Mythbusters: 9 Myths of Monetary Mishaps

I’ve been in the Miles & Points hobby for three years now, and I’d be lying if I told you I’d never once made a credit mistake.

Gone over a credit limit? Been there, done that. Missed a payment by a few days? Yup. Been called by a foreboding-sounding collections agency? Oh yeah, and although it was just a scammer, it’s not like a 21-year-old me knew that right away.

Today, I want to look at some of the most universal myths that persist in regards to when we make a faux-pas with our credit cards. There’s lots of conflicting information out there, but remember that if I’m calling a myth “busted”, “plausible”, or “confirmed”, it’s because my closest friends and I have often served as guinea pigs.

Myth #1: Opening Lots of Credit Cards Will Ruin Your Credit

I know that this issue has been utterly done to death within the Miles & Points community, but I’d be amiss to omit it.

Long story short: this myth is BUSTED.

You might be wondering why opening lots of credit cards in a short amount of time won’t instantly ruin your credit, and that’s a fair question to ask.

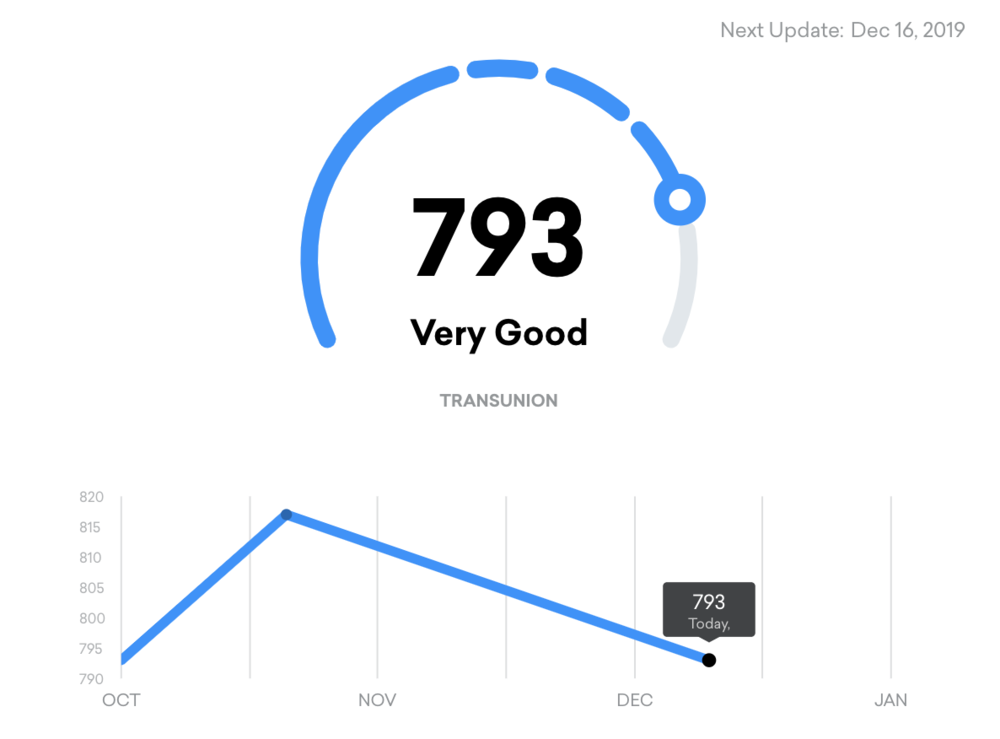

The first reason is that creditors tend to pull from various different credit bureaus, meaning that a hard credit pull at Equifax (used by banks such as BMO or TD) won’t necessarily negatively affect your TransUnion credit score.

Indeed, you’d have no problem opening a card whose issuing institution uses TransUnion shortly after opening that first card from a bank that uses Equifax!

The second reason is that the credit bureaus are much more interested in your total amount of actual debt, so you won’t feel much impact on your credit score for having $80,000 of open credit limits if your statements are only showing balances of $4,000.

Verdict: Busted.

Myth #2: Your Credit Files Are “Cleared” Every 7 Years

This myth is very important for people who may have made imprudent financial decisions in the past or even been obligated to file for bankruptcy.

I’m happy to inform you that while credit information may remain on your file after seven years, any mistakes you might’ve made no longer impact your credit file after that period.

If you forgot to pay a store credit card and your balance went to collections five years ago, then that derogatory mark on your credit file will only impact your score for another two.

But don’t run up all your credit cards trying to impersonate the Wolf of Wall Street in the hopes of writing off the debt. If a creditor wishes to, they can attempt to reclaim their money through the courts or by suing you for a period determined by your province (but generally adhering to within six years as required by federal Canadian law).

Verdict: Confirmed.

Myth #3: Mishaps Affect Your Credit Immediately

As a younger fellow, I remember accidentally forgetting to pay my credit card until a few days after the minimum payment was due. I called into the BMO call centre and begged them to scratch my mistake off my credit report.

Thankfully, my mistake had not been forwarded to the banks yet, because my statement was within 30 days of being past due, and so all I was charged was a late fee.

It turns out I was in good company when it came to forgetting to pay my credit card on time.

As always, pay your balances on time and in full. Doing anything else will eventually be reported to the credit bureaus, and then you’ll be sorry when it’s time to buy a new car or open another credit card.

However, almost all mistakes you could make, even serious ones, won’t be reported to the credit bureaus for at least 30 days past your statement due date. As most credit cards have a 21-day payment grace period, this means you actually have 51 days to make payment without incurring a black mark on your credit report.

Should you forget to pay in that 21-day grace period, but still within the 30 days prior to having the error be reported to the bureaus, it’s worth giving your financial institution a call. They’ll often be forgiving, and can even reverse any late fees you may have incurred unless you’re a repeat offender.

Verdict: Busted.

Myth #4: Equifax and TransUnion Share Your Mistakes

So, you missed a credit card payment. Or maybe even worse, you forgot that one card was open, and now you’re past due on the annual fee. Rats!

Will this impact your future credit card applications? How about harming your ability to get other credit products, such as a line of credit? Will this be reported immediately?

As I’ve mentioned earlier, mistakes aren’t always reported instantaneously. It often takes a little while for, say, your utility provider to report your payment as delinquent and in need of collections to Equifax or TransUnion. It might then take the bureaus longer to update this in their computer systems.

One thing I have noticed from my own experience is that not every single type of screw-up is shared between each bureau. I’ve seen one person’s overdue bill go to collections and be reported to TransUnion, tanking that score 100 points into the 600s, while that same individual’s Equifax went unaffected.

Still, it’s better to err on the side of caution and assume that while lenders and credit bureaus aren’t always the best at sharing information with one another, this is something you don’t want to be risking your place in the Miles & Points race on.

Also something to take note of is that there is in fact a total separation between American and Canadian credit bureaus. A mistake in Canada won’t follow you down south, nor will one in the United States migrate north.

Verdict: Plausible.

Myth #5: Different Credit Mishaps Are Treated Differently

Remember how I mentioned that I went over my credit limit in my days of youthful transgression?

Yeah, turns out that’s a big no-no, and not just because BMO was charging me $29 a pop each time I did it. It turns out that when my balance on my maxed-out credit card reported to the credit bureaus, it was reading at 103% utilization!

Needless to say, this dropped my credit score pretty badly.

To look at the “sunny side,” this wasn’t the worst thing I could have done, nor was it the most severe punishment I faced. In fact, it’s completely possible to go above your credit limit, and pay down your balance before the statement arrives and your over-utilization gets reported to either bureau.

In such a situation, you’d be out the awful over-limit fee, but your credit history would probably remain untouched.

No, what’s far worse for your credit score is when you not only miss payments, but ignore them altogether.

Let me give you an example: a friend of mine was over-billed by a cell phone company. He argued with them, and when they refused to budge, he refused to pay.

This resulted in him being hit with late fee after late fee. After being 60 days past due, his file was referred to collections. He didn’t pay that collection in full for another couple of years, and because he admitted his fault eventually, that means this paid collection was finally removed from his credit report only recently – seven years after payment, in fact!

Whatever your credit mishap, just remember: paying on time matters. Stiffing a creditor is a lot more likely to affect you negatively than you messing up and being charged late fees.

Verdict: Confirmed.

Myth #6: You Can’t Contest Entries on Your Credit Report

It’s a very sad reality that many Canadians are not aware of their rights as consumers. This trend is even worse for people who try dealing with financial institutions.

After all, most of us take on some debt during our lives, even if it’s just to have a few extra bucks on a honeymoon or retirement bonanza. We are thus less inclined to argue with the folks cutting us credit!

As I’ve covered before, though, you need not be stuck with past credit inquiries made in error. It’s definitely possible for you to have applied for a product by accident, or have a bank accidentally overcharge you and then try to collect.

In such instances, speaking with your financial institution can always help. Better yet is to practice a skill from bygone ages: writing letters via traditional postal services.

If you have any kind of credit inquiries or marks on your credit file, don’t hesitate. Reach out to Equifax and TransUnion via traditional mail, and dispute any mistaken entries you notice.

The bureaus respond better to old-school mail, and it provides you with a valuable physical record if you ever need to support your case, up to and including in small claims court.

Verdict: Busted.

Myth #7: Creditors Will Blacklist You for Messing Up

What I am writing below is somewhat speculative, but supported by a handful of anecdotal data points. That’s because we are discussing a drastic measure that banks are notoriously tight-lipped about: the process of permanently barring customers from holding their products.

Due to customer confidentiality laws and corporate desires to limit liability, banks never talk about decisions that have led them to either “exit” (ban) consumers, or permanently blacklist them from holding their products in the future.

However, I have several friends and acquaintances who have been able to verify certain common threads with me. For example, one individual wrote off a student credit card at TD Bank over a decade ago. They’ve since found it impossible to get approved for any TD products at all — including bank accounts!

I’ve heard similar stories from an individual who was walked from a smaller credit union for writing off a secure line of credit, but has since found it possible to recommence business with them.

While I can’t render judgment on this with absolute and total certainty, I’d lean towards the much stronger side of “plausible”.

Verdict: Plausible.

Myth #8: Consumer Proposals and Bankruptcy Are Treated Equally for Credit Applications

Have you ever seen this before?

This is basically your “kiss of death” when it comes to the first-rate credit cards available on the Canadian market. For those of you who’ve been through a bankruptcy, or known a loved one who survived one, then clicking “yes” on this box often results in either an instant decline, or not even being permitted to proceed with the application.

That’s because a recent bankruptcy, which I’d like to add is a complex legal procedure that should always be undertaken with the assistance of a trained professional, is seen as an enormous liability that means you can’t be entrusted with more credit.

But what about a consumer proposal? This is a situation where, as with a bankruptcy, you reach out to a trained professional. Instead of writing off all your debt, though, you make a partial repayment settlement for a portion of the funds that you owe to your creditors.

While this might sound good on paper, and may be a better option should you find yourself in such an unfortunate circumstance, be aware that the banks see a bankruptcy and a consumer proposal as one and the same thing when it comes to applying for just about any credit product.

If you want to access the best credit cards, it’s best to survive your bankruptcy or consumer proposal and wait seven years for it to drop off your credit report before starting anew.

Verdict: Confirmed.

Myth #9: “Second Chance” Issuers Are Second-Rate

It may be slightly silly, but “credit card snobbery” is a real thing. Let’s be real, no rapper worth their salt ever dropped a beat about sick store credit cards, even if those cards do have awesome benefits.

This snobbery can become a bit more pronounced when it comes to applying for products from “second chance” lenders.

These lenders are companies such as PC Financial or Canadian Tire Financial Services, and they tend to look more favourably upon Canadians who’ve had derogatory marks on their credit files, are new to the country, or have even declared bankruptcy recently.

There’s a bit of a perception that if a department store is hawking a credit card at you, it must be second-rate!

I absolutely beg to differ. Right now, some of the most competitive credit cards, such as the Canadian Tire Triangle World Elite Mastercard, are open to Canadians needing a bit of help with their credit or who have excellent credit alike!

While this card won’t fly you anywhere in business class anytime soon, features such as its free Canadian Tire Gold Roadside Assistance will help you drive your car on that sightseeing camping trip you always wanted, even if you are off the beaten path.

And the CTFS Triangle World Elite isn’t the only second-chance credit card on the market. Products such as the PC Financial World Elite Mastercard offer excellent earn rates on groceries at the Loblaws family of stores.

Alternatively, you could pivot toward prepaid credit cards like the Wealthsimple Cash Card, which can be used for daily transactions or thrown into your international carry-on for no-FX purchases without breaking a sweat.

Verdict: Busted.

Conclusion

Personal finances are never a fun thing to make a mistake with, especially when they’re linked so closely to the pursuit of Miles & Points.

Nobody wants to jeopardize their ability to collect points and fly the world on the cheap just because they went overdue on their natural gas bill by a few days, or be banned from a bank for life because of a mistake made in college.

Still, reality is not always as forgiving as one wishes it to be. As always, pay your credit cards on time and in full, and never take out more cards than you know that you can responsibly use.

If you do run into any issues or problems, never feel afraid to robustly fight for your consumer rights and to protect your credit score and financial future.

I hope that this article has proven useful to you and given you a better idea of how credit mishaps can affect you. Until next time, remember that old-school mail is an amazing tool.

Read More

Kirin explores the world through the lens of miles and points, sharing insights on premium travel experiences.

First-year value

$336

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners

Monthly fee: $15.99

• Earn 1,250 points per month upon spending $750 per month for 12 months

Earning rates

Key perks

- Transfer to airline and hotel partners