The Best Ways to Use Amex Cobalt Points [2021]

The American Express Cobalt Card was the first credit card of its kind, geared towards millennials and running on an innovative month-by-month structure for its fees, spending requirements, and points bonuses.

Notably, the card also earns a different class of Membership Rewards points compared to the traditional quartet of the Gold Rewards Card, the Platinum Card, the Business Gold Card, the Business Platinum Card.

Instead of the highest-tier MR First points or regular MR points, the points you earn on the Cobalt Card are known as MR Select points.

First-year value

$336

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

In general, transferring regular MR points to frequent flyer programs like Aeroplan or British Airways Avios tends to be the best way to use them, since the value you can capture from these programs far outstrips the various other uses of MR points.

But of course, the big difference with MR Select points is that airline transfers are off the table, leaving us with the question: what’s the best way to redeem MR Select points from the Cobalt Card?

There are quite a few possibilities, and which one works best for you will depend on the exact situations that crop up as you’re planning your travels.

Generally speaking, though, three options come to mind:

-

Redeeming against all purchases (Pay with Points) at 1 cent per point (cpp)

-

Redeeming for flights via Amex Fixed Points Travel at 1.5–2cpp

-

Transferring points to Marriott Bonvoy at a 1:1.2 ratio

Redeeming Points Against Purchases

Let’s start with the baseline scenario. One of the perennial selling points of Amex Membership Rewards points is the Pay with Points feature: the ability to redeem points against your credit card purchases at a fixed rate of 1,000 points = $10, thereby realizing a flat value of 1cpp.

This means that any purchase that you charge to your Cobalt – travel, groceries, gas, bills, etc. – can be essentially stricken from your statement by redeeming your MR Select points at 1cpp.

(Previously, only travel purchases qualified for the 1cpp redemption, whereas other purchases were limited to 0.7cpp when using Pay with Points. However, as of May 2021, the 1cpp redemption option has now been extended to all purchases.)

As part of its standard signup bonus, the Cobalt Card offers 2,500 MR Select points per month for every month that you spend $500 on the card. The annual signup bonus therefore totals to 30,000 MR Select points, which if used in this way, would equal $300 towards any of your travel purchases.

So there we have it: you can do no worse than getting 1cpp in value on your MR Select points. Now, how can we do better?

Amex Fixed Points Travel

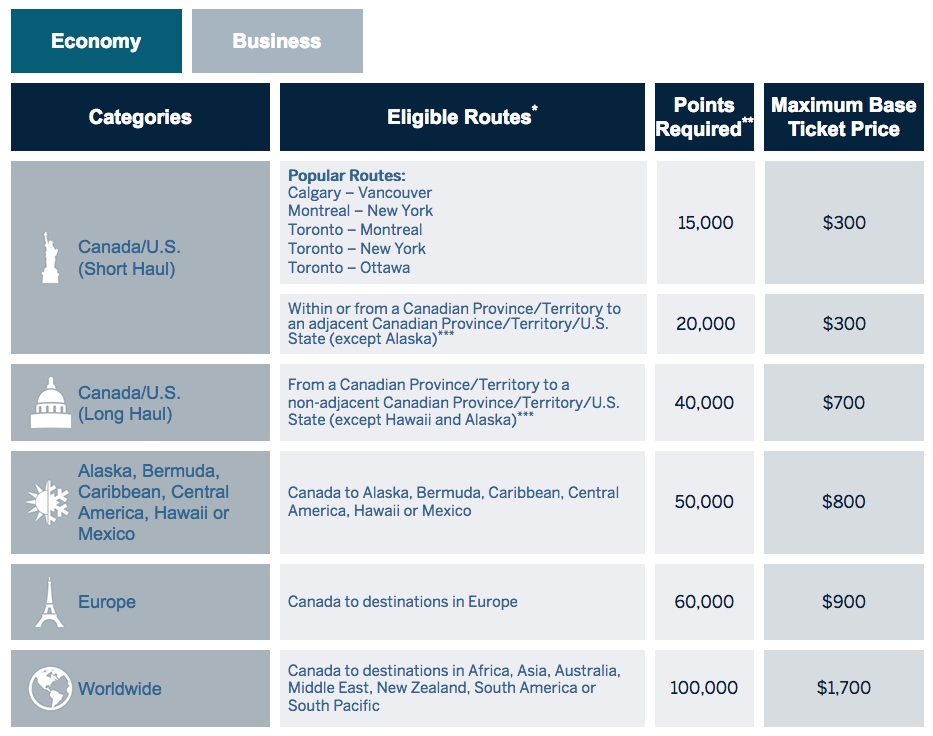

Amex Fixed Points Travel allows you to exchange your MR Select points for round-trip flights departing from Canada, according to a certain geographic redemption chart. Here’s the chart for round-trip flights in economy class:

Compared to other similar reward structures operated by RBC and CIBC, the good thing about Amex Fixed Points Travel is that there is a decently compelling redemption chart for business class flights as well:

As you can see, depending on the geographic zone you are flying to, you’ll have to redeem a certain amount of points in exchange for a certain “maximum ticket price” of the flight, which refers to the regular price of the flight if you were to pay for it using cash. Note that this maximum price covers the base fare only; the taxes and fees will be extra.

The good thing is that compared to redeeming points via a traditional frequent flyer program like Aeroplan, using Fixed Points Travel means that you don’t have to deal with limited award availability. In most cases, if you see a flight on Google Flights, you’ll be able to redeem MR Select points for it via Fixed Points Travel.

Now here’s the important thing: the amount of points you pay will be the same, whether or not you actually “achieve” the maximum ticket price. This means that how good of a deal you’re getting will vary directly with the cash price of the ticket you’re looking at.

Here’s an example. Imagine that you wanted to fly round-trip from Toronto to Los Angeles. With a little advance planning, this route can often be booked for a pittance – in fact, in the below example, the base fare only comes to a paltry $244, with the remaining $137 being composed of various taxes and fees.

If you were to redeem 40,000 MR Select points under Fixed Points Travel (based on the Canada/US long-haul award pricing) for this itinerary, you’d be getting a downright terrible value of $244 / 40,000 = 0.61cpp, in addition to having to pay that extra $137.

As we saw above, in this case, you’d be much better off purchasing the full fare of $371 and offsetting the charge at the baseline ratio of 1cpp – you’d only spend 37,100 MR Select points this way, and you wouldn’t have to pay anything extra on top of that.

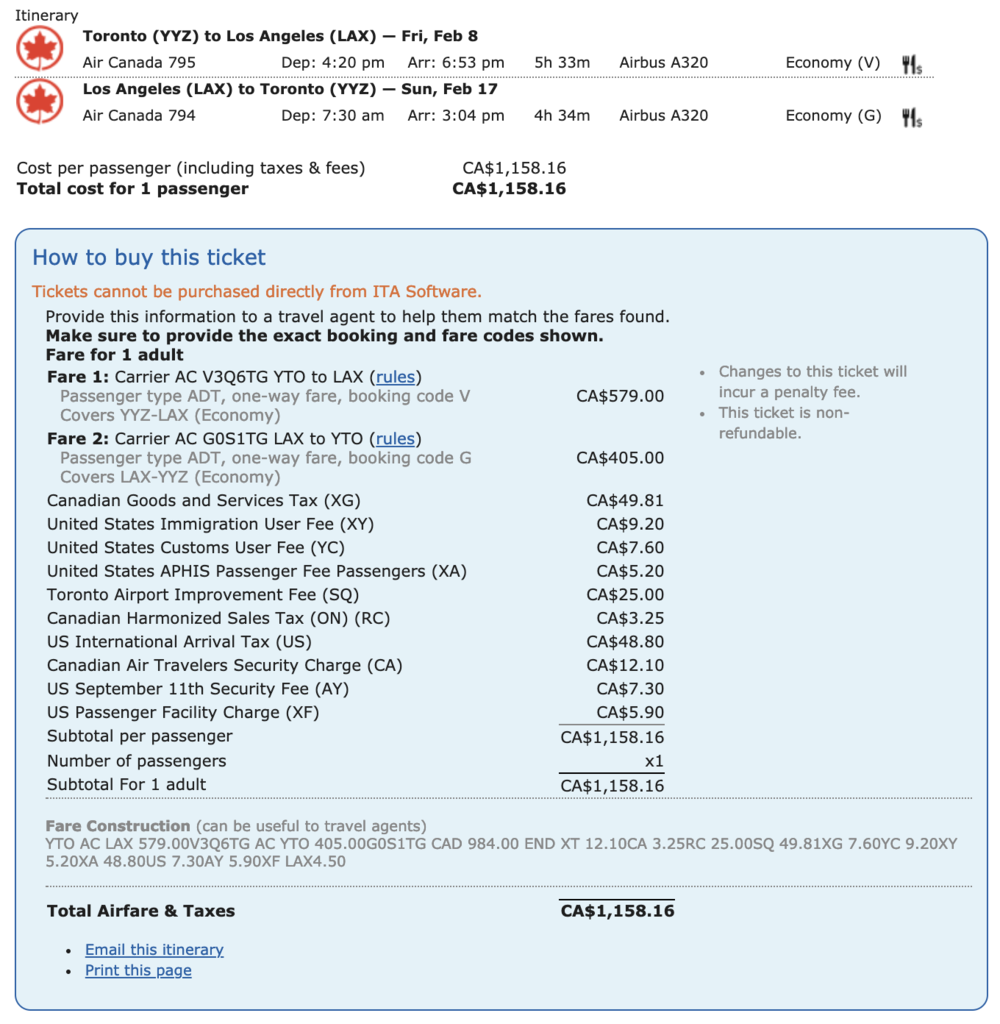

On the other hand, as the date of departure approaches, the Toronto–LAX fares can shoot up quickly. In the below example, the base fare is a total of $984, with the remaining $170 representing taxes and fees.

In this case, your 40,000 MR Select points would use up the full maximum ticket price of $700, with the remaining $284 in base fares and $170 in taxes and fees being paid out-of-pocket. You’d get the maximum possible value of $700 / 40,000 = 1.75cpp for your MR Select points, but you’d still have to pay that extra $284 + $170 = $454.

As you can probably guess, the sweet spot for Amex Fixed Points Travel is achieved when the base fare exactly equals the maximum ticket price. When that happens, you’re maximizing the value for your MR Select points, and you’re also minimizing your extra out-of-pocket expense, since the only thing you just pay is the taxes and fees.

If you do the math on the award chart, you see that the maximum value you can get out of Amex Fixed Points Travel lies somewhere between 1.5cpp (in the case of Canada to Europe in economy class) and 2cpp (in the case of popular short-haul routes in economy class).

That can certainly be a respectable return on your MR Select points, especially considering that you can book virtually any flight out there that has empty seats available.

And yet, Fixed Points Travel comes with quite a few limitations: your travel must originate in Canada, and your itinerary must be round-trip. Plus, the occasions when you can hit the exact maximum ticket price threshold with your base fare tend to be rather limited. Can we do any better?

Transferring Points to Marriott Bonvoy

One of the most popular uses of Amex Cobalt points is to transfer them to Marriott Bonvoy.

The transfer ratio is 1 MR Select point = 1.2 Marriott Bonvoy points, meaning that the standard annual signup bonus of 30,000 MR Select points would equate to 36,000 Marriott Bonvoy points.

Getting excellent value for your points through Marriott Bonvoy is certainly quite achievable; however, just because you can get good value doesn’t mean that you always will. Again, you’ll have to have a discerning eye as to which potential use of MR Select points is best suited to your specific situation.

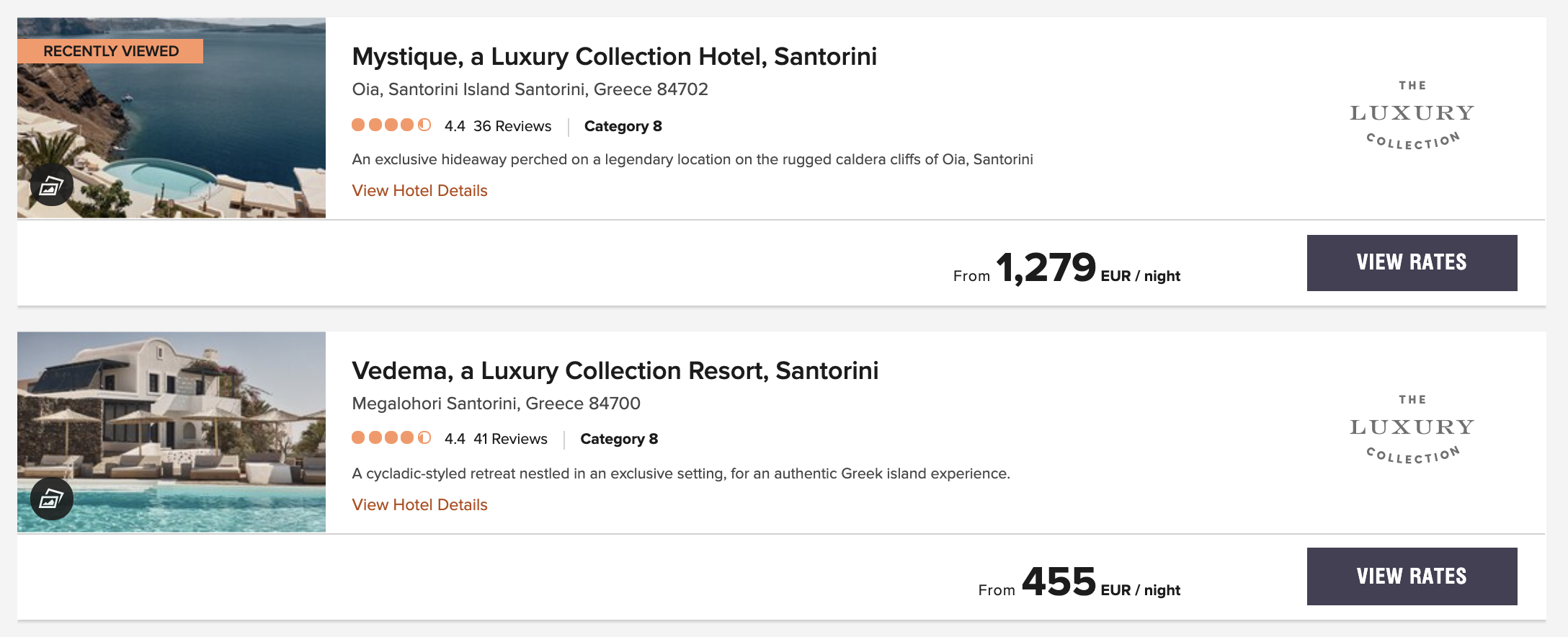

Let’s imagine you’re choosing between two luxury hotels in Santorini: Mystique and Vedema. Both are bookable for 85,000 Bonvoy points for a free night, which is equivalent to 70,833 MR Select points.

However, when you compare the cash rates, you see that Vedema can be booked for just €455 ($671) a night, while Mystique will run you €1,279 ($1,887) a night.

Running the numbers, then, we see that the value you’d get from redeeming 70,833 MR Select points would be $671 / 70,833 = 0.94cpp in the case of Vedema and $1,887 / 70,833 = 2.66cpp in the case of Mystique.

Can you see where I’m going with this? That’s right – transferring MR Select points to Marriott to book a night at Mystique would be a fantastic deal, while doing so for a night at Vedema would be a terrible one.

If you did want a free night at Vedema, the best course of action would in fact be to book the cash rate. Then, instead of transferring over 70,833 MR Select points, use only 67,100 MR Select points to offset the charge at the baseline 1cpp ratio!

This is merely one example, although you can apply it across all your potential Marriott hotel bookings. The thresholds you should be following are as follows:

| If you're redeeming points for... | You'll need this many Marriott points... | Which equals this many MR Select points... | So the cash price better be at least... |

| Category 1 | 7,500 | 6,250 | $62.50 |

| Category 2 | 12,500 | 10,417 | $104.17 |

| Category 3 | 17,500 | 14,583 | $145.83 |

| Category 4 | 25,000 | 20,833 | $208.33 |

| Category 5 | 35,000 | 29,167 | $291.67 |

| Category 6 | 50,000 | 41,667 | $416.67 |

| Category 7 | 60,000 | 50,000 | $500.00 |

| Category 8 | 85,000 | 70,833 | $708.33 |

Note that this value exercise only applies when you’re considering transferring your MR Select points to Marriott.

If you earned your Marriott Bonvoy points through other channels, such as the Marriott Bonvoy American Express Card or Marriott Bonvoy Business American Express Card, then it wouldn’t make sense to run this comparison.

Putting It All Together

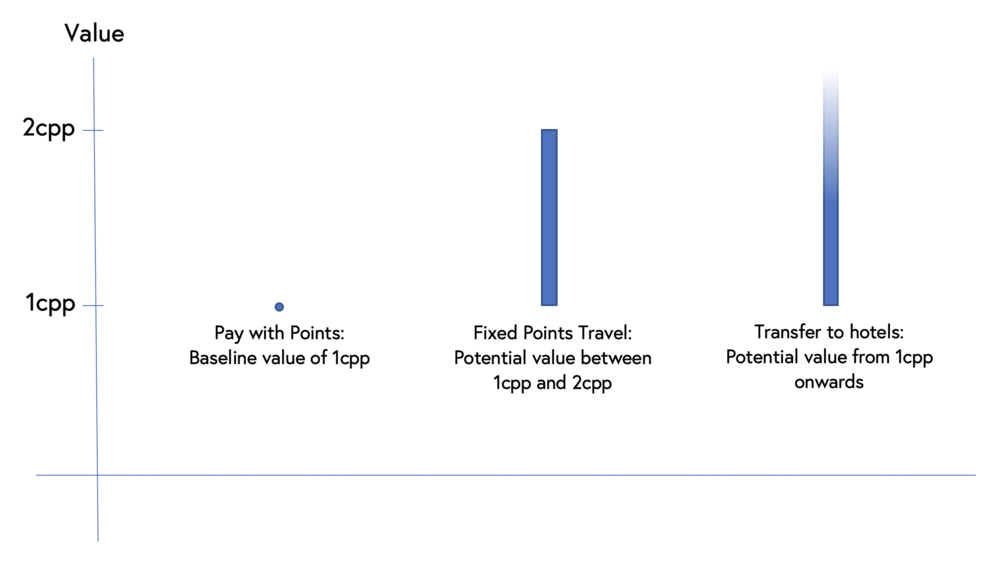

Let’s look at the overall picture now. There are three major uses of Amex Cobalt points: a 1cpp baseline redemption, a potential 1.5cpp to 2cpp via Amex Fixed Points Travel, and potentially even more value out of transferring to Marriott.

The optimal course of action therefore depends on each individual’s travel needs. If you don’t have much of a need for free hotel nights (or your travel plans aren’t taking you to places where Marriott would get you more than 1cpp in value), but you do travel frequently on routes that fall under Amex Fixed Points Travel, then getting 1.5cpp to 2cpp via Fixed Points Travel would be your best option.

If you can’t extract good value out of Amex Fixed Points Travel – perhaps the fares you book don’t quite meet the maximum ticket price, or you usually only book one-way trips – but you do stay with Marriott frequently, then your best bet would be transferring your MR Select points to Marriott Bonvoy and using them for high-value hotel redemptions.

If both Amex Fixed Points Travel and Marriott Bonvoy fit your travel needs, then it’s a question of which redemption avenue will bring you the most value.

Fixed Points Travel will get you a maximum of 2cpp in value, so if you can outstrip that with Marriott, then that’s the way to go. On the other hand, if you consistently travel on the popular short-haul routes and get 2cpp in value doing so, then that might be the best general strategy, since redemptions of 2cpp+ with Marriott can be pretty rare to come by.

Lastly, if neither option fits in with your upcoming travel plans, then you can always rely on the ability to redeem your points against any credit card purchase at 1cpp.

And indeed, as we’ve demonstrated, even when you plan on using either Fixed Points Travel or Marriott Bonvoy, it’s important to double check that it’s actually worth doing so, and that the value you’re getting exceeds the baseline value of 1cpp!

Conclusion

The American Express Cobalt Card allows you to earn 5x points on groceries and dining out, but as we’ve seen, figuring out the best use of these MR Select points can be surprisingly tricky.

It all depends on which flights and hotels you plan to book, and whether these travel plans might align with the sweet spots of Amex Fixed Points Travel or transferring out to Marriott Bonvoy. If not, the ability to redeem points against any credit card purchase at 1cpp is always a safe fallback.

First-year value

$1,181

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge

Annual fee: $799

• Earn 80,000 points upon spending $10,000 in the first 3 months

• Plus, earn 30,000 points upon spending in month 13

Earning rates

Key perks

- $200 annual travel credit

- $200 annual dining credit

- $100 NEXUS credit

- Unlimited Priority Pass lounge access

- Marriott Bonvoy Gold Elite status

- Platinum Concierge