RBC is in the midst of finalizing its acquisition of HSBC Canada, and it’s expected that existing HSBC Canada cardholders will be fully transitioned into the RBC ecosystem by the end of March 2024.

As part of the acquisition, HSBC Rewards points will be converted to RBC Avion points, and it’s supposed to be for comparable value. However, RBC has been mum on the conversion rate thus far, and we don’t yet know if it’s better to wait for the conversion or to redeem your HSBC Rewards points before it happens.

If you have a stash of HSBC Rewards points in your account, it’s worth taking stock of all options at this point, in case the ratio doesn’t wind up being favourable, or if you want to redeem your points for a predictable value before the transition.

With the above in mind, here are some of the best ways to redeem 100,000+ HSBC Rewards points.

In This Post

- Key Things to Know About Redeeming HSBC Rewards Points

- 1. Offset Travel Purchases

- 2. 40,000+ British Airways Avios

- 3. 36,000+ Singapore Airlines KrisFlyer Miles

- 4. 32,000+ Cathay Pacific Asia Miles

- Conclusion

Key Things to Know About Redeeming HSBC Rewards Points

HSBC Rewards points are a flexible points currency, in that you can redeem them in a variety of ways.

Depending on how you travel, you can either redeem them at a fixed value as a statement credit against any travel expense, or you can choose to transfer them to three airline loyalty programs.

Redeeming HSBC Rewards points against eligible travel purchases at a ratio of 200 points = $1 is generally seen as the “baseline” redemption option, giving you a value of 0.5 cents per point (cpp).

In addition, you can potentially unlock better value than 0.5cpp by transferring HSBC Rewards points to one of three frequent flyer partners – British Airways Executive Club, Singapore Airlines KrisFlyer, and Cathay Pacific Asia Miles – and using those points strategically for high-value flight redemptions.

It’s worth noting that you also have the option of redeeming HSBC Rewards points for gift cards, merchandise, or deposits into HSBC chequing or savings accounts, but the value in doing so is poor, and so this avenue is generally not recommended.

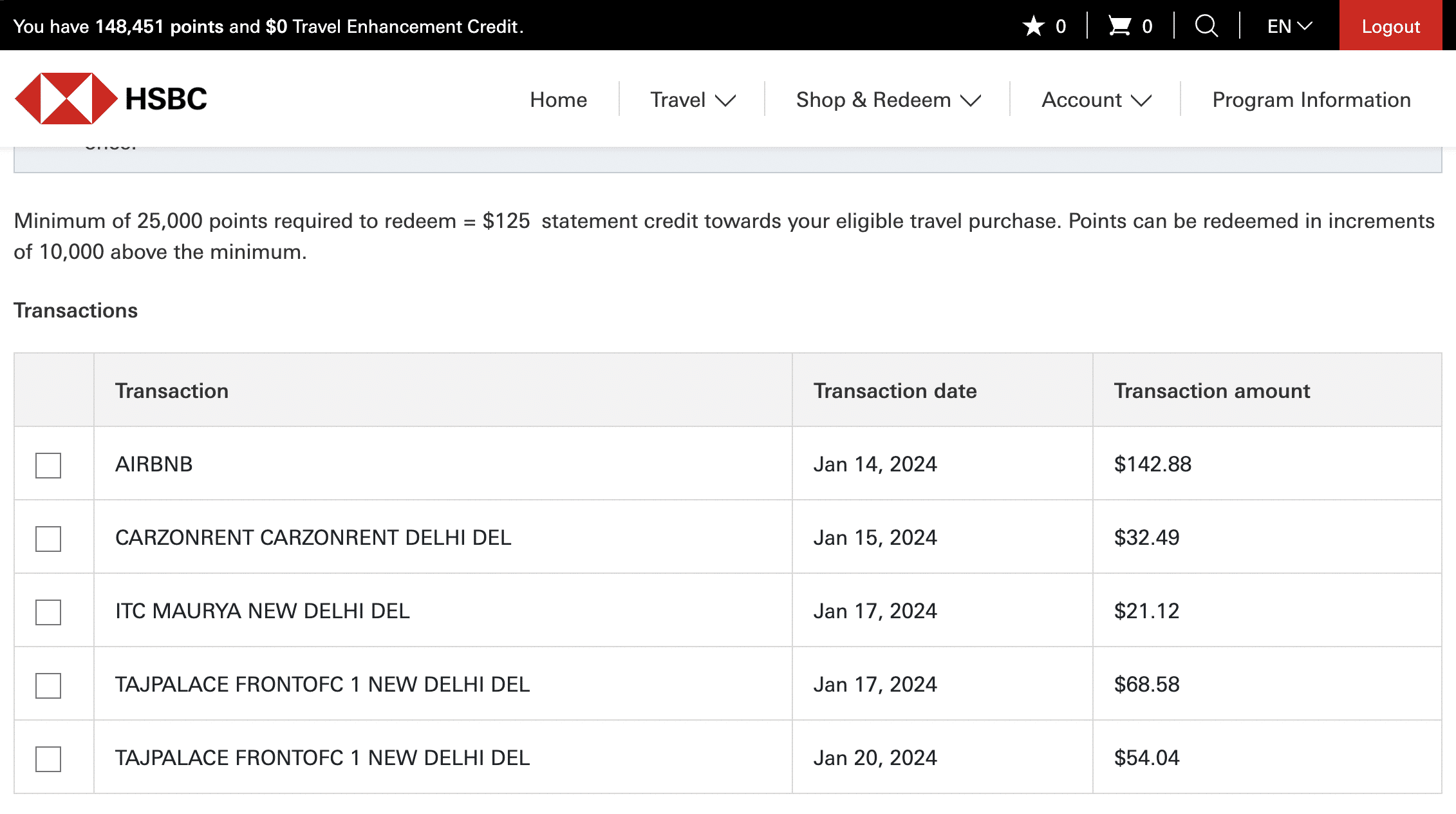

Now, both baseline travel redemptions and frequent flyer conversions are subject to the following rules:

- A minimum of 25,000 HSBC Rewards points must be redeemed at once

- On top of the minimum amount, HSBC Rewards points may be redeemed in increments of 10,000 points

When we combine that with the following transfer ratios to Avios, KrisFlyer miles, and Asia Miles…

- 25,000 HSBC Rewards points can be converted into 8,000 Cathay Pacific Asia Miles

- 25,000 HSBC Rewards points can be converted into 9,000 Singapore Airlines KrisFlyer miles

- 25,000 HSBC Rewards points can be converted into 10,000 British Airways Avios

…we get the following matrix of possibilities for the best possible ways to redeem your HSBC Rewards points.

HSBC Rewards | Travel Purchases | British Airways Avios | Singapore Airlines KrisFlyer | Cathay Pacific Asia Miles |

25,000 | $125 | 10,000 | 9,000 | 8,000 |

35,000 | $175 | 14,000 | 12,600 | 11,200 |

45,000 | $225 | 18,000 | 16,200 | 14,400 |

55,000 | $275 | 22,000 | 19,800 | 17,600 |

65,000 | $325 | 26,000 | 23,400 | 20,800 |

75,000 | $375 | 30,000 | 27,000 | 24,000 |

85,000 | $425 | 34,000 | 30,600 | 27,200 |

95,000 | $475 | 38,000 | 34,200 | 30,400 |

105,000 | $525 | 42,000 | 37,800 | 33,600 |

115,000 | $575 | 46,000 | 41,400 | 36,800 |

125,000 | $625 | 50,000 | 45,000 | 40,000 |

With the above rules and transfer ratios in mind, without some careful planning, you may end up leaving some HSBC Rewards points “stuck” in your account. If this happens, you’ll be unable to redeem optimally unless you top up your points balance with some extra spending.

For example, with 100,000 HSBC Rewards points in your account, you may be tempted to deploy the maximum possible amount of 95,000 points towards one of the four redemption avenues in the chart.

However, doing so would leave you with 5,000 points “orphaned” in your HSBC Rewards account, which you wouldn’t be able to use up until you topped up back to a balance of 25,000 points.

Instead, if you wanted to use up the full balance of 100,000 points in one go, it’d be wiser to redeem in two separate chunks – for example, 55,000 points followed by 45,000 points, 25,000 points followed by 75,000 points, and so on. These chunks can even be redeemed in different ways if you’d like to mix things up a little bit.

As you can see, the HSBC Rewards program is slightly more nuanced than other transferrable points currencies in Canada like Amex Membership Rewards or RBC Avion. However, there are still many great ways to redeem your points for travel, which we’ll go over below.

1. Offset Travel Purchases

Redeeming HSBC Rewards points against travel purchases is very straightforward, and can be done directly in your HSBC online dashboard as soon as the points and the travel purchase have both been posted to your account.

As we’ve discussed before, HSBC Rewards is one of the “good guys” when it comes to fixed-value points programs, allowing you to retroactively redeem your points to offset any travel purchases charged to your card.

Simply head to the “Redeem Points” section of your HSBC online dashboard, and you’ll be presented with a list of eligible travel purchases within the last 90 days, against which you can redeem HSBC Rewards points at a set value of 0.5 cents per point.

Remember, though, you’ll need to select a minimum of $125 in travel purchases – thus reaching the minimum redemption amount of 25,000 points – in order to proceed.

In this fashion, 100,000+ HSBC Rewards points can be used to directly offset against $500+ in travel purchases.

Overall, this is one of the most popular ways to use HSBC Rewards points, especially since they are so flexible in allowing you to offset any travel purchases on your statement.

This makes HSBC Rewards an excellent points currency for booking travel that wouldn’t normally be bookable on points, such as non-chain hotels, short-term rentals, train tickets, cruises, all-inclusive vacation packages, etc.

Moreover, this amount of $500+ is also the benchmark that you should compare against as we explore the possibility of transferring HSBC Rewards points to any of the three frequent flyer partners instead.

2. 40,000+ British Airways Avios

With an effective transfer ratio of 25:10 from HSBC Rewards to British Airways Executive Club, 100,000+ HSBC Rewards points is therefore equivalent to 40,000+ Avios.

Doing the math to compare against our baseline value outlined above, we see that an Avios redemption value of at least 1.25cpp is required to beat the value you’d get from simply using your HSBC Rewards points to offset your travel purchases.

Unfortunately, Avios sweet spots for direct flights out of Canada are few and far between. However, there are still plenty of ways to get outsized value from an Avios redemption that exceeds the goal of 1.25 cents per point.

Avios are generally considered most useful for short- or medium-haul redemptions in other parts of the world across the Oneworld route network.

Hopping around Europe on British Airways or Iberia, Southeast Asia on Cathay Pacific or Malaysian Airlines, or Australia on Qantas can all result in redemption values higher than 1.25cpp.

However, if you have your sights set on a premium cabin, remember that you can book Qatar Airways Qsuites – widely heralded as one of the world’s best business class products – with Avios.

A one-way flight in Qsuites from Montreal to Doha costs 70,000 Avios. While you’d need to transfer 175,000 HSBC Rewards to reach this threshold, keep in mind that British Airways Executive Club is also a transfer partner with American Express Membership Rewards and RBC Avion.

Therefore, you could consider converting your remaining HSBC Rewards to British Airways Executive Club, and then top up your account with other points you have available to get across the finish line.

Again, we don’t yet know at what ratio RBC will convert existing balances of HSBC Rewards, so you may want to hold out until those details are released before initiating a transfer.

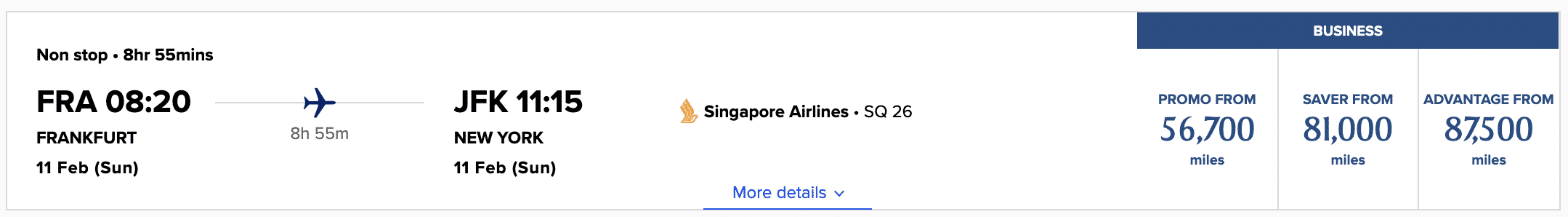

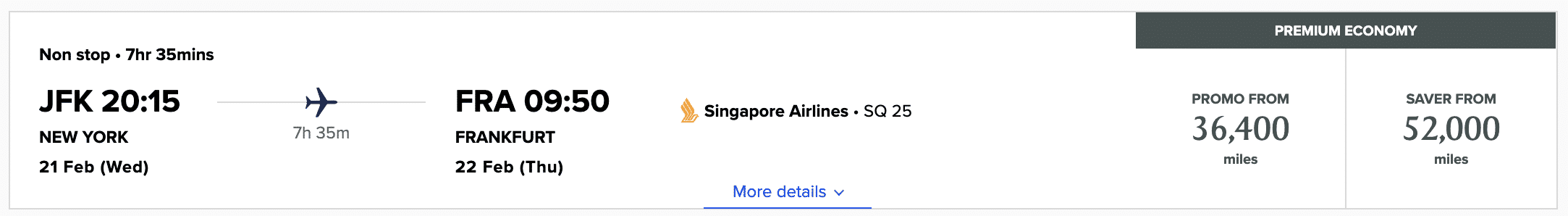

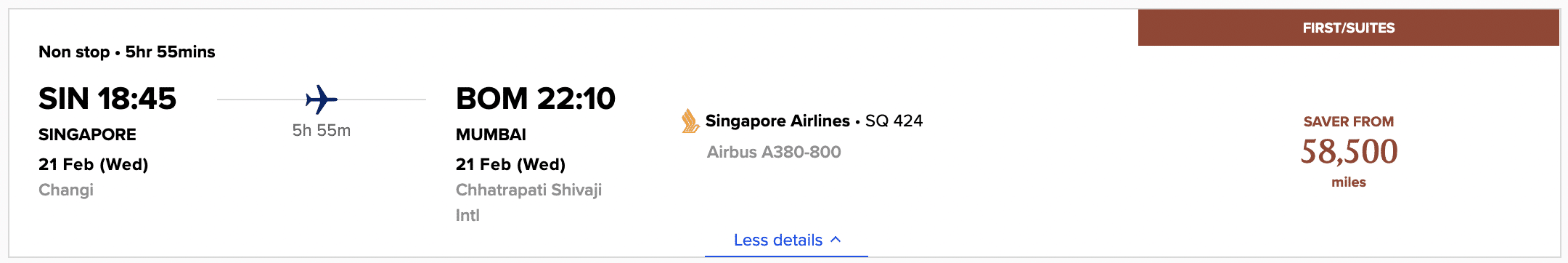

3. 36,000+ Singapore Airlines KrisFlyer Miles

Another option for redeeming HSBC Rewards points is to convert them to Singapore Airlines KrisFlyer miles.

In fact, aside from transferring Marriott Bonvoy points, HSBC Rewards is the lone Canadian points currency that provides access to KrisFlyer.

With an effective transfer ratio of 25:9 from HSBC Rewards to Singapore Airlines KrisFlyer, 100,000+ HSBC Rewards points would be equivalent to 36,000+ KrisFlyer miles.

Running the numbers, we can see that a KrisFlyer redemption value of at least 1.39cpp is required to do better than simply offsetting against travel purchases at a rate of 0.5 cents per point.

Singapore Airlines publishes monthly Spontaneous Escapes deals, which offer a 30% discount for travel on select routes in various classes of service.

For example, you can book a Singapore Airlines fifth freedom flight between Frankfurt and New York in business class for just 56,700 KrisFlyer miles, or in premium economy for just 36,400 miles, with a Spontaneous Escapes deal.

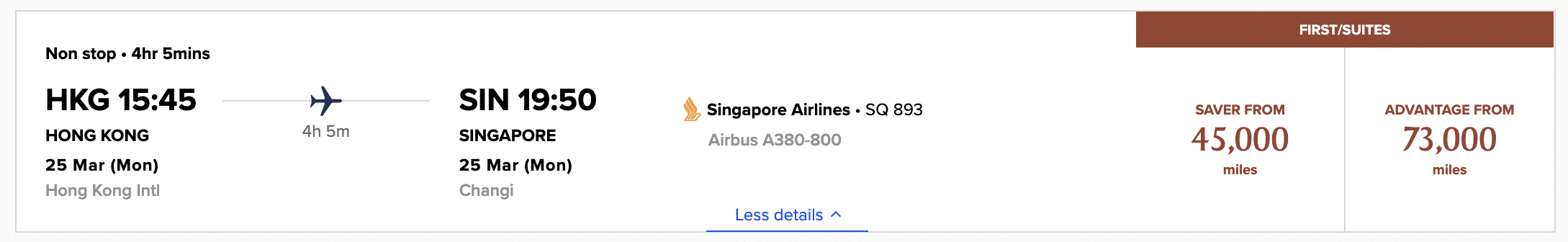

However, if you’ve gone through the trouble of earning KrisFlyer miles in the first place, then you likely have only one target redemption on your mind: Singapore Airlines’s premium flights, including the world-famous Suites Class.

Singapore Airlines keeps its most premium products out of reach to most partner programs, and with very rare exceptions, most are only bookable through Singapore Airlines’s own KrisFlyer program.

At the time of writing, Singapore Airlines is flying the Airbus A380 between Singapore and the following cities:

- Auckland (AKL)

- Delhi (DEL)

- Hong Kong (HKG)

- London Heathrow (LHR)

- Melbourne (MEL)

- Mumbai (BOM)

- Sydney (SYD)

- Tokyo Narita (NRT)

Of these, the best Saver-level prices for Singapore Airlines Suites Class are to Hong Kong (45,000 KrisFlyer miles), and Delhi/Mumbai (58,500 KrisFlyer miles).

Now, by far the most difficult step will be finding Saver-level Suites Class award availability, which is exceedingly rare.

However, if you’re looking to fly in one of the best aviation experiences out there without paying a tidy sum of cash, Singapore Airlines KrisFlyer is the only way to get you there.

Otherwise, there aren’t many major reasons to go out of your way to earn KrisFlyer miles when there are several more easily accessible programs available to Canadians. Plus, keep in mind that you can book Singapore Airlines business class using Aeroplan points at favourable rates.

Since KrisFlyer miles expire 36 months from the date of accrual, you’ll want to make sure to use them in due course so they don’t eventually disappear.

4. 32,000+ Cathay Pacific Asia Miles

The third and final airline transfer partner with HSBC Rewards is Cathay Pacific Asia Miles.

With an effective transfer ratio of 25:8 from HSBC Rewards to Cathay Pacific Asia Miles, 100,000+ HSBC Rewards points would be equivalent to 32,000+ Asia Miles.

Crunching the numbers here, we can see that an Asia Miles redemption value of at least 1.56 cents per point is required to outperform the value you’d get from simply redeeming against travel purchases.

Asia Miles is generally considered a useful program for travelling to Asia in premium cabins. This is especially so if you’d like to fly Cathay Pacific’s highly regarded business class or First Class products.

That’s because Asia Miles members get access to greater availability than partner programs on Cathay Pacific flights, so you’ll have a much easier time finding and booking these flights compared to through a partner like Alaska Airlines Mileage Plan or American Airlines AAdvantage.

Unfortunately, the program recently underwent a global devaluation in October 2023, and award pricing isn’t as attractive as it once was.

A one-way flight from Vancouver to Hong Kong in business class now prices out at 84,000 Asia Miles, and flying from Toronto now costs 110,000 Asia Miles in business class.

Therefore, a haul of 32,000+ Asia Miles won’t be enough for most long-haul redemptions all on its own, and you’d need to combine this amount with Asia Miles earned from other sources for a more meaningful premium redemption.

Thankfully, Asia Miles are very easy to come by: you can transfer from American Express Membership Rewards at a 1:0.75 ratio, from RBC Avion at a 1:1 ratio, from Marriott Bonvoy or from US credit cards as well.

If you travel frequently to Asia and would like to do so in comfort, and you’re able to gather Asia Miles from some other mileage-earning sources as well, then converting your HSBC Rewards points to Asia Miles could be the right fit.

Conclusion

As you can see, redeeming 100,000+ HSBC Rewards points comes with a very wide range of redemption possibilities.

The baseline redemption of $500+ in travel value is a great choice if you don’t tend to value transferring points to airline loyalty programs.

However, there are more valuable possibilities via the three frequent flyer transfer partners: British Airways Executive Club for the avid travellers who can take advantage of Avios’s global short-haul sweet spots, Singapore Airlines KrisFlyer for the aspirational luxury travellers who’d like to get a taste of Singapore Suites, and Cathay Pacific Asia Miles for any Asia-bound travellers who’d like to fly in the comfort of Cathay Pacific.

It bears repeating that there’s no rush to redeem all of your HSBC Rewards points, as the conversion rate to RBC Avion has yet to be announced. However, with the time winding down on RBC’s acquisition of HSBC Canada, you’ll do well to be aware of your options beforehand, so that you can be sure to get the most value out of your points.

And if you’re looking for a credit card to replace your HSBC World Elite Mastercard, be sure to check out our guide to suitable replacements.