With the pandemic wreaking havoc on many of the industries we care about, including travel, aviation, loyalty, and finance, the status quo in the Miles & Points landscape is bound to shift in many unpredictable ways.

In this article, I wanted to comment on a trend that I’ve been observing in recent months: the blurred line between cash and points that grows ever more blurry by the day.

The default mindset among the general public, and indeed among many newcomers to the game, is to think of Miles & Points as some kind of “free money” to be redeemed for “free trips”. Now more than ever, though, it’s important to resist the conventional wisdom and recognize the highly fluid nature between cash and points, lest you miss out on any killer opportunities that may arise.

In my view, the paradigm shift is being driven by a few primary factors, so let’s go through them one by one.

The Appetite for Liquidating Points into Cash

I’ve written previously about why it might make sense to consider liquidating points into cash at this time.

In the midst of a recession that verges on an economic depression, many households and businesses are facing a shortfall in cashflow, and in some cases would benefit from the additional cash to pay for essential everyday expenses.

Moreover, the mantra of “earn and burn” has been rendered ineffective by a pause in global travel, meaning that many points collectors – especially those who have earned far more points than they feel safe holding under the threat of upcoming devaluations – might well consider liquidating their excess points into cold hard cash instead.

Recognizing this appetite among consumers, several financial institutions have stepped up to meet this demand. For example, in lieu of the usual spring conversion bonuses to frequent flyer partners, we’re seeing RBC Avion (and several of its fellow Big 5 banks) offer 25% bonuses on gift card statement credit redemptions instead.

The most significant promotion in this regard, however, would have to be American Express’s Double Rewards promotion on the Platinum Card until July 20.

This promotion allows Platinum cardholders to redeem MR points against statement purchases at an elevated rate of 1,000 MR points = $20 (equivalent to 2 cents per point or 2cpp), and it has arguably been overly generous, as evidenced by Amex’s recent moves to slash signup bonuses and block the ability to link separate MR accounts until the promotion is over.

One point of contention among the Platinum user base has been whether it’s a good idea to cash out one’s MR balance at a rate of 2cpp. At the very least, it’s a highly tempting proposition.

If you had earned the points with the goal of flying business class or First Class via an Aeroplan transfer, then you’d be leaning towards keeping your MR points intact, as you’d be confident of getting higher than 2cpp in value on your eventual redemption.

But the decision would also depend on your current points holdings: if you’re already sitting on a few hundred thousand Aeroplan miles, how much value is there in an incremental hundred thousand miles compared to the solid $2,000 in cash – especially when you can still earn these miles in the future, but the 2cpp cash-out opportunity is limited until July?

Personally, I think a hedged strategy is optimal for most points collectors: even if you don’t need the cash, redeeming a small chunk of MR points at 2cpp will cover all the future occasions when you might choose to redeem miles at lower than 2cpp. (Sure, you might not intend to ever redeem at lower than 2cpp right now, but with how quickly things are changing in our space, you just never know.)

The Abundance of Cheap Cash Fares

The hedged strategy also allows you to apply your MR points towards another emerging trend these days: the widespread availability of cheaper cash fares.

While it’s predicted that airfare in economy class may be on an uptrend for the foreseeable future due to social distancing measures, the same may not be true for airfare in premium cabins. With business travel predicted to decline due to a heavier emphasis on working remotely, airlines will need to find more ways to tempt travellers into their premium cabins, one of which is through discounted business class tickets.

I don’t foresee a future in which $2,000 business class tickets to Europe or Asia are the norm across the industry, but I do believe we’ll see a greater number of targeted fare sales and steep discounts in premium cabins in the short- to medium-term future.

We recently saw JAL business class fares from Vancouver to Bali for $1,100 round-trip

But even though we can expect to see more and more of these sales, we won’t be able to predict the exact flights, dates, and fare rules (i.e., whether a stopover is allowed or not), so it isn’t a reliable strategy to simply forget about Miles & Points and focus exclusively on booking cheap premium fares.

Instead, it’s all about playing both sides of the field: redeeming points when it makes sense to do so, and recognizing that booking cheap fares will also make sense on some occasions… even if it doesn’t quite “feel” like it.

To take one example, consider the Qatar Airways rebooking deal that we saw recently. At the start of this deal, it was possible to effectively book a ticket from North America to anywhere in East Asia or some parts of South East Asia for around $2,300.

With the Double Rewards promotion on the Platinum Card, this would be equivalent to redeeming 115,000 MR points for a round-trip to Asia on the world’s best business class – a spectacular deal considering that Aeroplan and most other loyalty programs would price this redemption in the range of 150,000 miles.

And yet, that $2,300 price tag was a major psychological barrier for lots of people who learned about and had the chance to take advantage of this deal, even if that expense could then be immediately offset with MR points at 2cpp.

The newfound fluidity between cash and points naturally represents a new way of thinking for many of us, and it’s important to embrace that fluidity and be mentally prepared to spend both currencies in order to position ourselves optimally for high-value travel in the future.

We recently saw Air France business class fares from Budapest to North America for $750 round-trip

Airlines Looking to Raise Cash via Loyalty Programs

It’s no secret that the world’s airlines are in a tough financial spot at this moment, and it turns out that in the absence of flight bookings, the loyalty program remains one of the best ways to raise cash.

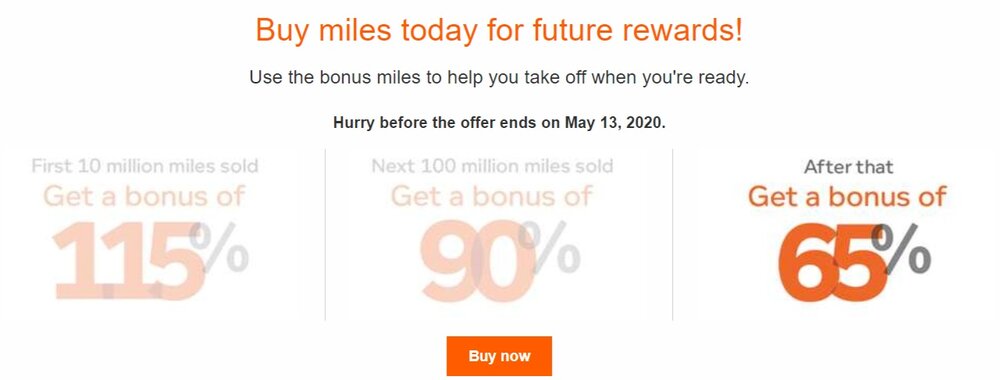

Just look at the recent Aeroplan Buy Miles promotion, which offered an unprecedentedly low rate of 1.4cpp (CAD) on the first tranche of 10 million miles sold during the promotion, followed by 1.6cpp (CAD) on the next tranche of 100 million miles. Both tranches sold out within the first hour of the promotion, netting Air Canada a cool $1.74 million in cash.

If we very conservatively assume that the same value was raised throughout the remaining week of the promotion, when miles were sold at the still-very-competitive rate of 1.8cpp (CAD), we see that Air Canada collected at least $3.5 million from our pockets. It’s no wonder that they’ve since brought back the 1.8cpp rate as part of their new rebooking policy for converting the value of your cancelled Air Canada tickets into Aeroplan miles.

And it’s not just Aeroplan, either: loyalty programs around the world from Marriott Bonvoy to British Airways Avios are offering promotions for buying miles with record-low rates (or very close to record-low rates).

And just like the debate of whether it’s worthwhile to liquidate points into cash, so too does the same question apply in the opposite direction: is it a good deal or a fool’s errand to buy points at these record-low rates?

The answer depends on whether you’re buying miles for short-term or long-term use: in the former case, it can be an inspired purchase, while the latter case only sets you up for disappointment.

In the short term, if you are comfortable travelling over the next year or so, there is clear value to be gained in a promotion like Aeroplan’s: even at the 65% bonus rate of 1.8cpp (CAD), buying 150,000 miles for $2,700 seems like a great deal if you’re then exchanging those miles for a round-the-world trip in business class.

In the long run, however, the value of every loyalty program only goes in one direction: downwards. And it certainly isn’t unreasonable to think that an airline that has just given out several hundreds of millions of miles in exchange for much-needed cash would then be more inclined to reduce their future liabilities by hastening that downward trajectory.

Finally, the fact that cash and points are easily convertible in both directions at this moment has given rise to several interesting arbitrage opportunities, such as cashing out MR points at 2cpp before buying Aeroplan miles during the Buy Miles promotion at 1.4–1.8cpp, thus effectively outperforming the usual 1:1 conversion ratio.

And as we know, the 1.8cpp rate of purchase will return on June 15, when Air Canada rolls out the ability to convert unused tickets into Aeroplan miles – effectively another mileage sale at the 65% bonus level. I’m sure we’ll all have eyes on the arbitrage methods that arise when the time comes.

Conclusion

Cash is king in times of recession. Consumers are liquidating points at a compelling rate in favour of cash, while airlines are giving away points at a compelling rate in favour of cash, and this has resulted in a much-changed landscape in which the line between cash and points is far more blurred than before.

In the past, we tended to think of these two portions of our travel budgets as disparate holdings with their own respective uses (well, unless you ventured into the grey area, anyway). But in the newly emerging post-COVID-19 landscape, there will be many ways to exchange fluidly between the two currencies and even more reasons why it is in your best interest to do so, so don’t let the old conventional thinking hold you back from a brand-new class of sweet spots and opportunities.

I just bought Aeroplan points with the recent promotion, but my hopes have been dashed. I hope to see your thoughts and advice on the new Aeroplan MPM changes.

I love all your amazing mRTW adventures, and was about to book my very first (YYZ-LIS-MUC-JTR-VIE-IST-CAI-DXB-SIN-PER;PER-SIN-DPS-BKK-ICN;NRT-TPE-YYZ) but now everything seems shot with the massive devaluation.

To add : I suspect there are many readers who have one of the following mindsets : (1) Biz must be nice, but I’d rather fly more often in economy or (2) I choose to fly my family rather than myself in First class.

I fail in the latter and when you consider 6 people, with school and jobs, flying the aspirational isn’t a realistic possibility atm. All this to say : the Platinum’s $ is much more valuable to my family than the points. Redeeming now, at 1000:20 and putting the cash in a travel account (for those who can) adds the flexibility a large family covets. Many hobbyists will not « need » those MR rewards because they ALSO have a stash of points in other loyalty programs.

Are you sure that there won’t be a transfer bonus for Avion this year?

It’s a bit late for the usual spring bonus, so I assume that has been skipped over and we may see one in the fall.

This plat card promo is killing me, in a good way though. Both my $ and MR balance is high and increasing daily as I put everything I can on it. I can afford to certainly to cash out a huge number to save some cash but I so want a huge stash to travel ‘in style’ when this is all over. But that might be years away. Well at least I have til July 20 so it gives me plenty of time to think about it. I am rather embarrassed what I just wrote, seeing how people are struggling through on a daily basis now. Perhaps I need to step back a bit from this game.

Perhaps you just need a better choice of words than saying the Double Rewards promotion is "killing you" – even though we all know what you mean 🙂

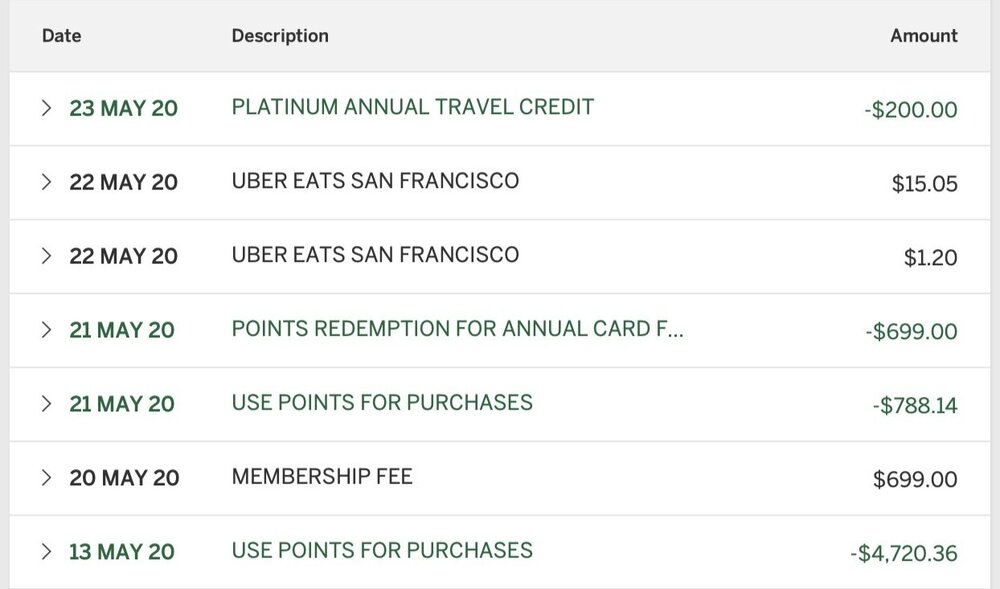

Points redemption for annual fee? Whats that all about? Do you get a better exchange than 2cents per point?

Still 2cpp, it just displays differently on the statement.

It’s the same, it just codes slightly differently when you use points for the annual fee I think.