Credit cards are a great way to earn cash back and travel rewards. But naturally, in order to benefit, you need to get approved for credit.

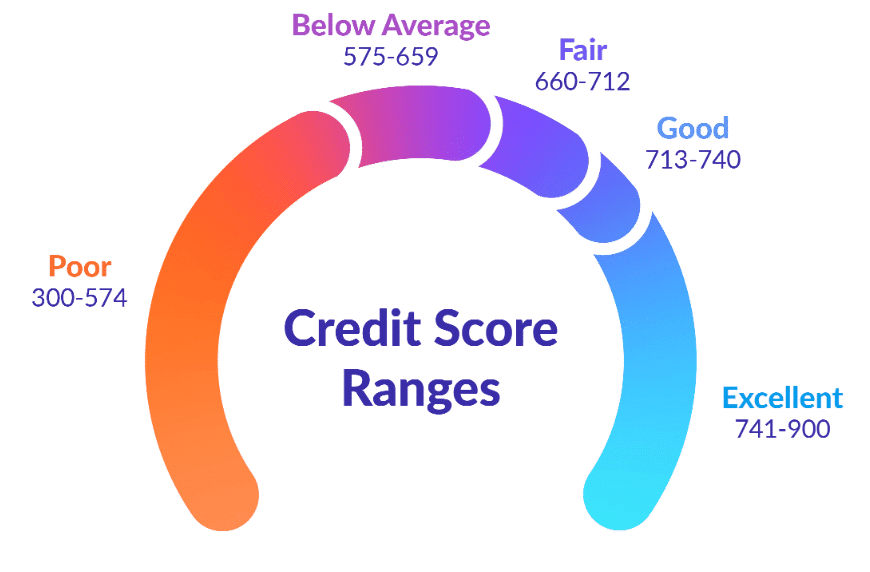

As you aim for premium credit cards, there are some barriers to entry, such as income, spending, and perhaps most importantly, your credit score. There’s no shortcut to fixing this, and it’s a bit of a chicken-or-egg problem: you need good credit history to be approved for more credit, but you need to have credit to demonstrate responsible credit usage.

For people with a weaker credit history, secured credit cards are a great way to get started, building a healthy foundation that will make you more attractive to lenders for all sorts of purposes.

What Is a Secured Credit Card?

Secured credit cards are almost exactly the same as regular credit cards, except you need to leave a cash deposit at the issuing bank to cover the entire credit limit. For example, for a limit of $1,000 on a secured credit card, the bank would ask for a $1,000 deposit.

You can effectively set your own credit limit, based on the size of your deposit. If you try to spend over your limit, the transaction will be declined.

Secured cards present minimal risk to the issuer. If a cardholder defaults on their debts, the bank will keep the security deposit. That way, the bank is guaranteed to get paid.

Some issuers, typically smaller ones, have specific products that they market as secured cards. Many of them don’t have rewards, such as the Home Trust Secured Visa card for no annual fee. Others have rewards or low interest rates, but with an annual fee.

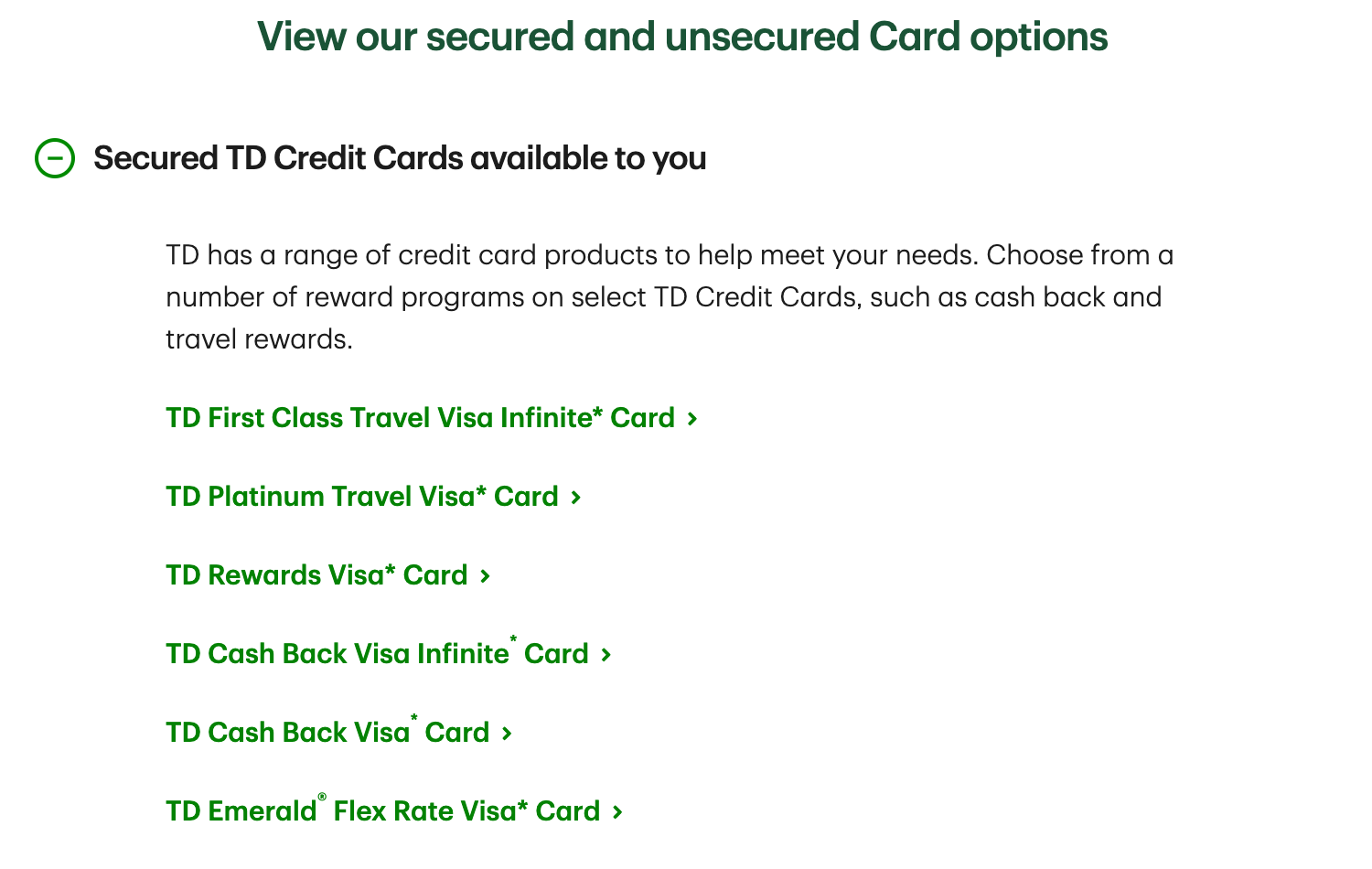

Larger banks offer a selection of their regular credit card products, with an option to secure them.

Depending on the bank, you may have different options for how to store your security deposit. Some banks treat it as a locked balance in a chequing account.

For example, if you have $2,000 in a chequing account, of which $500 is guaranteeing a $500 limit on a secured card, the spending power in your chequing account is only $1,500.

You might also be able to keep your security deposit in an interest-bearing account. TD lets you put it in a GIC, which is a nice perk while that money is idle anyway.

How Do Secured Credit Cards Work?

After you pay your deposit, secured credit cards work exactly the same as other credit cards. As long as you make regular payments, you won’t even notice a difference.

You make purchases on the card, up to your monthly credit limit. At the end of each billing cycle, you’ll receive a statement. Pay the full balance before the due date to avoid penalties and interest.

You must make at least the minimum payment to have a positive report to the credit bureau. Like any other credit card, late payments will have a negative impact on your credit score.

If you don’t pay your balance in full, a portion of your security deposit will be used to cover any interest, and your limit will be reduced accordingly.

After 6–12 months of good history, your issuer will usually unlock your security deposit, upgrading the card to an unsecured card. At that point, or earlier if you close the secured card, you can withdraw the secured balance.

Who Should Get a Secured Credit Card?

Regular credit cards are unsecured, meaning that the issuing bank will take you to collections if you default on your debts. While this poses a risk to the bank that they might not get the money they are owed, they are willing to extend unsecured credit on the basis of an applicant’s strong track record of repayment.

On the other hand, if you have poor credit or no history, you’ll have trouble convincing a bank to lend to you just on the basis of a “promise” to repay, without any collateral. In particular, anyone without a credit history, students, new immigrants, or people recovering from some bad debts might find themselves in this situation.

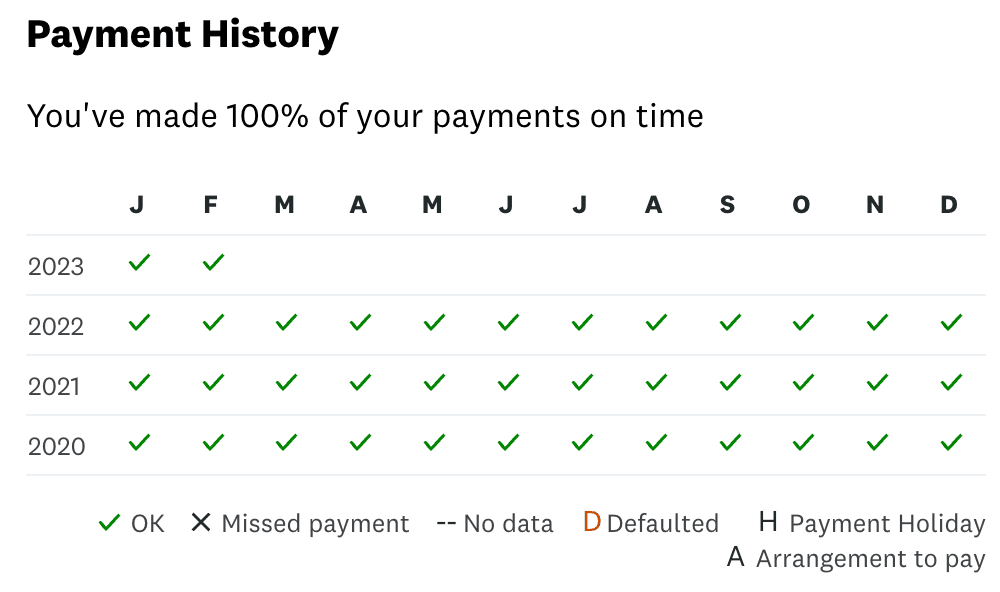

Secured credit cards are a great way to build or repair your credit history. They report to the credit bureaus and contribute to all of the same factors as other revolving credit accounts, like record of repayment and age of accounts.

Many secured cards are marketed at people with poor credit. Banks specifically advertise guaranteed approval, a minimum credit score of 300 (which is the lowest score possible), or that you’ll be approved if you’ve recently been discharged from bankruptcy.

If you’re having trouble getting approved for other cards, using a secured credit card will help. Usually, your credit score will improve significantly within 12–18 months.

If you must, you can also carry a balance on a low-interest secured card, and your credit health will improve as long as you make the minimum payment on time. However, even at a low interest rate, it’s probably better to clear your debts first, and then begin rebuilding your credit once you’re in the black.

How to Benefit from a Secured Credit Card

The main reason to get a secured credit card is to improve your credit score and to build a positive relationship with the issuing bank, particularly if you’re having trouble getting approved for other cards or loans.

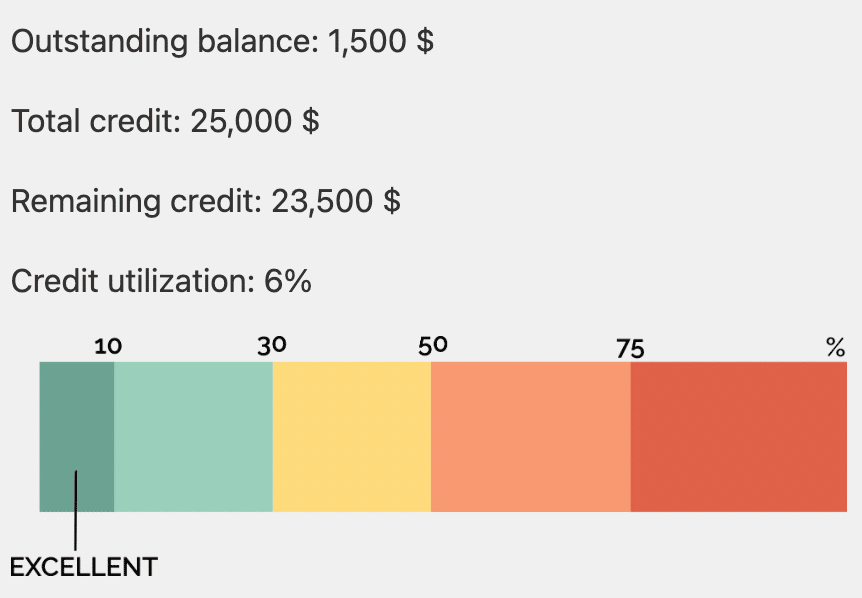

Basically, the bank wants to see that you’re using your credit limit responsibly. Low utilization is key, so use your card for small purchases like lunch or coffee, and then pay it in full at the end of your billing cycle.

Generally, it’s best for your credit history if you keep your monthly statement balance under 30% of your credit limit.

Remember, your long-term banking relationships and the health of your credit file take precedence over short-term spending power, as they can be leveraged into bigger rewards on better cards down the road.

In fact, when it comes to approvals, a good relationship with the bank is arguably more important than your credit file. After all, the bank is the one determining and bearing the risk of lending to you – they’re the party you need to convince.

That said, a good credit file is still necessary to carry your strong relationship from one bank to another. Luckily, you can work towards both goals in tandem.

Even if you have good credit history, not all issuers use the same criteria for credit card approvals. Banks use an internal score to evaluate clients, incorporating your credit history with their own factors, which may weigh your history with the bank more heavily.

For instance, one year of on-time repayment and low utilization might be sufficient for American Express, but not for RBC. If you’re rejected by a bank with tougher lending requirements, consider asking a banking advisor if you can push the application forward on the basis of a security deposit.

Notably, TD and BMO award the full signup bonus and regular earn rate on spending, even if you have to put down a security deposit to be approved. You may have to go into the branch to discuss secured versions of premium credits, but with a bit of effort, you can get bonuses from premium cards that are otherwise out of reach due to various credit factors.

Alternatively, Neo offers secured versions of most of its credit cards. From a rewards perspective, the most attractive option is the Cathay World Elite® Mastercard® – powered by Neo, which offers a welcome bonus and Asia Miles on every dollar spent.

Also, it’s all too common to run into an identity mismatch between the bank and the credit bureau. As that’s usually not a quick fix with TransUnion or Equifax, you can ask about opening a secured card to build positive history with the bank while you wait for your good credit history to be linked properly.

That way, you won’t fall behind on your rewards goals.

Other Ways to Build Credit History and Earn Rewards

A strong relationship with your bank can do wonders for your credit journey. As a lifelong client at TD with a stable record of saving, I had no trouble getting a basic unsecured credit card at the age of 18, and premium products by 22.

Not everyone is so lucky, and many people make financial missteps at a young age. Something as simple as missing a payment or two can hurt your credit file for years thereafter.

First, prioritize issuers that are known for easy approvals. American Express comes to mind, and Capital One also has a reputation for marketing to people with poor or no credit history.

Of the two, Amex has much better rewards, in the form of Membership Rewards points. Capital One might have a lower barrier to entry, but comes without any rewards.

Likewise, stay away from issuers that you don’t expect an approval from. That way, you’ll avoid unnecessary credit inquiries (which could be quite hurtful if your score is already low), and you won’t have to go to great effort trying to push an application through, only to come out empty-handed.

If any part of your credit story needs to be explained, it’s best to meet with a banking advisor, as the online application algorithm will probably reject you right away. Even if you have newer accounts in good standing, a bad mark on your file is enough to trigger a thorough manual review.

Be prepared to explain the situation that led to your late payments, and why you’re seeking credit now. Also, you may need to show evidence from the issuer or collection agency that any delinquent accounts have been paid in full and closed.

If you have a reasonable story about the bad mark on your file, and a spotless history since, you should be able to open premium products.

Whether you’re working with no credit or poor credit, having a personal connection at the bank can’t hurt. See if you can use a family member’s assets, a personal relationship with a banker, or even your own deposit accounts to push things forward with confidence.

Even newcomers to Canada can use this strategy. Many banks offer a new immigrant package, with free chequing and a secured credit card.

If you can’t or don’t want to lock up a security deposit, skip the secured card and just open the chequing account. Later, you might be able to use the banking relationship you’ve built, plus an employment contract demonstrating stability, to be approved for unsecured credit.

Whichever route you choose, it’s definitely helpful to work with a human at the bank if you anticipate any hurdles.

Conclusion

Secured credit cards aren’t for everyone, but they’re an incredibly useful tool if you need to build or rebuild your credit.

A healthy credit history is important for getting approvals for loans, mortgages, and credit cards, and new credit cards can be easily leveraged into bigger travel and cash back rewards. A record of responsible credit usage goes a long way to building strong banking relationships, which will benefit you in all sorts of ways, no matter how you choose to grow your wealth.

If you’re interested in getting a secured credit card, I’d suggest getting one from a Big 5 bank that will allow you to upgrade it in the future.

You’ll probably want to keep it open long-term as one of your oldest accounts, and bigger institutions generally offer more flexibility and a wider variety of products. That way, you can continue to benefit from perks and higher rewards rates, long after the card has graduated to its unsecured form.