Aeroplan has officially launched its Pay With Points feature, expanding redemption possibilities for TD and CIBC Aeroplan co-branded credit cardholders. This means you can now redeem points for more than just flights.

Initially introduced as a limited-time pilot program, the feature proved popular enough to become a permanent addition to Aeroplan’s redemption options.

It’s now accessible to all primary cardholders of TD and CIBC Aeroplan co-branded credit cards.

In this program, eligible cardholders can offset everyday purchases like dining, groceries, drugstore items, entertainment, and select online retail items with Aeroplan points, bringing an added layer of flexibility to their points usage.

In This Post

How Does Aeroplan’s Pay With Points Feature Work?

The goal of this new feature is to allow eligible cardholders to stretch their redemption options beyond the choices that were already available, like flights, HotelSavers, Air Canada Vacations, Aeroplan eStore, and more.

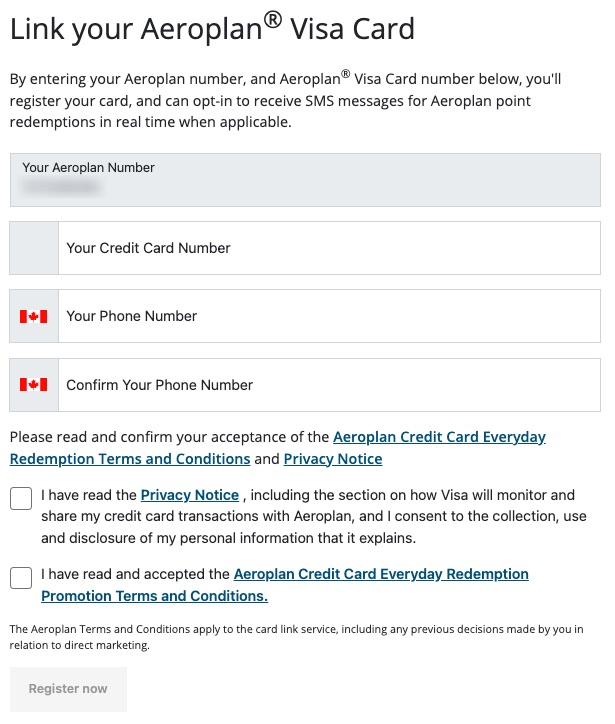

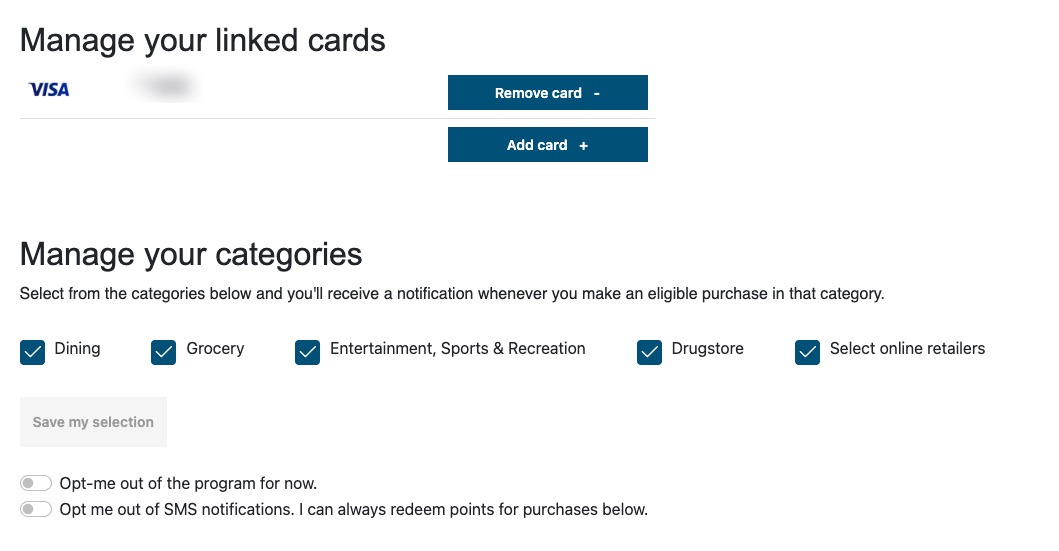

To get started with the Aeroplan Pay With Points feature, sign in to your Aeroplan account and register your eligible Aeroplan Visa co-branded credit card on the dedicated landing page.

Eligible cards include:

- TD® Aeroplan® Visa Infinite Privilege* Card

- TD® Aeroplan® Visa Infinite* Card

- TD® Aeroplan® Visa Platinum* Card

- TD® Aeroplan Visa Business Card

- CIBC Aeroplan® Visa* Infinite Privilege

- CIBC Aeroplan® Visa* Infinite

- CIBC Aeroplan® Visa* Card

- CIBC Aeroplan® Visa* Business Card

Once registered, any qualifying category purchases in the amount of $25–250 (all figures in CAD) are eligible to be offset by redeeming your Aeroplan points as long as you have a sufficient points balance to cover the full purchase price.

While the specific merchants that fall under the “select online retailers” category have not been publicly disclosed, examples include Amazon.ca and Costco.ca, and we will update this article as more information becomes available.

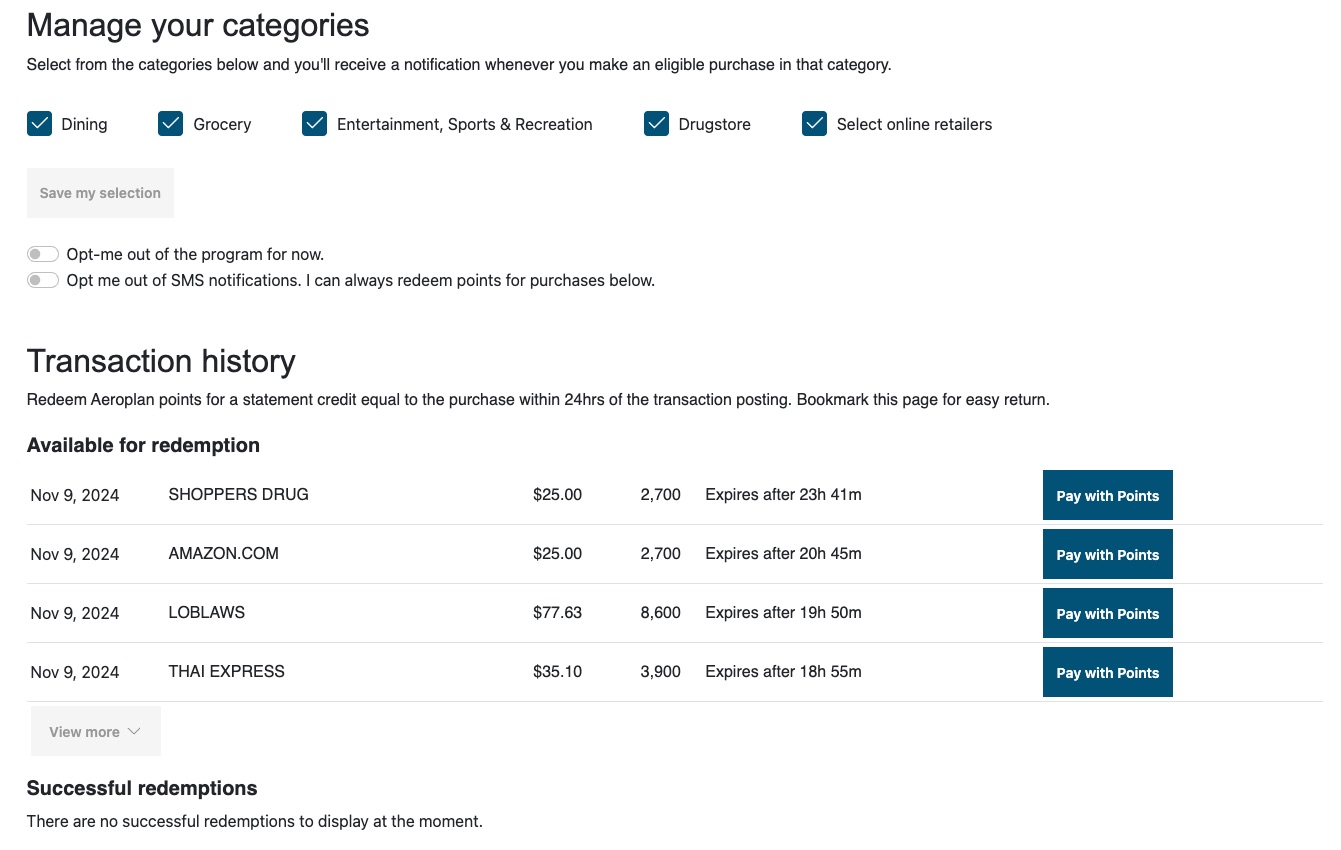

Eligible transactions will appear on the Pay With Points website, displaying the number of points required to cover the cost.

You’ll have 24 hours from the time of purchase to redeem. If you don’t act within that window, the redemption option disappears.

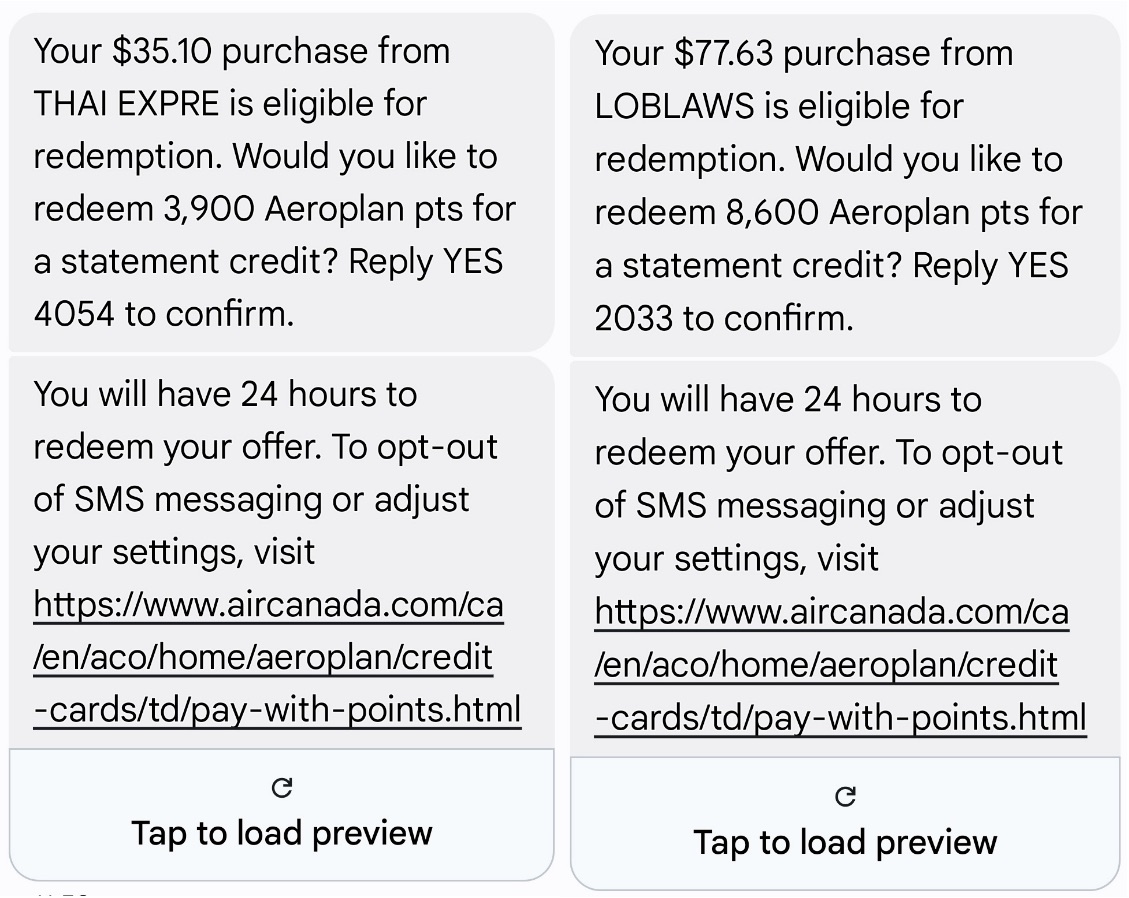

Alternatively, you can opt-in for text message notifications. With this feature, you’ll receive a text after an eligible transaction, giving you the option to redeem points for the purchase by simply responding to the message.

The text will include details such as the purchase amount, merchant, and the points required to cover it.

The text will include details such as the purchase amount, merchant, and the points required to cover it.

Each redemption’s value may vary, and you’ll have 24 hours to decide whether or not to redeem points for the transaction.

Once you’ve chosen to redeem your points, it cannot be reversed. If you return a purchase that was paid for using the Pay With Points feature, you will not receive a refund of points or cash in the traditional sense; instead, you’ll simply retain the statement credit that was originally credited to your account in relation to the Pay With Points redemption.

Also, you won’t earn Aeroplan points on purchases for which you’ve elected to redeem points, and the statement credit for these redemptions may take up to 30 days to post to your account.

If you wish to add or remove a card from your account, you can do so easily on the website, and you can register multiple eligible cards if you have them.

Is Pay With Points a Good Deal?

When it comes to value, Aeroplan’s Pay With Points feature does not publicly display its redemption rate. However, based on our transactions, we estimate the value to be around 0.9 cents per point, rounded down to the nearest hundred.

- $25.00 purchases at Shoppers Drug Mart and Amazon.ca required 2,700 points each.

Calculation: $25 ÷ 0.9 cents per point x 100 = 2,778 points, rounded down to 2,700 points. - $77.63 purchase at Loblaws required 8,600 points

Calculation: $77.63 ÷ 0.9 cents per point x 100 = 8,626 points, rounded down to 8,600 points - $35.10 purchase at Thai Express required 3,900 points

Calculation: $35.13 ÷ 0.9 cents per point x 100 = 3,900 points, no rounding needed.

While these redemptions offer a convenient way to use points on everyday purchases, Aeroplan points are generally most valuable when used for flight redemptions.

We value Aeroplan points at 2.1 cents per point, so for those looking to maximize point value, flight redemptions remain the best choice.

On the other hand, Pay With Points is a great option to have, offering an easy way to offset common expenses, and making the points more versatile.

For example, you might redeem points to cover a grocery bill, which could be beneficial if you don’t have any upcoming travel plans or if you’re looking to stretch your budget.

This added flexibility mirrors the concept introduced in the US with the Chase Aeroplan Card, where cardholders can “Pay Yourself Back” at a fixed rate of 1.25 cents per point (USD) for travel expenses.

We hope Aeroplan considers matching this fixed rate value in Canada, or perhaps increasing the eligible purchase limit, as grocery bills often surpass $250 for families in today’s economy.

Ultimately, it’s worth considering all available redemption options to find the best value for your points and to choose the approach that best suits your needs.

Conclusion

Aeroplan’s Pay With Points feature offers eligible cardholders the freedom to redeem points in a variety of new categories, making Aeroplan points more flexible than ever.

While flight redemptions remain the best way to maximize the value of your Aeroplan points, the Pay With Points feature is a welcome addition for those who prioritize flexibility.

Whether you’re covering a night out or stocking up on essentials, this feature allows for more ways to enjoy the benefits of being an Aeroplan Visa co-branded credit cardholder.

If you’re not yet an Aeroplan co-branded credit cardholder, now might be a great time to consider getting a card such as the TD® Aeroplan® Visa Infinite* Card and exploring all the ways that Aeroplan points can enhance your travel and daily purchases alike.