The art of saving money on travel can be endlessly complex.

Maximizing Miles & Points is one way to expand your range of travel possibilities without spending a lot of money, but there will always be times when you need to pay cash for a flight.

Whether it’s because you can’t find award availability on your desired dates, you don’t have enough miles saved up, or you’d just prefer to keep your miles for a later date, purchasing flights with cash is inevitable.

Luckily, there are quite a few techniques that can help you reduce the cost of your airfare, often by upwards of 30–40% if you combine a few of these tricks together.

In this article, we list some great techniques that you can use any time you need to pay cash for a flight, so keep it handy for the next time you’re looking to score some additional savings.

In This Post

- Saving Money on Flights

- 1. Redeem Miles One Way and Pay Cash the Other

- 2. Check Alternative Airports and Use Positioning Flights

- 3. Try Out Different Combinations of Flights & Explore Open-Jaw Itineraries

- 4. Buy Points At a Discount

- 5. Leverage Companion Vouchers

- 6. Maximize Points Earned on the Purchase

- 7. Airline-Specific Discounts

- 8. Fixed-Value Points & Travel Credits

- Conclusion

Saving Money on Flights

When purchasing flights with cash, most travellers will buy round-trip flights, either through the airline directly, through a travel agent, or through a third-party portal like Expedia.

Additionally, most travellers start their flight searches with relatively strict requirements, perhaps that they must leave on a specific day and come back on another specific day. As we’ll show in this article, this sort of mindset can restrict your ability to save on the cost of your flight.

If you’re willing to slightly adjust the way you approach booking a flight, the eight tips and tricks listed below will help you save money any time you need to book a flight with cash.

Also, if you’re not already familiar with using Google Flights as a search tool, check out our guide to using Google Flights to learn some invaluable skills for planning and booking the most cost-efficient flights.

1. Redeem Miles One Way and Pay Cash the Other

When travelling within North America, round-trip fares are often very close to being equivalent in cost to the sum of two one-way fares.

When round-trip fares happen to be higher than usual, it can often be the result of the one-way fare in a single direction being unusually high, while the fare in the opposite direction remains quite reasonable.

For example, if there’s a major event taking place in your destination near the date of your arrival, then the outbound flight will likely be very expensive. If you’re returning home a while after the event ends, the return flight will probably be priced more fairly.

Given this, it’s worth searching for both A–B round-trip flights and for the two A–B and B–A one-way flights separately. When you compare the prices of these two options, if one direction seems artificially inflated, this might be a good opportunity to try redeeming points for that one-way segment instead.

Depending on the redemption options available to you, you could potentially save a significant chunk of money.

Of course, it may be challenging to find availability, since the expensive flight will presumably be highly sought-after, but it’s always worth a look.

Also, note that this trick doesn’t work nearly as well on long-haul international routes to other continents, since the one-way fares tend to be priced much higher than round-trip fares on those routes.

2. Check Alternative Airports and Use Positioning Flights

Another way to save money on flights is to consider alternative airports whenever you’re searching for airfare.

Many cities and regions have more than one airport, and you may find cheaper flights by exploring these nearby options. Some cities even have designated low-cost carrier airports.

For example, in Bangkok, to find cheaper flights, you might want to check Don Mueang International Airport (DMK), the city’s low-cost hub. The main airport, Suvarnabhumi Airport (BKK), mostly serves full-service airlines.

Additionally, some cities have “co-terminal airports”, which technically are a set of one or more airports that are interchangeable when issuing tickets. These co-terminals open up a wider range of flight options and fares.

Cities with co-terminals usually have a city code, as is the case with Toronto (YTO), which covers Billy Bishop (YTZ), Pearson (YYZ), and sometimes Hamilton (YHM). You can do a fare search using these city codes to find a wider range of flight options.

Other common examples of co-terminal airports include the following:

- New York (NYC): JFK (JFK), LaGuardia (LGA), Newark (EWR)

- São Paulo (SAO): Congonhas (CGH), Guarulhos (GRU), Viracopos/Campinas (VCP)

- London (LON): City (LCY), Gatwick (LGW), Heathrow (LHR), Luton (LTN), Stansted (STN)

- Paris (PAR): Charles de Gaulle (CDG), Orly (ORY)

- Tokyo (TYO): Haneda (HND), Narita (NRT)

- Beijing (BJS): Capital (PEK), Daxing (PKX)

Looking beyond multiple airports within the same city, the further you expand your search radius in terms of both departure and arrival airports, the more options you open up.

If you’re not sure which alternative airports are near your origin and destination, you can use Google Flights’ “Explore” tool to show all the airports in the area.

For Canadians, driving south of the border to US airports like Seattle, Spokane, Fargo, Buffalo, or Syracuse might result in cheaper airfare that more than justifies the added time and expenses incurred.

Similarly, if you live in a smaller Canadian city but would like to take advantage of one of the frequent fare sales out of Toronto, Montreal, or Vancouver, this can be easier to accomplish than you might think.

From Winnipeg, for example, a short-haul positioning flight to Toronto can often be found for less than 20,000 Aeroplan points round-trip, and from there, you can book any number of the cheap deals to Europe, Asia, or South America that are always popping up.

Similarly, if the fares flying into a certain city in Europe, Asia, or South America are high, there are often cheaper alternatives within a reasonable distance that you could consider flying into instead. Once you’ve arrived at your alternative destination, you can either drive, take the train, or take a separate flight to your intended destination.

A couple examples that come to mind include Buenos Aires and Montevideo (take the ferry between the two cities for a scenic ride), and Kuala Lumpur and Singapore (or any other pair of places in Southeast Asia, where cheap budget airfare is commonplace).

3. Try Out Different Combinations of Flights & Explore Open-Jaw Itineraries

When planning an itinerary in which you’ll visit multiple destinations, a potential way to save money on the flights is to look at combining the flights in different orders and combinations, and booking open-jaw itineraries rather than multiple one-way tickets.

As a reminder, the term open-jaw refers to when you fly into one city but depart back to your origin from a different city, all on a single ticket.

To illustrate how different flight combinations work, let’s say you live in Toronto and would like to visit Paris and Rome as part of a trip to Europe. There are a few possible ways to book these flights, and it’s certainly worthwhile to spend some time determining which one would be the most cost-effective.

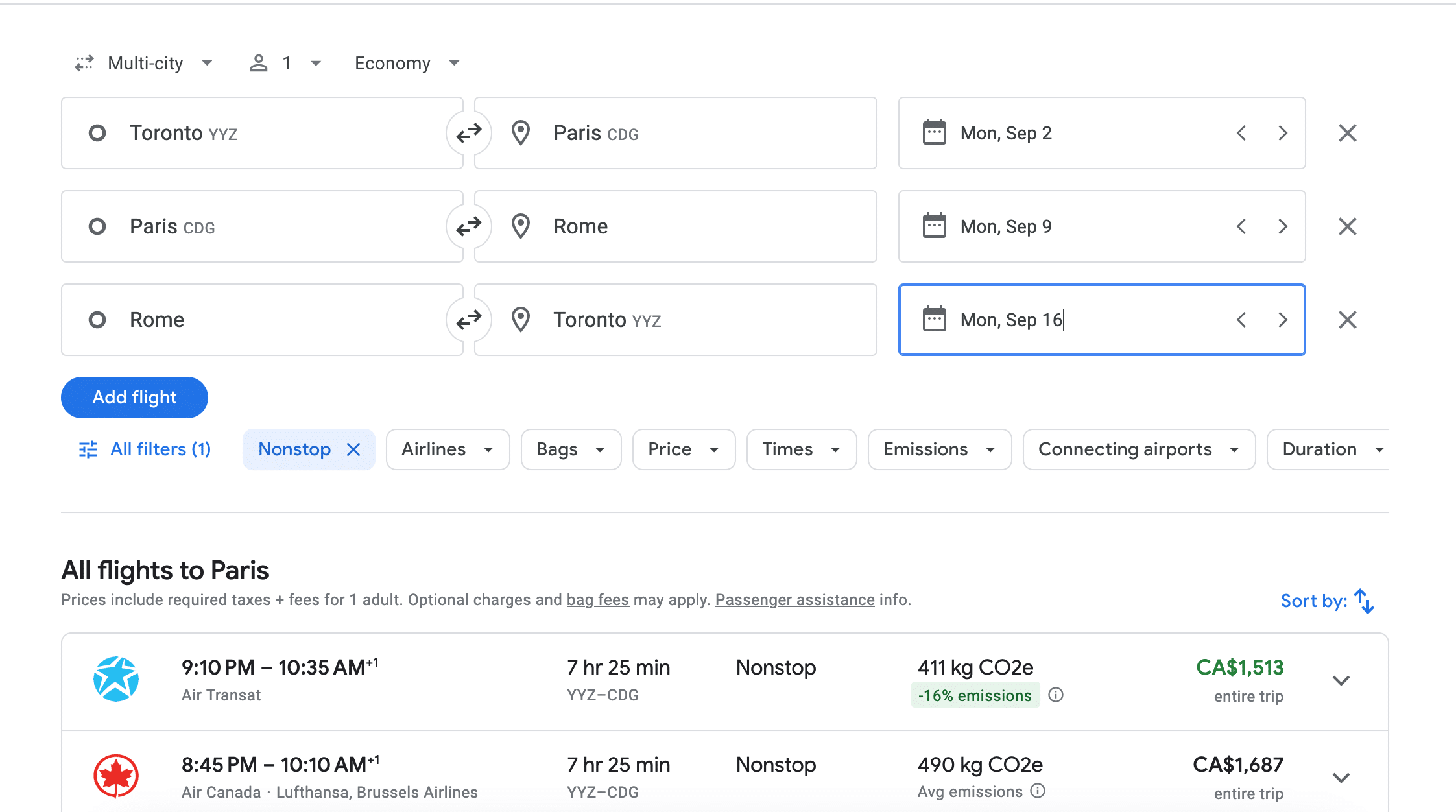

For example, you could book the whole thing as a multi-stop ticket that would come to $1,513 (all figures in CAD):

When booked as three one-way segments, the price comes out to $1,583, which isn’t that much more.

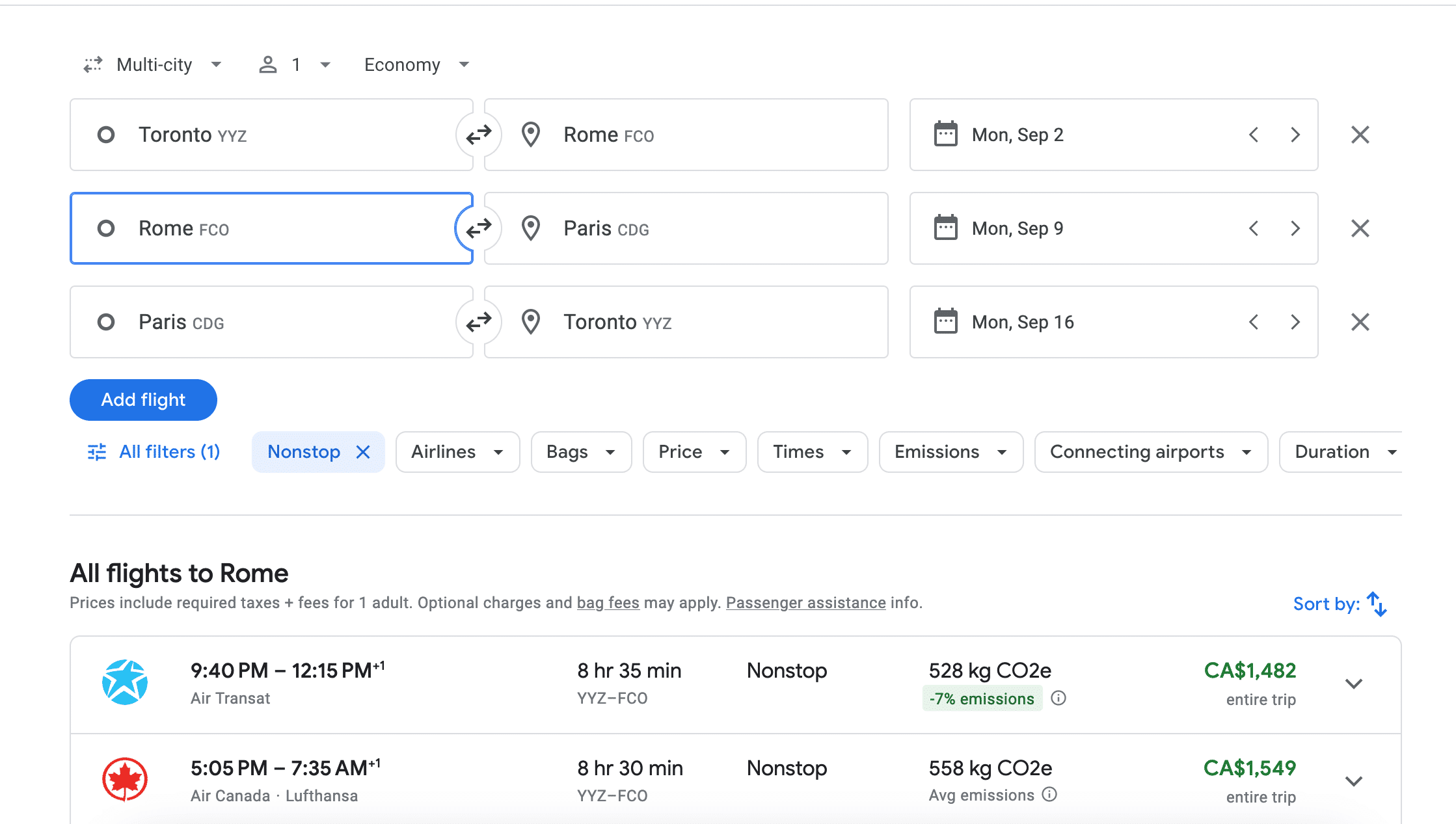

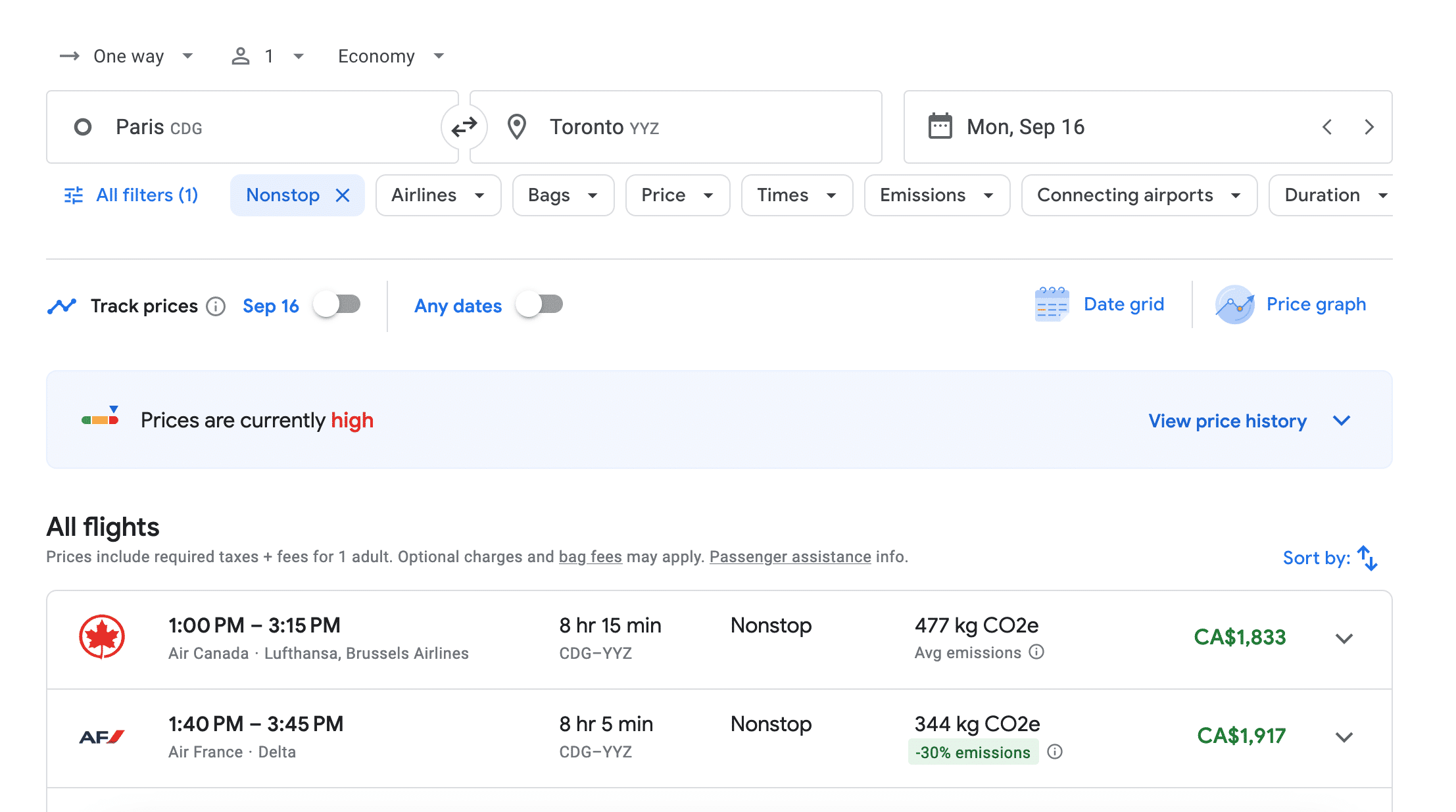

Now, if you don’t care about which order you visit the cities, you should play around with that as well. In our example, putting Rome before Paris in our one-ticket multi-city itinerary brings the price down to $1,482.

However, if you were to book this same route as three one-way tickets instead, the cost would be a whopping $2,689 for non-stop flights due to an extremely elevated cost on the returning Paris to Toronto flight.

In general, open-jaw itineraries are priced quite favourably and very close to “regular” round-trip tickets, so combining an open-jaw with a cheap short-haul one-way is also a great way to book a trip to two or more destinations in one go.

Keep in mind that if you have more than two destinations planned, you’ll have many more possibilities to play with. Also, it’s always worth checking to see if any one of your journeys can be booked with miles instead of cash, and if doing so, confirming if it makes the most sense financially.

4. Buy Points At a Discount

Airline loyalty programs often allow you to buy miles at a significant discount compared to the usual rates or with the inclusion of bonus miles, and these promotions can be leveraged to unlock some pretty big savings on premium class travel.

This trick is most suited to people who regularly pay cash for business class flights and who are hunting for a deal, or for someone who doesn’t mind paying more than what it’d cost in economy for an elevated experience.

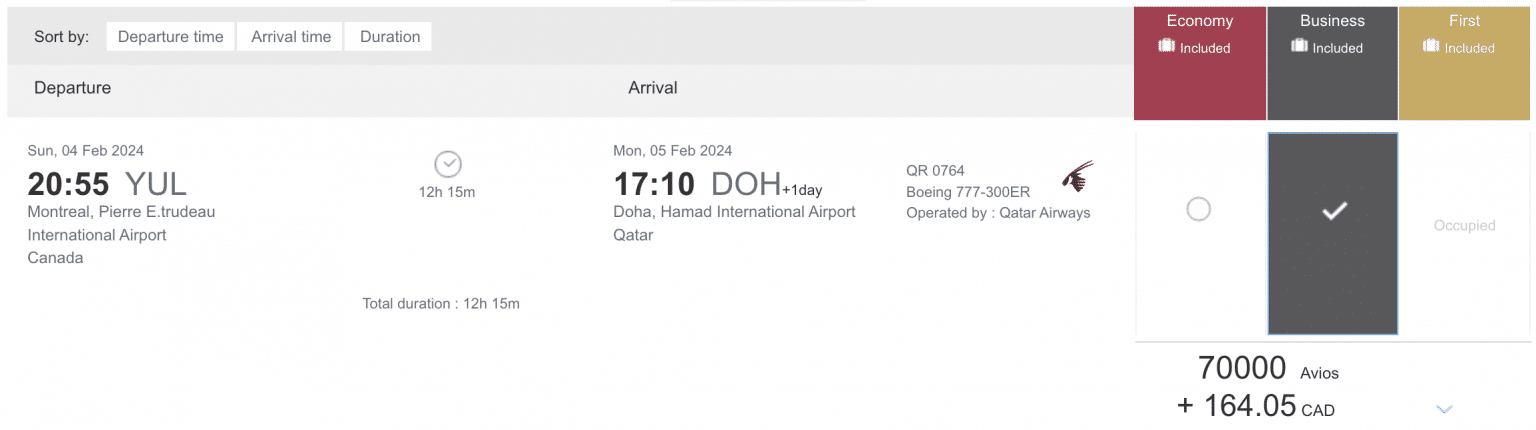

For example, let’s say you needed to book a round-trip flights in business class from Montreal to Doha in Qatar Airways Qsuites.

It’s not unusual to find round-trip cash fares for around $9,000, which is quite steep, or for around $5,000–6,000 when it’s a great deal.

However, instead of paying this fare, you could buy Qatar Airways Avios directly when they’re offering a discount or bonus on purchased Avios. You’d need to buy 140,000 Avios to book round-trip flights instead, which could cost around $3,000 during a sale.

By going this route, you’d be saving over 50% off the cash fare.

Of course, award availability is key here, and you’ll want to make sure there are available award seats on your desired flights before pulling the trigger on a large points purchase like this.

Also note that many of these types of points-purchase transactions are processed through the US-based Points.com service, which levies additional GST/HST on Canadian residents. Therefore, it’s optimal to use a US credit card and US billing address to make the purchase (if you have one).

5. Leverage Companion Vouchers

Companion vouchers are redeemable when at least two people are travelling together, offering a free or discounted ticket for the second passenger.

They can be a good way to save some money and are best used towards more expensive fares that thereby maximize the value of the voucher.

By using a companion voucher for a flight that you and your travel partner were already planning to take, you can certainly save some cash.

Companion vouchers are occasionally offered as a perk with credit card membership or after reaching a specific spending threshold.

The best companion vouchers that come as a credit card perk are the WestJet annual round-trip companion voucher, the Air Canada Worldwide Annual Companion Pass, and the British Airways Companion Award eVoucher.

Check out our updated guides (linked above) to these three vouchers to learn more about how to earn them and how to maximize their value and utility once you’ve got them.

Credit Card

Best Offer

Value

60,000 Avios†

$1,235

Apply Now

Up to 85,000 Aeroplan points†

$871

Apply Now

85,000 Aeroplan points

$858

Apply Now

70,000 WestJet points†

$536

Apply Now

6. Maximize Points Earned on the Purchase

Another way to “save” on flights is to think carefully about which payment method to use when booking a cash fare.

Although this trick doesn’t necessarily save you money at the time of booking, the points you earn as a result can prove useful for offsetting your out-of-pocket cost or helping you build towards your next points/miles redemption.

In Canada, the American Express Cobalt Card, American Express Gold Rewards Card and the American Express Platinum Card each offer 2 Membership Rewards points per dollar spent on travel, which is a respectable return.

American Express Membership Rewards (MR) points are particularly useful because they can be transferred to many popular loyalty programs, such as Aeroplan and Marriott Bonvoy.

Alternatively, if you’d prefer to offset your flight cost more immediately, you could choose a card that either earns cash back or an equivalent.

For example, the Desjardins Odyssey World Elite Mastercard lets you earn BonusDollars at a rate of 1.5% back on flights, and up to 3% back in other purchase categories.

BonusDollars are at par with the Canadian dollar and can be redeemed for gift cards and for statement credits against certain purchases made on the card.

7. Airline-Specific Discounts

Another way to save money on flights is to check for deals and discounts on the specific airline you’re booking with.

Although this may seem obvious, airline-specific deals and discounts often get overlooked when we use third-party booking portals like Expedia, or when we begin our searches through Google Flights.

Most airlines offer an array of destination/region-specific discounts throughout the year and also often have notable deals around key dates such as Black Friday and Boxing Day.

When you start putting together your travel plans, it’s always worthwhile to explore the websites of potential airlines to see if they have any promotions that you can take advantage of.

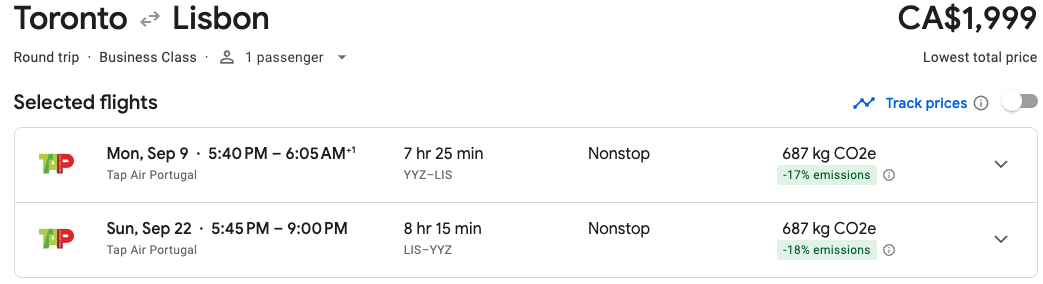

For example, TAP Air Portugal and Air France/KLM are known to offer excellent sales on economy, premium economy, and business class fares throughout the year.

By signing up for promotional emails and newsletters from your favourite travel websites, you can be notified of these deals, and then book them as soon as they become available.

8. Fixed-Value Points & Travel Credits

While the business class redemptions and luxury potential of programs like Aeroplan and Air France KLM Flying Blue might attract most of the spotlight, fixed-value programs like CIBC Aventura, TD Rewards, Scene+, and BMO Rewards can be equally important, if only a fraction as glamorous.

Given the utility that these programs can provide, it’s a great idea to keep a healthy balance of fixed-value points around at all times.

Fixed-value points are one of the best ways to deal with situations in which you have no choice but to pay cash for a flight.

In these instances, with fixed-value programs, you can simply proceed with the cash transaction, and then redeem your fixed-value points for a statement credit to help wipe this charge from your bill and ensure you spend as little of your own money as possible.

Additionally, a number of credit cards offer annual travel credits as part of their perks, and much like fixed-value points, these can prove very helpful in offsetting the cost of cash fares.

As an example of what’s available, the American Express Platinum Card, the Business Platinum Card from American Express, and the CIBC Aventura® Visa Infinite Privilege* Card offer a $200 annual travel credit, while the American Express Gold Rewards Card and the TD First Class Travel® Visa Infinite* Card both offer annual travel credits of $100.

Credit Card

Best Offer

Value

130,000 MR points

$1,794

Apply Now

70,000 MR points

$1,676

Apply Now

110,000 MR points

$1,581

Apply Now

Up to 165,000 TD Rewards Points†

$900

Apply Now

Up to 80,000 CIBC Aventura Points

$276

Apply Now

Conclusion

While travelling on points is great and often carries with it a greater sense of adventure and accomplishment, it’s well worth paying attention to the many ways to save money on revenue travel as well.

Since we don’t always have enough miles or points, it’s helpful to be familiar with different strategies that can reduce out-of-pocket costs when booking flights with cash.

We hope that you’re able to use the above tips and tricks to optimize your routings, itineraries, and payment methods, and to stretch your travel budget further than ever.

what do you mean by “3X” or “third strike” at the end?

Take a look at the article I wrote on fuel dumping to get an idea of what the 3X means.

Any thoughts on the Amex Platinum International Airline Program? Some of the US blogs seem to think that it can be a good deal for business class tickets.

If you’re booking a cash business class ticket (or even an economy ticket), it’s worth checking what price American Express is quoting on the trip. If it’s cheaper, great, otherwise you can still book with the cheapest OTA. All that being said, it might make sense to book through Amex if it’s only a little bit more since they seems to be a much better travel agency than some of the smaller OTAs.

I’m located close to a US border which we frequently fly out of. If I purchase tickets at the airport counter (ie Spirit Air), I can bypass some of the fees they levy on tickets bought online. For a family of five this can add up to a large savings. Do Air Canada or Westjet offer any similar savings for tickets purchased at the airport counter?

Air Canada and WestJet don’t charge booking fees when booking online so those wouldn’t be affected when booking in person.

Just doing a quick WestJet search for one way between YYZ – YYC they’re charging the following fees when booking online:

Air Travellers Security Charge (ATSC) $7.12

Harmonized Sales Tax (HST) $36.16

Airport Improvement Fee (AIF) $25.00

Since all these fees apply no matter how you book, you wouldn’t be able to save the fee. I don’t know if the fares at the airport counter are lower though or if they would be the same as what’s available online / through the call center (although that can incur a fee) or through the airline’s GDS.