RBC has finalized its acquisition of HSBC Bank Canada, and the transition of HSBC Canada customers into RBC products and services is now also complete. You can now begin using your new RBC credit cards, and you’ll soon be able to redeem RBC Avion Rewards.

Importantly, we now have more insight into the conversion rates RBC has used to transition customers from HSBC Rewards to RBC Avion Rewards, which was not previously disclosed.

RBC’s Conversion of HSBC Rewards to RBC Avion Rewards

As part of RBC’s acquisition of HSBC Bank Canada, balances of HSBC Rewards are being converted into RBC Avion Rewards.

RBC did not disclose the rates at which it would convert HSBC Rewards into RBC Avion Rewards prior to the conversion taking place, and only indicated that the converted points would have “equal or higher value in the flexible travel redemption category in the same way they book their travel today.”

On April 1, 2024, previous HSBC Bank Canada clients began receiving emails about the conversion rate RBC used. While the conversion is slated to be complete by April 5, 2024, we now have insight into the actual conversion rates being applied.

It’s worth noting that RBC has made personalized conversion rates for every customer, and the observations below may not apply to every case. Therefore, be sure to reference the communication sent directly to you for information as it pertains to your unique situation.

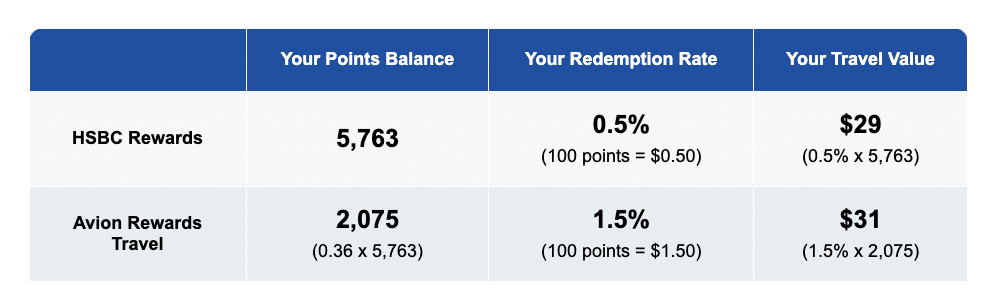

Many previous cardholders of the HSBC World Elite Mastercard who were transitioned to the RBC® Avion Visa Infinite† are having their HSBC Rewards points converted into Avion (Elite) points at a 1:0.36 ratio. In other words, if you had 100,000 HSBC Rewards points, you’d get 36,000 RBC Avion (Elite) points.

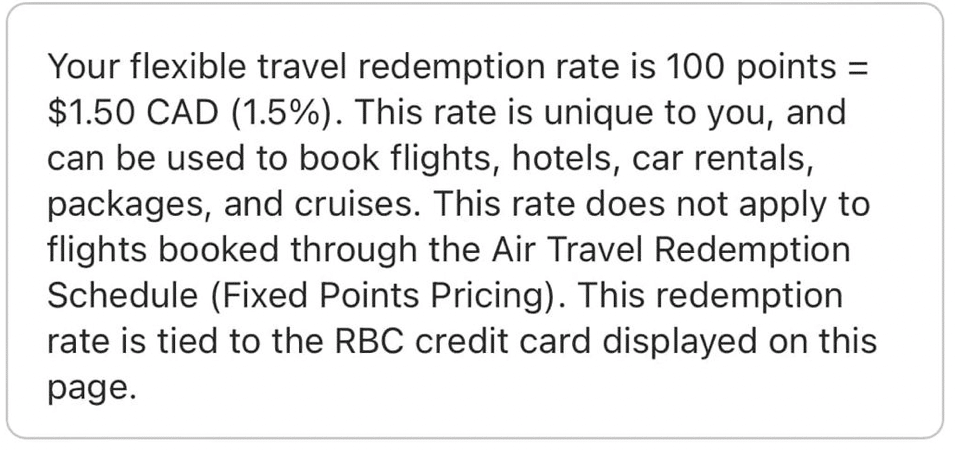

While this conversion rate is lower than the 2:1 ratio we had originally predicted, RBC’s statement of converted points having equal or higher value in the flexible redemption category holds true, since you can redeem these RBC Avion (Elite) points at a rate of 100 RBC Avion (Elite) points = $1.50 (all figures in CAD).

Importantly, this redemption rate is higher than what’s available for cardholders of the RBC® Avion Visa Infinite† who weren’t transitioned from an HSBC World Elite Mastercard, who have a redemption rate of 100 RBC Avion (Elite) points = $1 for flexible travel bookings.

(We’ll do an analysis of who stands to gain and who stands to lose from this transfer ratio in the following section of this article).

In the Prince of Travel Elites Facebook Group and in our membership community, we’ve also seen reports of a 1:0.34 ratio, which appears to be for previous cardholders of the HSBC Metal World Elite Mastercard who have been transferred to the RBC® Avion Visa Infinite Privilege†.

For those being transitioned to an RBC® ION Visa, which earns RBC Avion (Premium) points, we’ve seen reports of a 1:0.88 ratio. In other words, if you had 100,000 HSBC Rewards points, you’d get 88,000 RBC Avion (Premium) points. This opens up some unique possibilities, which we’ll discuss in detail below.

As a reminder, you can no longer use your HSBC Canada credit card products as of 11:59 pm Eastern Time on April 1, 2024. You’ll now need to activate and use your RBC credit card, which will earn RBC Avion points.

If you held an HSBC credit card with a travel credit, you’ll soon be able to view and redeem your credit.

You’ll first need to activate the credit on or after April 4, 2024, by logging into your Avion Rewards account, locating your travel credit on the Offers page, and then clicking “Load Offer”.

Once that’s done, you’ll need to make an eligible car rental or hotel booking through the Avion Rewards Travel platform between April 4, 2024 and April 5, 2025 to receive your one-time statement credit.

Analyzing RBC’s Conversion of HSBC Rewards Points

Depending on how you choose to redeem your points, you may wind up getting more or less overall value from your new RBC Avion points at the Elite or Premium tiers.

Previous HSBC World Elite Mastercard Cardholders

If you were a previous cardholder of the HSBC World Elite Mastercard and had your HSBC Rewards points converted into RBC Avion (Elite) points, you should get slightly better value from RBC Avion Rewards if you choose to redeem points for travel purchases.

For example, if you had 100,000 HSBC Rewards points prior to the acquisition, you could have redeemed them for $500 worth of travel.

With a 1:0.36 ratio, you’d wind up with 36,000 RBC Avion (Elite) points, which you can now redeem for $540, since you have a higher-than-usual redemption rate of 100 RBC Avion (Elite) points = $1.50.

However, you’ll only get this elevated rate if you book flights, hotels, car rentals, vacation packages, and cruises through the Avion Rewards Travel platform. In this sense, your points aren’t as flexible as they were with HSBC Rewards, since you could book travel directly with any vendor and simply redeem points for a statement credit.

Plus, your booking on Avion Rewards Travel may not be eligible for earning status with hotels or airlines, since it won’t be made directly with the vendor.

If you planned on converting your points into British Airways Executive Club, you’ll wind up with fewer Avios with points converted at a 1:0.36 transfer ratio than at the 25:10 ratio through HSBC Rewards.

For example, if you had 100,000 HSBC Rewards points, you could previously have converted them into 40,000 British Airways Avios at a 25:10 ratio.

Since RBC Avion points transfer to British Airways Executive Club at a 1:1 ratio, a converted balance of 36,000 RBC Avion points would equal 36,000 Avios, or 4,000 fewer (10% less) than what you’d have gotten through HSBC Rewards.

If you planned on transferring your points to Cathay Pacific Asia Miles, you’ll get slightly more Asia Miles with a 1:0.36 transfer ratio from HSBC Rewards to RBC Avion than through HSBC Rewards.

For example, if you had 100,000 HSBC Rewards, you could previously have converted them into 32,000 Asia Miles with the 25:8 transfer ratio. Since RBC Avion (Elite) points convert to Asia Miles at a 1:1 ratio, you’d now wind up with 36,000 Asia Miles, assuming you received a 1:0.36 conversion.

It’s worth noting that RBC Avion typically offers transfer bonuses to both programs throughout the year, which would theoretically boost your Executive Club or Asia Miles balance beyond what was possible through HSBC Rewards (assuming no transfer bonus was available.)

While you’re no longer able to transfer points to Singapore Airlines KrisFlyer with the loss of HSBC Rewards, you can now transfer RBC Avion (Elite) points to American Airlines AAdvantage at a 1:0.7 ratio. RBC Avion (Elite) points also transfer to WestJet Rewards at a 100:1 ratio, though you’ll likely get better value from the other airline partners.

Plus, if you redeem points for flights using the RBC Air Travel Redemption Schedule, you can squeeze more value out of your points, since you can get up to 2.33 cents per point for a redemption.

If you redeem points this way, you’d wind up with a higher value than what you’d have received for travel bookings with HSBC Rewards.

Previous HSBC Metal World Elite Mastercard Cardholders

If you had HSBC Rewards points transferred to RBC Avion (Elite) points at a 1:0.34 ratio, you’d still wind up with greater value if redeemed at 1.5 cents per point for flexible travel bookings. However, the overall possible value is less than what members who had a 1:0.36 transfer ratio would receive.

For example, if you had 100,000 HSBC Rewards points, those would be converted into 34,000 Avion (Elite) points at a 1:0.34 ratio. With HSBC, you could redeem them for $500, whereas with RBC, you’ll be able to redeem them for $510 for travel booked through Avion Rewards Travel at 1.5 cents per point.

However, as an RBC® Avion Visa Infinite Privilege† cardholder, you can redeem RBC Avion (Elite) points at a rate of 2 cents per point for business class and First Class fares. If you redeem them this way, you’ll wind up with more value ($680) than what you could get through flexible redemptions with HSBC Rewards ($500).

You’ll wind up with even fewer British Airways Avios than you would through conversions from HSBC Rewards, unless you hold out for a transfer bonus event.

For example, if you converted 100,000 HSBC Rewards to British Airways Executive Club at a 25:10 ratio, you’d have wound up with 40,000 Avios. With a 1:0.34 conversion ratio, you’d now wind up with just 34,000 Avios, assuming there’s no transfer bonus at stake.

You’ll still wind up coming out ahead with Asia Miles (34,000 vs 32,000) with your points converted to RBC Avion (Elite) points at a 1:0.34 ratio.

Previous HSBC Rewards+ & HSBC Travel Rewards Mastercard Cardholders

If your HSBC Rewards points were converted to RBC Avion (Premium) points at a 1:0.88 ratio, an intriguing opportunity presents itself.

With HSBC Rewards, you could redeem 100,000 points for a $500 statement credit for travel purchases. With 88,000 RBC Avion (Premium) points, you can redeem them for $511 worth of travel (172 RBC Avion (Premium) points = $100).

However, recall that RBC Avion (Premium) points can be converted into RBC Avion (Elite) points at at a 1:1 ratio if you have an eligible RBC Avion credit card.

Therefore, if you’ve been transitioned to an RBC® ION Visa or an RBC ION+ Visa, consider adding an RBC Avion credit card to your portfolio in the near future, since you’d then be able to move your RBC Avion points at the Premium tier into points at the Elite tier.

Credit Card

Best Offer

Value

Up to 70,000 RBC Avion points†

$826

Apply Now

35,000 RBC Avion points

$700

Apply Now

35,000 RBC Avion points†

$580

Apply Now

35,000 RBC Avion points

$580

Apply Now

35,000 RBC Avion points†

$580

Apply Now

Then, you could then transfer to British Airways Executive Club, Cathay Pacific Asia Miles, or American Airlines AAdvantage, or redeem them using the RBC Air Travel Redemption Schedule, for much greater value.

It’s worth noting that you can transfer RBC Avion (Premium) points to WestJet Rewards, too.

Conclusion

RBC’s acquisition of HSBC Bank Canada is now complete, and you can no longer use HSBC Bank Canada products.

If you had a balance of HSBC Rewards points, it is in the process of being converted into RBC Avion points at various membership tiers. Depending on how you choose to redeem your points, you could wind up with greater or lesser value than you did before.

Your new batch of RBC Avion points will be available to use as of April 5, 2024, so be sure to get your online accounts set up before then so you can begin to redeem points at your leisure.

†Terms and conditions apply. Refer to the card issuer’s website for complete, up-to-date information.

The problem with the conversion calculation that RBC did is that they compared arguably the worst use of HSBC points (flexible travel or statement credit at 0.5c) rather than looking at airline points, or the earn ratio.

Buying travel through Avion is — and tbh I’m guessing here — not going to be equivalent since — again guessing — they likely will not have the cheapest airline tickets, car rentals, etc. And I believe there is something about not using points for “fees/taxes”. So if the points only cover (say) 75% of the ticket, and the ticket price is 25% higher than open market, then the actual value is about 67% of nominal (.75 * 1/1.25).

Again, the fact that RBC did not disclose this ahead of time to let people choose is the big problem here, for me.

I have a written statement from an rbc rep that suggested hsbc customers would get the bonus points when being transitioned over to rbc. I’ll give it a few weeks and then are it (when I’m sure the bonus points aren’t added).

Would you be able to share that written statement? Thanks.

I’m not sure if this will work….

l’m currently with HSBC and

received notification that l’Il be

migrating to this credit card with

RBC as part of the takeover. Will L

receive this points bonus since ‘l

be a new RBC client? l’ve never

had an RBC avion card before.

3h

Like

Reply

1

RBC

Hi Dave

As mentioned,

your package will be arriving

shortly outlining your current

products with HSBC, and the

ones you will be migrated to

here at RBC. So it would be

similar to the Apple Watch

promotion, if you don’t

currently have a credit card

with RBC, then you would be

eligible.- Sara-Lynn

Hey David, who did you email at RBC to get this reply? I’m new to the RBC as well

Thank you David for sharing this.

I am in the same boat, never have any product with RBC. I will follow up with RBC credit card regarding the welcome bonus

All along I have been getting conflicting information. I had also a chat with RBC csr saying that there’s no welcome bonus points. The only thing I was assured was that the first year fee will be waived off. Don’t know what’s true and what’s not

So we don’t get welcome bonus points 35000k for new card holder’s transition from HSBC and another 20000k when spending 5k during the first three months?

That is correct. No new sign up bonus

I vaguely remember a politician using a wording along the lines of ‘customers would get the same deal or better – no negative impact.’

Yet my conversion is worse – and I no longer get six points per dollar spent on travel (or the equivalent).

I’ve talked to a few people with long relationships with HSBC that feel the same way. I guess it’s par for the course in this country that anything goes, but it’s still disappointing.

Well, HSBC’s points have always be valued at 0.5¢ per point (vs RBC Avion at 1¢ minimum), and to convert it out to another airlines, i.e. British Airways (BA) avios, the conversion ratio is 25,000 to 10,000. While RBC Avions can be transferred out to BA Avios at the ratio of 1:1 and sometimes 1:1.3. So this is not apple to orange comparison; earning 6 points with HSBC is not the same as 6 points with RBC. The conversion ratio isn’t too bad

RBC should let former HSBC card holder making their own decision if they would like to spend their HSBC Rewards or convert to Avion, if RBC disclosed the conversion rate two months ago, then we could make our own decision. The way they treated to HSBC Card holder is unfair.

Absolutely correct, the suspense screwed me over. I thought the conversion would be at 0.5 at least. The travel points alone is 6x with HSBC it’s worth more than RBC. The only reason I had to opt in for RBC bcuz I have travel arrangements booked via HSBC WE MC to cover the insurance coverage and the zero forex fee otherwise I would have redemption for cash or converted to asia miles instead.

With respect- $5000 travel spend got me 30,000 HSBC points, which converted to 12,000 Avios points….. That $5000 travel spend with my new RBC card (correct me if I’m wrong) gets me 1 point per dollar spend or 5000 Avion. Even with a boost on converting to Avios, I’m still way behind. That was not the deal they promised the gov’t or their customers. They’ve taken a terrific HSBC travel card, and made it a slightly above average travel card.

And as somebody who only used the HSBC card to get Avion points – a .36 conversion makes me worse off. Not much – fine – but again, that wasn’t the deal.

I understand that HSBC World elite mastercard gave 6 points per $1 spend in travel, but not all forms of spending though. It was only 2 points per $1 spend in non categories spending. Good multiplier is a great feature of this HSBC card. As different cards have different advantageous multipliers, it may not be a fair apple-to-apple comparison. Travel Earning rate, 100% it is better with HSBC World Elite Mastercard. But when comes to purely on points comparison after conversion, it is not too terrible.

And their communication has been garbage – I believe there was an article on here (again I could be wrong), as well as another prominent travel points website that talked about a minimum of .5 on the conversion of HSBC point. I’m presuming somebody at RBC had passed along that info, and/or certainly could have corrected that info if it was bad. But they didn’t. So to wake up this morning with a .36, was a bit of a shock.

I concur with you somebody did mentioned that per RBC avion ponies will be in 0.5 ratio or better

It is unclear to me why HSBC metal customers got a lower conversion ratio.

Because they (apparently) do not want those customers.

Personally I’m ticked off. It is a worse conversion rate than expected, and I certainly would have made different choices had I known what the rate would have been.

I knew there was some risk, and took the chance (transferred out half my points before but kept half). Still it is not a good start. I plan to transfer significant deposits away from RBC because of this, and the credit card will no longer be my “main” card.

Really shocked at the conversion rate difference considering that HSBC WE and Metal were functionally equivalent from an earning perspective so the points should be equivalent when converting.

I’ll note for reference that I was holding the HSBC Metal Mastercard with the annual fee waived. I’ve been transitioned to the RBC Avion VIP with the full annual fee waived (no end date specified) even though typically they only waive up to $120 of the annual fee. Earn rate is 1.25 points on every dollar, no FX fees, they carried over my unused $200 travel credit and added another $200 but this is only for the first year. Oddly, the card includes a dedicated Travel Concierge (separate from the VIP Concierge) but travel booked through the TC is not eligible for the travel credit – only travel made through Avion Reward Travel online portal.