Become a Member

Platinum Membership

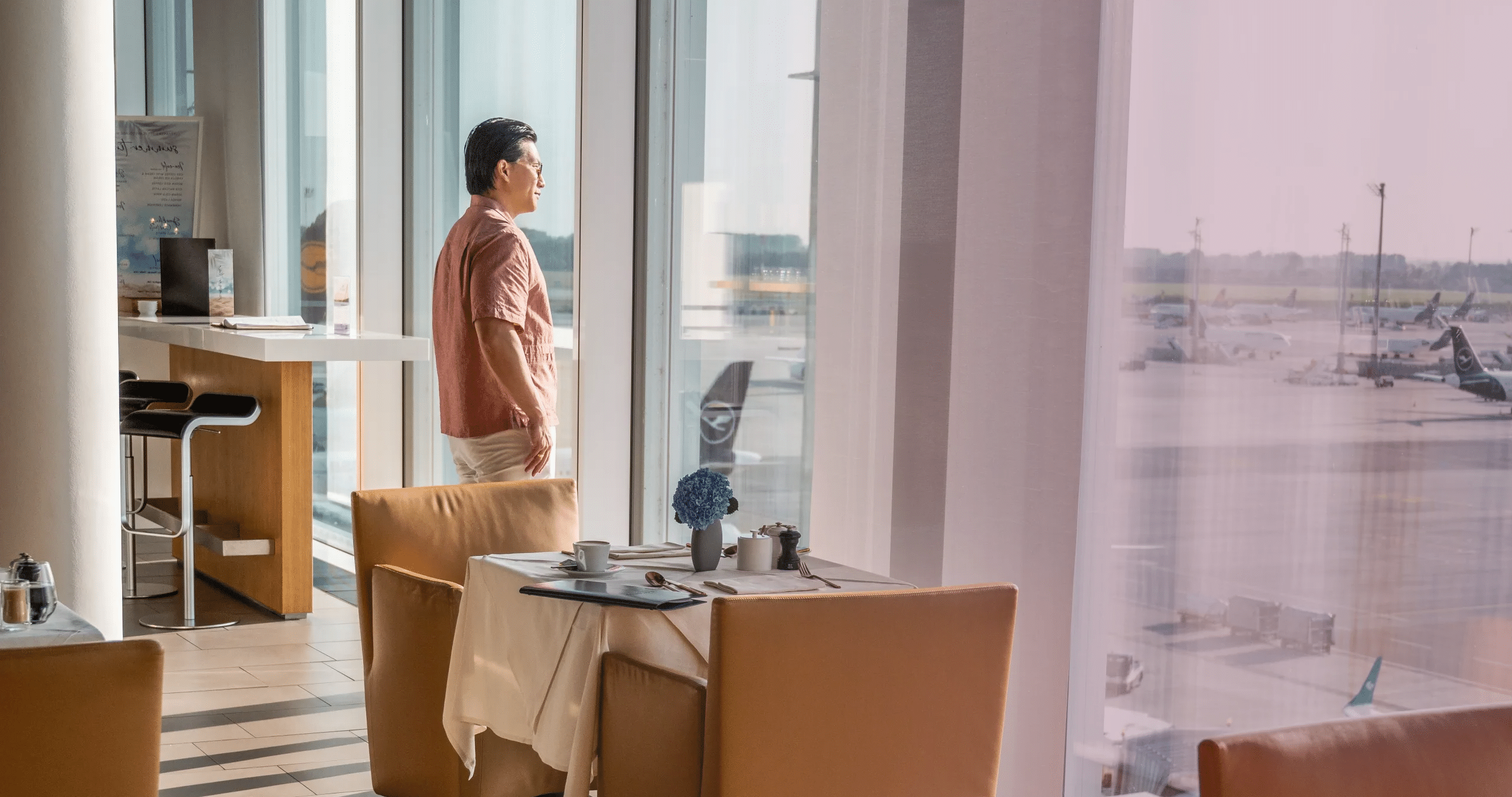

Our Platinum members get access to a Circle community, exclusive live learning sessions, and in-person gatherings with like-minded travellers.

Top Offers

2.1¢

Aeroplan2.2¢

American ExpressMembership Rewards

0.8¢

Marriott Bonvoy2.0¢

RBC Avion2.2¢

Alaska AirlinesMileage Plan

2.0¢

British Airways Avios1.6¢

Cathay PacificAsia Miles

0.7¢

Hilton Honors2.0¢

Air France/KLMFlying Blue

2.0¢

World of Hyatt1.0¢

Scene+0.5¢

IHG One RewardsNew to travelling the world on points?

For the vast majority of people, “rewards” or “points” are an afterthought at best.

Most people don’t realize that leveraging travel rewards to their full potential can truly transform the way you travel.

Check out our Newbie’s Guide to equip you with all the basic knowledge you need for racking up the points and travelling the world.