Last week, American Express launched the extraordinary Double Rewards promotion on their flagship product, the Platinum Card, as a means to dramatically boost the value of this card and justify its $699 annual fee at a time when its travel benefits are much less meaningful than usual.

While there was some uncertainty from the outset as to whether this promotion would apply to new cardholders, American Express has since confirmed that it will:

We know this is a challenging time and our goal is to help you get the most out of your Card. To enhance the everyday value on your Platinum Card, we recently put into place the Double Rewards offer which is available to all Canadian Platinum Cardmembers for a limited time.

— Amex Canada (@AmexCanada) April 23, 2020

With Double Rewards being one of the most lucrative promotions we’ve ever seen in the Canadian rewards space, in this post I wanted to take a look at nine different ways to squeeze maximum value out of this promotion before it ends on July 20.

You can also watch the video I made about this promotion and why it’s so powerful, before we delve into further details on the individual strategies.

In This Post

- 1. Apply for the Platinum Card

- 2. Apply for the Other Membership Rewards Cards

- 3. Spend Every Dollar on the Platinum Card

- 4. Bring Forward Your Future Spending

- 5. Pay Your Tax Bill with Plastiq

- 6. Refer a Friend

- 7. Look for Arbitrage Opportunities

- 8. Convert US MR Points to Canada

- 9. Save Your Points for Travel… But Only If You’ll Get 2cpp+ Value

- Conclusion

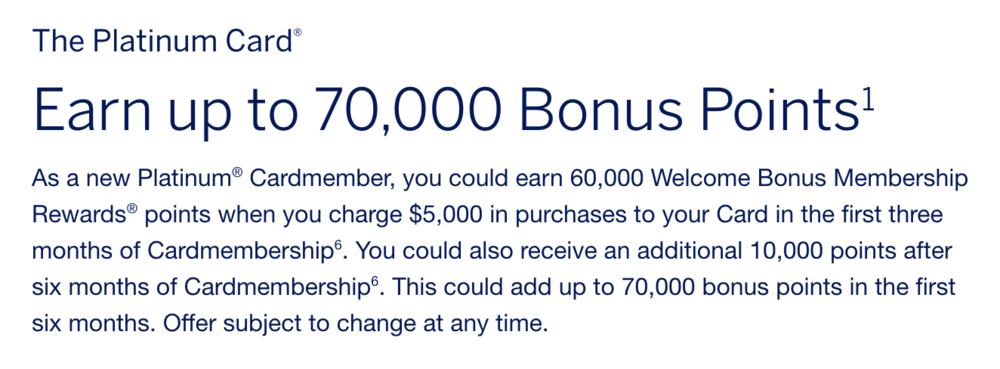

1. Apply for the Platinum Card

If you don’t already have the Platinum Card, it shouldn’t take a lot to convince you that it’s an absolute no-brainer to apply for one right now.

The current signup bonus is 60,000 Membership Rewards points, which you’d earn upon applying via referral link and then spending $5,000 in the first three months.

(The offer also comes with the promise of 10,000 MR points after holding the card for six months, although the Double Rewards promotion will be over by then.)

However, note that the $5,000 minimum spend will also earn you 10,000 MR points at a minimum, since all purchases are earning at least 2 MR points per dollar spent under Double Rewards. Indeed, if part of your spending falls in the dining or travel categories (which earn 6 or 4 MR points per dollar spent, respectively), this figure would be even higher.

So you’d end up with a total of 70,000 MR points in your balance. And with MR points being redeemable against purchases on your statement at a value of 1,000 MR points = $20 under Double Rewards, that’s equivalent to $1,400 in your pocket!

In fact, you can even redeem these points against some of that $5,000 in purchases that you had made initially – unlike purchase refunds, statement credits do not affect your net spend and will not cause you to dip below the minimum spending requirement associated with the signup bonus.

Taking that $1,400, subtract the $699 annual fee and add back the $200 annual travel credit, and you’re left with a net gain of $901. And that’s to say nothing of the actual travel benefits that may come in handy later, from the opportunity to earn Star Alliance Gold via Shangri-La Jade status to the status-match pathway to Ceasars Diamond and a free four-night stay in the Bahamas.

We often talk about the importance of grabbing the low-hanging fruit in this game we play, and, well, the fruit does not hang much lower than this!

2. Apply for the Other Membership Rewards Cards

While the Double Rewards promotion is limited to the Platinum Card, the fact that Membership Rewards points may be combined across different accounts means that the points you earn from other American Express products can also benefit from the elevated redemption rate.

You can reach out over Live Chat to request that your Membership Rewards accounts be linked to each other. The MR points from the Gold Rewards Card, Business Gold Card, and Business Platinum Card may be merged with the Platinum Card, while the lower-level MR Select points from the Cobalt Card and Business Edge Card may not.

Normally, we’d emphasize the fact that the signup bonuses on these cards are very well-suited to high-value flight redemptions via Aeroplan or British Airways Avios. But in these exceptional circumstances of Double Rewards, it must be pointed out that the signup bonuses on the Gold, Business Gold, and Business Platinum will net you $600, $800, and $1,500 in cash.

These are certainly some not-insignificant amounts, especially at a time when individuals and households may prefer to hold cash over travel rewards points, and even avid travellers might do the same, with the expectation of finding cheaper cash fares over the foreseeable future.

3. Spend Every Dollar on the Platinum Card

With the usual earning rates doubled, the Platinum Card will earn 6 MR points per dollar spent on dining (including food delivery services like Uber Eats and Skip the Dishes), 4 MR points per dollar spent on travel, and 2 MR points per dollar spent on everything else.

Combine that with the Use Points for Purchases redemption rate being doubled too, and you have a net return of 12% on dining, 8% on travel, and 4% on everything else.

At a time when we were expecting very little promotional activity from credit card issuers across the board, the Platinum Card transforming into a no-limit 4% cash back card with 8% and 12% bonus categories (albeit temporarily) is akin to divine intervention.

It goes without saying that this is one of the highest returns on spending you can possibly achieve compared to any other Canadian or US credit card, so it would behoove you to charge every possible dollar of your spending between now and July 20 onto your Platinum Card (without spending more money than you otherwise would, of course).

4. Bring Forward Your Future Spending

While you shouldn’t be tempted into spending more money than you normally would, it can be a good idea to bring forward the timing of purchases that you would’ve made at some point in the future, especially in the more rewarding categories of dining and travel.

What are your favourite restaurants that you’ll be certain of visiting as soon as we’re able to go out to eat again? Do they offer gift cards? What about your local pub or watering hole? Would they be open to setting up a prepaid tab for you as a loyal customer?

I’d kill for one of those Red Lobster biscuits right now.

It may be worthwhile to load up on your future spending in the dining category before Double Rewards ends on July 20, earning you a staggering 12% discount on these purchases instead of the 3% you’d normally receive.

The same goes for the travel category: travel purchases made with your Platinum Card will effectively enjoy an 8% discount. Even if you’re hesitant to book revenue flights because the airline may be reluctant to refund you if they cancel the flight, there are still other creative ways to load up.

For example, many Marriott hotels are known for selling Marriott gift cards in any denomination; these purchases would code as travel, thus earning you 8% off all of your Marriott hotel stays paid with cash in the future.

Of course, you should be careful when assessing the right amount of purchases to front-load under this promotion, making sure not to be tempted into a disproportionately higher volume of future spending than you’d otherwise incur.

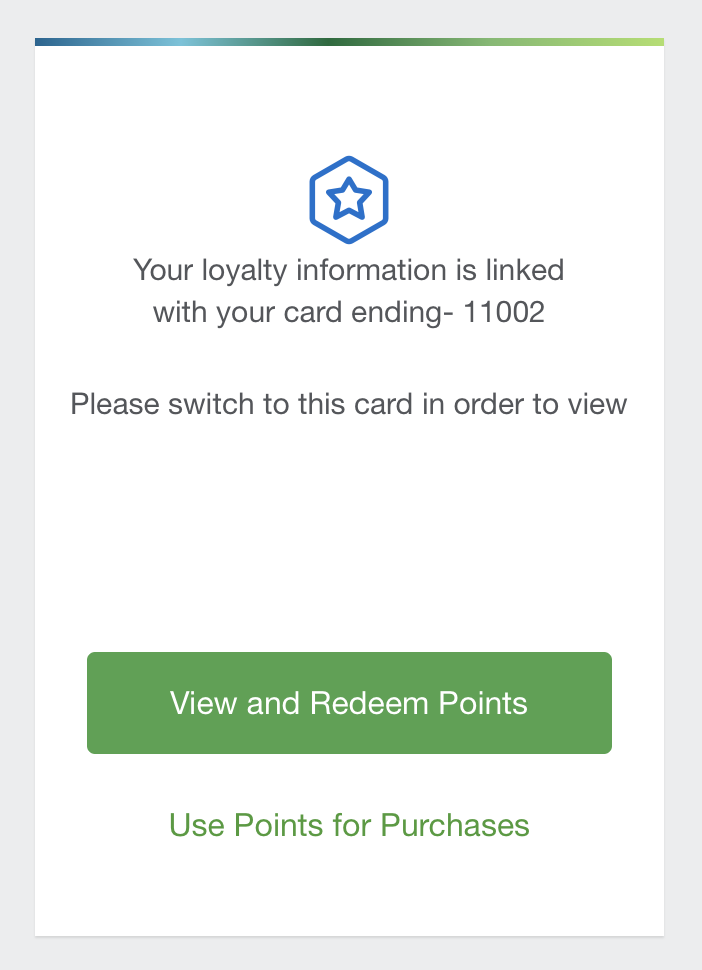

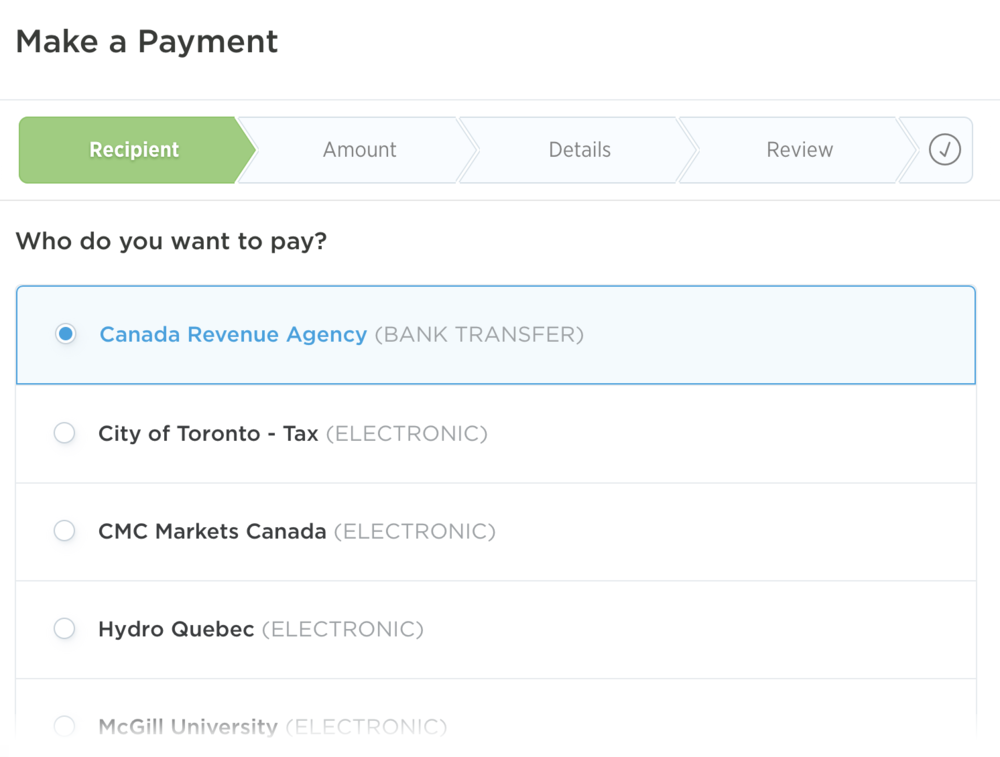

5. Pay Your Tax Bill with Plastiq

The CRA has extended the 2019 tax filing deadline until June, which gives us a few more months to sort out our tax returns and pay any amounts that we owe using our credit cards, thanks to bill-payment services like Plastiq or PaySimply.

The usual preferred credit card for Plastiq payments is the Amex Business Gold Card, which allows you to choose Plastiq as one of three preferred merchants with which to earn double MR points. However, the Platinum Card has now wrested that title away with a 4% return that dwarfs the Business Gold’s 2%, and easily justifies the 2.5% fee charged by Plastiq or the 2.29% fee charged by PaySimply.

(Yes, you can always combine the points on your Business Gold into your Platinum Card and get a 4% return that way as well, but charging it directly to your Platinum saves you that extra step.)

In addition to your tax bill, don’t forget about all the other bills that you can paying using Plastiq, such as your rent, business expenses, tuition, and property taxes. As before, front-loading these payments under the period of Double Rewards can allow you to extract even more value.

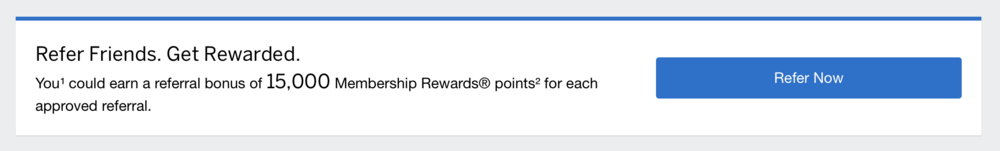

6. Refer a Friend

The highly lucrative Double Rewards promotion should give you ample fodder for convincing your friends and family members to sign up for the Platinum Card as well. I mean, who can say no to $901 in value upon signing up and up to 12% in cash back?

When a friend or family member signs up for the card though your referral link, you’ll earn 15,000 MR points on the Platinum Card as a referral bonus. Under Double Rewards, that’s equivalent to a spectacular $300 return – all for going through the trouble of telling your friends and family that $901 is waiting for them.

Even better, remember that the other Membership Rewards products are very much worth signing up for under this promotion as well. And if you held the Amex Business Platinum, what would your reward be for convincing your friends and family to sign up for a Business Platinum or Business Gold of their own?

You’d earn 25,000 MR points, which would be worth $500 all on its own – enough to cover your family and friends’ annual fees, should you choose to be so generous!

7. Look for Arbitrage Opportunities

Miles & Points aficionados tend to have a keen eye for arbitrage opportunities in their daily lives: buying low, selling high, and capturing the value in between. And with up to a 12% return available when purchasing stuff with your Platinum Card, the opportunities for “buying low” are aplenty – you just have to look for them.

If you’re a business owner with significant expenses, a 4% discount on your costs can make a significant impact to your bottom line at a time when your business might be going through a leaner period.

Meanwhile, to take another example, a certain pizza chain that’s ostensibly based in the northeastern United States, but primarily operates in Canada, makes its gift cards available at retail outlets and would code under the dining category for a 12% return. Concurrently, Cardswap.ca, a well-respected gift card marketplace, is currently buying said gift cards at 11% below their face value.

A 1% return might not justify the time and effort involved in pursuing this arbitrage opportunity (not to mention the rather frivolous visits to non-essential businesses), but it gets you thinking in the right direction of deals that may be lying in plain sight.

8. Convert US MR Points to Canada

I’ve written in the past about converting MR points between the US and Canada at the prevailing exchange rate. This can be done once every 12 months, and if you’ve delved into US credit cards but haven’t used your US MR points yet, this may be an angle worth considering.

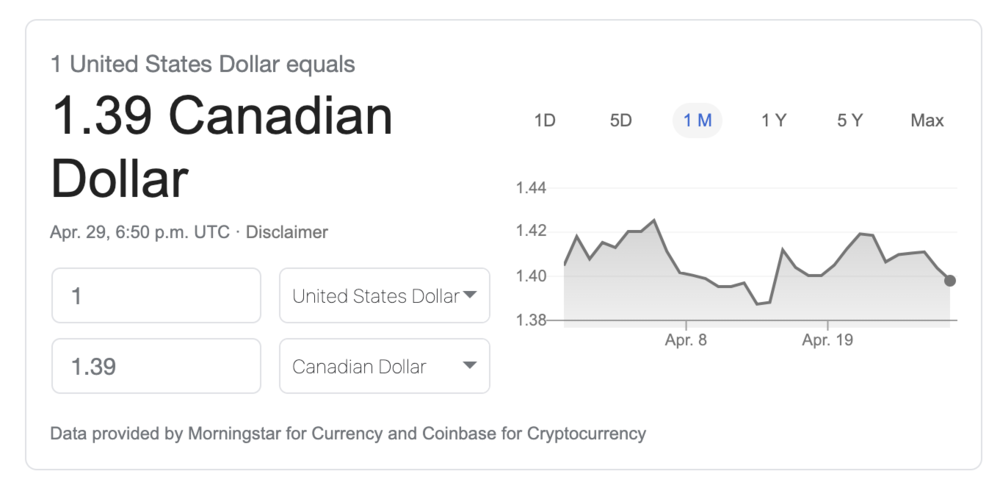

With the Canadian dollar weakening significantly in recent months, you’ll earn a higher return than before when converting US MR points in the northbound direction. As of the time of writing, 100,000 US MR points would earn you roughly 140,000 Canadian MR points, which would then translate into $2,800 if redeemed against statement purchases under Double Rewards.

Given the very favourable ratios, it’s at least worth crunching the numbers to see whether the cash-out option would make sense in your situation. However, I’d stop short of actively recommending that you pursue this.

After all, the once-a-year restriction on cross-border transfers means that you might be missing out on future redemption opportunities, and given that you would’ve had to go through a fair bit of effort to earn those US MR points in the first place, you might be better off saving them up for some spectacular flight redemptions via the unique transfer partners on the US side in the future.

9. Save Your Points for Travel… But Only If You’ll Get 2cpp+ Value

And on that note, I think it’s important to point out that while the prospect of redeeming MR points at 2 cents per point (cpp) is very tempting indeed, business class and First Class flights still offer the promise of much higher returns… as far off in the future as they may seem.

The uncertainty surrounding Aeroplan, in terms of when the new Air Canada loyalty program might launch and what it might look like when it does, only muddies the waters even more. However, I’m quite confident that high-value premium flight redemptions will continue to be within reach under the new program, and that returns of higher than 2cpp will certainly be attainable.

Ultimately, premium flights will still be the best way to redeem.

Therefore, those of you who play this game mostly for the luxurious travel experiences might choose to maximize the earning side of the Double Rewards promotion, while refraining from taking advantage of the 2cpp cash-out option and saving your points to fund some amazing trips in the future.

If so, just make sure that you’re redeeming those points for higher than 2cpp when the time comes – if you end up using them on a domestic flight at 1.8cpp, for example, you would’ve done yourself a disservice by not cashing out during Double Rewards instead.

Conclusion

American Express had a delicate problem to solve in these challenging times: how do they continue to offer value on the $699-annual-fee Platinum Card at a time when no one is travelling and making use of the card’s extensive travel perks?

Their answer was the Double Rewards promotion, which in reality offers quadruple the usual return on spending and many more times the benefit once you factor in the signup and referral bonuses, and I have to say that they’ve really knocked it out of the park with this one.

Double Rewards will be shaking things up in Canada until July 20, so make sure to take action early and maximize the above nine angles to their greatest effect before then.

MR accounts can’t be linked until July 20th

Hanging up and calling again is the only way forward it seems.

I switched from the platinum card to the business platinum 2 years ago, do you think i’m still eligible for the sign up bonus?

so is it confirmed if u buy gcs at resturants that sell gcs, u get 6x code? thx

when buying plane tickets, can u scalp it(resell for cash) like baseball game tickets?

No. Tickets planes got names on it.

If one buy a 1000$ refundable plane ticket during the 2x promo (and gets 4000 MRs) and has to cancel later during the year, how many MR will then be removed? 2000 or 4000?

After applying, how quickly are people receiving their cards? I hear platinums are overnighted in the US…

whats this said pizza chain? papa johns?

CardSwap.ca "Sorry, we do not accept American Express". Does not work in Quebec.

Just an FYI – looks like I only got 2x MR points for Uber Eats, not the 6x MR.

I got 2X MR points too for my Uber Eats orders as well.

Those people who claimed they got 6X probably the undercover of Uber.

I guess are trying to generate some kinds of sales. Shameful.

Delete Uber and Uber Eats already.

Just to clarify – If you but gift cards for the unnamed pizza chain at Loblaws or Shoppers, it will post as dining…….

……..makes its gift cards available at retail outlets and would code under the dining category for a 12% return.

Gift cards will post at 4% except if you buy them at Marriott hotels (8%) or directly at the unnamed (pretty cryptic) pizza store.

I applied and received the Platinum immediately upon hearing the announcement. During the call to activate the card, the agent confirmed that the promotion will apply.

I gave up my platinum a few months ago in order to get the signup bonus on the Amex Aeroplan Reserve. Now I wish I’d kept the platinum- don’t think enough time has gone by that I’d get the signup bonus yet. Do you think Amex will do something for the amex aeroplan card holders?

I don’t think the AeroplanPlus Reserve is a big priority for them, so unfortunately I don’t think you’re likely to see any dedicated relief measures for that card.

Does the screen shot of the Amex tweet actually confirm that new applicants will get the 2x Rewards? I’m ready to apply today, but the Amex application page makes no mention that I can see of the 2x points. Any thoughts?

“All Canadian Platinum cardholders” can only be read one way to me. You can also refer to the data points from new Platinum cardholders who’ve recently signed up and have been earning and redeeming at double value.

Correct me if Im wrong. Would I have to purchase the dining category gift cards from the actual store (ie The Keg), in order to qualify for the 6% or can we buy from them online. Im thinkin in store only

Do you think it’s a good time to apply for the Platinum card? when filling in an application, you think I can state my job and income even though I’ve been laid off?

Instead of using Plastiq to pay your tax bill at 2.5%, link your Platinum card with your PayPal account and use PaySimply at 2.29%. Not a huge difference but really maxes out the 4% return (especially on a large tax bill).

Great point, I’ve added a note about PaySimply’s lower fees in the article.

Possibilities galore. Would this arbitrage work. A diamond AP member (3x points spend) spends $3,400 through the AP estore during a special 10x points spend promo. $3,400 x (10+3) plus the original ($3,400 @ x 2 for double points)= 51,000 points. You then transfer the 51,000 to aeroplan and achieve Altitude Prestige 25K (plus your 51,000 miles) or credit your card for $1,020. Possibly even a better return if you could find something to code as travel or groceries through the estore.

Only the MR points earned on the credit card would be able to cash out at 2cpp, not the Aeroplan miles earned from the eStore. Otherwise, the overall gains would be very compelling indeed for any major purchases you can make via the eStore at this time.

FYI you can get those Red Lobster biscuits at Costco 🙂

Hoooo boy!!

What does that mean ;)?

Bad news for my waistline.

Just to add to all those food apps, for those that want to do local takeout instead of delivery, Ritual posts at 6x.

Awesome data point!

The other perk of cashing out and buying your flights is the ability to earn frequent flyer miles on those revenue tickets.

Cardswap.ca doesn’t appear to be buying gift cards from that certain pizza chain for 11% below face value anymore AFAIK

It still is, but you have to know "how" to look there.

I wish I knew "how"..:(

Gotcha. I will say, once we are able to have in-person points/miles meetups again I am definitely looking forward to attending for the first time! 🙂

Thanks Ricky.