For the past year, RBC® has been spoiling us with record-high welcome bonuses across its trio of Avion personal credit cards: the RBC® Avion Visa Infinite Privilege†, the RBC® Avion Visa Infinite† and the RBC® Avion Visa Platinum.

Now, the offers have shifted once again. The RBC® Avion Visa Infinite† and RBC® Avion Visa Platinum† have returned to a straightforward 35,000 points upon approval, while the RBC® Avion Visa Infinite Privilege† card continues to shine with a record-high bonus of up to 70,000 points† — including an anniversary bonus that adds long-term value.

Whether you’re looking for instant rewards with no spending required or aiming to maximize your returns with a premium card, RBC’s Avion lineup still has plenty to offer.

In This Post

- RBC® Avion Visa Infinite Privilege†: Up to 70,000 Avion Points† + VIP Benefits

- RBC® Avion Visa Infinite†: Up to 35,000 Avion Points!†

- RBC® Avion Visa Platinum†: Up to 35,000 Avion Points!†

- The Best Ways to Redeem RBC® Avion Points†

- Conclusion

RBC® Avion Visa Infinite Privilege†: Up to 70,000 Avion Points† + VIP Benefits

The high-end premium product in the Avion family, the RBC® Avion Visa Infinite Privilege†, is still offering a record-high bonus of up to 70,000 Avion points, structured as follows:

- Earn 35,000 RBC Avion points upon approval†

- Earn 20,000 RBC Avion points upon spending $5,000 in the first six months†

- Earn 15,000 RBC Avion points as a one-time anniversary bonus upon renewing the card for a second year

That’s a hefty sum, especially when you factor in the 1.25x earn rate on all purchases† and the ability to redeem against premium fares at 2 cents per point.

The welcome bonus of up to 70,000 Avion points† outweighs the $399 annual fee on this card in each of the first two years; however, the $200,000 minimum personal or household income requirement may be prohibitive for some applicants.

Nevertheless, if you’re looking to earn 1.25x Avion points on all purchases†, and try out the ability to redeem points directly against premium fares at 2 cents per point, now’s as good of a time as any to apply for the RBC® Avion Visa Infinite Privilege† with this bonus in play.

- Earn up to 35,000 Avion points upon approval†

- Then, earn 20,000 Avion points upon spending $5,000 in the first six months†

- Then, earn 15,000 Avion points as a one-time anniversary bonus upon renewal†

- Plus, earn 1.25x RBC Avion points† on all qualifying purchases

- Use your rewards for any business class flight with no restrictions on dates, seats, or airlines†

- Transfer points to one of four airline partners†

- DragonPass membership with six free lounge visits per year†

- Minimum income: $200,000 personal or household†

- Annual fee: $399†

RBC® Avion Visa Infinite†: Up to 35,000 Avion Points!†

The RBC® Avion Visa Infinite† is back to offering 35,000 Avion points upon approval, with no minimum spending required.†

That’s as easy as it gets: apply, get approved, and receive your points.

We value RBC® Avion points† at 2 cents apiece, given their flexibility and frequent transfer bonuses to airline loyalty programs.

Using this valuation, we’d estimate that the welcome bonus of 35,000 RBC® Avion points† is worth at least $700. However, you’d certainly be able to squeeze more value than that by transferring points out to The British Airways Club, Cathay Pacific Asia Miles, or American Airlines AAdvantage and redeeming them for travel in premium cabins.

If you haven’t added this card to your wallet yet, now’s a great time to do so without jumping through any spend hoops.

- Earn 35,000 RBC Avion points† upon approval†

- Earn 1.25x RBC Avion points† on qualifying travel purchases

- Transfer RBC Avion points to British Airways Executive Club and other frequent flyer programs for premium flights†

- Redeem Avion points for flights with the RBC Air Travel Redemption Schedule†

- Minimum income: $60,000 personal or $100,000 household

- Annual fee: $120†

- Supplementary card fee: $50

RBC® Avion Visa Platinum†: Up to 35,000 Avion Points!†

The RBC® Avion Visa Platinum† mirrors the RBC® Avion Visa Infinite† bonus, also offering 35,000 Avion points upon approval.†

There are a few minor differences between the RBC® Avion Visa Platinum† and the RBC® Avion Visa Infinite†, including the following:

- The Visa Infinite† earns 1.25 Avion points per dollar spent† on travel, whereas the Visa Platinum† earns a flat 1 Avion point per dollar spent† on all purchases

- The Visa Platinum† offers a less comprehensive insurance package – emergency medical insurance and mobile device insurance aren’t included, whereas they are included on the Visa Infinite†

- The Visa Platinum† doesn’t offer the unique dining, hotel, and events benefits that are exclusive to Visa Infinite† cards

However, the most important difference is that the RBC® Avion Visa Platinum† has no minimum income requirement, so this would be the right choice for you if you don’t meet the $60,000 or $100,000 in personal or household annual income, respectively, required for the Visa Infinite.†

While it lacks some of the premium perks of the Infinite† version – like mobile device insurance, emergency medical, and access to the Visa Infinite lifestyle benefits — it’s still a solid card with flexible redemption options.

- Earn 35,000 RBC Avion points† upon approval†

- Earn 1 RBC Avion point per dollar spent† on travel purchases

- Transfer RBC Avion points to British Airways Executive Club and other frequent flyer programs for premium flights†

- Redeem RBC Avion points with the RBC Air Travel Redemption Schedule†

- No minimum income requirement

- Annual fee: $120†

The Best Ways to Redeem RBC® Avion Points†

RBC® Avion is a powerful transferable points currency, which allows you to transfer the points you earn from any of these Avion cards to four frequent flyer programs:

- 1,000 Avion points = 1,000 British Airways Avios

- 1,000 Avion points = 1,000 Cathay Pacific Asia Miles

- 1,000 Avion points = 700 American Airlines AAdvantage miles

- 1,000 Avion points = 1,000 WestJet points

Therefore, you have the option of converting the 35,000 Avion points† you’d earn from the welcome bonus on the RBC® Avion Visa Infinite† or RBC® Avion Visa Platinum† into any of the following:

- 35,000 British Airways Avios

- 35,000 Cathay Pacific Asia Miles

- 24,500 American Airlines AAdvantage miles

- 35,000 WestJet points

On top of the usual transfer ratios, RBC® is known for offering occasional transfer bonuses of 20%, 30%, or even 50% to its transfer partners. This means that you can boost your balance even further by holding off for one of these transfer bonus events.

Currently, there’s a 30% transfer bonus when you convert your Avion points into British Airways Avios, which runs through to July 11, 2025.

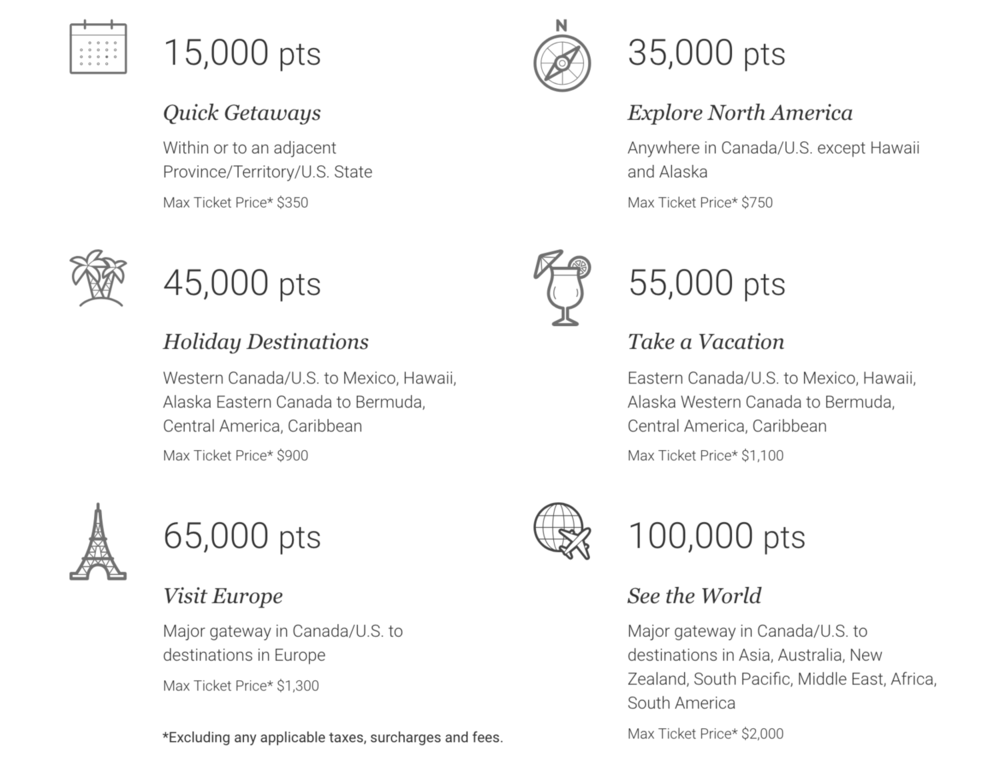

In addition, RBC® features the Air Travel Redemption Schedule, which allows to redeem a fixed number of points for a flight to a certain region with a maximum cash ticket cost allowance.

With this chart, the value is capped due to the maximum ticket cost, so it’s generally recommended to maximize your opportunities with RBC®’s frequent flyer partners instead.

Indeed, that’s where the bulk of the value in the Avion program lies, since you can transfer to any of their partners for a desired booking and aren’t locked in to a single loyalty program.

If, however, you find yourself in a situation in which you’re looking to book a one-way or round-trip flight within Canada and the mainland US, and you aren’t able to find any satisfactory options via The British Airways Club or WestJet Rewards, then the RBC® Air Travel Redemption Schedule is a great option.

Conclusion

The welcome bonuses on two of RBC®‘s Avion credit cards have been set at up to 35,000 Avion points,† or up to 70,000 RBC Avion points in the case of the RBC® Avion Visa Infinite Privilege†.

If you’re able to combine the offers with a potential transfer bonus to one of RBC®’s frequent flyer partners, you’re all set to be booking some spectacular travel in 2025 and beyond.

†Refer to RBC® page for up-to-date offer terms and conditions.

I have the avion infinite and avion infinite privilege already.

If I apply for the platinum will I still receive the welcome bonus?

yes, as long as the 90 days application rule is adhered to

Hi. We’ve had a terrible experience booking with avion points. There customer service is atrocious. Any chance you have a contact or a better way to make a complaint or at least try to get our issue resolved? I had to cancel a flight but my husband still went first they rebooked our flight home and didn’t put us on it. Then they didn’t return my points. The cancellation fee of $300 plus another $500 worth of points that they have not returned. I can’t get anywhere with trying to call them. After 25+ hours on the phone with them and I haven’t had one good customer service person. If you have a way to contact them or an email that would be fabulous. Thank you!

Chelsie

Hi Ricky,

You recommend picking up a second Avion product prior to the offer expiry but the T&Cs state: Additional cardholder(s), as well as existing cardholders of any RBC Royal Bank personal credit cards, applying for or transferring to an RBC Avion Visa Infinite, RBC Avion Visa Platinum, or RBC Avion Visa Infinite Privilege card as of the offer eligibility period, are not eligible for this offer.

Wouldn’t this just preclude someone from qualifying for this offer with a second Avion product?

Have you heard if Avion will be announcing a transfer bonus with BA anytime soon? Looking back over the years, there has been a traditional bonus period over August and September. Wondering if the move from RBC Rewards to Avion Rewards has delayed any announcements?

Am I able to apply to the VI twice with 90days in between instead of VI and then the Plat?

If I have the infinite visa from last year, what are the chances of getting the platinum despite the t@cs?

You never know until you try. 😉

There is a much better offer to get 55000 points plus $50 UPON APPROVAL without having to spend a penny. Hope I am not reading it wrong but only for first time people applying.

In order to qualify for the Promotion, You must:

Not currently have or have had in the past at any time a RBC Avion Visa Infinite. The Promotion is open only to new applicants for the RBC Avion Visa Infinite who have not before held a RBC Avion Visa Infinite either in their name, or jointly with another individual or entity. Other RBC terms and conditions may apply to qualify for the full welcome bonus;

Will I get the signup bonus if I do a product change?

RBC is hit or miss. Last time out it was a miss for me.

from the T&C “Additional cardholder(s), as well as existing cardholders of any RBC Royal Bank personal credit cards, applying for or transferring to an RBC Avion Visa Infinite, RBC Avion Visa Platinum, or RBC Avion Visa Infinite Privilege card as of the offer eligibility period, are not eligible for this offer.”

I already have an rbc personal credit card, does that mean I don’t qualify for this offer?

I just phoned RBC to get clarification as I had just read those terms and conditions. Agent confirmed I would not receive the Platinum card’s welcome bonus of 35,000 RBC rewards points as I already hold 2 other personal RBC credit cards. Too bad.

I can confirm I got the full bonus despite having previous RBC cards! This is rarely enforced unless you get too aggressive.

This is the first time such T&C are associated with Avion cards. Later data points will tell.

It actually looks like it’s been on there for a few years (a quick check on wayback machine confirms). Other DPs I’ve found online say that it’s rarely enforced unless you get too aggressive.

Hi PoT team, I (plus P2) each picked up the Avion VI in late Dec 2021 and got the 35k. I’ll apply for the Avion Plat just before April 18th deadline to try for the 35k again, but wondering if I should PS the VI t to WJ in early April before applying.

Right now, RBC is offering a 30% transfer bonus to British Airways Avios until September 24, 2021.

Ooh thanks for that!

Here is a DP for those concerned with holding the cards last year –

I had originally applied for Avion VI card in Feb 2020, got the 35k bonus then (applied in branch and the annual fee was waived), and switched to BA VI sometime in summer 2020. Got 15k bonus on that PS plus pro-rata refund of annual fee for Avion VI (which I never paid in the first place) and charged $165 for the new BA card. Then sometime in fall/winter last year (don’t remember the details but it was certainly before the April 19, 2021 date), PS from BA VI to Cashback MC with no fee. Received pro-rate refund of BA’s fee. Now, on Nov 2, 2021, applied for Avion VI as new application and have already received the 35k sign-up bonus. The annual fee is yet to post to my account.

Are the Visa Infinite benefits really that much better? i.e. applying for the Platinum vs the Infinite?I would assume that the person obtaining these cards have alternate cards with better insurance benefits, etc.

RBC Business cards run on a separate 1/90 cycle than personal cards. So you can apply for a personal card, then in 20 days, apply for a business card. You would wait 90 days from the first application to be eligible for a new personal card and 110 days from the first application to be eligible for a business card.

You can’t get 70.000 point for RBC Avion Visa Platinum and RBC Avion Visa Infinite at the same time:

” Additional cardholder(s), as well as existing RBC Avion Visa Infinite or RBC Avion Visa Platinum, Cathay Pacific‡ Visa Platinum, British Airways‡ Visa Infinite, RBC Rewards Visa Preferred, RBC Rewards+ Visa, RBC Avion Visa Infinite Privilege and RBC Avion Visa Infinite Privilege for Private Banking credit cardholders, applying for or transferring to an RBC Avion Visa Infinite credit card, RBC Avion Visa Infinite Privilege credit card or RBC Avion Visa Platinum credit card as of the start of the Offer Period, are not eligible for this offer. ”

You get 35.000 for one card and 15.000 for another.

Many have gotten 70,000 points from the two cards under these rounds of offers.

Looks like they extremely lucky: me and my wife got 35.000 + 15.000…

Did I read this correctly, I can hold Avion infinite and platinum at the same time? I just got the infinite so sounds like a no brainer to get the platinum.

Yes, it’s possible!

The RBC VI British Airways card perhaps does not earn a lot of Avios as HSBC for example, and indeed, the voucher might not be top value yet it does have two superb features: 10% off total price of BA flights (huge) the only such card in Canada with actual discount, and 31-days emergency travel insurance, these 2 features by themselves are worth having the card, if you happen to fly once per annum with BA

Just did a product switch from Cashback MasterCard to Avion Visa. They originally said no bonus will be awarded to PS, but after a contest to their CS, now a 15,000 points appears on my avion account as sign-up bonus!

So if I read the fine print correctly if I already have the Cathay Platinum card, I won’t qualify for this offer even if I do a new application?

For Evan. Westjet isnt listed. So PS to westjet from cathay pacific card. Then from westjet to Avion card then it should work becauze fine print says avion products or cathay or birtish airways cards. Which still gives room to movement.

If the fine print is enforced, yes.

How about redeeming 35k points for merchandise if someone doesn’t want to go for flight redemption? What option do i have!

I had redeemed those for $360 worth of gas gift card before I product switched that card. Usually the GCs have less than 1cent value but RBC was running some promotion last year that gave 25% discount on points for GC redemptions.

Hi Ricky, do you think we would be able to cancel these cards after the first month and still keep the points?

Even if it worked out, that would be a great way to harm your relationship with the issuer in the long run.

Ricky I dont think that if you can qualify for more than one card in this RBC Family. For this special offer. So you wont get 70k points, just 35k. Can you please read the 1st point of the T&Cs and verify? It says that new or existing cardholders holding one of these cards cannot get another one with the 35k bonus. Thanks.

I’ve read the T&Cs. There are two ways to interpret them.

“Additional cardholder(s), as well as existing RBC Avion Visa Infinite or RBC Avion Visa Platinum, Cathay Pacific Visa Platinum, British Airways Visa Infinite, RBC Rewards Visa Preferred, RBC Rewards+ Visa, RBC Avion Visa Infinite Privilege and RBC Avion Visa Infinite Privilege for Private Banking credit cardholders, applying for or transferring to an RBC Avion Visa Infinite credit card, RBC Avion Visa Infinite Privilege credit card or RBC Avion Visa Platinum credit card as of the start of the offer period on April 19, 2021, are not eligible for this offer.”

1) As of the offer’s start date of April 19, any existing cardholder of one of the listed cards is not eligible for this card. In this case, you’d be able to get 35,000 points from one product, but not 70,000 points from both, since you’d be an existing cardholder by the time you apply.

2) If you were an existing cardholder of one of the listed cards as of April 19, you aren’t eligible for this offer. In this case, you’d be able to get 70,000 points from both, since you were not an existing cardholder of either product as of April 19.

I like the second interpretation better.

What matters is how RBC sees it. I guess I need DPs on this.

Tricky stuff. Yes, youre right Ricky. Thanks.

Same can be said for AMEX in regards to bonuses and that doesn’t stop people, just saying. 🙂

Yea true Jay. Though I dont churn two same Amex cards unless at least a year apart, so not a big concern. But here its as long as promotion lasts so the timeline is potentially a lot shorter for RBC to notice.

Any DPs on upgrading from VI to VIP with Avion product?

Are we eligible for this if we applied to the one last year? Recently cancelled my card in Feb. Is there a time period we need to wait?

The terms and conditions only preclude “existing cardholders” (and even then, it’s anyone’s guess how strictly they’re enforced), so I’d say you should be good to apply.

Rick, can you keep us updated if you apply and receive again, as we cancelled 2 of these in Feb. also. Thanks, Susan

Any thought on churning this card? if i cancelled a year ago? Is that long enough?

Is this offer specific to the person received it, or anybody can get it? Don’t see this offer on RBC site.

It’s now publicly available on the RBC website.

Thanks Ricky! i was having some trouble finding it at first but I can also see the offer now for Platinum

I’ve added a direct link to the RBC website to help people find it, cheers.

If you Google rbc avion in Chrome incognito mode, you should see it as an ad in the first result

There is a 25k fyf offer floating around as well, if you value the cash over the 10k extra points.

If I product switch to this card from another RBC card, will that be eligible for the 35k bonus as well? I had this card last year when the 35k bonus was around but then I switched to a different product later. Thanks!

Only new applications are eligible for this or any “promo” offers, unfortunately

Hi Ricky, P2 has the BA VI currently and a product switch sounds interesting for this offer. However this language in the T&C’s makes me iffy.

Additional cardholder(s), as well as existing RBC Avion Visa Infinite or RBC Avion Visa Platinum, Cathay Pacific Visa Platinum, British Airways Visa Infinite, RBC Rewards Visa Preferred, RBC Rewards+ Visa, RBC Avion Visa Infinite Privilege and RBC Avion Visa Infinite Privilege for Private Banking credit cardholders, applying for or transferring to an RBC Avion Visa Infinite credit card, RBC Avion Visa Infinite Privilege credit card or RBC Avion Visa Platinum credit card as of the start of the Offer Period, are not eligible for this offer. ”

Any feedback on if a PS will be successful despite the language of the T&C’s?

Unfortunately PS are not eligible for this or any offer, only new applications