2022 is here, and with it, a new round of bank promotions and offers.

We haven’t quite seen anything similar to last year’s Summer of Love by American Express, but that’s to be expected. After all, it’s January, and what usually happens in January despite disappointing movie releases?

Fortunately, it looks like TD, one of the more conservative Big 5 banks, has upped its game and decided to join the refer-a-friend space.

If your “Player 2” or mother-in-law has been wondering about whether they should get a copy of that brand-new TD Aeroplan Visa Infinite they’ve been eyeing in your wallet, now’s the time to do it.

They could get a great new welcome bonus of Aeroplan points, and you could get up to $300 in gift cards as a referral bonus!

TD Joins the Credit Card Refer-a-Friend Game

Previously, credit card referrals have been the near-exclusive domain of American Express.

Amex really did perfect the notion of offering heightened referral welcome bonuses to new applicants, plus a nice reward for whosoever referred them.

It looks like TD has decided to test the waters this year. TD isn’t the first to try out referrals: CIBC has done so previously, but only for their Aventura credit card product line. This time, though, the bonuses are a lot nicer than the 10,000 Aventura points previously being offered over at CIBC.

The new TD referral program is welcome, but it’s also limited-time, so you’ll want to act sooner than later.

If you want the $300 in gift cards, you’ll need to get one of your friends or loved ones approved for the TD credit card product of their choice March 6, 2022.

How Does TD’s New Refer-a-Friend Program Work?

What I like about TD’s new refer-a-friend program is that it’s for credit cards instead of bank accounts. Previously, the only referral bonuses offered by TD Canada Trust were for recommending friends to open a new chequing or savings account, or to switch their entire banking over to TD.

These types of referrals were a harder sell because Canadians are often satisfied with their current bank, and the cash payouts for getting a friend onboard could often take a while to payout. Worse, many bank accounts have monthly fees that are only waived by maintaining a sizeable balance.

The new referral program, though, allows you to get friends and family signed up for TD’s credit card products, which offer exciting welcome bonuses, often at the competitive first-year price of $0.

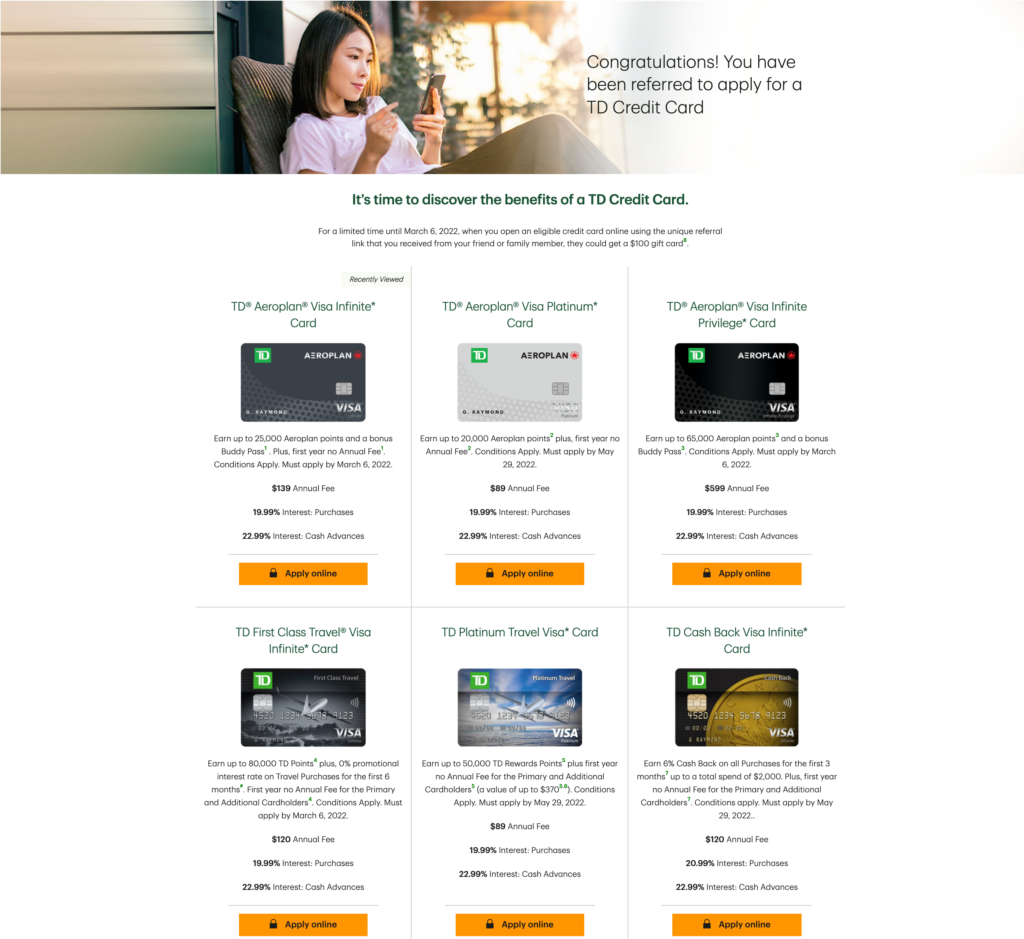

The following TD credit cards are eligible for the limited-time referral promotion, both in terms of existing cards that cardholders can refer from and the new cards that referees can sign up for:

| Credit Card | Best Offer | Value | |

|---|---|---|---|

|

Up to 85,000 Aeroplan points†

$599 annual fee

|

Up to 85,000 Aeroplan points† | $871 | Apply Now |

|

Up to 40,000 Aeroplan points†

First Year Free

|

Up to 40,000 Aeroplan points† | $683 | Apply Now |

|

Up to 85,000 TD Rewards Points†

First Year Free

|

Up to 85,000 TD Rewards Points† | $475 | Apply Now |

|

Up to 20,000 Aeroplan points†

First Year Free

|

Up to 20,000 Aeroplan points† | $434 | Apply Now |

| $350 cash back† | $385 | Apply Now | |

|

Up to 50,000 TD Rewards Points†

First Year Free

|

Up to 50,000 TD Rewards Points† | $258 | Apply Now |

Better yet, if you get someone you care about to apply via your link, not only will they get a new credit card, but you’ll earn one of three different $100 e-gift cards. You’ll get your pick of one or any of the following, up to a maximum of three referrals:

- $100 Amazon.ca gift card

- $100 Uber Eats gift card (only usable within Canada)

- $100 Sobeys gift card

Now I don’t know about you, but those are all tangible services I use in my daily life. Amazon is where I did much of my shopping for my new condo’s amenities, while Uber Eats provided the food until I’d gone to Safeway (owned by Sobeys) to do my first round of groceries.

That means you could choose to get $300 toward an Xbox One off Amazon, or maybe see how it feels to order a four-person lobster dinner off Uber Eats – the choice is yours.

How to Participate in TD’s Refer-a-Friend Promotion

Of course, anyone who’s been in the Miles & Points game long enough can tell you that a bank’s IT is often a fickle mistress. To participate in TD’s refer-a-friend program, you’ll want to ensure you follow the below procedure.

The first step is to clear your browser’s cache, as the new promotion page might not show up otherwise. Then, log in via the button on the Refer-a-Friend page.

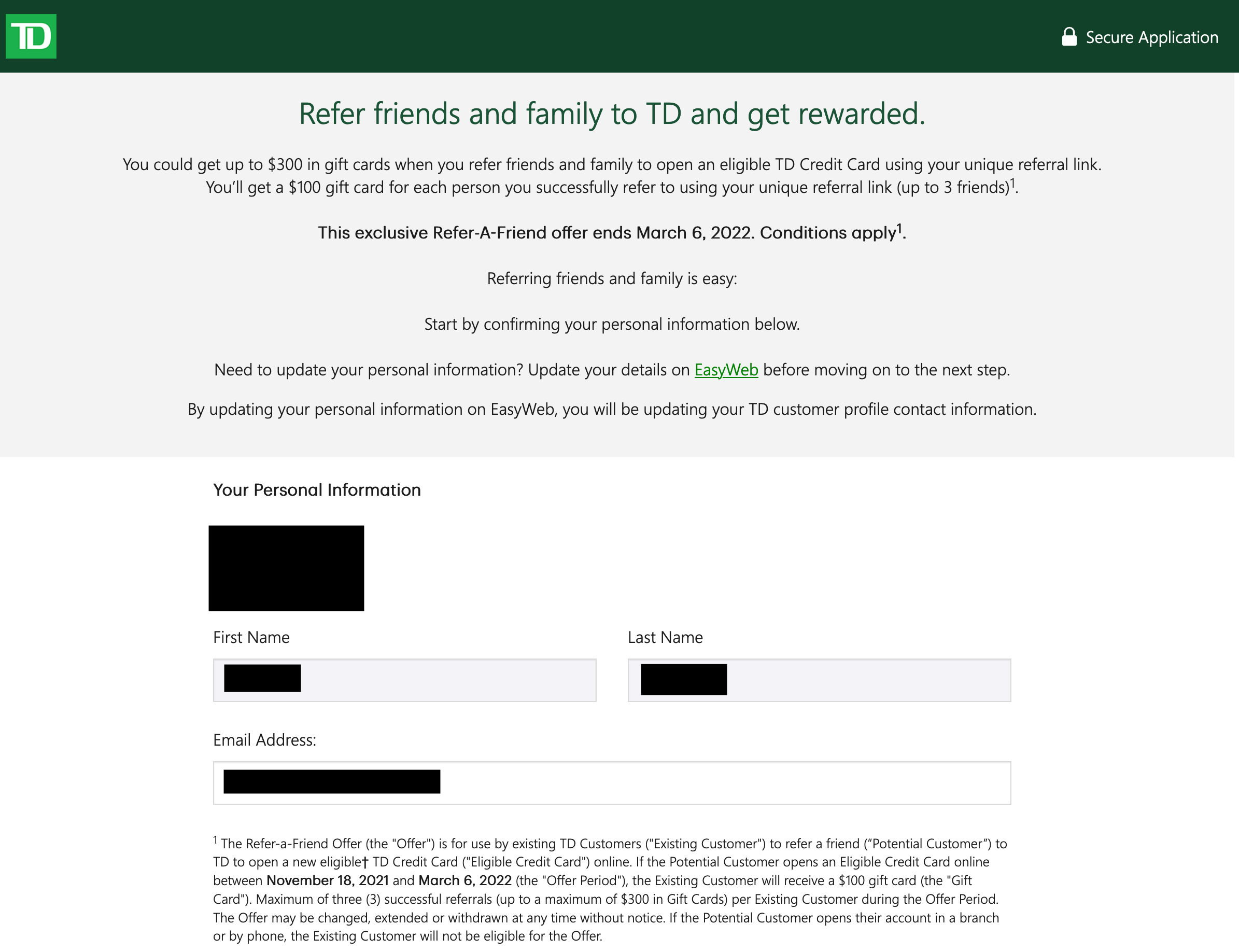

You’ll see a referral link generator form pre-filled with your information. It’ll look like this:

On the next page, obtain your referral link after confirming your details. Lastly, send the link to your buddy, loved one, or frenemy so they can apply.

And that’s it! If they’re approved, you’ll soon be in the land of free furniture and/or fudge. With any luck, you’ll be getting thanked soon for introducing your friends to the wonderful world of Miles & Points, too.

The Fine Print

Of course, no referral program would be complete without a plethora of legalese jargon to make sure you actually qualify for the gift cards TD is paying out.

This offer is only open to current TD credit card holders, and must be completed by March 6, 2022.

The rules also state that any referees must be “individuals with whom you have an existing personal relationship”, though of course we’re all keen to build personal relationships within the Miles & Points community, no?

There’s also a requirement that the referee “cannot already have an eligible credit card” and “cannot have had an eligible credit card that was closed on or after November 18, 2021”. So you’ll want to find individuals who aren’t already part of the TD credit card ecosystem to persuade them to join.

Lastly, in terms of the timing of payout, the fine print states that it may take “12–14 weeks” for the gift card to be fulfilled. This is quite a bit of time to elapse before being eligible to select your gift cards.

I’d recommend calling in after a couple of weeks if you’re certain a friend has applied and been approved but you haven’t seen your reward yet, just to be certain.

Conclusion

It’s always refreshing to see positive developments in the Canadian credit card space. TD has upped their game, and they’ve offered a very straightforward credit card referral program with an excellent selection of rewards.

Of course, I’d have preferred to receive Aeroplan points as a “thank you,” but hopefully this pilot project will succeed and perhaps the TD gods will make this a permanent fixture. Moreover, here’s hoping TD isn’t the only bank to join the brave new world of refer-a-friend programs in 2022.

Until next time, happy applying!

promo still valid til may 29, 2022

HI,

Everybody has the same problem with TD. It is very complicated. This is completely crazy.

Suggestion: do an article specially about TD so people don’t accumulate hard hits on their credit score for nothing. Some of those answers were mention in this forum.

Thank

For those who are having trouble getting approved by TD (even with great credit scores), there is another option you might want to consider. TD does allow clients to put security funds on ANY of their cards. What you could do is apply for a basic Aeroplan card or even their Emerald card with a security deposit of $5000 — the funds will be frozen in your checking account for at least 12 months but once the card issued, you can product switch to the desired card (Infinite etc) after four months. Many of those cards are eligible for the welcome bonus assuming you’ve never had them before. (obviously check ahead before product switching). I know a few people who did the “secured” card route to get into TD’s ecosystem.

If my sister would be willing to give me the $300 of gift cards, do you then think this is a better deal than the secret deal on Air Canada’s website for 40,000+150 statement credit?

The referral program states that the potential referred person “Cannot already have an Eligible Credit Card”, does this mean that they cannot have that specific card? i.e. if they are referred for the TD AP Visa Infinite card, but hold the TD First Class Visa card, will this make them eligible to be referred or not eligible? Will I, as the referrer, receive the promotion in this situation

I read it as any TD Credit Card, as they’re all technically eligible for this promotion.

Whether their IT can differentiate and exclude is beyond my limited mechanical knowledge, though.

My sister has the same problem with TD. Has a score of 833 very small mortgage and no other debts. Gets any cards she wants Biz Amex, Aeroplan Amex cobalt etc. but always declined for TD no matter what. It’s the weirdest thing!

Hey Al, so to address your comments, I’ve heard via rumour and word of mouth (and so take this with Mariana Trench quantity of sodium) that TD counts any outstanding credit lines as essentially maxed. So if you have $15,000 in other credit cards, they count it internally as being $15,000 of debt and then they determine if you can service that debt.

Once again, this is a rumour not a fact, but it would explain at least a bit why this weirdness occurs.

I can confirm this “rumour” – TD takes all credit card debt and treats it as maxed out. They take the total limits and multiply them by 0.03 (3%) to come up with your estimated monthly payment should you go on a spender bender. Using your $15,000 example, TD is banking on a worst case scenario of $450 monthly payments to service that debt. They do a DTI calculation to see if you are “over” or “under” — TD also assumes YOU are responsible for the entire rent payment, even if you are sharing with a spouse/partner etc. So if your rent is high, TD may decline you. Hope this extra salt helps 🙂

Thanks for the detailed article, Kirin. I have a TD Aeroplan VIP and my wife is a supplementary cardholder on that account. Wondering if she would qualify as a referee under this promotion? I read the terms but they are silent on this specific issue.

I am 90% certain you’ll be good to go because in Canada, supplementary cards don’t require any proof of anything.

You could have one issued in the name of the late great Freddie Mercury and it wouldn’t really matter. In my opinion, go right ahead with your lovely wife!

I’m not sure what TD doesn’t like about me, but they’ve declined my applications several times over the past few years. I’ve got Amex Plat, Gold and Cobalt, CIBC AP VIP, HSBC WE MC, Tangerine World, Brim WE, RBC Avion VI, but they won’t let me have a single card of theirs. Can’t figure it out, wonder if anyone else has trouble getting approved for TD cards?

Same as you, I have varying cards from pretty much everyone else (CIBC, RBC, Brim, Amex, BMO, Canadian tire) and haven’t had an application other than TD declined in ages. But I can’t even get approved for the base TD Aeroplan platinum card. I’ve heard of people having multiple profiles in the TD system and that causing problems, but I just haven’t gotten around to going into a branch. One of these days I’ll get around to it.

I don’t and haven’t ever had a single product with TD, but I took my brother into the branch after he was denied online (has been a TD banking client since 2004), good credit scores and a few other credit cards. After spending about half an hour with an advisor in her office, she finally pushed the app through, but they approved him only for $1K limit with a base cashback Visa. He’s been using it and paying it for 18 months, tried to get him a CLI of $500 to bring him to $1500 so we could product switch into base Aeroplan Visa, they denied it online, so we called it in, rep denied it as well. Bonkers to me.