As you may have heard, airline reward programs in Canada have undergone a massive overhaul over the last several weeks.

Air Canada has launched their new Aeroplan, which has been met with a mixed bag of reactions from the Miles & Points community. Meanwhile, WestJet has also relaunched their Member Exclusive fares, which was quite disappointing for those who had found immense value in the previous edition of the program.

How you view the new changes will depend on your own travel patterns and goals. If you tend to travel solo, or even as a couple, and save up your points for aspirational Mini-RTW trips, then your view will be very different from mine.

As someone who travels with my family of five at least twice a year, let me share my perspective on how it will impact my future travel plans and redemptions.

The Past

I dabble in quite a few different airline award programs, but the ones I am most heavily invested in before November were Aeroplan, WestJet Rewards, Alaska Mileage Plan, RBC Avion, and American Express Membership Rewards.

Here’s my previous strategy in using these programs.

Aeroplan

To be honest, the only time I redeemed Aeroplan miles for family travels was during the 50% Miles Back and Big Summer Miles promotions, when it was 30–50% off reward fares and I had Aeroplan 25K status (earned from another promotion, Travel at Home) where surcharges were waived.

Prior to this, the redemptions just didn’t make sense – as a young family wanting direct flights to my destinations, you would think Air Canada metal would often be our first choice, but with surcharges costing up to 50% of the revenue ticket, I often did not see it as a worthwhile redemption.

Sure, I could book on partner airlines to avoid the surcharges, but then I would be limited by the number of seats released by those airlines. The only consistent airlines releasing at least four seats at a time were Swiss, Turkish Airlines, TAP Air Portugal, Asiana Airlines, and EVA Air. Having that third child – for a total of five passengers – complicates redemptions even more.

So instead, I saved Aeroplan for premium redemptions that my husband and I would make once or twice a year.

WestJet Rewards

Alas, WestJet’s old Member Exclusive fares were golden. At 125 WestJet Dollars (WSD), I could score a long-haul North American flight, and that was my main use of the program. Although only four seats were released for each flight, I could always use my WSD at a 1:1 ratio at the cash rate for my third child.

WestJet Dollars were pretty easy to earn by getting the WestJet RBC World Elite Mastercard, which had signup offers from 250 to 450 WSD, including an annual companion voucher and free checked baggage for up to eight passengers on the same ticket.

If award space wasn’t available, the companion voucher was great for locking in flights within North America with a co-pay of $119.

RBC Avion

RBC Avion was the first rewards currency I became familiar with, so I have a particular soft spot for it. Sentiments aside, though, it is a very good, flexible program in which points are quite easy to accrue.

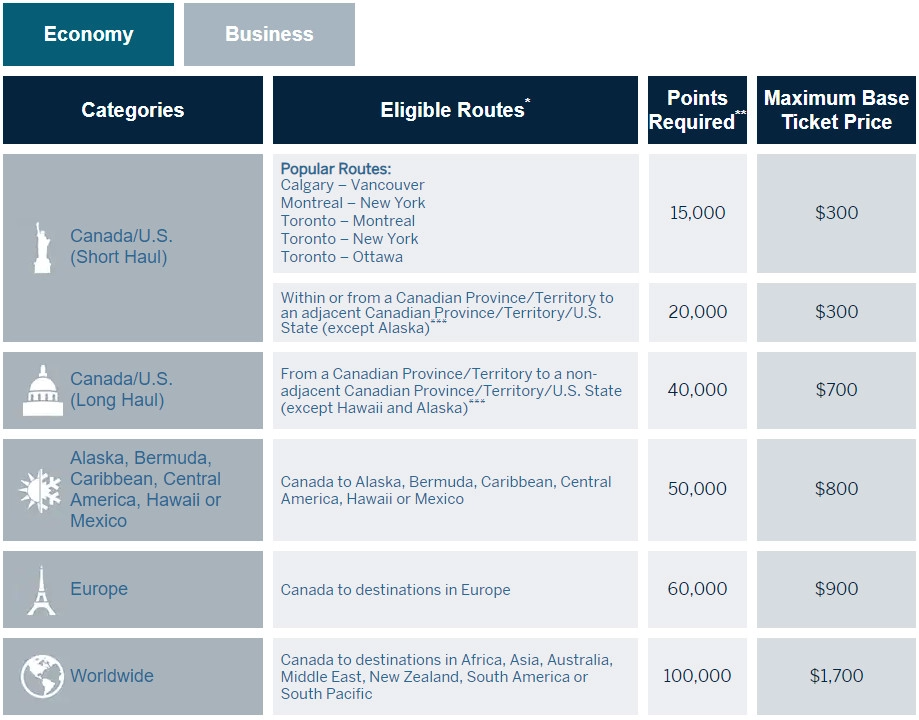

On the redemption end, they have a few good airline transfer partners (WestJet Rewards, American Airlines AAdvantage, Cathay Pacific Asia Miles and British Airways Avios) in addition to a fixed air travel redemption chart.

The latter approach gives me the flexibility to book any economy class seat with my points at a predictable rate, and still accrue airline status miles from my redemptions. I like this predictability when it comes to family travel.

I can also redeem for any business class or First Class seat at 2 cents per point (cpp) by holding the Avion Visa Infinite Privilege or the Avion Visa Infinite Business.

My main uses for the program were:

- Transfer to Avios during transfer bonuses (last year this was at a whopping 50% bonus) to help redeem for that Aer Lingus sweet spot when I want to travel to Europe with the kids (as Aer Lingus consistently releases five economy seats on each flight)

- Transfer to WestJet Rewards to take advantage of their Member Exclusive fares for North American travel (no longer applicable, more to come later…)

- Transfer to American AAdvantage to book Qsuites on Qatar Airways;

- Redeem for flights at a fixed rate when I cannot find enough award space or the flight I want;

- Redeem for Hotels.com gift cards (my only non-flight redemption) during promotions so I can book hotel stays that aren’t affiliated with Marriott or Hilton

American Express Membership Rewards

I like Amex MR points for its flexibility. I can transfer points to six airline programs and two hotel loyalty programs, with Aeroplan, Avios, and Marriott Bonvoy being my top choices.

It’s a great way to accumulate points when you don’t have a redemption in mind yet. Keep in mind that the Cobalt Card and Business Edge Card earn a special type of MR points known as MR Select points, which can only be transferred to hotel partners.

In addition, I can also redeem MR points for the exact flight of my choice through the Amex Fixed Points Travel chart.

However, I find RBC Avion’s redemption chart to be more favourable compared to Amex Fixed Points Travel, as it has higher allowances for the maximum base fare and generally costs fewer points to redeem, except to Europe or to vacation destinations from the East Coast. But RBC’s higher redemption cost in these two scenarios has to be balanced against the lower maximum base fare on the Amex side, too.

Keep in mind that using points for RBC and Amex’s fixed-value travel redemptions really only makes sense if the flight’s surcharges and taxes are low, as the redemption rates are exclusive of taxes and fees.

Prior to November, I found good value for short-haul flights redemptions in particular, as usually Aeroplan often had limited availability on fixed-mileage awards for direct flights during popular flight times for a family of five.

The Present

What changed at the beginning of November? Both WestJet and Air Canada came out with their revamped reward programs. If you had difficulty keeping up with it all, you’re not the only one. It’s been a bit of an information overload, so let’s do a quick review.

On November 5, WestJet came out with their revamped Member Exclusive program. There was a lot of anticipation for the new program, but that anticipation was met with huge disappointment.

Although we could now use WestJet Dollars to book all classes of seats (economy, premium economy and business class), they moved from their fabulous fixed redemption rates to dynamic pricing, whereby you now only get a small discount off your fare by redeeming your WSD. That’s a big devaluation compared to before.

On November 8, Air Canada released their highly anticipated Aeroplan program, which Ricky has covered extensively. There were some significant devaluations on the redemption side, but there were also some positive changes that I found valuable for family travellers:

- Through the new Family Sharing feature, I can now pool my points together with up to eight members of my family, which makes redemptions easier.

- No more fuel surcharges on Air Canada-operated flights means it may actually be worthwhile redeeming on Air Canada metal now, if you can book on the low end of their redemption range.

- Any seat, any time means I don’t have to worry about there not being enough reward seats for my family (albeit, I may have to pay more points for it).

- eUpgrades can be cleared at any time on latitude and Premium Economy (Flexible) fares, which means I have another option to plan for premium redemptions for family travel as well.

- If I grab a core or premium Aeroplan credit card, I get free checked bags for myself and family members travelling with me on the same booking (up to eight people), as well as better Aeroplan redemption rates. Currently, I can also get a one-time Air Canada Buddy Pass as part of the signup bonus that is essentially a buy-one-get-one free offer for any economy class ticket within North America.

The Future

So how do these changes affect family flying going forward? This will vary depending on how big your family is, how often your family travels, and where you typically travel.

I’ll share my plan going forward, but keep in mind that my family situation may differ from yours, and you may have a better strategy that works for you. My goal is just to give you some food for thought.

Unfortunately, the clear advantage that WestJet’s program once had over Aeroplan for family travel is now eliminated by the devaluation of its Member Exclusive fares.

While I’ll still find value in the WestJet RBC World Elite Mastercard‘s annual companion voucher, Air Canada is also offering their new Buddy Pass as well, which has a $0 co-pay compared to WestJet’s $119. I must say that on balance, I’m more likely to book with Air Canada than WestJet going forward.

Many North American destinations served by WestJet are also served by Air Canada. Meanwhile, outside North America, Air Canada has the clear advantage, and most of their routes are direct, which is a big win for travelling with young kids. Plus, now that there are no fuel surcharges on Aeroplan, it will cost me less out-of-pocket to book with points.

(Of course, these factors also has to be weighed against dynamic pricing and the increased redemption cost on the points side for most routes outside North America.)

So, what strategies can we use to book at a decent rate?

- Book early. With dynamic pricing, as demand for a particular flight picks up, the redemption cost will likely increase. As you can imagine, demand at this time is at an all time low, and with Aeroplan’s flexible cancellation policy (which they recently updated again), there is no reason not to make some speculative bookings now at a good rate, and then cancel later if needed. This is especially the case if your family tends to travel during the peak times of March Break, summer break, and the winter holidays.

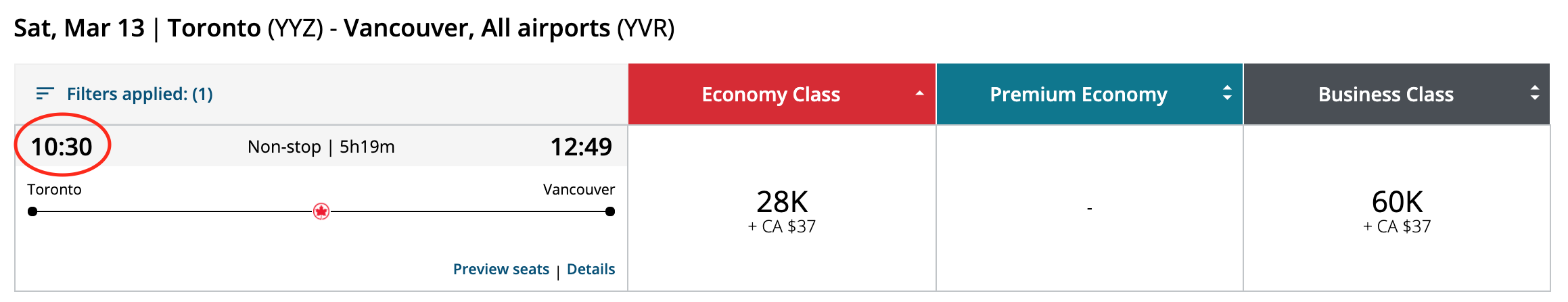

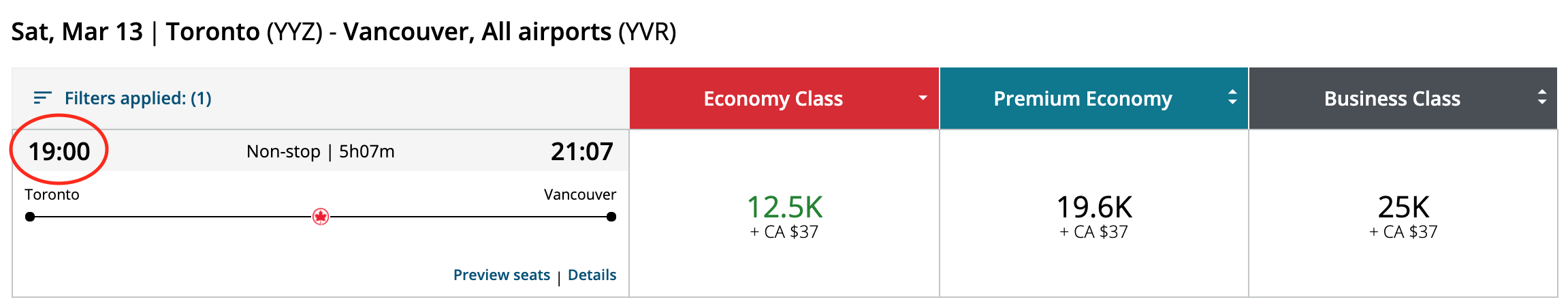

- Be flexible with flight times and dates. If you do a quick search for various routes, you will find that for many routes, there will be prices at the lower end of the dynamic pricing if you play around with departure and arrival date, as well as choosing different flight times. For example, here are two different Toronto–Vancouver flights on the same date:

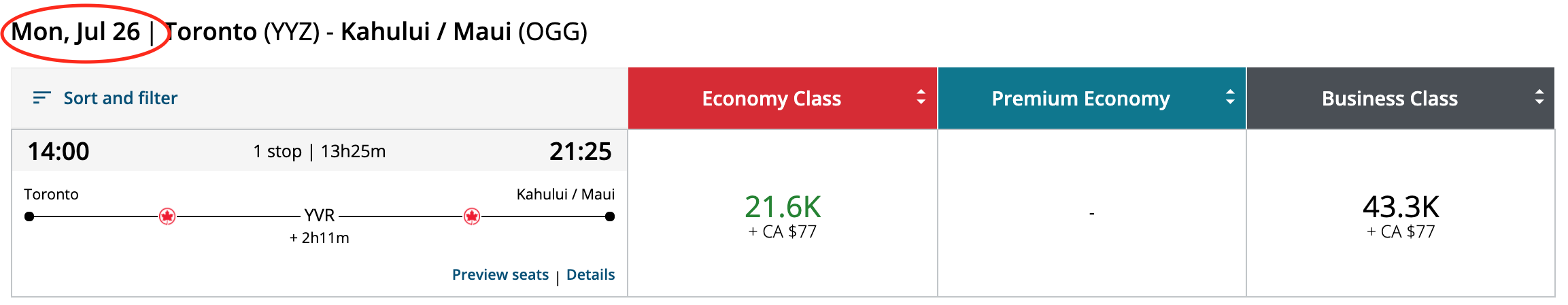

- And here are two different Toronto–Maui flights less than a week apart:

- Sign up for a core or premium Aeroplan credit card. The above examples show the pricing for someone without a credit card and without any Elite Status. If you sign up for a credit card, this will unlock preferred pricing on Aeroplan redemptions, Air Canada travel benefits, as well as a signup bonus. Read up on the various signup bonuses and see which suits your travel needs.

Air Canada Buddy Pass: Yay or Nay?

As part of the sign-up bonus for the core and premium Aeroplan credit cards, you can now get an Air Canada Buddy Pass. If you were a fan of WestJet’s companion voucher in the past and made good use of it, then the Air Canada Buddy Pass will probably appeal to you as well.

This Buddy Pass is essentially a 2-for-1 ticket to anywhere in North America, including Hawaii and Mexico.

Many in this community have dismissed the utility of the Buddy Pass, preferring to have had a hefty amount of points as a signup bonus instead. Indeed, the utility of the Buddy Pass depends on:

- Whether you see yourself travelling within North America with a companion in the coming two years, as the Buddy Pass expires after 12 months, but can be applied to a trip for the following year

- Whether you’re willing to pay a cash fare, as the Buddy Pass cannot be applied to an Aeroplan points redemption

- Whether you’re aiming to redeem for a premium cabin, as the Buddy Pass can only be applied to economy fares… although Latitude fares can be upgraded with eUpgrades if you have them

- Whether the routes and dates that you are planning to travel are showing some outrageous pricing

- Whether or not you have a large enough Aeroplan points balance to cover flights for the family otherwise, or perhaps you’d rather save your Aeroplan points for premium redemptions further down the road

Assuming the COVID situation improves to the point that families feel safe to travel again, let’s take a couple of examples of how a family of four can use the new Aeroplan program.

Example 1: A family of four wants to take a ski trip to Whistler over March Break from March 13–20, 2020, costing $2655.40 for the family:

Now consider if both parents sign up for the TD Aeroplan Visa Infinite to each take advantage of a welcome bonus of the Air Canada Buddy Pass and 10,000 Aeroplan points, giving them a total of two Buddy Passes and 20,000 points in their joint accounts – and for free, as the first-year annual fee is waived.

With the pass, their trip now costs $1605.40, a savings of 40% (I’ve also included the cost in Aeroplan points for the same flights, for comparison):

Base Fare | Taxes & Fees | Total | Aeroplan Points | |

Parent 1 | $525.00 | $138.85 | $663.85 | 34,600 |

Parent 2 | $525.00 | $138.85 | $663.85 | 34,600 |

Child 1 | $0.00 | $138.85 | $138.85 | 34,600 |

Child 2 | $0.00 | $138.85 | $138.85 | 34,600 |

$1,605.40 | 138,400 |

Great deal? Maybe not…

…because the couple could instead sign up for the American Express Aeroplan Reserve Card, pay $499 each (after the $100 statement credit), and be up 150,000 points, which would be enough for the same trip.

(The only caveat is that the points would be earned over six months, so if you were travelling in the near future, this wouldn’t work.)

So in this case, the Buddy Pass provides a welcome $1,000 in savings, but isn’t exactly great value when compared to a points redemption.

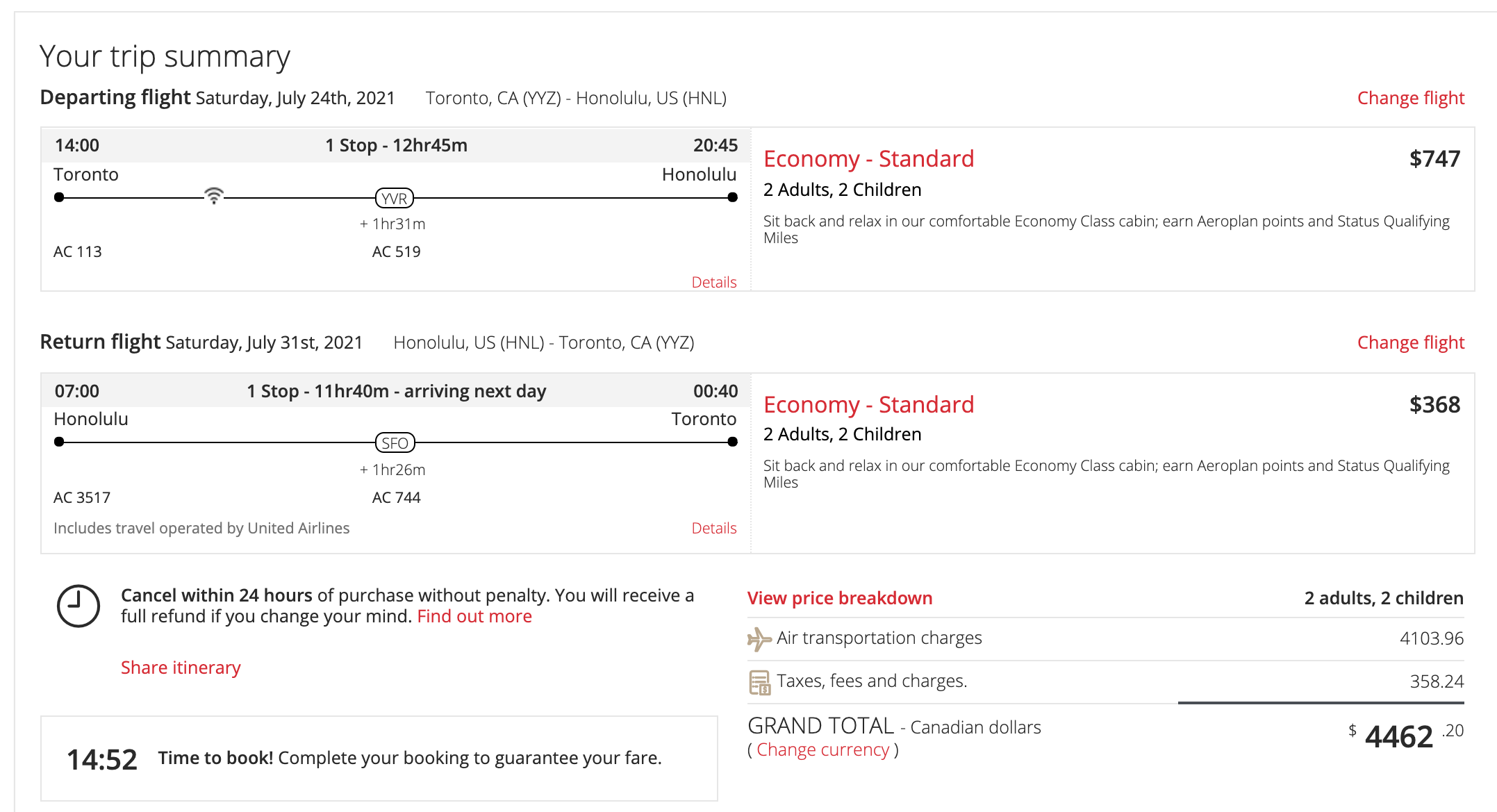

Example 2: A family of four would like to go to Hawaii during summer break for July 24–31, 2020. They want to minimize the stopovers, so they’ve chosen the following flight, costing $4462.20 for the family:

With the Buddy Pass, their trip now costs $2410.22, a savings of 46% (I’ve also included the cost in Aeroplan points for the same flights, for comparison):

Base Fare | Taxes & Fees | Total | Aeroplan Points | |

Parent 1 | $1,025.99 | $89.56 | $1,115.55 | 73,400 |

Parent 2 | $1,025.99 | $89.56 | $1,115.55 | 73,400 |

Child 1 | $0.00 | $89.56 | $89.56 | 73,400 |

Child 2 | $0.00 | $89.56 | $89.56 | 73,400 |

$2,410.22 | 293,600 |

Great deal? I would say so in this case.

It’s a substantial cost savings on the total fare. Plus, if you recall, the lower end of the redemption range from Toronto to Hawaii is 35,000 points round-trip; however, these particular dates will cost more than double that, so it wouldn’t be a good redemption anyway.

What if you have more than two children? There are a few options for the additional flights:

- Pay the full cash fare the remaining child(ren)

- Sign up for another Aeroplan credit card to have enough points to redeem for an additional ticket, and don’t forget to use Family Sharing!

- If short on points for the remaining ticket(s), a portion of the flight can be paid using cash, as Aeroplan now has a Points + Cash option at checkout (which works out to paying 1.8 cents per point)

- Putting some spend on their credit card, make a few Aeroplan eStore purchases, or take advantage of the current Black Friday promotion where each member of the family could earn up to 5,000 points each

What Won’t Change in My Strategy

As much as I like the certain features of the new Aeroplan program, the dynamic pricing does add an element of unpredictability.

As a result, I will still continue to work on my Amex MR points and RBC Avion points to provide myself that extra flexibility when I need it. The Buddy Pass is only a one-time sign-up bonus and not an annual feature, so at some point in time, I may find myself needing to pay an astronomical price for a redemption that frankly isn’t worth it. Having other point currencies allows me shop around and find the best deal.

In particular, I may still continue to access Europe through the British Airways Avios sweet spot of booking Aer Lingus from Toronto to Dublin for 13,000–20,000 Avios in economy class or 50,000–60,000 Avios in business class, one-way.

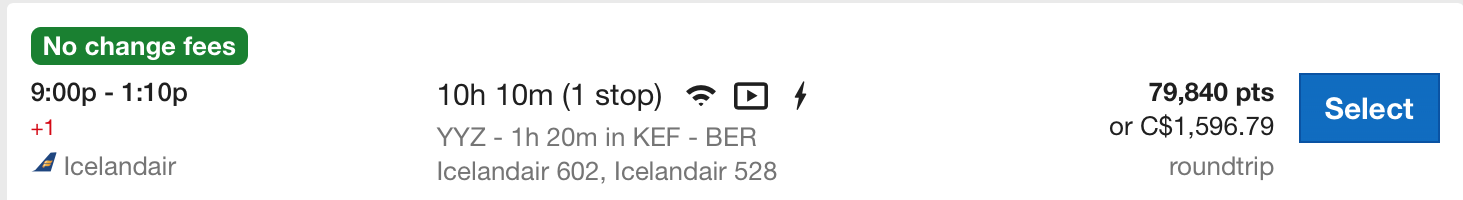

Another interesting way that I may try to get to Europe on points is on Icelandair, which connects to quite a few European gateways.

A quick search on Google Flights shows that most of Icelandair’s fares from Toronto to Europe in business class are priced between $1,400–$1,700 after mid-March next year. (They also fly to Vancouver, but the availability of flights at this price point is more limited.)

Since I have the RBC Avion Visa Infinite Business Card, I can redeem my points at 2cpp, bringing the cost of this flight to 70,000–85,000 Avion points including taxes & fees.

Although Icelandair business class is more like a transatlantic premium economy product, it still gets decent reviews, especially among family travellers.

What about Asia? Although I didn’t go into detail about it earlier, I also collect miles in Alaska Airlines Mileage Plan. To be honest, when I first started collecting this currency, it was mainly to achieve my goal of flying first class with Emirates.

Now that that flight is booked, I still see value in keeping this one around, as redemptions to Asia range from 30,000–52,500 Alaska miles one-way in economy class on various airlines, including Cathay Pacific, Emirates, and Japan Airlines, which actually beats Aeroplan’s rates of 45,000–90,000 points (for the distance band of 5,000–11,000 miles from Toronto).

Keep in mind that this may change when Alaska Airlines joins Oneworld next year, so I’ll be sure to revisit the strategy for travel to Asia once we have a clearer picture of our best options.

Conclusion

For families who enjoy travelling at a bargain, the landscape in Canada has now changed. Where WestJet once played a big role in my strategy, it has now fallen out of favour. Where Aeroplan was commonly overlooked for family redemptions, it will now play a bigger role.

Certainly, if I can book the lower end of the dynamic pricing, Aeroplan is not a bad deal. However, if demand is high, the redemption cost can seem a little ridiculous, and those costs can really skyrocket for a family of four or more.

I think this is where the new Air Canada Buddy Pass associated with Aeroplan credit cards can be useful, albeit only for North American flights. Otherwise, like the saying goes, don’t put all your eggs in one basket – always diversify and give yourself some extra flexibility.

Rewards Canada is throwing a little shade at your article 😉 At least they were nice mention this blog is usually pretty insightful

Love the tips and insight! Thank-you! Have you ever or would you recommend using Alaska airline points for short-haul flights? Wouldn’t they possibly be a better deal than aeroplan?

Hi Rachel! If you live in BC or Alberta, then absolutely Alaska Airlines mileage plan has some great redemption options for short haul flights starting at 5000 miles one way. Ricky covered it at https://princeoftravel.com/blog/9-sweet-redemptions-with-alaska-mileage-plan/#alaska.

Also, ur website looks awesome 😉

Anyone is more than welcome to have their opinion and I appreciate the insight. It shows that we all have different approaches to the points game. I tend to save my MR-S for transfers to hotel partners and the reality is, many people have other Amex cards that won’t be accumulating 5x the points, and these points are more valuable when spent elsewhere.

It was, however, quite unprofessional of the writer to make an unfounded assumption regarding the buddy pass example. His actions have been frowned upon by many in the community already. It’s unfortunate that we unintentionally used the same travel destination, but given the pandemic, many plan to travel within Canada and there are only so many winter destinations to choose from.

Side comment, you stated “Although we could now use WestJet Dollars to book all classes of seats (economy, premium economy and business class), they moved from their fabulous fixed redemption rates to dynamic pricing, whereby you now only get a small discount off your fare by redeeming your WSD. That’s a big devaluation compared to before.”

I don’t think this statement is accurate since before you could always redeem your WSDs against Econo, Premium or Business – just not at “Member Exclusive” rates. Given the merger discounts, using a promo code on Premium or Business would work just as well as the new “Member Exclusive”.

Hi Andrew, thanks for the comment. As you pointed out, that is what I meant …that member exclusive fares now apply to classes other than just economy. I’m not sure what you mean by merger discounts though. If you are referring to the introductory offer discount of 15% off that they are offering right now, I still don’t quite see the value.

Sorry, made a typo, should be meager discounts on ME. As an example, Perkopolis offers up to 15% off base fares which would probably be a better deal when booking premium cabins.

Amy Great Article.

I do have a question regarding my personal situation

Family of four 2 Adults 2 kids (4 and 2)

I do travel on Winter break and Xmas time

I own the Amex Platinum and Bizz Platinum (will keep only based on spending pattern)

I do value Lounge Access at Pearson.

Besides Amex Plat what other credit cards would you recommend for Lounge Access if possible Airline Agnostic?

Consider the BMO world elite with 4 free passes a year (and FYF currently)

Thank you for the article. Any suggestions on how to maximize the family share plan. Currently my wife and I put all our points to one Aeroplan account. Should I open additional accounts for her and my children?

Hi Matt, yes, I would definitely open an account for everyone in the family, including the kids. For example, prior to November, my kids each had 15-20K points in their own accounts and it wasn’t enough for any substantial redemption on its own. Now with family sharing, pooled together, I have 50K points to work with and that’s enough to redeem for one round-trip ticket within North America. Also, with Aeroplan’s Black Friday promo, each member could potentially max out on 5K bonus points right now. Just do a bit of shopping via the e-store on each person’s account 😉

Excellent insight

I love this article and I love the way it’s written! It definitely applies to me and my family. For someone who is just starting out, would you recommend the AMEX Business Platinum or the AMEX Aeroplan Reserve?

I’m glad you enjoyed it! The Biz plat right now has a sign up bonus for 50K MR points for $499, while the Amex AP reserve has a sign up for 75K AP points for $499. I would go for the AP reserve, unless you have another redemption in mind with a different airline for the 50K MR points.

That was a great read, thanks!