If you’ve read our introductory post on Miles & Points for Families, hopefully we’ve convinced you that the pursuit is worthwhile to help your family travel better and for less.

When it comes to earning points for family travel, the challenge often lies in accumulating enough points to cover travel expenses for the entire family.

The good news is that with some careful planning around your everyday expenses it’s an achievable feat, so let’s explore how to get started.

Miles & Points for Family Travel – How to Start Earning

Starting out in the Miles & Points hobby is often the hardest part of the process of accumulating points. With so many points currencies and credit card options, how do you figure out what to sign up for and what points to accumulate?

My advice: Start by working backwards.

Look at your past and future travel plans and take note: Do you typically travel domestic, transborder, international, or anything goes? Is there an airline you typically fly with? What future destination(s) do you want to visit?

The best way to start your Miles & Points journey is to settle on a destination, and from there you can determine what airline will get you there and what point currencies you’ll need – then you can start focusing on earning that currency.

We’ve written a great beginner’s guide that focuses on this exact goal-setting step, so check it out for more details on how to best approach this process.

When choosing which points currencies to collect, you want to consider your travel preferences and tailor your choices accordingly, and then pair them with the right credit card(s).

If you travel to many destinations served by Air Canada, then you may want to focus on accumulating Aeroplan points and sign up for card like the TD® Aeroplan® Visa Infinite* Card. Plus, you’ll get a free checked bag for yourself and up to eight people on the same booking when you fly with Air Canada, which is a great perk.

If you like to stay in Marriott hotels, you might consider signing up for an Marriott Bonvoy American Express Card to earn Marriott Bonvoy points for hotel stays and an annual Free Night Award.

If you often fly with ultra-low-cost or smaller airlines, or you prefer staying at Airbnbs or other accommodations that don’t have loyalty points, then you likely want to focus on cards that earn fixed-value points that can be redeemed for a statement credit against any travel charges, like the Scotiabank Gold American Express® Card or TD First Class Travel® Visa Infinite* Card.

And what if you don’t have any travel plans, but still want to get started? Then choose a card that will earn a flexible and transferable points currency like American Express Membership Rewards (MR) points or RBC Avion points. With these options, you can start accumulating points immediately, and once you have a trip on the horizon, you can then transfer your points to the right loyalty program for the redemption.

A key thing to remember is that when you’re starting off it’s best to focus on only one or two award programs that best suit your needs. Later on, once you’ve got a handle on the earning and redeeming process, you can diversify further.

Also, for international family travel on points, it’s best to plan trips two years in advance. At two years out, you can start accumulating the points that you’ll need to get you and your family to your chosen destination, and then at about one year before your preferred travel dates, you can start looking at redemption options.

Strategies for Earning Points for Family Travel

When it comes to earning points as a family, the onus falls on the adults.

In a family of four with two young kids, the two adults must earn enough points between themselves to fund travel for all four family members. The larger the family, the more work the adults will have cut out for them.

Accumulating enough points for a trip just through day-to-day spending could take quite a while. Thankfully, there are ways to accelerate your points earning, but how aggressively you pursue these means will depend on your exact travel goals.

1. Welcome Bonuses

The quickest and easiest way to get started earning points for family travel is through credit card welcome bonuses. Welcome bonuses offer a one-time opportunity to significantly boost your balance, and depending on the offer, a welcome bonus from a single card may be enough for flights for one or two people in your family.

For example, the largest welcome bonus in Canada tends to be offered on the Business Platinum Card® from American Express. While the offer may change from time to time, it’s held steady at up to 120,000 Membership Rewards points for the past couple of years, which is good enough for at least a few flights in economy, and even one or two flights in business class.

Welcome bonuses are often earned, at least in part, after meeting a minimum spending requirement on the card. Given this, you want to make sure the minimum spending amount is achievable before applying for a card, and never spend beyond your means for the sake of points.

If you find yourself needing to pay interest because you’re carrying a balance on your credit card, you’re paying more for the points that you’re earning which significantly cuts into the value you’re getting. Carrying a balance can also have a negative impact on your credit rating, so always consider what is economically sustainable for your family.

2. Referral Bonuses

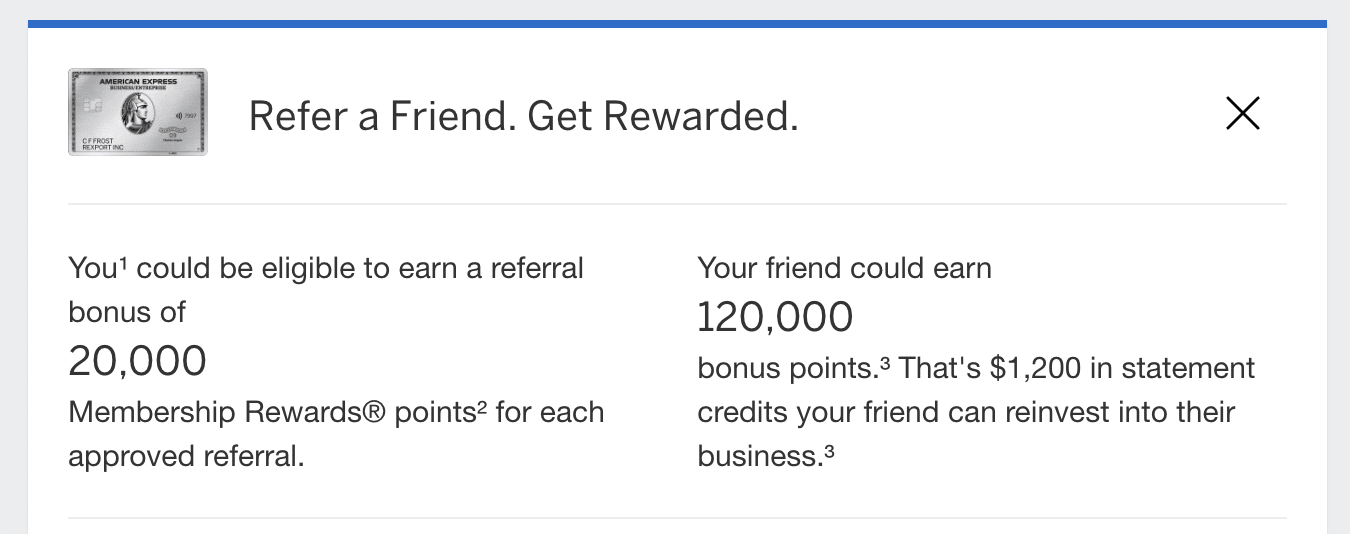

Welcome bonuses aren’t the only way to acquire larger chunks of points quickly. With American Express, you can earn referral bonuses for referring friends and family for an eligible card. Take for example the Business Platinum Card® from American Express which earns you 20,000 MR points for each referral, up to an annual maximum of 225,000 points.

If one family member has this card and refers the card to their spouse, the referer would earn 20,000 MR points from the referral, while their spouse earns another 120,000 MR points after meeting the minimum spending requirement (assuming a welcome bonus of 120,000 points). In this scenario, it’d effectively add 140,000 points to your family’s pool of points.

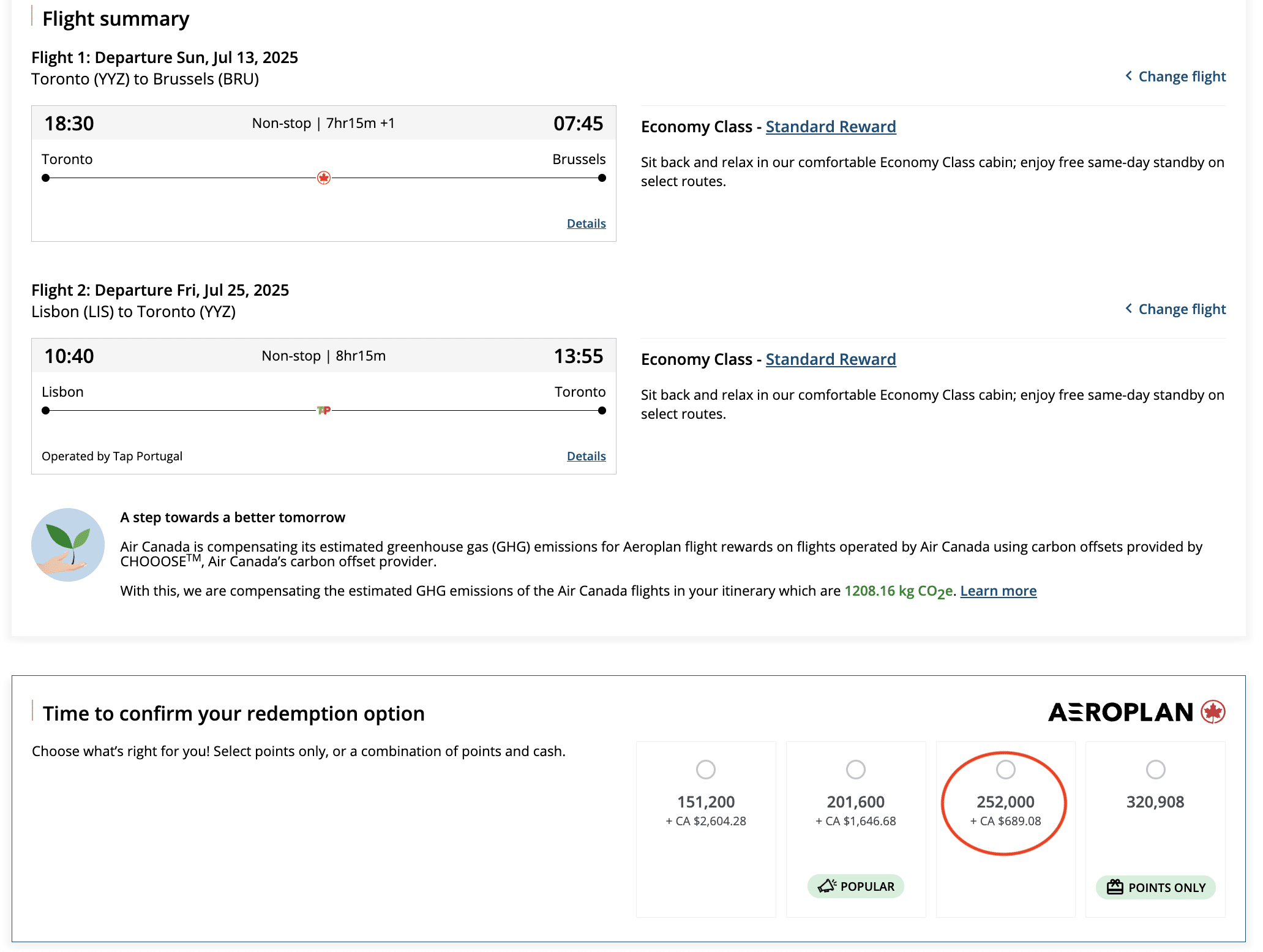

Add this to the welcome bonus points the first family member earned (again, assuming that the welcome bonus is 120,000 MR points) and that’s already 260,000 MR points earned in one year, which could be enough for a family of four to fly round-trip to Europe!

(As a reminder, American Express Membership Rewards points transfer to Aeroplan at a 1:1 rate).

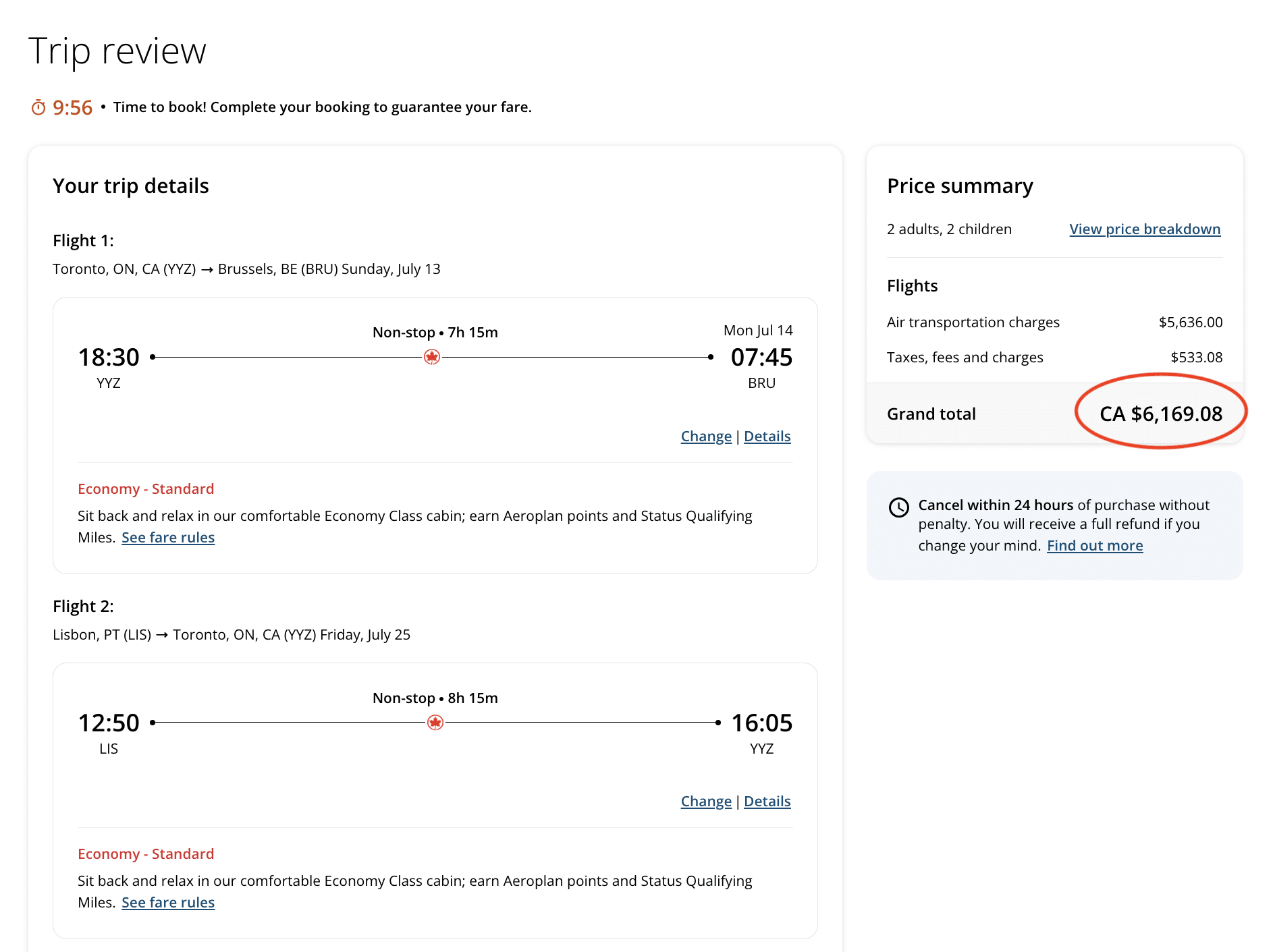

This trip on similar flights for the exact same dates would have otherwise cost over $6,000 (CAD).

Plus, since the Business Platinum Card® from American Express can refer to almost every card in the Membership Rewards family, you can earn 20,000 points for each successful referral you make to other cards, including the American Express Cobalt® Card, the American Express® Gold Rewards Card, the American Express® Business Gold Rewards Card, etc.

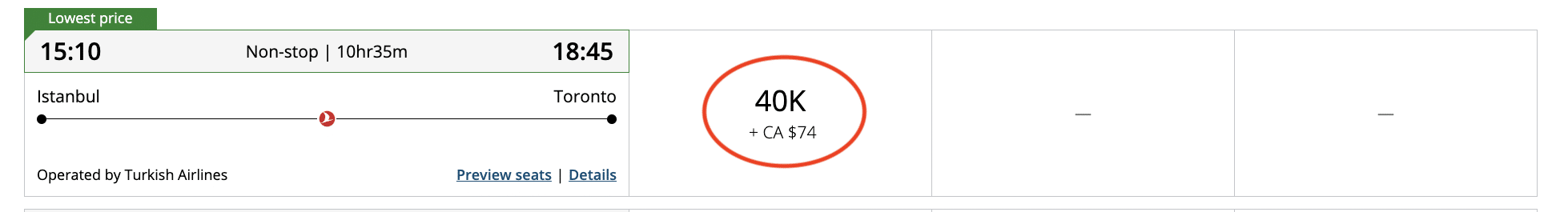

American Express has also been putting on a promotion each spring where you can earn double the referral points. If you time your referrals for then, you’ll earn a staggering 40,000 points per referral, which is enough for a single one-way economy ticket from Istanbul to Toronto…

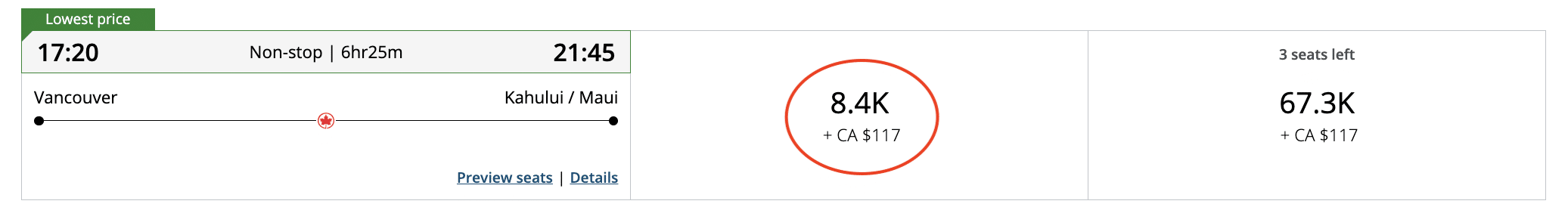

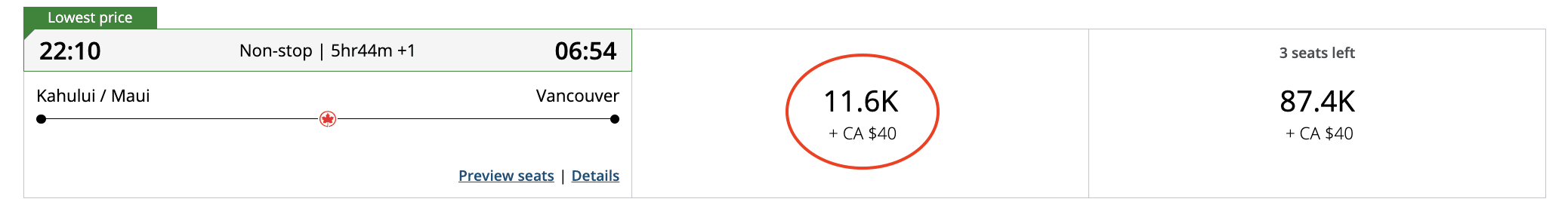

Or two round-trip economy tickets from Vancouver to Maui…

Once your child turns eighteen, you can refer them as well, and don’t forget that grandparents need credit cards too!

Check out our in-depth guide about American Express’s Referral Program to learn more.

3. Maximizing Earn on Regular Spending

If you’re still pulling out cash and debit cards to pay for things, it’s time to stop. Use your credit card whenever you can and pay attention to earning rate category multipliers.

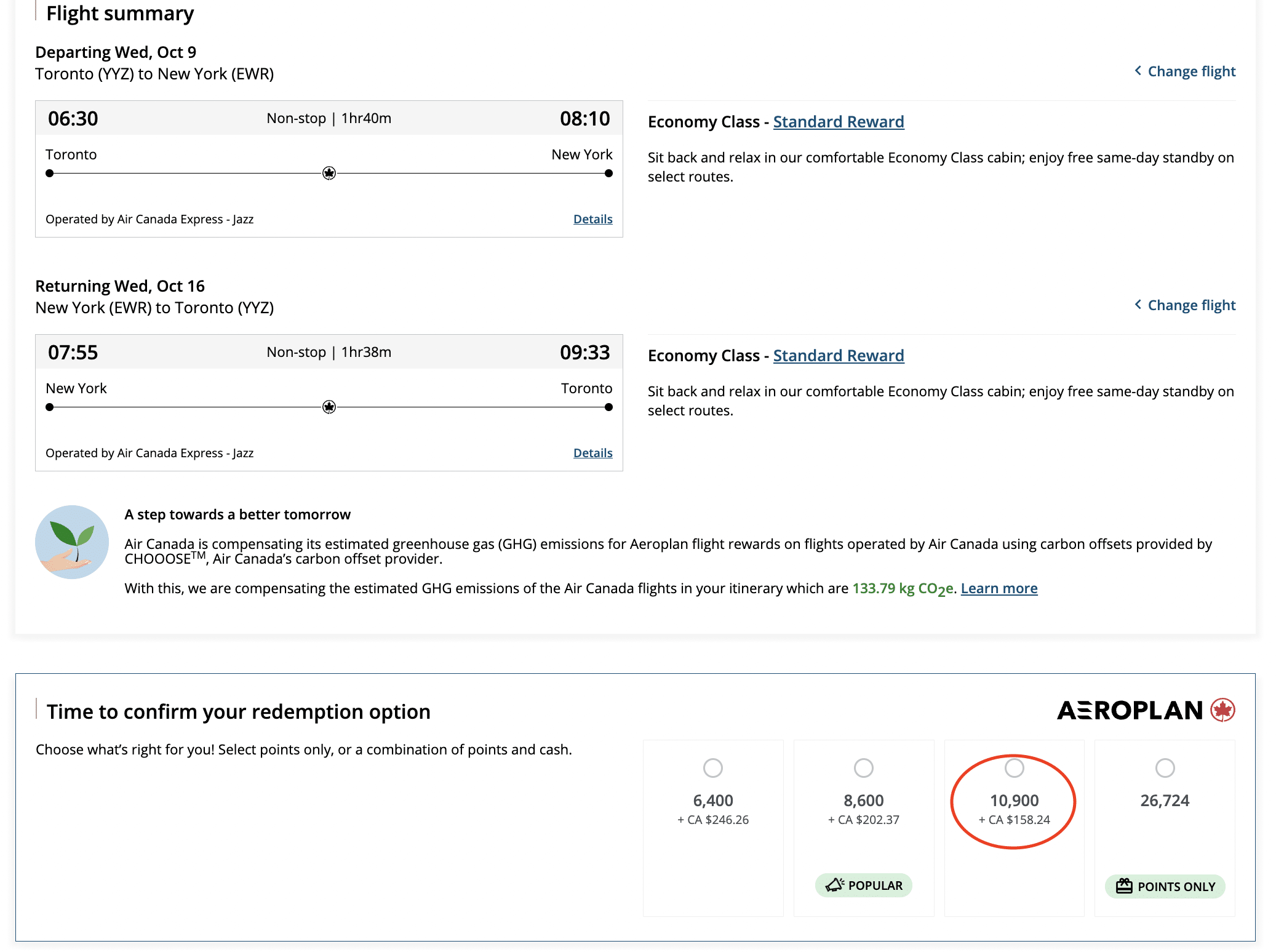

That weekly family trip to McDonald’s for $50 (CAD) could earn you 13,000 points over the course of the year if spent on the American Express Cobalt® Card that earns 5 points per dollar spent on dining. The earnings from this expense alone could be redeemed for a round-trip flight from Toronto to New York City with Aeroplan points.

Many credit cards offer multipliers on various categories of spend, which you should aim to maximize as much as possible.

For example, you can use the American Express Gold Rewards Card to earn 2 points per dollar on gas, travel, and transportation expenses. If your family flies frequently with Air Canada, put all Air Canada purchases on the American Express® Aeroplan®* Reserve Card to earn 3 points per dollar.

Choose a few cards with multipliers that make sense for your family, and that will allow you to maximize your points earning on daily spending. Read our detailed guide to maximizing your earnings through category multipliers to learn more about how to make the most of your expenses.

Use alternative payment service providers. Some expenses traditionally paid by debit, like summer camp fees, school tuition, rent, and utilities can now, in most cases, be paid for using a credit card through platforms like Plastiq, PaySimply, and Chexy. Tax season and property tax deadlines are also great times to use these services for meeting a minimum spend requirement on a new credit card.

There is a small fee to use these platforms, but you can come out ahead if using the right credit card or if you’re using them for the purposes of meeting a minimum spending requirement to earn a juicy welcome bonus.

Use shopping portals. When it comes to online shopping, don’t forget to go through e-store portals to earn bonus points on your spending in addition to the points you earn through your credit card. Most airline programs have their own portals, so choose the one you travel with most.

Air Canada has its Aeroplan eStore, and during certain times of the year, they’ll run promotions where you can earn up to 10x the Aeroplan points on everyday purchases at eligible stores. Air France KLM Flying Blue has its Shop for Miles portal, although the number of stores currently offered is quite limited.

When booking travel, you can earn extra cash back by going through Rakuten for bookings with Marriott, Expedia, Viator, Hertz, and a lot more. And if you’re planning to stay at an Airbnb, consider booking through British Airways’s Avios portal to earn extra Avios.

Conclusion

It takes a little more leg work to earn enough points for family travel, but it’s definitely a doable and worthwhile pursuit. By taking advantage of welcome bonuses, referral bonuses, and maximizing your points earnings on regular spending, you’ll be well on your way to having a healthy points pool for your family.

Be sure to get your spouse or partner involved in the process too so you can double your earning potential. If they’re hesitant to join in your venture, show them the savings; and if that doesn’t do it, fly them in business class and then see what they think!

Stay tuned for the third and last part of our series where we’ll look at planning and booking redemptions for three or more passengers.