If you’ve gotten involved with US credit cards, chances are that you have an account with both American Express Canada and American Express US.

You might have wondered: is it possible to convert your Canadian American Express Membership Rewards (MR) points into Amex US MR points, and vice versa? The answer is yes, and it can unlock an entire world of new opportunities.

In This Post

- American Express International Transfer

- Sweet Spots for Transferring Points Between US and Canada

- Conclusion

American Express International Transfer

American Express doesn’t seem to publish any information about converting points between countries on either their Canadian or US sites.

However, if we turn to other regions – specifically, a set of Membership Rewards Terms & Conditions from Amex UK – we can understand more about the process of transferring MR points between countries.

This process allows cardholders with another American Express card account, which is under the same name but denominated in a different currency, to transfer points from one account to the other.

Previously, American Express has referred to this as an International Transfer, although that name has been removed from the latest update to the terms and conditions.

Note the terminology here: an American Express Global Transfer refers to using an existing Amex card to establish a new Amex relationship in a different country, while an American Express International Transfer refers to transferring Membership Rewards points between accounts domiciled in two different countries.

What’s the Transfer Ratio?

In the Amex UK terms and conditions, it states that points transfers are subject to a different set of terms and conditions, and the transfer ratios aren’t displayed.

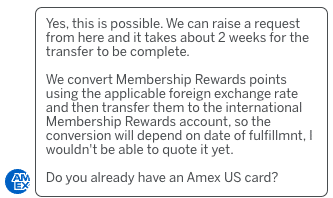

However, using the Amex Live Chat feature, it’s possible to confirm the following transfer ratios:

- When converting Canadian Amex MR points to Amex US MR points, the prevailing exchange rate is applied.

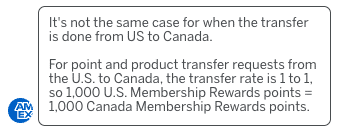

- When converting Amex US MR points to Canadian Amex MR points, a 1:1 ratio is applied.

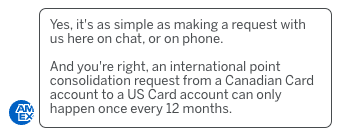

Importantly, there is also a timeframe restriction: you’re only allowed one International Transfer within a 12-month period.

The Transfer Process

Converting points between Amex Canada and Amex US is best done through the phone. The Amex Live Chat service can also handle these requests, although they don’t always get put through successfully when initiated via chat.

In the past, it was possible to convert points in either direction by calling either Amex Canada or Amex US. However, now you’ll need to call the originating country to initiate your International Transfer.

You’ll be asked for the card numbers in the origin and destination countries that you’d like points deducted from and deposited into, respectively. You’ll also be asked for how many points you want to transfer, beginning with a minimum transfer of 1,000 points.

The entire process can take 1–2 weeks to complete, after which you should see the points added to your destination country’s Amex account based on the transfer ratios outlined above.

Sweet Spots for Transferring Points Between US and Canada

Now that we know how to transfer your Amex MR points between countries, let’s figure out when it would beneficial to convert your MR points between Canada and the US, in either direction.

Remember that every cardholder is limited to one International Transfer per 12-month period, so you should definitely approach this opportunity with a specific redemption goal in mind.

First of all, let’s take a look the eight airline and hotel partners that are common to both countries’ Amex MR programs:

- Aeroplan: 1:1 ratio in both Canada and the US

- Air France KLM Flying Blue: 1:1 in the US, stronger than 1:0.75 in Canada

- British Airways Executive Club: 1:1 ratio in both Canada and the US

- Cathay Pacific Asia Miles: 1:1 in the US, 1:0.75 in Canada

- Delta SkyMiles: 1:1 in the US, stronger than 1:0.75 in Canada

- Etihad Guest: 1:1 in the US, stronger than 1:0.75 in Canada

- Hilton Honors: 1:2 in the US, stronger than 1:1 in Canada

- Marriott Bonvoy: 1:1.2 in Canada, stronger than 1:1 in the US

Additionally, the following 13 transfer partners are only available via Amex US, but not via Amex Canada:

- Aer Lingus AerClub: 1:1

- Aeromexico Club Premier: 1:1.6

- ANA Mileage Club: 1:1

- Avianca LifeMiles: 1:1

- Choice Privileges: 1:1

- Emirates Skywards: 1:1

- Hawaiian Airlines HawaiianMiles: 1:1

- Iberia Plus: 1:1

- JetBlue TrueBlue: 1:0.8

- Qantas Frequent Flyer: 1:1

- Qatar Airways Privilege Club: 1:1

- Singapore Airlines KrisFlyer: 1:1

- Virgin Atlantic Flying Club: 1:1

There are no transfer partners that are only available via Amex Canada, but not via Amex US.

Knowing this, we can then examine the specific reasons why you might find it worthwhile to convert points in either direction across the 49th parallel.

Converting Amex MR Points from US to Canada

Canadian points collectors who have gotten US credit cards will likely find themselves with a stash of Amex US MR points at some juncture. You have the ability of converting these Amex US MR points into Canadian MR points at a 1:1 ratio – but should you?

As mentioned earlier, there are no transfer partners that we can access in Canada, but not in the US. Thus, we wouldn’t be unlocking any additional transfer possibilities by initiating a northbound transfer.

Of the eight programs that are common to both countries’ MR points, only Marriott Bonvoy offers a stronger transfer ratio from Canada than from the US — 1:1.2, instead of 1:1. Therefore, if you collected US MR points for the purpose of converting them into Bonvoy points, it’d be best to transfer to the Canadian side first before converting.

However, Marriott Bonvoy is far from the most valuable use for Amex US MR points, given their wide array of additional transfer options. So unless you desperately wanted to earn hotel points instead of airline miles, this option likely wouldn’t be worth pursuing.

Indeed, there’s a lot more potential when we think about transferring points in the opposite direction…

Converting Amex MR Points from Canada to US

If you hold Amex MR points in both countries, why might you want to convert points from Canada to the US?

By far the most compelling reason to do so is that you’d gain access to the 13 new loyalty programs via the Amex US MR program outlined above, which unlocks a whole new world of redemption possibilities.

We could spend a whole day talking about all the new award chart sweet spots that Canadians would unlock through these programs. To pick a few of the most outstanding ones:

- Transferring to Virgin Atlantic Flying Club to book ANA First Class for 85,000 miles one-way

- Transferring to Emirates Skywards to book Emirates First Class to Europe for 102,000 miles one-way

- Transferring to ANA Mileage Club to book an ANA round-the-world award or sweet spots on round-trip bookings

- Transferring to Singapore Airlines KrisFlyer to book elusive Singapore Airlines business class, First Class, and Suites Class awards

We can run the numbers to factor in the prevailing exchange rate when converting points from Amex Canada.

For example, consider a traveller who wanted to book a round-trip business class flight from Chicago to Tokyo with ANA:

- If booked through ANA Mileage Club, this would cost 75,000 ANA miles round-trip during low season

- If booked through Aeroplan, this would cost 150,000 Aeroplan points round-trip

The CAD/USD exchange rate at the time of writing is about 1 USD = 1.35 CAD. Thus, factoring in the conversion, the round-trip award would cost only 101,250 Canadian Amex MR points – a far better deal than the 150,000 MR points required to book a similar round-trip through Aeroplan.

It’s worth noting that as of April 18, 2024, ANA is increasing award prices, and the same round-trip flights will cost 100,000 ANA miles. However, even once you factor in the exchange rate, you’d still be coming out ahead, especially since you’ll have access to more award seats through ANA Mileage Club than through Aeroplan.

Moreover, Amex US seems to implement conversion bonuses much more frequently than Amex Canada. For example, in September 2022, we saw a transfer bonus bonanza that boosted the conversion ratio to a dozen airline and hotel partners all at once.

If you timed an International Transfer with a transfer bonus bonanza, you’d effectively have the opportunity to convert points at close to par from Amex Canada to all of Amex US’s unique partners.

As you can see, for Canadians, the ability to transfer points to the US takes the already highly versatile Amex MR program to a whole new level.

Instead of only eight airline and hotel partners, you really have an unbelievable 21 partners at your fingertips – with the caveat that you must plan your redemptions with the 13 US-based partner programs very carefully, as a result of the once-in-12-months rule surrounding International Transfers.

Conclusion

The American Express International Transfer can open up a wealth of new opportunities for points collectors on both sides of the border.

Canada-to-US transfers are generally carried out at the prevailing exchange rate, while US-to-Canada transfers are generally carried out at a 1:1 ratio.

For Canadians, it’s all the more reason to get started with US credit cards, as it allows you to easily supplement your Amex US earnings with a Canadian points transfer and benefit from a vastly expanded pool of airline transfer partners.

DP – Just had a very frustrating call with Amex about the transfer process. Wanted to transfer MR from the US to Canada for my wife. Called the US first who said it should be the receiving country that must initiate the transfer. Called Canada Platinum customer service (apparently the best CS guys) who flat out denied transfer is possible. The fact that I said I have done this in the past did not matter to him. Would not even care to consult his colleague as he was ‘100%’ confident. In the end, he suggested we talk to the US team if they do something like that. We were transferred to the US MR points ‘specialist’ who repeated the same thing. point transfer is not possible and has never existed!

Hung up and called the Canadian number again. This time the rep denied such policy at first but agreed to check and came back with the information that this does exist but we must call the US guys. WTF…We asked him to call internally and stay on the call and explain everything to the US guys. Fortunately, he did and the US person initiated our transfer request.

To summarize, the whole process is a bit PITA. I guess the effort is worth it if you have the appropriate point use planned in either country.

A new DP from my own experience. Starting from 2021, US MR points are transferred to Canada at a ratio of 1:1, while the FX rate is applied to the transfer from Canada to US.

Update on my earlier comment. SG is right. I noticed that the 1:1 transfer rate applied to the US: Canada transfer. Called but I was told that’s what the new policy is. …

Strange. I just got them to agree that the transfer rate will apply for my point transfer from the US to Canada. I will report if something goes wrong.

I used to travel from Milwaukee to Toronto every year using either Air Canada or United pre Covid. I expect to earn 75000 US MR points in the next few months after completing minimum spend for the Amex Gold Card (this was before the all time high offer for the Amex Platinum). When travel returns, I will be making yearly trips to Toronto and other parts of Canada, and hope to travel to Nunavut and other parts of the Canadian North. I intend to convert the US MR points to Aeroplan miles and Avios.

Since I have a US and not Canadian address, I would like to know if I can convert US MR points to Canadian MR points, then use the Canadian MR Points to convert to Aeroplan and Avios without a Canadian mailing address. Are there forwarding services that can be used in Canada to do this? I am also afraid that Amex may shut me down and say I was gaming the system

Can additional cardholders transfer points to their account in Canada? E.g. my wife is an additional cardholder on one of my US cards, could she transfer points to one of her Canadian Amex cards.

Hi Ricky, I initiated a transfer from Mrs to MR 2 weeks ago. Got an email today saying the transfer was failed. Call the US MR customer line and was told Canadian MRs cannot be transferred to US MR anymore. Only Canadian MR can be transferred to US MR. Do you have any DP whether this is dead or should I try again later? thank you,

AMEX MR (US) offers some great transfer bonuses, including the currently available 40% bonus for BA Avios (this is offered about once a year). Thus, it doesn’t make sense transfer MR from the US to Canada for BA Avios redemptions.

Sure, but Amex Canada has 30% bonuses every now and then to BA as well. If you’re waiting around for transfer bonuses, you might as well wait from the Canadian side to get a ~70% bonus (accounting for FX) rather than 40%.

This is a very interesting post, thanks Ricky.

Do your American and Canadian cards have to be similar for the transfer or can you transfer Canadian MR points to an American Platinum account?

I’m a US citizen with a US address and SS# living in Canada (legally, LOL) and would love to see if I could do this!!!

MR to Hilton in the States is 1:2 I believe

Thank you Ricky!