It’s been fun covering the various prepaid products that are hitting the market these days. Every time something new gets released I can’t help but think: what is the unique value proposition being made to the customer? What makes this card stand out from the pack?

Products like the Wealthsimple Cash Card provide both cash back rewards and no foreign exchange fees. Others, such as the Wise Card, have small load fees, but allow you to exchange dozens of international currencies with the click of a button.

Today, I’d like to introduce you to the PC Financial Money Account. I’ll admit that I was a bit skeptical of this product at first, but after reading through the fine print, it has some unique elements that neither free online banks nor other prepaid credit cards possess.

PC Financial: An Interesting History

President’s Choice Financial was founded as the banking arm and in-store loyalty credit card of the venerable Loblaws empire of grocery and drug stores back in 1996.

As a kid, I remember my mom and dad were always trying to waive off PC Financial representatives trying to get them to apply. The company later expanded to also provide day-to-day banking services for regular financial transactions.

Originally, PC Financial was a co-branded partnership managed with CIBC. However, in 2017, PCF’s parent company the Loblaw Group decided to end the relationship with CIBC and venture along the banking route alone.

To my untrained eye, this made sense: if Loblaws could manage their credit card services, it would help them keep a closer eye on their Optimum loyalty program. This is the currency in which all PC Financial products earn their rewards, at a valuation of 0.1 cents per PC Optimum points.

While PC Financial’s credit cards remained available to the public throughout the 2017–2018 transition, its banking services were closed to the public. This finally changed last year with the release of the PC Financial Money Account, which serves as PCF’s flagship everyday financial service.

Getting the PC Financial Money Account

Before applying, it’s important to understand that the PC Financial Money Account Prepaid Mastercard is not, in fact, a debit card. It is marketed as being similar to debit, but it will only work where you can use a regular Mastercard credit product.

Fortunately, the card is entirely no-fee and doesn’t require a hard credit pull in order for you to be approved for the card. All I had to do was upload a piece of identification via PC Financial’s secure application portal.

Once approved, the PC Financial Money Account will be mailed to you quite quickly, and activation is a breeze via their app or online banking.

Loading the PC Financial Money Account

There are three ways to load the PCF Money Account:

- Set up a pre-authorized debit from your legacy bank account

- Link your external account to your prepaid Mastercard to withdraw funds on demand

- Send Interac e-transfers to the Money Account to keep it topped up

If you choose to set up your payroll as a direct deposit, you can also receive a bonus of 25,000 PC Optimum points, worth $25 in Loblaws Group store credit. The points will be credited after the second direct deposit transaction is successful.

Whatever you choose is up to you, though this does, in my opinion, continue the baffling trend of “disruptive” prepaid products being largely reliant on legacy banking for funding purposes.

PC Financial Money Account: Card Features

This is one of the first prepaid credit cards I’ve seen that is trying to act more like a traditional bank account product than its competitors.

The PC Financial Money Account possesses a bill pay feature just like most regular banks, thus allowing you to pay expenses such as your property tax bill and other credit cards. You can also send Interac e-transfers free of charge.

If you hold the PC Financial World Elite Mastercard, then congrats – both items will be displayed in your online banking or via the PCF’s app, and you can freely exchange money between both accounts.

If you require cash, you can withdraw money without convenience fees from the PC Financial Money Account at co-branded ATMs, which are usually located within Loblaws Group stores. Here in Edmonton, I most often see these ATMs inside Shoppers Drug Marts.

Possibly the most unique feature of this card is its early payroll deposit feature, which states you can get your entire paycheque up to two days early (assuming you’ve enabled payroll deposits).

I don’t know how much utility I’d get out of this feature, but I’m certain there are some Canadians who might. This is also novel because, while I’ve seen other prepaids offering a set amount of cash for early payroll access, the PCF Money Account is the only one offering you early payment in its entirety.

Should you feel that you require a bit of overdraft protection, you have the option to enroll your card in it. It will necessitate a hard pull of both credit bureaus and costs an extra $5 per month. Unfortunately, overdraft also has a hefty interest rate of 19% APR.

Is the PC Financial Money Account the Same as a Bank Account?

In short, the PC Financial Money Account is designed to act as a surrogate chequing substitute, and can conduct most banking-like transactions independently. The exception to this is physical cheques, which you can neither write nor deposit with this card.

If you receive your employment income via the legacy system of physical paycheque, you may want to select a different product. Ditto if you’re concerned about depositing your refund cheques for, say, cancelled credit cards with high annual fees that you’d accidentally paid.

There are also certain types of payments that require pre-authorized debits (PADs), such as mortgages or condo fees. I have seen nothing in the PCF Money Account’s paperwork to indicate it can support PADs, and so this is another feature you’d need a traditional bank account for.

Finally, like so many of its credit card brethren, this product levies the 2.5% foreign exchange fee we’ve all come to know and dislike. This is definitely a negative when compared to the no-FX Wealthsimple and Wise cards.

PC Financial Money Account: Rewards Structure

The rewards structure of the PC Money Account is very straightforward: earn a flat 10 PC Optimum points per dollar spent, everywhere, all the time.

10 PC Optimum points can be redeemed at Loblaws Group stores at a valuation of 1 cent per 10 points, or 0.1 cents per point (cpp).

Because this card is a prepaid product, and because PC Financial offers credit cards with accelerated earn rates at their storefronts, I think the play is to get the co-branded credit cards and use the Money Account to pay your bills instantly.

Of course, not everyone can get approved for the credit products, so this is a decent stopgap.

Welcome Bonus and Referrals

The PC Financial Money Account has a referral scheme that is exclusive to its product, which differs from the referral programs offered by other prepaid credit cards and bank account products.

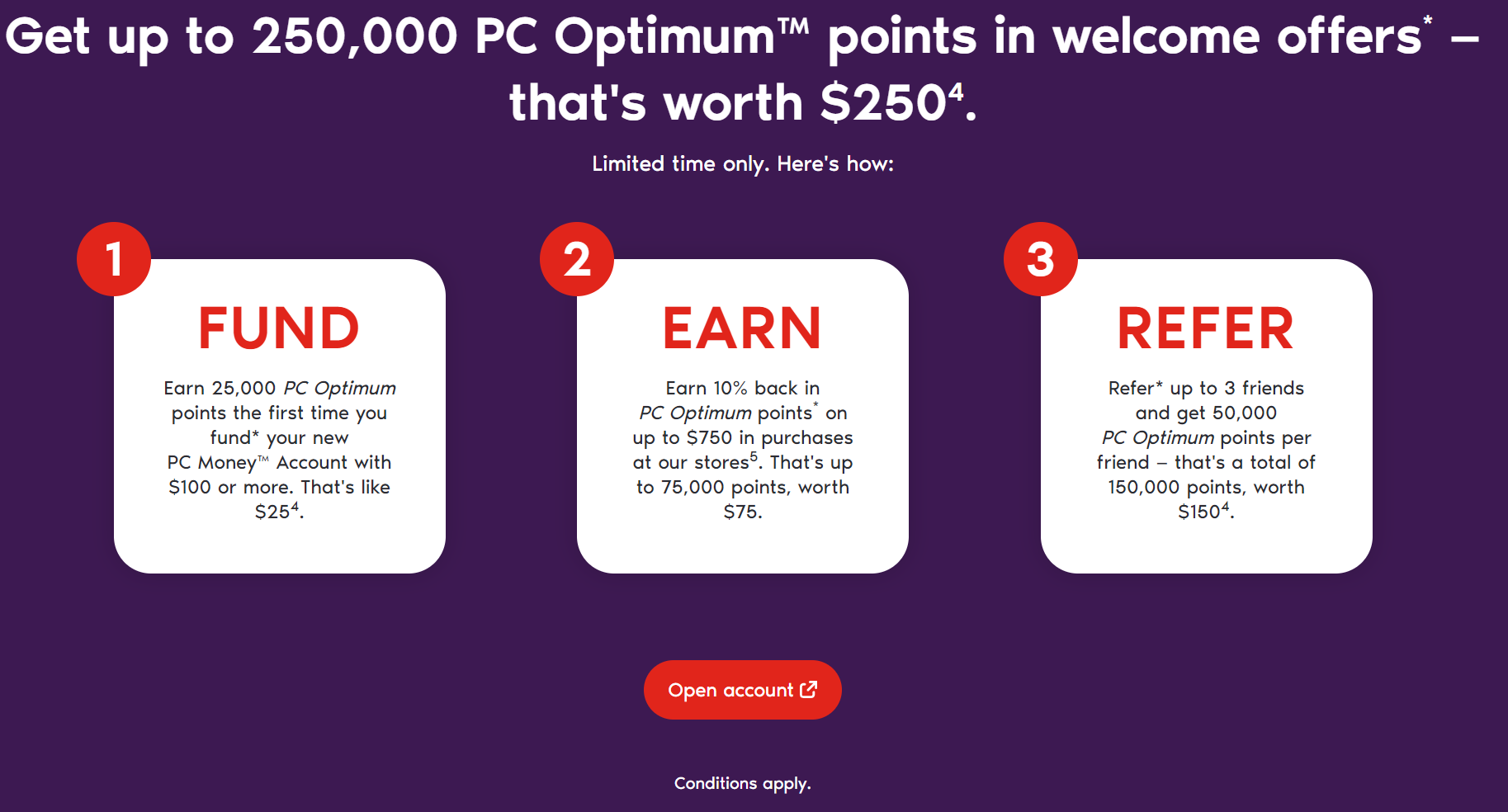

As we can see from the above image, you have a variety of ways to earn a heightened number of PC Optimum points.

Most interesting to me is the additional 10% back in PC Optimum points on up to $750 spent at Loblaws Group stores, as most other prepaid credit cards don’t have any kind of tiered spending-based welcome bonus such as this.

On the topic of welcome bonuses, you’ll also get $25 in PC Optimum points after you fund your card, which isn’t bad for a free prepaid product.

Finally, if you refer three different friends who open and fund their PC Financial Money Accounts, you’ll get $50 in PC Optimum points per person. Again, no other Canadian prepaid issuers offer a refer-a-friend bonus quite as high.

Of course, there would be nothing stopping you or any of your circle of friends from safely placing this card into reserve once you’ve redeemed your PC Optimum points on this month’s grocery bill.

The above set of welcome bonuses is advertised to end on February 2, 2022, though always with the possibility of extension.

Hidden Fees?

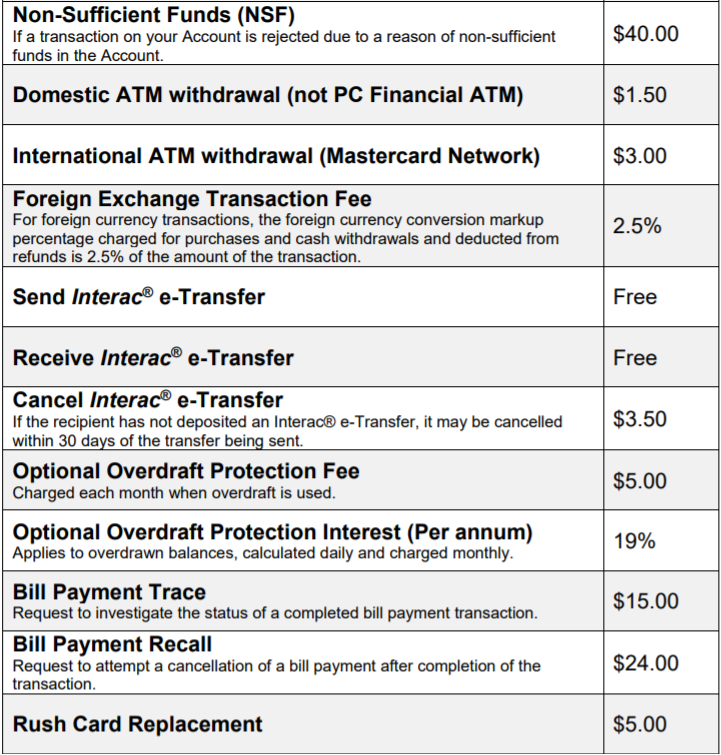

While the PC Financial Money Account does not have any monthly fees or annual fees, it does have a series of additional fees in the event of banking mishaps.

As we can see, there’s a variety of extra things the PC Financial will charge you for, and I think the pricing is a little steep. For example, $1 for conducting phone transactions seems a bit punitive, as any such transaction would likely be made only as a last resort.

Still, the information is publicly available on their website and is spelled out clearly on what will cost you extra. It’s best to avoid these extra fees, but there’s at least full transparency from PC Financial here.

Will I Be Getting the PC Financial Money Account?

In my estimation, this product is meant for people who have had issues opening or utilizing traditional banking services in the past.

This fits in with PC Financial’s brand as a strong lender for newer immigrants or “second chance” clients. While it’s not as functional as a bank account, it is unique because its functionality exceeds that of other prepaid credit card products.

Likewise, I am happy to see a product that acts similarly to a bank account, but still offers cardmembers a flat reward rate of 1%.

In the end, my curiosity is why I signed up for it; however, I don’t feel this card is right for my wallet at this time.

I’m doing just fine with my Tangerine and Simplii chequing accounts, though of course I acknowledge these aren’t perfect solutions for everybody. They also don’t offer the early payroll feature of the PCF Money Account, but hey, I can’t pay my mortgage with early payroll!

I’m also really not a fan of the 2.5% FX fees or additional fees structure. $1 to do a phone transaction?! I mean really, that’s just not fair when you’re advertising yourself as “no fee”.

Conclusion

The PC Financial Money Account feels like more of a hybrid prepaid card bank account than other products that we’ve seen in Canada.

While I don’t think it will have much of a place in my wallet, I can see its value for people who may need something with the flexibility of a Mastercard but wish to avoid fees.

Personally, I’ll be sticking with my online-only legacy banking options, though I appreciate the PCF Money Account for its unique features and will be sure to maximize its refer-a-friend feature.

Until next time, don’t drain your money on needless expenses!

“Link your external account to your prepaid Mastercard to withdraw funds on demand”

That is interesting. With the growth in HISA accounts that do external transfers but don’t give out debit cards (EQ, CTFS, Wyth, Saven, etc.), this could be a good supplementary product as long as you’ve got access to a PCF ATM.