maybe try calling the phone number on the letter.

Will do. I’ve also had 4 hard pulls in the past 6 months. Not sure if that’s a factor. How long is the recommended wait time to re-apply for a card that one has been denied? Thank you guys…