It’s November 8, 2020, and that means the Aeroplan co-branded credit cards by TD, CIBC, and American Express have officially launched or relaunched under their brand-new identities.

Accompanying the launch are a variety of different welcome bonus offers on all 11 products, which are meant to appeal to a wide range of different types of travellers.

We were told to expect “something amazing” – so did Aeroplan and its three partner issuers live up to the hype? Let’s find out.

If you’d prefer to digest the new offers in video form, I’ve made the below YouTube video to help you get caught up. Otherwise, read on for an at-a-glance summary of all the new offers, followed by in-depth discussion of each one.

Spoiler alert: TD and CIBC’s offers most likely fell short of our expectations. Amex, on the other hand, pulled through with flying colours.

(We’ll be focusing on the new signup offers in this post. For more detailed information about the earning rates, travel benefits, and insurance perks of all 11 new products, refer to my original post on “The New Aeroplan Credit Cards by TD, CIBC, and American Express”.)

In This Post

- Summary

- TD

- CIBC

- American Express

- What Is the Air Canada Buddy Pass?

- Which Aeroplan Credit Card Should You Apply For?

- Apply Now

Summary of New Aeroplan Credit Card Offers

To start, I’ve created the following table to summarize all 11 new credit card offers, showing the total bonus, breakdown of the bonus, and annual fee structure:

TD | CIBC | American Express | |

Entry-level |

|

| – |

Core |

|

|

|

Premium |

|

|

|

Small Business |

|

|

|

New TD Aeroplan Credit Card Offers

TD’s four Aeroplan co-branded credit cards will launch with the following welcome offers, valid until January 17, 2021.

TD’s entry-level card, the TD Aeroplan Visa Platinum, will offer 10,000 Aeroplan points upon first purchase. The $89 annual fee for the primary cardholder, as well as the $35 annual fee for the first supplementary cardholder, is waived for the first year.

TD’s core card, the TD Aeroplan Visa Infinite, will offer 10,000 Aeroplan points and an Air Canada Buddy Pass:

- 10,000 Aeroplan points upon first purchase

- Air Canada Buddy Pass when you spend $1,000 within the first 90 days

- The $139 annual fee for the primary cardholder, as well as the $75 annual fee for the first supplementary cardholder, is waived for the first year.

TD’s premium card, the TD Aeroplan Visa Infinite Privilege, will offer a total of 50,000 Aeroplan points and an Air Canada Buddy Pass:

- 20,000 Aeroplan points upon first purchase

- 30,000 Aeroplan points AND an Air Canada Buddy Pass when you spend $1,000 within the first 90 days

- $599 annual fee

Finally, TD’s small business card, the TD Aeroplan Visa Business, will offer 10,000 Aeroplan points and an Air Canada Buddy Pass:

- 10,000 Aeroplan points upon first purchase

- Air Canada Buddy Pass when you spend $1,000 within the first 90 days

- The $149 annual fee for the primary cardholder, as well as the $49 annual fee for the first supplementary cardholder, is waived for the first year

If you’re wondering what the Air Canada Buddy Pass is and how it works, you can jump below to the section on “What Is the Air Canada Buddy Pass?” for more details.

Essentially, you can think of it as a companion fare that allows you to book any Air Canada revenue ticket in economy class and pay a $0 base fare for the second passenger (only the taxes and fees), to any destination within Canada, the US (including Hawaii), and Mexico.

As you can see, TD’s offers place an emphasis on the Air Canada Buddy Pass as a key component of the welcome bonus. As a result, the number of Aeroplan points associated with each offer is certainly lower than what we all would’ve expected.

Those of you who, like myself, want to redeem Aeroplan points for the maximum possible value under the new program (especially to book business class and First Class trips) may well have reason to be disappointed with these offers from TD. On the other hand, there are also some travellers who’d find greater value in the Buddy Pass instead, and we’ll talk more about the potential upsides in the dedicated section below.

Note also a subtle change to the terms and conditions of the TD offers: “If you have opened an Account in the last 12 months, you will not be eligible for this offer,” whereas these terms had stated six months previously.

New CIBC Aeroplan Credit Card Offers

CIBC’s four Aeroplan co-branded credit cards will launch with the following welcome offers, valid until January 31, 2021.

CIBC’s entry-level card, the CIBC Aeroplan Visa Card, will offer 10,000 Aeroplan points upon first purchase. There is no annual fee on this card, and in fact, it’s the only Aeroplan co-branded credit card with no annual fee.

CIBC’s core card, the CIBC Aeroplan Visa Infinite, will offer 10,000 Aeroplan points and an Air Canada Buddy Pass:

- 10,000 Aeroplan points upon first purchase

- Air Canada Buddy Pass when you spend $3,000 in the first four months

- The $139 annual fee for the primary cardholder, as well as the $50 annual fee for up to three supplementary cardholders, is waived for the first year

CIBC’s premium card, the CIBC Aeroplan Visa Infinite Privilege, will offer 20,000 Aeroplan points and an Air Canada Buddy Pass:

- 20,000 Aeroplan points upon first purchase

- Air Canada Buddy Pass when you spend $3,000 in the first four months

- $599 annual fee

Finally, CIBC’s small business card, the CIBC Aeroplan Visa Business, will offer 10,000 Aeroplan points and an Air Canada Buddy Pass:

- 10,000 Aeroplan points upon first purchase

- Air Canada Buddy Pass when you spend $3,000 in the first four months

- The $180 annual fee for the primary cardholder, as well as the $50 annual fee for up to three supplementary cardholders, is waived for the first year

Clearly, CIBC’s credit card offerings have also placed an emphasis on the Air Canada Buddy Pass like TD’s, but their offers are much less generous.

For example, CIBC’s premium card clocks in at a full 30,000 points lower than TD’s equivalent product, even though both have an annual fee of $599, while the minimum spends required to unlock the Buddy Pass are also significantly higher on CIBC’s cards than TD’s ($3,000 vs. $1,000).

If TD’s credit card bonuses might’ve left aspirational travellers a little bit disappointed, CIBC’s are downright weak, plain and simple.

Thankfully, there’s one more issuer that has historically always taken up the mantle of strong welcome bonuses…

New American Express Aeroplan Credit Card Offers

American Express’s three Aeroplan co-branded credit cards will launch with the following welcome offers.

American Express’s core card, the American Express Aeroplan Card, will offer up to 20,000 Aeroplan points and an Air Canada Buddy Pass:

- 9,000 Aeroplan points upon spending $1,500 in the first three months

- 1,000 Aeroplan points for each of the first six months in which you spend $500, up to a total of 6,000 points

- An extra 5,000 Aeroplan points upon approval if you had signed up for the American Express waitlist and apply before December 31, 2020

- Air Canada Buddy Pass when you spend $1,500 within the first three months

- $120 annual fee

American Express’s premium card, the American Express Aeroplan Reserve Card, will launch with two separate offers that the cardholder may choose between.

The primary offer is for up to 75,000 Aeroplan points + $100 statement credit:

- 35,000 Aeroplan points upon spending $3,000 in the first three months

- 5,000 Aeroplan points for each of the first six months in which you spend $1,000, up to a total of 30,000 points

- An extra 10,000 Aeroplan points upon approval if you had signed up for the American Express waitlist and apply before December 31, 2020

- $599 annual fee, which is offset by a $100 statement credit upon spending $3,000 in the first three months, resulting in an effective annual fee of $499 for the first year

There’s also a secondary offer on the Amex Aeroplan Reserve, which can only be obtained by applying over the phone. This offer gives you up to 40,000 Aeroplan points, an Air Canada Buddy Pass, and the $100 statement credit:

- 10,000 Aeroplan points and an Air Canada Buddy Pass upon spending $3,000 in the first three months

- 5,000 Aeroplan points for each of the first six months in which you spend $1,000, up to a total of 30,000 points

- $599 annual fee, which is offset by a $100 statement credit upon spending $3,000 in the first three months, resulting in an effective annual fee of $499 for the first year

Finally, American Express’s premium small business card, the American Express Aeroplan Business Reserve Card, will offer up to 75,000 points + $100 statement credit:

- 35,000 Aeroplan points upon spending $5,000 in the first six months

- 5,000 Aeroplan points for each of the first six months in which you spend $2,000, up to a total of 30,000 points

- An extra 10,000 Aeroplan points upon approval if you had signed up for the American Express waitlist and apply before December 31, 2020

- $599 annual fee, which is offset by a $100 statement credit upon spending $5,000 in the first three months, resulting in an effective annual fee of $499 for the first year

Of the three issuers, American Express is clearly the one that best understands Aeroplan’s most dedicated members, putting forth a spectacular offer of 75,000 Aeroplan points on not one, but two of its premium cards: the Amex Aeroplan Reserve for individuals and the Amex Aeroplan Business Reserve geared towards small business owners.

While TD and CIBC have placed their emphasis on the new Air Canada Buddy Pass, American Express has gone the full distance with two credit card offers that rank among the best we’ve seen in Canada.

Indeed, the only other offer in this ballpark has been on American Express’s very own Business Platinum Card and its 75,000 MR points, which of course can be transferred to Aeroplan at a 1:1 ratio as well.

Assuming you signed up for the American Express waitlist before today, these two new offers on the Aeroplan Reserve and Aeroplan Business Reserve are now just as strong – and the $100 statement credit brings the annual fee down to a net $499 in the first year, in line with the Business Platinum as well!

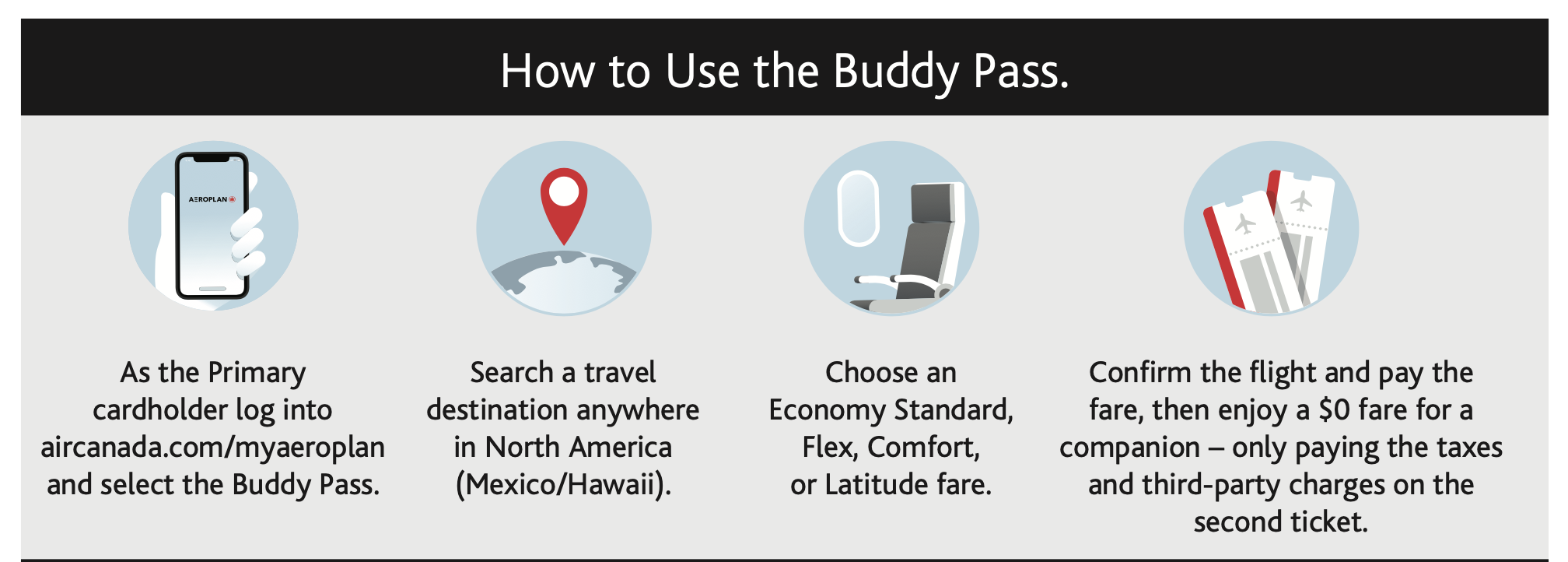

What Is the Air Canada Buddy Pass?

A large number of the new Aeroplan credit card offers include the Air Canada Buddy Pass as part of the welcome bonus. So what exactly is the Air Canada Buddy Pass, and how does it work?

You can think of it as a $0 companion voucher that’s good for any Air Canada flight within North America (i.e., Canada, United States including Hawaii, and Mexico). When redeeming the Air Canada Buddy Pass, the first passenger pays the full fare, while the second passenger enjoys a $0 base fare and only pays out-of-pocket the taxes and fees associated with the ticket.

The Buddy Pass must be redeemed on revenue fares only, and cannot be used in conjunction with an Aeroplan award. It can only be redeemed on economy class tickets, although you’re free to choose between any fare family (Standard, Flex, Latitude, etc.)

The Buddy Pass gets deposited into your Aeroplan account as soon as you’ve met the minimum spending threshold on your associated credit card. From that point on, it’s valid for one year, although you can use it to book travel for further than one year out. In that sense, you effectively get a two-year window in which to use your Buddy Pass to book travel for yourself and a companion at a steep discount.

There are no blackout dates on the Buddy Pass, so it’ll fetch maximum value if used during peak travel dates like Christmas, New Year’s, or March Break. Paid fares are highest during these times, so if you regularly travel during peak periods and don’t have the flexibility to avoid doing so, the Buddy Pass will help you unlock significant savings on Air Canada flights.

Moreover, even though the Buddy Pass is limited to economy class bookings, you’re able to redeem eUpgrades from your Aeroplan Elite Status for upgrades to premium economy and business class. Combined with eUpgrades, the Buddy Pass can therefore make for, say, an affordable yet luxurious trip to somewhere like Hawaii for yourself and your spouse (or the entire family).

Which Aeroplan Credit Card Should You Apply For?

The 11 new Aeroplan credit cards (and the 12 new offers that they come with, since the Amex Aeroplan Reserve comes with two separate offers) cater to a wide range of travellers’ wants and needs.

If you’re a solo traveller, or you’re the aspirational type who wants to maximize the value of your Aeroplan points to fly in business class or First Class, then the American Express offers will definitely appeal the most to you. 75,000 Aeroplan points is certainly nothing to scoff at, and under the new program, this signup bonus alone will be enough for:

- A one-way business class flight from the East Coast to Europe

- A one-way business class flight from many places in Canada to Asia

- A one-way business class flight from Vancouver to Brisbane or Auckland

(Certainly, I think this is what many of us had in mind when we were told to expect “something amazing”. I personally would’ve loved to see a 100,000-point offer, but I do think that may have been over-ambitious here in the Canadian market.)

Meanwhile, if you travel regularly as a couple or as a family and you generally see yourself booking trips closer to home for the foreseeable future (as I imagine is the case for many of you), then consider giving the Air Canada Buddy Pass a spin as well.

It may not be the type of signup bonus we usually expect from premium travel credit cards, but there are clearly circumstances under which the Buddy Pass will present value to the right type of traveller: such as if you’re flying over the festive period, where cash fares are sky-high (and Aeroplan redemptions will likely be as well, thanks to the new program’s dynamic pricing model on Air Canada flights).

And if you’d still like to add a touch of luxury to your Buddy Pass booking, then you always have the option of buying a Flex or Latitude fare (at the buy-one-get-one-free pricing) and applying eUpgrades to your booking, too.

If you do want to try out the Air Canada Buddy Pass, then it’s clear that TD’s offers are superior to CIBC’s, since they have a lower spending requirement and also offer a greater number of Aeroplan points in addition to the Buddy Pass in the case of the premium card from both banks.

Ultimately, though, if you don’t value the Buddy Pass all that much (say, if you’re in it for the business class and First Class trips), then the TD and CIBC offers are pretty disappointing, and we can only hope they come out with something better in January 2021.

Apply Now

If you’re interested in the new American Express Aeroplan cards, it would be best to apply via the dedicated email link from signing up for the waitlist in order to unlock the maximum bonus. You can also learn more about each card on its dedicated information page:

- American Express Aeroplan Card

- American Express Aeroplan Reserve Card

- American Express Aeroplan Business Reserve Card

If you’re interested in the new TD Aeroplan cards, consider using the following links to apply, which helps support Prince of Travel:

- TD Aeroplan Visa Infinite

- TD Aeroplan Visa Infinite Privilege

- TD Aeroplan Visa Platinum

- TD Aeroplan Visa Business

And if you happen to be interested in the CIBC Aeroplan cards, you may consult the following information pages:

- CIBC Aeroplan Visa Card

- CIBC Aeroplan Visa Infinite

- CIBC Aeroplan Visa Infinite Privilege

- CIBC Aeroplan Visa Business

Finally, if you’d like to hop on a livestream to discuss these offers, the upcoming new Aeroplan program, and more, then check out our Virtual Miles & Pints session tomorrow, Sunday, November 8 at 1pm Eastern / 10am Pacific, as we await the delayed launch of the new Aeroplan on Monday.

Does Panama count as North America?

Geographically? Yes. For the purposes of the Buddy Pass? No.

Ricky- Does any of the new aeroplan cards come with “no foreign transaction fees”?

When the eupgrades rollover, do you know what their new expiration date will be? For example the ones that expire Feb 28 2021, will they align with the new status period (Dec 31) or will they be a full year from original expiration? As well do you know if the promo ones issued last year qualify for roll over? I received some expiring in May 2021… Thank you!

Sadly, nope.

Has anyone been approved for the $599 TD card? TD seems to think they’re special and has set the annual income (including investments) arbitrarily at $200,000. Beware TD allows one to close a credit card account even where a balance is still present. My credit rating was damaged when they did not inform me of a remaining balance so it continued accruing missed payments and interest for six months past cancellation of the card!

Hi Ricky – I applied for the old TD Aeroplan Visa Infinite (15K welcome bonus, with 10K bonus after $1,500 spend) on November 6th, two days before the transition to the new cards. My application was pending.

I finally called in today to inquire, and they noted that I needed to submit a new application after visiting a TD branch because I apparently have two profiles in their system, as well as two profiles in Equifax.

The CSR was unable to guarantee the additional spending bonus and welcome bonus after a new application given the cards are now under a new ‘campaign’.

Should I bother continuing with the application in hopes of getting the welcome bonus and spend bonus?

How should we use the free first checked baggage benefit? Do I have to buy ticket on this card or I can just show the card when checking in at airport? Not very clear to me.

As a cardholder, your card will be linked to your Aeroplan number, so as long as you include your Aeroplan number on your reservation then the first free checked bag will automatically apply.

Hi Ricky,

Would you happen to know the previous TD aeroplan visa infinite privilege card’s MSR?

I believe the WB is 25K but can’t find any info on MSR anywhere.. thank you kind sir.

I believe it was $1,500 in three months.

In connection with the new aeroplan program and some flight research. This is the Welcome Subscription Offer, Buddy Pass, Year 1 Free, and a minimal 10K Aeroplan. What I conclude Air Canada is asking us to buy tickets preferably to use points. At the end of this welcome promotion what can we expect in gain or loss for the next offers? Remove the buddy pass, keep it free for the 1st year, increase the number of points? Ricky I would like you to pull a bunny out of your hat. How do I get points again for almost free travel? Am I to conclude that this time is over? This opinion is always personal and without prejudice.

Has anyone received the Amex waitlist email offer yet?

How does one get on the get an Amex waitlist email offer?

Yes, I received it around 5:30pm Eastern Time today.

Are there any referral bonuses associated with the Am Ex Reserve or Business Reserve cards?

The benefits between the Amex Reserve and Business card look identical, but the Business card needs higher spending. Any advantage to get a Business card over Reserve?

Pretty much only if you’ve already gotten the Reserve first and need another chunk of points.

Just to confirm, in order to get 75K from AMEX Aeroplan® Reserve Card, I have to spend a total of 9K (initial 3K + 6 months of 1K each)? Sounds pretty steep!

A minimum of $6k is required, since you could spend $1,000 per month for the first six months, and the first three months would count as the initial $3k.

Can you use the annual companion voucher from the privilege card when booking on points?

Did I miss it, or are there no cards that include Priority lounge passes?

The TD and CIBC Visa Infinite Privilege cards both offer a Priority Pass membership with six free lounge visits per year.

The sign up bonus is definitely horrible, most of us have expected much better than what they are offering now. Real disappointment for sure. I guess if most people don’t apply and they see that will have to jack up the bonus offer in the next around so I would wait.

This is a clear shift from the pre-pandemic to current situation with overall huge de-valuation. The new aeroplan program appears to be making an effort to discourage churners. Could this be the end of churning?

Things are definitely headed in that direction, but that’s not new – the game is constantly broadly moving in a downward direction over the years despite the occasional peaks. That’s as true now as it was a few years ago, when the easy deals from a few years before that were no longer available and thought of as the “good old days”. I’d say the pandemic has only hastened the process that might’ve taken place over the next 2-3 years.

From the change to terms and conditions we can see that “12 months” is basically the new “6 months” in this particular ecosystem. At this stage it may be about making moves in other ecosystems before they too change, and so on.

I am surprised Prince of Travel didn’t address this point. The churning game has clearly been targeted, the companies are spreading points over 6 months periods and limiting J class retention with buddy pass systems. Obviously churning will never be the same, PofT needs to write an article on this asap.

All these offers are absolute trash. As others have mentioned, do not apply for these cards, indirectly let the banks know that the offers are terrible.

What a shame

Has Amex sent out any details about how to apply for the cards with the wait list offer yet?

Not yet. My guess would be that we’ll see those details on Monday.

Correct, i asked them and theu said the waitlist emails are coming tomorrow. Kind of weird to me that they put you on the waitlist but then make you wait a day after they publicly release before they write tou about it but oh well.

That’s why they call them waitlists….

Curious if you think the buddy pass is worth the 35k in points.

The WestJet companion fare has been disappointing in cost savings over the last few years. Ex/ booked a trip to Vancouver in December and it dropped my partners cost of her ticket from $350 to $275.

Do you foresee the Buddy Pass being similar, with limited savings given we’ll likely only travel within Canada for the next year?

Peter covered the bases pretty well. For me it just depends on your usual travel style and whether or not you pay for cash fares on AC flights on a semi-regular basis. If so, then there’s definitely value to be unlocked, and if one of your eligible base fares is worth $700+ then you’re winning in the comparison against 35k points at 2cpp. If you rarely book cash fares and only want to redeem points for premium flights for nearly free, then the Buddy Pass doesn’t really help with those goals at all and 35k points would be much preferred.

Thanks Peter and Ricky,

It seems as though the question becomes will you purchase a base fare that’s $700+ within the next year.

There isn’t a ban on international travel at this point. The only thing keeping you from traveling is your ability to quarantine at your destination +/- when arriving home. Certain places have testing criteria that would decrease/eliminate any time you might need to quarantine on arrival (ex Hawaii) or when returning home (ex Calgary). If you choose not to travel for health and safety concerns, that is a different story.

Compared to the WestJet companion voucher, the Buddy Pass has no associated co-pay so you’re already coming out $99-299 ahead. Whether you think the Buddy Pass is worth 35K depends mostly on your travel goals. The Buddy Pass is only good for economy class fares. At a 2CPP valuation, 35K points would be worth $700. The Air Canada graphic advertises a potential $1300 savings on a Toronto to Hawaii booking so that’s almost double the value of most economy rewards you’ll find. If you prefer premium cabins, you might be able to get 5-10CPP which would put the 35K points at $1750-3500 value.

Wow! Is this suppose to be a joke? I will not apply for sure and wonder how many people will apply these cards. LOL!

Is the “Buddy Pass” an annual benefit (like Alaska Airlines) or is it a one shot deal?

Wasn’t the Buddy Pass supposed to be an annual offering on the highest tier card upon reaching a certain spend amount? Any news on that – I don’t see it advertised on the bank websites but it’s on the Air Canada site.

As Peter said, there are two companion vouchers: the Buddy Pass ($0 companion fare, within North America only) as part of the welcome bonuses outlined above, and then there’s the Annual Worldwide Companion Voucher which you earn after $25k spending on the premium cards which has a co-pay amount of $99–599 depending on the destination.

The Buddy Pass is a one-time signup bonus without copay (only taxes) after spending $1000 in the first 3 months. There is a separate annual companion pass with the Amex Reserve after spending $25000 that has a variable copay (plus taxes).

Does the buddy pass have to be booked at the same time? And also both on the AC website?

I have to book business travel through my company. I can’t book then get a reimbursement. Would be grand to be able to do that then book a buddy flight for my spouse.

My mistake, variable spending requirement depending which card you have for the Buddy Pass

It is a sign-up bonus

I was under the impression with the Aeroplan Amex Reserve that there would be a yearly companion pass after signup?

My mistake, you can earn annual companion pass after spending $25000. This is different from the Buddy Pass that has no co-pay. The companion pass is more similar to the WestJet companion voucher, with variable pricing from $99-599 plus taxes depending on destination

Phew! I got a bit nervous there for a minute. Thanks!

These are horrendous.

Maybe the idiot down the street will apply for one but me and every other churner than reads your blog will definitely not.

Hey Ricky,

Not sure if I missed it but if I have the ‘old’ TD Aeroplan infinite card and the Amex Aeroplan platinum card, are we eligible for the new welcome bonuses, when they automatically switch us over ?

I received my Amex platinum card October 21st last year. I called last month to consider cancelling and they told me that I had one additional month grace period until November 21 if I wish to cancel and have the annual fee reimbursed. If I cancel the platinum that I presently have and go for the new Amex card is there a risk of them cutting me off as they have with others recently?

I just tried to trsnsfer my MR points to Aeroplan, however there system appears to be down during the switchover.

These are sign-up bonuses, as in you need to newly acquire the card to get the bonus. When your cards get grandfathered over, you’ll have access to the new benefits for the same fee without the welcome bonuses.

https://princeoftravel.com/blog/new-aeroplan-credit-cards/#summary

You would be eligible for the TD WB if you were to apply for the VI again 12 months after your last application. For Amex, YMMV on getting repeat WB and you risk shutdown if you try.

I feel like given the current economic and travel situations they could have given a 6 month window instead of 3 months for spend. Sure I can buy a ticket for next year but what if that gets cancelled and I get refunded then I lose my points. I don’t like using Amex to buy big ticket items since their purchase protection maxes at $1000.

Sadly, the six-month gesture for the minimum spending window ended in June and doesn’t seem likely to return.

Wow so terrible…

No one should apply for these new cards so Air Canada and the banks realize they need to offer something better and don’t treat us like idiots.

The TD VIP is the best value of the offerings, and is potentially better than the pre-Nov 8 offer.

TD VIP Pre-Nov 8: 50K First Spend Bonus (FSP) + 1875 Spend Earn (SE) + $1500 worth of goods/services for $399 AF + $1500 MSR = $1037.50 in points at 2CPP + $1500 / $399 + $1500 = $1.34/dollar spent or 34% ROI

For comparison, Amex Biz Plat: 75K WB + 8750 SE + $7000 worth of goods/services for $499 AF + $7000 MSR = $1.16/dollar spent or 16% ROI

TD VIP Post-Nov 8: 50K FSP + 1250 SE + $1000 worth of goods/services for $599 AF + $1000 MSR = $1.27/dollar spent or 27% ROI. This is better than the Biz Plat as a churner. This doesn’t take into account the Buddy Pass, which Milesopedia values between $200-1000. This would bring the ROI to 39%-89%.

Written like a blogger who pumps card applications.

Look, $7000 value of Good and Services! $1500! only for a fee of $599! SMH

So if someone purchases a laptop for $1500 that they would have otherwise bought, is that not $1500 worth of goods they have obtained? You could pay with cash or debit and get straight 1:1 value for your efforts. You could use a no fee card to get maybe 1-1.5% cash back or points. Or you could get a card like the Amex Gold with $150 fee for the equivalent of 29% value back. If you found a roundtrip flight to Hawaii for $150 plus taxes, do you think that’s a good deal? Is it less of a good deal if you paid $150 for the points required for the same trip?

I’m curious why you bother coming to a site like this if this type of thinking disgusts you. Unless you shop exclusively at places that have an added fee for using credit cards, the cost of using a credit card and obtaining these points is built into the price you see. You’re paying an upcharge for no extra benefit. The point of this community is to leverage your normal spending to attain travel goals that would otherwise be unaffordable.

I don’t own a blog. What’s wrong with “pumping” credit card applications? Banks and financial institutions do not exist altruistically. Do they need to charge 20% interest when the bank lending rate is currently 0.25%? Does it really cost $29 to process your over limit status? These are multi-billion dollar companies that we are utilizing under their offered terms. If they have a limit on how long you need to keep the card for or how often you can get a new card, that is up to them to enforce to maintain profitability. I’m not aware of any legal restriction on having 100 credit cards or any moral implications.

I guess I was talking about the core cards, which I believe are the mainstream cards.

For those of us who only fly business class using miles, the buddy pass is 100% useless, so we are essentially getting 10,000 miles only compared to 25,000 or 30,000 miles pre-Nov 8.

Very disappointing. I will likely skip these new cards for now and get the HSBC World Elite MC card before the end of the year

They are all poor offers but in line with the trend of devaluation.

Ricky, I still haven’t got waitlist email… any idea of when I can expect that?

Not sure, we’re all still waiting. I would think Monday would be a good bet.

Also wondering, seems weird they went through the trouble of getting us all on a waitlist only to release all the cards before emailing the folks on the waitlist…

Question Ricky, what would make more sense, Amex Platinum or the new Amex Reserve?

Ultimate goal is Star Alliance Gold as I mostly travel YYZ to ZRH or FRA (however travel to SIN is challenging at the moment and getting the additional 3 segments – was planned for March 2021). Am currently Elite 25K. Thanks for your input 😊

Right now the Amex Aeroplan Reserve makes the most sense, since the Amex Platinum is at a historically low bonus of 25k MR points. If it goes back up to the range of 60k, then I think the Platinum’s international Priority Pass access would work better for your travel patterns – if you’re Star Alliance Gold you’d already have access to the Maple Leaf Lounges from the Reserve anyway, and it’s always nice to have a backup lounge option.

What offers are available to existing cardholders? Obviously not the signup bonus but will existing cardholders receive the buddy pass when reaching the spend thresholds?

The Buddy Pass is part of the welcome offers on several cards, rather than a standalone credit card perk. It’ll only be available if you sign up for one of the other cards as a new applicant and meet the required spend thresholds.

I opened the TD Visa Aeroplan Business Card in the summer. Am I excluded from all the welcome bonuses on the TD cards until next summer?

No – the new 12-month rule refers to each specific card as its own “Account”. You’ll still be eligible for the Platinum, Infinite, or VIP cards in the meantime.

Have the Amex Aeroplan cards always been charge cards?

The core Amex Aeroplan Card is a charge card, just like its predecessor the Amex AeroplanPlus Gold.

The premium Amex Aeroplan Reserve Card is now a credit card, even though its predecessor the Amex AeroplanPlus Platinum was a charge card.

The Amex Aeroplan Business Reserve Card is a brand-new credit card.

I previously had the Amex Aeroplan Plus Platinum card (charge card) until Amex discontinued it and automatically switched me over to the Amex Aeroplan Reserve card. After the switch, with no input from me, I noticed in my new card statements that the reserve card also shows as a charge card (no pre-set spending limit). It has been this way for months now. I also didn’t get the welcome points bonuses but did get the minimum monthly spend bonuses and the $100 statement credit for the annual fee. This whole process has been perplexing to me.

Does Amex still have a limit of 2 credit cards per person? Was that ever a thing?

Any idea when we can expect the waitlist email offer?

It’s 4 credit cards

Are the TD offers available with a product switch?

I don’t see anything to the effect of “Online Only” or “available only on a new application” in the terms, so I would imagine yes.

Any referrals on the AMEX cards? Reserve is the clear winner, and it would be nice to boost the offer with a P2.

No word on this yet, but I’ll get back to you here when I know more.

I can’t believe how weak the CIBC offers are! I guess they won’t be cannibalizing their Aventura program.

In hindsight, really glad I got the core TD and CIBC AP cards and WBs a few months back.

The Amex core offer is decent, but I’m in no rush to apply right away, since 15000 pts don’t really move the needle much, and the buddy pass is only good for a year. Maybe better to wait until Jan to maximize the amount of time it could be used?

I can forego the 5000 pt wait list bonus.. Rather wait for a potential $100 cash back from GCR!

Agreed, CIBC really dropped the ball on these offers. I imagine they’ve continued to take a backseat among the three issuers (like before), and Aeroplan probably also takes a backseat for them compared to their own Aventura cards, like you said.

Keep in mind that the Buddy Pass is good for a year but can be booked for one year ahead. But yes, if you’re interested in the Buddy Pass but don’t have plans to travel currently, then signing up in January but meeting the spend in, say, April would prolong its validity the furthest.

Don’t forget though, you have to apply by December 31 to get the waitlist bonus.

I am happy I have signed for a TD and CIBC cards just recently – as those new cards are just awful!

I am surprised Ricky is not calling it by its name – an ugly devaluation!

Definitely it will be waaaaay more hassle to earn aeroplan miles frim npw on..

The TD and especially CIBC offers are pretty disappointing, and I’ve called them out as such. They aren’t what we had hoped for at all.

Does the owner of the buddy pass have to be flying to use the buddy pass? I think there would be more value to the buddy pass if I could use it on my friend and their buddy.

This would allow for the possibility to “give” the buddy pass to someone else.

Based on the terms, yes, the Buddy Pass allows a companion to accompany only the Primary Cardholder for a $0 base fare.

And I assume the Buddy can’t accumulate points/miles flown from that flight?

Correct: “Companions who are members of the Aeroplan program or other partner frequent flyer programs will not be eligible to accumulate points or miles for the ticket issued in exchange for the companion pass.”

To further confuse, I note these T&C’s in the Amex Reserve details for the Companion Pass. I guess it was too easy to have similar T&C’s for each pas, so that there was no possibility of a mix-up.

Companions who are members of Aeroplan or other partner frequent flyer programs are eligible to accumulate points and/or miles for the ticket issued in exchange for the companion pass according to conditions of the fare brand purchased. Aeroplan EliteTM Status benefits and upgrades are applicable if the traveler holds appropriate status and the fare purchased allows.

The pass must be redeemed at the time of purchase, and if multiple companion passes are available in association with the same Aeroplan number, the pass that would expire first will be used. Booking must be made before the pass expiry date, but travel may occur after the pass expiry date subject to flight schedule availability at the time of booking.

Wowwwwwwww

‘Something amazing’ LOL that’s hilarious. Yup amazingly bad.

Also Ricky you neglected to mention that these cards are virtually unchurnable as they now require a 12 month waiting period between sign up bonuses.

Well the points game is done. The glory days were good, lots of memories. On to greener pastures!

Good catch! That’s now added.