Credit cards can be very helpful tools to help enhance your travel game. Between lounge access, elevated earning rates, and welcome bonuses, credit cards are one of the best ways to help meet and exceed your travel goals.

As amazing as credit cards and their attendant perks can be, not every person meets minimum income requirements for mid-tier or premium cards, and other folks may just be getting back on their feet following an unfortunate financial pitfall.

For anyone feeling affected by the aforementioned issues, the good news is that there are some great alternatives in the form of prepaid and secured credit cards.

But what are the differences between the two, and which might be best for your travel or cash flow goals? Let’s take a look.

What Are Prepaid and Secured Credit Cards?

Before delving any further, let’s first establish what prepaid and secured credit cards actually are, and why they have slightly different rules which govern them.

First up, let’s cover prepaid credit cards.

As the name might suggest, a prepaid credit card is prepaid. This means that you need to deposit or load your own funds onto your card in order for it to work, and you can’t expend funds past those which are loaded onto the card.

Secondly, prepaid credit cards work almost identically to credit cards: they use the Visa or Mastercard payment networks to process transactions, which means that you have the same accessibility and most of the same protections against fraud as regular credit card users.

However, this also means that you can’t use prepaid credit cards at merchants that only accept debit, such as when paying tax to the Canada Revenue Agency directly.

Thirdly, prepaid credit cards are unsecured outside of the funds which you choose to deposit. You don’t need additional collateral to open a prepaid account, and so they also have no specific credit score requirements.

This also means that prepaid cards don’t count toward building credit history with the major credit bureaus, which is an important factor to consider if you’re working on building your credit score.

On the flipside, you have the option of looking into secured credit cards. Whereas prepaid credit cards can be opened by anyone and don’t require you to retain a minimum balance, a secured credit card requires a cash deposit in order to open your account.

This is called the “security deposit,” after which secured credit cards are aptly named.

How large of a deposit you have to make largely depends on your specific financial situations.

Some lenders may require only a small deposit, and will offer you a greater credit limit than the money you deposit up front. Others might require a full $1,000 deposit if you’re looking to get a $1,000 credit limit on the card.

Ultimately, a secured credit card is helpful because it can help someone who’s finding their financial feet open a revolving credit account to help them build their score and track good financial habits.

Unlike prepaid cards, secured credit cards report to credit bureaus, which means that they’re more beneficial if you’re looking to improve your credit score.

What Is the Best Credit Card for Someone with Poor Credit?

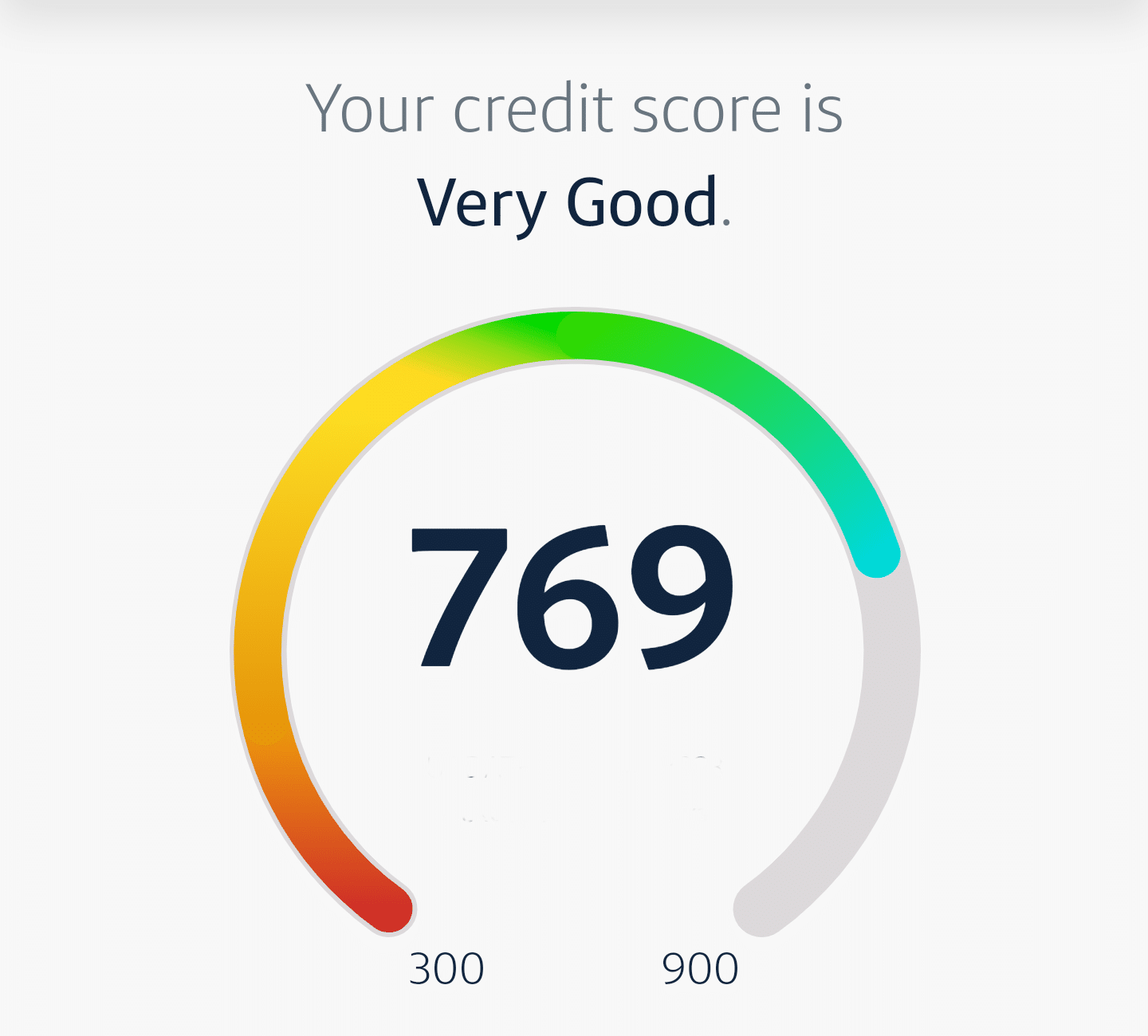

Let’s face it: not everyone’s credit situation is pristine. Some are just getting started on the credit journey, while others might have made mistakes in their youth, or have been subject to recent misfortunes.

It happens, and that’s why there’s a subset of the market geared towards meeting the financial needs of Canadians with less-than-ideal credit.

If you find yourself in this situation, what makes more sense: a prepaid or a secured credit card?

There’s good news up front: even with poorer credit, you could be eligible to open a prepaid or secured credit product.

In the case of secured credit cards, your credit score and credit history will determine the amount of security deposit you have to part with. On the other hand, a prepaid credit card will require you to link your bank account and make deposits to top-up your balance as needed.

However, you should remember: a prepaid credit card won’t build your credit history. While it can be a great way to access services that require a credit card to pay, such as rideshare or online shopping services, prepaids will not assist you in building or rebuilding your credit.

For such needs, you’ll need to turn to a secured credit card if you aren’t otherwise eligible for an unsecured credit product.

For choice of products in either category, the world is your oyster.

Many Canadian financial institutions issue prepaid credit cards. One of the better options is the EQ Bank Card because of its 0% foreign transaction fees and reimbursed ATM fees within Canada. This product is great even for people who have excellent credit because of its swath of benefits.

If you’re looking to enhance your travel game with a non-optimal credit score, TD, BMO, or HSBC might be ideal lenders. This is because each of these banks offers a secured version of their full-fledged unsecured travel rewards cards, and are known to also award a full sign-up bonus for these secured products.

This means you’ll get to expand your rewards points balances, while still practising healthy credit habits.

Therefore, for most people who need to improve a damaged credit score, the best choice is a secured credit card. The most frustrating part of this process is often going to be the size of security deposit, as nobody likes tying down a large quantity of cash; however, it’s often a necessary requirement.

Which Credit Cards Are Best for Beginners?

If you’ve just turned the age of majority in your jurisdiction and opened a credit file, it’s likely to be quite thin. This means that you’re going to have some work to do before you can qualify for a variety of other loans or financial products on which much of modern life depends.

As unfortunate as it is, most of us don’t have the hard cash to purchase a home, a vehicle, or an education with cash, and so we need to turn to the credit market to enable us to make these potentially life-changing purchases.

If you’re just beginning on your credit journey, take heart in knowing that while stories about racking up terrible credit card debts can be true, they needn’t apply to you personally.

Even if you do qualify to open an unsecured credit product, you may instead choose to utilize a prepaid product at the outset. Even having an unsecured credit card or student line of credit open will help build the length of your credit history and payment history over time; however, you don’t have to use those products for your daily needs.

If you instead opt to use a prepaid credit product, you can tightly control and monitor your spending, and won’t rack up debt because you can’t spend any more money than that which you’ve loaded onto your prepaid card.

You’re also assured better protections when using a prepaid product than with a debit card, and as we’ll see in the next section, you’re also eligible to potentially earn rewards, which can really boost daily spending in your advantage.

Of course, if you want to build your credit while also having the peace of mind that you won’t go broke from debts, then a secured credit card may be best for you. However, for young, budget-conscious customers, the prepaid market seems to edge out its secured competition.

Do Prepaid and Secured Credit Cards Earn Rewards?

When it comes to cash back or rewards points, prepaid and secured products vary drastically.

The vast majority of secured products that are publicly advertised as being available for people with mediocre or poor credit don’t come bundled with any form of rewards or incentives.

On the other hand, most prepaid products earn cash back or points redeemable for cash equivalents, such as PC Optimum Points on the PC Money Account prepaid Mastercard.

However, banks such as HSBC, TD, and BMO offer secured variants of their rewards credit cards, so long as you apply in-branch with proof of income and a security deposit. While the requirements for these products are therefore stricter, it also means that there are some rewards to be found in the secured credit card space.

Ultimately, both secured and prepaid products offer customers a method by which you can get a rewards credit card with either bad credit, a short credit history, and little to no money up front.

While both have their niche, prepaid cards win on accessibility, since it’s easier for a customer to get a prepaid product without a lot of effort.

On top of this, most prepaid products offer a variety of additional attractive benefits, such as the Koho Prepaid Mastercard card earning daily interest on any deposited balance.

For those customers willing to go to the bank, undergo manual underwriting, and pay a security deposit, the secured credit card landscape offers up more opportunities by granting exposure to programs like RBC Avion or HSBC Rewards.

Conclusion

Wherever you are on your credit journey, it’s best to be informed about what payment solutions are available to you. While there’s plenty of marketing buzz around both prepaid and secured credit card products, both offer competitive solutions for people with different financial histories.

While prepaid cards tend to win on their ease of accessibility and rewards programs, they don’t help build credit in the same way that secured products do. Then again, there are no lengthy underwriting processes needed to acquire the most competitive prepaid products, unlike the secured variants of desirable rewards credit cards.

Remember that you have the right to spend your money when and where you wish, and it’s always best to do so with the payment solution that serves your needs and your goals.

Until next time, refrain from using debit.