It’s time for the inaugural Reader Success Story here at Prince of Travel for the month of September 2019.

Reader Daniel R. sent me a detailed account of his first foray into the world of Miles & Points with a trip to Las Vegas and the Grand Canyon, including a particularly clever use of his Marriott Gold Elite status. You’ll find his full account reproduced here, with a few of my comments below the fold.

Hey Ricky, I wanted to share with you my very first success story in the world of travelling on points and maximizing benefits. I only recently discovered the world of points and award travel, and have been somewhat cautious about applying to a tonne of cards or spending a lot on annual fees.

That said, with all the tips and articles you have written and diligently reading online, I made my first trip with a conscious selection of cards and points to help make it happen.

My fiancée and I took a trip to tour the Grand Canyon and spent a couple days in Las Vegas. Travelling from Vancouver Island in Canada, we booked WestJet flights using WestJet Dollars from the RBC MasterCard welcome bonus, as well as some travel bank dollars I had from a previous flight where they damaged my suitcase.

We both got the Marriott Bonvoy personal card and collected our points into one account. We used this to book one night in a Marriott in Vegas in a Category 5 hotel, and one night in Flagstaff, AZ in a Category 6 hotel.

However, the real benefit of the Bonvoy program came through getting the Gold status and status matching through Wyndham Rewards and Caesars Rewards. We booked a business meeting at a local Marriott property, and got our 10 elite qualifying nights posted to give me Marriott Gold status (the conference room cost us about $150).

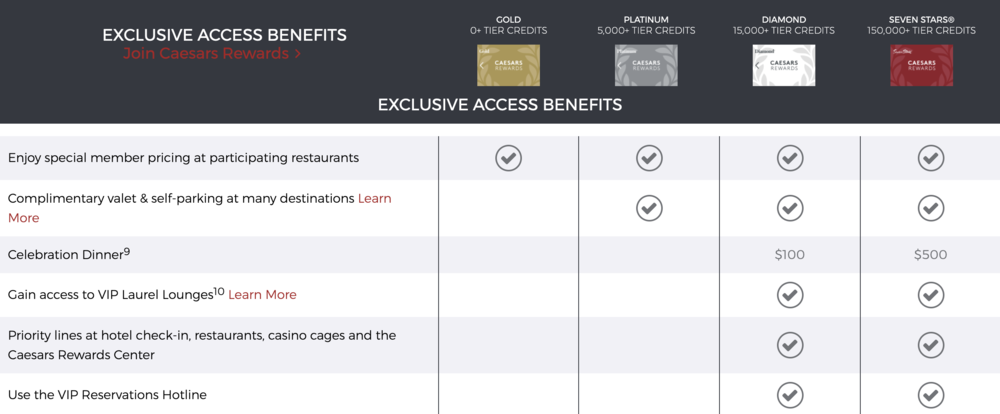

Through status matching, we got to Caesars Rewards Diamond, which, at the Caesars resort property we stayed at in Vegas, gave us resort fees waived (about US$35 per night, and for a three night stay totalled over US$100, or about the cost of our business meeting).

We also got free valet parking (about US$25 per day), as well as late checkout and priority lines just about everywhere you could imagine. From check-in and checkout, to the casino cashier, to the pizza joint in the fast food court, we got a priority line.

We also leveraged Caesars’ “Celebration Dinner” perk and enjoyed a US$100 dinner for free at a restaurant on the Strip that was lined up out the door. With our Diamond status, we were able to be seated immediately without a reservation and enjoyed a delicious dinner all for free!

Finally, I picked up the Scotia Passport Visa card for no FX fees, as well as some lounge passes to relax and enjoy one last drink before leaving Vegas!

Although most of this could have been accomplished with the Amex Platinum Card (for Marriott Bonvoy Gold status, lounge access, and MR points that could be used towards hotels), picking up individual cards slowly and as different First Year Free promos came up allowed me to enter the game slowly without a huge daunting annual fee and minimum spend.

I was also amazed at the crazy benefits that Caesars Diamond status gave, and although this is a niche use-case, I think it is a must-have for anyone looking to make a trip to the Las Vegas Strip for a couple nights.

This trip certainly whetted my appetite for travelling on points, and demonstrated the importance in planning out a trip and picking credit cards and reward programs that work towards that trip. Hopefully this experience will help others looking to make a first foray into this kind of travel, or simply be another tool in the toolbox of veteran travellers looking to maximize their dollar!

I don’t think I ever wrote about the Wyndham and Caesars status matching opportunity, although I may have mentioned it in one of my emails at one point.

Essentially, Marriott Gold Elite status, which you can obtain as a complimentary perk on the Amex Platinum Card or Business Platinum Card, can be matched to Wyndham Rewards Diamond status, which can then in turn be matched to Caesars Rewards Diamond status as well.

And as Daniel discovered, one of the strongest benefits of Caesars Rewards Diamond status is a host of complimentary perks, priority benefits, and dining credits at many Caesars-affiliated Las Vegas establishments. As Daniel says, status-matching your way to Caesars Rewards Diamond status can make a real difference towards elevating your Las Vegas experience.

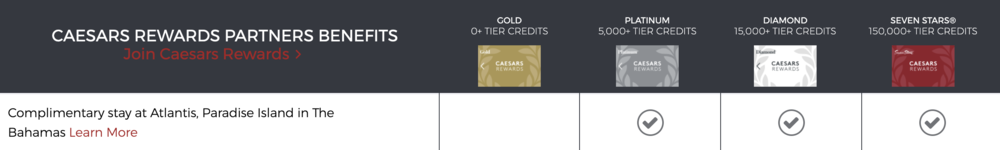

(In fact, another benefit of Caesars Diamond is a complimentary four-night stay at the Atlantis Paradise Island in the Bahamas. That’s a ton of value that you can squeeze out of mid-tier Marriott Gold Elite status!)

In addition to leveraging the niche status matching opportunity available from Marriott Gold, another reason I was impressed with Daniel’s story, and the reason I selected it for this month’s submission, was that I thought it was an excellent example of a newbie to the game sharpening their skills and taking their first trip on points despite initially feeling intimidated by the Platinum Card’s high annual fee and minimum spend.

It’s undeniable that high annual fees and minimum spending requirements such as those on the Platinum Card and the Business Platinum Card can be quite intimidating to newcomers who aren’t used to the idea of paying annual fees for credit cards.

As someone in this position, Daniel employed a measured approach by obtaining the more reasonably priced WestJet RBC World Elite MasterCard and Amex Bonvoy Card as a first foray into the game and squeezing an impressive amount of value out of them. Indeed, the Bonvoy cards don’t offer the same benefit of Marriott Gold Elite as the Platinum cards, but Daniel was able to bridge this gap with the inspired move of booking a cheap meeting room for 10 elite qualifying nights.

Now that Daniel has lived through the tangible benefits that resulted from his efforts, he knows from firsthand experience the value of collecting Miles & Points, and will have developed the comfort level to go for those cards with higher fees and higher returns.

Thanks for sharing, Daniel, and I’ll be sending you 5,000 Aeroplan miles as a reward to get you closer towards the next big trip.

And if you’d like your story to be featured too, send me an email with “[Success Story]” in the subject line for a chance to be selected for the October edition!

Hi Ricky,

Thanks for this post, I followed suite and matched the status 🙂

I can still book the hotels via AMEX/Expedia or 3rd party sites and take advantage of the Diamond Status on Caesar Rewards? All I have to do is to show them I’m a Diamond member during check in?

Thanks

Hey Ricky, just out of curiosity, how are you transferring 5000 points to Daniel? Are you taking the 5000 points from your own Aeroplan stash and transferring to his account or from another loyalty program (i.e., Bonvoy)?

Has anyone taken advantage of the Atlantis complimentary stay? They mention "Atlantis management reserves the right to modify, change or cancel at its sole discretion. If you accept this offer and do not show any rated casino play, the Atlantis may charge you for some or all of your upfront complimentaries including rooms, food & drink, limos, etc" – what does this mean?

The free Atlantis Hotel room via the Caesars Diamond rewards card is legitimate. But your room type varies based on their on/off season. The one way they get you is the resort fees which I believe are around $60USD per night