Earn Up to $120 Cash Back with Tangerine Mastercards

Tangerine has elevated welcome bonuses for its duo of cash back credit cards: the Tangerine Money-Back Mastercard and the Tangerine® Money-Back World Mastercard®*.

This time, you can earn up to $120 cash back on the Tangerine® Money-Back World Mastercard®*, and up to $100 cash back on the Tangerine Money-Back Mastercard.

These offers are available through to January 30, 2026, so let’s see what’s at stake this time around.

Tangerine® Money-Back World Mastercard®*: $120 Cash Back

The Tangerine® Money-Back World Mastercard®* is currently offering $120 cash back upon spending $1,500 in the first three months.

Importantly, this cash-back boost comes in addition to the cash back you earn on your spending.

For a card with no annual fee and a very reasonable minimum spending requirement, this is certainly a solid offer in the cash back world of Canadian credit cards.

This card was formerly known as the Tangerine World Mastercard.

If you’re interested, this offer runs through to January 30, 2026, leaving plenty of time to apply.

50,000+ travellers get this email

Weekly deals, credit card insights, and points strategies – free forever.

First-year value

$128

No annual fee

• Earn 120 points upon spending $1,500 in the first 3 months

Earning rates

Key perks

- Mobile device insurance

No annual fee

• Earn 120 points upon spending $1,500 in the first 3 months

Earning rates

Key perks

- Mobile device insurance

Tangerine Money-Back Mastercard: 10% Cash Back in the First Two Months

Meanwhile, the Tangerine Money-Back Mastercard is offering 10% cash back on the first $1,000 spent in the first two months, equivalent to $100 cash back.

That’s all there is to it, with no requirement to spend in any particular categories or to hold the card for any specified length of time.

The 10% cash back offer has been extended once again, this time through to January 30, 2026.

This is lower than the highest 15% cash back welcome offer that Tangerine has put out in the past few years; however, with no annual fee and a low minimum spending requirement to maximize the offer, it falls squarely in the category of low-hanging fruit.

First-year value

$105

No annual fee

• Earn 0.1x bonus points on purchases (up to $1,000 spend)

Earning rates

Key perks

- No annual fee

- Purchase assurance insurance

No annual fee

• Earn 0.1x bonus points on purchases (up to $1,000 spend)

Earning rates

Key perks

- No annual fee

- Purchase assurance insurance

What’s Unique About the Tangerine Mastercards?

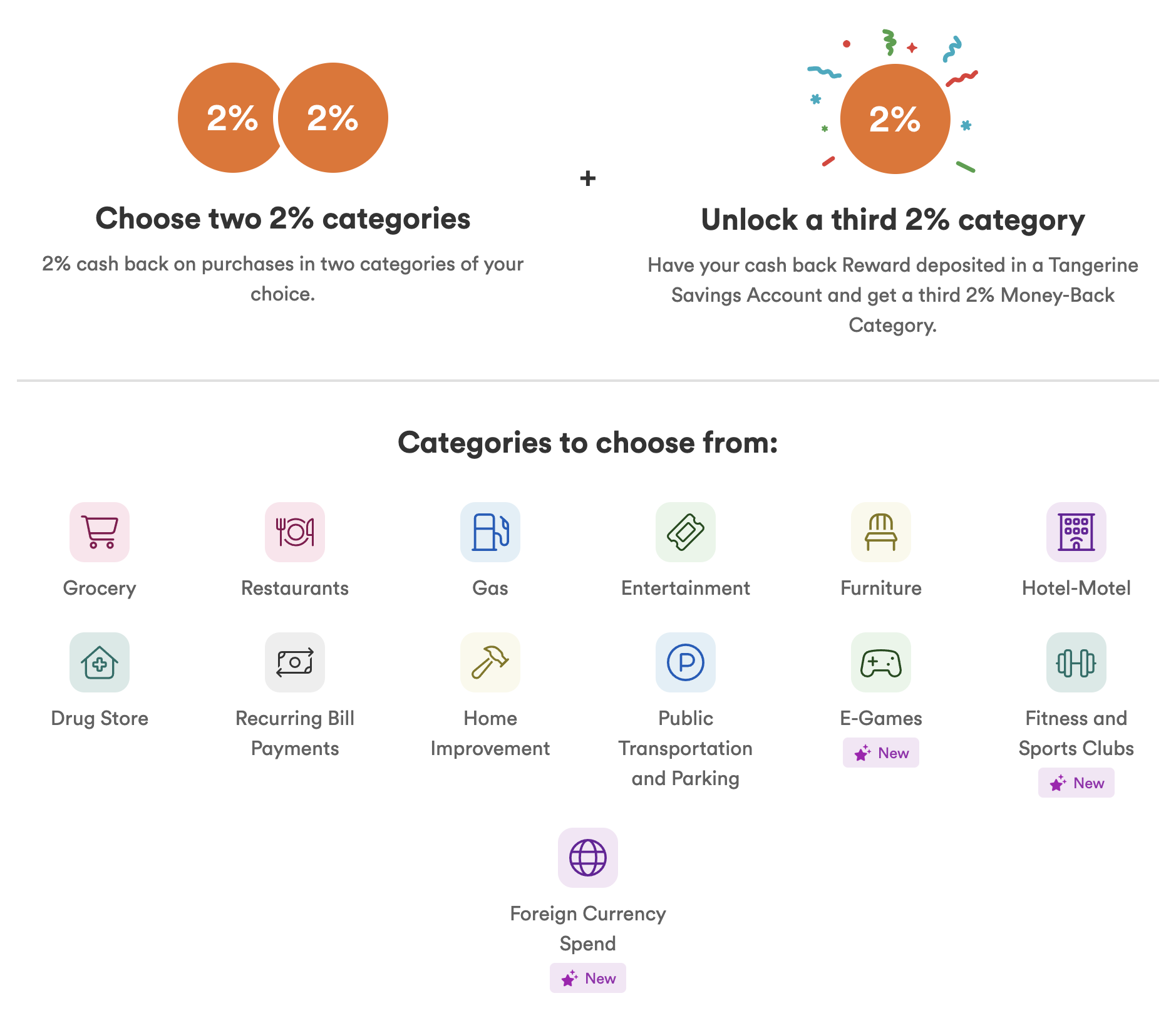

Tangerine is known for offering a “choose your own adventure” approach to bonus earning categories: you’ll receive 2% cash back on up to three categories of your choice.

This is identical across both the Tangerine® Money-Back World Mastercard®* and the Tangerine Money-Back Credit Card.

This makes either an excellent long-term “keeper card” for just about anyone, since you can simply choose the categories that you most commonly spend in, and then use it as your regular card for ongoing purchases in those categories.

The 13 categories available for selection are as follows:

- Groceries

- Furniture

- Restaurants

- Hotel/Motel

- Gas

- Recurring bill payments

- Drugstore

- Home improvement

- Entertainment

- Public transportation & parking

- E-games

- Fitness & sports clubs

- Foreign currency spend

Cardholders who only hold the credit card get to choose two categories, while those who have a Tangerine Savings account can choose a third category.

Even if you use more powerful credit cards for some of the more commonplace spending categories (like groceries and dining), Tangerine offers an elevated 2% return on select categories that no other credit card matches, such as furniture and home improvement.

In all other categories, both Tangerine cards earn a flat 0.5% cash back, so it wouldn’t necessarily be the best choice for regular uncategorized purchases.

If you’re deciding between the Tangerine® Money-Back World Mastercard®* and the Tangerine Money-Back Credit Card, note that they have identical earning structures and both have no annual fee.

We’d recommend those with a respective personal or household annual income of at least $50,000 or $80,000 to apply for the Tangerine® Money-Back World Mastercard®*, since it offers a beefier insurance package including car rentals and mobile device protection.

Conclusion

Tangerine elevated welcome offers for both the Tangerine® Money-Back World Mastercard®* and the Tangerine Money-Back Mastercard.

Now is a great time to apply for anyone eyeing the Tangerine credit cards for their “choose your own adventure” bonus structure.

The current offers are available until January 30, 2026.

T.J. is curious about everywhere he hasn’t been to yet. Exploring countries by foot and connecting with locals guide his love for travel. Earning and redeeming points to jazz up the experience has become the icing on his travel cake.

First-year value

$105

No annual fee

• Earn 0.1x bonus points on purchases (up to $1,000 spend)

Earning rates

Key perks

- No annual fee

- Purchase assurance insurance

No annual fee

• Earn 0.1x bonus points on purchases (up to $1,000 spend)

Earning rates

Key perks

- No annual fee

- Purchase assurance insurance