In the world of flight rewards, the fixed-points airline reward chart is something that is often overlooked by Miles & Points maximizers, and often for good reason.

Most in the game know that it’s often much harder to derive value using these redemptions, compared to flight rewards directly with an airline’s currency. However, there could be a multitude of reasons why you might want to consider using a fixed-points redemption – convenience being chief amongst them.

With a few major programs in Canada between American Express, RBC, and CIBC, we’ll examine which one provides the most value.

The Methodology

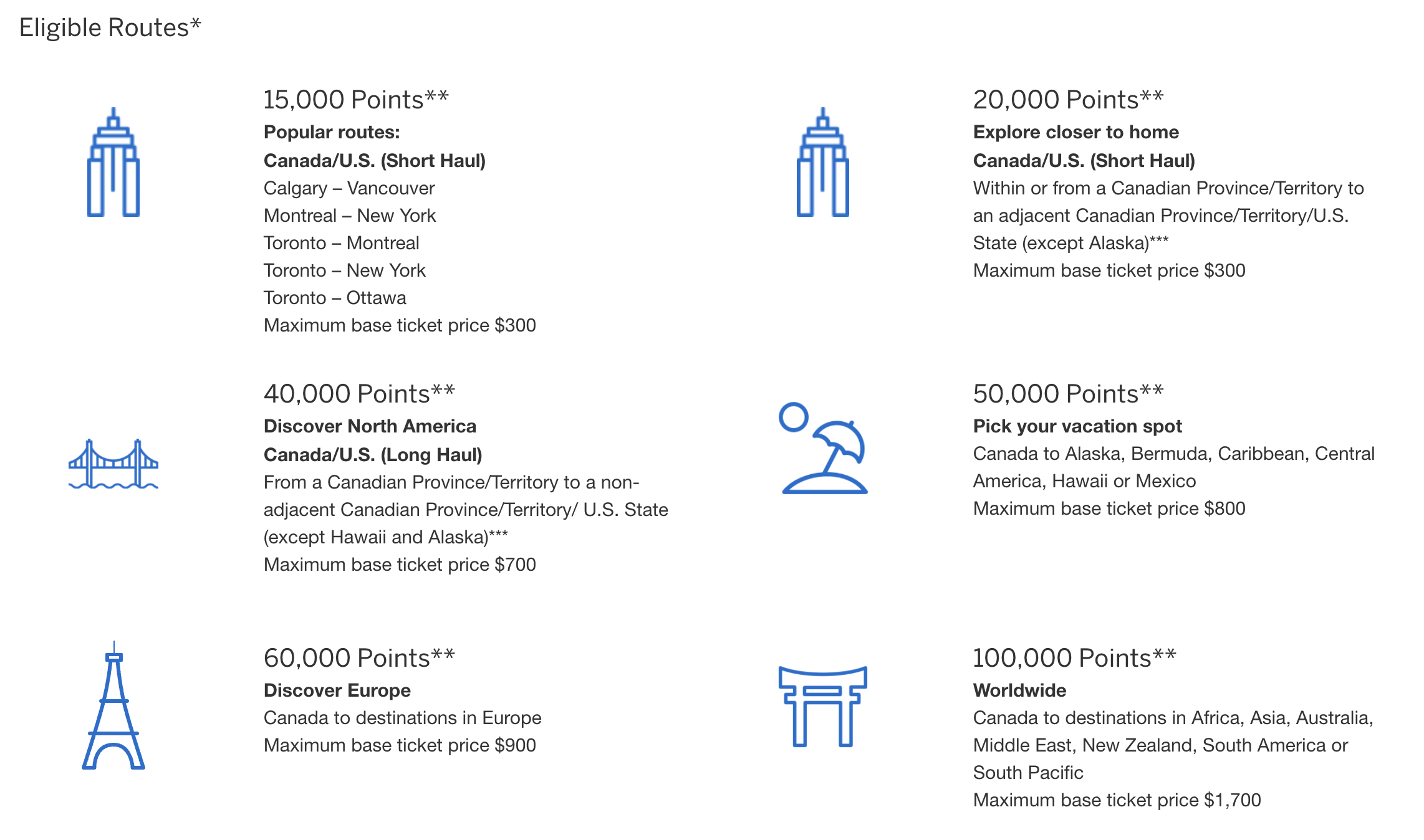

We’ll be comparing the three fixed-points travel programs by American Express, RBC, and CIBC. Here is the Amex Fixed Points Travel reward chart for economy class:

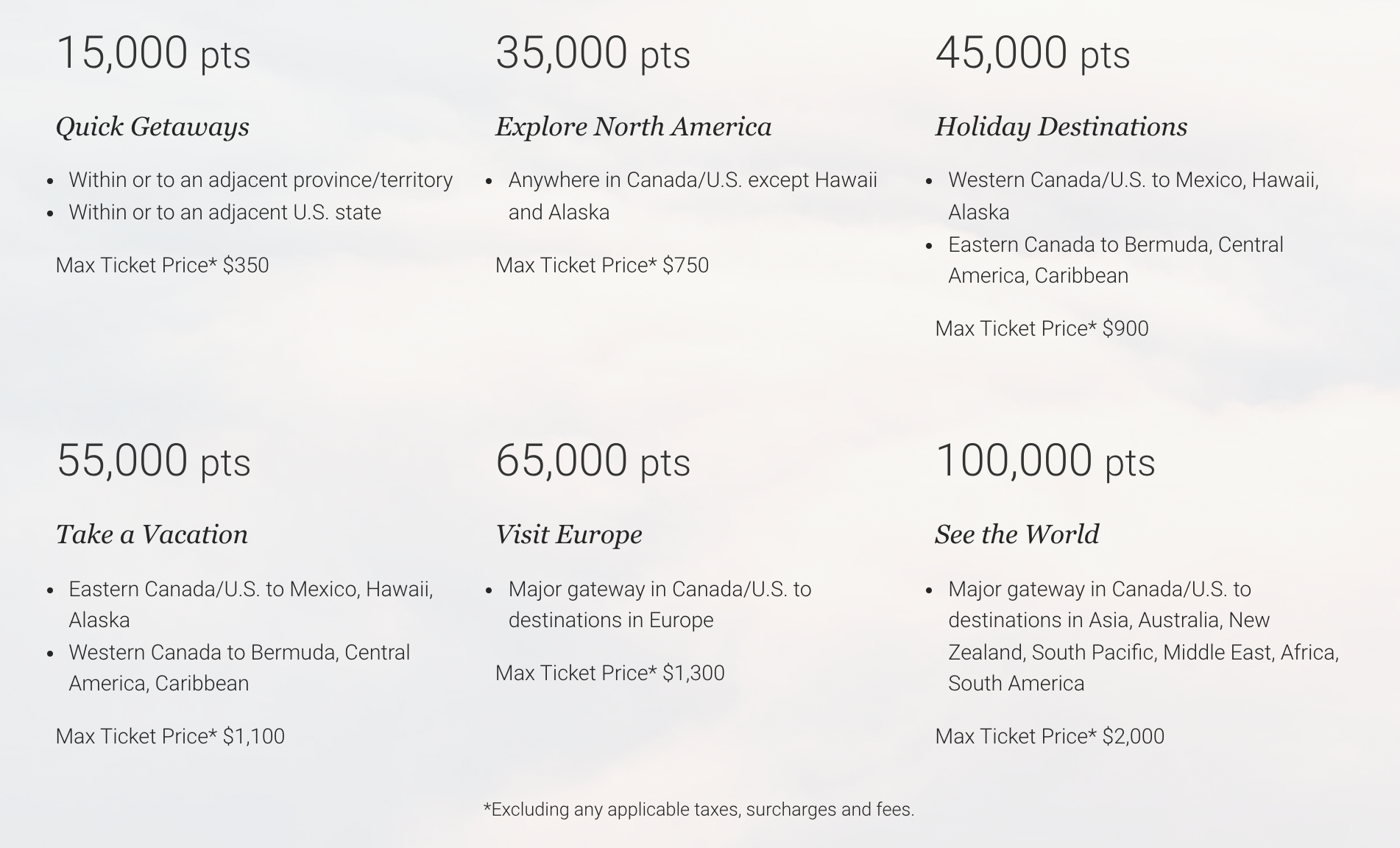

Here’s the RBC Air Travel Redemption Schedule:

And here’s the CIBC Aventura Airline Rewards Chart:

With each program being somewhat different in terms of the number of points needed to book based on your destination and the ticket’s maximum value, the easiest way to compare is to look at round-trip flights to a few sample destinations.

For easy comparative reasons, we will rank the winner of each destination based on a cents per point (cpp) valuation.

An additional item to keep in mind is that regardless of the program, only the base fare is covered as part of the redemption. Each program may have an additional methodology to pay for taxes and fees, but they are often of poor value.

One other caveat that I want to pass along is how we review the CIBC Aventura Travel Rewards Program. CIBC uses a range of points when quoting the cost of a redemption, but they do not make it clear as to how the range is determined. Therefore, we will be using the maximum redemption pricing as a “worst-case scenario” view of the pricing.

Lastly, we will be examining economy class redemptions in this article, with a follow-up post specific to business class redemptions.

1. Canada/US Short-Haul

While short-haul redemptions are often the least “sexy”, these types of redemptions are often the most common “real-world” redemptions that most programs see.

Most people join a rewards program with aspirations of travelling to Paris, Dubai, or maybe the Maldives, but often find themselves redeeming points to get a cousin’s wedding a province over. Because of the high likelihood of these types of redemptions, strong attention should be paid to each program and its redemption values.

American Express | RBC | CIBC | |

Redemption limitations | Select popular routes* | Within or to an adjacent province/territory or within or to an adjacent US state | Within a province or territory or US state or to an adjoining province or territory or US state |

Maximum ticket value | $300 | $350 | $400 |

Points required | 15,000 MR points | 15,000 Avion points | 10,000–20,000 Aventura points |

Cents per point | 2¢ | 2.3¢ | 2¢ |

Verdict: While CIBC Aventura allows you to cover the highest base fare using Aventura points under the short-haul category, the RBC Avion program offers the highest possible value with a lower number of points required.

2. Canada/US Long Haul

Similar to short-haul flights, the Canada/US Long-Haul redemption is another popular redemption type. While it’s a shame that each program treats Hawaii and Alaska separately, many of my personal travel redemptions fall within this category.

American Express | RBC | CIBC | |

Redemption limitations | From a Canadian Province/Territory to a non-adjacent Canadian Province/Territory/US State (except Hawaii and Alaska) | Anywhere in Canada/US except Hawaii and Alaska | From a Canadian Province/Territory to a non-adjacent Canadian Province/Territory/US State (except Hawaii and Alaska) |

Maximum ticket value | $700 | $750 | $800 |

Points required | 40,000 MR points | 35,000 Avion points | 25,000–35,000 Aventura points |

Cents per point | 1.75¢ | 2.14¢ | 2.29¢ |

Verdict: The CIBC Aventura program offers both the highest possible base fare and the highest value for your points in the Canada/US Long-Haul category. If you’re looking for a transcontinental round-trip flight in economy class, it might be an opportune time to burn some Aventura points.

3. Sun Destinations

When most casual travellers think about what they’d like to redeem their points on, the answer is often Hawaii or the Caribbean, so this redemption level is one of the most important in the eyes of many.

Note that RBC splits the redemption for this chart based on what side of the country you reside in and where you are going. Therefore, I have included two RBC charts below.

American Express | RBC | CIBC | |

Redemption limitations | Canada to Alaska, Bermuda, Caribbean, Central America, Hawaii, or Mexico | Western Canada/US to Mexico, Hawaii, Alaska or Eastern Canada to Bermuda, Central America, Caribbean Eastern Canada/US to Mexico, Hawaii, Alaska or Western Canada to Bermuda, Central America, Caribbean | From any location in Canada or US to Mexico, Hawaii, Alaska, Bermuda, Central America, or the Caribbean |

Maximum ticket value | $800 | $900 $1,100 | $1,000 |

Points required | 50,000 MR points | 45,000 Avion points | 40,000–60,000 Aventura points |

Cents per point | 1.6¢ | 2¢ | 1.67¢ |

Verdict: Whether you live in Western or Eastern Canada and are travelling to the western or eastern sections of Sun destinations, the RBC Avion fixed-points travel chart will serve you the best.

4. Europe

Europe is another very commonly desired destination for rewards travellers; however, due to the larger number of points required, many of these redemptions may be out of reach in the short term.

It’s therefore important the understand the best program to derive value before you set out on your journey to rack up the points.

American Express | RBC | CIBC | |

Redemption limitations | Canada to destinations in Europe | Major gateway in Canada/US to destinations in Europe | From a major gateway in Canada or US to select destinations in Europe |

Maximum ticket value | $900 | $1,300 | $1,300 |

Points required | 60,000 MR points | 65,000 Avion points | 50,000–70,000 Aventura points |

Cents per point | 1.5¢ | 2¢ | 1.86¢ |

Verdict: The RBC Avion chart gives you the best value for booking round-trip economy class flights to Europe, while also allowing you to book the joint-highest base fare using your points.

5. Rest of the World

Lastly, we have the “Rest of the World” category of destinations, which includes most of Asia, Africa, Oceania, and South America.

American Express | RBC | CIBC | |

Redemption limitations | Canada to destinations in Africa, Asia, Australia, Middle East, New Zealand, South America, or South Pacific | Major gateway in Canada/US to destinations in Asia, Australia, New Zealand, South Pacific, Middle East, Africa, or South America | From a major gateway in Canada or US to select destinations in Africa, Asia, Australia, New Zealand, South Pacific, Middle East, South America |

Maximum ticket value | $1,700 | $2,000 | $2,000 |

Points required | 100,000 MR points | 100,000 Avion points | 75,000–125,000 Aventura points |

Cents per point | 1.7¢ | 2¢ | 1.6¢ |

Verdict: Once again, RBC Avion offers the highest value against an economy class round-trip ticket in the “Rest of the World” category, along with the joint-highest base fare compared to the other programs.

The Winners and Losers

Based on our review of the three fixed-points travel programs, the clear winner of the bunch is the RBC Avion program’s Air Travel Redemption Schedule. RBC’s chart wins in four of the five destination categories, and only loses the Canada/US Long-Haul category by a fraction of a cent.

CIBC came in a clear second, beating American Express in all categories except for the Rest of the World, and only by 0.1¢ per point.

The Amex Fixed Points Travel program was the clear loser in the trio of fixed points travel programs, with consistently the least value per point derived.

The results of this comparison were a bit of surprise to me, as I had always been under the impression that American Express tended to outclass the competition with any sort of flight redemption, but this isn’t quite universally true when it comes to these fixed-points redemption charts.

Earning Points and Status on Fixed-Points Redemptions

There’s one significant advantage to booking through Amex Fixed Points Travel, though, which may move the needle in its favour.

Flights booked through Amex Fixed Points Travel can be credited to a frequent flyer program to earn additional points (such as Aeroplan points) or get you closer to airline elite status (by earning, say, Status Qualifying Miles, Segments, or Dollars for Aeroplan Elite Status).

Meanwhile, recent data points indicate that airline tickets issued through RBC and CIBC’s reward charts are usually noted as “non-mileage earning”, which means that you won’t earn redeemable points or elite-qualifying miles from these flights.

Other Considerations

When we choose a points program to invest our time in, many factors are at play. While the fixed-points redemption charts for each of Amex, RBC, and CIBC are important, they are but a piece of the larger puzzle.

Another consideration is what you can do with the points outside of these direct bookings for round-trip flights. This is where both American Express and RBC Avion leave CIBC in the dust.

American Express Membership Rewards boasts many travel partners that you can transfer your points into, including Aeroplan and British Airways Avios at a 1:1 ratio. With these transfers, you are often able to derive much higher values than via the Amex Fixed Points Travel program.

RBC also has strong transfer partners in British Airways Avios, Cathay Pacific Asia Miles, and American AAdvantage, all of which can unlock more valuable premium cabins with Oneworld airlines.

CIBC, unfortunately, does not have any travel partners where you can transfer your Aventura points, leaving a major gap in comparison to the other two programs.

Conclusion

RBC has a surprisingly strong rewards program that is especially powerful if you are looking for a simple round-trip flight booking in economy class for a fixed level of Avion points.

While savvy points collectors may find this type of redemption pedestrian, there are many occasions where a fixed-points flight redemption makes a lot of sense.

Many times when I am looking for a positioning flight or a long-haul flight on a route that just isn’t available, the various banks’ fixed-points reward charts have come in very handy.

Based on this review, I’ll be putting more of an emphasis on collecting RBC Avion points for this purpose, and you may want to consider doing the same.

Very informative analysis. I am surprised by the conclusion, however, that RBC Avion Points program is the winner here. Customer Reviews during the last year of the RBC Avion Infinite card (on a Canadian credit card comparison site) show many card holders unhappy with the value derived from Avion points because of the high taxes, fees and surcharges that must be paid for a ticket which severely offers the value of the ticket where the base fare is only covered by Avion points. I was pre-approved for this card but have delayed taking the plunge because of the experiences reported by existing card holders.

Interesting. I think you should do more of these. Would be interesting to see how the other players compare.

Jayce,

For RBC Avion Infinite card, can you:

(1) redeem open jaw ticket?

(2) redeem round trip ticket with one stopover?

(3) redeem business class up to $2,000, then pay for the difference with cash?

Thanks!

Yeah I’d like to see how earn rate of the best respective cards factors in to considerations.

It would be very beneficial to see a discussion on the best way to use MR points – either book directly with the MR points or first convert to Aeroplan. I think that converted MR points do not contribute to Elite status but as stated in the article a MR points booked flight would. That difference could greatly influence the choice.

The only contention would be if you can earn 5x points on say cobalt vs RBC card you still out earn per dollar spent even if the reward is lower of a cent value